Injective Review: A Deep Dive Into INJ

In the diverse realm of DApps, DeFi reigns supreme. According to DappRadar, the top-10 DApps are all decentralized finance apps when ranked by the fiat value of incoming token transfers from unique active wallets.

Unlike traditional finance, DeFi welcomes all. Traditional financial services require extensive paperwork and credit checks, but DeFi does away with all of that, opening its doors to anyone with an internet connection and a digital wallet. Speaking of, check out our best hardware, desktop and mobile wallet picks if you're undecided on which one to choose.

As the demand for secure and interoperable platforms grows, Injective stands out for its innovative solutions.

In this Injective review, we'll delve into everything you need to know about the company.

Injective Review Summary:

Injective is a Cosmos-based Layer 1 blockchain for building financial apps that can access other blockchains.

| Headquarters | New York |

| Year Founded | 2018 |

| Founders | Eric Chen and Albert Chon |

| Native Token | INJ |

| Total Funding | $56.7 million |

The Main Features of Injective Are:

- CosmWasm Compatibility

- Bridge

- Staking

- Burn Auction

- Insurance Funds

What Is Injective?

Injective is a blockchain platform distinguished by its set of pre-built modules, including a decentralized orderbook, offering developers the resources to create sophisticated applications. It operates as an open and interoperable smart contracts platform.

Utilizing the Cosmos SDK and the Tendermint proof-of-stake consensus framework, Injective ensures instant transaction finality. It excels in facilitating swift cross-chain transactions across major Layer-1 networks like Ethereum and Cosmos Hub.

The Injective ecosystem comprises a network of decentralized applications focused on delivering a superior user experience. By providing unrestricted access to decentralized financial markets, products, services, and tools, Injective empowers individuals to efficiently allocate capital.

Injective has a lot going for it:

- Optimized for DeFi: Injective offers pre-built financial primitives like a fully decentralized order book for developers to create mainstream DApps. These applications can leverage the order book to launch exchanges, prediction markets, and various on-chain strategies.

- Interoperable: The platform is inherently interoperable and seamlessly integrates with multiple sovereign blockchain networks and features Inter-Blockchain Communication-enabled capabilities. Injective facilitates cross-chain transactions across networks such as Ethereum, Moonbeam, CosmosHub, and Wormhole integrated chains like Solana and Avalanche, among others.

- Build DApps Using CosmWasm: Injective supports CosmWasm, a smart contracting platform designed for the Cosmos ecosystem, allowing developers to launch smart contract-powered applications. Smart contracts compatible with other CosmWasm-supported chains can be smoothly migrated to Injective.

- Launch Ethereum and IBC-compatible tokens: The platform enables the launch of Ethereum and IBC-compatible tokens, as it supports cross-chain transactions with Ethereum and all IBC-enabled chains. Tokens launched on Injective can be accessed across multiple networks by default.

You'll need a MetaMask, Ledger, Trezor or Trust Wallet, among others, to interact with Injective.

In April 2021, Injective raised $10 million in a private placement from Mark Cuban and other investors that included Pantera Capital and BlockTower. A year later, in August 2022, it raised $40 million in a round led by Jump Crypto.

“It’s really about bringing on valuable stakeholders rather than having more capital at hand.” - TechCrunch

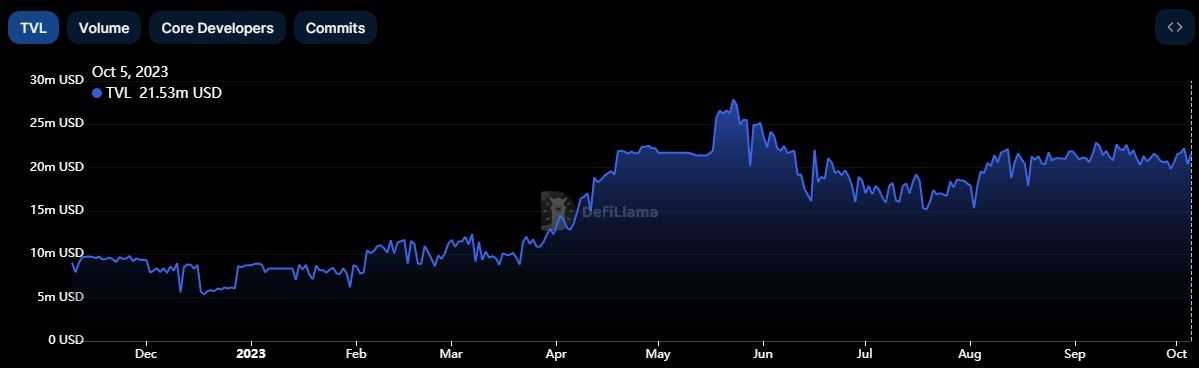

Injective currently has a total value locked of $21.5 million. It is the 47th largest chain by TVL.

