M6 Labs Crypto Market Pulse: Alpha and Opportunity Everywhere!

The article provides a comprehensive overview of the Fantom blockchain and its recent surge in popularity. It highlights the importance of monitoring crypto Twitter and other platforms to track emerging narratives in the cryptocurrency market. The article lays out a step-by-step process for investigating a narrative, including identifying the narrative, researching the project, analyzing metrics, evaluating leadership and community response, and continuous monitoring.

The article also delves into the opportunities and ecosystem of the Fantom blockchain, including wallets, bridges, and top protocols. It discusses the rise of BRC20 tokens and ordinals on the Bitcoin blockchain and the potential of Runes as an alternative token standard. The article provides insights into the web3 gaming industry, highlighting the pillars of web3 gaming and the opportunities for monetization.

Furthermore, the article explores current opportunities in the web3 gaming sector, such as the GAM3SGG platform, Apeiron game on the Ronin blockchain, and the Gaming Catalyst Program by Arbitrum. It emphasizes the importance of following companies and protocols in the web3 gaming industry and engaging with games on blockchain networks like Arbitrum.

Overall, the article provides a detailed analysis of the Fantom blockchain, the web3 gaming industry, and the potential opportunities for investors and users. It offers a comprehensive guide for investigating narratives, understanding ecosystems, and capitalizing on emerging trends in the crypto market.

The article provides a comprehensive overview of the Fantom blockchain and its recent surge in popularity. It highlights the importance of monitoring crypto Twitter and other platforms to track emerging narratives in the cryptocurrency market. The article lays out a step-by-step process for investigating a narrative, including identifying the narrative, researching the project, analyzing metrics, evaluating leadership and community response, and continuous monitoring.

The article also delves into the opportunities and ecosystem of the Fantom blockchain, including wallets, bridges, and top protocols. It discusses the rise of BRC20 tokens and ordinals on the Bitcoin blockchain and the potential of Runes as an alternative token standard. The article provides insights into the web3 gaming industry, highlighting the pillars of web3 gaming and the opportunities for monetization.

Furthermore, the article explores current opportunities in the web3 gaming sector, such as the GAM3SGG platform, Apeiron game on the Ronin blockchain, and the Gaming Catalyst Program by Arbitrum. It emphasizes the importance of following companies and protocols in the web3 gaming industry and engaging with games on blockchain networks like Arbitrum.

Overall, the article provides a detailed analysis of the Fantom blockchain, the web3 gaming industry, and the potential opportunities for investors and users. It offers a comprehensive guide for investigating narratives, understanding ecosystems, and capitalizing on emerging trends in the crypto market.

GM, Anon! The halving is around the corner and memecoin season seems to still be in full swing. We have an action packed edition for you today covering all the hottest trends in crypto. Let’s get into it!

Today we’ll be covering.

- Overview of Fantom

- Learning to investigate a crypto narrative with Fantom

- Fantom ecosystem and opportunities

- The rise of Ordinals

- Community response towards Ordinals

- What are Runes?

- Runes actionables and opportunities

- Overview of web3 gaming

- Web 3 gaming actionables and opportunities

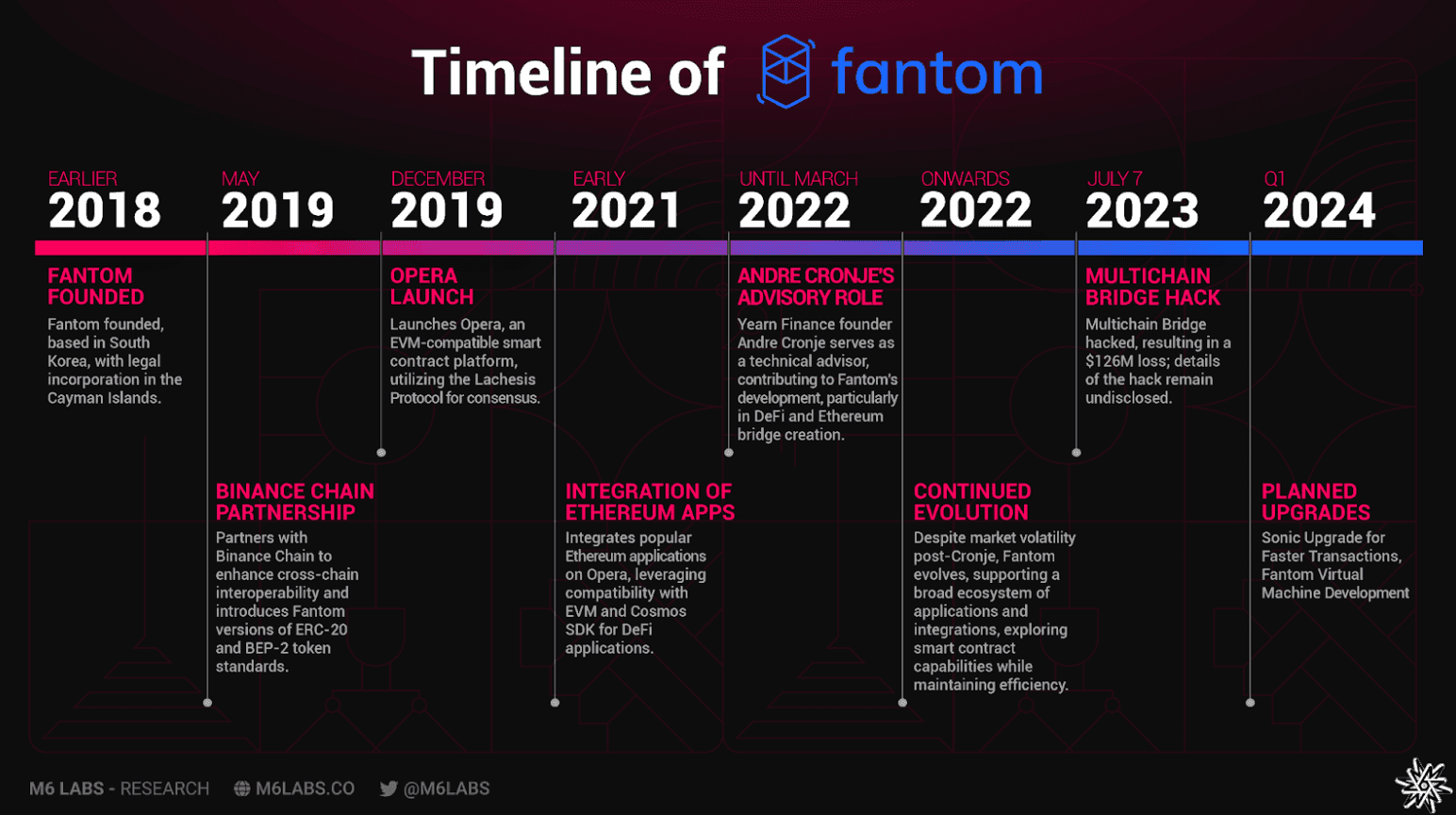

Fantom’s Timeline

If you’re active on Crypto Twitter, you may have noticed people beginning to talk about Fantom recently. Fantom is an EVM-compatible layer 1 blockchain. It is one of the main projects in the “Ethereum Killers” category.

You may even have just seen that the price was performing well and asked yourself what’s behind the move? Tracking bullish narratives in the cryptocurrency market is vital for investors looking to capitalize on emerging trends. As of right now, Fantom is an extremely hot narrative.

So, today, let’s do a real-time case study to understand what is happening with Fantom and show you how to do this for any project.

Because of the Sonic upgrade, Fantom has suddenly become a very hot narrative. In the next section, let’s explore how to navigate and analyze emerging narratives like this to make your investment decisions.

How to Investigate a Narrative

Step #1: Monitoring Crypto Twitter and Other Crypto Platforms

Crypto Twitter and social media are crucial for spreading crypto narratives, with influencers, developers, and community members sharing updates and speculations highlighting emerging trends. Subscribing to reputable newsletters like Crypto Pragmatist can also alert investors to bullish narratives.

Tools like LunarCrush or CryptoMood can help quantify social sentiment, offering a data-driven approach to narrative tracking.

These platforms offer insights into market sentiments and potential investment opportunities, making them indispensable for tracking real-time narrative shifts in the crypto ecosystem. In this case, we can see that Crypto Twitter has been talking a lot about Fantom.

Step #2: Identify the Narrative

The next step is recognizing the narrative. In the case of Fantom, the buzz is around its Sonic upgrade, which is expected to significantly enhance transaction speeds and ease developer migration with the new Fantom Virtual Machine (FVM). Such upgrades can lead to heightened interest and investment in a project, presenting the potential for substantial price movements.

Step #3: Research the Project Deeply

Upon identifying a bullish narrative, delve into the specifics. For Fantom, this means understanding what the Sonic upgrade entails, including its components like the FVM, Carmen Database Storage, and the optimized Lachesis Consensus Mechanism.

This phase requires studying the project's whitepapers, community discussions, and official announcements to grasp the upgrade's potential impact on the project's ecosystem and the broader crypto market.

Step# 4: Analyze, Analyze, and Analyze Some More

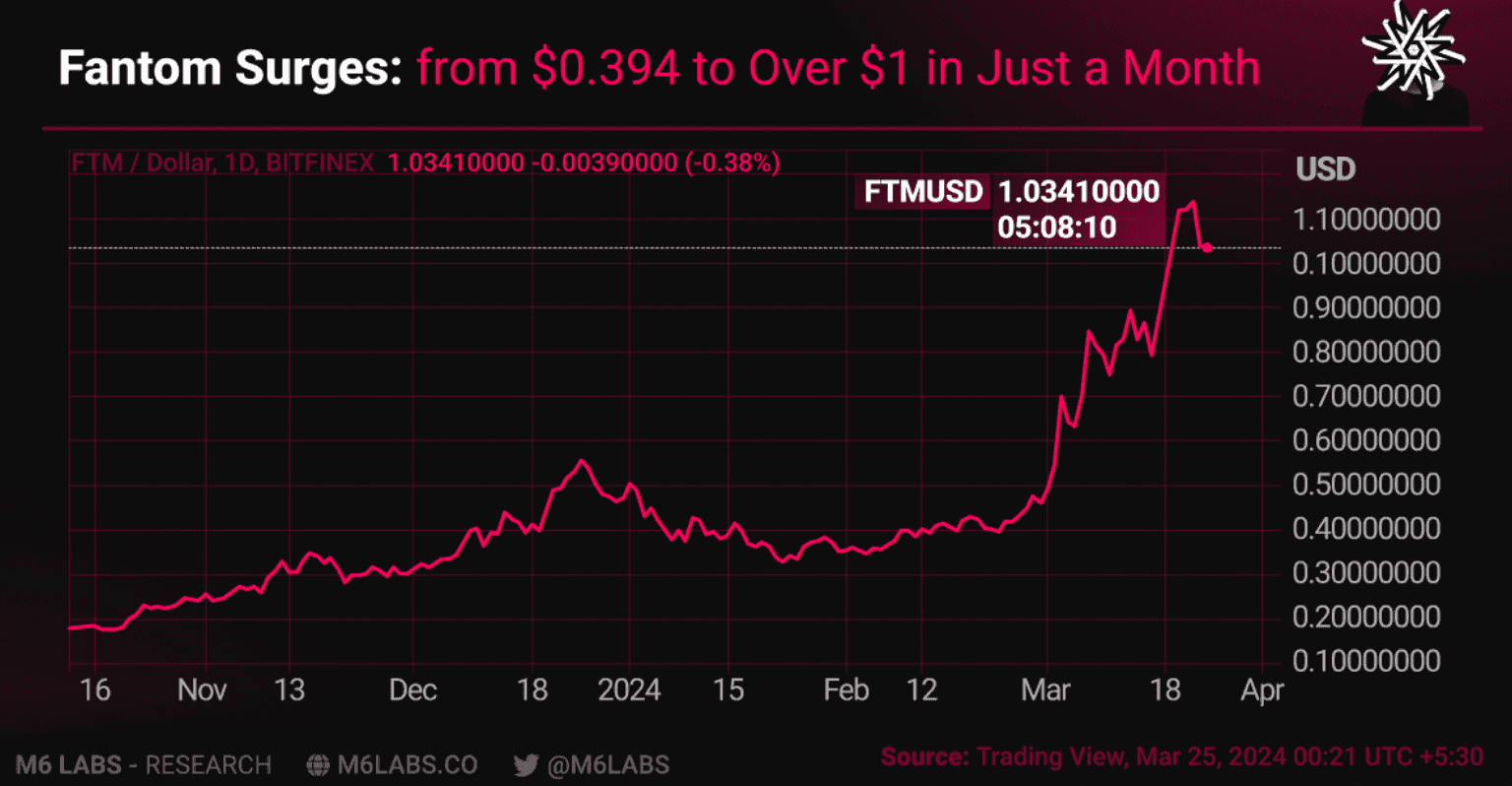

Understanding the market response to the narrative is crucial. The first thing is to see the price action.

