M6 Labs: Tis The Season of Giving & Airdrops

GM, Anon! Never a slow week in crypto, however, when it comes to price action, things have been relatively stagnant as the market remains within a range. Some are anticipating a downward movement toward lower lows in the short-term, while others believe we may have already hit the bottom. Let's take a closer look!

L1s, L2s & DeFi

TLDR

- The Federal Reserve maintains interest rates at 5.5%, causing a minor market dip, while a potential rate cut looms in March.

- Bitcoin's mining difficulty rises, driven by speculators and short-term holders, despite market sentiment hitting a three-month low.

- The UAE conducts its first digital dirham transfer using the mBridge CBDC platform, signaling advancements in digital currencies.

- Grayscale experiences significant outflows, while newly launched US ETFs attract inflows.

- Spot Bitcoin ETFs see renewed interest, while Ethereum ETF approval may happen in May.

The Federal Reserve announced its decision to maintain interest rates at 5.5%. In their statement, the Fed mentioned, "The committee does not anticipate reducing the target range until it has a stronger belief that inflation is steadily progressing towards the 2 percent mark."

- This unexpected decision led to a minor market downturn, as many had anticipated a rate cut.

- However, the second interest rate decision scheduled for March indicates a 47% probability of a 25bps rate reduction.

Bitcoin's mining difficulty is on the rise, indicating a positive trajectory, and speculators are driving a bounce in the market with renewed activity among short-term holders. However, market sentiment has hit a three-month low due to sell-side pressure and concerns about the Grayscale Bitcoin Trust. In other news, the UAE conducted its first digital dirham transfer via the mBridge CBDC platform, sending 50M dirhams to China. Vitalik Buterin gave his thoughts on the promise and challenges of crypto + AI applications in an article, exploring how AI can enhance crypto mechanisms.

X has received a money transmitter license for payment services in Nevada, while Russia prioritizes moving away from the US Dollar for trade settlements in 2024. Additionally, PayPal has announced layoffs of 2,500 employees. Visa is partnering with Transak to simplify crypto-to-fiat conversions in 145 countries, offering greater accessibility to crypto users globally.

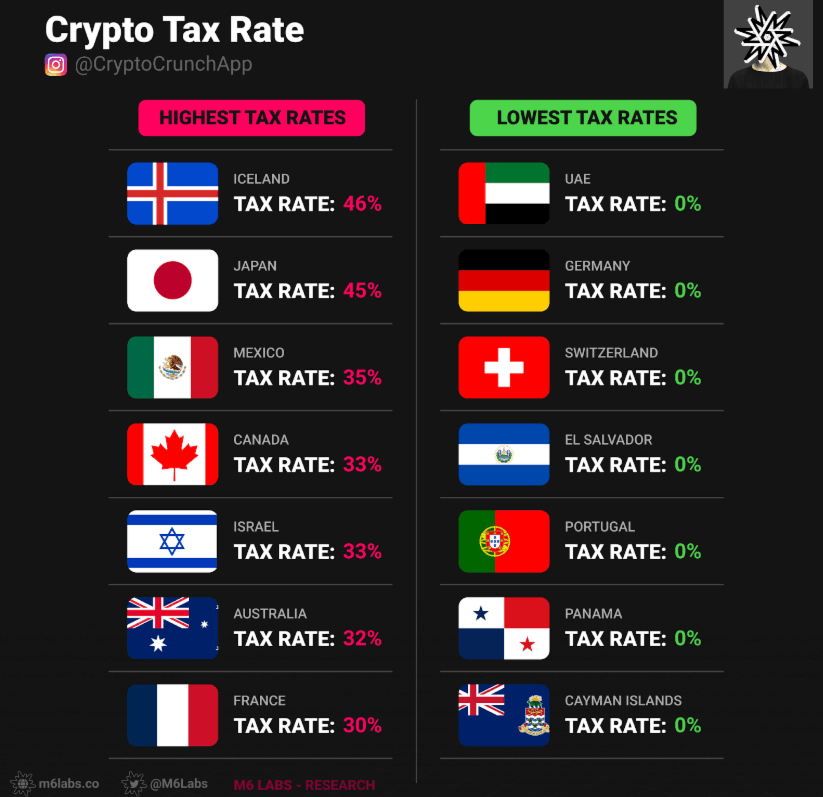

In other noteworthy developments, the Argentine government has eliminated taxes on crypto, potentially positioning Argentina as a burgeoning crypto-friendly destination. It will be intriguing to observe how the crypto landscape evolves in Argentina with a government that supports crypto initiatives. Simultaneously, the European Securities and Markets Authority (ESMA) has issued two consultation papers, marking a significant move in regulatory matters.

Take a look at the intriguing graphic shared by CryptoCrunchApp, which highlights the countries with the highest and lowest tax rates worldwide.

