Coinmama Review 2024: Complete Beginners Guide

Coinmama is a crypto exchange that allows clients to buy and sell cryptocurrency using multiple payment options like Apple Pay, Google Pay, credit card, bank transfers, or wire transfers like SWIFT and SEPA.

You're ready to start trading Bitcoin, investing or selling your cryptocurrency and on the search for a reputable cryptocurrency exchange. The challenge presents itself when you realise hundreds of crypto exchanges are available, so how do you know the right one to choose?

Coinmama is an established crypto exchange based in Ireland. Nimrod Gruber, Iian Schuster and Laurence Newman founded Coinmama in 2013. The platform has a small number of popular cryptocurrencies available, notably established cryptos like Ethereum (ETH), Bitcoin (BTC), Litecoin (LTC), and stablecoins USDC and USDT.

"We're Coinmama, a financial service that makes it fast, safe and fun to buy digital currency anywhere in the world. We believe that the future of money is one where we, the people, are in control of our own economy. A future where there's no place for middlemen, hidden fees and fine print." (Source: Coinmama)

Coinmama is an easy platform to navigate and is ideally suited to novice crypto enthusiasts who may feel overwhelmed when faced with hundreds of cryptos and a plethora of tools and services available on a larger cryptocurrency exchange.

This Coinmama exchange review will help you decide if it's the right fit for you.

Coinmama Review: Summary

Below is a quick overview of the Coinmama cryptocurrency exchange.

| HEADQUARTERS | Ireland |

| YEAR ESTABLISHED | 2013 |

| REGULATION | Regulated money service business registered with FinCEN & FINTTRAC |

| SPOT CRYPTOCURRENCIES LISTED | BTC, ETH, DOGE, XRP, AAVE, LINK, ETC, BCH, USDT, USDC, UNI |

| NATIVE TOKEN | NONE |

| TRANSACTION FEES: | 0.99% to 3.90% |

| SECURITY | 2FA and funds not held on the platform |

| BEGINNER-FRIENDLY | Yes |

| KYC/AML VERIFICATION: | Yes |

| FIAT CURRENCY SUPPORT | All fiat currencies accepted |

| PAYMENT METHODS | Google Pay, Apple Pay, or any debit card, Fedwire, SEPA instant, SEPA, SWIFT, Skrill |

| PAYMENT FEES | $4.99 for Google Pay, Apple Pay & Debit/Credit card. Zero cost for other payments |

| MINIMUM ORDER | $30.00 |

The Key Features of Coinmama Are:

Coinmama has an excellent range of features, including the following: -

- Beginner friendly

- Quick account verification

- $30.00 minimum orders

- Instant order delivery

- A small range of popular and in-demand coins

- Range of payment methods: For example, Google Pay, Apple Pay, credit cards, and SWIFT

- High transaction limits compared to other exchanges: Up to $5,000 at level 1

- Loyalty program: Discounts for volume

- Accepts all fiat currencies

What is Coinmama?

Coinmama is an established cryptocurrency exchange where users can buy and sell popular cryptos. Unlike many leading crypto platforms, with hundreds of cryptocurrencies listed, Coinmama has a small range of the top coins.

- Bitcoin (BTC)

- Ethereum (ETH)

- Doge (DOGE)

- Ripple (XRP)

- Aave (AAVE)

- Chainlink (LINK)

- Ethereum Classic (ETC)

- Bitcoin Cash (BCH)

- Uniswap (UNI)

- Tether (USDT)

- USDC

Coinmama is also a "Fiat Gateway, " meaning users can exchange their fiat currency for cryptocurrency. Coinmama accepts all fiat currencies, which makes it attractive compared to crypto platforms with limited fiat money options. Other established exchanges offer a fiat gateway service, so how is Coinmama different?

Unlike many other crypto exchanges, you cannot trade crypto with Coinmama. You have two options, buying and selling crypto. There are no staking opportunities, and Coinmama does not have a mobile app or a crypto wallet.

While it may appear that Coinmama doesn't have as much to offer as some other crypto exchanges, it provides simplicity, and when you're starting on your crypto journey, the less complicated, the better.

Coinmama is available in 200 countries and has over 3 million users. Only a few countries and several territories are restricted, such as Hawaii and New York.

Coinmama Customer Support

Coinmama supports its clients well. It has customer-focused values, endeavouring to put the customer first. They describe the platform as the “friendliest exchange in the world”, and the team page only lists first names, which is a nice touch.

