Poloniex Exchange Review: Complete Beginners Guide

In November 2023, Poloniex was hacked to the tune of at least $114 million. In a post on X, founder Justin Sun said the exchange would fully reimburse the affected funds. He has also announced a 5% white hat bounty to the hacker. We urge our readers to conduct due diligence before doing business with Poloniex.

Poloniex is a cryptocurrency exchange platform that offers advanced trading features such as margin trading and order types, as well as a highly functional mobile app. The platform is respected within the industry and known for being highly secure and 24/7 customer support.

Poloniex is one of the more well known exchanges and is based in The United States of America. Having been in operation since 2014, the exchange has been able to capture a significant portion of the market and experiences high trading volumes for altcoins.

Up until a year ago, traders interested having access to a large selection of altcoins often used Poloniex. The exchange specializes in crypto to crypto trades and as a result, generally suits more experienced cryptocurrency traders.

Over the last year, the emergence of exchanges such as Binance, Kucoin, and HTX (previously Huobi) has seen Poloniex lose some of its market share. However, its recent acquisition by Circle may see the company rebound in 2018.

Overview

Poloniex was founded in 2014 by Tristan D’Agosta, and the company was originally based in Wilmington, Delaware, USA. Up until recently there was little information available online regarding ownership of the company, however, the site now lists Poloniex, LLC as being based in Boston, MA, USA.

The platform gained traction as it made its services accessible to traders located anywhere around the world, and also provided support for a large number of digital assets, and was one of the top providers in terms of variety.

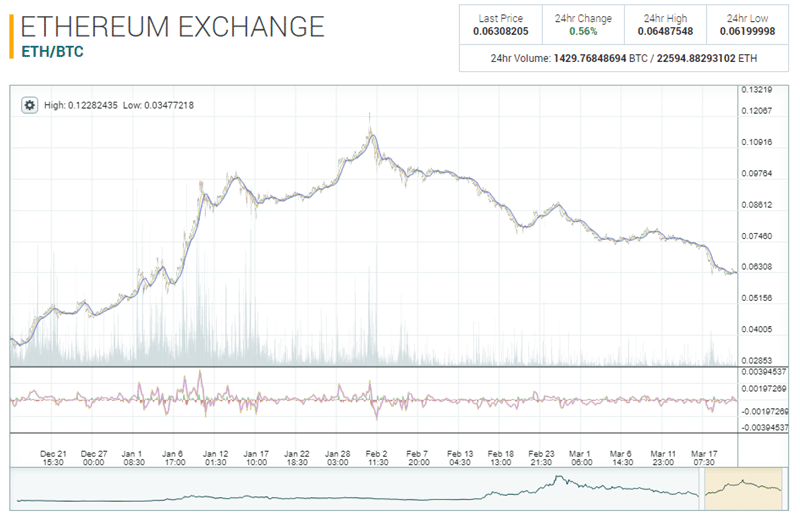

Poloniex was the world’s largest Ethereum exchange by average volume in 2017 and often ranked within the top ten cryptocurrency exchanges with regards to overall volume. The exchange is currently averaging approximately $85m worth of daily trading, and sits inside the world’s top twenty exchanges in terms of overall volume.

While the platform is based in the United States, it does not operate any geographical restrictions. This is mostly due to the pure cryptocurrency setup on the platform, and as a result, it hasn’t been required to conform to local banking and finance regulations as there’s no fiat currency being used.

This has allowed it to function with greater freedom than exchanges such as Bitfinex which recently closed their exchange to US customers or to fully regulated exchanges such as Coinbase, Gemini, and Kraken.

Is Poloniex Safe?

When it comes to choosing a cryptocurrency exchange, one of the most important concerns for the user comes down to the safety of the exchange. Exchanges are prime targets for hackers and this is something that Poloniex knows intimately.

Back in 2014, Poloniex exchange suffered a hack that saw it lose 12.3% of all the Bitcoin that it held in its wallets. According to the owner of the exchange at the time in a bitcointalk post, the hacker was able to find a vulnerability in the code.