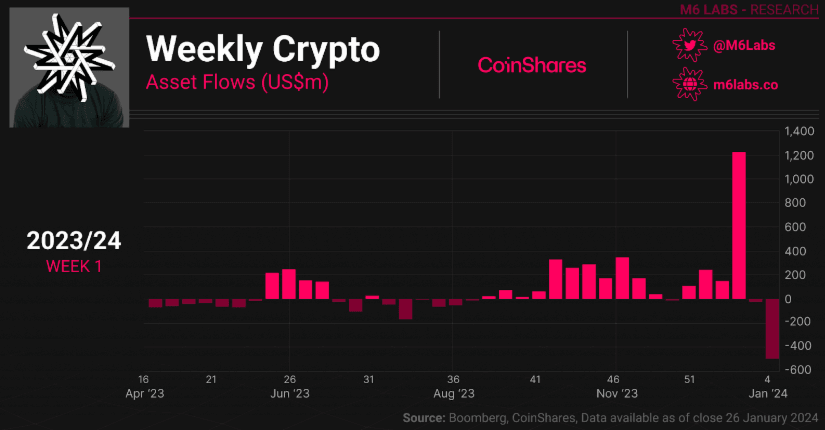

Inflows & Outflows: Digital asset investment products experienced significant outflows on a global scale, amounting to $500M.

- The United States, Switzerland, and Germany were the regions with the most substantial outflows, totaling $409M, $60M, and $32M, respectively.

- Grayscale witnessed outflows of $2.2B last week, although these outflows appear to be tapering off gradually.

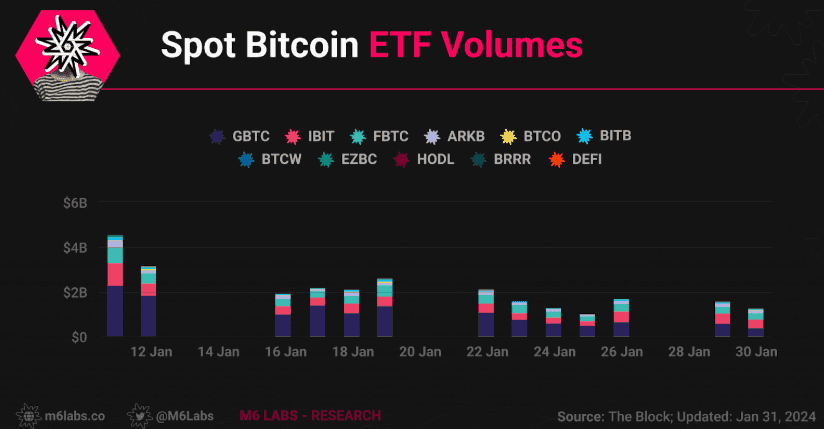

- In contrast, newly launched US ETFs received inflows totaling $1.8B last week and have attracted $5.94B in inflows since their launch on January 11, 2024. When considering Grayscale's inflows since the launch, the net total of inflows amounts to $807M.

- These positive inflows did not prevent price declines, which were likely influenced by the acquisition of Bitcoin seed capital before January 11.

- Bitcoin experienced significant outflows of $479M, while short-bitcoin products received inflows totaling $10.6M.

- Most altcoins saw outflows last week, with Ethereum experiencing $39M in outflows, and Polkadot and Chainlink seeing $0.7M and $0.6M in outflows, respectively.

- Blockchain equities, on the other hand, received inflows totaling $17M during the same period.

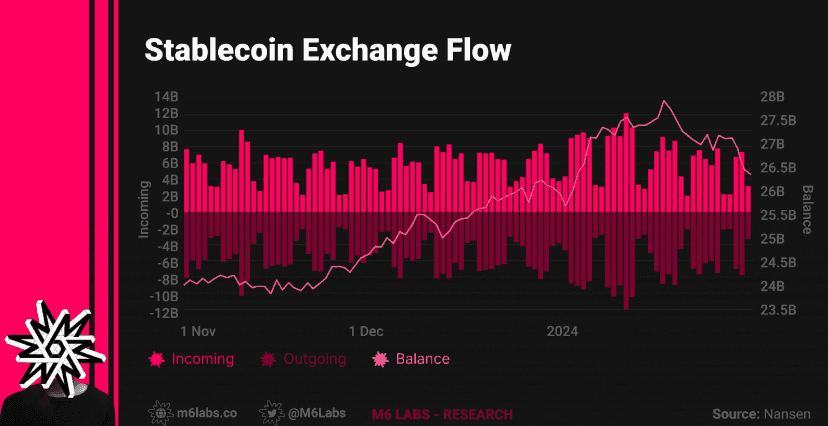

The decrease in stablecoin flows to exchanges over the last week suggests reduced trading activity and potential caution among investors. This trend might also indicate decreased demand for crypto in the short term.

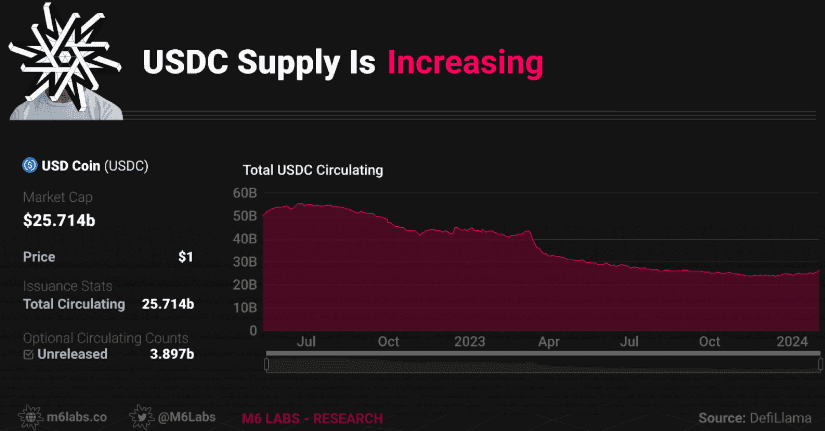

The supply of USDC appears to be increasing once more, with a recent surge of over $1B. Will USDC potentially challenge the dominance of USDT in the future, as it once seemed likely? Only time will tell.

