NordFX Review: Complete Broker Overview

NordFX is an international forex broker that provides online trading services in currencies, cryptocurrencies, and other financial instruments. The broker offers low spreads and access to leverage, reliable support, and fast order execution.

NordFX is a large international Crypto, Forex and CFD broker that has been around for a fair amount of time.

They offer leveraged trading on a respectable range of assets. This is done through their raw ECN trading accounts which allow their clients access to some of the lowest spreads on the market.

However, is NordFX a safe broker?

In this NordFX review, I will give you everything you need to know about them. I will also give you some essential trading tips that you need to know.

Overview

NordFX was founded in 2008 and is owned by NFX Capital Vu Inc. which is based and registered in Vanuatu.

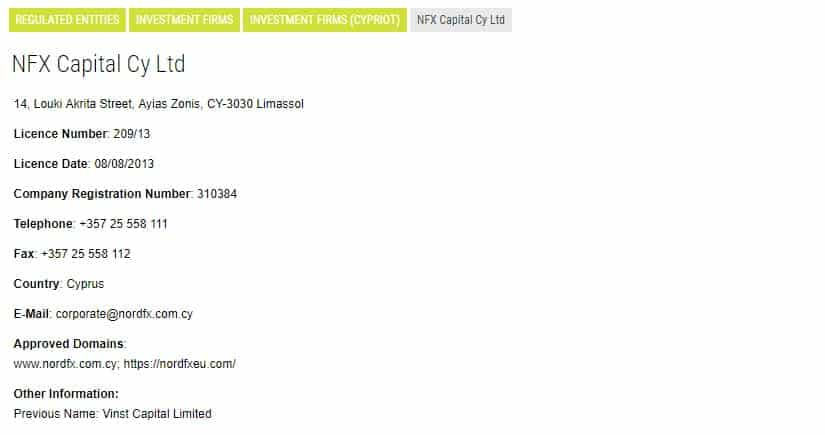

However, the brand is also operated by a company that is based in Cyprus called NFX Capital CY Ltd. This company allows NordFX to sell their services in Europe and its address is 14 Louki, Akrita street, Ayias Zonis, 3030, Limassol.

NordFX offers you the opportunity to open ECN accounts which means that they outsource all of their client's orders to external liquidity providers. Given this direct connection, traders are able to get spreads that are as close to market as possible.

As a margin trading broker, NordFX gives their traders the ability to trade Forex, Equities, Metals and Crypto with leverage of up to 1000:1.

Since their inception, the broker has grown substantially. There are 1.2 million accounts that have been created world wide and they have expanded to almost 200 different countries. They have translated their website into over 10 different languages.

Despite their global operations, there are some regions where they do not accept clients from. One of the most notable of these is the United States.

Is NordFX Safe?

This is perhaps the most important question that any trader can ask.

There are a number of things that we look at when determining how safe a broker is. These include regulatory licences as well as internal protocols.

Regulation

NordFX has two regulatory licences. They have a licence that is issued by the Vanuatu regulatory authority for NFX Capital Vu as well as a CySec licence for NFX Capital CY. The latter is by far the more reputable so we will look at that.

NFX Capital CY's license number is 209/13. You can see the below copy of the licence as well as the approved domains.

Given that NordFX has a CySec licence, it means that they are authorised to take clients from a number of different countries in Europe. This is due to the financial passporting rules mandated by ESMA.

There are a number of client protections that come with a CySec regulated firm:

- Capital Requirements: Before a firm is granted a license, they have to have significant capital reserves. In the case of CySec, that is €750,000.

- Investor Compensation: All CySec regulated firms are required to contribute to the Investor Compensation Fund. This is a deposit insurance fund that will guarantee all accounts of up to €25,000 in the even that a broker were to go under.

- Regular Financial Statements: The broker is required to keep regular financial statements and CySec will periodically review these to confirm compliance.

