24option Review: Complete Broker Overview

24option is a broker that has a relatively long history in the online trading industry.

Originally started as an online option broker, they have recently moved exclusively into CFDs. They offer traders the ability to trade CFDs on a number of different assets using both native trading technology and MT4.

However, is the broker safe and can you trust them?

In this 24option review, we will attempt to answer that question. We will give you everything you need to know about their regulation, technology and fees. We will also give you some top tips in order to make the most of your 24option trading experience.

Overview

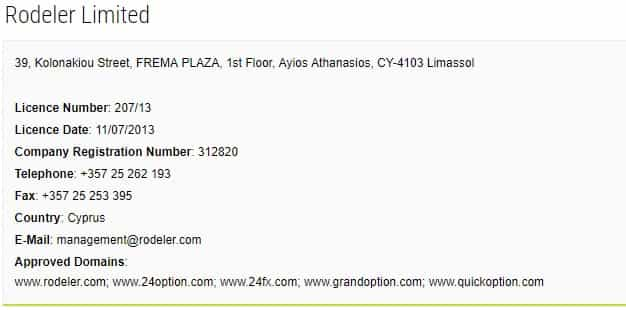

24option was started in 2013 and is based in Limassol, Cyprus. They are located at number 39, Kolonakiou Street, CY-4103.

In Europe, they operate under Rodeler Limited as the holding company. They also have a holding company that is based in Belize called Richfield Capital limited. The latter company services their non-EU international clients.

So, a bit of background...

24option used to operate as an option broker. These are financial instruments that offer traders binary outcomes from particular trades. However, in 2016 they decided to transition fully into the CFD market.

Since then, they have been expanding their CFD offering and now give traders the opportunity to trade CFDs with leverage up to 500:1 (in certain regions). 24option provides CFDs on hundreds of different assets in numerous asset classes.

Although their headquarters are based in Cyprus, they take traders from a number of regions around the world. However, there are some regions that they do not operate in including most notably, the United States.

For those regions in which they do operate, they have tried to create a complete multilingual experience and have translated their website into over 8 different languages.

Is 24option Safe?

This is perhaps one of the most important questions that you may have on your mind. Broker safety and regulation is of paramount importance for us.

The latter is the first and most important criteria you should think about when choosing any online broker. You will want to make sure that they are regulated by a well-regarded financial authority.

Regulation

24option is regulated by two financial authorities. They are regulated by the Cyprus by the Cyprus Securities and Exchange Commission (CySEC) as well as the Belize International Financial Services Commission (IFSC).

CySEC has issued them a CIF licence with a number of 207/13. The IFSC has given them a license number of IFSC/60/440/TS/18. Through the MiFID directive, the CySEC licence allows them to provide their services in the European Union whereas their IFSC one covers other countries.

So, what does this mean for you?

Well, taking a look at the CySEC regulation in particular, it provides you with a number of protections that unregulated brokers and exchanges just won’t offer you. Below are some of the most important of these:

- Segregation of Funds: This is really important from a client perspective and ensures that the funds that you have deposited are kept separate from the broker's funds. This means in the event of the broker going bankrupt, all of your funds are safe from creditors, directors etc.

- Background Checks: There are a number of background checks that the operators must undertake. These are with respect to both the holding companies applying for the license as well as the directors of the company.

- Regular Reporting Standards: It is not just about the broker getting the licence. They have to constantly send updated reports to the regulators about their operation and financial standing.

- Investor Compensation Fund: All CySEC regulated companies have to contribute funds towards the shared investor compensation fund. This protects client accounts up to €20k in the event of an unforeseen circumstance at the broker.

Apart from using a the that had to pass these numerous checks, it is great to know that you have an authority to turn to. In the event that you are ever to suspect any wrongdoing on your account then you can always report a broker to CySEC. They have internal policies in place to deal with these types of complaints.

Secure Communication

As one can expect from any site that deals with financial information, 24option makes use of secure and encrypted communication. They have full 256-bit SSL encryption on their site.

This means that when you login to 24option and when you submit credit card or personal information, it cannot be stolen by an online snoop. It is also a handy tool for you to confirm that you are not on a phishing site.

When you visit the 24option website you will see the SSL padlock in the browser address bar. This means that you are on the official 24option website and not some imitation broker or hacker's site.

