While it seems many U.S. citizens haven’t been paying taxes on their Bitcoin mining activity, it is important for you to know that mining bitcoin is not exempt from taxes in the U.S.

It doesn’t matter if you’re mining specifically for profit as a business, or if you’re mining casually as a hobby, there are tax consequences that need to be addressed.

With the IRS reporting that just 802 people paid tax on cryptocurrency profits in 2017, I think this message needs to be spread.

U.S. Cryptocurrency Tax Regulations

The IRS created a regulation for cryptocurrency mining back in 2014. It is known as Notice 2014-21, Q-9 and it relates how the IRS applies existing tax code to the treatment of virtual currencies, including mining Bitcoin and other cryptocurrencies.

According to the document, Bitcoin and other cryptocurrencies obtained through mining can generally be considered self-employment income, so long as the mining is not done by an individual in the capacity as an employee.

Self-employment income is treated in a similar fashion to regular earnings from employment, although there are some differences, such as deductions allowed, and self-employment taxation.

Wages vs Self-Employment

When you work as an employee you receive wages, and you pay half of the self-employment tax, while your employer covers the other half. Income derived from self-employment requires you to pay the full self-employment tax, which is 15% as of 2018.

However, if you’re claiming your mining activities as self-employment you’re also able to take advantage of certain deductions, which I’ll cover later in this post.

If you claim your Bitcoin mining activities as a hobby, the earnings are handled the same as wages. Additionally, only amounts over $400 legally need to be reported for self-employment tax purposes.

The IRS notice stipulates that cryptocurrencies obtained from mining activity must be recognized as income during the tax year in which they were mined. The market price of the cryptocurrency is equal to the market price on the day the coins were awarded on the blockchain, and that price is also used as the basis for the Bitcoin to calculate gains and losses going forward.

The IRS has clarified this with the following example:

“…[A]ssume you mine 1 bitcoin in 2013,” the government tax agency writes. “On the day it was mined, the market price of bitcoin was $1,000. You have $1,000 of taxable income in 2013. Going forward, your basis in the bitcoin is $1,000. If you later sell the bitcoin for $1,200, you have a taxable gain of $1,200 – $1,000 = $200.”

Of course there is some ambiguity in the calculation of value. As we all know, the value of cryptocurrencies can vary greatly, even within a single day. The IRS notice says the value of the coins mined are based on the price on the day they were mined, but they don’t specify if that’s the high price, low price, average price or even from which exchange price data should be obtained.

To clarify to some extent, the IRS notice also contains the following guideline

“…fair market value of the virtual currency is determined by converting the virtual currency into U.S. dollars (or into another real currency which in turn can be converted into U.S. dollars) at the exchange rate, in a reasonable manner that is consistently applied."

The key there is at the end of the statement “in a reasonable manner that is consistently applied.” Using the day’s average from a single exchange in all your transactions could certainly be considered both reasonable and as long as it is done in the same way for all transactions, consistently applied.

Other Crypto Tax Considerations

The IRS admits that the tax treatment of Bitcoin and other cryptocurrencies is “uncertain”, and recommends you get advice from a tax professional to determine whether your mining activity constitutes a hobby or business, and what your tax obligation would be

Remember, it doesn’t matter if your mining is classified as a business or a hobby, you still have to pay taxes on the coins you mine. Self-employment taxes don’t kick in until you receive more than $400 in a tax year, and are 15% of the value of the coins mined.

If you can pass the test to list your activity as a business you will probably be able to reduce your tax liability with deductions and credits. If the IRS sees your mining activity as a hobby you still might be able to deduct some expenses, but only if they exceed 2% of your gross income

You will also need to consider the tax implications of selling your Bitcoin in the future. When you sell the Bitcoin (or other cryptocurrency) it is a taxable event and is subject to capital gains taxes. Of course if the coins are worth less when you sell them than their basis you can claim a loss for tax purposes.

This makes it critically important to track the data and value of all coins you mine. Consider too that capital gains taxes are different for short term holdings – if you sell after holding the coins less than a year – and long term holdings of longer than a year

Not only does the information above apply to coins you mine yourself, it also applies to coins you might receive through mining pools, faucets, or cloud mining. And if you’re considered to be self-employed in mining cryptocurrencies you’ll likely be required to make quarterly tax payments or face a penalty for late payment

Crypto Mining Costs and Your Taxes

Since you incur costs such as electricity and the cost of hardware when mining cryptocurrencies you might be wondering if these costs are deductible on your taxes.

The quick answer is “Yes”, you can deduct your cryptocurrency related expenses. The amount you can deduct will depend on whether your mining activity is categorized as hobby or business. I’ll look closer at the two scenarios later in this post.

