Coinbase Review 2024: Complete Exchange Overview

Coinbase is the most regulatory-friendly, largest and well-respected exchange in the US. Specializing in user-friendliness, Coinbase is a good choice for those looking to buy their first digital assets.

Coinbase sits among the top cryptocurrency exchanges in the world and is one of the most respected businesses in the crypto space. In April 2021, it was listed on the Nasdaq exchange and became the first major cryptocurrency company to go public. Many mark this event as a significant milestone in improving the image of blockchain as a legitimate industry.

The exchange’s popularity also led to a popular phenomenon known as the ‘Coinbase effect,’ where cryptocurrencies saw a huge surge in price following their listing on the exchange. Coinbase has also been exceptionally proactive and cooperative in seeking a well-defined regulatory framework for crypto businesses in the US. Coinbase is a sound choice for traders looking to enter the crypto space, and to help you decide if it is the ideal exchange for you, we present the Coinbase Review.

Coinbase Review TL; DR Verdict and Summary

Coinbase is the most beginner-friendly and regulatory-compliant centralized cryptocurrency exchange. It is available in limited countries and provides the whole suite of solutions for blockchain investing, including a trading terminal, Earn program, debit card, NFT marketplace, self-custody, and institutional solutions.

| Headquarters: | No headquarters as of May 2020, previously, San Francisco, USA. |

| Year Established: | 2012 |

| Regulation: | Yes- Coinbase complies with all applicable laws and regulations in each jurisdiction where it operates. -Money Transmission License -Registered with FinCEN |

| Spot Cryptocurrencies Listed: | 140+ |

| Native Token: | N/A |

| Maker/Taker Fees | Lowest: 0.04%/ 0.0% Highest: 0.50%/0.50% |

| Security: | High |

| Beginner Friendly: | Coinbase: Very Beginner Friendly Coinbase Advanced: Slight Learning Curve |

| KYC/AML Verification: | Yes |

| Fiat Currency Support: | USD, GBP, EUR |

| Deposit/Withdrawal Methods: | USA Coinbase: ACH Bank transfer and bank wire, Debit/Credit, bank account, wire transfer, PayPal, Apple Pay, Google Pay

GBP Coinbase: Faster Payments bank transfer, SEPA, Faster Payments, 3D Secure Card, PayPal (withdraw only)

EUR Coinbase: SEPA bank transfer, SEPA, 3D Secure Card, Ideal/Sofort (deposit only), PayPal (withdraw only), Apple Pay (buy only) |

Coinbase Key Features at a glance

- User-Friendly Interface: Coinbase offers an intuitive and straightforward platform that simplifies buying, selling, and managing cryptocurrency portfolios for users of all experience levels.

- Security Measures: Coinbase employs robust security protocols such as two-factor authentication, cold storage for customer funds, and insurance against certain types of losses, ensuring a secure trading environment.

- Educational Resources (Coinbase Earn): Users can learn about various cryptocurrencies through educational content and earn free crypto as a reward for completing simple quizzes and tasks.

- Diverse Cryptocurrency Selection: The platform supports a wide range of cryptocurrencies, allowing users to trade popular coins and numerous altcoins, catering to diverse investment preferences.

- Staking Rewards: Coinbase provides users with the ability to earn staking rewards on certain proof-of-stake (PoS) cryptocurrencies, offering a way to generate passive income by holding eligible assets on the platform.

Coinbase Review – Background and History

Coinbase is the most popular cryptocurrency exchange in the US. Brian Armstrong, a former Airbnb engineer, founded Coinbase in June 2012 and still serves the company as its CEO. The multi-faceted exchange with 100+ listed assets, billions under management, and an extensive suite of investment services began operations in October 2012 by facilitating buying and selling Bitcoin through bank transfers.

Coinbase Global, Inc. was later incorporated as the holding company for the Coinbase exchange. In January 2015, the company launched an exchange for professional traders, which would be known as Coinbase Pro. While Pro catered to professional traders, Coinbase Prime was the company’s other leg to address institutional customers.

Coinbase has earned several feathers on its cap over the years, including one of the first global companies to adopt a fully remote work culture with no formal headquarters and one of the first listed companies to launch a blockchain-based DeFi network called Base.

Here are some flagship products offered by Coinbase:

- Coinbase Custody - A service provided by Coinbase that offers secure digital asset storage for institutional investors, providing financial controls, audit trails, withdrawal limits, and support for multiple signers.