- Tier 1 European Banks: Brokers are required to store their funds in a Tier 1 European Bank that ensures security of deposits.

Apart from knowing that the broker had to meet these requirements, it is also helpful to know that there is a regulator to turn to in the case of any complaints.

Other Protections

There are a number of other protections that NordFX has implemented internally to help protect their clients.

For example, they operate a segregated bank account structure. This means that they keep all of their client funds in a bank account that is separate from the main broker bank accounts - which ensures protection of your funds in liquidation.

They also have an advanced risk management system in place that is able to provide negative balance protection. This means that no matter how far a position moves against you, it will be protected from going below 0.

Finally, there are all the standard SSL protections that you would expect of most websites dealing with sensitive information. All communication is encrypted as it is sent to their servers.

Asset Coverage / Leverage

There is a pretty respectable range of assets available at NordFX. They have Oil, Forex, Metals, Equity indices and cryptocurrencies.

The exact assets that you will be able to trade depend on the type of account that you set up as well as the platform that you are going to be trading on.

There are between 20-30 different FX pairs that you can trade. You can also trade Gold / Silver from the commodity complex. This is actually on the light side and we would have liked to see more selection of commodities to trade.

You can also trade Equity index CFDs at NordFX with contracts on indices such as the Nasdaq, Dow Jones, Nikkei etc. Unfortunately, there are no single stock CFDs on offer at NordFX. Therefore, you wont be able to trade your favorite companies individually here.

For those crypto fans, there is a pretty respectable range of cryptocurrencies that you can trade. This will range from 15-17 depending on the type of platform. These include most coins you will want to trade such as Bitcoin, Ripple, ZCash, Monero etc.

Something quite unique that NordFX has are crypto basket CFDs. You can trade the below baskets that are based on market cap weightings of coins:

This means that you can easily trade the top 10 Altcoins or the top 14 cryptocurrencies all at once. It also leads to better diversification from a risk perspective. You can see exactly what each of these is composed of in the crypto account overview.

Leverage

The exact leverage that you will be able to get at NordFX will depend on the type of account that you have as well as the asset that you are trading.

The max leverage on their Forex pairs is up to 1,000:1. This is indeed quite high and we have not seen too many brokers provide such leverage. This will be offered through their Vanuatu licence as ESMA does not authorise leverage of higher than 30:1.

Note ✍️:Margin level is scaled according to lot size. For example, 10 lots or less has 1,000:1 leverage whereas more than 50 lots has 50:1 etc.

You also have 50:1 on the indices and Brent Crude oil CFD contracts. When it comes to the cryptocurrencies, this depends on whether you are trading on MT4 or MT5. Below are an example of USD margin level per lot:

| Pair | Forex Accounts | Crypto Account |

| BTCUSD | $150 | $50 |

| ETHUSD | $15 | $5 |

| XRPUSD | $0.02 | $0.02 |

| ZECUSD | $15 | $5 |

| XMRUSD | $15 | $5 |

| LTCUSD | $10 | $3 |

Each lot above is worth one of the asset. So, taking a look at the MT5 Crypto account margin on Bitcoin we have an implied leverage factor of 120:1 at current prices. This is about in line with other CFD brokers but less than other Futures exchanges such as BitMEX.

Of course, leverage is a double-edged sword…

You should take note of all the margin call and liquidation levels that apply to particular assets. Keeping your account fully funded is a requirement to avoid getting closed out of your positions.

Protection 👛: NordFX offers negative balance protection on their accounts (never less than 0).

NordFX Spreads & Commissions

Given that NordFX operates as an ECN broker, the spreads that you are likely to pay on the trading pairs are going to be quite low with some close to 0.

