Where to Buy XRP in 2024: Complete Guide!

Ripple XRP is a cryptocurrency and payment token that serves as the backbone of the Ripple payment network. Its main function is to facilitate fast, secure, and cost-effective cross-border transactions. XRP acts as a payment token within the Ripple network, enabling transactions between different currencies and serving as a bridge currency for exchanges between other cryptocurrencies.

The speed, cost-effectiveness, and security of XRP make it valuable in global financial transactions. It aims to address inefficiencies and high costs associated with traditional cross-border payments by providing almost instantaneous settlements and significantly lower fees compared to traditional methods.

However, Ripple Labs, the company behind Ripple, has been involved in a legal battle with the U.S. Securities and Exchange Commission (SEC) since 2020. The SEC alleges that XRP is an unregistered security, and Ripple Labs violated securities laws by selling XRP to investors without registering it as such. The outcome of the lawsuit will have a significant impact on the future of XRP and the Ripple network.

Despite the legal challenges, XRP remains one of the most efficient and dominant cryptocurrencies in the payments space. It has consistently ranked among the top 20 crypto assets and spent multiple years in the top ten. XRP's lightning-fast and low-cost transactions contribute to its success.

To acquire XRP, there are several options available. Centralized crypto exchanges are the most popular choice, offering low fees, convenience, and a wide range of cryptocurrencies. Some popular centralized exchanges for XRP trading include Binance, Coinbase, Kraken, and Bybit.

Peer-to-peer (P2P) services connect buyers and sellers directly, eliminating the need for intermediaries. While P2P support for XRP is limited, platforms like Binance, KuCoin, Bybit, and OKX offer P2P marketplaces where XRP can be traded.

Decentralized finance (DeFi) platforms built on blockchain technology also offer opportunities for XRP trading. These platforms enable peer-to-peer transactions, decentralized lending and borrowing, and participation in liquidity pools. Some popular DeFi platforms for XRP transactions include Sologenic XRP, Aave, Compound, Uniswap, PancakeSwap, and Cream Finance.