- Coinbase Wallet – Launched in 2017, the Coinbase Wallet is one of the most used crypto apps. It allows users to store and trade cryptocurrencies and digital collectables from their phones.

- Coinbase Prime – It enables institutional investors to trade cryptocurrencies, offering more advanced features than the Wallet.

- Coinbase Commerce – It helps businesses integrate crypto payments in their checkout process.

- USD Coin (USDC) – Coinbase partnered with Circle, a key player in the cryptocurrency space, to launch the USDC stablecoin pegged to the US Dollar. USDC is one of the most transacted stablecoins in the space.

Coinbase’s strategic acquisitions have been pivotal in cementing its position and resilience in the crypto ecosystem. Key acquisitions like Neutrino helped Coinbase improve theft prevention and security. The purchase of Paradex and Bison Trails marked a foray into decentralized services and robust blockchain infrastructure. Acquiring Xapo's institutional custody business significantly bolstered Coinbase's asset custody capabilities, catering to institutional clients. The acquisition of Tagomi and Skew expanded its reach into advanced trading and real-time data analytics, appealing to professional and institutional traders.

Coinbase began with a humble vision of helping customers buy Bitcoin and broadened its scope through complementary acquisitions and commitment to regulatory compliance to amass millions of casual traders and institutional investors under its umbrella.

Coinbase Headquarters

Initially headquartered in San Fransisco, Coinbase transitioned to a remote work culture with the onset of Covid-19. In January 2020, over 29% of its workforce from San Fransisco were working from home.

Coinbase claims that most of its new hires in Q1 of 2021 were remote, and the benefits of a decentralized workforce have outweighed its negatives. With most of its employees working remotely, including the executive team, Coinbase no longer designates a single location as its official headquarters. Moreover, Craft claims Coinbase maintains several office locations worldwide, including New York, Portland, Berlin, Dublin and Tokyo.

However, being an American publicly traded company (ticker: COIN), Coinbase Global, Inc. was incorporated in Delaware as a holding company for Coinbase and its subsidiaries.

Coinbase requires all customers on their platform to comply with Know Your Customer (KYC) laws to confirm their identity. First-time customers will go through a typical KYC process where they provide the relevant government-issued identification documents.

Is Coinbase Safe?

As a public company in the US and one of the global leaders, users consider Coinbase safe for conducting transactions, trading, and storing cryptocurrencies. The exchange implements various security measures to protect accounts and user funds.

Coinbase provides 2-step verification on all accounts as an additional layer to prevent unauthorized access. Furthermore, the account passwords stored in Coinbase’s database are encrypted to be unrecognizable to the human eye. Users can configure the Coinbase Vault to include additional security steps for withdrawals.

To protect the deposits, all customer funds are held 1:1 and never lent out without their consent, diminishing the risk of runs on the exchange during acute market volatility. Coinbase keeps 98% of funds in “air-gapped” cold storage wallets operated with multi-signature mechanisms. These assets are disconnected from the Web and inaccessible to hackers, malware, and phishing attacks.

Despite its robust measures and commitment to security, Coinbase has been the target of a handful of attacks over the years. For instance, Coinbase users and employees have been the target of sophisticated phishing and social engineering attacks. One user sued Coinbase after reportedly losing $96,000 in a SIM card change attack.

In response to such attacks, Coinbase has always responded promptly by swiftly addressing the weak links and mitigating any potential for a widespread fallout. Coinbase has not disclosed incidents of a successful breach leading to a widespread loss of customer funds. However, users are always advised to exercise caution and follow best practices for securing their accounts and personal information.

We go deeper into the security of Coinbase in our article: Is it Safe to Keep Crypto on Coinbase?

Proof of Reserves

Coinbase is a publicly traded company that has to file statements to the SEC to prove ownership of customers’ assets and provide proof of its hot and cold storage wallets. While the exchange does not release Proof of Reserves data explicitly, its status as a listed company is a proxy that proves that the exchange does not tamper with customer’s funds without their consent.

Coinbase Regulation

Coinbase is committed to regulatory compliance in all jurisdictions where it operates. In the United States, Coinbase, Inc., which operates the Coinbase exchange and its ancillary services, is licensed to engage in money transmission in most US jurisdictions. Most of Coinbase’s money transmission licenses cover US Dollar cash balances and transfers. In some states, these licenses also cover cryptocurrency balances and transfers on the platform. Coinbase is also registered as a Money Services Business with FinCEN.