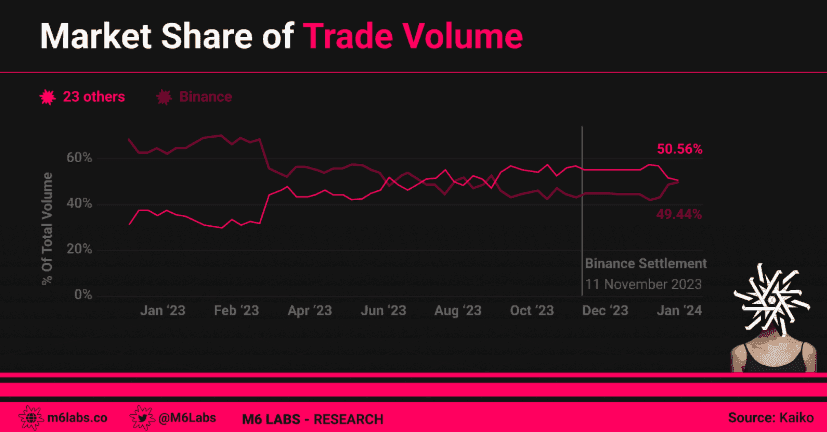

Two months after the settlement of certain regulatory concerns, Binance is showing signs of recovery in terms of market share.

- During this period, trading volumes on Binance have experienced a notable resurgence, climbing to 49%.

- This represents a significant increase from the multi-year lows the exchange had previously encountered.

- The recovery in market share and trading volumes indicates renewed confidence and participation from traders and investors on the platform.

- It suggests that users who may have temporarily shifted their activities elsewhere due to regulatory uncertainties are now returning to Binance.

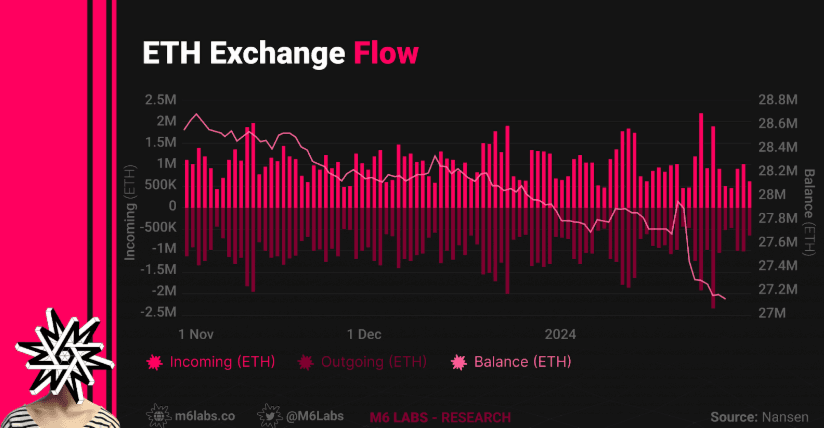

The noticeable outflows of ETH from exchanges over the past few weeks can indicate several potential scenarios and trends within the crypto market:

- This could be an indicator of long-term confidence in the asset, as users often withdraw their holdings from exchanges when they don't intend to trade them actively.

- Outflows from exchanges could also be related to the growing use of Ethereum in DeFi protocols.

- Many investors might be accumulating ETH for long-term holding or staking purposes. If a significant portion of withdrawn ETH is being staked or held off-exchange, it could reduce the circulating supply available for trading, potentially affecting price dynamics.

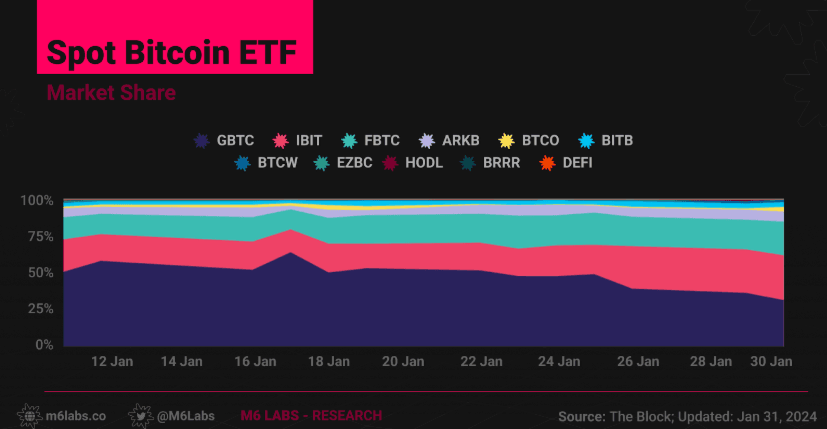

In the latest developments on the spot Bitcoin ETF front, there's been a significant shift with $14.8M in daily net inflows, marking the first net inflow since January 19th. This signals renewed interest in spot Bitcoin ETFs.

- Additionally, Bitcoin futures premiums on CME are rising, reflecting a shift to contango.

- In a competitive move, Invesco and Galaxy have slashed their Bitcoin ETF fee from 0.39% to 0.25%, challenging market leaders.

- Meanwhile, new spot Bitcoin ETFs have managed to accumulate 150,000 BTC, while the market share of GBTC has fallen to 36%, indicating a shift in investor preferences towards these ETFs.