FTM’s price has jumped from $0.394 to over a dollar in one month. That’s a pretty impressive price jump.

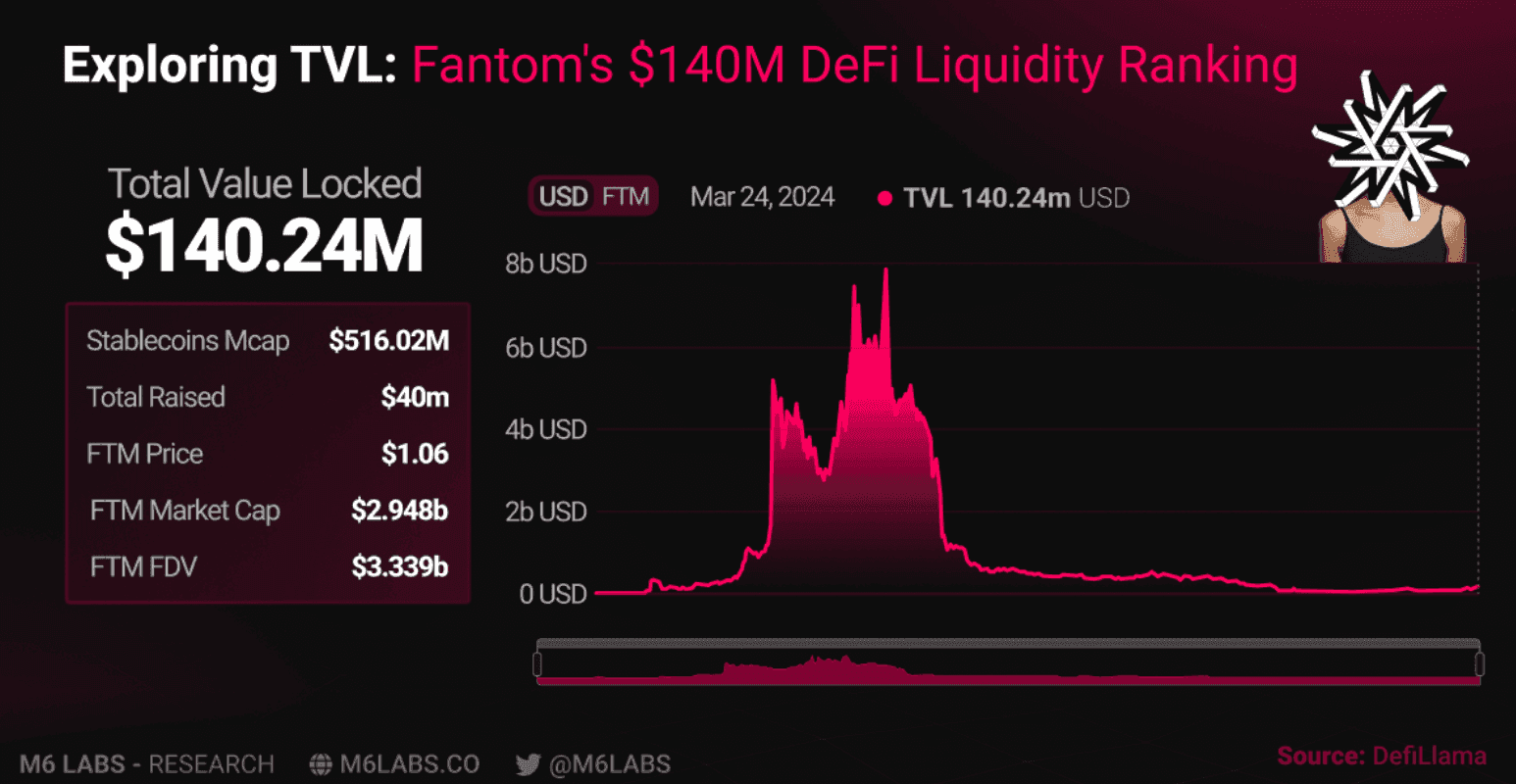

What about TVL? TVL or “total value locked” is the amount of liquidity locked up in DeFi apps within a network like Fantom. With ~$140 million, the TVL isn’t really that impressive. That’s number 32 among all chains.

In fact, Ethereum alone has as many as 49 protocols that currently hold more TVL than Fantom! But what about developer contribution?

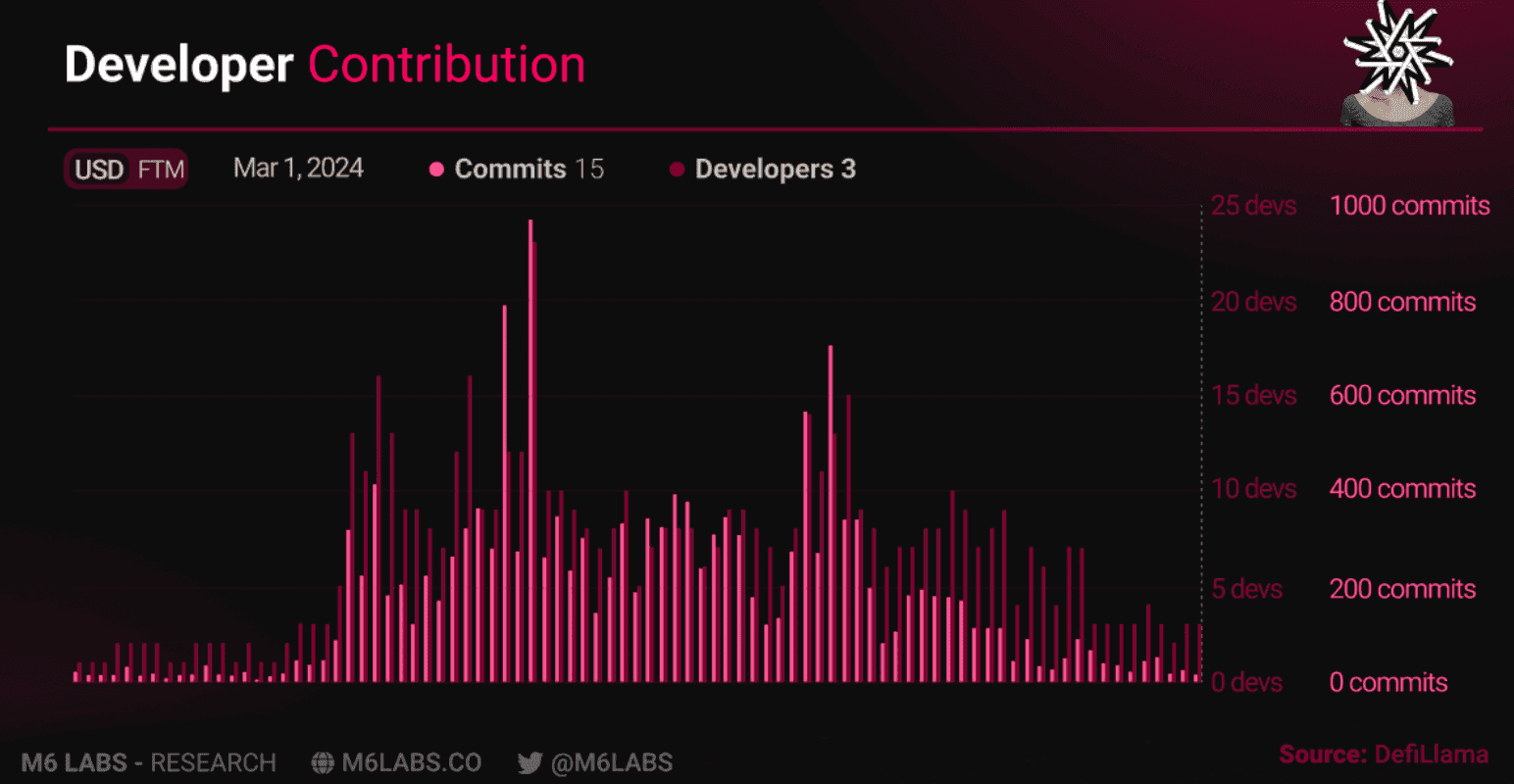

The number of developers and GitHub commits is minuscule compared to its peak. In comparison, Solana currently has 32 core developers and 758 commits.

Let’s check the Artemis terminal for a few more stats.