Coinbase is required to comply with many financial services and consumer protection laws, including the Bank Secrecy Act and the USA Patriot Act. The Bank Secrecy Act requires Coinbase to verify customer identities, maintain records of currency transactions for up to 5 years, and report certain transactions. The USA Patriot Act requires Coinbase to designate a compliance officer to ensure compliance with all applicable laws, create procedures and controls to ensure compliance, conduct training, and periodically review the compliance program.

The European Union recently passed the Markets in Crypto-Assets (MiCA) regulation, set to come into effect in December 2024. Coinbase applied for a license under the new MiCA regulations, with Ireland as its chief base for operations and regulations in the European Union. Unlike the US, if MiCA approves the application, Coinbase will achieve the green light to operate in any state under the EU, like Germany, France, or the Netherlands, without applying for regulations separately.

Coinbase Crypto Listings

Coinbase envisions swiftly listing all assets that meet their strict standards. As a vocal advocate of regulation, compliance with local law is the linchpin of those standards, among other crucial qualities like utility and trade ability. Due to vast disparities in local law governing digital assets, token listings vary significantly across the countries where Coinbase provides exchange services.

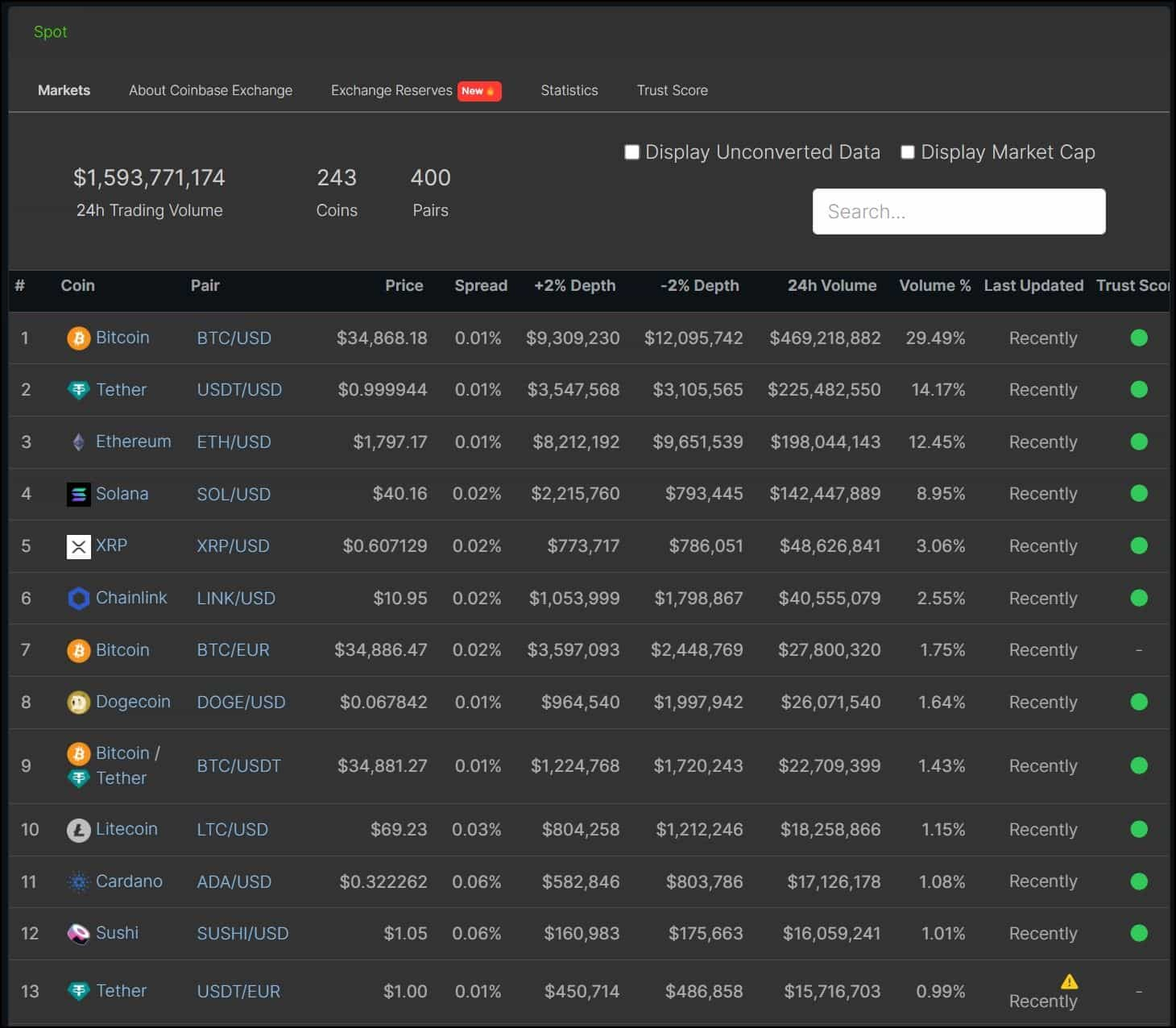

According to Coingecko, the Coinbase exchange supported 243 coins and 400 trading pairs. One class noticeably absent across all regions is tokens like XMR. Privacy tokens are infamous for harbouring illicit transactions, leading some countries to ban the possession and trading of such assets.

While the specific number of token listings may vary across countries, Coinbase enables sitewide support for all major cryptocurrencies, which comprise the bulk of global trading volume. Therefore, most traders will not be hindered by limited listings on Coinbase.

Coinbase Fiat Support