- The approval of a spot Ethereum ETF is anticipated, with the potential for it to materialize in May, although according to analyst TD Cowen's speculations suggest a much later timeline.

Moving on to noticeable project updates

- The Floki team has responded to a warning from Hong Kong regulators, highlighting the ongoing regulatory scrutiny faced by crypto projects globally.

- Meanwhile, in a surprising turn of events, Solana-based decentralized exchange Jupiter surpassed Uniswap in trading volume, signaling a shift in the DeFi landscape.

- In a concerning revelation by on-chain detective ZachXBT, Ripple suffered a major theft of 213M XRP, valued at $112.5M, with the stolen funds laundered through various exchanges, causing a drop in XRP's price.

- Polygon's Immutable zkEVM mainnet has launched in early access mode, marking a significant step in scalable blockchain solutions.

- Solana-based Unibot announced a new token, sparking debate within its community regarding the project's direction.

- Treasure DAO saw a governance proposal put forward to move to Optimism.

- Abracadabra Finance's MIM stablecoin deviated from its peg following a $6.5M hack, highlighting the vulnerabilities in the stablecoin sector.

- In a positive development for the Bitcoin ecosystem, Bitcoin-based decentralized exchange Portal secured $34M in seed funding, showcasing growing investor interest in Bitcoin-centric DeFi solutions.

- Ethereum continues to evolve, with the 'Dencun' upgrade going live on its second testnet, paving the way for further advancements in the Ethereum network.

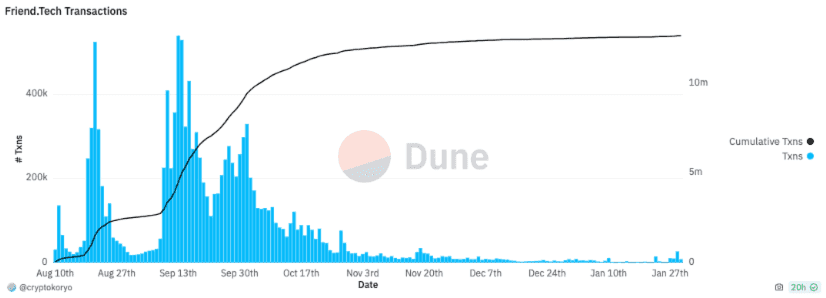

- Lastly, Friend Tech, once a viral sensation, now faces challenges as its user base dramatically drops.

Excitement continues to brew in the crypto community as notable projects prepare for upcoming releases and events. The Jupiter launched on prominent exchanges like KuCoin, HTX, OKX, and more. Simultaneously, developer Ming Ng and the Ovols team introduced WEN, a Solana meme-coin, as part of the Jupiter airdrop buildup.

WEN, a proof of concept for the WEN New Standard (WNS), introduces a novel token standard for Solana NFTs, backed by LFG. Over one million wallets received WEN, surpassing a total value of $100M, serving as a stress test for Jupiter's infrastructure and the Solana network. Expect further innovations as Solana projects leverage these token standards.

Meanwhile, ZetaChain is on the cusp of launching its mainnet, aiming to bridge major cryptocurrencies like Bitcoin and Ethereum, ushering in a new era of interoperability for seamless cross-chain transactions. In another exciting development, Meson Network is conducting a token sale on CoinList on February 8. This sale offers 5M MSN tokens, equivalent to 5% of the total supply, at $1.75 per token. Meson Network's mission to create a bandwidth marketplace for the Web3 era reflects the diverse and innovative projects emerging in the crypto space.

Blue Chip and Majors Overview

Jupiter

Jupiter Exchange, a prominent Solana-based decentralized exchange, recently executed one of the largest token airdrops in history, distributing approximately $700M worth of its JUP token to nearly a million wallets. The airdrop, which took place without major issues on the Solana blockchain, saw the JUP token price soar from an initial $0.41 to $0.72, achieving a fully diluted market cap of over $6B. However, the price has since dropped to $0.60.

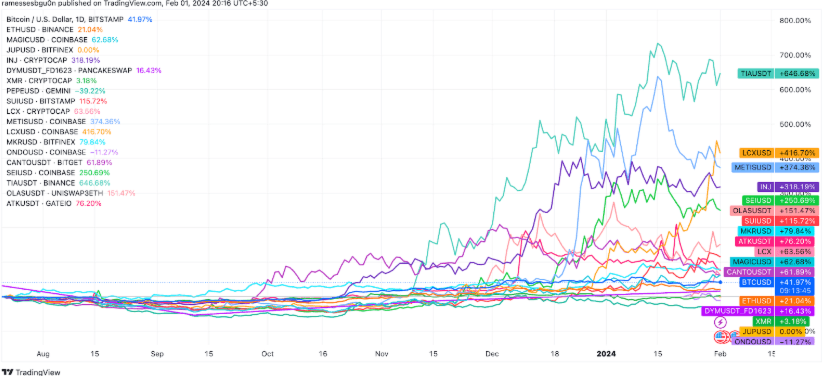

- Bitcoin (BTC) - Bitcoin has just hit its 5th straight month of gains after registering a 2% increase in January when it saw considerable price swings following the spot Bitcoin ETF approvals. Following its recent drop to the $38,500 mark, Bitcoin has made a strong recovery and is currently trading at $42,043. With the GBTC outflows slowing down and the Bitcoin Halving event under three months away, BTC holders are hopeful for a significant price increase over the next couple of months.