Assets & Leverage

In terms of the assets that you can trade at 24option, you have quite a selection. They offer CFDs on stocks, Indices, Commodities, Forex and cryptocurrencies. Below are the cryptocurrency assets that you can trade:

- Bitcoin (BTC)

- Litecoin (LTC)

- Ethereum (ETH)

- Dash (DASH)

- Monero (XMR)

For some of these assets, they are offered crossed with the USD, EUR and GBP. Furthermore, given that lot sizes can be quite high, they also offer some "mini" cryptocurrency contracts. These usually have a small "m" in front of them.

Something that we liked about 24option was that they offered single stock CFDs. This is something that is not really available at other larger CFD brokers. Here are some of those companies that you can trade:

- Amazon

- Ferrari

- Nike

- Apple

- Netflix

- + 60 more...

As mentioned, 24option is a CFD (Contracts for Difference) broker. These instruments are derivative instruments that are traded on the margin. This means that you will only require a margin amount that is a fraction of the notional trade size.

Trading on margin means that you are trading with leverage and your gains / losses are maximised. Leverage levels at 24option will differ according to the account you have as well as the region that you are based in.

The max leverage in the EU for non-professional traders is 30:1 and in other countries it can go up to a maximum of 500:1. If you are in the EU and would like more leverage then you could apply for a professional account (see below) which will allow you to trade with leverage up to 400:1.

In terms of the max lot sizes that you can trade, it is 30 lots for major forex pairs and 10 lots for the minor forex pairs. For stocks, it is 10 and for indices it is 3.

Margin Requirements

If you are going to be using 24option then you need to be aware of their protocol when it comes to margin calls and stop out levels.

For all accounts, the margin call level is 100%. This means that if your margin level is below 100% you will be called on to deposit more funds. You may also be stopped from opening new positions.

If your position continues to deteriorate and it reaches the "stop-out" level then 24option will close out your positions. This stop-out level will depend on whether you are a retail trader (50%) or a professional trader (20%).

As you can see, there are risks that come with trading on the margin and you need to be aware of these risks. Leverage is a double-edged sword which can chop both ways...

24option Spreads & Fees

Fees and spreads have a direct impact on your trading profitability. This is especially true when you are trading on a notional amount that is much larger than the margin.

There are number of different fees that you will incur at 24option so it is important that you know exactly what these are and how they could apply to your account.

Trading Spreads

CFD brokers do not charge a fixed fee on your trading volume but will instead make money on the spreads between the buy and sell price of the asset.

At 24option, these vary according to the asset in question as well as the account that you have set up. We decided to get a rough idea of the live spreads that were being charged on the platform so we jumped right into a live account. Here are some of the indicative spreads:

- EURUSD: 1.0 pip

- GBPAUD: 4.0 pips

- CHFJPY: 2.9 pips

- Oil: 2 points

- Gold: 23 points

- Boeing: 76 points

- McDonalds: 37 points

- FTSE: 600 points

- DOW: 275 points

- Bitcoin: 3,624 points

- Ethereum: 122 points

So, the spreads that they have on some of their forex pairs and stocks appear quite reasonable. However, their crypto spreads are way too high. For example, the spread on the Binance exchange on Bitcoin is only 136 points.

However, you will be happy to know that unlike other CFD brokers, you will not be charged a lot commission. You will also not be charged a financing charge.

The only other trading fee that you are likely to incur is the "Swap Fee". This is basically the fee that is applied in order to account for interest rate differential.

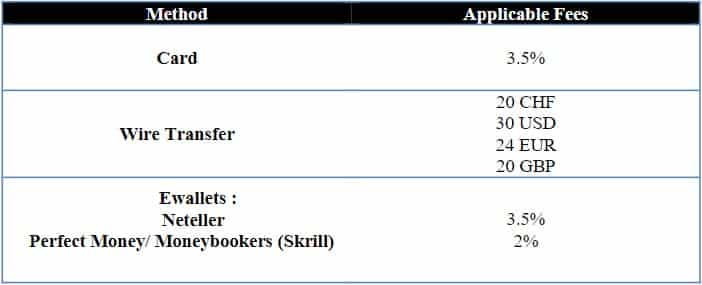

Deposit / Withdrawal Fees

24option will not charge you any fees for sending money in although they will charge you for withdrawals. We were quite surprised to see how high some of these fees are and they are presented below:

This does make sense in the context of other CFD brokers like Axitrader that do not charge any fees on their withdrawals.