Of course this was over 4 years ago and the exchange has not suffered a severe hack since. Moreover, unlike other high profile hacks, Poloniex gave the affected users a partial refund of their coins.

So how do Poloniex's security features look now?

Cold Storage & Monitoring

Poloniex uses the most advanced procedures in air-gapped cold storage for their Bitcoin holdings. What this basically means is that Poloniex will store the vast majority of their coins offline in a safe and secure environment.

They will also only keep a limited number of coins online in the hot wallets for a certain period of time. This will limit the exposure of their coin reserves to potential hack attacks for a very limited period of time.

From an operational security perspective, they also have to keep an eye on suspicious activity that may want to get a foothold into their systems. That is why they will monitor all exchange activity on a 24/7 basis. The moment that they spot any suspicious activity they will block those IP addresses.

Lastly, unlike banks, Poloniex does not operate on a "fractional reserve" model that is used with traditional banks. What this means is that your funds are used only to facilitate trading and not for any other exchange purposes.

Two Factor Authentication

On the user side, Poloniex offers you the standard two factor authentication security features. This is an added layer of security that will help protect you from any attempts to fraudulently access your account.

This is not activated as a default so you are advised to enable it the moment that you start trading. It could be the one barrier between hackers and your coins. In fact, last year hackers were able to get into user's accounts through a fake poloniex app.

In any event, you are encouraged not to leave large amounts of coins on an exchange. You should either consider your own personal cold storage or invest in a hardware wallet.

Currencies

The wide range of altcoins made available for trading has proved to be a major attraction for users of the platform. There are currently 99 markets involving 68 coins available on the exchange and trades are tied to the four base currencies of Bitcoin (BTC), Ether (ETH), Tether (USDT), and Monero (XMR).

Poloniex operates as a crypto to crypto exchange and provides an option to store value in USDT (Tether), a stablecoin that represents the US Dollar, with 1 USDT being equal to 1 USD. This is a useful tool that comes in handy as there is no fiat currency support on the exchange.

Customer Support

A lack of a decent customer support service has been a major disadvantage for Poloniex for some time. Users of the exchange have been known to complain of extremely long response times when reporting issues to the support team. Queries have gone unanswered for weeks and months, and horror stories have begun to rack up on forums such as Reddit and Bitcointalk.org.

There are also serious issues with withdrawals taking a long time to process and at best the exchange has just been struggling to deal with a sudden surge in demand. However, other top exchanges have been able to service their customers to a much higher standard.

While the slow customer service is no doubt a concern for traders, there are additional resources that you can use in order to get answers to your questions. They have compiled a list of FAQs that the traders have asked previously.

More likely than not, if you have a query you are likely to find the solution in this support center. For example, they cover everything from using the Poloniex API to exchange fees, activating two factor authentication etc.

However, if your problem is technical in nature or related to your account only then you will have to deal with the long support times. However, there is hope on the horizon with the Circle acquisition (more below).

Poloniex Fees

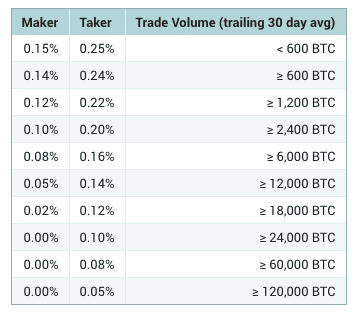

Poloniex currently charges a 0.15% maker fee and a 0.25% taker fee, and maintains an up to date summary of all fees, Poloniex also employs a volume-tiered, maker-taker fee schedule. All users were moved to this model on March 20, 2016 and users should check their Trading Tier Status page to track their progress. For lenders, a 15% fee is applied to earned interest.

Every trade occurs between two parties: the maker, whose order exists on the order book prior to the trade, and the taker, who places the order that matches or takes the maker's order. When trading on an exchange you can buy an asset at the lowest offer provided, or place a bid at another desired price. If you decide to immediately execute your trade, you would effectively be taking away liquidity from the market. Here, you become a “taker”, and pay a slightly higher fee.