The company is backed by crypto heavyweights including Binance.

Who Founded Injective?

Eric Chen and Albert Chon are the co-founders of Injective. Today, Chen is the CEO and Chon is the chief technology officer.

Prior to Injective, Chen was a researcher at Innovating Capital working on trading strategies and protocol research. Chon's resume includes a stint at Amazon where he was a software development engineer. Chon went to Stanford where he completed his MS in computer science with a specialization in systems.

Injective Review: Top Features

Here is an overview of Injective's top features:

CosmWasm Support

CosmWasm is a smart contracting platform built for the Cosmos ecosystem. CosmWasm is written as a module that can plug into the Cosmos SDK, allowing anyone currently building a blockchain using the Cosmos SDK to add CosmWasm smart contracting support to their chain, without adjusting existing logic.

Rust is currently the most used programming language for CosmWasm, but there's a possibility that other programming languages like AssemblyScript may be supported in the future.

Interoperability

Injective lets you securely transfer crypto assets and Web3 data from prominent blockchains to utilize on any application built on Injective. All DApps within Injective’s ecosystem can natively access sovereign Layer 1 chains for frictionless interoperable communication.

You can use the Injective Bridge to transfer assets in and out of Injective with the following blockchains:

- Ethereum

- Solana

- Cosmos Hub

- Osmosis

- Evmos

- Axelar

- Moonbeam

- Persistence

- Secret Network

- Stride

- Crescent

- Sommelier

Staking

Injective follows a proof-of-stake mechanism, in which users can stake their tokens to certain Injective validators who will do the work of validating transactions, while the user reaps the benefit through only contributing assets.

Currently, the APR stands at 15.98% and 44.2 million INJ ($326.4 million) have been staked.

Rewards start accruing the moment you stake INJ and you can monitor your rewards in the staking section of Injective Hub. Once you have earned a sufficient amount of rewards, you can withdraw them at any time. You can also instantly transfer staked INJ from one validator to another. However, the unstaking period takes 21 days to complete.

Also, check out our complete guide to staking crypto.

Burn Auctions

As an incentive mechanism to encourage exchanges (acting as relayers) to build on Injective and source trading activity, exchanges who originate orders into the shared orderbook on Injective's exchange protocol are rewarded with 40% of the trading fee arising from orders that they source. The other 60% goes to Injective.

Each week, an auction is held to allow community members to use INJ to bid for the basket of trading fees collected by Injective that week. At the end of the auction, the winning bidder receives the full basket of assets and the winning bid (paid in INJ) is burned. This creates deflationary pressure on the INJ token supply.

Insurance Funds

During periods of high volatility in margin trading, the losing party on a trade might not be able to afford to pay the winning party if they run out of margin, i.e. the position becomes bankrupt. If the trader's position is liquidated and the new trader takes it over at a worse price than the bankruptcy price, the insurance fund is utilized to cover the resulting deficit.

Unlike most exchanges, the insurance fund on Injective is market-specific, meaning there is no common pool of insurance capital collected, but rather a new fund exists for each derivative market launched on Injective. This way, the risk for underwriting insurance is isolated to each individual market.

When a user underwrites insurance for a derivative market, they stake the collateral currency for that market and, in turn, receive insurance pool tokens specific to the market. These pool tokens represent pro-rata ownership of the insurance fund. Thus, as an insurance fund grows from liquidation proceeds, the insurance fund stakers gain profit from the increase in value of their stake of the insurance fund.

Injective allows users to build derivatives markets on chain. Any user can create an insurance fund for a derivatives market, as well as become an underwriter by adding funds to it. Based on the ownership percentage, the underwriters may receive more or less than they originally put into the fund.

IMPORTANT: Margin trading is extremely risky. Head over to our complete guide to crypto leverage to learn more.

INJ Token

INJ is Injective's native staking token, allowing holders to govern and decide the future of the protocol. The token was released via Binance Launchpad, which marked its 16th project.