- Ethereum (ETH) - Following the approval of spot Bitcoin ETFs by the SEC, all eyes are on Ethereum. BlackRock filed for a spot Ethereum ETF in November 2023. However, the SEC delayed its decision to March. Now, Standard Chartered Bank has stated it expects the SEC to approve a spot Ethereum ETF on the 23rd of May, adopting the same strategy as it did for the spot Bitcoin ETFs. It also expects such an approval to push the price of ETH from the current $2263 to $4000.

- Magic (MAGIC) - MAGIC is the utility token that connects gaming communities in the Treasure Metaverse. The Treasure Metaverse is a decentralized NFT ecosystem on Arbitrum, a Layer-2 scaling solution for Ethereum. According to crypto analyst World of Charts, Altcoins ranked between 150 and 300 in market value and have considerable potential for growth, at the forefront is MAGIC, which is on the verge of a breakout. MAGIC had dropped to $0.41 on the 19th of October but has since recovered, rising to $1.21. World of Charts predicts a potential increase of 65%, which would see MAGIC cross $2.

- Dymension (DYM) - Multilayer rollup deployer Dymension is in the midst of launching its mainnet and is gearing up to airdrop 70M DYM tokens. The airdrop will be worth a staggering $210M at current prices. Currently, DYM is trading around the $4.6 mark.

- Injective (INJ) - While Injective has been in the red over the past month, INJ has registered a staggering increase of 933% over the past year. Recently, it emerged that the team will be unlocking INJ tokens worth $150M. This unlock could impact the token’s price, which is currently trading at $34. A previous unlock worth $22M back in August 2023 saw the price of INJ drop over 12%. In more positive developments, BitFinex announced the upcoming listing of INJ on its platform.

- Dogwifhat (DIF) - Dogwifhat (DIF) had been on an absolute tear in recent weeks, reaching its all-time high just two weeks ago. However, since then, its price has fallen by over 50%. Currently, the token is trading at $0.22, down 17% in the past 24 hours.

- Pepe (PEPE) - Another memecoin in the doldrums is Pepe. The PEPE token’s price has been on a steady downward trajectory, dropping over 35% in the last 30 days.

- Sui (SUI) - Sui recently broke into the top ten DeFi blockchains less than a year after its inception, with its TVL surging by over 1000% in four months. The SUI token has been on a similar trajectory and has registered an increase of nearly 8% over the past week. Currently, SUI is trading at around $1.44, having registered a drop over the past 24 hours.

- Metis (METIS) - The METIS token has seen an impressive surge in January, registering an increase of 173%, as its network continues to grow. This impressive surge can be attributed to MetisDAO launching the ecosystem development fund and increasing confidence in MetisDAO’s potential following its integration with the BitGet wallet.

- LCX (LCX) - LCX has registered impressive gains over the past month, rising by over 180%. The price has seen a fair amount of volatility over the past 24 hours but, nonetheless, is on an upward trajectory.

- Maker (MKR) - Maker (MKR) has been relatively bullish over the past month, registering an increase of 19%. Analysts expect that MKR could see a further price increase due to its trading volume being on the rise, resulting in short-term gains for holders.

- Ondo (ONDO) - Investors are rushing to purchase the ONDO token, which was launched on the 18th of January. Such has been the hype around the token that it topped $1B in its first week. Currently, the token is trading at $0.206, down by over 9% during the past 24 hours.

- Canto (CANTO) - Canto is an EVM-compatible layer-1 blockchain and part of the Cosmos ecosystem of interoperable chains and decentralized applications (dApps). Exactly a year ago, the CANTO token hit its all-time high. However, since then, the price has registered a gradual decline and is currently trading at $0.22

- Akash Network (ATK) - The native token of the Akash Network has had an impressive start to 2024. The token’s peak price for 2024 occurred on the 10th of January when it hit $3.34. However, the price dropped considerably following that, and AKT was trading at $2.32 by the 23rd of January. AKT has since recovered, rising by over 8% over the past seven days, and is currently trading at $2.76.

- Manta Network (MANTA) - The past 24 hours have been a little choppy for MANTA, with the token dropping by 6%. However, if you look at 2024 as a whole, MANTA’s price has continued to test new highs and registered a new all-time high of $3.83 just four days ago. The price has since corrected, and is currently trading just over the $3 mark.

- Bittensor (TAO) - TAO has registered an incredible increase of 61% over the past 30 days. In fact, TAO has been on an absolute tear, going from $340 on the 29th of January to its all-time high of $479 on the 31st of January. The reason behind TAO’s unprecedented increase is Ethereum’s Vitalik Buterin seemingly endorsing the token. Buterin mentioned the token in an article that talked about the challenges and promises of integrating artificial intelligence and blockchain technology.

- Velodrome Finance (VELO) - Velodrome Finance was recently added to Coinbase’s listing roadmap. The addition positively impacted the price, with the token going past $0.060 for a brief time. However, the price has since dropped, with the token trading at $0.053.

- TrustSwap (SWAP) - TrustSwap has been extremely bullish over the past couple of days, with its price registering a considerable increase. The price went from $0.156 on the 30th of January to $0.319 on the 31st of January. However, following this surge, the price registered a considerable decline and is currently trading at $0.221

- Ronin (RON) - Ronin’s end to 2023 and beginning of 2024 has been nothing short of impressive. At the end of October 2023, RON was trading at $0.49. However, since then, RON has gone on a bull run that has seen it surge into 2024. By the end of December 2023, it had gone past the $2 mark, ending the year on a high. RON continued its bullish momentum in 2024 and is currently trading at $2.80 and could very well cross the $3 mark again.