The maker-taker model encourages market liquidity by rewarding the makers of that liquidity with a fee discount. It also results in a tighter market spread due to the increased incentive for makers to outbid each other. The higher fee that the taker pays is usually offset by the better prices this tighter spread provides.

For those traders who are making markets at volume that is over 24,000 BTC trading volume, you will be trading with no fees.

KYC and Accounts

This is something that has become quite contentious for many users recently.

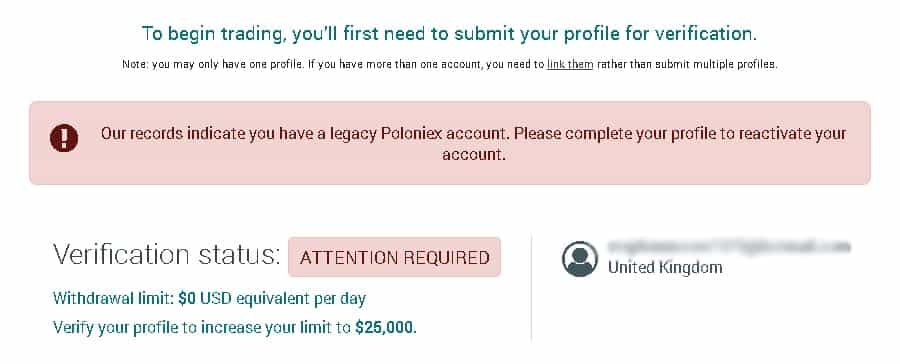

Poloniex used to allow users to run an anonymous account that did not require any form of identification. This was their first level of account and many traders left it at this level. The first level of account had a limit of $2,000 withdrawal in a day.

However, it seems as if Poloniex has changed their policy recently. They had decided that they will no longer allow these types of accounts and wanted all of their traders to be verified on their systems.

What this meant, essentially, is that all traders on Poloniex would be required to be verified to their level 2 account status that had a $25,000 daily withdrawal limit. However, there were many traders who took issue with the manner in which Poloniex handled this.

They claim that Poloniex had promised not to hold "funds hostage" in the event that legacy accounts were not verified on the deadline day. Now, these users are claiming that Poloniex is not allowing them to withdraw their funds unless they send them the required documentation.

So, what does this mean for you?

It depends how comfortable you are sending Poloniex your personal identification documents. This is indeed becoming the norm with exchanges now as regulators require the exchanges to carry out appropriate KYC and Anti Money Laundering procedures.

Assuming that Poloniex is able to protect your personal information and prevent any sort data breach then you should not be worried using them.

Poloniex Trading Platform

Let us move onto one of the most important features of any exchange. This is the trading platform and matching engine.

Once you have logged into Poloniex, you will have the option to go to three different tabs. One is the "Exchange", the other is the "Margin Trading" platform and the third is the lending platform. We are looking at the exchange platform.

Our first impression of the Poloniex trading platform was that it is slightly dated but functional. This is in fact the same platform that has been in use by the exchange for the past few years. Having said that, it is quite user friendly.

For example, you have your main chart right in front of you. Just below that you have the order forms where you can place an array of different orders quickly and efficiently. On the right you have the option of switching the markets and the assets that you would like to trade.

Unfortunately, you will have to scroll down a bit if you want to observe the order books, previous orders and market depth. Hence, this does not make for the most efficient trading platform layout.

Charting

For those traders who are technical analysts and are looking for the most advanced trading tools, you may be slightly disappointed. The Poloniex charting package is extremely basic. You only have simple indicators such as moving averages and Bollinger bands.

You also cannot complete any chart drawings to identify any sort of retracement levels on the platform. At least you can zoom in and out and adjust your time horizon to get a better picture of the market.

Hence, if charting is that much of an important part of your trading then you should either consider completing your charting analysis with external software, or you should move to another exchange such as Kraken.