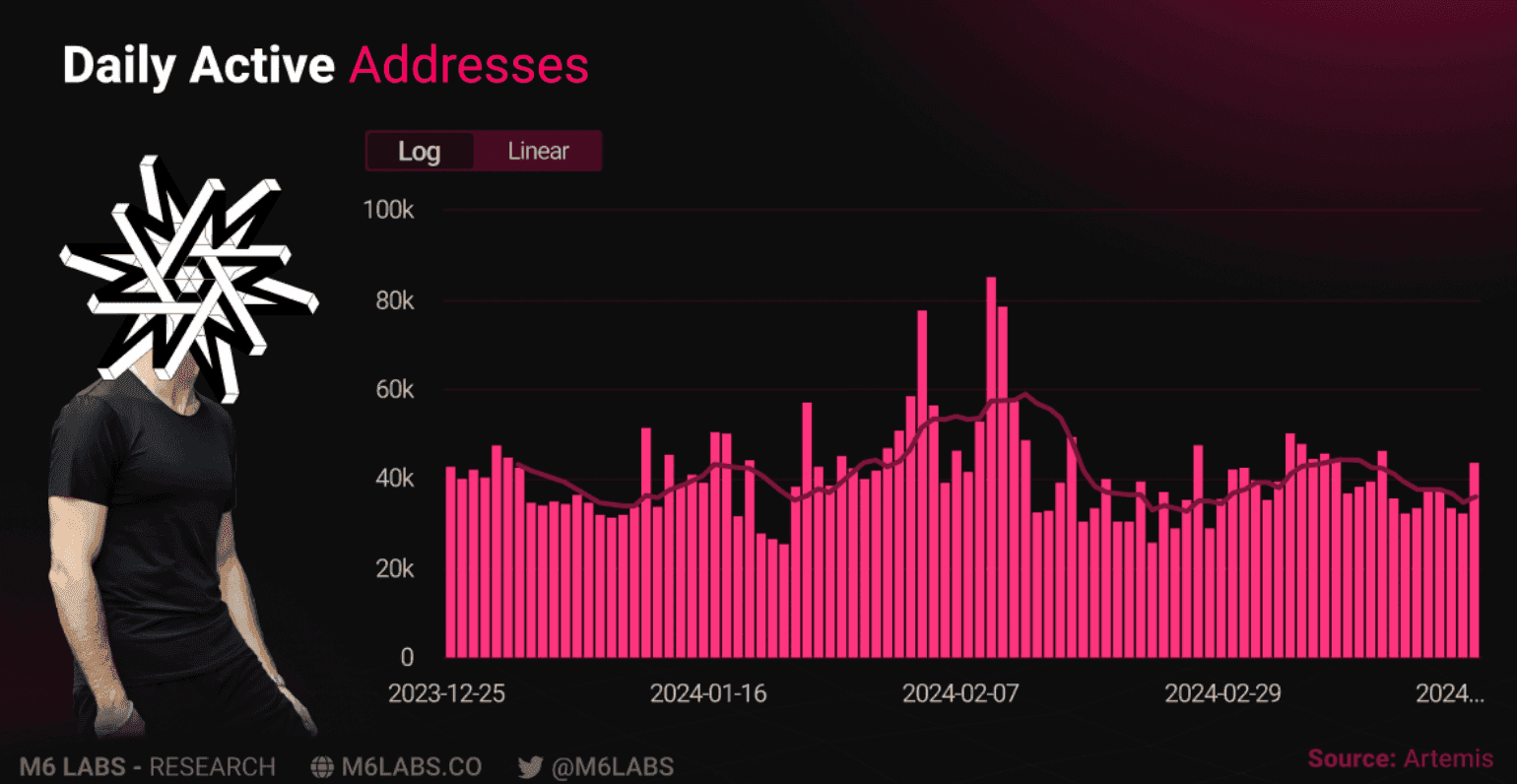

First, let’s check the number of daily active addresses. As you can see, the number of active addresses on Fantom is around 40,000 on average. It has maintained this number since Christmas 2023.

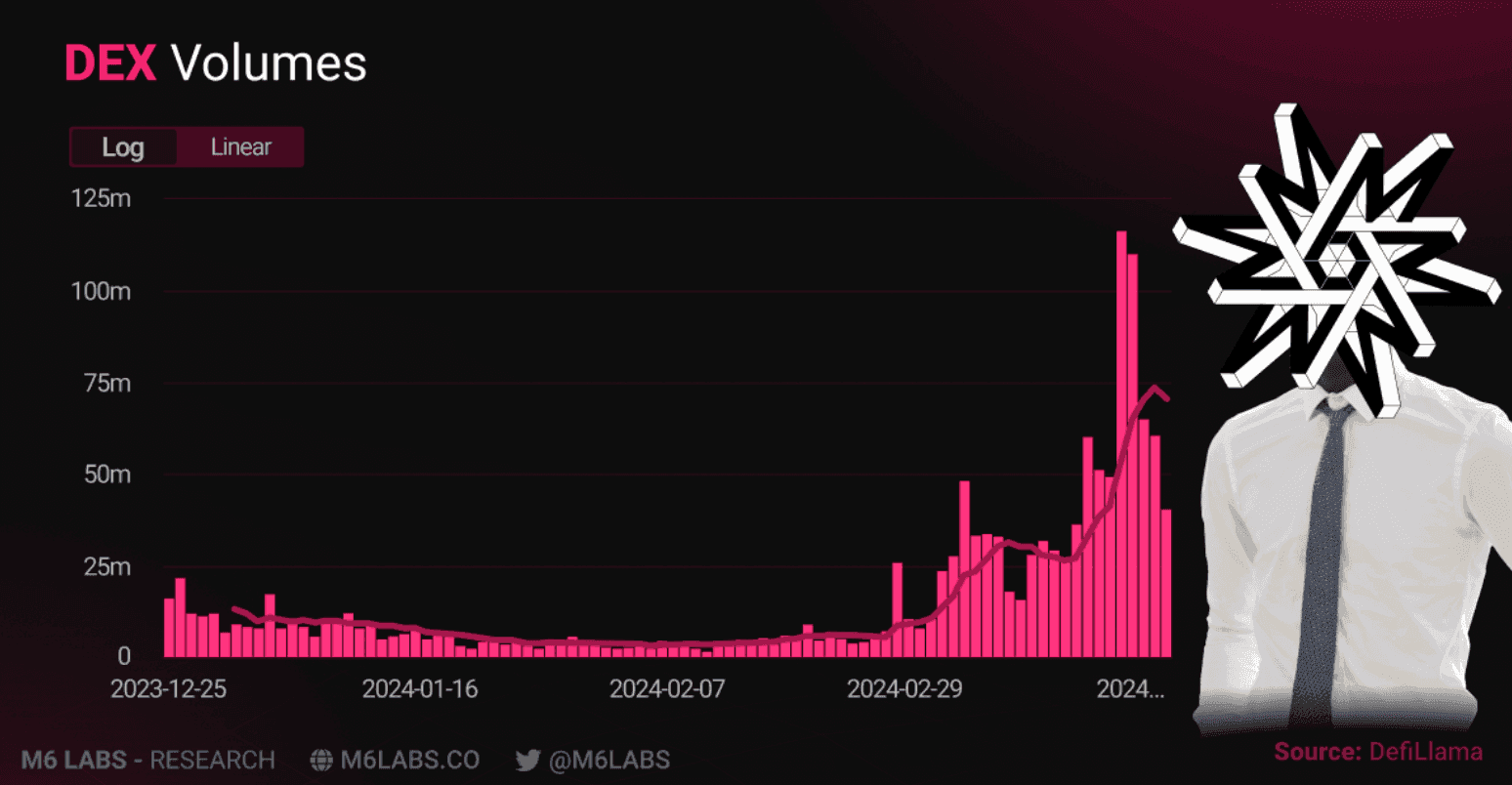

While the DEX volumes on Fantom have increased significantly, it still pales compared to the competition. This could mean two things:

- Fantom doesn’t have a lot of traction.

- Fantom’s upside is higher, and we are just getting started.

Studying so many metrics allows you to conduct your own study and not just listen to the noise.

Step #5: Evaluate the Leadership and Community Response

Fantom's past challenges, including leadership issues and community setbacks, highlight the importance of strong leadership and community in sustaining a project. DeFi savant Andre Cronje (the creator of Yearn Finance) is one of the most important leaders in Fantom.

While he is a genius, he can be temperamental. In March 2022, Cronje left the Fantom Foundation. However, in July 2023, news came out that he never left Fantom in the first place. Regardless, he is a respected builder, and sentiment towards Fantom could change based on his temperament.

Step #6: Continuous Monitoring

Bullish narratives can evolve rapidly. Keeping a continuous watch on the developments, both from the project's team and the community's response, is key. For Fantom, following the progress towards the Sonic upgrade's mainnet launch and observing the community's engagement levels are ongoing tasks.

Now that we've covered the fundamentals of investigating a new narrative, specifically focusing on Fantom, let's delve into how you can potentially profit from Fantom protocols.

Step #7: Drawing Your Conclusions

In the last step, assimilate everything you have studied and researched to draw your conclusions.

In this case, the metrics suggest that Fantom doesn’t have as much value as its competition, and its ecosystem isn’t nearly as rich as the others.

However, it could be a simple matter of FTM being extremely undervalued - both as an asset and an ecosystem.

Fantom Ecosystem and Opportunities

So now you’ve examined the narrative and decided you want to get involved. Let’s go through what you’ll need. Fantom boasts all the features one would expect from a thriving ecosystem. Most wallets readily support Fantom, making it as easy as adding the Fantom chain to your wallet to get started. You can use Chainlist to seamlessly add Fantom to your wallet or any other chain you wish to interact with.

Wallets

All major wallets, including Metamask, Trust, and Atomic wallets, support the Fantom blockchain. Additionally, Fantom has introduced its dedicated wallet, the Fantom PWA Wallet, designed for handling and storing FTM tokens. Leading hardware wallet manufacturers like Ledger and Trezor also support these chains, offering enhanced security. Ensure to store your Fantom tokens on a hardware wallet for added security measures.

Bridges

One of the most effective methods for potentially earning airdrops is by utilizing bridges that have received significant funding and operate without their own token. Bridges like Hop, for instance, have rewarded users for utilizing their services.

Taking advantage of these opportunities is typically straightforward, as users often need to transfer their funds across chains anyway. So, why not use a bridge that is rumored to offer an airdrop and reap the benefits for actions you were planning to take regardless?

Bridging technology has made considerable advancements since the last bull market, becoming more cost-effective and user-friendly. With the bridges discussed in this section, users can bridge to almost any desired chain and begin engaging within minutes.

Squid Router

Squid, a cross-chain router facilitating seamless token swaps and interactions across various blockchains, has recently secured $4M in strategic funding. This funding round was led by Polychain Capital, with participation from various investors, including Nomad Capital and North Island Ventures.

- This funding aims to support Squid's expansion in providing support for chains within the EVM and Cosmos ecosystems, as well as enhancing integrations with decentralized applications.

- Squid has experienced rapid growth, facilitating over 500,000 cross-chain token swaps, LP deposits, and NFT purchases, amounting to over $950M in volume, serving over 200,000 users.

- Looking ahead, Squid plans to further develop its capabilities to enable more complex transaction sequences and efficient routing of assets, while also integrating with additional interoperability networks.

- Given its funding and popularity, the likelihood of an airdrop from Squid is high since it also has no token.

- Visit squid router here.

Jumper

Jumper Exchange, created by LI.FI, aims to revolutionize crypto exchanges by offering a comprehensive solution to the challenges faced by users navigating multi-chain environments. LI.FI's vision is to simplify cross-chain transactions and provide users with a seamless experience.

- Jumper Exchange aggregates liquidity from the biggest and best sources, including bridges and decentralized exchanges, into a single interface, supporting 20 chains, 30 DEXs, and 15+ bridge integrations.

- With Jumper, users can swap, bridge, trade, or transfer tokens effortlessly, with automatic route recommendations based on factors like security, speed, cost, and clicks.

- LI.FI Protocol, the infrastructure behind Jumper, has received substantial funding, totaling $23M, through fundraising rounds involving prominent investors like Coinbase Ventures, DragonFly Capital, and CoinFund.

- While Jumper Exchange does not have its own token, its extensive funding and innovative approach make it a platform worth trying out, especially for potential airdrops when bridging to Fantom or other supported chains.

- Visit jumper here.

Bungee

Bungee, an innovative bridge aggregator built on the SocketLL infrastructure by the Socket team, revolutionizes token transfers across blockchains.

- The project has secured $12M in funding from Seed, Pre-seed, and Strategic rounds, with the potential for additional investments.

- Bungee has achieved impressive daily volumes exceeding $75M and has hinted at the possibility of a future airdrop.

- Supported by prominent investors such as Coinbase Ventures, Framework, Geometry, Mark Cuban, Folius, and Polygon co-founder Sandeep Nailwal, Bungee offers bridging capabilities across multiple chains, including Ethereum, Polygon, BSC, Avalanche, Fantom, and more, with minimal gas fees.

- While Bungee does not have its own token, its substantial backing and prospects for future development make it a promising platform, particularly for users interested in potential airdrops when bridging to Fantom or other supported chains.

- Visit Bungee here.

It’s important to keep these bridges handy for whenever an opportunity presents itself and you need to act quickly. Whether it be Solana, Base or Fantom, you need to be prepared to move funds around like a crypto pro.

