Kraken Review 2024: Is This the BEST Beginner-Friendly Exchange?

Kraken is one of the most respected and secure crypto exchanges in the industry. Ranked #1 in terms of security by independent research firm Certified, and ourselves here at the Bureau, Kraken is the only major exchange to never suffer a security exploit. Not only is Kraken secure, but also incredibly beginner friendly, making it the ideal choice for new crypto users or anyone seeking a simple-to-use no frills crypto exchange.

Kraken is a top-notch, US-based crypto exchange that has expanded in popularity and user base and now enjoys physical locations worldwide. Kraken exchange has held the #4 position as the largest exchange by trading volume for several years and is considered one of the major five exchanges by user base and popularity. As one of the top exchanges in the world, we at the Coin Bureau felt it was time to provide our community with a Kraken review.

The Kraken exchange provides a fantastic alternative to Coinbase for crypto investors and traders looking for a solid US-based crypto exchange that offers more than simply buying, selling and swapping assets. This Kraken review will give you a deep dive into all the nooks and crannies of the platform to help you decide if the Kraken exchange is suitable for you.

Kraken Exchange Review Verdict:

Kraken is a highly dependable and trustworthy exchange. They are often ranked #1 in terms of both security and customer service by independent auditors, as well as from my personal findings. The fees are reasonable, and Kraken is a great Coinbase alternative that has become popular with Futures traders and offers more robust trading functionality.

Disclaimer: I have used Kraken Exchange as part of my personal crypto trading strategy.

Kraken Summary

| Headquarters: | San Francisco, USA |

| Year Established: | 2011 |

| Regulation: | FinCEN, FINTRAC, FCA, AUSTRAC, FSA |

| Spot Cryptocurrencies Listed: | 186 |

| Native Token: | N/A |

| Maker/Taker Fees: | Lowest: 0.00%/0.10% Highest: 0.16%/0.26% |

| Security: | Very High: 2FA, email confirmation, customizable API keys, PGP encrypted emails, real-time platform monitoring, account timeout, global time lock, SSL encryption, password requirements |

| Beginner-Friendly: | Yes |

| KYC/AML Verification: | Yes |

| Fiat Currency Support: | USD, EUR, CAD, AUD, GBP, CHF, JPY |

| Deposit/Withdrawal Methods: | USD-ACH, Wire, SWIFT, Signet, SEN EUR- Debit/Credit card, SEPA, SWIFT

GBP- Debit/Credit card, FPS, CHAPS, SWIFT

CAD- Debit/Credit card, Wire, e-Transfer, SWIFT, EFT

AUD- Debit/Credit card, Bank Transfer, Osko, SWIFT

CHF- Debit/Credit card, SIC, SWIFT

JPY- SWIFT, Furikomi/Domestic remittance

Crypto deposits +withdrawals supported, Apple/Google pay also available depending on jurisdiction.

|

Review: What is Kraken

The Kraken is a legendary sea monster of massive proportions that is said to hunt sailors off the coast of Norway. The terrifying giant squid creature has been the subject of sailors’ superstitions and myths dating back to the 1180s when the King Sverre of Norway first wrote about it.

What does a giant sea creature have to do with crypto?

Honestly, I have no idea. Maybe the founder really likes calamari, which segues me to the important stuff.

Kraken (the exchange, not the squid) The crypto exchange was founded in 2011 by former CEO Jesse Powell in San Francisco, USA. Jesse Powell is a veteran in the crypto space and is well respected for helping drive the crypto industry forward, above and beyond the scope of the simple Kraken exchange. Interestingly, before Kraken, he worked as a security consultant for Mt. Gox. Powell anticipated the Mt. Gox collapse and decided to start up a more sustainable and robust crypto exchange and released the Kraken… Oh, come on, you knew the joke was coming 😒

Kraken has become one of the most well-established and highly respected crypto exchanges in the industry. They saw so much success in the early days that in 2014, Kraken received a $5 million Series A funding investment. A month after that, the platform became one of only two exchanges to be listed on Bloomberg Terminal; then, in 2015, they opened the first dark pool for Bitcoin, resulting in Kraken becoming a suitable place for institutional investors to trade Bitcoin on the Kraken trading platform.

According to Crunchbase, the company has raised $136 million in funding over 32 rounds and is backed by 33 investors, including some of the biggest names in the space. They are currently valued at a whopping$10 billion; there is no shortage of funding or capital here.

So, it is safe to say that Kraken is well-funded, well-trusted, and well-respected, which is a good start, but instead of relying on reputation, let's look at the legalities. In crypto, we often say, "don't trust, verify."

Fortunately, from a legal standpoint, Kraken is a stickler for licensing and regulations. They comply with legal and regulatory requirements in all the jurisdictions where they operate and hold the following registrations:

- FinCEN in the USA as a Money Services Business

- FINTRAC in Canada as a Money Services Business

- FCA regulated in the UK for CryptoFacilities LTD, which is a Kraken service

- AUSTRAC in Australia as a Digital Currency Exchange

- FSA in Japan for Payward Asia, K.K, registered as a Crypto Asset Exchange Operator.

You can learn more about their licenses, registrations, and its brands and partners on their About Kraken Support Page.

As one of the world's largest and oldest crypto exchanges, Kraken is one of the most secure and beginner-friendly places to buy, sell, and trade crypto. Right from the horse's mouth, this is Kraken's mission:

“Our mission is to accelerate the adoption of cryptocurrency so that you and the rest of the world can achieve financial freedom and inclusion.”

Sounds great. They are making great strides in the "rest of the world" area as they have fantastic fiat currency/country support and multiple withdrawal and deposit methods depending on the jurisdiction, which we will cover later. Kraken is available in most countries globally with the exclusion of sanctioned countries and:

- Afghanistan

- Cuba

- Guinea-Bissau

- Iran

- Iraq

- North Korea

- Tajikistan

- New York and Washington states

Kraken has physical locations in San Francisco (USA), Halifax (Canada), London (UK), Tokyo (Japan), Sydney (Australia), and the British Virgin Islands.

If you want to see how Kraken stacks up against other crypto exchanges, feel free to check out our Top Exchanges article where we break down the best exchanges in different categories to help you find the right one to fit your needs.

If you would like Guy's take, here's a Kraken Beginner's Guide he has put together:

Kraken Exchange Key Features:

Now we will cover the main features of the Kraken trading exchange. Kraken is available as a web platform and mobile app for IOS and Android. Kraken also offers Kraken Pro included on the site, an advanced platform for advanced traders. We will cover the exchange itself later in the platform design and usability section; for this next part, we will look at the key features aside from the exchange.

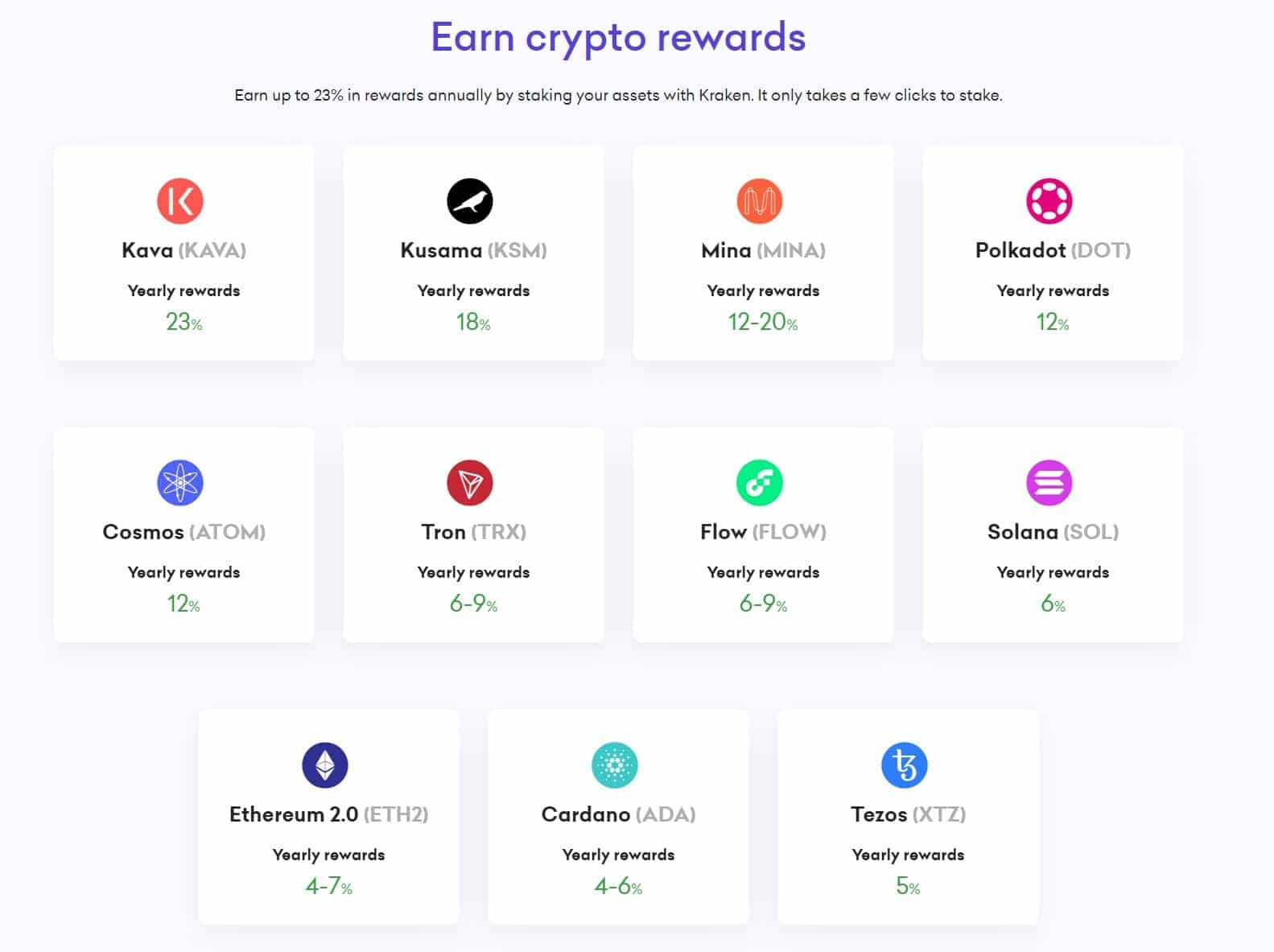

Staking

Like most good exchanges, Kraken has a section where users can stake popular Proof-of-Stake crypto assets and earn up to 23% in staking rewards.