Coinmama's core values are the following: -

• Customer-centric

• Communication

• Result-oriented

• Ownership

• Teamwork

• Innovative

• Integrity

• Growth

• Simple

• Fun

It's uncommon to find a cryptocurrency exchange with rave reviews, but Coinmama succeeds where others fail, proving a solid commitment to its users.

Coinmama has a Trustpilot rating of 4.4 stars with comments like "I absolutely recommend it" and "Excellent customer support as always." The few negative comments are from users who did not understand that KYC is for their long-term account security.

It's good to note that the Coinmama team responds considerately to every Trustpilot review.

If you have a problem with your account or any issue, Coinmama has a help page with several sections for immediate answers: -

- New to Crypto

- Get Verified

- Buy and Sell

- My Order

- Account and Security

- Wallets

Each section opens to more in-depth details on each subject, so you might be able to get an immediate answer. If not, click on "Connect" at the top right of the page, and you have two options, send an email form or call Coinmama on the telephone.

How Does Coinmama Work?

Coinmama is excellent for beginners because it is easy to use. The first step is to open an account and wait for verification. As Coinmama is an MSB (Money Services Business), you must provide the details as asked for KYC reasons. Providing your email address, full name, address, and other relevant information helps to protect your account. It's a good idea to create a strong password and then submit your application.

Coinmama is typically speedy at verifying new accounts. Some users reported a response within thirty minutes, which is exceptional, although probably best not to expect it to be that fast every time. A more realistic timeframe would be 24 hours, so don't rush to live chat if thirty-five minutes pass without verification!

Registration and Verification

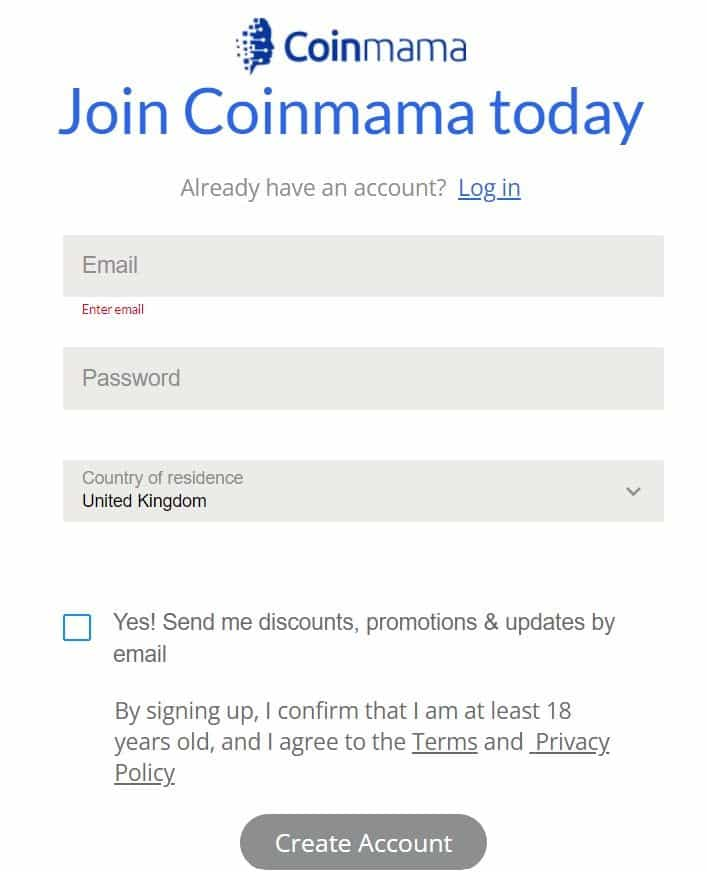

It's easy to register an account with Coinmama by entering your email, password and other details required (see below image), and clicking ‘Create Account’.

In order to begin purchasing coins, you first need to verify your identity.