Of course, this will depend on the type of asset that you are trading as well as the account type. To give you an idea of the difference between pairs / accounts, we have the below indicative spread levels for the Forex Accounts (in pips).

| Pair | Fix | Pro | Zero |

| EURUSD | 2 | 1 | 0.3 |

| USDJPY | 2 | 1 | 0.2 |

| EURGBP | 2 | 1.5 | 0.5 |

| USDSGD | 6 | 3.4 | 2.2 |

| CHFJPY | 8 | 2.2 | 1 |

| GBPAUD | 6 | 2.2 | 1.2 |

These do indeed seem pretty reasonable and are in line with some of the other ECN brokers on the market. As you can see, the Zero has the lowest spreads although on this account you will have to pay a 0,0035% commission each side of the trade.

Note ✍️:If you trade more than 1,000 lots then you can get a discount on Commissions

In addition to the standard spreads / commissions, you will also be charged a "swap fee". This is standard in the Forex industry and is a measure of the difference between the two different interest rates on the currencies. It could be a fee or a rebate.

If you are going to be trading equity indices then you will be charge a flat fee or commission on the size of the position. This is set at 0.005% of the notional of the trade.

Finally, cryptocurreny fees are charged a little bit differently and they are based on a maker / taker fee dynamic. This essentially means that you will get given a rebate for making a market and you will be charged a fee for taking liquidity off their books.

Cryptocurrency trades also have a swap fee but these are set at a constant 14% per year.

Deposit / Withdrawal

If you are going to be funding your account then there are also some fees that you could incur. This depends on the method that you will use to fund your account. Below are some of the fees:

- WebMoney: 0.8%

- Visa / Maestro: 1.75% - 4.95% / 0 - 4.95%

- Perfect Money: Premium account 0.5%, Unverified account 1.99%

- Pay Today: 4%

- Bank Wire: This will be charged depending on where you are sending fees from

We found this slightly less than ideal. Even if these are fees that they have to incur from the payment processor, other brokers typically eat the fee.

If you want to withdraw your fees then you will also be charged a fee depending on the type of method:

- Bank Transfer: Will depend on wiring fees

- Visa / Maestro: 4% + $7.50

- Perfect Money: 0.5%

- Pay Today: 2%

- Skrill: 1%

Some of these withdrawal fees are quite high. For example, if you are going to be withdrawing via credit card you will have to pay the 4% (on top of the 1-4% for funding). We were also quite surprised to see that they are charging 1% on Skrill as well.

If you are looking for the most cost-effective way to withdraw your cash then you are probably best suited to try another web wallet such as Neteller.

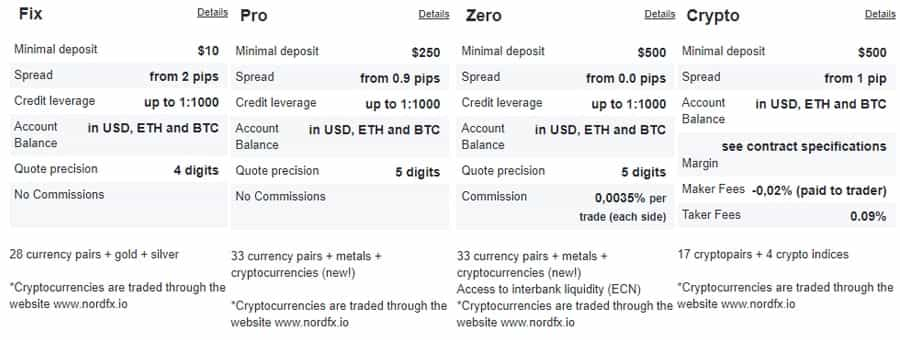

NordFX Account Types

There are 4 different account types at NordFX. These will give you access to the different spreads, markets and platforms.

For the 3 forex accounts at NordFX, you will use the MT4 trading platform. The cryptocurrency account will have you trading on the MT5 platform. If you are looking for more information in these you can read our platform section below.

Although all of the accounts offer crypto, you will get different leverage limits and 2 more crypto assets when you trade with the crypto specific account on MT5.