Kraken staking allows users to earn attractive APYs easily with just a few clicks of a button in a flexible manner for 13 different crypto assets, USD and EUR.

Education

I am a huge fan of any platform that goes out of its way to provide in-depth crypto education, and Kraken gets a massive thumbs up from me on this front. Obviously, the Coin Bureau shares a similar passion for crypto education as we understand that education is the key to adoption, and crypto can be a heck of a confusing jungle to navigate for those first getting involved.

The traditional financial and education systems have let the average person down with a lack of education, transparency, and understanding surrounding finances, which is one of the reasons most people are drowning in debt and living paycheck to paycheck.

With crypto, we have a fresh start, a chance to change that. Thanks to companies like Binance with the Binance Academy, Kraken with Kraken Learn, and companies such as ourselves, we have an opportunity to pick up and build upon where traditional finance failed us and did society a huge injustice.

The Kraken Learn section is full of everything users need to navigate the wacky world of crypto. The articles, videos, and guides are not only specific to Kraken but can help out regardless of the crypto path that a person chooses to walk.

They also have fantastic interviews and panel discussions on the Kraken Blog; it is an excellent resource for everything crypto. I signed up to their mailing list as they periodically send out insanely in-depth research and market analytics on the state of crypto.

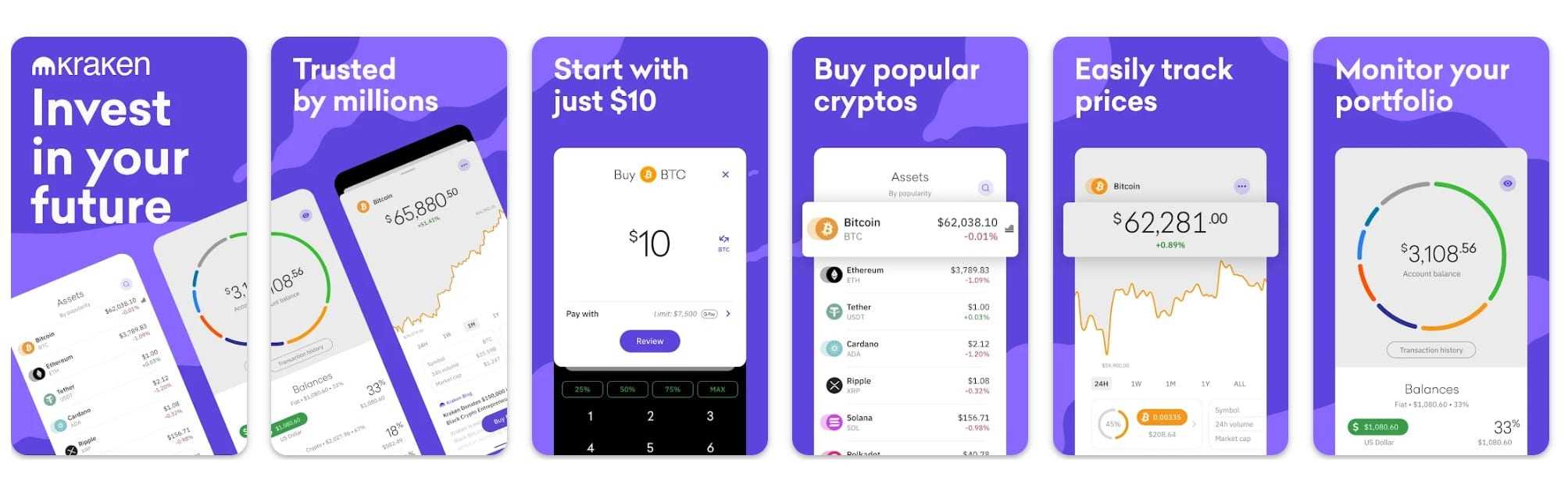

Kraken App

Similar to how Coinbase and Crypto.com have two apps, one for day-to-day crypto use and buying, selling, and hodling, and a second app for advanced trading, Kraken also has two apps:

- Kraken

- Kraken Pro

I don’t know who claimed the names first but come on, guys, Coinbase and Coinbase Pro, FTX and FTX Pro, Kraken and Kraken Pro… How original. Of all the words in the English language that they could have used, they all went with Pro.

Lack of naming originality aside, the Kraken mobile app is a beautifully designed and fantastic app that makes using it an absolute breeze and a treat. Aesthetically and functionality speaking, they nailed the UI/UX of the platform.

First, let’s take a look at the Kraken App:

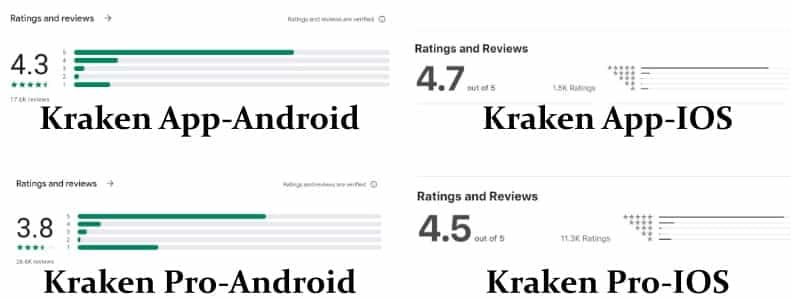

The app is solid for buying, selling, converting, tracking, and managing your crypto and has over 1M+ downloads. The Kraken app has a fantastic rating of 4.3 out of 5 on Google, and 4.7 out of 5 on the App Store, so yeah, it’s a great app. Here are some of the highlights:

- Easily buy and sell over 120 crypto assets

- Low fees for buy/sell orders

- Accurate price tracking, so users know the price before they buy/sell

- 24/7 support

- Multiple payment options for crypto

- Viewable transaction history

- Graphic showing crypto allocation and balance

- Review the value of each investment and its % of your portfolio

- Asset overview features, price, volume, charts, and other details

- Summary of the project behind each crypto asset

And most importantly, it is secure. If your mobile is lost, Kraken support can revoke access remotely. In addition, there is password and biometric protection, and users can access a list of devices that have access to the account. We will cover security later on in the Kraken Security section.

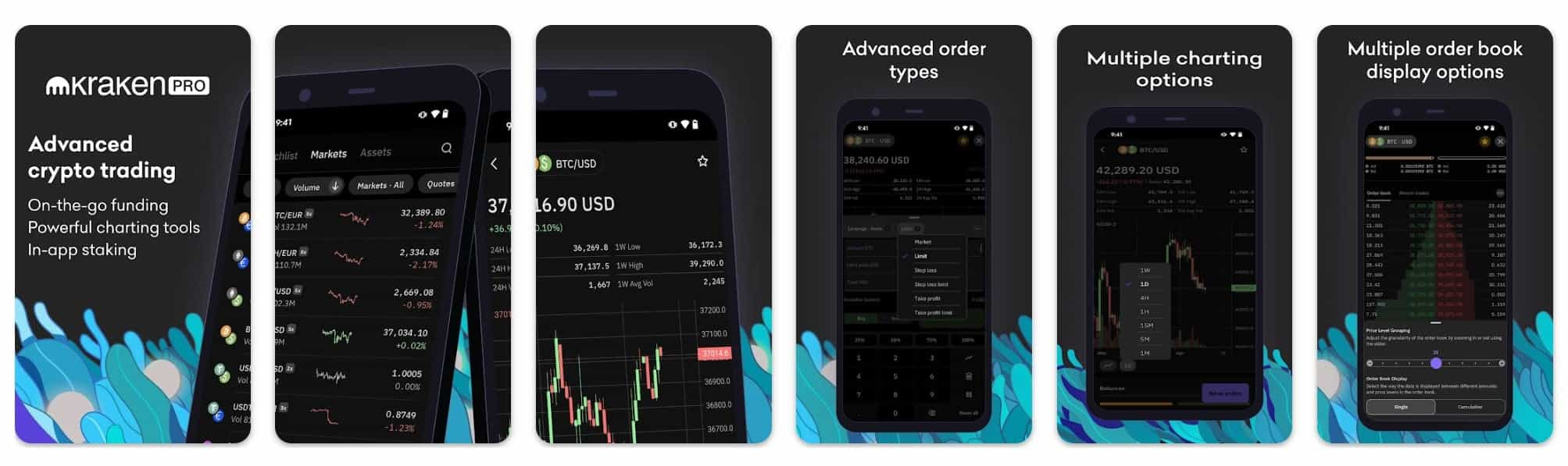

Kraken Pro

Kraken Pro is an advanced trading platform that is available on the Kraken platform as well as a separate mobile app. It is designed for traders who need access to advanced trading features and functionality, with the corresponding app suitable for trading on the go. Kraken Pro features lower fees than the standard Kraken platform and provides an interface for advanced trading, charting, and order types not available on the standard platform.

Now, in my review article for Coinbase Pro, I mention why here at the Coin Bureau, we do not generally recommend the use of mobile trading apps as a primary tool for trading as trading is a serious career and requires a lot of multitasking that cannot be done easily on a mobile, I recommend you check out the Coinbase Pro review where I cover the reasons why in more detail. There’s a reason you don’t see professional traders trading from a mobile device while waiting in line for a Big Mac.

That aside, the Kraken Pro app is as good as any of the top mobile trading apps and is very useful for monitoring open trades or making slight adjustments on the go. Or even in the rare event something big happens while you are out enjoying that Big Mac, and you need to make a quick trade to take advantage of breaking news.

Let’s look at some of the highlights for Kraken Pro:

- On-the-go deposits, withdrawals and trading

- Low fees

- Crypto staking

- High security

- Over 115 crypto assets available to trade over 400 markets

- 24/7 customer support

- Low trading fee

- Advanced cryptocurrency trading tools with an easy-to-use interface

- Fast order execution and real-time price updates

- Multiple charting and order book display options

- Viewable trade history

- Margin trade up to 5x

- Advanced order types and conditional close parameters

👉 Sign-Up and get access to Kraken Pro!