Having said that though, 24option does give the various accounts a certain number of free withdrawals a month. If you decide to open a VIP account then you will not be charged any withdrawal fees.

Other Fees

There are also a few other fees that you may incur on your account that we think warrant a mention.

For one, you are charged a monthly maintenance fee of €10. This actually quite bizarre and we have not seen it at other brokers / exchanges. Merely having an account at 24option will cost you €120 a year.

However, if you do not trade on this account then you will incur "inactivity fees".

These are fees that are charged on dormant accounts and are applied to said accounts with no activity for over 2 months. They start at €80 for 2-3 months, then go to €120 for 3-6 months and €200 for more than 6 months.

Inactivity fees are not unique to 24option however and have been used at brokers such as Plus500.

Account Options

As mentioned above, the spreads that you will pay and the leverage that you will be able to trade with are dependent on the type of account that you have at 24option.

There are 4 different account types at the broker and these are your Basic, Gold, Platinum and VIP. These require different levels of funding and come with other benefits. Below is the breakdown:

| Basic | Gold | Platinum | VIP | |

| Min Deposit | €250 | €5,000 | €10,000 | €50,000 |

| EUR/USD | 2.3 pips | 1.8 pips | 1.4 pips | 0.9 pips |

| GBP/USD | 2.5 pips | 2.2 pips | 1.6 pips | 1.1 pips |

| Crude Oil | $0.08 | $0.06 | $0.05 | $0.05 |

| Gold | $0.59 | $0.49 | $0.39 | $0.22 |

| Lessons | 1 Basic Lesson | 2 Basic Lessons | 3 Advanced Lessons | 5 Advanced Lessons |

| Webinars | NA | 1 Monthly Webinar | 2 Monthly Webinars | 5 Monthly Webinars |

In addition to the above, on all accounts you will get the benefit of the daily news that comes through to the platform as well as trading central and the trading central SMS alerts.

Moreover, if you are a professional trader then you can apply for their professional account. This allows you increased leverage in regulated regions like Europe. It also gives you lower stop-out levels.

In order to be a professional trader, you have to have worked in a financial services job for over a year or you have to have a certain net-worth / income.

Which account you eventually do choose depends on your own personal preferences. We think that the basic account should do just fine to start with. You can always move on up from there.

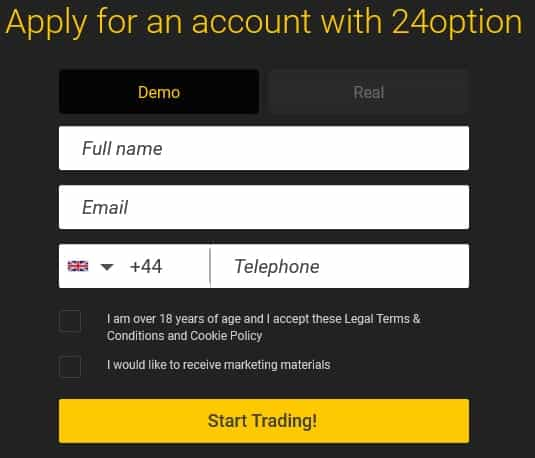

24option Demo Account

If you are still uncertain as to whether you want to trade with them, why not try the demo account? This is a great way for you to test out the platform in a non-threatening way.

Demo accounts have all of the functionality that you can expect on the live account but come without the risk. 24option will give you €100,000 demo funds when you sign up for this type of account.

Using demo funds is also a great way for you to trade as if it were real life conditions. Moreover, it does not seem as if they have placed any time limits on their demo accounts. This separates them from other brokers such as Pepperstone.