Types of Deductible Mining Expenses

The U.S. tax code specifies any ordinary and necessary expenses can be deducted, which means anything that’s typical, helpful and appropriate to mining activities. Yes, this is a bit flexible, but in general it would cover any of the following mining expenses

- Mining hardware (GPUs, ASICs, and component parts)

- Electricity

- Internet service

- Newsletter/forum subscriptions

- Mining pool fees

- Accounting/bookkeeping

- Tax preparation

- Coin storage (USB, hardware wallets, safe deposit boxes, etc.

You will need to determine the proper allocation of some of the above expenses for your mining operation. For example, you won’t be able to deduct 100% of your electricity expenses, since your electricity is also used to power many other things in your house aside from your mining rigs.

It might even make sense to purchase a portable electricity meter (which would be a deductible expense), so you would know exactly how much electricity your mining rig uses. For large hardware purchases you may have to use the depreciation method for deducting the expense.

Your accountant can give further guidance on the rules that cover assets which depreciate.

Crypto Mining as a Business vs. Hobby

As alluded to above, you’ll need to determine if your cryptocurrency mining is a business or a hobby under IRS guidelines. To qualify as a business the activity must be done on a continuing, consistent basis, with the purpose of profit generation. If it is sporadic and/or insubstantial it is a hobby and reporting will be different

Deducting Mining Expenses As A Hobby

Most people’s cryptocurrency mining efforts fall under the hobby umbrella, because most miners won’t meet the substantial, continuous test for business activity. This isn’t necessarily a bad thing as it does free you from the 15% self-employment tax.

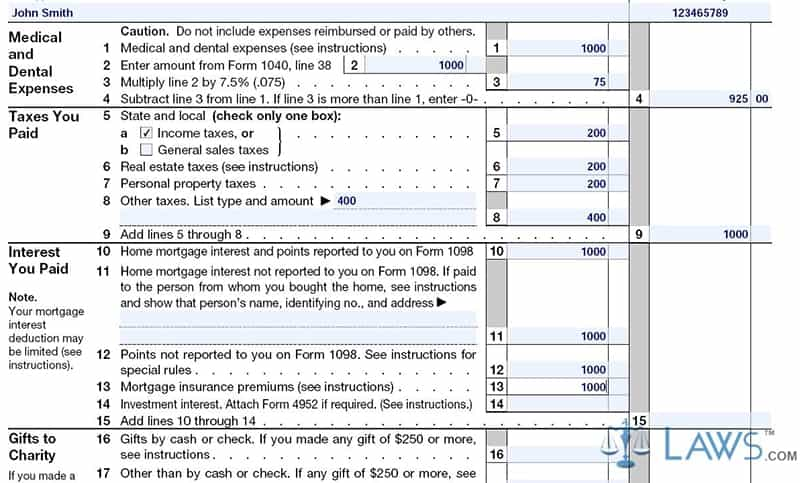

If your mining is a hobby, any deductions are reported on Schedule A as itemized deductions.

The downside here is that itemized deduction rules don’t allow for home office deductions, start-up costs, or continuing education costs like conferences. And you can only deduct expenses that exceed 2% of your adjusted gross income. Further, it is not allowed to deduct any losses from your mining activity.

Also, you are only allowed to itemize your deductions if you aren’t taking the standard deduction.

In 2017 the standard deduction was $6,350 for singles and $12,700 for married couples, so you would need to have substantial itemized deductions to make it worth your while to itemize. Those with mortgage expenses will likely be able to qualify, but many others will not.

Deducting Mining Expenses As A Business

If you can qualify your cryptocurrency mining as a business you’ll have a much easier time declaring deductions. Business expenses are calculated using schedule C and are far more generous.

You can include your continuing education expenses, home office expenses, and start-up costs if you are filing as a business. Plus there are no limitations as there are with itemized deductions. It’s definitely a greater benefit, but it also comes with a cost.

The cost is that a business is subject to self-employment tax of 15% on top of your usual income tax. So, it’s possible that qualifying as a business could wipe out the benefit of your deductions due to this self-employment tax.

Additional Thoughts

If you are someone who finds taxes a royal pain and would rather avoid them altogether (legally, of course), have you considered moving to a country that doesn't tax crypto? You can find some options in our article on Crypto Tax-Friendly Countries.

If you are seeking more information on whether relocating is right for you, feel free to book a call with our friends from Offshore Citizen to plan and execute your move legally with as little hassle as possible. They help with residency permits, bank accounts, company structures, etc.

Conclusion

As you’ve now learned, cryptocurrency mining is subject to taxation in the U.S., as are gains on cryptocurrency holdings. This is offset by the fact that you can deduct expenses related to cryptocurrency mining, but those deductions will possibly be limited depending on whether your activity qualifies as a business or a hobby.

If your mining is a business you’ll have greater deductions, but also be subject to additional self-employment taxes. If it’s a hobby your deductions are limited, but you won’t have to pay the additional self-employment tax.

Knowing which is better will take some careful calculations, and is completely dependent on each individuals personal situation.

Disclaimer: These are the writer’s opinions and should not be considered investment advice. Readers should do their own research.