Top DEX & Apps

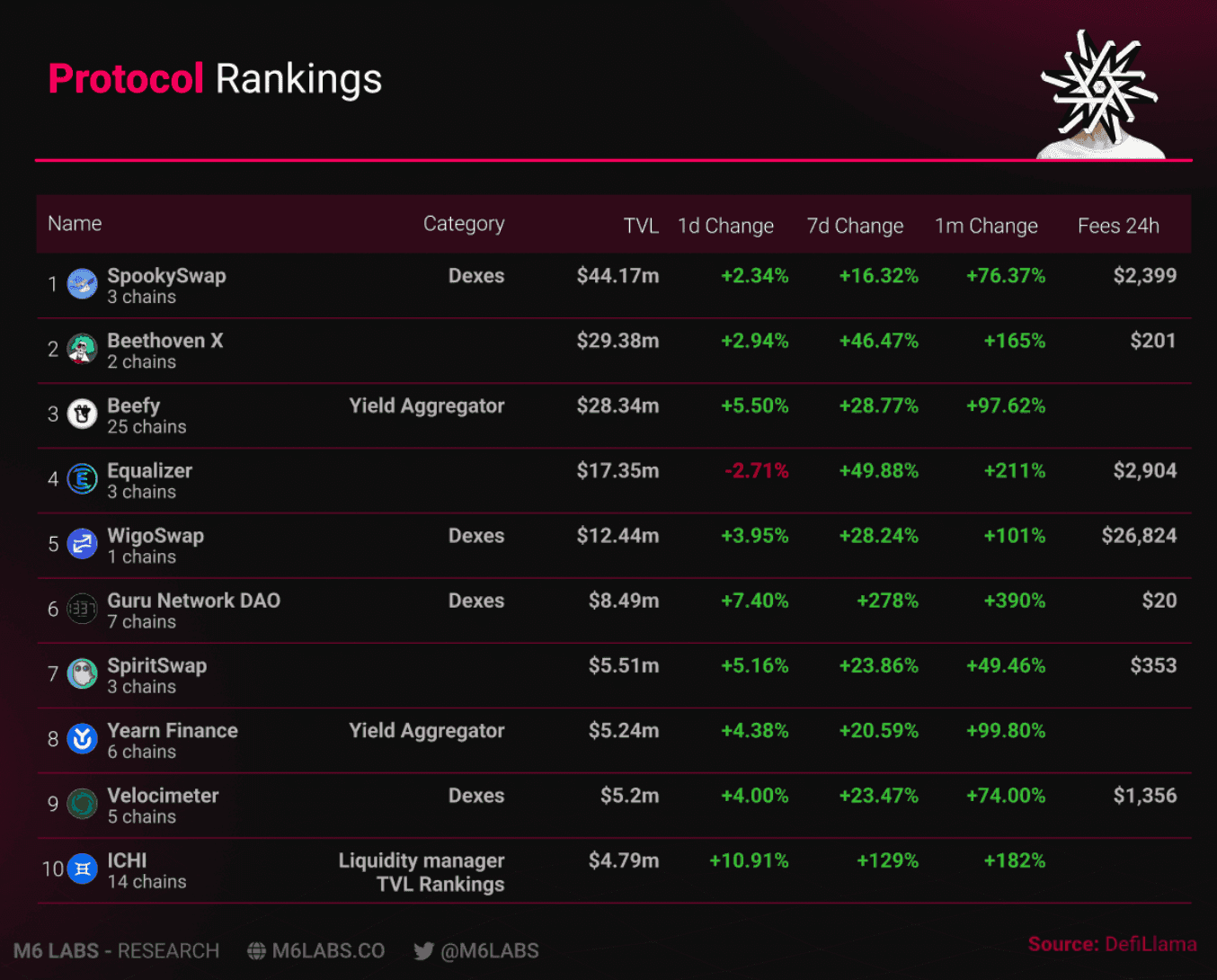

Now that you're familiar with the wallets and bridges used to access the Fantom ecosystem let's explore some of the protocols you can experiment with.

Taking a look at the top protocols by TVL on Fantom, we see familiar names such as Yearn Finance, but also some lesser-known protocols. While most of these platforms already have a token, the opportunity for yield farming could be beneficial.

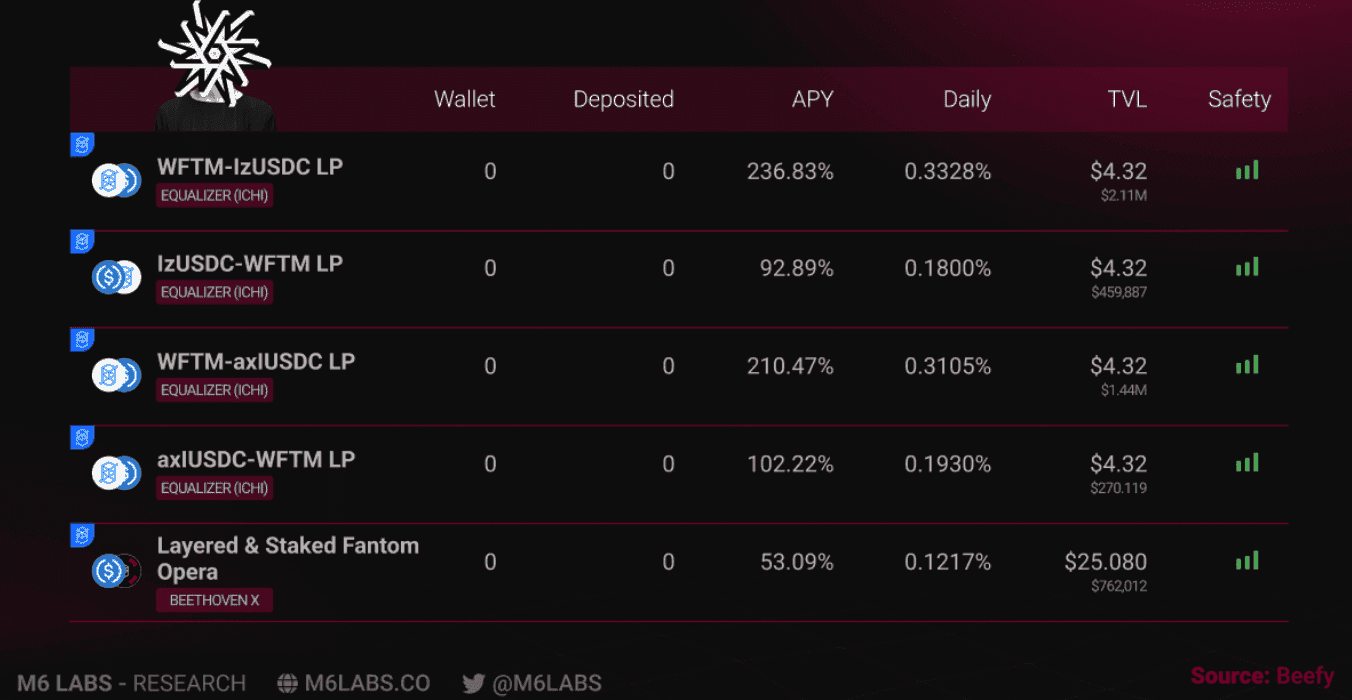

When examining Beefy, we observe some intriguing yields reminiscent of the last bull run, with APYs reaching as high as 236%. Stake tokens here to experience yield farming, but be sure to monitor them closely.

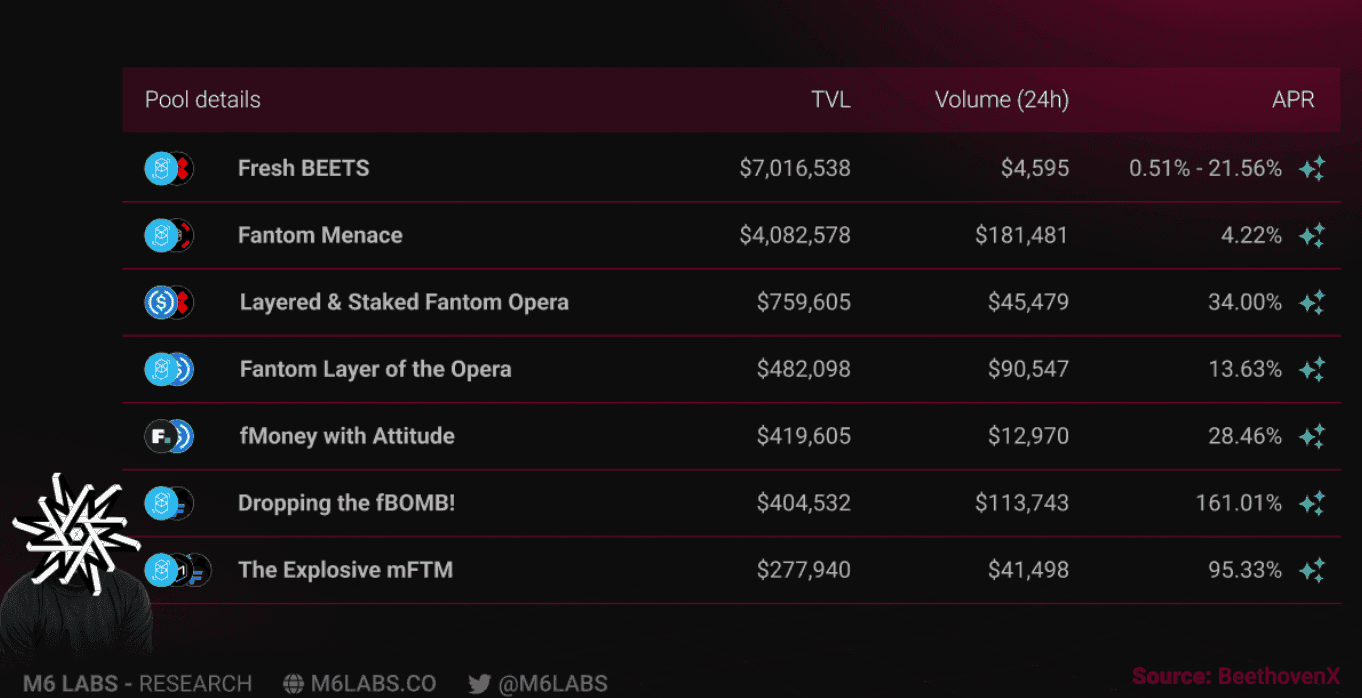

BeethovenX also offers similar yields, although its volumes are still relatively small. However, given the early stage of development, experimenting with yield farming in the Fantom ecosystem could yield benefits in the future.

For those who want to stake their unused FTM tokens or stablecoins, consider staking your FTM tokens on a CEX such as Coinbase for a current APY of 3.33% or stake with the Fantom Foundation for an APY of 6.3%, depending on the duration of your lock-up period. For stablecoin staking, checkout the pool on Stargate Finance and Beefy Finance, which currently have APYs of 22.9% and 10%, respectively.

Now moving onto Runes and Brc-20 tokens

The Rise of Ordinals

Back in the day, Bitcoin was primarily known as a simple cryptocurrency. However, times have changed. Recently, the Bitcoin network has embraced more complex functionalities with the advent of BRC20 tokens and Ordinals.

As things took off, people made a lot of money. For example, investing $100 in ORDI in December 2023 could have yielded $423 in less than 3 months!

As you can imagine, BRC20 tokens have drawn considerable attention, which, in turn, has sparked intense debate within the Bitcoin community. Critics have raised concerns that these innovations could clog the network, leading to higher transaction fees and slower processing times. The crux of the debate centers around finding a balance between expanding Bitcoin's capabilities and maintaining its efficiency and scalability.