24option Trading Platform

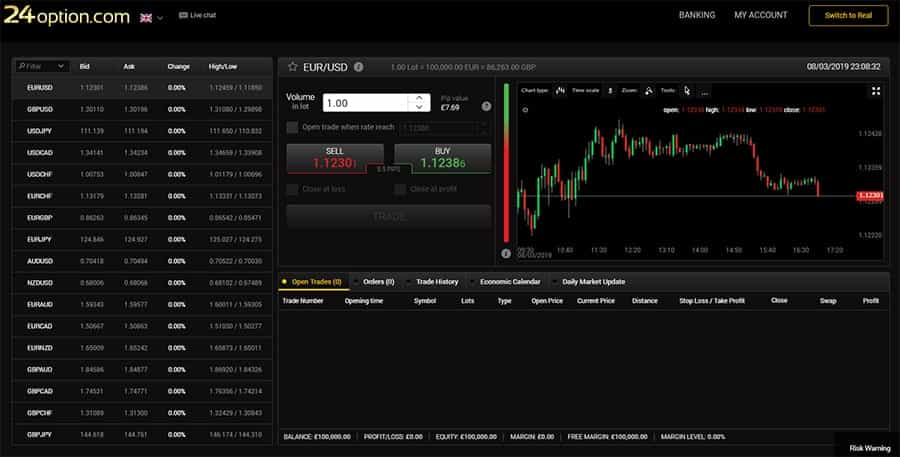

Their main platform is their web based CFD platform. This was built in house specifically for 24option.

This platform is well laid out and relatively simple to use. On the left of the platform you have all of your markets. These can easily be filtered based on either the asset class you want to trade as well as the favourite assets on the market. Here you can switch the market that you are trading.

In the center of the platform you have your order forms and to the right of that you have the charts. Below these two you have all of your previous orders, open positions, economic calendar and the daily market update.

Now, while the platform is well laid out, panels cannot be detached unfortunately.

Being unable to detach the panels means that you can't move them around into more convenient places on the screen. It also means that you cannot view more than one market at the same time. If this is a deal breaker for you then you may want to consider their MT4 platform.

WebTrader Charting

In terms of the charting, it seems to be really quite functional.

Firstly, you will notice that on the left of the charts you have a sentiment indicator. This is a handy feature that will let you know the general market view of the other traders on the platform (bullish or bearish).

If you are a technical analysis trader then you will be happy to see the plethora of charting tools and features. For example, you can easily change the chart type in the top left of the chart (candlestick, line, HLC etc).

You can also overlay your chart with a number of technical studies. These include such indicators as the MACD, RSI, Parabolic SAR, Bollinger bands and over 50 other indicator types.

The 24option web platform also comes with a host of drawing tools to better map your trendlines and identify key levels. These include Gann fans, triangles, Fibonnaci levels etc.

Top tip: You can even expand the chart to the full screen in order to more easily complete your charting.

Order Form

Placing orders on the webtrader platform is really pretty simple. In fact, we thought is a bit too simple.

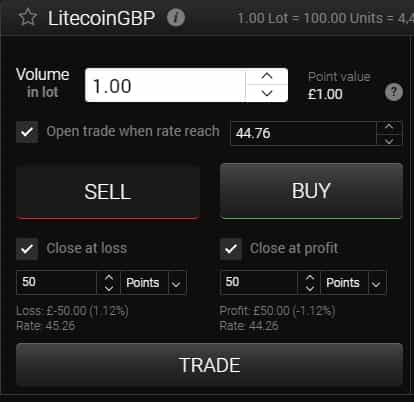

There are only two types of orders that you can place and these are the limit order and a market order:

- Market Order: The market order is the simple buy / sell that will take place at the rate that is given at the market at the time. Here you will select the amount that you would like to trade and then you will hit the "buy" or "sell" button at the rate that is being presented.

- Limit Order: This means that you will place an order at a predetermined level away from the market rate. This can be for a buy or sell and it will only be executed when the asst has reached that level. Unfortunately, there is no option to change the life of this order so can assume it is a standard "good till cleared" limit order.

It should be noted that for both of these order types you can set the stop loss as well as the take profit at the outset of the trade. You can define these as a certain number of pips away from the current market price.

Why use these?

These are great risk management tools that you can use to limit the amount of downside risk that you have on your position. These can also be placed at key technical levels for more efficient trading.

24option MT4

Those more advanced traders among you will be pleased to know that 24option also offers an MT4 platform.

For those who do not know, MT4 is the external trading program that is developed by the Metaquotes software company. It is perhaps one of the most well known and widely used third party trading platforms in use today.

This platform has been developed for traders by traders and as such, has endless functionality and tools. When you download it from 24option's website you will link it up to their trading servers and your account.

You can run the MT4 platform in your browser just like you do the traditional web-based platform. However, the most optimal set-up is for you to install the platform on your PC. MT4 is supported in both MacOS as well as Windows and Linux.

Of course, the 24option MT4 platform may not be for everyone.

