Clover Finance Review: Foundational Layer For Cross-Chain Compatibility

In the summer of 2020, Decentralised Finance (DeFi) took off like an absolute rocket. While the rest of the world was busy trying to figure out what the next steps would be, crypto enthusiasts were captivated by this unique digital asset ecosystem and were ready to start experimenting with all of its new exciting features.

In very similar fashion to the recent craze with NFTs, DeFi ignited somewhat of a ‘FOMO’ fever in the industry which resulted in more and more users being on-boarded as they progressively grew comfortable with its innovative use cases and alternative financial utilities.

Decentralised Finance was at the heart of the conversation for most of the year and started gaining exponential traction at the beginning of February 2020 when its Total Value Locked (TVL), meaning the dollar value of assets locked in DeFi protocols, first surpassed $1 billion. From there, the TVL in DeFi assets carried on climbing throughout 2020 and peaked at an all-time-high of approximately $86 billion in May 2021.

The success of DeFi protocols is primarily linked to the wide array of services that they offer including decentralised exchanges, lending, borrowing, staking, yield farming, as well as annual percentage yield (APY) rates that quite frankly are unthinkable in traditional banking systems. However, some issues do persist.

While Decentralised Finance is clearly opening up a new frontier in crypto and is proving incredibly advantageous for its participants, DeFi platforms themselves are indeed anything but user-friendly, especially for newcomers. For instance, navigating through the vast ocean of Decentralised Exchanges (Dex's), engaging in complex staking programs on Uniswap or having to pay exorbitant gas fees just for an on-chain transaction can leave users perplexed and can potentially drive them away completely from DeFi applications.

This problem is further exacerbated by the fact that many DeFi-based projects choose to remain siloed within their own respective ecosystems, which is a by-product of the general lack of interoperability between projects and is expressive of the growing demand for intercommunication and cross-chain composability.

Arguably, the full implementation of cross-chain bridges represents one of the missing pieces in the overall development of the DeFi ecosystem, and this is precisely where the Clover Finance parachain comes into play.

Introducing Clover

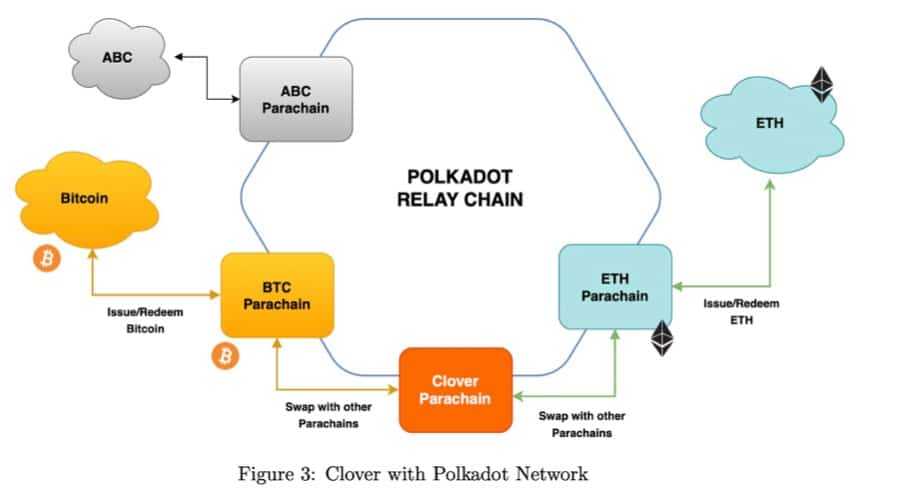

Clover is a Substrate-based, one-stop DeFi service provider that looks to compete as parachain on the Polkadot Network. Defined as a ‘foundational layer for cross-chain compatibility’, Clover aims to solve the current lack of blockchain intercommunication by becoming the first non-custodial, fully-decentralised cross-chain bridge from Ethereum to Polkadot.