Order Types

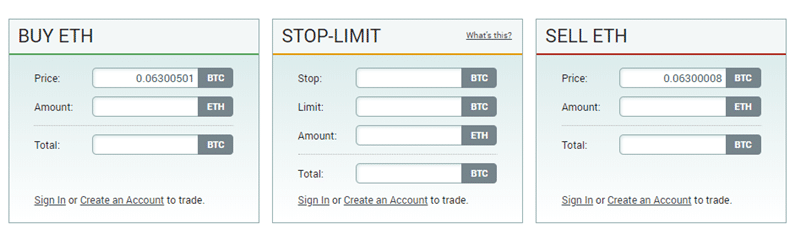

Poloniex sits somewhere in the middle when it comes to their order functionality. They have the standard buy / sell order forms where you can select a price or trade at market. Of course, this will impact on your fees as per the "maker-taker dynamic".

However, for those traders who would like to have the safety of a stop loss in place, Poloniex has that as well. You can place a stop loss level which will automatically execute an order for you once the price has fallen to a certain level.

You can also set a limit order which will lock in a profit once the price has reached a certain level. These are helpful orders which can limit your risk. We would always encourage those traders who are trading with a short term horizon to make use of these orders.

Poloniex Margin Trading

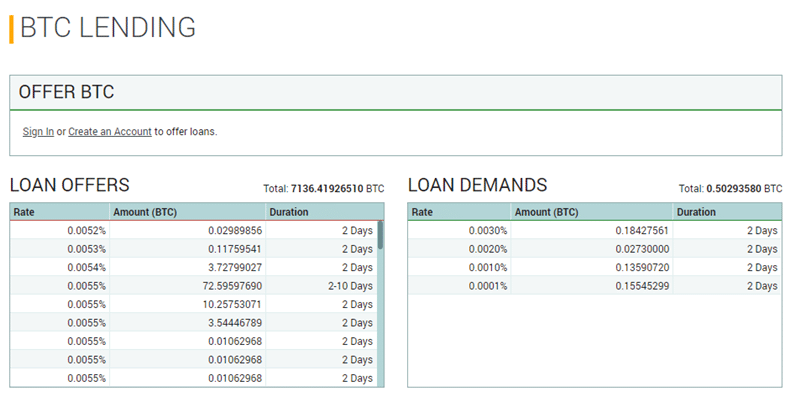

By offering margin trading, Poloniex is able to dominate the majority of its competition. Users of the platform can utilize a peer-to-peer function to borrow funds and start margin trading.

The system efficiently allows traders to secure trading funds, and also take advantage of the lending feature to gain from lending funds out to other traders. This feature is only offered by a few exchanges and is still a major advantage as it attracts a good number of more experienced traders.

Trading on margin is synonymous with leveraged trading. You are taking positions that are larger than your initial investment.

In terms of the leverage that you can trade with, these are not excessively high. For example, in the image below you can see that the leverage on Ethereum margin trading is only 2.5x.

You will also need to deposit an initial margin of 40% on your trade. If we were to compare this to other exchanges and brokers, IQ Option has CFD leverage of 20x and Bitmex has futures leverage of up to 100x.

However, this are really volatile and risky instruments so it could indeed be a wiser decision to only start margin trading with the lower leverage levels.

Poloniex API

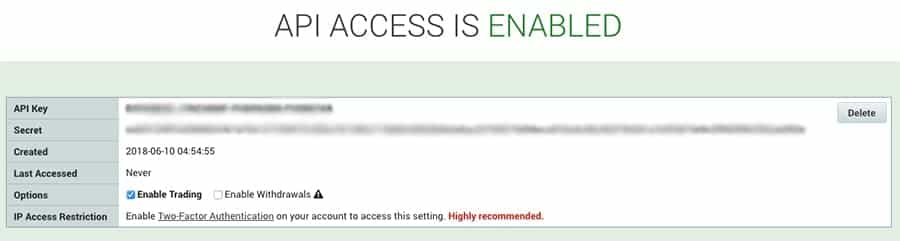

For those users that like to code their own trading bots, Poloniex offers API connectivity. In order for you to make use of the API, you have to get your API key. This can be retrieved by clicking on the "API Keys" of your settings.