Coinbase does not explicitly mention all the fiat currencies accepted by the exchange. However, based on the fiat deposit and withdrawal channels accepted by the exchange, Coinbase supports the Euro (EUR), US dollars (USD), and British Pound Sterling (GBP).

Coinbase Pay

Coinbase Pay is a payment feature that supports various crypto and fiat currency payment options. Coinbase Pay is on the Coinbase Wallet, Coinbase NFT, and some third-party apps, supporting about 60+ fiat currency and several crypto payment options.

Coinbase Fees

Coinbase does not charge any additional fee for crypto deposits, and depositors only pay the associated blockchain transaction fees. However, there are separate fee structures for the various Coinbase products like the exchange, Coinbase Advanced, and Coinbase Commerce.

Makers and Takers

To understand the fee structures, it is helpful to understand how Coinbase defines makers and takers. Takers are market participants whose orders get immediately filled from the open orders in the order book. If an order you place is not immediately fulfilled (like when placing orders away from the current market price), you are considered a market maker. Makers are typically charged less than takers.

On Coinbase Advanced, fee tiers are calculated based on the user’s 30-day USD trading volume, excluding volume from trading stable pairs. The tiered fee structure on Coinbase Advanced looks like this:

The Coinbase Exchange also deploys a maker-taker fee model spread across tiers. While a maker may pay anything between 0.00% and 0.40% on the exchange, a taker’s fee ranges between 0.05% and 0.6%.

The Coinbase exchange also supports fiat deposits and withdrawals, with different rates based on the fiat currency. The exchange supports the following currencies:

Coinbase Fees Summary:

To sum up, the fees on Coinbase are competitive but not the lowest in the industry. Users who value Coinbase’s security guarantees and commitment to following appropriate licensing and regulations may be willing to pay a higher fee for its services.