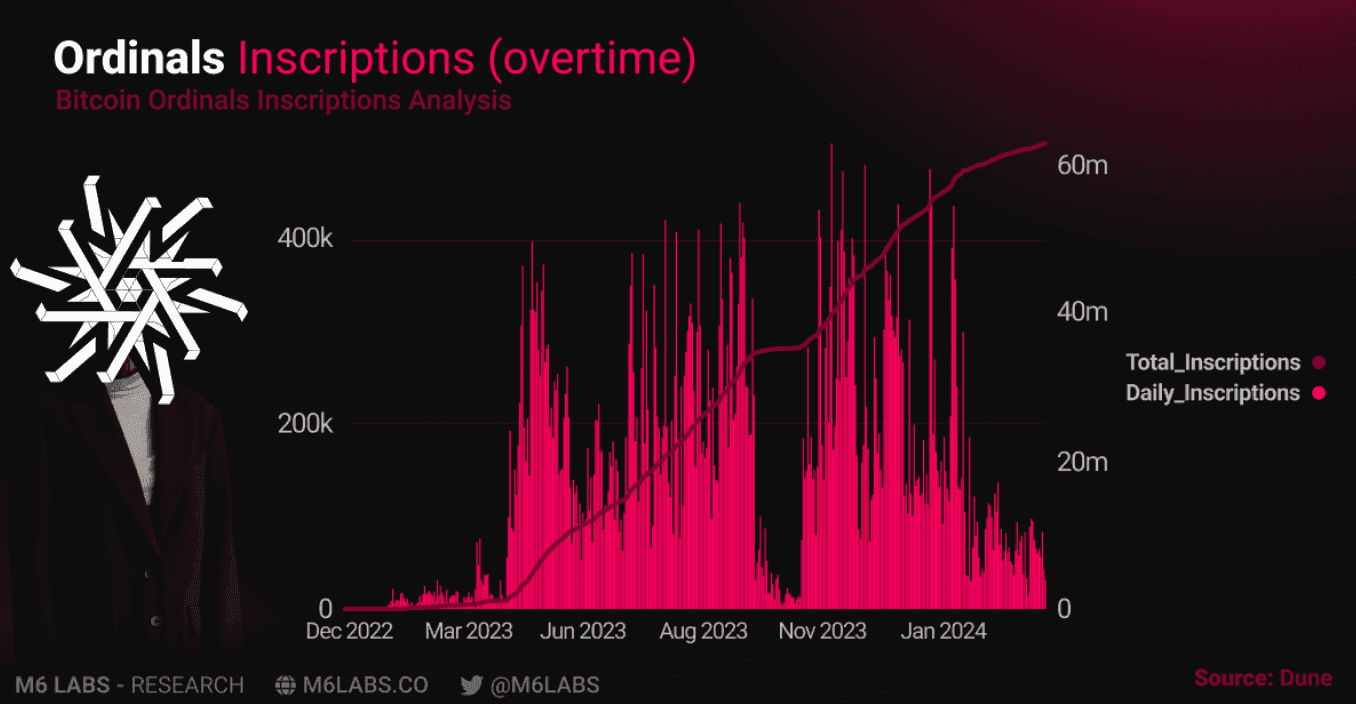

Ordinals have been an instant hit. The total number of ordinals minted over time has already crossed 60 million.

This evolution, spurred by the Taproot upgrade, has introduced a layer of programmability and uniqueness to Bitcoin that was previously associated with platforms like Ethereum.

So, before we go any further, let’s understand what Taproot is and how it works.

Taproot: The Gateway to Innovation

The journey towards BRC20 tokens and ordinals began with activating the Taproot upgrade in November 2021. Taproot is designed to enhance Bitcoin's scalability, privacy, and security. In essence, it makes Bitcoin transactions faster and allows for the creation of complex contracts in a simpler and more efficient way.

Taproot consists of three main upgrades:

- Schnorr Signatures (BIP340): This feature allows multiple transactions to be signed with just one signature.

- Taproot (BIP341): Focuses on making Bitcoin transactions smaller and faster by only showing essential information. This also adds an extra layer of privacy by making complex transactions appear simple.

- Tapscript (BIP342): Makes the Bitcoin programming language more flexible, allowing for easier future improvements.

Ordinals and BRC20

Ordinals bring the idea of non-fungible tokens (NFTs) to the Bitcoin blockchain. Introduced by developer Casey Rodarmor in early 2023, ordinals allow for the inscription of digital content, such as images, text, or code, onto individual satoshis—the smallest unit of Bitcoin. This inscription process transforms these satoshis into unique digital assets, each with its own identity and content. Ordinals have opened up new avenues for creativity and digital ownership on Bitcoin, from art and collectibles to unique digital experiences.

Parallel to the development of ordinals, BRC20 tokens represent an effort to integrate fungible token functionality into the Bitcoin ecosystem. Inspired by Ethereum's popular ERC20 token standard, BRC20 tokens are designed to allow users to create, exchange, and transfer tokens on the Bitcoin blockchain. This development aims to leverage the security and reliability of Bitcoin while expanding its utility to include tokenized assets, decentralized finance (DeFi) applications, and more.

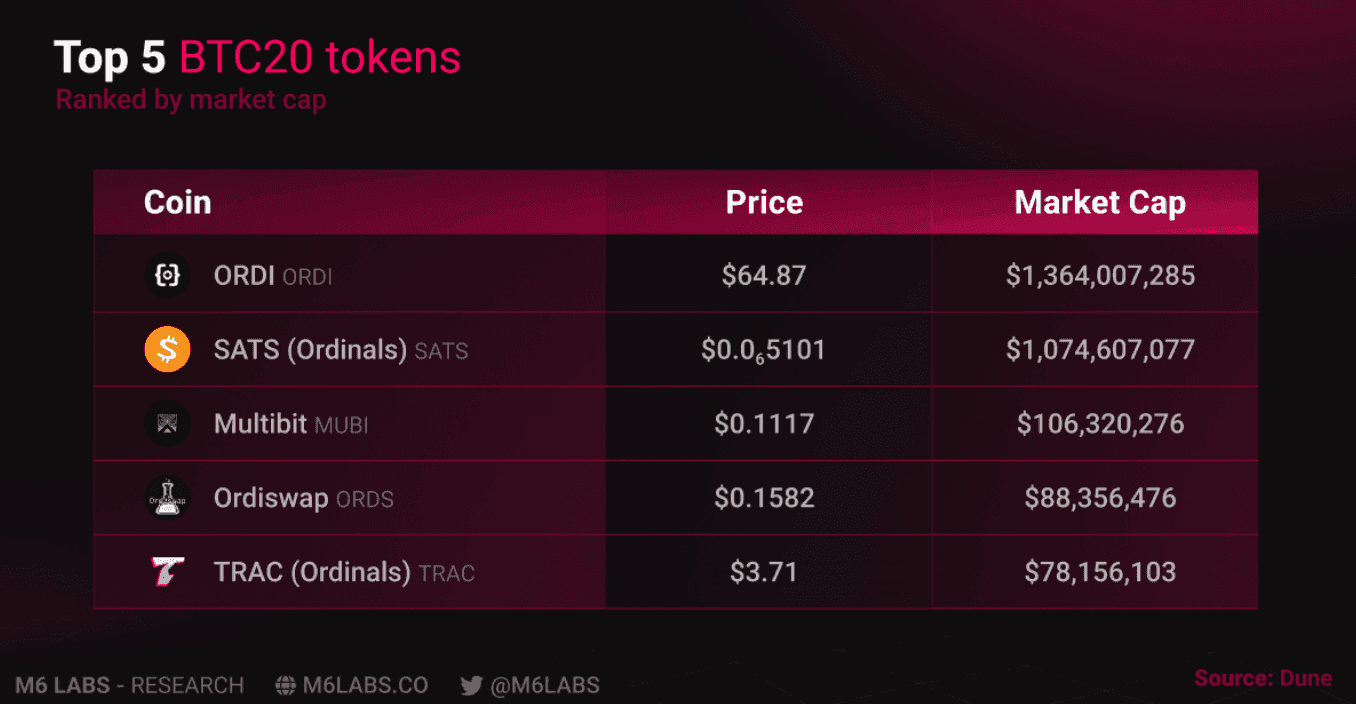

Here are the top 5 BRC20 tokens ranked by market cap:

The introduction of BRC20 tokens and Ordinals significantly shifted the “Bitcoin narrative.” No longer seen as just a digital currency, Bitcoin is now emerging as a platform for a wide range of decentralized applications and digital assets.

Community Responses and Debates

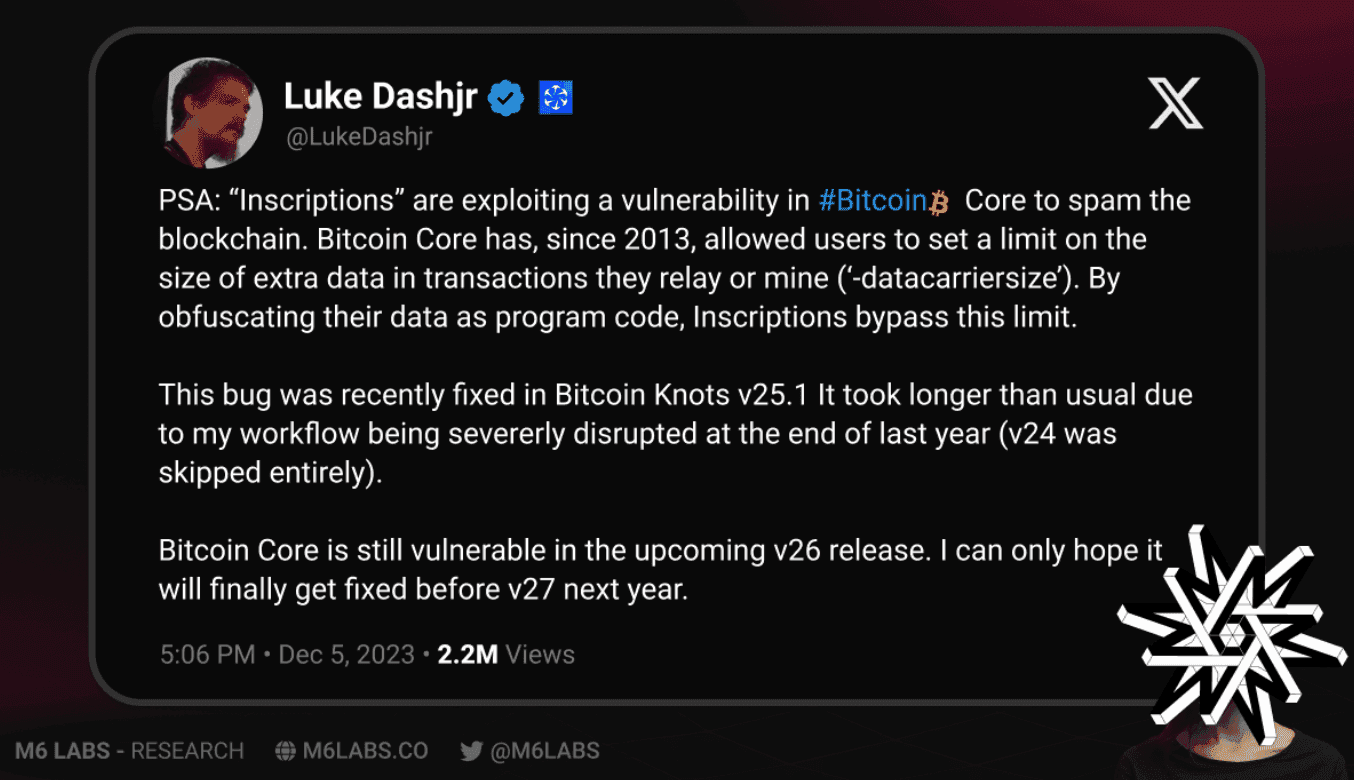

Community reaction to BRC20 tokens and ordinals hasn't been without controversy. Concerns have been raised about their impact on the Bitcoin network, particularly regarding blockchain bloat and potential spam. Critics argue that these new applications could lead to congestion, increasing transaction fees, and slowing the network. Critics worry these new functionalities could strain the network and distract from its core mission.