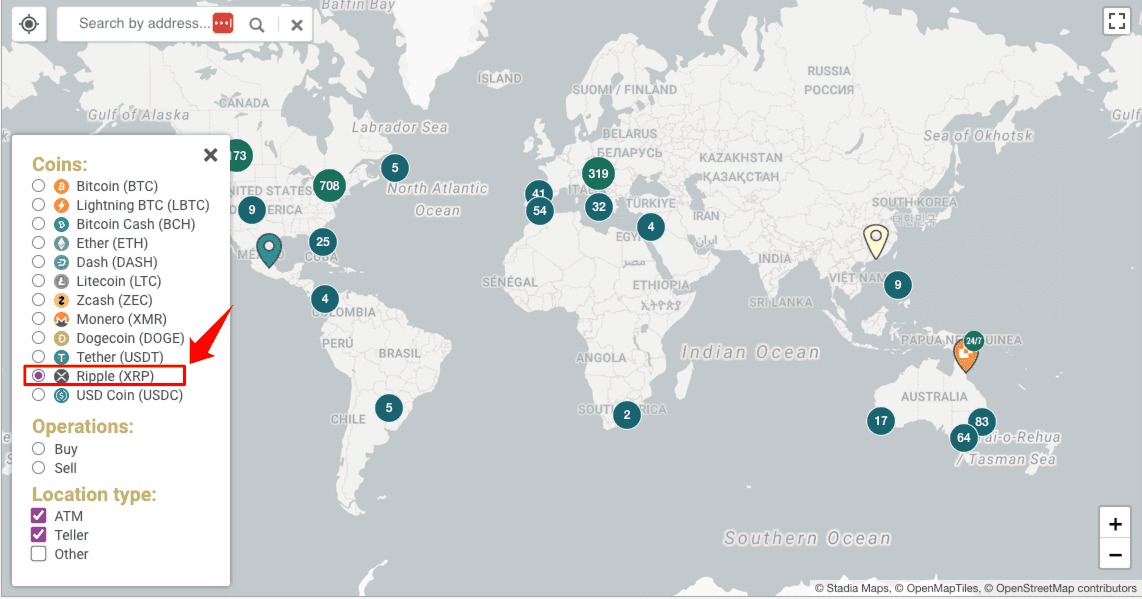

Crypto ATMs provide another option for buying and selling XRP. They offer instant access, greater anonymity, and fast transactions. However, crypto ATMs may not be available in every jurisdiction, and XRP support is not as common as for other cryptocurrencies.

Cryptocurrency wallets play a crucial role in storing and managing XRP. Hardware wallets provide the highest level of security by storing XRP offline, while software wallets offer a balance between security and convenience. Custodial wallets, such as those provided by exchanges, hold and manage XRP on behalf of users but carry higher risks. Some recommended XRP wallets include Ledger Nano X, Trezor Model T, Exodus, and Trust Wallet.

In conclusion, XRP is a prominent cryptocurrency used for fast and cost-effective cross-border transactions. It faces legal challenges, but its efficiency and prominence in the payment space have contributed to its success. Investors can acquire XRP through centralized exchanges, P2P platforms, DeFi platforms, crypto ATMs, or by using cryptocurrency wallets. Safety and security should always be prioritized when buying, storing, and trading XRP.

Ripple XRP is a cryptocurrency and payment token that serves as the backbone of the Ripple payment network. Its main function is to facilitate fast, secure, and cost-effective cross-border transactions. XRP acts as a payment token within the Ripple network, enabling transactions between different currencies and serving as a bridge currency for exchanges between other cryptocurrencies.

The speed, cost-effectiveness, and security of XRP make it valuable in global financial transactions. It aims to address inefficiencies and high costs associated with traditional cross-border payments by providing almost instantaneous settlements and significantly lower fees compared to traditional methods.

However, Ripple Labs, the company behind Ripple, has been involved in a legal battle with the U.S. Securities and Exchange Commission (SEC) since 2020. The SEC alleges that XRP is an unregistered security, and Ripple Labs violated securities laws by selling XRP to investors without registering it as such. The outcome of the lawsuit will have a significant impact on the future of XRP and the Ripple network.

Despite the legal challenges, XRP remains one of the most efficient and dominant cryptocurrencies in the payments space. It has consistently ranked among the top 20 crypto assets and spent multiple years in the top ten. XRP's lightning-fast and low-cost transactions contribute to its success.

To acquire XRP, there are several options available. Centralized crypto exchanges are the most popular choice, offering low fees, convenience, and a wide range of cryptocurrencies. Some popular centralized exchanges for XRP trading include Binance, Coinbase, Kraken, and Bybit.

Peer-to-peer (P2P) services connect buyers and sellers directly, eliminating the need for intermediaries. While P2P support for XRP is limited, platforms like Binance, KuCoin, Bybit, and OKX offer P2P marketplaces where XRP can be traded.

Decentralized finance (DeFi) platforms built on blockchain technology also offer opportunities for XRP trading. These platforms enable peer-to-peer transactions, decentralized lending and borrowing, and participation in liquidity pools. Some popular DeFi platforms for XRP transactions include Sologenic XRP, Aave, Compound, Uniswap, PancakeSwap, and Cream Finance.

Crypto ATMs provide another option for buying and selling XRP. They offer instant access, greater anonymity, and fast transactions. However, crypto ATMs may not be available in every jurisdiction, and XRP support is not as common as for other cryptocurrencies.

Cryptocurrency wallets play a crucial role in storing and managing XRP. Hardware wallets provide the highest level of security by storing XRP offline, while software wallets offer a balance between security and convenience. Custodial wallets, such as those provided by exchanges, hold and manage XRP on behalf of users but carry higher risks. Some recommended XRP wallets include Ledger Nano X, Trezor Model T, Exodus, and Trust Wallet.