The Kraken Pro app also has pretty solid reviews with a 3.8 out of 5 on Google Play and 4.5 out of 5 on the Apple App store.

While the majority of reviews are positive, there was one consistent issue that caused many of the low ratings: the app being very slow and laggy for some Android users. Though many positive reviews did not report this, it only seems to affect certain users.

Kraken Pro users can connect their regular Kraken account using the same username and password for both platforms, or the accounts can be linked using an API key.

Pro Tip: Never search for crypto apps directly in an app store due to multiple fake app download links from scammers nearly indistinguishable from the real app. Always hit the download or redirect link directly from the company website.

Kraken NFT Marketplace

Following suit with other major cryptocurrency exchanges, Kraken will be launching an NFT marketplace in the near future.

The Kraken NFT marketplace will offer a zero-gas fee platform for NFTs custodied with Kraken. There will be no blockchain network fees for trading activity on the platform, though transfers off the platform will come with a network fee.

The platform will provide a rarity tracker, pay with cash option, will support multiple blockchains, and NFT creators will be rewarded with profits from each resale of an NFT. Ethereum and Solana are the only two announced networks supported so far, but the team mentions adding additional blockchain support in the future.

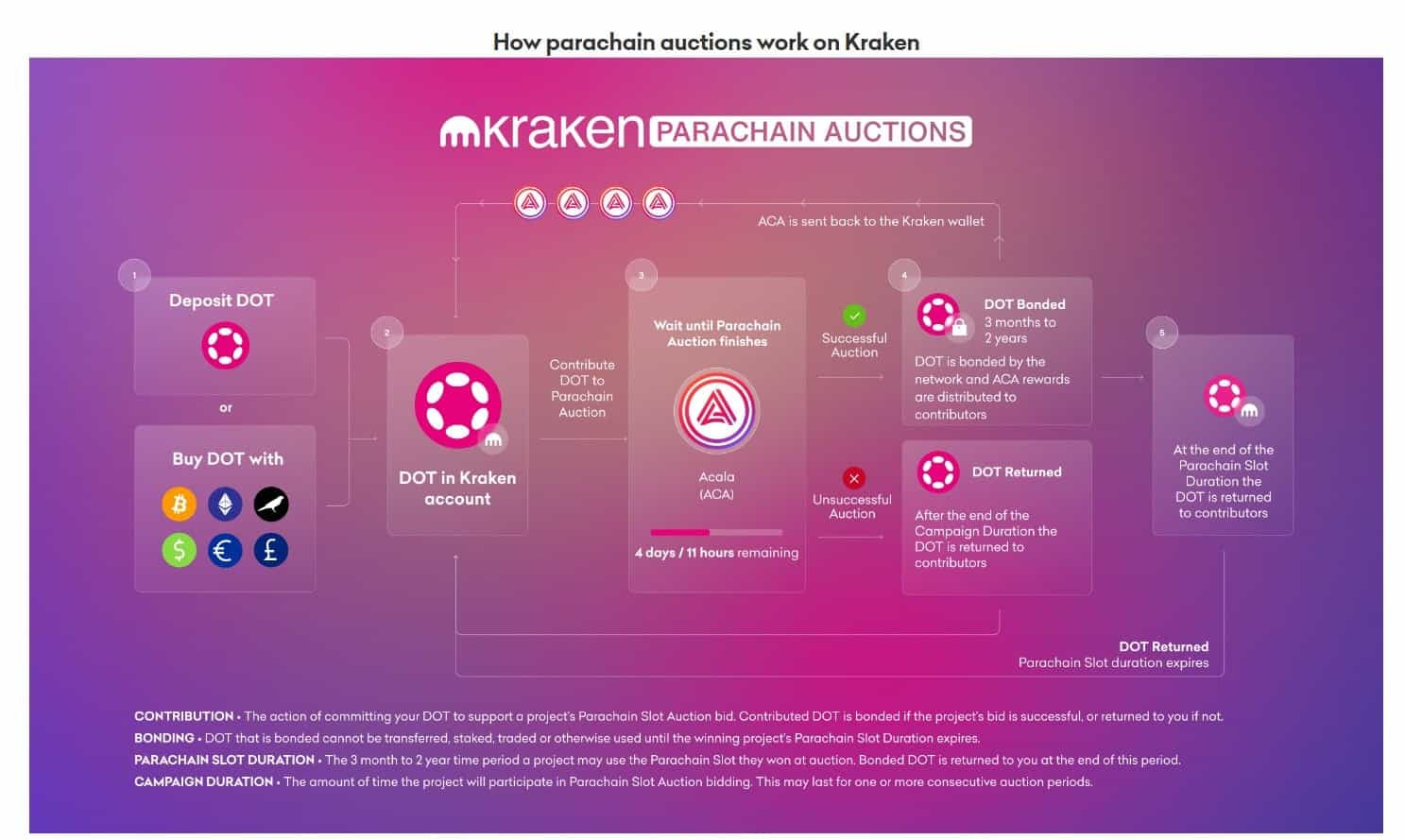

Polkadot and Kusama Parachain Auctions

Kraken is one of the few exchanges to support DOT and KSM parachain auctions, and I think this feature is amazing, a huge driver attracting fans of the Polkadot ecosystem. Polkadot is an exciting project with huge potential, but it is quite complex and confusing to navigate, leaving many crypto users at a loss with no idea how to get involved with the DOT and KSM auction process.

Kraken has found a way to simplify the process for platform users, allowing them to participate in parachain slot auctions without the technical know-how needed to navigate the complex Polkadot DeFi environment.

If you are just hearing about Polkadot parachain auctions for the first time, or want to learn more, check out Guy’s Ultimate 101 Guide to Polkadot Auctions:

To participate in parachain auctions on Kraken, users must verify their account to intermediate level or higher. Once that is done, users can navigate to the Earn section and deposit their DOT or KSM into the auction for the project they would like to support.

DOT or KSM bonded to the auction will be locked for the duration of the auction and will be returned to the user after the auction period has ended, along with the rewards if the project wins the auction and is accepted into a parachain slot.

The fees to involved to get involved with parachain auctions are as follows:

- 5% fee on the project’s token reward that Kraken claims on a user’s behalf for Polkadot projects.

- Contributions to a single project exceeding 1000 DOT will be subject to a 2% fee on the project’s token reward that Kraken claims on a user’s behalf for Polkadot projects.

- Contributions to a single parachain project exceeding 100 KSM will be subject to a 2% fee on the project’s token rewards that Kraken claims on a user’s behalf.

The benefits from the user perspective for participating through Kraken as opposed to the DIY method are as follows:

- Quickly unstake DOT or KSM to participate in an auction.

- Purchase DOT or KSM and participate within seconds.

- Be protected with Kraken’s state-of-the-art security protocols.

- Fund, trade, stake, and participate in parachain auctions within a single interface.

- Beginner and user-friendly interface and process

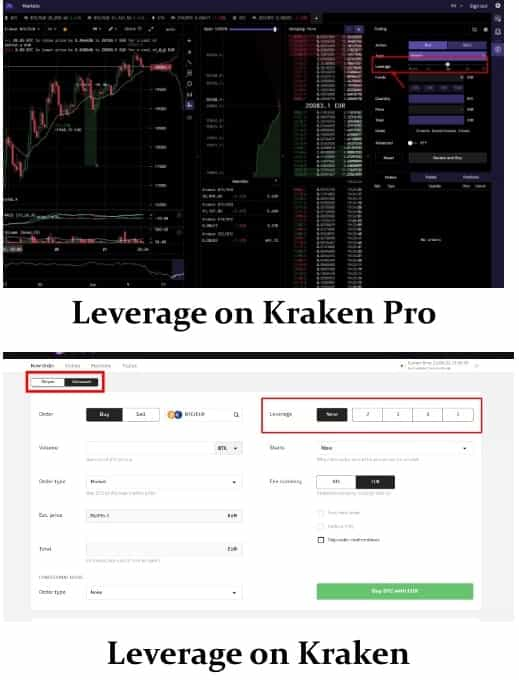

Kraken Margin Trading

One of the biggest attractors for those looking for a solid US-based and regulated exchange is that Kraken allows for 1X to 5X leverage, which Coinbase had to cease offering.

Note that Kraken is unable to offer margin trading for residents of the United States and Japan. Intermediate and Pro level accounts outside the United States and Japan are supported in most jurisdictions.