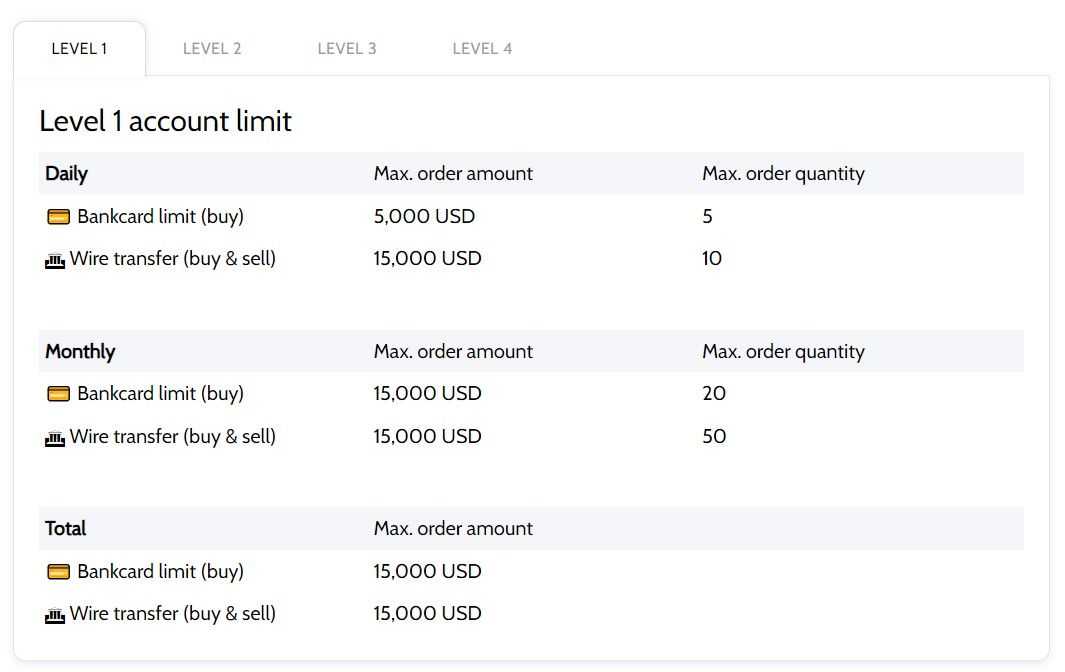

Coinmama has 3 levels of verification for crypto purchasing, each requiring more details than the last.

- Level 1 allows you to buy up to $15,000

- Level 2 allows up to $50,000

- Level 3 allows up to $1 million.

After registering, Coinmama sends an email asking you to verify your account. After clicking the link, you will be redirected back to the site.

What's The Best Wallet for Coinmama Crypto Purchases?

Before buying cryptocurrency on Coinmama, you will need a crypto wallet supporting the coin of your choice. Coinmama does not provide a wallet.

All Coinmama cryptocurrencies are established in the market, so choosing a supporting wallet for your crypto purchases is easy. You might consider a hot wallet (online) or a cold wallet (an offline hardware wallet), which is regarded as "safer" than an online wallet.

For example, here is a list to save you time searching: -

- Trezor or Ledger (cold wallets)

- Trustwallet (online wallet)

- Metamask (software wallet)

Multiple crypto wallets are available, so research online if you don't wish to use the above options or check the best crypto hardware wallets of 2024.

After verifying your Coinmama account, decide which cryptocurrency you want to buy and connect your wallet. Choose a payment option from the multiple choices available, such as Google Pay, Apple Pay, bank transfer, credit card etc.

Coinmama does not store your credit card details or have access to your cryptocurrency holdings at any time. The platform is a non-custodial crypto broker, so your crypto purchases are always sent to your secure crypto wallet and not held on the exchange.

Once Coinmama confirms payment, your newly purchased tokens will be on the way to your secure crypto wallet and should usually arrive within minutes.

What beginners love about Coinmama is how easy it is to buy and sell cryptocurrencies. You don't have to deposit funds, wait for them to clear and then buy your cryptocurrencies. It's also an added safety feature because you aren't storing your fiat currency on an exchange, or registering bank account details.

How Many Cryptos Can I Buy With Coinmama?

Depending on the account verification levels, Coinmama provides surprisingly high transaction limits. It gives monthly buying and selling limits of $15,000, $50,000, and $100,000 in level 1, level 2, and level 3, respectively.

For each level, Coinmama requires deeper verification details. Level 1 needs a government ID like a driver's licence, passport or national ID card if you don't drive or travel abroad. Users must complete a KYC and submit a utility bill (no older than six months) for level 2 and above.

Coinmama even has a VIP verification for high limits of transactions.