Through its extensive support for Ethereum’s EVM-based applications, its built-in 2-way peg (2WP) design and by offering a wide selection of Substrate-native developer tools, Clover’s interoperable blockchain infrastructure aims to increase cross-chain composability between the Ethereum and Polkadot Networks. Furthermore, thanks to its architectural hybridity, Clover aspires to essentially become the ultimate ETH-DOT bridge protocol by leveraging its built-in cross-chain interoperability and by introducing new value propositions to DeFi on Polkadot.

In addition to cross-chain capabilities, Clover is building a foundational layer for DeFi applications to seamlessly operate by firstly reducing their development threshold through the implementation of Substrate frameworks, and secondly by facilitating a gasless transaction model to simplify user experience. Clover aims to provide DeFi applications with a variety of Substrate-based developer tools such as identity-based scripting capabilities and multiple digital signatures (multisig) to increase their overall protocol security.

The project is also developing the foundational layer for a cross-chain compatible, DeFi-centric, integrated financial service platform on Polkadot, using the Substrate framework. In fact, its objective is to provide its platform users and other projects with financial services such as modular DeFi protocols and application tools. Clover’s modular DeFi protocols include Staking Liquidity, Decentralised Trading, Decentralised Lending, Token Dividend, Governance and Synthetic Asset Protocols.

Built On Substrate

By merging its own innovative cross-chain bridge architecture with pre-existing frameworks on Substrate, Clover proposes a rather compelling, dynamic infrastructure.

Substrate, being Polkadot’s foundation layer and a standalone blockchain framework enabling developers to build highly advanced, customised blockchains, is technically fit for Clover. In fact, by building on top of Substrate, Clover is able to leverage its extensive ‘out-of-the-box’ functionalities as opposed to building them from scratch.

These Substrate-native functionalities include peer-to-peer networking, EVM implementation, governance and consensus mechanism, and integrating them directly from Substrate drastically reduces the time and work required to implement Clover. Furthemore, Substrate enables a high degree of protocol customisation and versatility, which is essential when achieving compatibility with Ethereum.

Thus, by leveraging Substrate’s inherently flexible architecture and database, Clover can enhance cross-chain composability between Polkadot and Ethereum-native projects and limit the overall development threshold through its Substrate-based developer tools.

Indeed, the process of implementing Substrate-native infrastructural features within its own design to bolster greater cross-chain interoperability makes Clover the ultimate representation of what a DeFi parachain should look like and how it should operate.

Therefore, before diving deeper into Clover’s architecture and its functionalities, it is productive to briefly discuss the importance of parachains, and specifically of the Clover parachain, in not only the Polkadot ecosystem but in crypto as a whole. This will help to better contextualise Clover’s utility in the realm of Decentralised Finance and will shed light on the general demand for interoperability within the space.

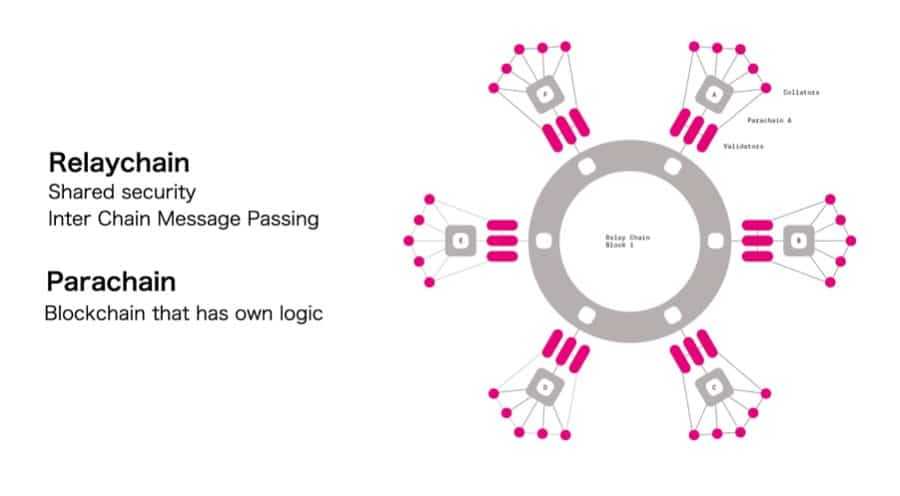

The Role Of Parachains

Given Polkadot’s leading cross-chain technology and rapid advancement in the space, Clover will compete to join as parachain on its Network. This will allow Clover to gain greater cross-chain interoperability features and enable it to communicate with all the other existing parachains on Polkadot, Bitcoin and Ethereum.