Smart Money Movements

- Smart Money has interacted the most with $INS and $EMERALD recently.

- $INS is an omnichain marketplace for inscriptions which has launched recently; they had two airdrop phases in the last few weeks and handled around 20M transactions in that period.

- $EMERALD is a new test project which introduced fungible NFTs, a pretty weird concept :) because what's the point of NFTs (Non-Fungible Tokens) then?! It has caught a good amount of attention.

- Smart Money is detected in $Trestle's LBP as well. It's a Celestia <=> ETH bridge that has plans to become a launchpad on Celestia as well. They will create a DEX on Celestia, so the launchpad could function smoothly. It has a pretty interesting concept because there are no smart contracts on Celestia, so creating a DEX on it will have a similar structure to OrdiSwap functions on Bitcoin, which doesn't have smart contracts too.

Yield-Farms

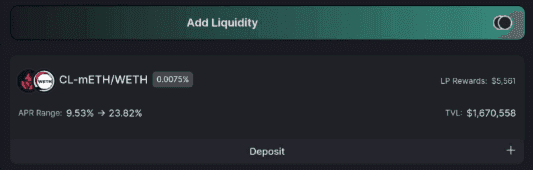

- Cleopatra is still favored by the smart yield farmers on Mantle. Check out the CL mETH + WETH pool ;)

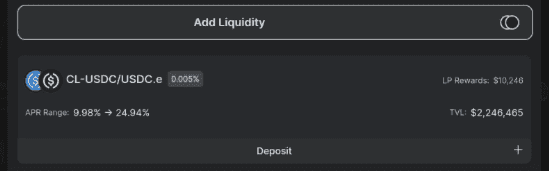

- Ramses on Arbitrum has gained some traction from the Arbitrum smart farmers. The stablecoin maximalists are in the CL USDC/USDC.E pool and enjoying the 10-25% APR.

Airdrop

- Smart Money has recently started depositing some funds into MODE Network, which is a new L2 and launched the mainnet. TVL has been growing at a rapid rate.

- Part of the Optimism Superchain, and they're airdropping 5.5% of the supply if you've had activity on ETH mainnet; you're eligible for the airdrop!

- It is a combination of SEI airdrop and BLAST/MANATA's airdrop, where you just need to bridge some ETH in.

- Currently invite-only, so use the link below: ref.mode.network/zGaUwj

- For the next week, you get boosted rewards and 2x rewards for interacting with dApps in the ecosystem.

Always Do Your Own Research (DYOR), but crypto has a way of rewarding users who are early!

NOTE: Because it's built on Optimism, it'll take a week to withdraw.

- You can use Pheasant Network as an alternative to bridge in and out since the main bridge currently only supports Ethereum.

This is just a preview of our L1, L2 and DeFi Weekly report, be sure to check out the full version of this report here.

NFTs & Gaming

Though the market is still ranging, and metrics across the ecosystem appear stable, builders are busy creating, and ecosystems continue to expand. Let's dive in!

Project Updates

- A new team of owners now leads the formerly popular NFT project, Lazy Lions.

- Holders of Pudgy Penguin and Lil Pudgy tokens can submit their NFTs for IP licensing to potentially secure individual brand deals.

- NiftyKit, a no-code NFT solution, is integrating with the Coinbase Base Blockchain, aiming to transform NFT creation.

- Amid ongoing legal disputes involving Binance, Ronaldo participated in a football match with holders of his NFT collection at a Binance-sponsored training event.

- Sotheby's marks the first individual poem sale with Bitcoin Ordinals Inscription.

- Taproot Wizards has delayed the 'Quantum Cats' sale for the second time following a turbulent debut. Sale was then delayed again till Feb 5th.

- NFT marketplace Magic Eden introduces a multi-chain wallet.

- Apeiron (APRS) has partnered with Talon Esports, where Talon will provide gaming and esports advice, insights, guidance, and co-host tournaments to expand Apeiron's reach.

- Immutable launches an early access mode for its Polygon-powered zkEVM mainnet.

- Amazon is developing a film based on the $3B Bitfinex hack, exploring the psychology of a crypto hustler linked to the Bitfinex breach.

- Forgotten Playland secures $7M in funding from Merit Circle, Spartan, and other investors.

- The P2E mobile strategy game, Heroes of Mavia, plans to launch its token on February 6th, with the game's release on iOS and Android scheduled for January 31st.

- Dtravel is tokenizing vacation rental bookings on the Polygon PoS blockchain with its v3 smart contract upgrade.

- Binance casts doubt on an NFT game that raised $115M during its minting process.

- A billionaire biohacker enters the world of NFTs with the Drip Solana airdrop.

- Gaming platform SkyArk Chronicles announces the completion of a $15M funding round.

- OpenSea CEO Devin Finzer remains open to acquisition rumors.