Moreover, when you are on the crypto specific account, you have access to all of those unique crypto indexes. These are not available on the MT4 platform with the Forex accounts.

Pro Tip ✔️:All accounts allow you to run an EA. Why not use the VPS offer below and trade the crypto markets 24/7/365.

When it comes to execution of the orders, the Fix account is executed immediately whereas all the other accounts have market (ECN) execution.

So, which account should you choose?

In the end this will really depend on your own preferences. If you are more of cryptocurrency trader then you will want to go for the crypto account. This of course assumes that you are used to trading on the MT5 platform.

If you trade high Forex volumes then the Zero account could be for you - watch those lot commissions though.

NordFX Demo Account

Why risk your funds at a live account initially when you have access to a full no obligation demo account?

NordFX offers their traders free use of demo account on any of the platforms that are listed below. This could be a great way for you to test the platform in a non-threatening way without risking your funds

Caution ⚠️: Demo accounts won't replicate the effects of “slippage”

If you wanted to set up a demo account you would need to register at NordFX. They need your contact information as well as an email to send you the login details. They will top up your account with "phantom" demo funds which would allow you to practice your strategies.

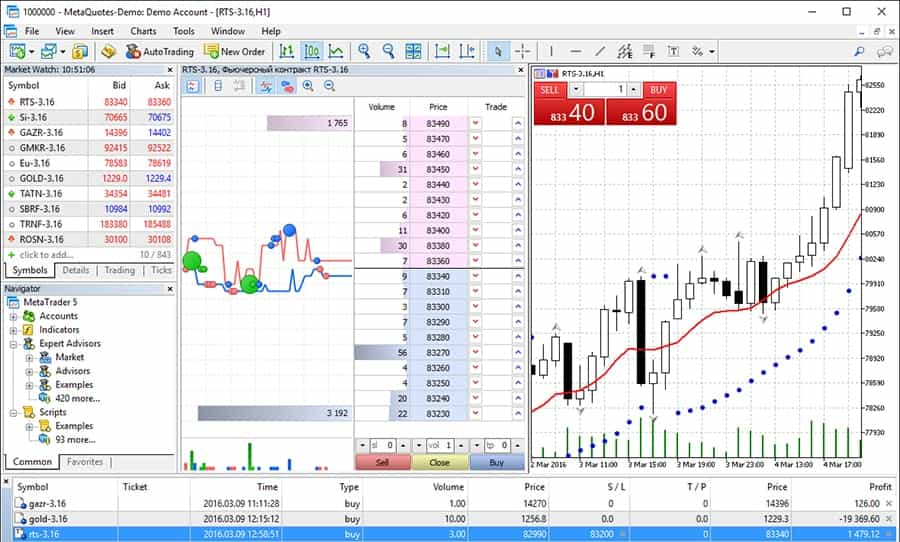

Platforms

One of the most important things that you are interested in as a trader is the platforms that you have access to at a broker.

NordFX uses the widely popular "MetaTrader" platforms. These were developed by the MetaQuotes company and are used by millions of traders globally as well as numerous brokers.

There are two MetaTrader platforms and these are the MT4 and MT5.

MT4

MT4 is the standard in the online trading world. It is time tested and is the most well-known platform among traders. It was developed specifically to trade forex markets.

MT4 is great for technical analysis traders as it has a host of tool and features. For example, it has advanced charting, order management, indicators and technical studies. The UI is also quite functional as the panels are "widgetised".

Moreover, given that the MT4 is used by so many brokers, it is really easy to switch if you so desire. You do not have to learn how to use a completely different platform with a different layout.

The MT4 platform also comes with its own coding language, MQL4. This is the language that is used to code Bots and algorithms which can trade the markets automatically and continuously.

The platform is available through a number of operating systems. You can download it for PC, Mac and on a Linux. You can also trade it online through your browser (although this is less optimal).

MT5

As most will probably tell, the MT5 is the upgraded platform that is offered by MetaQuotes.