Polkadot was designed to be a Layer-0 multi-chain network, meaning that its central Relay Chain can provide Layer-0 security and interoperability for up to approximately 100 Layer-1 blockchains connected as parachains. Thus, parachains can be defined as the diverse layer-1 blockchains running in parallel within the Polkadot ecosystem, on both the Polkadot and Kusama Networks. Connected to and secured by the Relay Chain, parachains benefit from the security, scalability, interoperability and governance provided by Polkadot.

Polkadot’s parachain model is based on the conviction that future blockchain infrastructures will require greater interoperability, scalability and intercommunication in order to cater to the growing demand for assets and value to be moved seamlessly within space. For this very reason, Polkadot allows any asset or data to move between its connected parachains, creating a new hub of opportunities in blockchain and, more specifically, in DeFi.

Because Polkadot does not enforce any specific criteria on the design of parachains, this essentially allows them to develop as individual, flexible entities within the greater Polkadot ecosystem and create a value-rich environment of diverse infrastructures. The only thing that parachains need to do is prove to the Polkadot validators that every block of the parachain follows the agreed-upon protocol.

This flexibility means that each parachain can have its own design, token and governance model, allowing it to deliver highly-specialised utilities and use cases. This flexibility also means that parachains can be run as public or private networks, as communities or enterprises, as applications for other projects to build on top of or, in Clover’s case, as cross-chain bridges and DeFi service providers.

Therefore, parachains can be thought of as the underlying architecture to Polkadot’s cross-chain technology as they allow for interoperability to exist among themselves and enable the Polkadot ecosystem to tap into the infrastructure of other chains as well.

This is precisely what the Clover parachain aspires to do, that is to leverage Polkadot’s underlying architecture to establish ETH-DOT cross-chain bridges for Ethereum-native assets to seamlessly migrate to the Polkadot Network.

Clover’s 2-Way Peg System

The demand for parachain-like, interoperable architectures in the DeFi space is currently at an all-time-high. This is primarily due to the fact that the decentralised finance networks of today remain siloed and isolated within their own ecosystems and cannot trustlessly communicate with one another to exchange value. This, in turn, leads to some third party custodial services who cause the whole ecosystem to become more centralised, taking away from blockchain’s decentralised essence as a whole.