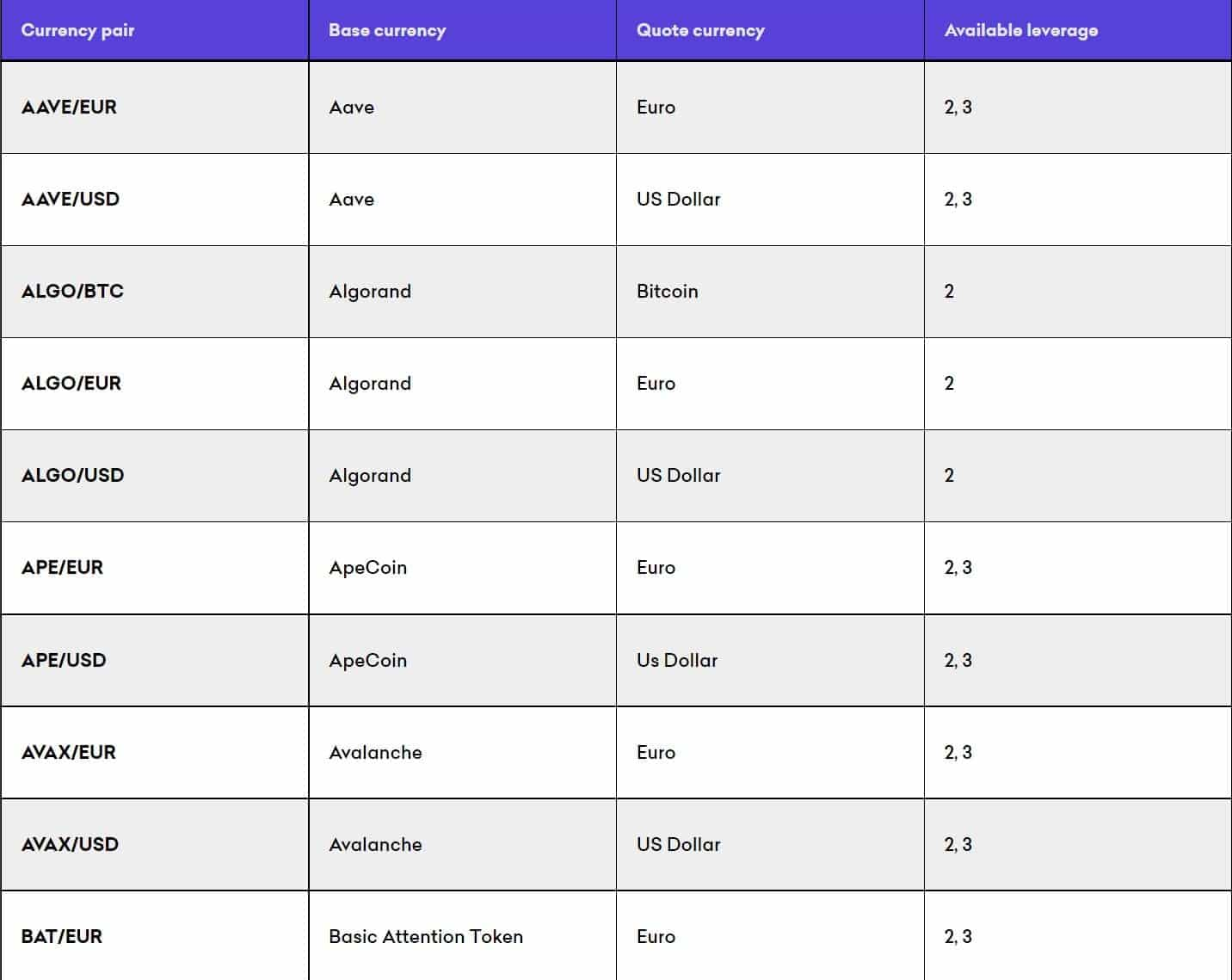

Kraken offers margin trading for over 100 pairs, with the leverage depending on the pair:

We will dive deeper into specific trading features later on in this review. A full list of the available pairs and leverage limits can be found on the Kraken Margin Trading Page.

Kraken Futures Trading

Kraken offers futures trading on the platform, and unlike margin trading, futures trading can be done with up to 50X leverage on certain pairs.

Futures are different from traditional margin instruments in that they are based on the asset's price at some future time. These future times are called the "expiry times", and they allow market participants to hedge market risk or take a future view on the asset's price.

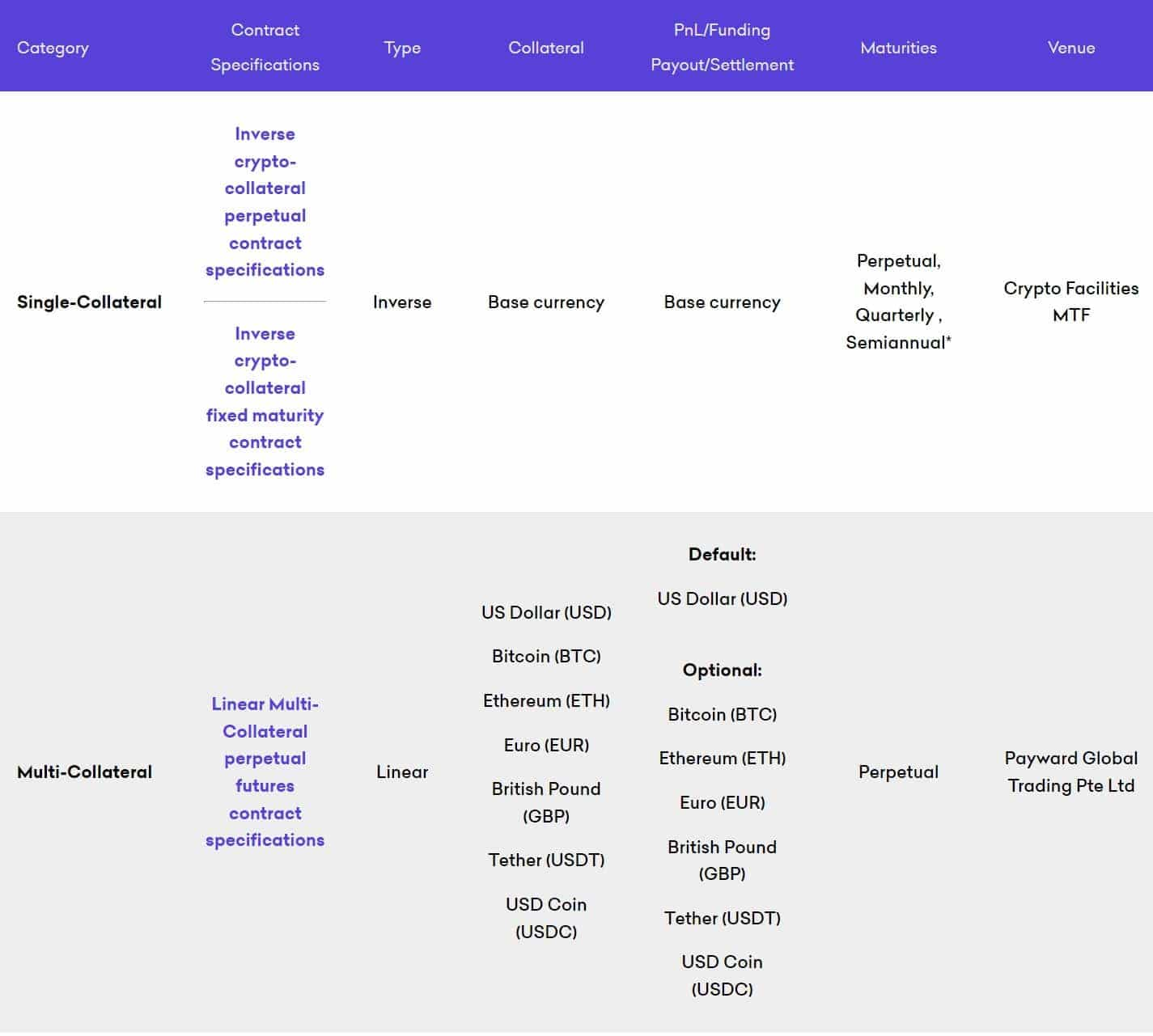

The following Futures contracts are available:

Kraken Futures trading is only eligible for users in certain jurisdictions. It is not available for those residing in the US, Japan, some European countries, or UK and AU clients who are classified as retail. A full list can be found on the Kraken Futures Eligibility Page.

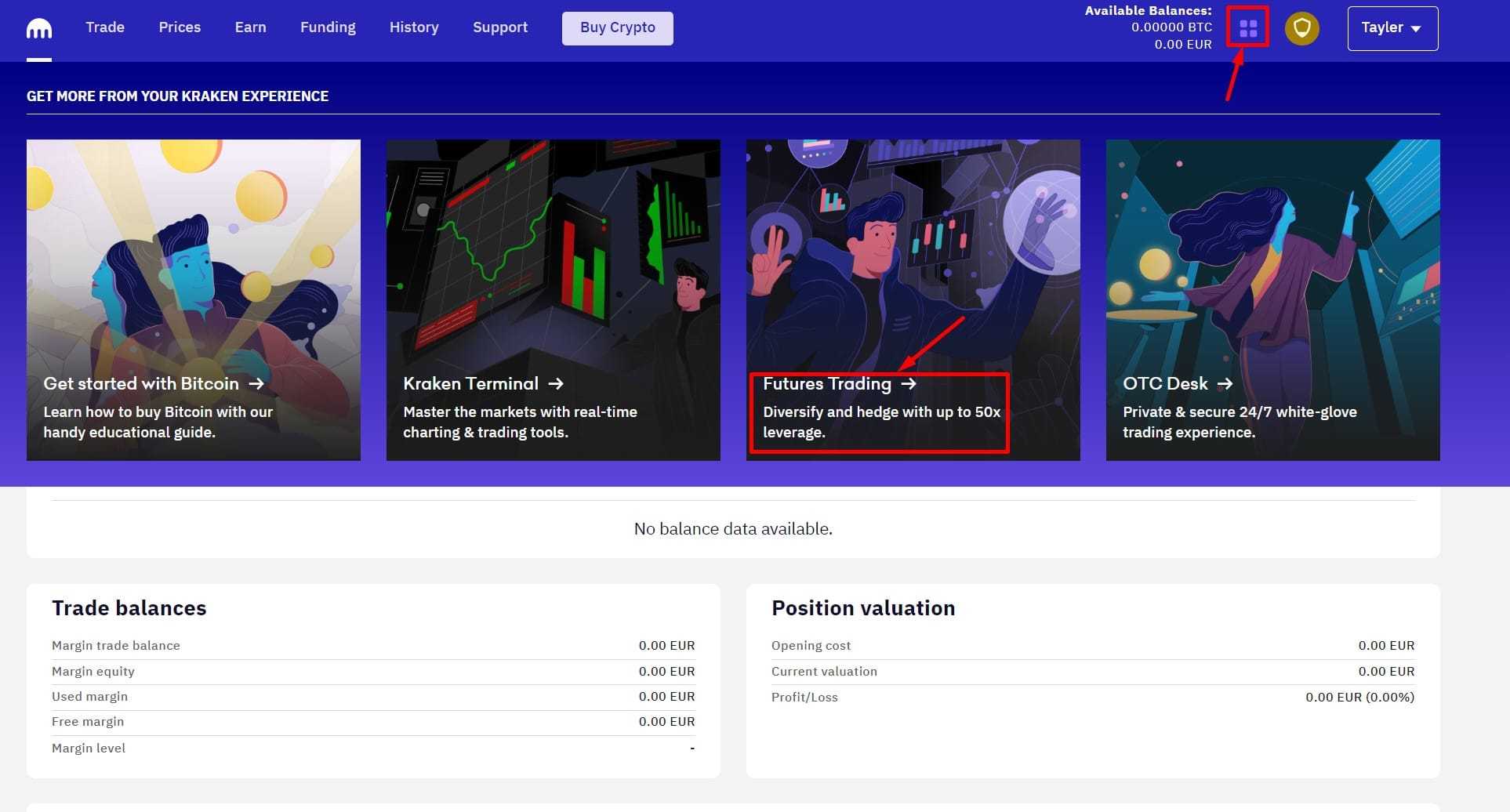

Futures trading can be accessed from a user’s main screen by clicking the four squares on the top right and selecting “Futures Trading” or by logging directly into the Futures trading platform:

Once you have accessed the Kraken Futures Trading platform you will be taken to the futures trading platform screen, which looks like this:

The futures platform is well laid out and offers great functionality. Here traders can switch between various currency pairs and markets, and there are options to switch expiry times, adjust contract specifics, see the order form, view the order books, and see a market depth chart to provide traders with futures trading sentiment.