The main benefits that this has over the MT4 as it relates to NordFX is that you can trade a wider array of assets. These include the cryptocurrencies through their crypto account.

In terms of the platform itself, there are a host of other features that are not offered on the MT4. There is an updated User Interface that is slightly easier to navigate and is more intuitive than the MT4.

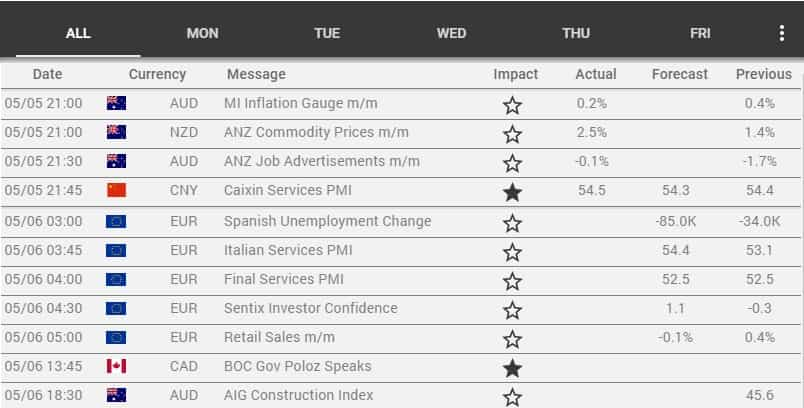

You can also graph out the order depth and see how the market looks across buys / sells. The NordFX MT5 platform has also included an Economic calendar right there so that you can see a timeline of the latest upcoming economic events / announcements.

The MT5 platform also has an upgraded programming language for coding EAs. This is MQL5 that is is an "object orientated" language. This allows you to code your own unique indicators on the platform.

Handy Hint ✔️:Why not use the MQL5 developer community for unique trading scripts? You can test these in the MT5 strategy tester

Like the MT4 platform, the MT5 is available on PC, Mac, Linux and through the web browser.

So, should you use MT4 or MT5?

If you are going to be trading forex then you still can't beat the efficiency and robustness of the MT4. However, if you want access to specific markets and are not bothered by the unique nature of the MT5 platform then you can use this.

MetaTrader MultiTerminal

If you are a trader that works with more than one trading account and you are looking for the best tool to manage them all then you can use the MultiTerminal Platform at NordFX.

This is also ideal for those brokers that have to manage multiple client accounts all at once. It has the same trading interface of the MT4 platform but allows you to place these orders across a number of accounts.

Note ✍️:If you are going to be managing multiple accounts they have to be run on the same trading server

With the NordFX multiterminal, you also have a manual or automatic distribution of the required trade volume for each account.

NordFX Mobile App

Unfortunately, NordFX has not developed their own mobile app for account administration etc. This means that if you are looking to manage funds / funding and other admin you will need to use the mobile browser.

However, you can still trade on your phone by using the MT4 and MT5 mobile applications that are provided by MetaQuotes.

These are some of the most popular trading applications on the market and have extensive features and functionality. For example, you can do charting, manage orders, overlay indicators etc. You can also buy / sell with one click ordering functionality.

The MT4 app has been downloaded over 10m+ times whereas the MT5 has over 1m+ downloads. They are both available in iOS and Android version. If you take a look into the ratings on the respective app stores then you can see that traders are indeed quite positive about the app.

Should you use a mobile app?

Well, if you do not have constant access to a PC then it could be the best choice. However, we would always prefer desktop and PC trading. Mobile networks are always slow and it is really hard to chart on a mobile screen.