How to Purchase

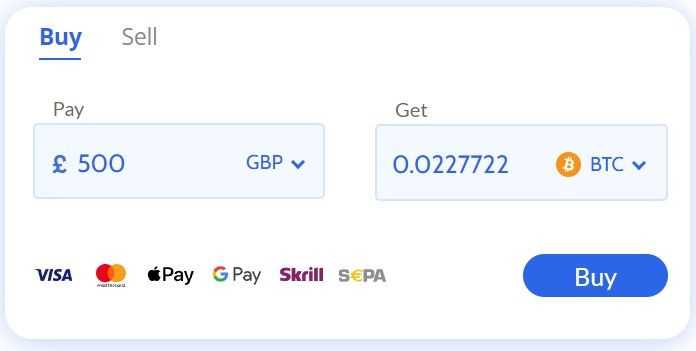

Once your identification is verified, you can begin purchasing cryptocurrencies by clicking on the “Buy” tab on the Coinmama website.

Suppose you choose Bitcoin (BTC). In the example below you can see that you enter the fiat currency amount and Coinmama automatically shows how much Bitcoin (BTC) you will get for that purchase.

Once you’ve selected the amount of Bitcoin you want, the exchange rate at the time of the purchase is locked in, meaning you will receive the exact amount of cryptocurrency ordered, regardless of market fluctuations during the payment process.

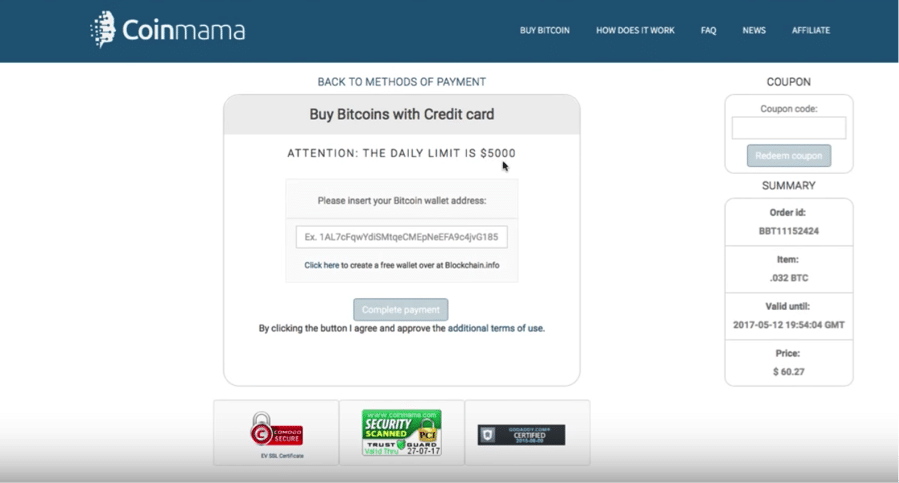

The next step is to select your method of payment. After completing the payment information, enter your wallet address then click ‘Complete Payment’.

Once the payment details are accepted, the Bitcoin (BTC) is immediately sent to your wallet address. If, for whatever reason, the order aborts, Coinmama reverses the money into your bank account within 48 hours.

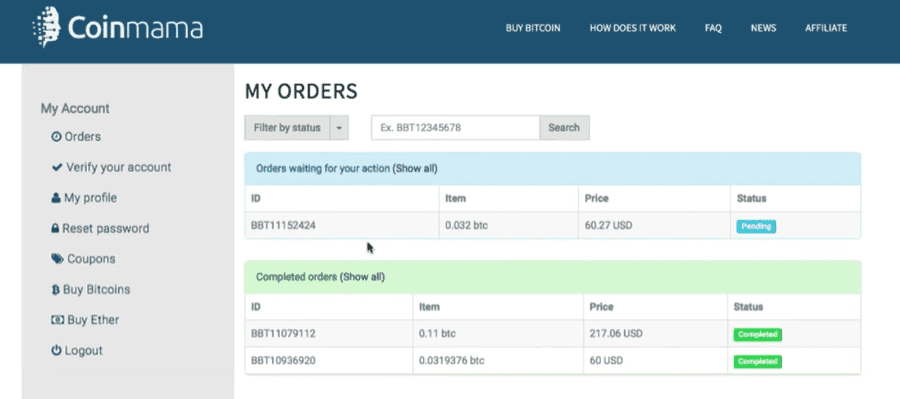

On your account dashboard, you can click the ‘Orders’ button on the sidebar menu to review your orders.

Is Coinmama Safe?

Coinmama does not store your bank card details, and there is no requirement to add a bank account. The exchange follows a KYC process, requiring details such as name and address and submission of a valid ID like a driver's licence or passport.