In conclusion, XRP is a prominent cryptocurrency used for fast and cost-effective cross-border transactions. It faces legal challenges, but its efficiency and prominence in the payment space have contributed to its success. Investors can acquire XRP through centralized exchanges, P2P platforms, DeFi platforms, crypto ATMs, or by using cryptocurrency wallets. Safety and security should always be prioritized when buying, storing, and trading XRP.

Ripple (XRP) is a cryptocurrency and payment token that is the backbone of the Ripple payment network. It's designed to enable fast, secure, and cost-effective cross-border transactions.

Purpose as a Payment Token

XRP's main function is as a payment token within the Ripple network. It facilitates transactions between different currencies, making it ideal for cross-border payments. XRP also serves as a bridge currency for exchanges between other cryptocurrencies.

Relevance in Global Financial Transactions

XRP's speed, cost-effectiveness, and security make it a valuable tool in global financial transactions. It aims to address inefficiencies and high costs associated with traditional cross-border payments. By utilizing XRP, financial institutions can settle transactions almost instantaneously with significantly lower fees compared to traditional methods.

Legal Challenges Faced by Ripple Labs

Ripple Labs, the company behind Ripple, has been embroiled in a legal battle with the U.S. Securities and Exchange Commission (SEC) since 2020. The SEC alleges that XRP is an unregistered security and that Ripple Labs violated securities laws by selling XRP to investors without registering it as such. The lawsuit's outcome will significantly impact the future of XRP and the Ripple network.

XRP is one of the longest-standing and most successful cryptocurrency projects in the crypto industry. It consistently remains a top 20 crypto-asset, spending multiple years as a top ten. Despite the legal troubles that have had a negative impact on price, XRP remains one of the most efficient and dominant cryptocurrencies in the payments space due to its lightning-fast and low-cost transactions.

You can learn more about Ripple XRP in our in-depth XRP review. For additional resources, check out:

- SEC vs. Ripple Lawsuit Explained

- How to Set Up an XRP Paper Wallet

- XRP as a “Banker's Coin”- Ripple Joins Central Bankers to Discuss the Future of Payments.

Where to Buy XRP

If you're looking to acquire XRP, there are several options available. This guide will walk you through the different methods of obtaining XRP, from centralized exchanges to decentralized platforms. We'll also discuss the factors to consider when choosing the right purchase method for your needs.

Centralized Crypto Exchanges

Centralized crypto exchanges are the most popular place for crypto enthusiasts to buy XRP thanks to the low cost and ease of platform navigation and use. Similar to traditional financial institutions, where an intermediary acts as a custodian of your digital assets, these exchanges offer a wide range of cryptocurrencies, including XRP, and provide a user-friendly interface for trading and investing.

Pros of Centralized Exchanges for XRP Trading:

- Convenience: Typically easy for beginners to use

- Variety: Support multiple cryptocurrencies

- Security: Secured by the platform's security measures

- Low Fees: Some exchanges offer superbly low fees

- Fiat Services: Most major exchanges offer fiat on and offramps for fiat to crypto transactions.

Cons of Centralized Exchanges for XRP Trading:

- Trust required: You must trust the exchange with your funds

- Fees: Some may charge high fees for trading and withdrawals

- Centralization: Controlled by a single entity

- Target for hackers: Centralized exchanges are tempting targets for hackers and many of the leading exchanges have suffered security breaches in the past.

Popular Centralized Exchanges for XRP Trading:

Be sure to check out our picks for the best crypto exchanges where we highlight which exchanges are leaders when it comes to beginner friendliness, low fees, high security, and more!

Peer-to-Peer (P2P) Services

P2P exchanges connect buyers and sellers of XRP directly, eliminating the need for intermediaries. This approach often results in lower fees and greater privacy compared to centralized exchanges.