In fact, some, like Bitcoin core dev Luke Dashir, have even called Ordinals and “Inscriptions” a “flaw” in Bitcoin’s design.

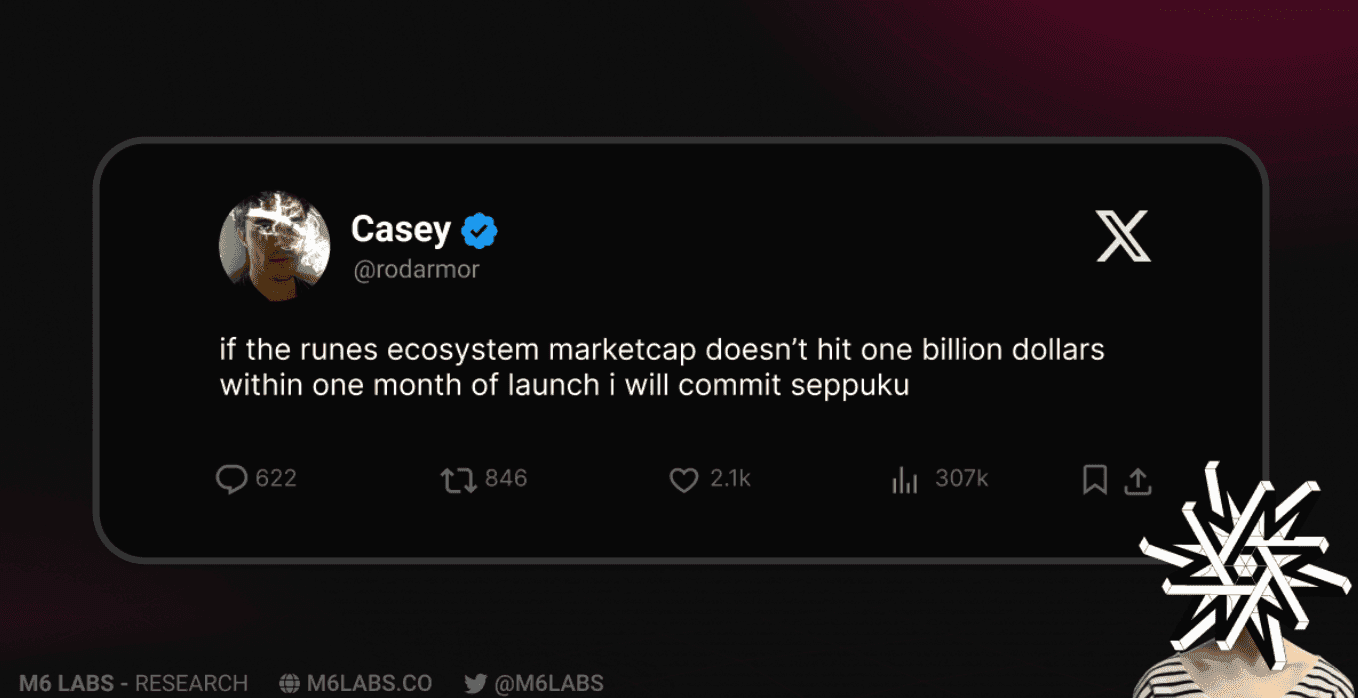

In response to these challenges, Casey Rodarmor proposed Runes, a protocol designed to offer a more efficient alternative to BRC20 tokens. Runes aim to minimize the blockchain footprint and manage UTXOs (Unspent Transaction Outputs) more responsibly, addressing the inefficiencies associated with the BRC20 standard.

What Are Runes?

If understanding Runes and the Bitcoin ecosystem seems confusing, don't worry. This aspect of the crypto ecosystem can indeed be challenging to grasp. Many users are accustomed to Ethereum, other EVM chains, and Solana. The user experience and level of knowledge required to profit from the Bitcoin ecosystem are more in-depth and complex, but that's why we're here! We'll make sure you stay ahead of the curve every step of the way.

The Potential of Runes

Runes protocol, spearheaded by Casey Rodamor esteemed creator of ordinals, aims to supplant existing token standards such as brc-20s with a more streamlined and efficient alternative.

Noteworthy for its potential for lucrative opportunities and strategic launch timing coinciding with the halving event, Runes has attracted significant attention. With Ethereum tokens valued at approximately $100B, excluding ETH, and ordinals around $2B, the fungible token market presents vast untapped potential.

As the Runes protocol debuts, early investors stand to benefit from its projected substantial market value within its inaugural week. Despite the subdued anticipation preceding its launch, astute investors are encouraged to explore this promising opportunity before wider adoption and subsequent market fervor ensue.

Runes Features

- Efficient UTXO-Based Model: Runes leverages Bitcoin's UTXO model for token management, minimizing network congestion and ensuring responsible UTXO management.

- Streamlined Token Creation: Unlike the cumbersome BRC-20 standard, Runes simplifies token creation and management, facilitating seamless asset issuance directly on the Bitcoin blockchain.

- Improved Usability: By eliminating reliance on off-chain data or native tokens, Runes enhances user experience and usability, making it more accessible to developers and users alike.

- Enhanced Utility: Runes enables the issuance of various fungible tokens, expanding Bitcoin's utility and attracting a broader user base.

- Increased Scalability: Lightning compatibility ensures near-instant and low-cost transactions, promoting scalability and mainstream adoption.

- Revenue Growth for Miners: Runes generates additional transaction fees, providing a crucial revenue stream for Bitcoin miners amid diminishing block rewards.

- RSIC Metaprotocol: Innovators are exploring novel applications like RSIC, combining Bitcoin Ordinals with yield farming to incentivize token holders and drive adoption.

- Transformative Potential: As developers continue to explore its capabilities, Runes is poised to play a pivotal role in shaping the future of decentralized finance on the Bitcoin blockchain.

Now that we've covered the basics let's explore how you can benefit from these developments.

Actionables and Opportunities

However, this barrier to entry increases profitability compared to other airdrops, where widespread user participation dilutes potential rewards, coupled with this, protocols often implement stringent measures to filter out users, ensuring more concentrated rewards for participants.

First and foremost, you'll need a wallet to engage with apps on the Bitcoin ecosystem, enabling you to purchase ordinals and tokens.

Xverse Wallet

Xverse is a comprehensive Bitcoin web3 wallet that allows users to manage BTC and other tokens like STX and interact with decentralized applications.

- The Xverse wallet, a Chrome browser extension and mobile app, ensures users retain full control over their private keys and crypto-identity.

- To set up your wallet, download Xverse and choose to create a new wallet or restore an existing one using a seed phrase.

- Securely backup your wallet's recovery phrase, choose your preferred security mode, and fund your wallet by purchasing tokens or receiving assets.

- Customize your asset view, manage digital collectibles, and earn Bitcoin rewards through the Xverse Stacking pool.

- Lastly, connect to Bitcoin web3 decentralized applications for a seamless experience.

- Download the wallet by clicking here.

Profiting From Runes

Now that you have your wallet set up and funded let’s head over to Magic Eden the most popular website for buying and trading Ordinals.

- To buy Bitcoin ordinals on Magic Eden, you first need to connect your wallet, such as Xverse.

- Once connected, ensure you have both the ordinals address for receiving your digital artifacts and the Bitcoin address for payments and transaction fees. Prepare your wallet by approving a transaction, which may take some time to process on the Bitcoin blockchain.

- Once prepared, browse oridnals on Magic Eden and purchase the desired item. Note that transactions may take up to 7 minutes to be confirmed, and purchased Digital Artifacts will be locked from trading until the transaction is finalized.

- Visit Magic Eden here.

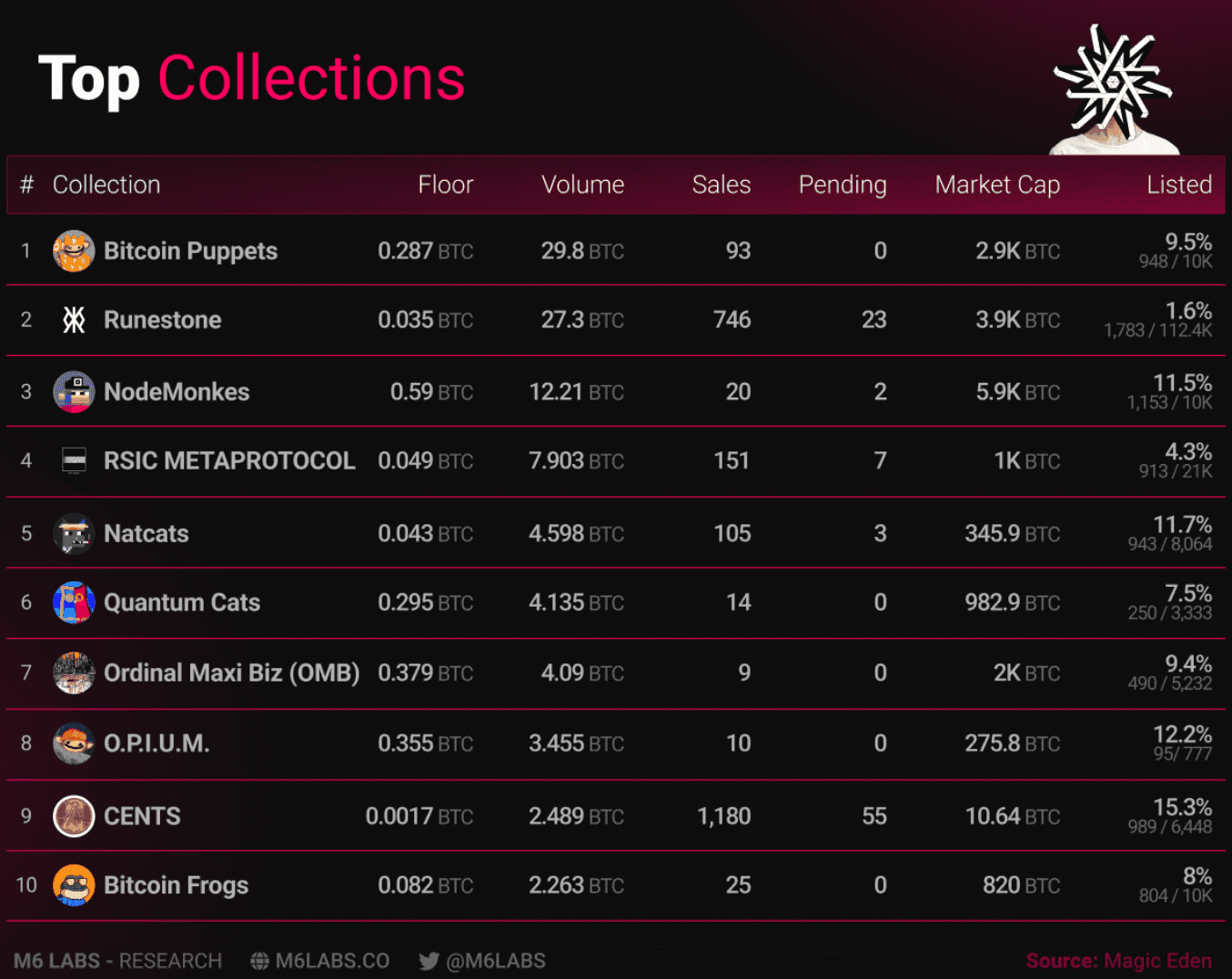

Below are some of the most popular collections on Magic Eden. However, things can get a bit tricky here. Many of these collections, but not all, are planning to launch their own tokens following the Runes upgrade. To be eligible for these airdrops, you must purchase and hold specific NFTs before the halving event. Let's explore some of these collections.