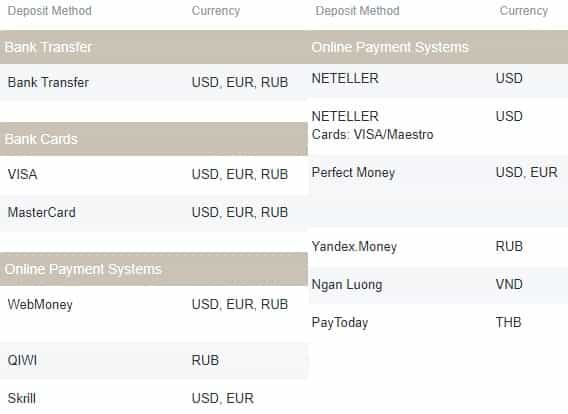

Funding / Withdrawal

Assuming that you were happy testing the NordFX demo, you will need to fund your live account in order to start trading.

Funding an account is pretty straightforward and can be initiated right on your dashboard. There are a range of options that you have to fund your account. Below are some of the most relevant:

All of these are instant payments apart from the wire option. This could take 3-5 business days to process depending on where you are sending the funds from.

Note ✍️: As part of their AML policies, you have to send / receive to an account in your name only. i.e. Third party transfers are not allowed

As with most brokers that have AML policies in place, you have to send the funds from an account that is in your name. In other words, NordFX does not accept third party deposits or withdrawals.

Withdrawals are just as easy but you do have less options when it comes to the type of withdrawal that you would like to initiate. If you were to choose a method, your fastest would probably be with a web wallet of some sort.

It is also important to point out that if you funded your account with a credit card then they will first return the deposited amount onto that card. Anything above that will have to be sent using another means such as a wire.

NordFX Customer Support

Customer support is an important component of your trading experience. Hence, we decided to dig into that of the support staff at NordFX.

If you need to get quick access to these agents then perhaps the best way of going about it is to reach out to them on the live chat. When we did this we were helped immediately and they appeared to be quite knowledgeable about the entire broker offering.

If you have an ongoing issue then you are perhaps better suited to raise that as a ticket inside your admin panel and dealing with it there. This ensures that if support agents change, they can track your issue.

Note ✍️:If you had a more general question, answers to this can easily be found in their FAQ section

If you prefer a more personal touch and want to speak to someone on the phone, then there are a few direct phone lines that you can call. They have multilingual agents in China, India, Russia, Sri Lanka and Thailand.

Finally, for those that are happy communicating through simple email, then you can reach their support agents at [email protected].

Other Tools at NordFX

It is always a nice touch when a broker includes other tools and resources to help improve your trading edge.

NordFX is no exception in this regard and they have bundled some useful trading tools that could either inform your trading or help you gain a competitive edge.

Analysis and Economic Calendar

NordFX provides regular weekly commentary that goes over the most important market movements, insights, trading setups and forecasts.

These are in-depth and long form pieces that are written up by Roman Butko, the head of research at NordFX. There are also more thoughtful pieces that he has done including the most recent analysis piece on the Basel III capital requirements.

In general, we found these pieces to be thoughtful, well written and easy to follow. Moreover, they are public so you can head on over to their analysis section now and see what Roman has been posting.

NordFX also includes an economic calendar on their website which you can use to track the latest Economic releases and announcements. However, if you have the MT5 platform then you will have a comprehensive version there at least.

Trading Signals

NordFX has directly integrated trading signals into their MT4 platform. This will allow you to follow some of the best traders on the market and decide whether to replicate their trading strategies.

You can also see a breakdown of their historical trading history. This allows you to filter the most profitable traders and follow only them on your trading dashboard. You also have full control of the automation / replication procedure.

Whether you will pay for these signals or get them for free will depend on the provider themselves. NordFX is merely facilitating the connection to the traders through the MT4 platfrom.

VPS

As we mentioned earlier, EAs are a great way for you to trade the markets in an automated way.

If you are going to be using them then the most optimal trading setup is to get yourself a trading Virtual Private Server (VPS). With this, you can leave your EA trading from a dedicated machine all the time.

There are a number of other benefits that come with a trading VPS server.