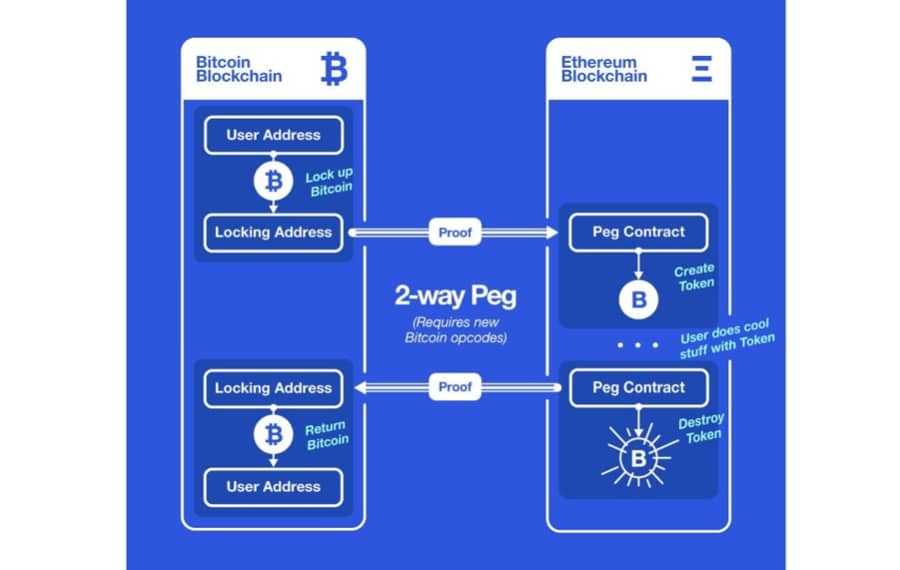

To solve this issue and achieve a new layer of interoperability, Clover designed its own in-house 2-Way Peg (2WP) system through built-in SPV Simulation Technology. This 2-Way Peg system is one of the most important features in Clover’s infrastructure and it looks to tackle some of the centralised elements that persist within the cross-chain DeFi space.

How 2-Way Pegs Work

A 2-Way Peg system allows the transfer of an asset from a base chain to a secondary blockchain, and vice versa. However, this transfer is quite the illusion as in fact base layer assets are not transferred, but rather temporarily locked on the base blockchain while the same amount of equivalent tokens is unlocked on the secondary blockchain. The base layer assets can unlock when the equivalent amount of tokens on the secondary blockchain becomes locked again.

The concept of a 2-Way Peg dates back to the early days of Nakamoto and, while it theoretically works, this system actually comes with some inherent risks. Any 2-Way Peg system relies heavily on assumptions of trust and honesty between the two actors involved in the 2-WP. In addition, another required assumption is the honesty of any third party holding custody of assets locked on a blockchain. If these assumptions fail to hold, then base layer assets and secondary blockchain assets could both unlock at the same time, causing a malicious double-spend.

To counter this, Clover looks to decentralise the process even further by designing its built-in SPV Chain Simulation Technology, allowing seamless cross-chain communication and trustless 2-way pegs between Turing-complete and non-Turing-complete blockchains.