- RSIC: Considered a thought leader in the Runes space, RSIC was freely airdropped to early ordinal collectors, automatically activated upon purchase. It's believed that the RSIC team might be developing a full Runes DEX, offering potential rewards and incentives for holding post-halving.

- Runestone: A community-driven initiative spearheaded by Leonidas, Runestone tokens were recently airdropped to addresses with at least three Ordinals. While tokenomics are still being finalized, each Runestone holder is expected to receive a certain number of Runestone memecoin tokens post-halving.

- Rune Totems: Rune Totems offer maximum rewards when sent to the Bitcoin Genesis Address. However, this entails sacrificing the Totem to generate the most Runes, emphasizing a unique gameplay aspect within the collection.

- Rune Guardians: Rune Guardians comprise three types with varying rarity: Keepers, Sentinels, and Guardians. Unlike RSICs, Rune Guardians are automatically activated upon receipt, with the rarity determining the amount of Runes earned post-halving.

These are just a few key collections that can prepare you for the Runes upgrade. Many others are out there, so consider this a starting point to dive in. Time is of the essence, as the halving event is fast approaching!

For those eager to dive into the world of Runes and explore their potential within the Bitcoin ecosystem, our guide offers a detailed, step-by-step walkthrough on interacting with Runes through the Xverse wallet.

Crypto Gaming

Web3 Gaming combines blockchain technology with online gaming to completely redefine your gaming experience. Here, every click and conquest could turn into real-world treasures, redefining what it means to "play."

But hold on, why should this matter to you? Why ride into the Web3 wave?

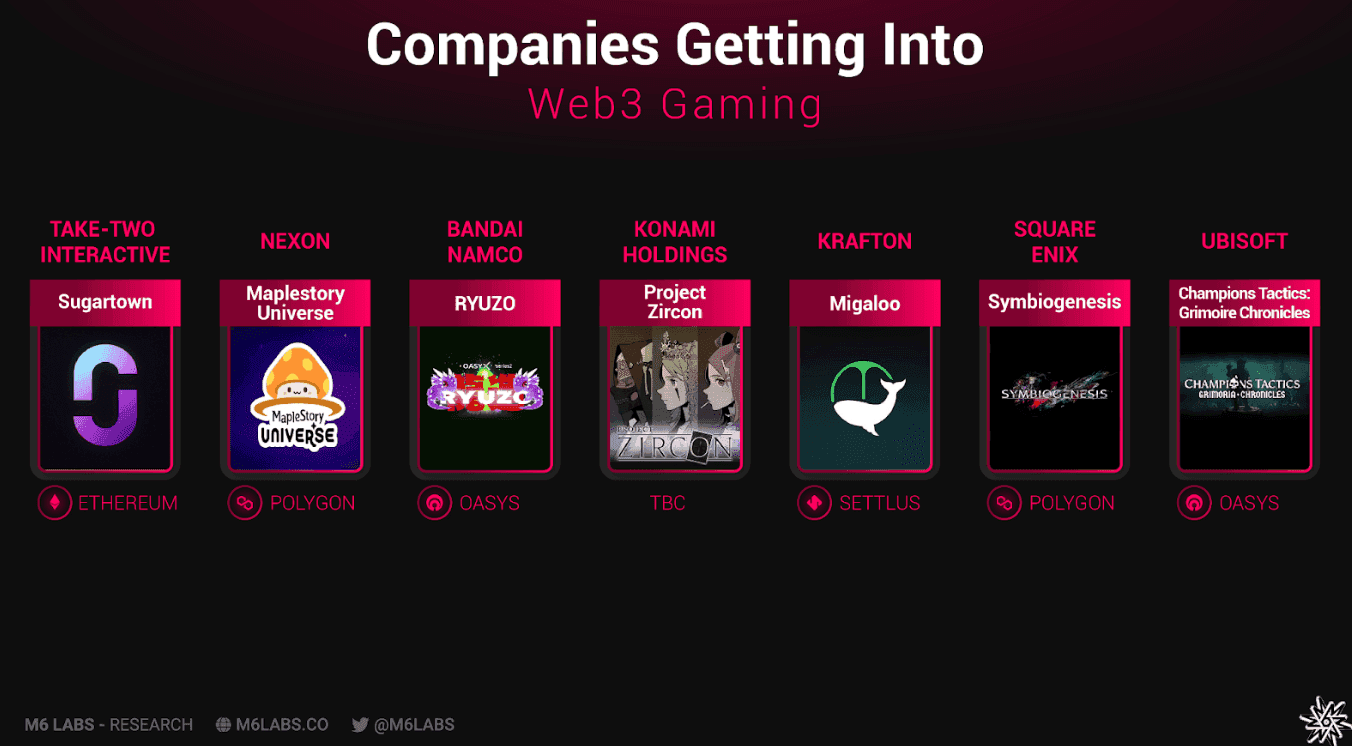

Check this out:

These are billion-dollar behemoths of the gaming world, and they are all zeroing in on Web3 gaming.

Yes, they're all in, betting big on the boundless potential of this sector. If these giants are making moves, you know there's something monumental at play!

If that doesn’t seal the deal, how about this?

Gaming tokens are currently worth ~$30.5 billion, and we’re just getting started. We are just in the beginning stages of the bull cycle!

According to a recent study by Fortune Business Insights, the global blockchain gaming market is projected to grow to $614.91B by 2030, at a CAGR of 21.8%!

But here's the deal - we're not about reckless gambles. We're here to arm you with the intel you need to make your own investment decisions with confidence.

In this power-packed edition, we'll decode the mysteries of Web3 gaming,

How Do Web3 Games Work?

To understand the core philosophy, let’s look at the pillars of Web3 Gaming

- True Ownership: In Web3 gaming, when you earn or buy a digital item, it's truly yours. This means you can prove ownership, trade items with others, or even sell them for real-world currency, something unheard of in traditional gaming models.

- Play-to-Earn (P2E): A revolutionary aspect of Web3 gaming is the "Play-to-Earn" model. As you engage with the game, you can earn digital assets or cryptocurrency with real-world value. It's a model that makes gaming more rewarding and opens up economic opportunities, especially in parts of the world where they may be scarce.

- Community and Governance: Web3 games often come with built-in governance structures that give players a say in the game's development and direction. Through decentralized autonomous organizations (DAOs), players can vote on major decisions, contributing to a game that truly reflects its community's desires.

Web3 Gaming vs Traditional Gaming

Web3 Gaming and Traditional Gaming clearly contrast how they approach player engagement and ownership.

In traditional gaming, developers control all aspects of the game, including assets, servers, and rules, with any investment by players staying locked within the game's ecosystem.

Web3 Gaming, on the other hand, introduces a player-centric model through blockchain technology. It grants players actual ownership of in-game items, such as NFTs, allowing them to keep, trade, or sell these assets outside the game.

This not only makes gaming experiences potentially profitable but also shifts the control and value of gaming investments into the hands of the players, fundamentally altering the dynamics of online gaming.

Web3 Gaming: The Story So Far

Web3 gaming traces its origins to late 2017 with the launch of CryptoKitties, a blockchain-based game that revolved around the collection, breeding, and trading of digital cats. CryptoKitties ignited a lot of interest in the potential of blockchain gaming, leading to an array of innovative games like Splinterlands, Gods Unchained, and The Sandbox.

A significant milestone in this journey was the rise of Axie Infinity, which championed the P2E model. This model gained immense popularity, especially in regions with limited employment opportunities, as it allowed players to earn real income through gameplay.

At its peak, Axie Infinity's revenue from fees surpassed that of major cryptocurrencies like Bitcoin and Ethereum, showcasing the massive potential of P2E models. However, the sustainability of such models came into question as the influx of players led to a decrease in individual earnings.

Eventually, developers learned the importance of making entertaining games that enhanced user experience.

Future of Web3 Gaming

- Gamers may increasingly engage with DeFi through games that integrate DeFi elements in a user-friendly manner, making the complexities of decentralized finance more accessible and appealing.

- More traditional gaming companies are expected to adopt NFTs and blockchain technologies, indicating a shift towards mainstream acceptance and the blending of conventional gaming with crypto gaming innovations.

- A focus on fun and gameplay quality is anticipated to become a priority, with developers aiming to produce more engaging and entertaining games that happen to use blockchain technology rather than leading with the technology itself.

- Crypto game developers might start to minimize the use of blockchain jargon in their games and marketing, making their titles more approachable to traditional gamers who may be put off by complex terminology.

- 2024 could be a pivotal year for crypto gaming if developers listen to feedback and continue refining their strategies, focusing on fun, simplifying blockchain concepts for a broader audience, and integrating with traditional gaming worlds meaningfully.

How to Make Money With Web3 Gaming

Here's how users can monetize their involvement in Web3 gaming.

- Trading NFTs: Engaging in the buying and selling of in-game NFTs, including characters, items, or virtual land, on digital marketplaces offers a way to convert virtual achievements into real-world profit.

- Virtual Real Estate: Acquiring virtual land in games like Decentraland provides a unique investment opportunity. Owners can develop, lease, or sell these digital properties, capitalizing on their growing value.

- Earning Through Play-to-Earn: Many Web3 games reward players directly for their gameplay, offering a simple yet effective means to earn by participating in the game world.

- Creating and Marketing In-Game Items: Players with a knack for creativity can design and sell virtual goods within games. The appeal and utility of these items can lead to substantial earnings.

- Breeding and Selling Game Characters: Players can breed unique characters in certain games to produce new NFTs. These can be sold for a profit, representing a longer-term investment in the game's economy.

- Token Investment and Staking: Those who prefer a more hands-off approach can invest in blockchain games by purchasing and staking their tokens, benefiting from the game's success without active participation.