Pros:

- Lower fees: No fees or low fees

- Privacy: Transactions are more private

- Decentralization: Not controlled by a single entity

Cons:

- Limited liquidity: May not always have ample liquidity or the ability to match buyers with sellers

- Security: Transactions are not as secure or reliable as with centralized exchanges

- Complexity: Can be more complicated for beginners as P2P platforms add a layer of complexity.

Unfortunately, Peer-to-Peer crypto exchange support for XRP is very limited, with most of the leading P2P exchanges supporting Bitcoin and Stablecoins only. You may want to explore popular exchanges such as Binance, KuCoin, Bybit and OKX, which offer a P2P marketplace.

Decentralized Finance (DeFi) Platforms

DeFi platforms, built on blockchain technology, empower users to access financial services without relying on traditional institutions like banks or brokerages. These platforms are revolutionizing XRP trading, offering unique perks and challenges.

Decentralized exchanges (DEXs) typically operate within a specific blockchain ecosystem, limiting trading to assets native to that blockchain. However, certain assets, often referred to as pegged or wrapped tokens, are designed to function on a different blockchain from their native one.

For instance, consider a token created on a blockchain other than the XRP Ledger (XRPL) but backed by actual XRP. This setup would enable trading of XRP on a DEX operating on a separate blockchain. A common example of this would be wrapped XRP on the Ethereum network, allowing users to gain access to a token pegged to the price of XRP but tradable on popular DEXes and DeFi platforms like Uniswap and Aave. We go into more detail on wrapped and pegged tokens in our article on cross-chain bridges if you want to learn more about the concept.

Role of DeFi in XRP Trading:

- Facilitating peer-to-peer transactions, increasing your control and privacy.

- Offering decentralized lending and borrowing services, letting you lend or borrow XRP for earning potential.

- Enabling participation in liquidity pools, where you contribute XRP to support trading and earn rewards.

Note that the XRP network isn't known for its DeFi ecosystem. Many of the mentions below support a wrapped ERC20 (Ethereum) version of XRP, although recent announcements of advents such as a stablecoin, the XLS-30 AMM proposal, and lending protocol on the XRP Ledger could be changing that.

Popular DeFi Platforms for XRP Transactions:

- Sologenic (XRP-Native DEX)

- Aave: A decentralized lending and borrowing platform where you can lend or borrow XRP (wrapped XRP) and earn interest.

- Compound: A protocol for earning compound interest on your wrapped XRP holdings, allowing you to grow your wealth passively.

- Uniswap: A decentralized exchange that runs on the Ethereum blockchain, supporting XRP trading via wrapped XRP tokens.

- PancakeSwap: A decentralized exchange on the Binance Smart Chain, providing low-cost wrapped XRP trading and yield farming opportunities.

- Cream Finance: A decentralized lending and borrowing platform similar to Aave, with the added bonus of offering margin trading.

Pros of Using DeFi for Buying and Selling XRP:

- Decentralization: DeFi eliminates the control of intermediaries, giving you more power over your XRP.

- Earning opportunities: DeFi platforms offer passive income opportunities through lending, borrowing, and yield farming.

- Privacy: DeFi platforms generally offer greater privacy than centralized exchanges and most DeFi platforms do not require KYC.

Cons of Using DeFi for Buying and Selling XRP:

- Most DeFi platforms only support Wrapped XRP

- Volatility: DeFi platforms can experience high volatility, potentially leading to significant losses.

- Security: DeFi platforms might have security vulnerabilities, exposing your XRP to theft or loss.

- Complexity: DeFi platforms can be complex to navigate, requiring technical knowledge.

Crypto ATMs

Cryptocurrency ATMs aren't as popular as centralized and decentralized exchanges but are gaining popularity in some areas as a convenient way to buy and sell digital assets. These kiosks offer a user-friendly interface, making them accessible to both experienced investors and newcomers alike. If you're looking to purchase XRP via ATM, first you will need to locate an ATM that supports XRP.