In order to first set it up, they will send you an email that will ask you to confirm your choice of accessing the API key. Once this is done you will have to generate your API key and confirm it as well. You will then be presented with your API key like this below:

As you will see, you need to determine what you will allow your Bot to do in your account. If you are merely getting prices then you can disable trading. If you are trading but do not want to withdraw funds then you can select that only.

In terms of the API functionality, it appears to be relatively robust and a number of developers have coded on the Poloniex API.

What We Didn't Like

There were a few things that we think warrant mention in order for you to make the most informed decision about Poloniex.

Firstly, the platform is pretty dated and scope for more advanced analysis is quite limited. This could probably be one of the reasons that the volume on the exchange has been falling over the past few months. While other exchanges such as Kraken have taken steps to improve outdated systems, Poloniex remains as is.

We also have to take issue with the customer service. This is something that has been a major thorn in the side of Poloniex over the past year. It is also something that has now reared its head at locking out of for those users that held legacy accounts.

The lack of Fiat funding options could also be a problem for many traders. This is something that many exchanges including Binance and fellow US exchange, Bittrex, are pursuing.

One should not allow these supposed drawbacks to deter you however. This is because of the recent purchase of Poloniex by Circle. There is no doubt that the cash flush circle has some big plans for the exchange. In fact, there were many commentators who thought this was one of the best options.

Acquisition by Circle

Despite generating an impressive quantity of trading volume, Poloniex has been plagued by a growing number of issues. There was a general lack of information on the make-up of the organization, with little known about the co-founders, top management, or ownership structure.

There also seemed to be an absence of a physical office which all led to a lack of trust in the exchange as companies such as Coinbase, Kraken and Gemini all operate with far more transparency and credibility.

Public opinion seemed to have reached an all time low and the number of negative online reviews relating to customer support continued to grow over the last twelve months. There were also questions about liquidity as users faced difficulties when trying to withdraw funds. The elongated withdrawal times made it almost impossible for traders to swiftly liquidate funds after trading with money often being frozen while awaiting approval.

This could have proved ruinous for Poloniex but even with all these existing doubts, the exchange was still able to attract a significant amount of trading activity and Poloniex receives around 50 million visits per month to its website. However, the site has clearly lost ground to competitors such as Binance, HTX, OKEx, and GDAX.

The recent acquisition by Circle could signal a change of fortunes and Circle Internet Financial Ltd. announced that it has acquired Poloniex for a price of $400m in a recent blog post.

The Goldman Sachs-backed company was founded in 2013, and acts as a peer-to-peer payment platform which allows instant transactions via the Circle Pay mobile app. Circle Trade offers crypto liquidity options to its customers, and the company has received approximately $60m in revenue from this service over the last few months.

In their blog post, Circle co-founders Jeremy Allaire and Sean Neville outline their plans for Poloniex, stating:

Firstly and immediately, you can expect Circle to address customer support and scale risk, compliance, and technical operations to bolster the existing product and platform

They went on to state:

In the coming years, we expect to grow the Poloniex platform beyond its current incarnation as an exchange for only crypto assets. We envision a robust multi-sided distributed marketplace that can host tokens which represent everything of value: physical goods, fundraising and equity, real estate, creative productions such as works of art, music and literature, service leases and time-based rentals, credit, futures, and more.

Conclusion

Poloniex remains an extremely well known exchange which is able to generate a decent amount of trading volumes. Its advantages have continued to attract traders to the platform while the issues surrounding customer support and withdrawals have seen the exchange lose ground to current industry leaders such as Binance and GDAX.

Going forward much depends on how quickly the new management can turn things around by solving the key issues regarding transparency and the overall level of professionalism found on the exchange.

Poloniex still has much to offer and remains a viable option for those traders interested in a wide variety of altcoins and in taking advantage of the margin trading and lending services available on the platform.

There’s a wide range of competition now available to cryptocurrency traders, and other more reliable exchanges are currently in operation so it may be best to look at some other options, however it is also a good idea to keep an eye on Poloniex and gauge how customer sentiment changes over the coming months.

Disclaimer: These are the writer’s opinions and should not be considered investment advice. Readers should do their own research.