How Clover’s 2-WP Works

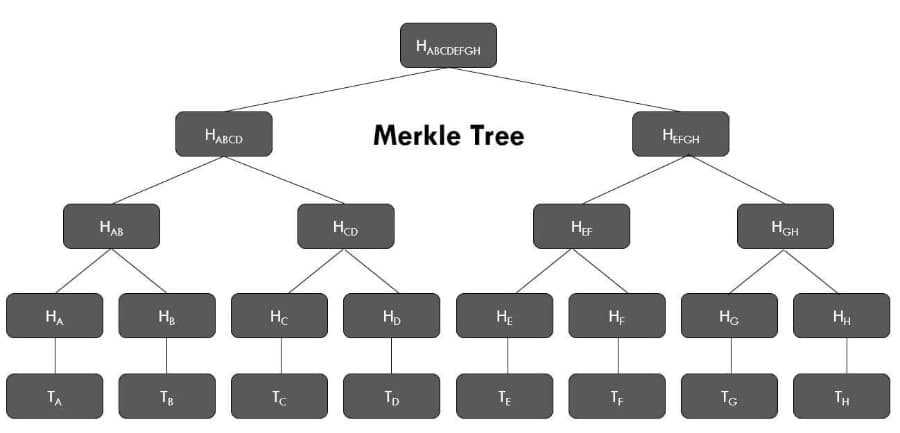

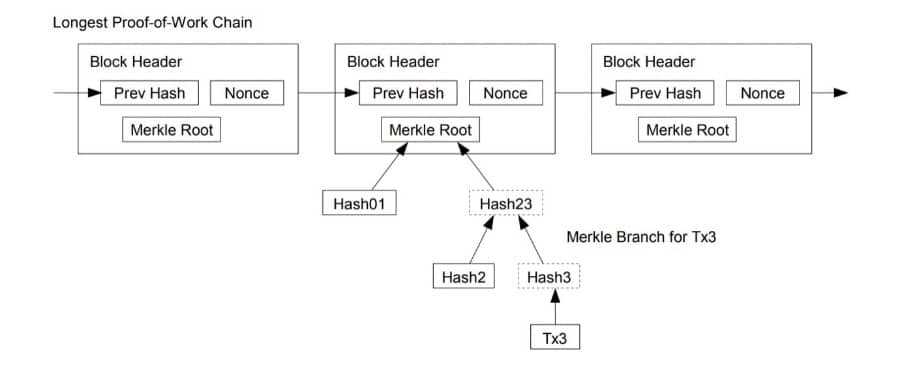

To better understand how this works it is important to note that, contrary to popular belief, an EVM can verify Bitcoin transactions by dissecting its block headers. Block headers are essentially used to identify specific blocks on an entire blockchain and allow users to pinpoint data or transaction history on a particular block. In addition, it is important to understand that Bitcoin and Ethereum transactions are mapped on a Merkle tree structure.

In essence, a Merkle tree is a way of mapping out, or hashing, large ‘chunks’ of data in one place. These chunks are then split into different ‘buckets’, where each bucket contains only a few chunks of data. Then, the same process is applied to the hash of each bucket and repeated until there is only one hash leftover, called the root hash.

This hashing algorithm creates a neat mechanism called a Merkle proof. A Merkle proof consists of a chunk, the root hash of the Merkle tree and the ‘branch’ containing all the hashes along the path from the chunk to the root hash. This structure allows anyone who is reading the proof to verify the hashing consistency for a particular branch and identify the exact position of a chunk of data, such as a transaction, in the Merkle tree.

In a Merkle tree, the block header contains the root hash of the tree for that block’s transactions. Thus, given a header and a transaction, Clover can verify the path from the root hash of the tree to the branch that contains the transaction through a process called Merkle-based inclusion proof. Basically, Clover can check if a transaction is included by validating the hashing consistency of the branch that holds that transaction and by following the linear structure of its Merkle tree.

Furthermore, Clover only needs a base layer’s block header, a transaction and its proof of inclusion for it to be stored in the Clover contract. This means that through Merkle-based inclusion proof Clover can initiate a cross-chain bridge between a base layer blockchain and a second layer blockchain, simply by verifying the base-layer’s transaction, block header, root hash and branch.

A user looking to peg-out Bitcoin, for instance, can do so through Clover by sending funds to a predetermined contract address and Bitcoin script that escrows funds for further peg-ins, initiating a communication bridge between the base layer and the secondary blockchain. Clover, in turn, can then confirm that the transaction for the pegged-out BTC is included in a block by checking its Merkle path of inclusion and verifying the hashing consistency of its branch, thus eliminating altogether the need for a third party custodial service.

On the other hand, a user willing to peg-in Bitcoin or Ethereum sends tokenised assets to the Clover-deployed peg-in contract and, through Merkle inclusion proof, can then redeem real assets back on their own chain. Clover’s peg-in and peg-out architecture will potentially incentivise ETH-based projects to transfer their ERC-20 assets to the Polkadot Network via Clover’s cross-chain architecture and native contract.

Ultimately, it is this in-house 2-Way Peg system that gives Clover its inherently interoperable capabilities and allows it to build a decentralised cross-chain bridge from Ethereum to Polkadot, while greatly reducing the need for third party escrows in Decentralised Finance protocols.

Threshold Schnorr Signatures

While Clover is not the only project offering cross-chain bridge capabilities, it does however propose an alternative, more secure digital signature system. In fact, today’s cross-chain bridges operate under a federated model governed by a trusted set of off-chain relayers who, if they really wanted to, could cooperate to steal funds with a single point of failure. This represents one of the biggest pain points in decentralised infrastructures, but Clover offers an innovative solution through its Schnorr Threshold Signatory Protocol.

With its Schnorr Signatures, Clover can provide a high level of decentralisation by accommodating up to an unlimited number of signatories within its framework and by greatly reducing verification costs. Essentially, the more signatories a bridge accommodates the more decentralised it is, however this is quite the challenge because doing so requires high gas fees and high costs.

Having a multiplicity of signatories who validate transactions constitutes a multisig operation and, while it is technically ideal, Bitcoin can only have a maximum of 15 signatories in a multisig operation. Ethereum, on the other hand, can process more sophisticated multisig operations but the cost of doing so still remains unsustainably high due to gas fees on the ETH Network.