Coinmama uses Trust Guard and Comodo to ensure your security (both using 256-Bit SSL encryption on pages that contain private information).

Coinmama is a centralised exchange, meaning they have one single point of failure. If the platform got hacked, your personal information could be more exposed than with a decentralised exchange.

It may seem inconvenient that Coinmama doesn't provide an online wallet. Still, the benefit is that it makes you think seriously about setting up a secure digital wallet instead of taking the easy option. Many leading cryptocurrency exchanges provide an online (hot) wallet, but the downside is they have access to your private keys.

Coinmama offers 2FA for your account, but it isn't mandatory. We would advise opting in, as it's better to be safe than sorry.

Coinmama Academy

New to Crypto? Don't worry. Coinmama can help. The Academy is easy to navigate and written for even the virgin crypto novice. Advice is straightforward and follows a linear journey.

"Don't worry, crypto isn't as cryptic as you might think, and we're here to make it as easy as possible for you. Let's jump right in…" (Source: Coinmama)

The Coinmama blog is up to date and has several sections, including Coinmama updates and tutorials, Bitcoin news, altcoins and crypto education, which lists crypto basics, crypto how to, crypto knowledge, crypto safety and crypto lite.

The more you understand the crypto space, the better your grasp of how to secure your cryptocurrency holdings.

Coinmama VIP Service

The Coinmama VIP service provides an OTC (over-the-counter) customised service for institutions, businesses or "high net-worth individuals" that want to place large orders that, if placed independently, could affect the crypto market.

- 1-on-1 Personal Success Manager: This person has a wealth of trading experience and will be your guide.

- Self-Custody Storage: "Not your keys, not your coins". We'll help you secure your coins in an ultimate setup suited to your needs. (Source: Coinmama)

- Multiple Digital Assets: The Coinmama over-the-counter service offers dozens of popular cryptos and continues to add more.

- Multiple Funding Methods: Coinmama has an excellent range of payment methods.

- Fast Execution: There is no mention of how fast you can expect.

- Competitive Fees: These fees are not transparent on the Coinmama website.

- 24/7 Support: Coinmama has an excellent reputation for customer support.

To apply for the VIP service, click "VIP" and complete the form at the top of the page.

Coinmama Transaction Fees

Coinmama fees are competitive. Depending on your loyalty level, they range from 0.99% to 3.90%. It's tricky to find details of fees on the Coinmama website, but it is information quickly revealed from Coinmama documentation with a quick Google search.

"Buy & sell crypto instantly. Join the world's friendliest crypto exchange." (Source: Coinmama)

Coinmama charges $4.99 for Google Pay, Apple Pay, and debit and credit card purchases.

You can use any payment method for purchases but cannot use bank transfer, debit or credit card, Google Pay, SEPA Instant or SWIFT for selling cryptocurrencies.

Coinmama has a loyalty program with three levels, starting with the “Crypto Curious” with zero discounts.

At the second level (Crypto Enthusiast), users get a 12.5% discount if they spend $5,000 over 90 days, and Crypto Believers (third level) get a 25% discount if they spend $18,000 over 90 days or $50,000 over a lifetime.

Funding / Withdrawal Options

You cannot deposit funds into Coinmama as crypto purchasing is a direct sale. You choose your crypto from the drop-down list, enter your wallet details and pay with your preferred method. Coinmama does not store your cryptocurrencies on its system, so there are no withdrawal options. When you pay for crypto purchases, they immediately transfer to your wallet.

There are no charges to transfer coins to your wallet address, and that's refreshing because some crypto exchanges have set transaction fees and a minimum withdrawal limit for every cryptocurrency listed.

Coinmama vs. Coinbase

Maybe you're looking at the Coinbase exchange as an alternative to Coinmama. If so, here are a few comparisons: -

- Coinbase has 98 million users compared to Coinmama's 3 million registered users.

- Both exchanges were established in 2013

- Coinbase is based in San Francisco, USA. Coinmama's base is in Dublin, Ireland.

- Coinmama does not provide a crypto wallet, but Coinbase does.

- Coinmama lists 12 cryptocurrencies, and Coinbase has over 240 listed cryptos.

- Coinbase offers a trading market, but Coinmama does not.

- Fees are comparable for both exchanges.

- Coinmama is only accessible on the web and mobile browsers, while Coinbase has a mobile app.

Comparing Coinbase with Coinmama is tricky because they're different beasts. Coinbase has an excellent reputation but has a few negative user reviews. Customer support can sometimes be a Coinbase failing. Coinmama, however, openly promotes its commitment to customers, and the glowing reviews confirm the efficacy of its efforts.