The charting screen is powered by TradingView, allowing for a massively rich smorgasbord of features and tools, more than enough to suit any style of trader.

Caution ⚠️: Trading futures with high leverage is risky and best suited to experienced traders. Ensure you have adequate stops in place and understand the difference between spot and futures trading.

Kraken Fees

Fees are a significant determining factor when deciding which crypto exchange is right for you, especially if you will be trading frequently or large amounts; the difference between a percent or two can really add up.

To their credit, Kraken fees are quite competitive and refreshingly transparent. No hidden or "surprise" fees here. Kraken fee for Maker and Taker fall towards the cheaper end of the fee scale, having lower fees than Coinbase but a little higher than OKX, KuCoin, or Binance.

Pro Tip: Consider funding via your bank account and try to avoid purchasing crypto with a card or using the "Instant Buy" feature as Kraken has some steep fees for card purchases and using the Instant Buy feature. More on that in a moment.

Many Kraken users who frequently enjoy the exchange feel the fees are well worth using a well-respected, highly secure, regulated US-based exchange that has been battle-tested since 2011. Unlike most of its competitors, Kraken has a spotless security record as one of the few exchanges to never fall victim to a successful hack.

As far as fees are concerned, users on Kraken can expect the following:

- For the Instant Buy feature, digital wallet and card purchases will come with a 3.75% + $0.25 fee or a 0.5% fee for online banking/ACH purchases. Kraken's purchasing partners charge these fees.

- Crypto deposits are free for most crypto assets.

- Crypto withdrawals have a variable fee structure depending on the asset.

- An additional 1.5% fee per transaction for stablecoin purchases, or 0.9% for purchases with USD for the Instant Buy option is tacked on by Kraken.

Fiat deposits vary depending on currency and method used but range between:

- USD- $0 to $10

- EUR- €0 to €3

- CAD- $0 to 1.5% or $3

- AUD- $0

- GBP- £0 to £21

- CHF- 0 Fr.to 0.75 Fr.

- JPY- ¥0

Detailed information can be found on the Kraken Deposit Fees Page.

Fiat withdrawals vary depending on currency and method used but range between

- USD- $0 to $35

- EUR- €0.09 to €35 (1 EUR for SEPA)

- CAD- $0 to $35 or 0.25%

- AUD- $0 to $35

- GBP- £1.95 to £35

- CHF- 1 Fr. to 35 Fr.

- JPY- 35 USD equivalent in JPY or ¥250

The fee-free or low-fee options seen above are generally for users who reside in a country and are transacting locally in their national currency. The higher fees are mainly associated with international users transacting in a different nation's currency. Detailed information can be found on the Kraken Withdrawals Fees Page.

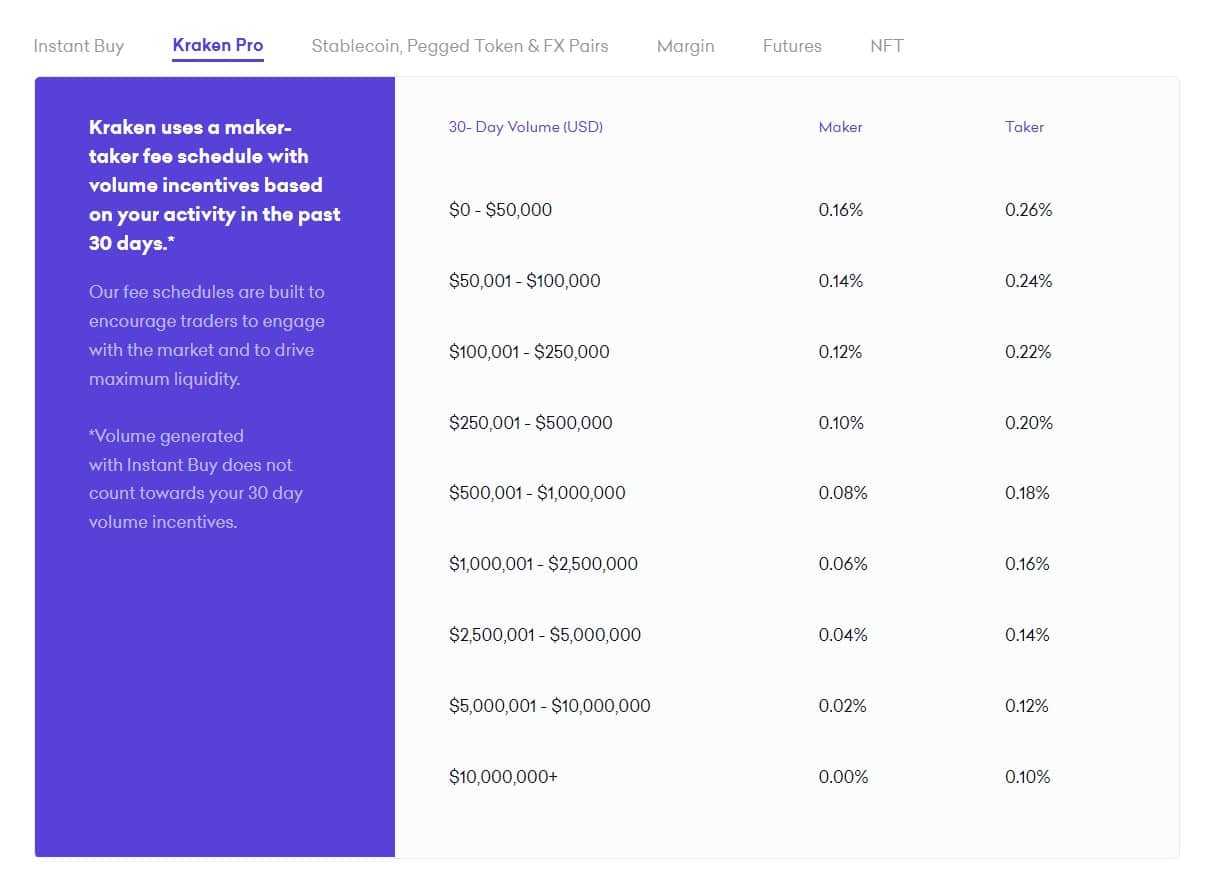

For Kraken trading fees, the trading fee is dependent on 30-day trading volume. Here is an image showing the Maker and Taker fee breakdown on Kraken Pro:

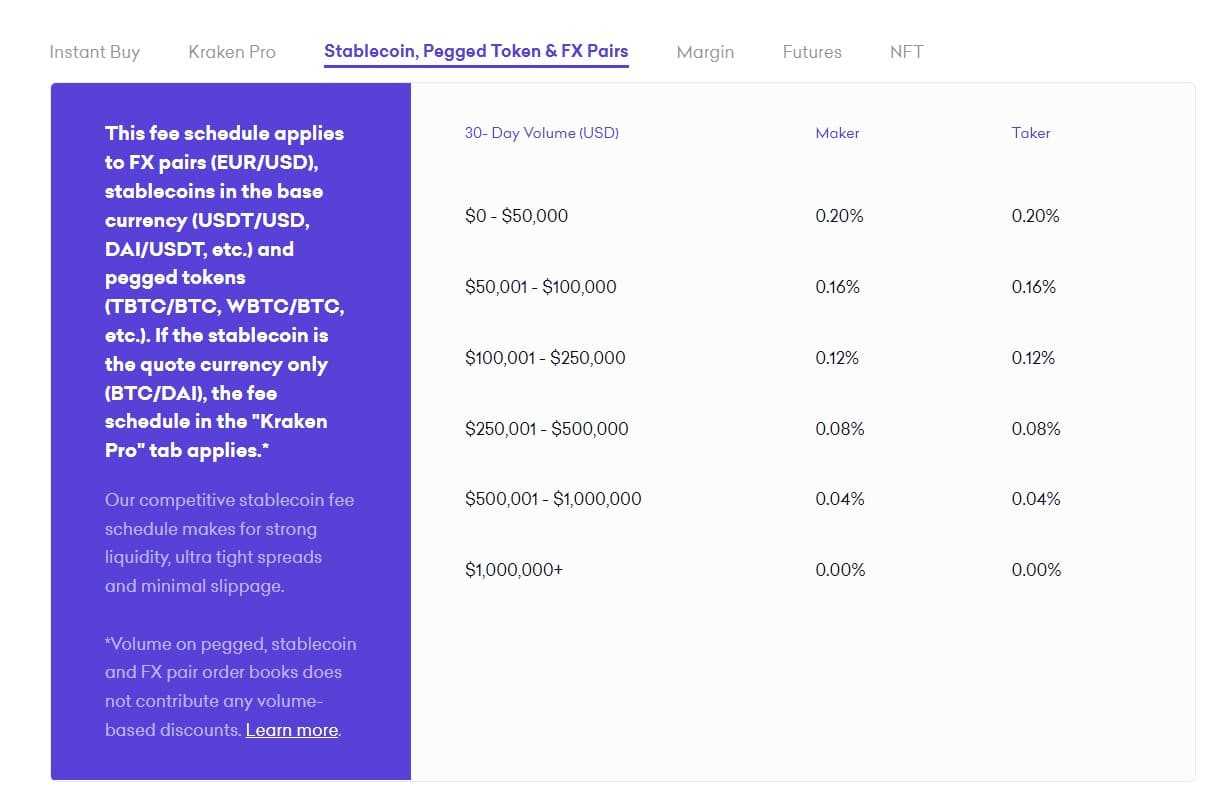

For users interested in trading stablecoins, pegged tokens, and forex pairs, here are the fees you can expect:

Kraken traders who opt for margin trading will have an additional opening fee, and rollover fee tacked on, which are variable depending on the asset. Those fees can be found on the Kraken Trading Fees Page.