With the Clover bridge, the entire multisig operation is condensed into one major aggregated public key, or pubKey, which can be verified with a single signature check, consuming only 85,000 in Ethereum VM and 291 weight units in Bitcoin script. In essence, Clover’s Schnorr multisig operations offer a more stable and secure methodology for validating transactions and help the project preserve the overall decentralisation of its architecture.

Gasless Transactions And Builder Incentives

Even with Ethereum 2.0 on the horizon, high gas fees remain one of the most pressing issues in the DeFi space. Thus, it is not surprising that certain DeFi projects have chosen to completely by-pass the Ethereum Network from the get-go and build on more sustainable platforms offered by Polkadot, Solana, NEAR and Algorand, for instance.

Ethereum 2.0 will, to some extent, enhance scalability in DeFi but other Layer-1 solutions, such as Clover, with optimised gas fee structures will indeed continue to thrive in the cross-chain DeFi sphere. To tackle the high gas fees on the Ethereum Network, Clover proposes a more worthwhile fee-economic structure based on gasless transactions and developer incentives to create a more sustainable, more democratic DeFi ecosystem on Polkadot.

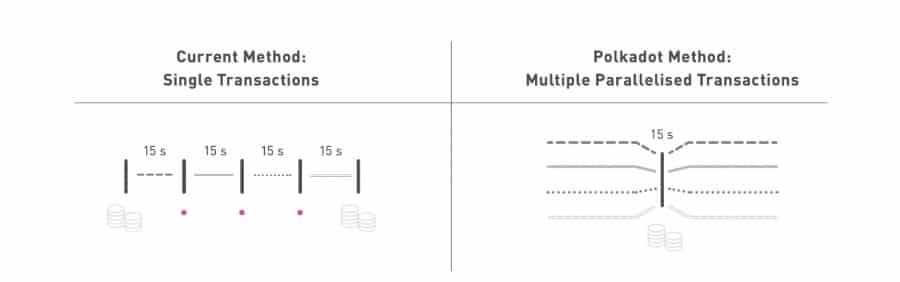

As a sharded multi-chain network built on Parachains, Polkadot brings a new level of scalability to Layer-1 infrastructures and is able to process multiple transactions on several chains at once. Thus, Polkadot creates the right conditions for Clover to realise low gas fees and deliver a fast trading experience to its platform users.

In addition to building an interoperable infrastructure for various assets to seamlessly operate, the Clover parachain has redesigned the networking layer to allow relayers to act on behalf of senders where relayers can cover gas fees in the base currency and subsequently receive compensation in the denominated asset. Clover creates a near-zero gas fee transaction ecosystem by using ERC-20 token to pay for gas fees and liquidating them into its native CLV token on the market.

Clover created this innovative transaction model to, firstly, allow users to completely detach from expensive base currencies such as Ethereum, secondly, incentivise third-party developers and relayers and, thirdly, boost external dApp development to bolster the growth of its ecosystem and that of Polkadot.

DeFi Service Provider

Clover aspires to leverage Polkadot’s leading cross-chain technology to deliver the smoothest, most hassle-free DeFi experience to its users and aims to furnish the DOT ecosystem with a series of DeFi related products and services designed to cater to the needs of its vast user base.

Clover Is A One-Stop, All-Round DeFi Service Provider - Image via Clover Finance Whitepaper

Clover Is A One-Stop, All-Round DeFi Service Provider - Image via Clover Finance Whitepaper

As a DeFi service provider, Clover offers modular DeFi protocols and application tools to ease the overall process of developing Decentralised Finance infrastructures and facilitate developer experience. Clover’s modular DeFi protocols include: Staking Liquidity, Synthetic Assets, Decentralised Trading, Decentralised Lending and Governance.

Staking Liquidity

Through its Staking Liquidity modular protocol, Clover seeks to tackle the illiquidity issue of staked assets and proposes the concept of a tokenised staking pool. When users stake their assets in the staking pool, Clover then takes these assets and tokenises them as S-Assets, allowing users to redeploy them in other DeFi applications or investments.