Blue Chip and Market Overview

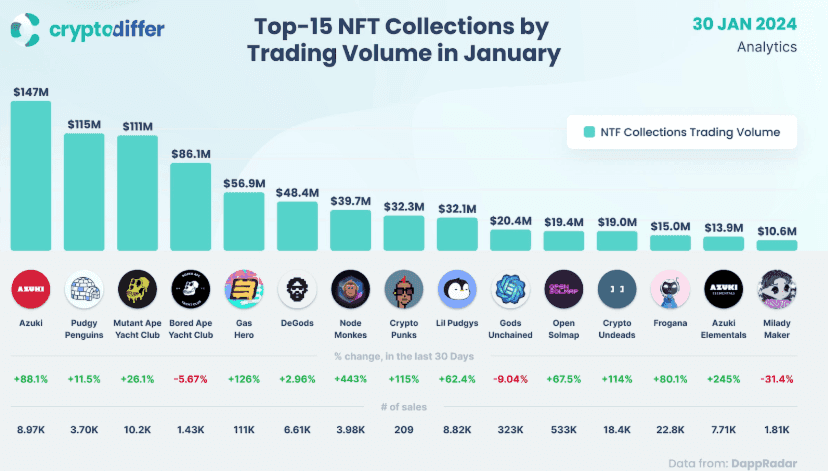

Azukis and Pudgy Penguins have emerged as dominant players in January's trading volume. Their continuous project updates and ecosystem growth have proven fruitful, causing both collections to surpass BAYC.

- Notably, there has been a decline in volume for BAYC, Gods Unchained, and Milady Maker. It is highly likely that in this bull market, we will witness significant changes in the top collections.

- Collections led by strong teams with well-defined goals and successful execution are expected to rise to prominence.

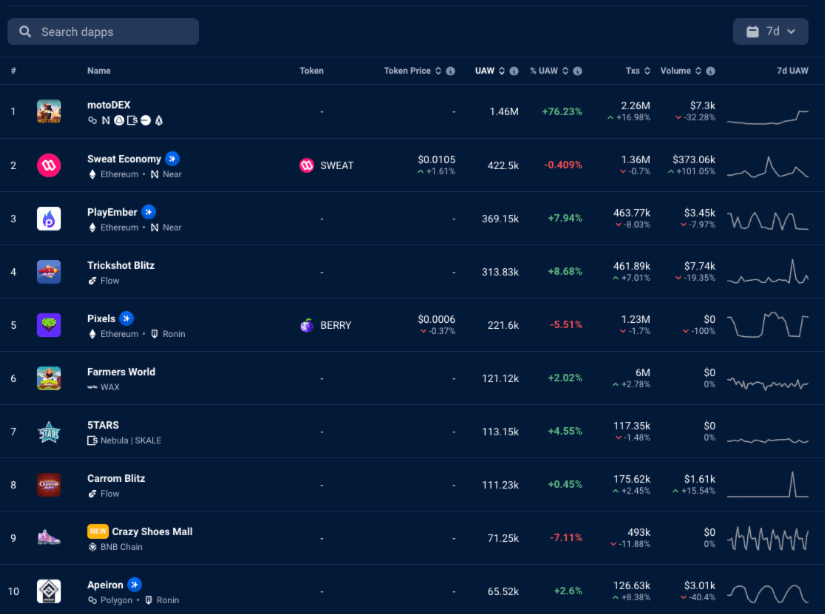

Projects such as Motodex, Sweat Economy, Pixels, Playember, and Farmers World are achieving remarkable success in terms of user engagement within the realm of crypto games. Particularly, Motodex has witnessed a substantial surge in its player base.

- One of the predominant challenges in the crypto gaming industry has been the integration of effective tokenomics with a captivating and enjoyable gaming experience for users.

- Traditional gamers have often been skeptical about crypto games, expressing concerns that the introduction of monetary aspects may negatively impact the gaming experience. However, it has been hypothesized that finding the right balance between these elements has yet to be achieved.

- It would not come as a surprise if, during this cycle, crypto games emerge that successfully address these concerns and pave the way for a new direction in the world of crypto gaming.

Wax Casino has emerged as a prominent player in the crypto gambling scene within the past week. In contrast, the success of Doge Casino appears to have been fleeting, as the protocol has dropped out of the top five rankings.

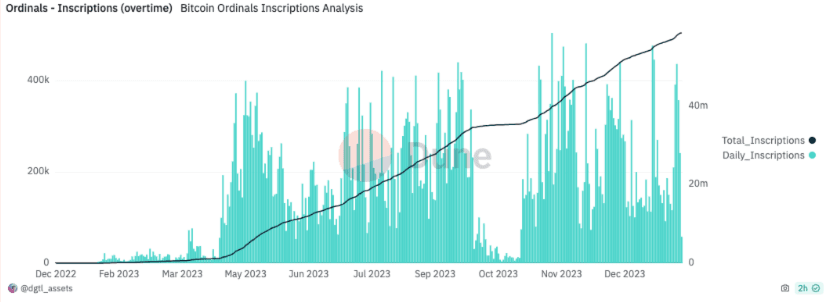

After experiencing a decline in Ordinals inscriptions in October of the previous year, inscriptions have been on a remarkable upward trajectory ever since.

- Despite occasional pullbacks, this trend shows no signs of slowing down, as the total number of inscriptions continues to increase significantly.

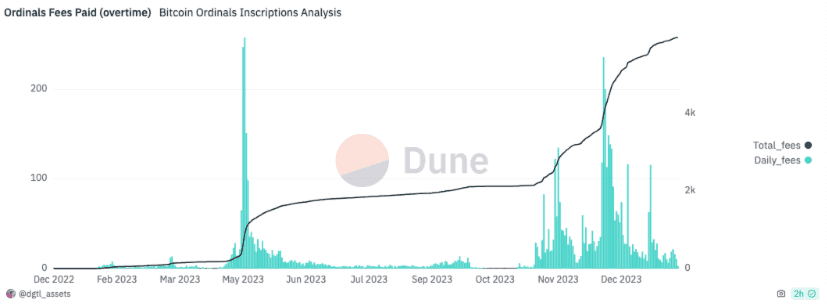

During May and December of 2023, Ordinals experienced some of its highest daily fee periods.