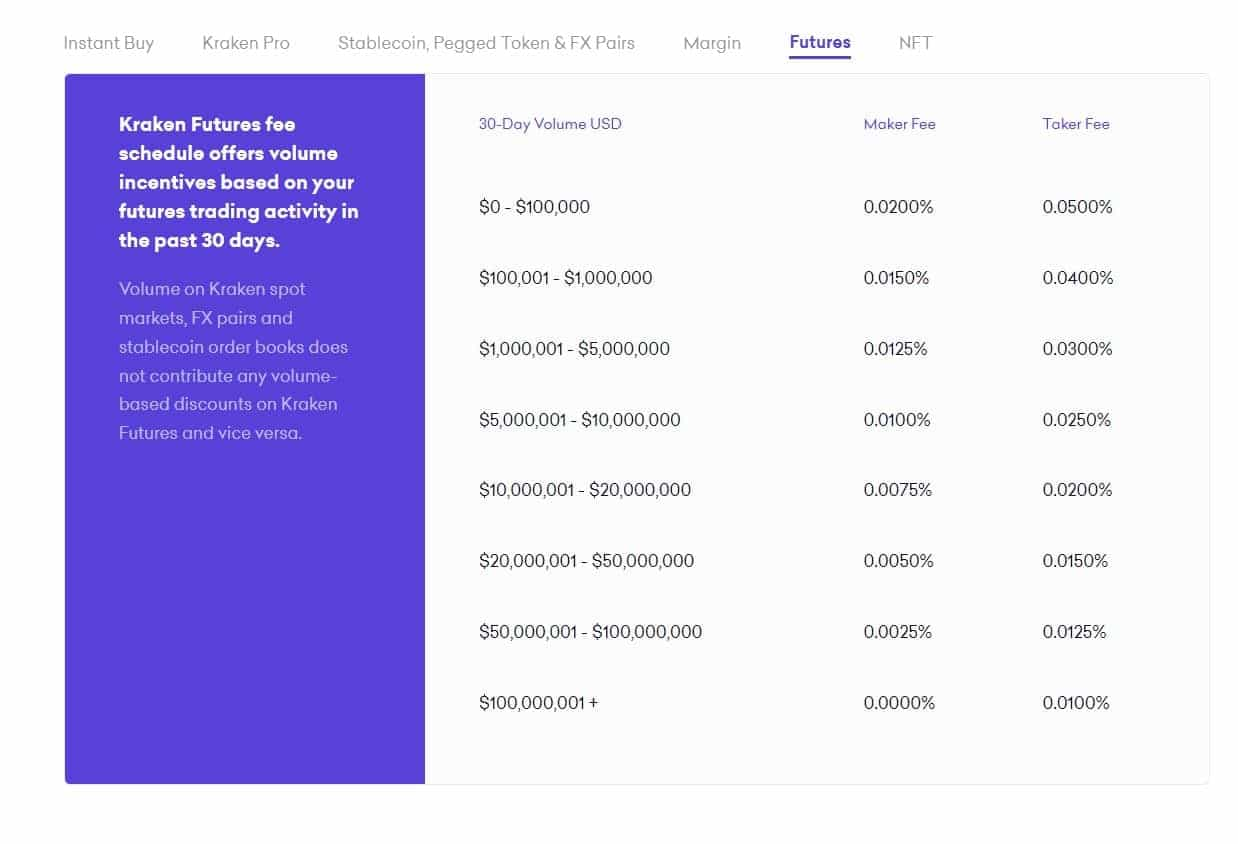

As for our Futures traders, this is an area where Kraken matches cost leadership in terms of industry-low fees. Here are the Maker and Taker fees associated with Futures trading:

For NFTs, Kraken charges a 2% transaction fee, $0 for listing, 0.01 ETH for withdrawals on Ethereum and 0.02 SOL for withdrawals on Solana.

KYC and Account Verification

Because Kraken is highly regulated and plays friendly with the authorities, you know they have KYC/AML and verification requirements coming out the wazoo.

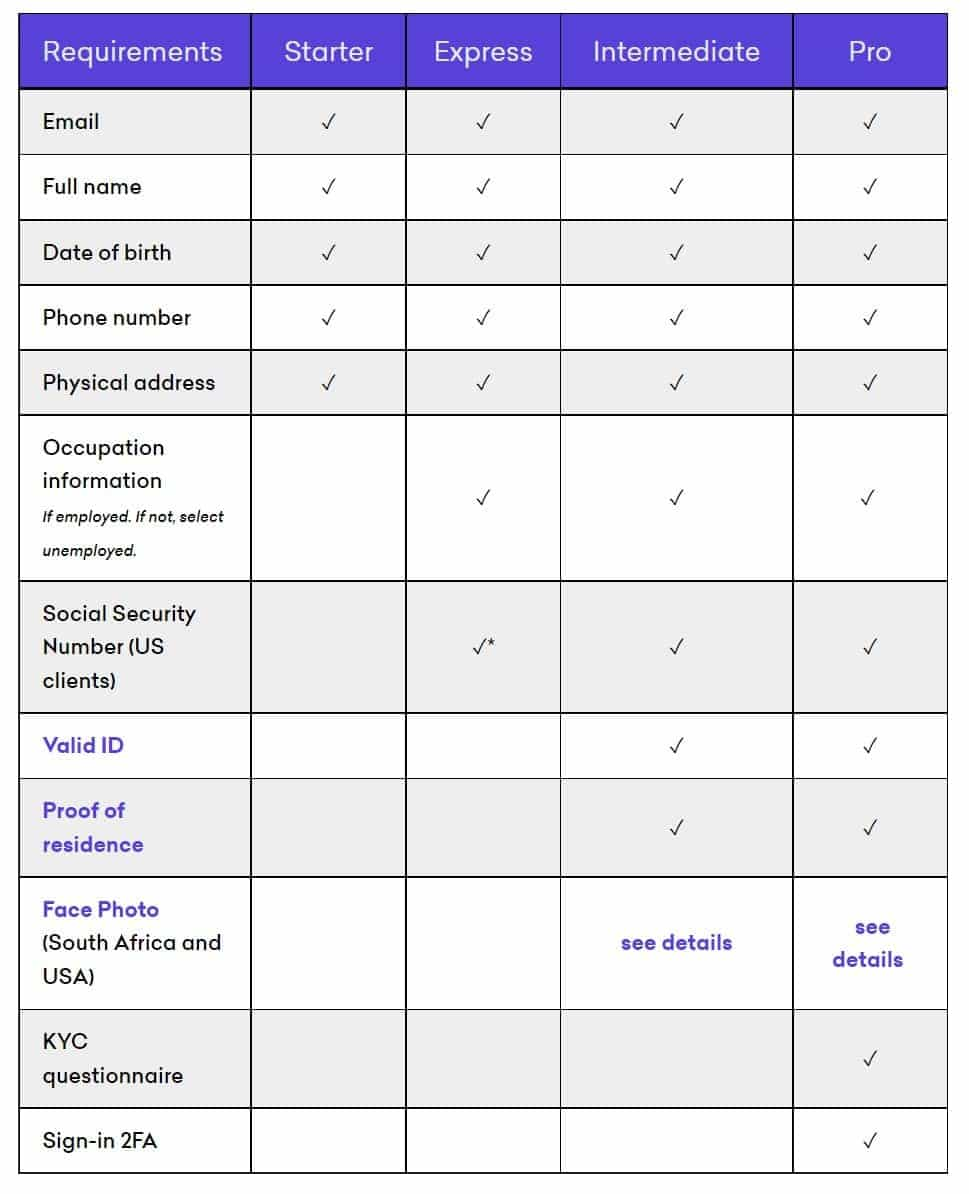

To get started with crypto trading, users can get going with just their email, full name, DOB, phone number and physical address. This will allow for limited functionality on the platform. However, for anything above that, they will want DNA samples and the rights to your firstborn child… Just kidding, but they do ask for some hefty info. Here is a look at the requirements to reach different verification levels:

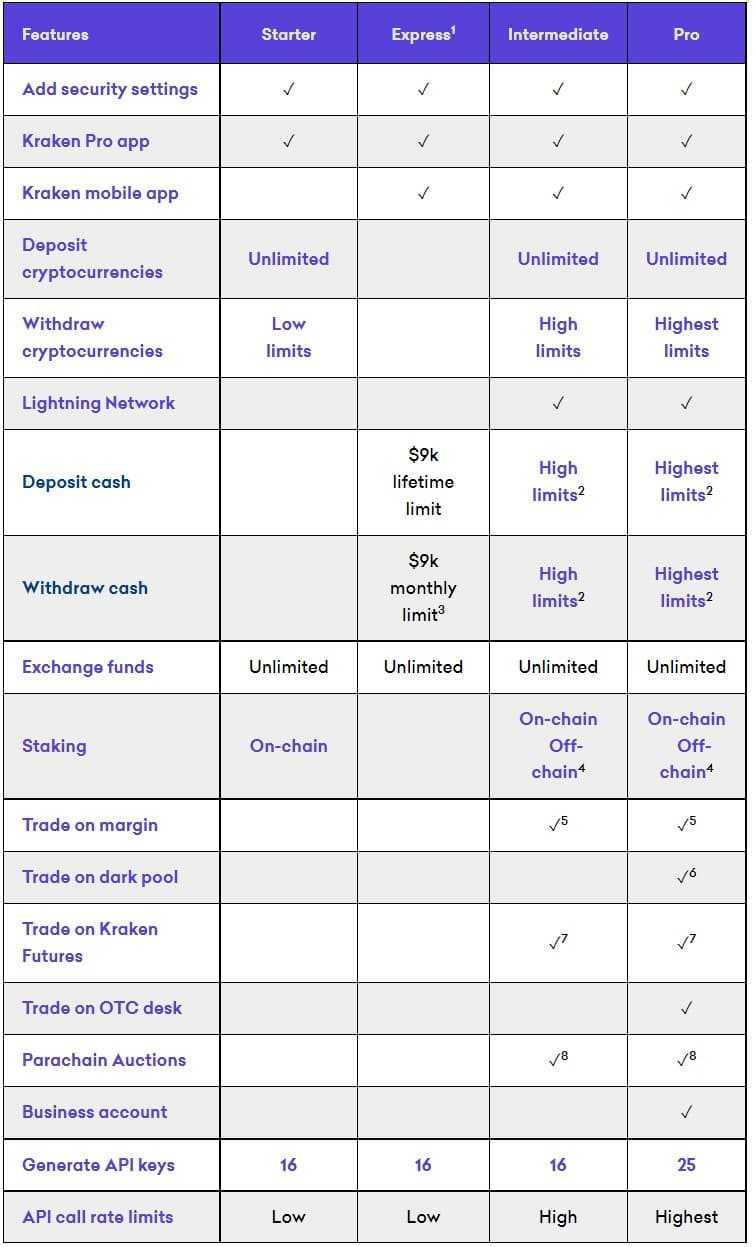

And instead of me writing out everything you can do at each level, Kraken has this handy chart showing what is involved so you can decide if the extra KYC is necessary for your needs:

Kraken’s KYC and account verification process is on par with other exchanges and industry standards. There was a time when exchanges could play fast and loose with KYC requirements, but those days are over, unfortunately.