- Low Latency: The VPS providers that NordFX uses co-locate their trading servers with those of NordFX. This means that your orders will have very low latency and be executed within 1 millisecond. This is over 200 times faster than on your standard PC!

- Trade 24/7: The VPS has near 100% up-time so this means that you can trade the markets 24 hours a day.

- Simple: Most trading VPS servers these days are relatively easy to operate and maintain. You can easily log into the remote machine and maintain your EAs from your PC

Promo Code 🎁:NordFX traders get a 50% discount at Fozzy Forex VPS. Use the "NordFX_fozzy" promo code in order to claim your discount

Given that NordFX collaborates with Fuzzy VPS, once you have set up your account the MT4 will be preinstalled. It really just is a plug and play!

RAMM Service

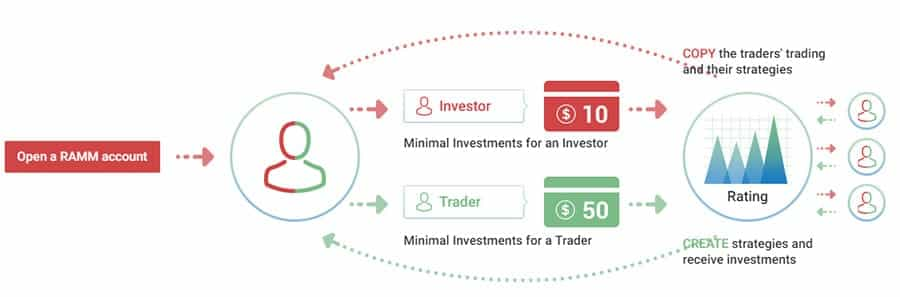

For those of you who are looking for a tool that gives you more control over your portfolio risk then NordFX has included a RAMM service.

RAMM (Risk Allocation Management Model) is a new investment model and is hybrid between PAMM account management and signal services. RAMM allows you to invest in several different trading strategies based on your risk tolerance.

The RAMM service is also unique as it allows you to invest in numerous different strategies while running only one account. You can use the strategies of expert advisors or you can trade independently if you wish.

Something that we really liked about the RAMM service is that you can determine the level of capital protection on your account. Once this level has been breached, all trading on the account will cease.

NordFX RAMM accounts also have a relatively low minimum investment requirement of $50 if you want to act as a managing trader or $10 if you want to act as an investor. You will have the same leverage ratios and limits that you have in the individual accounts.

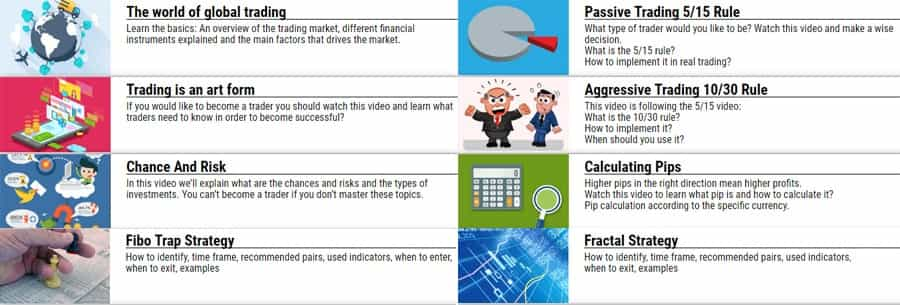

Education

When you are just starting out trading Forex, it can be slightly daunting. That is why it is always a nice touch when a broker includes guides and other resources.

NordFX has a range of helpful material that is targeted at traders with varying skill levels. Below are some of the essential resources:

Forex Resources

These are an extensive list of videos that explain numerous concepts in the Forex markets. All of these videos have been custom developed just for NordFX and you won’t find it anywhere else.

These videos are all well presented and quite informative. They are positioned to a number of different skill levels with the beginners guides on elementary forex disciplines and trading strategies.

For the more advanced traders out there, they have advanced technical analysis guides. This includes trends, channels, fractals and numerous other charting disciplines.