For instance, users can lend S-Assets to earn interest or use their S-Assets as collateral for a stablecoin such as USDT. Furthermore, Clover’s Staking Liquidity protocol:

- Manages the issuance of S-Assets.

- Manages the locked/staked assets.

- Makes S-Assets liquid and tradable across all chains on the Polkadot Network.

- Creates a new derivative market for tokenised assets (S-Assets) on Polkadot.

- Provides Polkadot-like security, reliability and speed.

To contextualise this, users can stake DOT and receive its tokenised equivalent S-DOT. S-DOT can then be redeployed or reinvested in other DeFi applications as S-DOT is liquid and tradable across all Polkadot chains. This is also advantageous for developers as it essentially allows them to leverage Clover’s ‘ready made’, modular staking protocol to gain access to Polkadot’s large user base.

Decentralised Trading Protocol

Clover offers its own Automated Market Maker (AMM) modular protocol to combat transaction slippage issues. On DEXs such as Uniswap, for instance, when the liquidity pool for a trading pair is too small, the transaction slippage can cause a bothersome, unfavorable experience for users and this indeed constitutes a major hurdle in the DeFi landscape.

To remedy this, Clover designed an AMM protocol with built-in pending order capabilities to increase the trading depth of the book and reduce slippage overall. Clover’s Decentralised Trading protocol is a powerful tool that allows users to fill orders at a fixed price and enables developers to implement a built-in, optimised AMM in new DeFi applications and external dApps.

Decentralised Lending Protocol

Clover introduces a Compound-influenced lending platform with integrated Lending Supply & Demand Index and Real-Time Interest Rate Calculation. As previously mentioned, users can mint synthetic assets, S-DOT for example, by supplying the underlying assets (DOT) to the market where these are used as collateral for asset borrowing. In terms of interest rates, Clover’s Lending protocol adjusts this by calculating the rate equilibrium between supply and demand. Consequently, when demand is low, interest rates will also be low, and vice versa.

Moreover, for an external dApp looking to implement its Decentralised Lending protocol, Clover will provide the following advantages:

- The dApp will be able to borrow from Clover’s system without waiting for order execution or requiring off-chain computation.

- The dApp’s traders will be able to put up their existing investment portfolios as collateral to borrow DOT or stablecoins.

Clover Finance Governance

Governance allows a project’s community to actively take part in decision-making events and have a say in the development of the project itself. Clover’s Governance protocol will implement on-chain voting and execution and reduce the impact of human intervention, creating a decentralised modular infrastructure. Clover’s Governance model offers: Proposal, Vote Policy, Governing Parametres and Governing Development.

In addition, through Clover’s Governance module, a protocol’s community will be able to vote, propose and implement changes with regards to:

- New asset listings.

- Withdrawal of the reserve of a token.

- Updating oracle addresses.

- Updating interest rates.

CLV Token

CLV is Clover’s native utility token and has a variety of use cases. Much like Ethereum’s ETH, the CLV token is used as gas on Clover’s platform to pay for transactions, but it also plays a vital role in its own gasless transaction model. Clover’s near-zero transaction fee design is based on its ability to take ERC-20 assets, use them to pay gas fees, and subsequently liquidate the ERC assets into CLV on the market.

In addition, the CLV token possesses a variety of utilities and allows its holders to:

- Stake to run nodes on Clover.

- Participate in consensus and earn rewards.

- Transact on exchanges and marketplaces.

- Earn rewards from platform usage.

- Participate in governance activities.

Elect, vote and govern on the Clover platform.

CoinList ICO

Clover’s CLV token enjoyed a very successful launch on CoinList on April 20th, April 21st and May 4th of 2021. Its Initial Coin Offering (ICO) price ranged between $0.20, $0.29 and $0.35, based on the different lock-up parametres. From its ICO prices, Clover’s CLV token peaked at an all-time-high of $42.21, returning investors over 21,000% gains.