Locating Crypto ATMs with XRP Support

Leverage online aggregators like localcoinatm.com, cryptoatmlocator.com, Coin ATM Radar, CoinATMs, and Crypto ATM Map to pinpoint ATMs near you. These websites provide comprehensive listings of ATM locations, allowing you to filter your search by supported cryptocurrencies, including XRP.

Benefits of Using Crypto ATMs for XRP Purchases:

- Instant Access: ATMs enable you to buy XRP on the spot, eliminating the need for lengthy online registration processes.

- Anonymity: Unlike online exchanges, crypto ATMs typically provide a higher level of anonymity. Transactions can often be completed without revealing personal information.

- Fast Transactions: XRP transactions through crypto ATMs are processed quickly, allowing you to receive your tokens almost instantaneously.

- Convenience: Crypto ATMs are conveniently located in various public places, offering easy access to digital assets.

Drawbacks of Using Crypto ATMs for XRP Purchases

- ATMs are not located in every jurisdiction

- XRP support is not as common as other crypto assets

- Crypto ATMs can be more complex than using a centralized or decentralized exchange

With the ability to locate crypto ATMs that support XRP withdrawals, you can seamlessly convert your XRP into cash when needed.

Cryptocurrency Wallets

Cryptocurrency wallets have revolutionized the way we interact with digital assets. With the integration of payment processors such as Moonpay, ChangeNOW, Mercuryo and others directly within the wallets, these user-friendly apps provide a secure and accessible platform for storing, sending and buying cryptocurrencies, including XRP.

XRP wallets with payment provider integrations offer several benefits for XRP users:

- Convenience: Mobile wallets allow you to manage your XRP on the go, making transactions a breeze.

- Security: Reputable hardware wallets implement robust security measures to protect your funds.

- Simplicity: User-friendly interfaces and intuitive navigation make mobile wallets accessible to all levels of users.

- Purchase XRP: Some wallets offer built-in features for purchasing XRP directly within the wallet app.

Drawbacks to Buying XRP From a Crypto Wallet App:

- High Fees- Payment processors often charge higher fees than exchanges

- KYC is required

By utilizing crypto wallets, you gain the flexibility and convenience to manage your XRP investments in a self-custodial manner without needing to trust third parties. Whether you're an active trader or simply want to store your XRP securely, wallets provide a powerful and user-friendly solution. I recommend the following articles for more on this subject:

- Top Mobile Wallets

- Top Hardware Wallets

- Ripple XRP Wallets

- Crypto Safety Guide- We provide crypto safety tips and compare/contrast the strengths and weaknesses of mobile wallets vs hardware wallets.

How to Buy XRP

The process of buying Ripple XRP will vary depending on your chosen method and platform, but here we will try and cover the most common considerations you will need to consider if you are keen to pick some up.

On Centralized Exchanges:

- Create an account: Register on a reputable centralized crypto exchange such as Coinbase, Binance, OKX, Bybit or Kraken.

- Verify your identity: Complete the identity verification process required by the exchange for anti-money laundering regulations.

- Fund your account: Choose a funding method (e.g., bank transfer, credit/debit card) and deposit funds into your exchange account.

- Navigate to the XRP market: Search for the trading pair you want (e.g., XRP/USD) and navigate to its trading page.

- Place a buy order: Choose between limit and market orders. Enter the desired amount of XRP you want to buy and the price you're willing to pay or accept.

- Confirm your order: Review your order details and click the "Buy" button to complete your XRP purchase.

On Peer-to-Peer Platforms:

- Find a reputable P2P platform: Conduct research to identify a trustworthy platform.

- Create an account: Register on the platform and provide necessary information for verification.

- Search for a seller: Explore available sellers, filtering by payment methods and exchange rates.

- Initiate a trade: Contact a seller you prefer and open a trade request to buy XRP.

- Complete the trade: Negotiate payment terms and follow the platform's instructions to transfer funds and receive XRP.

On Decentralized Exchanges:

- Connect a Web3 wallet: Install and connect a compatible Web3 wallet such as MetaMask or Trust Wallet to the decentralized exchange.