If you are a still new to the concept of trading on the MetaTrader platform then they have video guides on this too. These take you through everything from setting up the trading platform to adjusting trading parameters.

Finally, they have included two quite extensive eBooks that you can download and read offline. These are the beginners guide to Forex trading as well as a more advanced eBook. These are great as they have questions and answers at the end of them to test your knowledge.

Trader's Guide & Glossary

You also have more extensive analysis and in depth how to guides

For example, you have the guide to markets which gives you an overview and disciplines required to make money in a sustainable way over a longer period of time. They also have crypto analysis and trading guides.

There are also the more advanced trading analysis. This long form guide gives you the steps required to code, manage and test your own forex trading robots.

Finally, you also have an extensive Forex glossary. This has a collection of all the terms that you may come across on the trading platforms as well as in the broader forex / cryptocurrency markets.

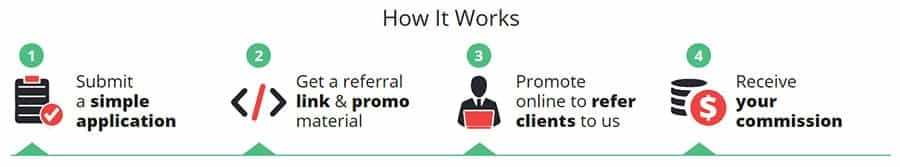

Affiliate Program

If you have found your experience at NordFX to be a pleasant one, then you can always sign up to their affiliate program and start earning some referral commission.

When you refer a trader to NordFX through their affiliate scheme, you will earn a commission of up to $700 for that trader. This is perhaps one of the largest that we have seen amoung Forex brokers recently.

NordFX also has a two-tiered referral structure. This means that not only will you earn commission from your direct referral but you will also earn 10% of the commissions that they earn on their referrals

Note ✍️: There are very specific requirements your referral must meet. You are also prohibited from giving investment advice. Make sure you read their T&Cs.

If you want to create an affiliate account and start referring traders to NordFX then you will have to submit an application here. They will need to first verify you and make sure that the traders you are sending are all above board.

Areas for Improvement

Our NordFX review would not be complete if we did not go over some of the aspects that we did not really like and that warrant improvement.

Firstly, the funding / withdrawal fees are really quite high. For example, the credit card fees are particularly hard to justify. While it is important to note that these are third party fees, they are still higher than most of the other brokers we have covered. Hence, it could be a challenge for some traders to get on board with.

Secondly, we would have liked to have seen more asset coverage particularly as it relates to single stock CFD products. You cannot trade any of your favourite companies on NordFX which is slightly frustrating. If you want to trade equities you will have to settle for the index CFDs.

Finally, while they do have educational resources, there are no live trading webinars and other types of personal training. Other brokers provide these resources and they are a great way to get traders to communicate interactively and take part in the broader NordFX trader pool. If this is really important to you then NordFX could always introduce you to one of their education partners for more in-depth training.

Conclusion

In summary, our NordFX review found them to be a well-established global broker with a proven track record. Their ECN liquidity gives traders some of the lowest spreads on a range of different assets.

Their regulatory status should assuage any fears by traders and their customer service helps make the process that much more pleasant. It is also a big plus for us that they use some of the most established trading technology in the MetaTrader MT4 & MT5.

While there are a few areas for improvement, these should not be a deal breaker. These are things that can easily be worked on by NordFX so one would hope that they take trader feedback on board.

So, should you consider NordFX?

We would encourage you to do your own research but if you are looking for a practical broker that ticks most boxes then they should be on your list.

Warning ⚡️: Trading CFDs is very risky and you could lose your entire investment. Make sure that you practice adequate risk management

Disclaimer: These are the writer’s opinions and should not be considered investment advice. Readers should do their own research.

Disclaimer: These are the writer’s opinions and should not be considered investment advice. Readers should do their own research.