Here are some details from the October 2020 sale:

- Hard Cap: $3.6 million

- Tokens allocated to Binance Launchpad: 9 million INJ, representing 9% of the total supply

- Public sale price: 40 cents per INJ

- Token sale format: Lottery

- Max number of winning lottery Tickets: 18,000

- Allocation Per Winning Ticket: $200 or 500 INJ

- Supported sessions: BNB only

INJ Tokenomics

In addition to being used for governance and incentivize exchange DApps, INJ is also used for a few other purposes, including:

- Proof-of-stake security: As noted, the Injective PoS blockchain is governed by its native INJ token. The initial supply is 100 million tokens and should increase over time through block rewards. The target INJ inflation is 7% at genesis and will decrease over time to 2%. Gradually, the total supply of INJ may be lower than the initial supply due to its deflationary mechanism.

- Collateral backing for derivatives: INJ will be utilized as an alternative to stablecoins as margin and collateral for Injective's derivatives markets. In some derivative markets, INJ can also be used as collateral backing or insurance pool staking where stakers can earn interest on their locked tokens.

INJ Token Performance

In November 2020, a month after its debut, the token was trading around the $0.75 level, giving Launchpad buyers a roughly 100% return in just a month.

The price started climbing further, and by December 2020, it was around $1.50. Taking profits then may have been tempting, but those who did probably kicked themselves because the token soared to $16.87 on Feb. 19, 2021.

Many people may have sold at that level, and in the following month, and price pulled back but never dipped below $10. Instead, INJ resumed its rally, reaching an all-time high of $24.89 on April 30, 2021.

CoinGecko ranks INJ as the 60th largest token by market cap. It is currently down 70% from its all-time.

Injective Partnerships

Injective has struck a number of strategic partnerships.

- Ecosystem Fund: Pantera Capital, Kucoin Ventures, Jump Crypto and Delphi Labs backed a $150 million Injective Ecosystem Fund that will support projects aimed at accelerating the adoption of interoperable infrastructure and DeFi.

- Espresso Systems: Injective collaborated with Espresso Systems, a protocol helping to create decentralized rollup sequencers. Injective said the partnership was a step towards bringing decentralization to rollups built within its ecosystem.

- Hackathon: Injective launched the Illuminate Hackathon supported by Google Cloud and co-hosted with DoraHacks. The four-week online Hackathon is the prime builder launchpad for Web3 finance applications with a $100,000 prize pool.

Injective Review: Closing Thoughts

Injective stands as a pivotal player in the DeFi landscape. With its innovative solutions and interoperable framework, the company not only facilitates seamless cross-chain transactions but also provides a fertile ground for the development of sophisticated financial applications. Its commitment to transparency, security, and accessibility is evident through features like CosmWasm compatibility, the Injective Bridge, staking mechanisms, innovative burn auctions, and insurance funds.

Injective's strategic partnerships and its backing from investors like Pantera Capital, Kucoin Ventures, and Jump Crypto underscore its potential and credibility within the blockchain space. The platform's native token, INJ, not only acts as a governance tool but also plays a vital role in the security and collateral backing of derivatives markets.

As the demand for secure and decentralized financial solutions grows, Injective's DeFi platform offers users a promising gateway to a decentralized financial future.

Frequently Asked Questions

Injective is a Layer 1 blockchain platform designed for building decentralized finance (DeFi) applications. It provides a range of pre-built modules, including a decentralized order book, offering developers the tools to create sophisticated financial applications. Injective operates as an open and interoperable smart contracts platform.

INJ is Injective's native staking token. It serves multiple purposes, including governance, incentivizing exchange DApps, and acting as collateral for derivatives markets. INJ holders have the power to influence the protocol's future decisions and participate in governance processes.

Injective enables the creation of a wide range of financial products, including decentralized exchanges, prediction markets, and various on-chain strategies. Its fully decentralized order book empowers developers to build mainstream decentralized applications (DApps) within the DeFi space.

Yes, Injective follows a proof-of-stake mechanism, allowing users to stake their tokens. Stakers can delegate their assets to specific Injective validators, who validate transactions and contribute to the network's security. Stakers earn rewards for their contributions, and these rewards can be monitored and withdrawn through the Injective Hub.

Injective stands out due to its innovative solutions and interoperable nature. It enables instant transaction finality using the Cosmos SDK and Tendermint proof-of-stake consensus framework. Additionally, Injective facilitates seamless cross-chain transactions across major networks like Ethereum and Cosmos Hub, enhancing its usability and reach.

Disclaimer: These are the writer’s opinions and should not be considered investment advice. Readers should do their own research.