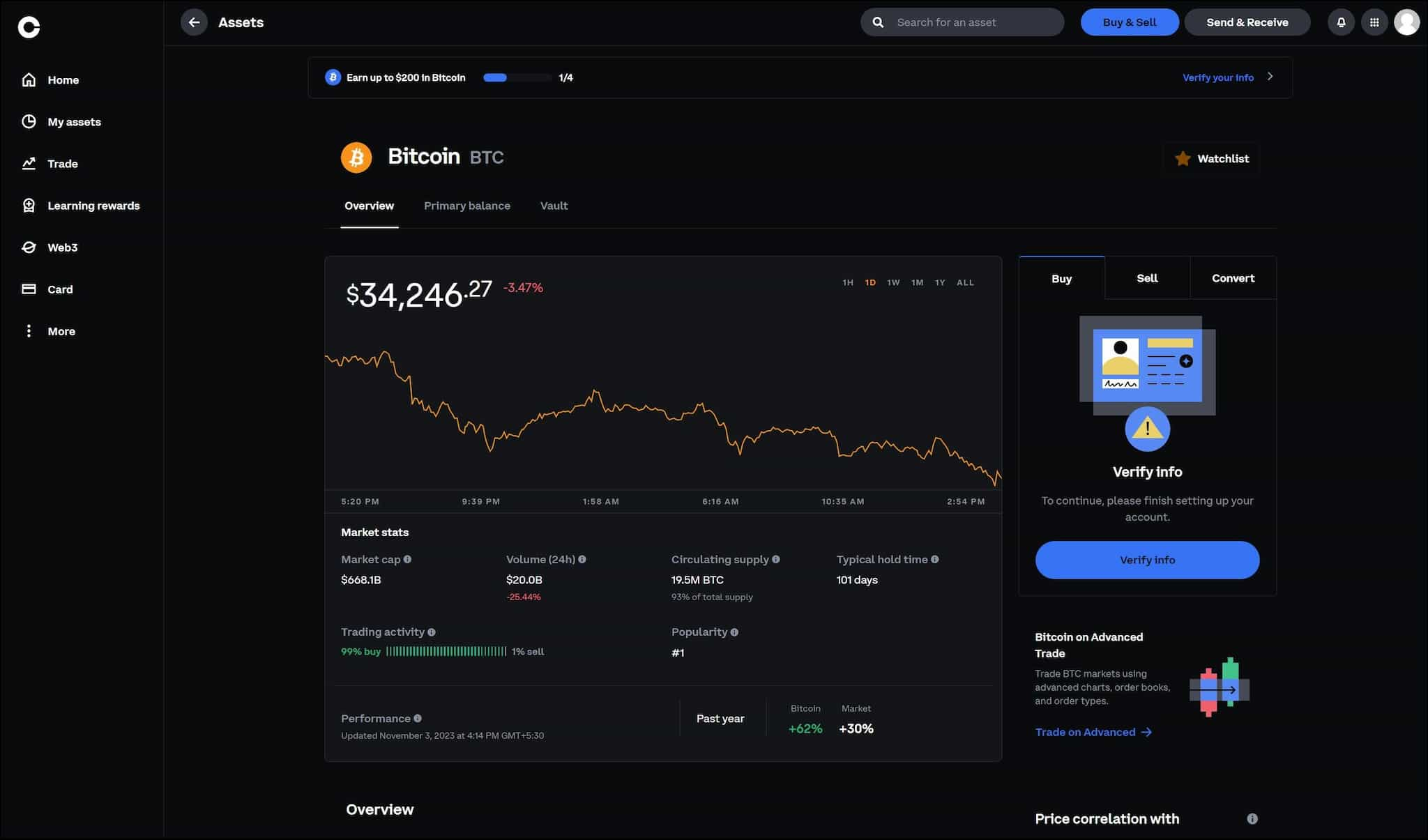

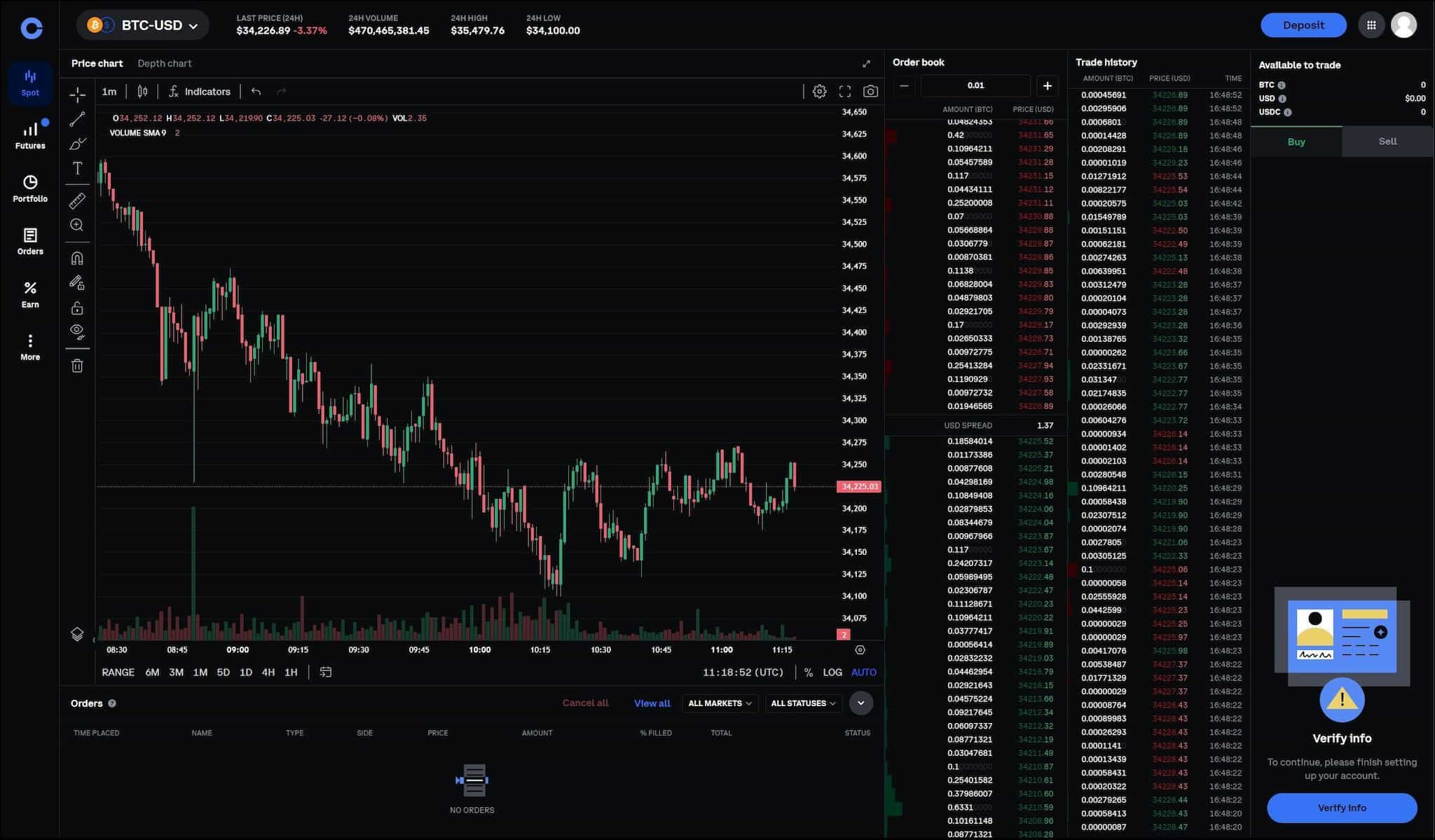

Coinbase Trading Platform

The Coinbase trading interface stands out by enabling users to choose between a simple and an advanced interface. The simple interface replaces traditional candlestick charts with easy-to-understand line charts so that traders not technically initiated are not overwhelmed by a lot of information at once. The simple interface provides the necessary information to place straightforward buy or sell trades.

While the simple interface is ideal for beginners and novices, those who are familiar with the traditional interface or need advanced trading options for technical analysis will be happy to know that access to the “Advanced” interface is just a click away.

To switch to Coinbase Advanced, click on your profile icon and toggle Coinbase Advanced. The advanced interface contains all the elements we are familiar with, giving traders more information about the market activity of the pair they