The only major exchange holding out and allowing for KYC free trading (in a very limited capacity) is KuCoin, which is attracting traders who don’t need to trade much and want to avoid KYC. You can learn more about them in our KuCoin Review. Bybit is another good choice for traders who want to skip KYC.

Kraken Security

If someone asked me for my opinion on the most secure cryptocurrency exchange, I would have to say Kraken. The reason? Out of the top 5 biggest exchanges, Kraken is the only one that has never been hacked, and Kraken has been around for nearly as long as Bitcoin itself. To go that long without ever falling victim to a hack is seriously impressive.

Kraken invests heavily in security, safeguarding funds, NFTs, and privacy. They employ a world-class security team who take a risk-based approach to ensuring client assets remain protected at the highest levels.

The team has decades of experience building security programs for the world’s top brands, investigating consumer data breaches, developing security technology trusted by millions of businesses, and discovering vulnerabilities in technology used by billions of people every day. Kraken security employs the following procedures and features:

Safe Coin and NFT storage- 95% of all deposits are kept in offline, air-gapped, geographically distributed cold storage. Kraken holds full reserves so that users always have access to fund withdrawals.

Platform Security- Kraken servers reside in secure cages under 24/7 surveillance by armed guards and video monitors. Physical access is strictly controlled, and all code deployments are reviewed.

Information Security- All sensitive information is encrypted at both the system and data level. In addition, access is strictly controlled and monitored.

Penetration testing- Kraken employs an expert team dedicated to testing its systems via different attack vectors to identify any vulnerabilities. Kraken also offers a bug bounty for anyone identifying potential issues with the platform’s security.

Platform Monitoring- A dedicated security team continuously monitors the platform for suspicious activity.

From a customer perspective, users can enjoy peace of mind with the following security features to protect their accounts:

- 2FA- Google Authenticator or Yubikey

- Email confirmations for withdrawals with self-serve account locks

- Customizable API key permissions

- PGP signed and encrypted email

- Configurable account timeout for another layer of protection

- Global settings time lock

Kraken’s security is so top-notch and respected in the industry that they have taken their expertise to the next level and created Kraken Security Labs.

Kraken Security Labs is an elite team of security researchers that aim to protect and grow the cryptocurrency ecosystem by providing their services to other platforms, offering to test third-party products, working with other vendors to help resolve their security issues, and informing the public about ways they can best protect themselves.

Kraken feels that industry leaders are responsible for enhancing the security of the entire crypto community and working tirelessly with other companies in the space to contribute to the benefit of everyone. The safer we can all work together for the benefit of the community, the better we will all be. Big kudos to Kraken for this fantastic initiative.

Proof of Reserves

Kraken was one of the first exchanges in the industry to provide Proof-of-Reserves before any of the FTX shenanigans occurred. I remembered, as a Kraken client, receiving emails way back in Dec last year, asking me to verify that my funds are safe on their exchange. That was the first time I’d heard of Proof-of-Reserves.

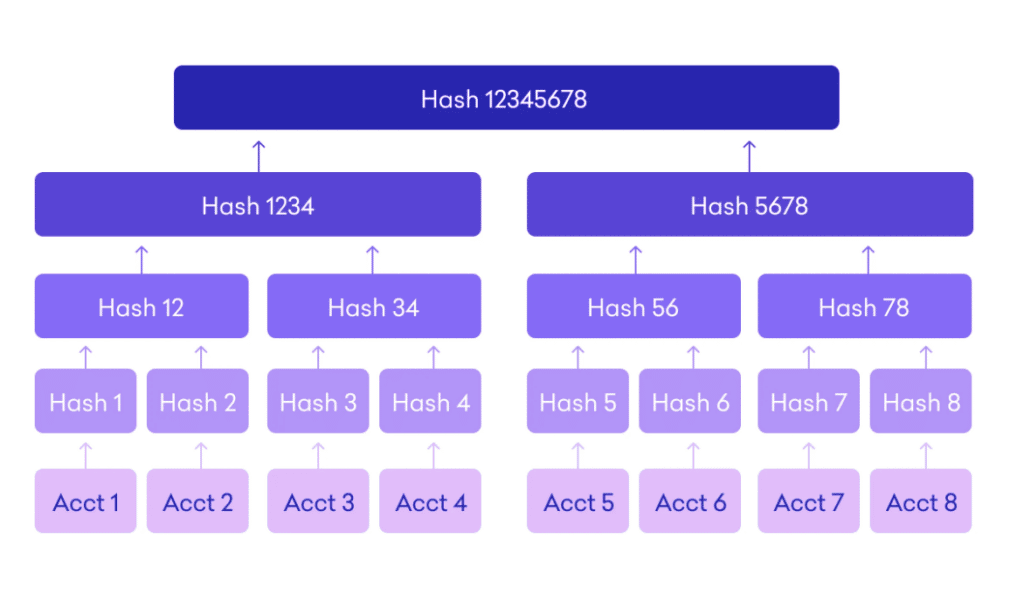

Proof of Reserves (PoR) is an audit done by a third-party auditor that checks whether the exchange has the assets claimed by its clients. It involves an algorithmic function known as the Merkle Tree.

How It Works

According to the Kraken blog, "The auditor takes an anonymised snapshot of all balances held and aggregates them into a Merkle tree - a privacy-friendly data structure that encapsulates all client balances.” The final proof of the pudding is the Merkle root, basically, a unique cryptographic fingerprint that identifies the balances when the snapshot was created.

Next, the auditor compares this data with what is provided Kraken to ensure there is a match. The data also includes client liabilities, not just funds held. This is an important distinction as not all exchanges provide this information.

How Do Users Verify on Their Own?

Customers log into their account and navigate to Settings > Account. Then select the Audit tab. Information related to the Audie appears including the date, the name of the audit firm, and the type of audit conducted. There is also an Audit ID used to identify which audit is done. This is because Kraken intends to perform numerous audits throughout the year in the future.

Users can also verify their records with the auditor or do it on their own, but the latter option is usually reserved for those with programming knowledge. You’ll need to know what you’re looking at.

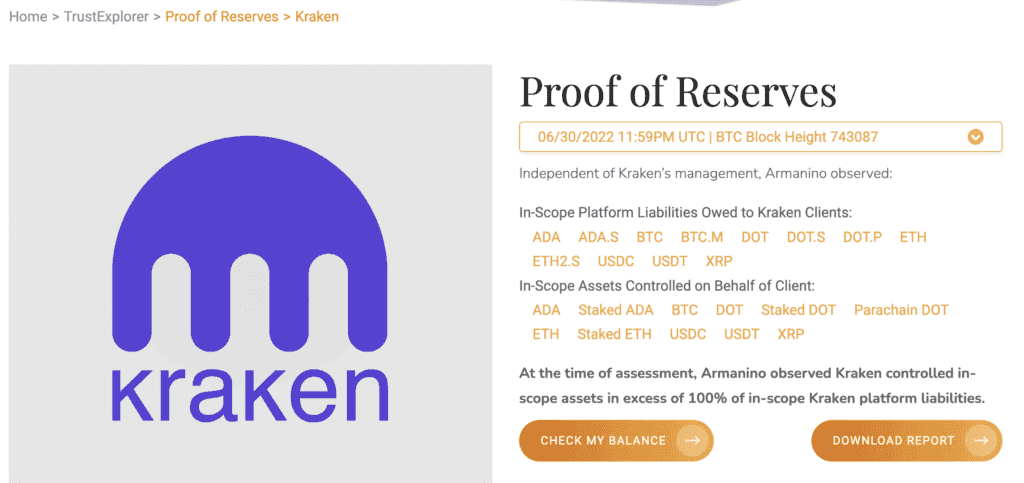

The audit is done by Armanino, a respectable accounting and tax firm with under 5000 employees worldwide, according to Glassdoor. Kraken’s holdings as verified by Armanino are as below:

The full report of what Armanino found is available for public scrutiny.

What to Look Out For

While it’s all well and good that the funds are secure, it’s worth noting that the above screenshot does not cover all the assets currently held in Kraken.

In addition, there’s no way to tell whether funds were moved to pass the audit or removed after the audit has been passed. Unless audits are done in real-time on an up-to-the-minute basis, one can only rely on the integrity of the exchange.

The integrity of the company performing the audit could be called into question. What we, the users, can only do is trust that the auditor is an honest one. This may be assisted by having it belong to other associations or organisations in its field.

As one of the oldest exchanges in the crypto industry, Kraken has seen more than its fair share of disasters in the market. Their integrity in the industry can be further attested by Nic Carter’s webpage on Proof of Reserves as being under the “gold standard” tier. At this point, there’s only so much one can ask for while keeping fingers crossed.

Kraken vs. SEC

In November 2023, the US Securities and Exchange Commission sued Kraken in a sprawling lawsuit that accused the exchange of unlawfully facilitating the buying and selling of crypto assets.