It takes some time to get used to the numerous features, widgets, chart tools and order forms. This is perhaps something that is better learned in a demo account before you put any money at risk.

However, the main benefit of the MT4 platform is that the knowledge that you learn is highly transferable to another broker. Given that it is in use at so many brokers, you do not need to re-learn trading on other platforms.

24option Mobile App

For those on the go, there is a nifty mobile app that you can use.

This is available in both iOS and Android and has some of the most important features that you could need to trade on your account. It has charting, order forms, calendars and daily news. The app has been translated into 12 different languages.

You can view the app reviews in the iTunes store or the Google play store. They appear to generally be quite positive with numerous 5-star ratings and comments mentioning the advanced technology.

What is even more encouraging is that the 24option support team is very responsive on these reviews. Even if there are negative comments the team has responded to them promptly and were receptive to development suggestions.

Metaquotes also develops a mobile application for the MT4 technology. The MT4 mobile app is the most downloaded trading app in the world and has much more functionality than the standard 24option mobile app.

So, should you trade on a mobile?

Well, you will never be able to replicate the charting functionality of the standard platforms. Moreover, there is likely to be a latency in execution given that you are connecting to mobile networks.

We would suggest that you do your primary trading on the 24option webtrader or the MT4 platform. If you have to monitor your positions on-the-go then you can always check in on the mobile apps.

Withdrawal & Funding

There are a number of different funding methods that you can use at 24option. Below are some of the most common ways that you can fund your account:

- Credit Card: They accept a number of the major credit cards including Visa, MasterCard and Discover.

- Electronic Paymets: Skrill, Neteller, Qiwi, Astropay etc.

- Wire Transfer: You can fund your account with a traditional wire into 24option's bank account. You will need to reach out to an account manager to confirm

The minimum deposits for the Web wallets and the credit cards is $250 whereas it is $1,000 for a wire transfer. The maximum deposit limits are $10,000 per day or $40,000 per month. 24option accepts payments in EUR, Japanese Yen and GBP.

Perhaps the fastest way to make the deposit is through a credit card or a Web wallet as these are instantaneous. If you are going to be making a wire then this could take 3-5 business days depending on where it is coming from.

Withdrawals

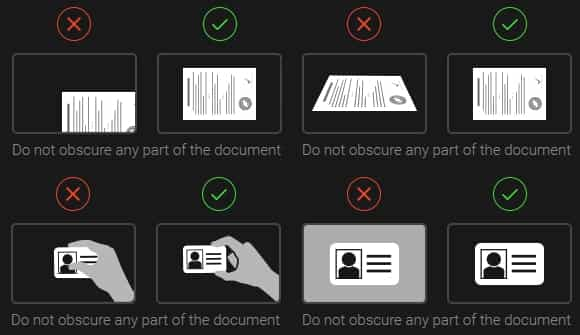

When it comes to withdrawal, you will need to complete an extra step.

Unlike most brokers, 24option only requires you to complete KYC once you are requesting a withdrawal, not when you are setting up the account. Hence, if you do request a withdrawal, you will need to verify your identity and details.

This KYC requirement is something that is required by law from CySEC in order to prevent money laundering. Hence, 24option will need you to submit the following:

- Photo ID: You will need to send them a copy of some form of government ID. This could be a driver's licence or a passport.

- Proof of Address: You will need to send them a copy of a document that confirms your address. This could be a utility bill, a bank statement or an official government document.

- Copies of Credit Cards: If you have funded via a credit card then they will also need a copy of the front and the back of the credit card.

This has to be done each time that you need to confirm a new withdrawal method but if you are using the same method again then it should be sufficient. This should take about a day to process.

Take note: If you funded via credit card then they will refund you your initial deposit and the bulk will be withdrawn through another method (bank wire for example).

Withdrawals are processed during normal Cyprus office hours and there is a minimum withdrawal amount of $10. As is the case with deposits, the time that this takes is dependent on the method that is used.

It is also important to note that they will not process any withdrawals that are sent to third party accounts (those that are in someone else's name).