Whether you choose Coinbase or Coinmama will depend on your needs and expectations. If you don't want to trade cryptos but want to buy and sell coins, Coinmama has you covered.

Coinbase also has an interchangeable platform in Coinbase Pro, which is more suitable for intermediate to advanced traders.

Coinmama Development And Growth

In March 2022, Wellfield Technologies acquired Coinmama for $40 million. Coinmama is now a subsidiary of Wellfield Technologies, a DeFi protocol

So, Coinmama customers can still buy Ethereum and other top cryptos, and it will be interesting to observe if Coinmama develops further from its current offerings as a crypto exchange.

"We have seen a significant acceleration in demand for a broad selection of DeFi services. Wellfield has developed a unique suite of products and services under its Seamless brand that address some of today's most critical DeFi infrastructure gaps, and that will give us the technology we need to make DeFi adoption possible", said Nimrod Gruber, Co-founder and Co-CEO of Coinmama. (Source: Coinmama)

What Can Be Improved?

The most notable observation was the lack of essential details directly on the Coinmama website, which is quite basic in design and a bit slow to load.

We've come to expect transparency in the crypto space. When certain information isn't readily available, a newbie might ask, "What are they hiding?" for example, the website does not list Coimama fees.

You can find a Coinmama page listing fees from a Google search, but that's not the point. In my opinion, they should be fully transparent on the main website. In addition, the VIP page states "competitive fees" without mentioning what they are.

The blog is current, but the tutorials date back to 2019, though much of the information is probably still relevant.

If we're going to nitpick a little, Coinmama could be more transparent concerning security and protection for its customers. It's a bit vague. Hackers breached user data in early 2019, gaining access to 450k email addresses and hashed passwords. At the time, hackers were rampant in the crypto world, and exchanges became more aware of the need to safeguard potential vulnerabilities.

Some users lament that Coinmama doesn't have a crypto wallet, but it's easy to set up a wallet quickly. Then there's the absence of a mobile app. You either love or hate them, and there would be little point as your cryptos aren't on the Coinmama system. They are in your crypto wallet, which you can probably download to your mobile.

Conclusion

Coinmama is an established, reputable, beginner-friendly and easy-to-use platform. When navigating a crypto exchange with multiple tools and services, hundreds of tokens and a trading platform, it can be overwhelming when you're starting. If you just want to buy and sell Bitcoin (BTC), Ethereum (ETH), or a few other cryptos, Coinmama is a suitable option.

The Coinmama website would benefit from adding more details, such as transaction fees. However, it is easy for new users to open an account and start buying cryptocurrencies without the hassle of tackling reams of information.

The platform has a limited range of cryptocurrencies, all established, well-known tokens. Coinmama doesn't provide a wallet as many other exchanges do, but that's not necessarily bad. It's essential to choose a secure crypto wallet and research which one is best for the coins you wish to buy.

Coinmama has many payment methods for crypto purchases, such as Google Pay, Apple Pay, Debit cards, SWIFT, SEPA, Fedwire, SEPA Instant and Skrill. Another bonus is the low minimum order value of only $30.00.

Coinmama supports users with 24/7 access via email or telephone, which positions it well in the cryptocurrency space when compared to other exchanges.

Hopefully, you now better understand Coinmama and how it works and can decide if it is the right platform for you.

Frequently Asked Questions

Yes, you can buy crypto using your credit or debit card.

Coinmama accepts all fiat currencies.

According to the website, Coinmama is available in 200 countries, excluding several restricted territories.

Wellfield Technologies acquired Coinmama in March 2022. Coinmama is registered in Ireland.

Once your wallet address and payment are confirmed, you should receive your coins in minutes. However, it depends on how fast the payment is processed. SEPA can take up to 12 hours, SWIFT from 3 to 5 days. All other payments should clear within an hour.

No, Coinmama does not save your credit/debit card details.

As a Money Services Business (MSB), Coinmama must collect specific details about its clients. In addition, it helps Coinmama combat fraud and keep your account safe.

Coinmama is GDPR compliant, and all personal information and documentation is encrypted. Coinmama does not store credit or debit card details on the website or servers.

No, you cannot do peer-to-peer transactions on Coinmama. All transactions are between you and Coinmama only.

Disclaimer: These are the writer’s opinions and should not be considered investment advice. Readers should do their own research.