plan to trade. Separating simple and advanced interfaces may be helpful for traders with limited experience using technical indicators and charting tools.

Learning how to use the advanced chart can be useful for crypto traders who want to buy in and sell at better levels. If you are looking to up your crypto game, be sure to check out our articles on How to Read a Crypto Chart and our Guide to Technical Analysis.

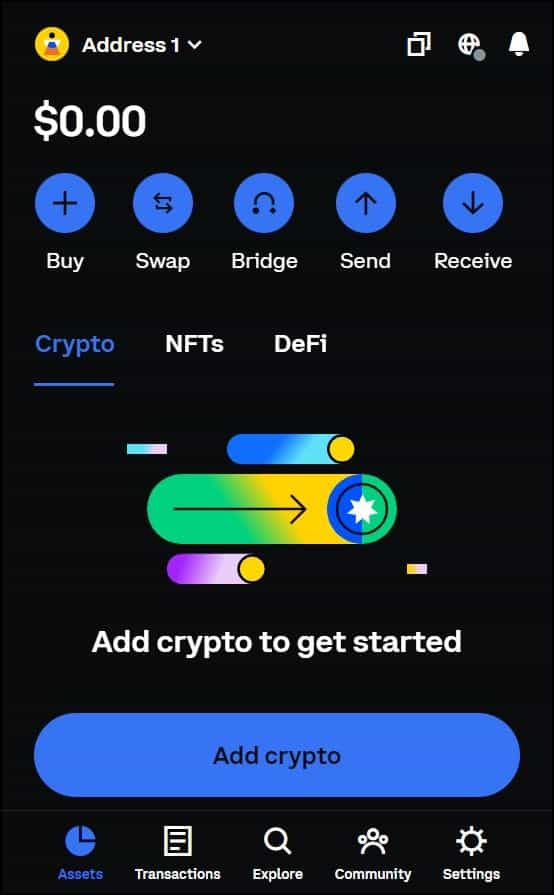

Coinbase Wallet

The Coinbase Wallet is an online crypto wallet that users can access to maintain self-custody of their crypto assets. Note that the wallet is an independent service accessible without registering on Coinbase.com. Similar to other wallets like Metamask, Coinbase Wallet users maintain self-custody of their assets that are protected with a seed phrase. It supports EVM and Solana-compatible networks through a browser extension or a mobile app, with major networks like Arbitrum, Avalanche, Polygon, Base, and BNB already pre-installed.