Web3 Gaming Stats

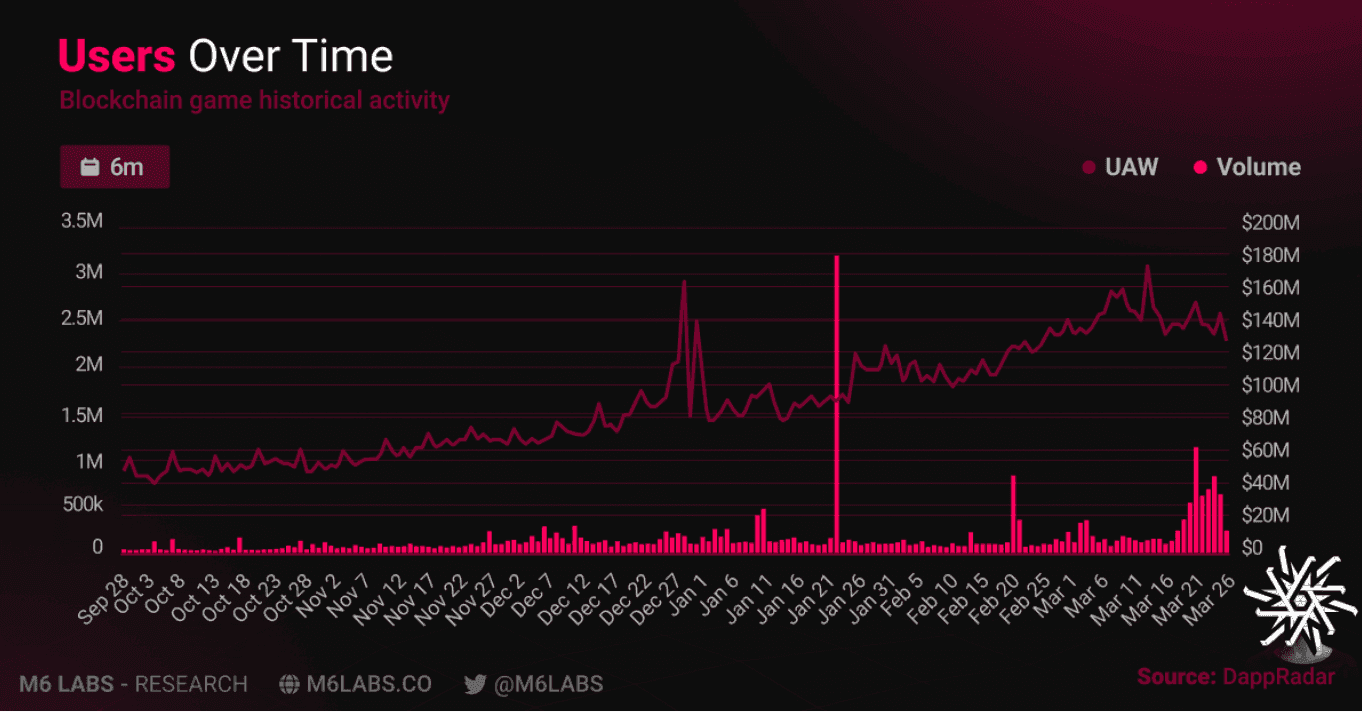

#1 Users Over Time

According to DappRadar, weekly active users have been trending upward over the past six months. Since the last week of January 2024, the number of weekly active users playing blockchain games has consistently exceeded 2 million.

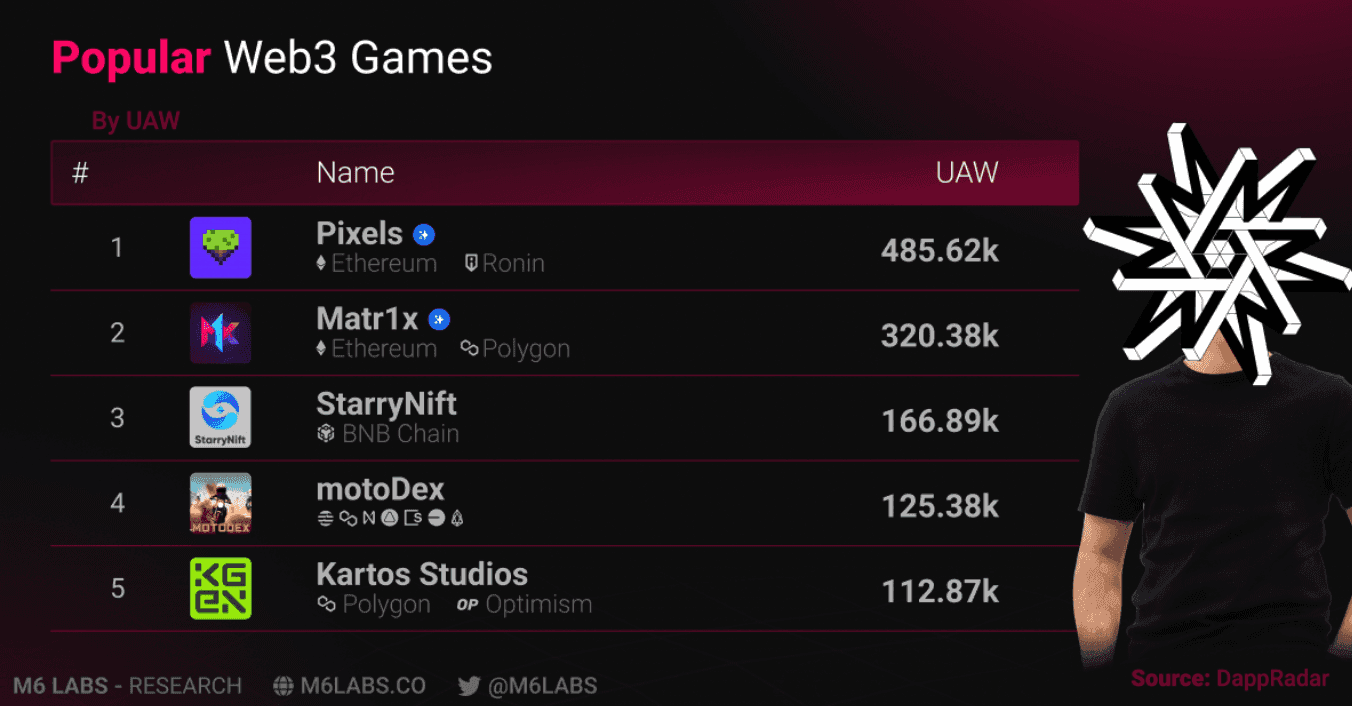

#2 Popular Web3 Games by UAW

As of now, Pixels on Ethereum is the most popular Web3 game. Three of the top 5 most popular games are on Ethereum.

Going Down The Gaming Rabbit Hole

Now that you've been provided with insights into the vast potential of web3 gaming, let's explore a workflow you can implement today, along with exciting opportunities that promise lucrative rewards down the road!

Getting The Basics Right

First on the list is to follow the companies and protocols that are at the forefront of web3 gaming. We recommend using the following list to get started:

- Ronin Network

- Beam

- Avalanche

- Sky Mavis

- Dapper Labs

- Splinterlands

- Animoca Brands

- Immutable

- Uplandme.

- Illuvium

- Mythical Games

- Autonomous Worlds

Follow them on X and join their Discords. From there, focus on games and protocols that you find have exciting gaming mechanics capable of enduring over time, while also integrating fun with clever tokenomics. This balance is often one of the most challenging aspects for a web3 gaming company to perfect.

The next step is to examine quantitative data, such as what games users are playing and how many users are engaging with them. Two excellent sites to start with in this regard are DappRadar and Footprint Analytics.

Monitor the most popular games across different chains, play these games to get a feel for web3 gaming, and take note of which games consistently rank in the top 10. Then, be sure to investigate the developers, their backers, and their upcoming projects. This is where the opportunity for alpha lies, putting you ahead of the competition and ensuring you're among the earliest adopters.

Now that the fundamentals are covered, let's explore some immediate opportunities you can capitalize on.

Getting In On The Action

#1 GAM3S.GG

GAM3S.GG is a web3-focused gaming platform specializing in unbiased, gamer-dedicated content and reviews. Their emphasis lies in fostering a robust community across major platforms such as Twitch, YouTube, Twitter, and more.

- As a community member of GAM3S.GG, you gain access to unbiased GameFi content, early access gameplay, exclusives, and insights into the state of web3 gaming.

- Backed by prominent partners like Polygon, Momentum 6, Rok Capital, and Amazon, GAM3S.GG is emerging as a significant player in the web3 gaming media space.

- Out of the 50M tokens, 15M tokens were allocated to phase one, which has just concluded. The remaining 35M tokens will be distributed in subsequent phases alongside platform launches.

- Stay tuned for phase 2 and 3 updates. Keep connected for future events and airdrops by linking your socials and web3 wallet.

- Get started here.

#2 Apeiron

Apeiron, a God Simulation Hybrid game on the Ronin blockchain, offers players the chance to create and govern their own planets, interacting with unique creatures and wielding divine powers.

- The game recently implemented a rewards system alongside its migration to the Ronin network, granting players free NFTs and Apeiron S3 Axie Battle Stickers for completing quests.

- Subsequently, Apeiron launched its $ANIMA Airdrops Campaign, where players can accumulate points to increase their rewards during the token generation event.

- The game continues to introduce various NFT airdrops, quests, and minting events throughout the year, with some activities concluding by the end of March.

- Apeiron boasts an impressive list of investors, including Morningstar Ventures, Momentum 6, DeFiance Capital, and Spartan Group.

Two immediate actions you can engage in are:

Firstly, participate in token sales offered by platforms like Impossible Finance, Coinlist, and Seedify. These platforms frequently feature gaming tokens, offering users the opportunity to acquire tokens at a lower price than during listing. For instance, APRS is currently trading at $1.8, marking a 15x increase from its ICO price on Impossible Finance.

Secondly, to participate in the ongoing Apeiron airdrop, new users can engage in various activities within the game, such as participating in the Apeiron Arena leaderboard from March 19th to April 26th.

- By playing the game, users can earn $ANIMA directly, which will contribute to their rewards upon the S3 launch.

- Additionally, participating in the PvP leaderboard allows users to acquire $APRS tokens, which serve as premium rewards for top performers.

- Start playing Apeiron here.

Arbitrum, The Sleeping Gaming Giant

Arbitrum has launched the Gaming Catalyst Program (GCP) with the aim of boosting Web3 gaming development. The program requested 200M ARB tokens over two years to support developer onboarding and gaming projects.

- The goal is to establish Arbitrum as a leading choice for game builders and to foster a long-term gaming ecosystem on the network.

- The initiative plans to co-invest in promising studios and games to attract 200 to 300 builder applications and have a significant portion of Web3 games choose Arbitrum as their base network.

While Immutable and Ronin are typically associated with Web3 gaming ecosystems, Arbitrum has made remarkable strides in this space.

- For instance, Xai, powered by Arbitrum technology and developed in collaboration with Offchain Labs, aims to revolutionize blockchain gaming by making it more accessible to traditional gamers.

- Additionally, ApeCoin DAO is introducing ApeChain, a Layer-2 scaling solution incorporating Arbitrum technology, which is poised to significantly impact the utility and governance of the APE token.

- Moreover, Azuki chose Arbitrum for it anime-focused project AnimeChain.

So, how can you benefit from this? Well, by playing and monitoring the games being released on Arbitrum, of course!

- Make sure to keep a close eye on Xai and the other names we mentioned for the latest developments, as their ambitious roadmaps are just as impressive as their recent partnerships with Arbitrum.

- Follow the top games on Arbitrum on this leader board by GAM3S.GG

Lastly why not play an actual game built on Arbitrum?

- Embark on an intergalactic adventure with Cosmik Battle, developed by Cometh.

- Players gather resources and craft cards to customize their decks, fostering dynamic gameplay. Integration of NFTs and blockchain ensures asset ownership and tradeability.

- With the recent early access launch and Season 1 Genesis announcement, now is the ideal time to join the Cosmik Battle saga.

- Play Cosmik Battle here.

That's a wrap for today, anon! See you next week for another action packed edition!

Enjoyed this article?

- Subscribe to Crypto Pragmatist by M6 Labs newsletter for crypto-native industry insights and research read by 30k+ subscribers

- Follow us on Twitter for Tweets providing top-notch insights and bridging the gap between users, builders, and leaders in the crypto space

Disclaimer: These are the writer’s opinions and should not be considered investment advice. Readers should do their own research.