24option Customer Support

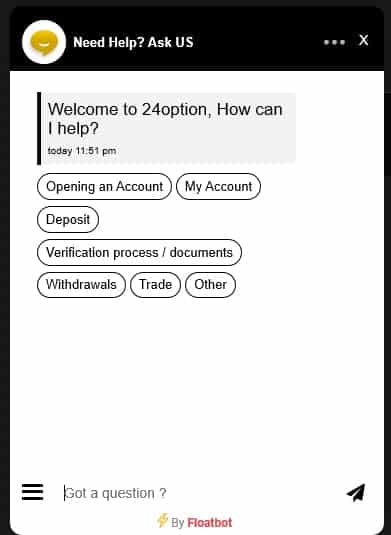

No one likes waiting days for some customer support...

24option seems to have quite a few options when it comes to their support functions. Perhaps the easiest way to get hold of them is through their online chat function. This operates 24/5 and has a pretty quick response time.

Of course, if you have an account related query that you want to solve through email then that is an option as well. Typical response times here are a few hours.

You can also visit their contact page and you can get their local telephone support numbers. We found this quite a nice touch and it is something that more international brokers and cryptocurrency exchanges should consider.

Finally, if you have a question that is more routine in nature then you can always head on over to their Frequently Asked Questions.

Education

It's nice to know that a broker provides more value than just a great platform.

24option has included a number of educational resources for you to peruse at your leisure. These could be a great way for those beginner traders among you to learn about the markets and improve your trading chances.

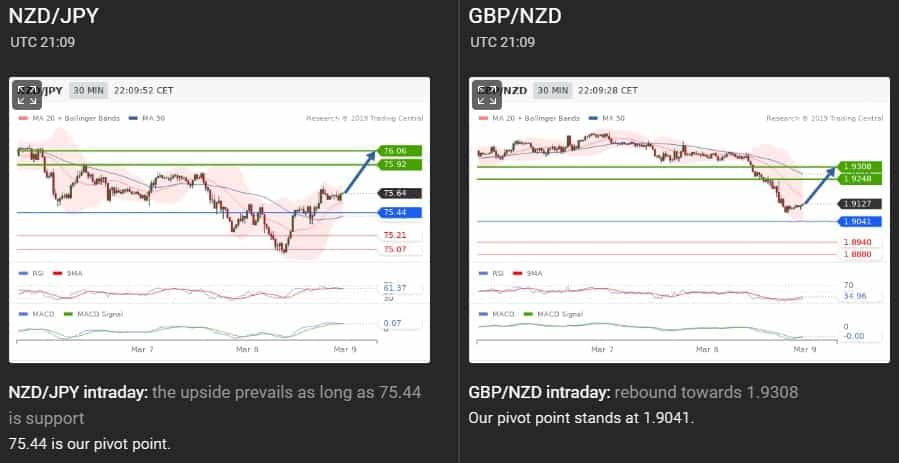

Daily Market Reports

These are sent straight through to the platform and are pieces of advanced market analysis. They are drawn up and sent out by the team over at Trading Central who are a bunch of international investment research professionals.

This commentary will cover a number of different markets and will include potential suggestions for trade set ups. You can also have these sent you as an alert via SMS.

Something else that is included with the daily market report is the economic calendar. This contains a list of some of the most important dates that are coming up during the week which could impact the markets.

Ebook

The 24option Ebook is quite a comprehensive guide that will cover the most important disciplines in trading. This is positioned at not only the beginner traders but also those that are at the intermediate level.

It covers numerous topics such as trader psychology, capital management, Technical and Fundamental analysis etc. They also have quizzes after each question where you can test the knowledge that you have just picked up.