Apart from all ERC-20 tokens and EVM-compatible chains, the wallet stands out by supporting Bitcoin, Dogecoin, and Litecoin. You can access Web3 by connecting supported dApps to your Coinbase wallet. The non-custodial nature of the Wallet enables it to support a greater number of jurisdictions than Coinbase’s custodial services (like the exchange).

Coinbase Earn

Like every other major cryptocurrency exchange, Coinbase hosts an Earn program, where users can earn interest by investing their crypto holdings in passive income products. Note that one can only access the Earn program with their Coinbase account. The exchange employs a geographical limit on who can register on Coinbase.com. Therefore, Coinbase Earn is only accessible to users residing in a country where they can create a Coinbase account and prove their residential status by completing Coinbase’s KYC norms.

There are three passive income programs under Coinbase Earn: Staking, DeFi Yield, and Learn and Earn, offering APYs up to 6% on average, but the yields on specific assets may considerably vary with time and market volatility.

Coinbase lacks the Earn features offered by many of the leading exchanges and falters quite significantly in this area. For users looking for the best centralized exchanges to earn yield, we recommend checking out SwissBorg, Binance, or Bybit.

Coinbase Earn - Staking

In Staking, Coinbase delegates your crypto investment to the Proof of Stake consensus of the corresponding blockchain network to earn the network’s token inflation rewards. On-chain consensus processes typically impose a lock-up period before you can unstake your assets and charge transaction fees at every step.

Coinbase staking abstracts such complicated steps associated with participating in consensus manually, allowing users to stake or unstake at any time without worrying about transaction fees. The exchange charges a certain portion of your earnings as a commission for providing seamless staking services. The assets supported in staking vary with time and location as Coinbase adds or removes assets to adhere to local laws, which are still maturing.

If you want to learn more about staking, we have a dedicated article that covers what staking is and how it works.

Coinbase Earn – DeFi Yield

Coinbase DeFi Yield is a yield farming product where crypto investments fuel DeFi smart contracts, like lending protocols, swap services, and Automated Marker Makers (AMMs) in exchange for fees or interest. In DeFi Yield, Coinbase plays the mediator between such DeFi protocols that invests subscriber’s funds and forwards their proportionate rewards after its commission.

Coinbase Learn and Earn

Learn and Earn is an interesting initiative by Coinbase where participants receive rewards for learning about cryptocurrencies. The program provides free educational resources to Coinbase Earn users. Users can then earn crypto assets to prove their knowledge by passing various quizzes on the platform. Do remember that the educational resources are meant for beginners, making rewards potentially underwhelming for high-volume investors.

Coinbase Earn Fees

There is no fee for staking or unstaking on Coinbase. The exchange charges a commission based on the user’s earnings. Typically, general users incur an interest of 35% from earnings in DOT, ATOM, and SOL and 25% for ETH. Coinbase One members can access Coinbase Earn at a discount. Subscribers are charged just 26.3% for accessing altcoin DeFi protocols.

FYI: DeFi protocols are nascent markets subject to high volatility. As a mere facilitator, Coinbase does not guarantee any return from DeFi Earn products.

Other Coinbase Features

Coinbase also offers a variety of other products beyond cryptocurrency trading and investing. They are summarised here:

- Coinbase Card – Allows US residents to transact cash and crypto transactions via Visa channels. Check the Coinbase Card help center to know more about eligibility and application details.

- Coinbase One – It is a subscription service offering trading fee discounts, taxation, and analytics services.

- Coinbase Advanced – Formerly known as Coinbase Pro, Advanced is now integrated within the Coinbase trading terminal. Advanced offers charting tools and technical market data and lets users place customized orders.