- While fees may have subsided since then, data suggests that fees generated from Ordinals transactions still play a crucial role in the broader BTC ecosystem.

Highlight recently published an article that provided some intriguing insights.

- A review of blockchain royalties in the NFT market reveals a significant decline in effective royalty rates for Ethereum NFTs over the past two years, with the average rate now at 0.8%, down 84% from about 5% two years ago.

- This decline resulted in artists and creators missing out on approximately $37M in payouts in December 2023 compared to 2021 rates.

- While some platforms like LooksRare, X2Y2, and Sudoswap contributed to these rate decreases by removing royalty enforcement, OpenSea and Blur remain influential.

- OpenSea plans to stop enforcing royalties on all collections by February 29, 2024. The impact of these changes varies by project type, with PFP projects experiencing the most significant decline, while art projects maintain relatively higher effective royalty rates, indicating a desire among collectors to support individual artists.

- The report suggests that there is an opportunity to reinforce positive-sum ecosystem behaviors and increase the effective royalty rates for artists in the NFT market.

Degen Corner

Immutable zkEVM, an Ethereum layer-2 network powered by Polygon's zkEVM technology, has launched its mainnet in early access, allowing approved developers to start building on the chain.

- The network aims to open access to all builders in 2024. In the meantime, the zkEVM testnet is available for experimentation and testing.

- The network's unique features include gas-free functionality, product integrations, smart contract templates, and a secure gaming environment.

- Games like Guild of Guardians, Shardbound, and MetalCore are set to launch on Immutable zkEVM in the first half of 2024.

- Immutable's IMX token has become a valuable gaming token with significant market cap growth.

Serum City, a city-building game featuring NFT assets from various collections, has been released.

- To access the game, you'll need an access pass, which is currently available to holders of specific NFT projects.

- Owners of NFTs from Mutant Hounds, Mutant Cartel Oath, Bored Ape Yacht Club, and Mutant Ape Yacht Club can claim a pass for free, with regular Ethereum gas fees applying. The game utilizes Ethereum NFTs and employs ApeCoin as its in-game currency, focusing on Mutant Ape characters.

- While it's not an official Yuga Labs project, Faraway, one of the co-developers, is collaborating with Yuga Labs on its own game initiatives.

Solana gaming platform MixMob is gearing up to release its MXM governance token and has plans for an airdrop to reward early supporters.

- MixMob intends to distribute 63M MXM tokens through an airdrop, which will be extended to those who purchased MixBot NFTs and participated in the game's incentivized beta testing.

- Notably, MixMob's recent MixBots NFT sale achieved tremendous success, generating over $2.25M in revenue.

- Following the token generation event, MixMob will introduce a new in-game season for Racer1, their initial game, which will be connected to an additional airdrop.

OKX is expanding its support for various blockchain token standards, including Atomicals (ARC-20), Stamps (SRC-20), Runes, and Dogecoin's Doginals (DRC-20).

- The platform plans to introduce a marketplace in the near future to facilitate transactions involving these tokens. OKX is set to integrate the SRC-20 standard for Bitcoin token viewing and transfers on February 5, followed by the integration of ARC-20, DRC-20, and Runes standards later in February.

- Currently, OKX Wallet's inscription tool supports minting on 23 different networks, including Bitcoin, Dogecoin, Ethereum, Polygon, BNB Chain, Avalanche-C, and Arbitrum One, among others.

- OKX's Chief Innovation Officer, Jason Lau, emphasized that inscriptions are purely Web3 products and will endure as long as the underlying blockchain exists. Lau views inscriptions as a new canvas for Web3 creators, offering flexibility and permanence.

- He highlighted the importance of selecting the appropriate blockchain for different NFT projects based on factors like block space and demand, emphasizing the need to store art and data immutably on-chain.

Yuga Labs is launching "Dookey Dash Unclogged," a sewer racing game that will be free to play and available on mobile devices and PC in February.

- Players race through sewers, dodging obstacles and earning points.

- The game will feature new characters, vehicles, leaderboards, in-game stores, tournaments, and prizes.

- NFT holders from BAYC, MAYC, BAKC, and HV-MTL collections can expect token benefits.

Learn about the first inscription protocol on Metis, Nuvo, with the following thread.

https://twitter.com/MoneyCrptBunny/status/1752269304580718862

Notable investors have raised concerns about certain web3 gaming projects. In the case of AOFverse, Dingaling sold all his AOFverse NFTs at a significant loss due to disappointment with the newly announced $AFG token details, which caused a sharp drop in floor prices. For a more detailed overview, check out the thread below.

https://twitter.com/lambolandnft/status/1752170540461121997?s=46&t=uFhFxWu2a5HxIKlrqf2s0A

This is just a preview of our NFT Weekly report, be sure to check out the full version of this report here.

Enjoyed this article?

- Subscribe to Crypto Pragmatist by M6 Labs newsletter for crypto-native industry insights and research read by 30k+ subscribers

- Follow us on Twitter for Tweets providing top-notch insights and bridging the gap between users, builders, and leaders in the crypto space

Disclaimer: These are the writer’s opinions and should not be considered investment advice. Readers should do their own research.