Clover received early-stage, long-term support from heavyweight firms in the blockchain industry such as Bitcoin.com, Alameda Research, OKExchange, Kyros Ventures, Moonwhale, Hypersphere, Polychain Capital and KR1.

Clover Wallet

Clover has its own Metamask-like browser extension wallet with integrated support for many existing EVM-compatible networks such as Fantom, Avalanche, Ethereum and BSC. In addition to current Polkadot and Kusama support, Clover’s wallet will be adding all major Polkadot Parachains in the near future, in order to cultivate an interoperable environment of cross-chain DeFi utility on Polkadot.

Clover’s Team

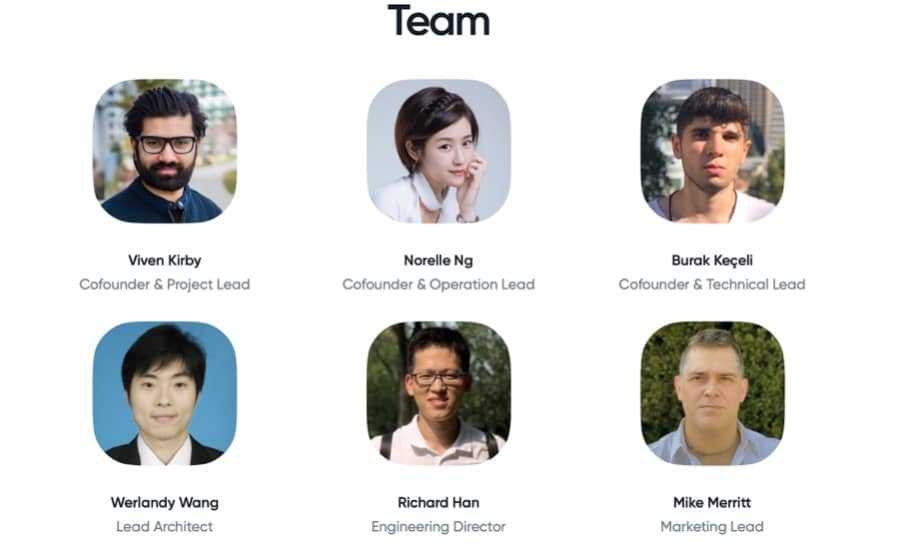

Achieving innovation in the DeFi and parachain space is no easy feat, but Clover can count on a solid Team of blockchain architects, engineers, project and marketing leaders to help it stay ahead of cutting-edge technologies and ensure its continuous development. Clover’s Team is composed of:

Viven Kirby - Cofounder & Operation Lead

Norelle Ng - Cofounder & Operation Lead

Burak Keçeli - Cofounder & Technical Lead

Werlandy Wang - Lead Architect

Richard Han - Engineering Director

Mike Merritt - Marketing Lead

Conclusion

Clover can be characterised as the ultimate embodiment of a Polkadot parachain as it addresses the wide-spread lack of interoperability in today’s DeFi and smart contract infrastructures, and sheds light on the demand for intercommunication between DeFi projects.

Clover is furthermore looking to leverage the cross-chain composability features inherent in the Polkadot ecosystem to solve some of the most pressing issues in the world of Decentralised Finance such as high gas fees and siloed, isolated networks. To remedy this, Clover has developed its EVM-compatible, 2-way peg system to help Ethereum-based projects and their tokens seamlessly migrate to the Polkadot network and has also designed a user-friendly, community-driven gasless transaction model.

As an all-in-one DeFi service provider offering a selection of financial services and modular protocols, Clover aims to deliver a smooth, DeFi-centric experience for non-savvy newcomers, crypto veterans and developers alike.

Clover ultimately aspires to create a new paradigm in the world of DeFi by bringing life to cross-chain interoperability through its ETH-DOT bridge, by breaking the barriers between separate, siloed chains and by modelling itself on the idea that all future blockchains will, indeed, be fully-composable.

Disclaimer: These are the writer’s opinions and should not be considered investment advice. Readers should do their own research.