- Coinbase Prime - Coinbase Prime is an integrated prime brokerage platform designed primarily for institutional investors, including asset managers, corporates, hedge funds, high-net-worth individuals, endowments, family offices, and private wealth managers. It provides a unified investing experience, combining trading, financing, and custody services in one platform.

- Coinbase NFT – A platform for creating, discovering, trading, and showcasing NFTs, which are accessible with the Coinbase Wallet.

Coinbase Base

Base is an Ethereum layer-2 scaling solution built by Coinbase in collaboration with Optimism. Base is an Optimistic Rollups-based layer-2 network built using the OP Stack. With Base, Coinbase became one of the first publicly traded companies to launch a proprietary blockchain network.

Base has attracted considerable developer attention since its inception. Several DeFi applications have already built smart contracts on Base, including Dexes like Curve, Uniswap, and Balancer; cross-chain protocols like Stargate and Hop Protocol; and lending protocols like Compound.

Friend.Tech, a Social Finance (SoFi) protocol, launched on the Base network and saw record-breaking growth quickly. The protocol allows users to trade "keys" for access to private chatrooms, positioning itself as a game-changer in the social media domain. Check out the Base review on Coin Bureau to learn more about the protocol.

Coinbase vs Competition

Coinbase is a secure exchange with an excellent track record of providing fault-proof services, but it might not be for everybody. Constraints such as geographical availability and a lack of complex trading products may steer investors to other exchanges. We’ve got dedicated articles that compare Coinbase against other well-known exchanges:

Coinbase is undeniably, one of the most trusted, secure and reputable exchanges in the industry, attracting traders who favour simplicity and safety above all else. Though, in our opinion, here are the exchanges that outclass Coinbase in a few key areas:

Best “all-in-one” exchanges- Binance, Crypto.com, Bybit

Best Earn section- Binance, SwissBorg

Most Secure- Kraken, SwissBorg

Lowest Fees- Binance, KuCoin, OKX

Coinbase Review – Conclusion

The most apparent downside to the Coinbase exchange is its lack of global availability across all locations. However, wherever Coinbase operates, it respects the region’s regulatory compliances, making Coinbase the most ideal option for investors who value security.

In the Top Cryptocurrency Exchanges list curated by Coin Bureau, Coinbase is listed as the best exchange for beginners due to its simple interface. With Coinbase, beginners can get a taste of everything DeFi, including trading crypto assets, participating in DeFi protocols, or even trading NFTs. With the addition of Coinbase Advanced, the exchange provides a smooth transition to more intricate tools for investors looking to dive deeper after testing the shallow waters.

Frequently Asked Questions

Absolutely! Crypto users will often echo my sentiment in saying Coinbase is the best platform for beginners. Coinbase is one of the easiest and most convenient platforms, while Coinbase Advanced Exchange is easier to use than most other crypto exchanges.

Yes. Coinbase is the only publicly traded crypto exchange. It is fully compliant and regulated by the authorities in the jurisdictions in which they operate.

It is of my opinion and most users in the crypto space that Coinbase is not better than Binance. Binance is by far the largest crypto exchange in the world by users and volume for a reason. Binance offers far more functions, features, markets, assets, and products, not to mention offers substantially superior trading products including leverage, options, and futures.

Binance also has a more functional trading platform. They have their own designed trading screen, or users can choose one powered by TradingView that is built right into the exchange for ultimate convenience.

Coinbase is renowned for its user-friendly interface, making it accessible for beginners in cryptocurrency. It offers a wide range of cryptocurrencies for trading, providing users with a diverse portfolio. Security is a top feature, with strong encryption and insurance in case of a breach. Additionally, Coinbase provides educational resources to help users understand crypto markets. Its mobile app is highly rated, offering convenience for trading on the go. Lastly, Coinbase has a robust API for developers.

- Coinbase (Simple): This is the standard Coinbase platform most retail users start with. It's designed for ease of use, allowing quick purchase, sale, and management of cryptocurrency with a straightforward interface.

- Coinbase Advanced: Targeted at experienced traders, Coinbase Advanced offers charting features, detailed transaction history, and lower transaction fees. It provides more control over trades with market, limit, and stop orders.

- Coinbase Prime: Specifically designed for institutions, Coinbase Prime provides additional services such as margin finance, over-the-counter (OTC) trading, and dedicated support. It's built for higher volume trading with sophisticated trading and security features that meet institutional requirements.

Disclaimer: These are the writer’s opinions and should not be considered investment advice. Readers should do their own research.