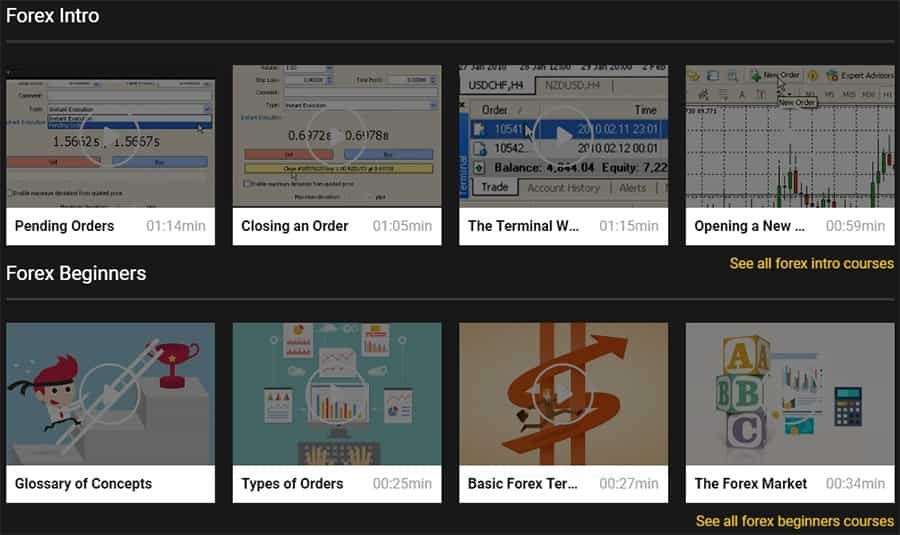

Videos On Demand

Why read the guide when you can watch a video?

24option has included a number of handy Videos On Demand (VODs) where you can learn about some of the topics that are covered in the eBook. We viewed some of these and they were quite easy to digest in relatively short clips.

Moreover, the presenter seems to know what he is talking about and explains all the topics in a beginner friendly way. This does not mean that is unsuitable for the more advanced users though and could give them some unique insight as well.

Webinars

This is something that we really liked at 24option.

They run regular webinars where you can get some live insight from a professional trader. These are run almost daily and are joined by thousands of traders all around the world. They are also a great way to ask questions and hear some of the questions being asked.

When we took a look at the webinar schedule there appeared to be quite an interesting selection of topics and included subjects such as Risk Management, Pattern recognition, gold trading and algorithmic trading.

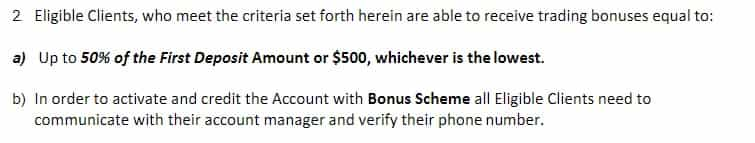

24option Bonus

It was interesting to see that they still included a bonus option as these have mostly being discarded by CFD brokers in recent years.

This is because the MiFID directive has outlawed the use of bonus incentive structures to those clients that are based in the EU. However, this is not the case in other international markets.

Through their Belize holding company, 24option gives their traders the opportunity to take part in a deposit bonus. They will credit your account with up 50% or $500 of your initial deposit (whichever is lowest).

This bonus can then be seen as free trading money that you can use to bolster your liquidity. It is, however, important to point out that there are certain terms and conditions that are attached to these bonuses.

Although the prospect of "free money" sounds great, there are always going to be strings attached. As such, we would actually suggest that you avoid all types of deposit bonuses - avoid the hassle.

What We Didn't Like

We could not complete a full 24option review if we did not take a look at some of the things that we thought warranted improvement.

Firstly, the additional fees that are being charged are unnecessary and exorbitant. Very few brokers will charge withdrawal fees these days and even fewer will charge a "maintenance fee". Moreover, it seems quite unfair for those traders who are away from their accounts to get whacked with an inactivity fee.

We also thought that they could have done slightly better on their cryptocurrency CFD spreads. These are really quite wide and are far above those of other CFD brokers and exchanges.

Secondly, we found the order functionality on their web-based trading platform to be really quite basic. This makes it quite difficult for the more advanced traders. If you are one of them then we would suggest the MT4 platform.

Finally, it is unfortunate that 24option is not available in some pretty large markets. For example, they are not allowed in the US, Canada and Australia. Traders from these regions will have to look somewhere else.

Conclusion

In summary, we found 24option to be a pretty well-established broker with a large asset coverage. They are fully regulated by a reputable governmental agency which ticks the security boxes.

Moreover, they have a healthy selection of trading technology that is well suited to users of different skill levels. They have the MT4 for the more advanced traders whereas they have the relatively intuitive and easy to understand web-trader.

Yes, there were some things that we thought warranted improvement but these can all be worked on. 24option seems to be quite a receptive broker and they may take these points into consideration as they refine their offering.

So, should you use 24option?

We can't tell you exactly which broker to use but it seems that they have ticked most of our boxes. If you are in the market for a new CFD broker then 24option should be on top of that list.

Disclaimer: These are the writer’s opinions and should not be considered investment advice. Readers should do their own research.

Disclaimer: These are the writer’s opinions and should not be considered investment advice. Readers should do their own research.