- Fund your wallet: Send cryptocurrency (e.g., ETH) that the DEX supports to your wallet.

- Navigate to the XRP market: Search for the trading pair you want (e.g., XRP/ETH) and navigate to its trading page.

- Swap crypto: Enter the amount of cryptocurrency you want to exchange for XRP and confirm the swap.

With a Crypto Wallet:

- Download or purchase a reputable mobile wallet: Choose a wallet that supports XRP, such as Trust Wallet, Exodus or Ledger.

- Fund your wallet: Send supported cryptocurrencies to your mobile wallet address and swap for XRP within the wallet if your wallet of choice has that functionality

- Purchase XRP (if available): Some wallets such as Exodus, Trust Wallet and Ledger offer built-in features to purchase XRP directly. Follow the app's instructions to complete your purchase.

Storing XRP

If you are going to own some XRP, you are going to need someplace to store it. There are a few different options here. Fortunately, as XRP is a popular cryptocurrency that has been around for quite a few years, there are some great options for XRP Wallets.

Importance of Securing XRP Holdings:

- Protection from theft: Storing XRP in secure wallets helps prevent unauthorized access and theft.

- Control over assets: Self-custody wallets give users full control over their XRP, eliminating the risk of third-party interference or account freezing.

- Resilience against hacks: Hardware and software wallets provide advanced security features that reduce the likelihood of hacking or malware attacks.

- Access to funds: Once you have custody over your XRP, you are free to transact with your funds as you wish.

Types of XRP Wallets:

Hardware Wallets:

- Physical devices that store XRP offline, providing the highest level of security.

- Examples: Ledger Nano X, Trezor Model T, Trezor Safe 3

Software Wallets:

- Desktop or mobile applications that store XRP on the user's device.

- Examples: Exodus, Trust Wallet

Custodial Wallets:

- Third-party services that hold and manage XRP on behalf of the user.

- Examples: Coinbase, Kraken, and other major exchanges. This method is often considered the least secure as users who store crypto on an exchange or custodial service open themselves up to third-party risk and increased risk of hacks and cyber attacks.

Recommendations for Choosing a Suitable XRP Wallet:

Consider the following factors:

- Security: Hardware wallets offer the best security but are more expensive and less convenient. Software wallets provide a balance between security and convenience.

- Control: Hardware and software wallets give users full control, while custodial wallets require trusting a third party.

- Compatibility: Ensure that the wallet supports the features and devices you need (e.g., hardware support for hardware wallets).

- Reputation: Choose wallets from reputable providers with a track record of security and reliability.

- User Interface: Select a wallet with an easy-to-use interface that suits your technical expertise.

Where to Buy XRP: Conclusion

XRP stands out as a leading cryptocurrency that facilitates fast and cost-effective cross-border payments, supported by the Ripple network. Its widespread availability across various trading platforms, both centralized and decentralized, offers investors ample opportunities to buy and trade XRP. However, in the rapidly evolving landscape of cryptocurrencies, conducting thorough research is important before making any investment decisions.

While accessibility is a key advantage of XRP, it's equally important to prioritize safety and security. Choosing reputable cryptocurrency exchanges with robust security measures ensures a safer trading experience. Additionally, storing XRP in secure wallets helps safeguard against potential theft or loss.

By combining accessibility with diligent research and safe practices, crypto enthusiasts can navigate the world of XRP with confidence.

Frequently Asked Questions

US-based users can buy XRP on Coinbase

XRP is a cryptocurrency designed for fast and cheap global payments. Unlike Bitcoin, it's not intended to be a store of value, but rather a facilitator for transactions between different currencies and assets. XRP runs on the XRP Ledger, a blockchain specifically built for efficient financial transactions. It's particularly appealing to banks and financial institutions looking to streamline international payments.

Disclaimer: These are the writer’s opinions and should not be considered investment advice. Readers should do their own research.