The SEC alleges that Kraken intertwines the traditional services of an exchange, broker, dealer, and clearing agency without having registered any of those functions with the Commission as required by law. Kraken’s alleged failure to register these functions has deprived investors of significant protections, including inspection by the SEC, recordkeeping requirements, and safeguards against conflicts of interest, among others. - SEC

The SEC is arguing that Kraken commingles its customers’ money with its own, including paying operational expenses directly from accounts that hold customer cash. Kraken also allegedly commingles its customers’ crypto assets with its own, creating what its auditor had identified as “a significant risk of loss” to its customers. It's important that in February 2023, Kraken agreed to cease offering or selling securities through crypto asset staking services or staking programs and pay a civil penalty of $30 million to the SEC.

In response, Kraken said it disagrees with the regulator's claims and that it will vigorously defend the lawsuit.

The SEC alleges that Kraken “commingled” its own funds with its clients’. This is a similar allegation already made of other crypto trading platforms. The SEC cannot and does not allege that any customer funds are missing, or any loss has occurred. Nor does it allege that any loss will occur. The complaint itself concedes that this so-called “commingling” is no more than Kraken spending fees it has already earned. - Kraken

Cryptocurrencies Available on Kraken

The Kraken cryptocurrency exchange has a decent number of financial products and cryptocurrencies listed, with over 180 available, which is fewer than many of its competitors. They support the major coins like Bitcoin and Ethereum, along with harder-to-find tokens like Yield Guild Games and Star Atlas.

For stablecoin support, the exchange supports USDT on Ethereum and Tron and supports tokens on Polkadot, Solana, and Cardano, along with many other networks. Ripple is also available on Kraken for those XRP enthusiasts. You can find the full list on the Kraken Supported Assets Page.

Kraken Exchange Platform Design and Usability

Now let’s dive into the important stuff, design and usability for the Kraken platform and Kraken Pro.

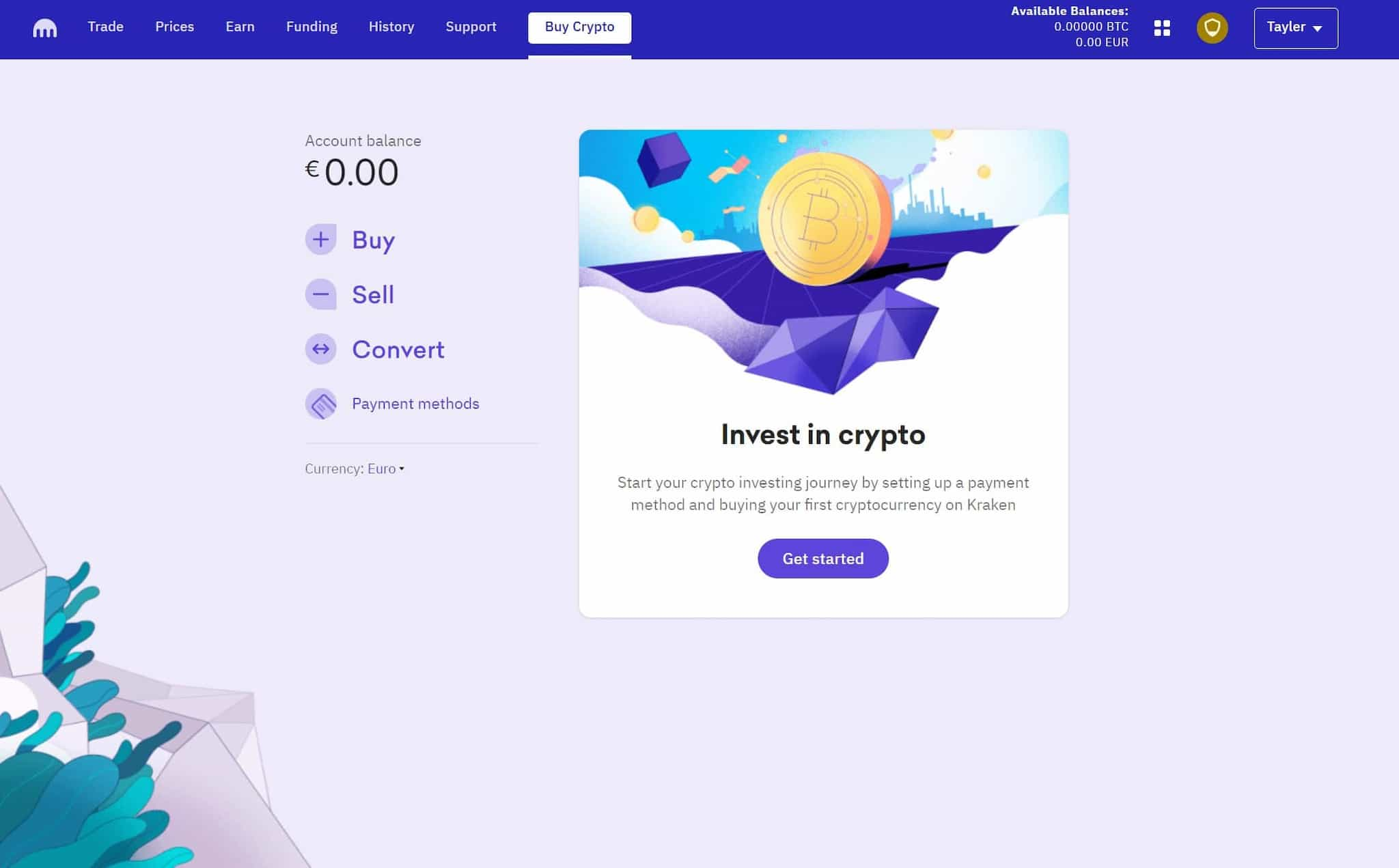

First, the Kraken platform is extremely user-friendly. For anyone who enjoys the simplicity of Coinbase, Kraken is well matched in this regard. Coinbase and Kraken both pride themselves on being the most simplistic, beginner-friendly platforms that are great for first-time crypto users. Here is a look at how clean and straightforward the “buy crypto” section looks, there are no overwhelming frills and features here:

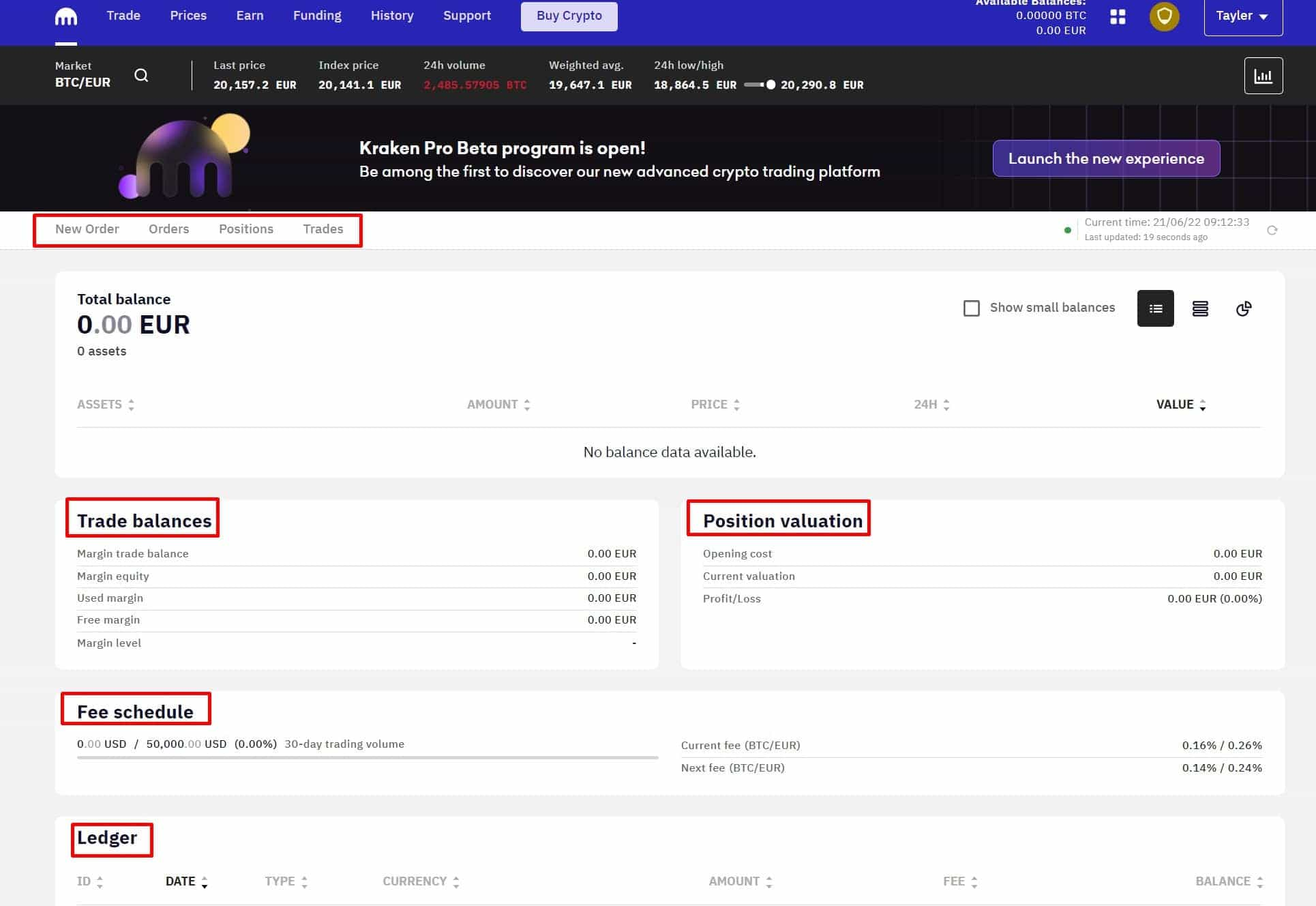

Simple options to buy, sell and convert. It couldn’t be easier. For insight into your account, you have the main screen that shows all your available balances, open positions, and a ledger history of your spending, buys and sells:

Platform usability is where I feel Kraken outshines Coinbase as it is a good mix between the simple yet too-basic functionality of Coinbase and the often considered too-complex and feature-packed exchanges like Binance or Kucoin, which many crypto users find overwhelming.

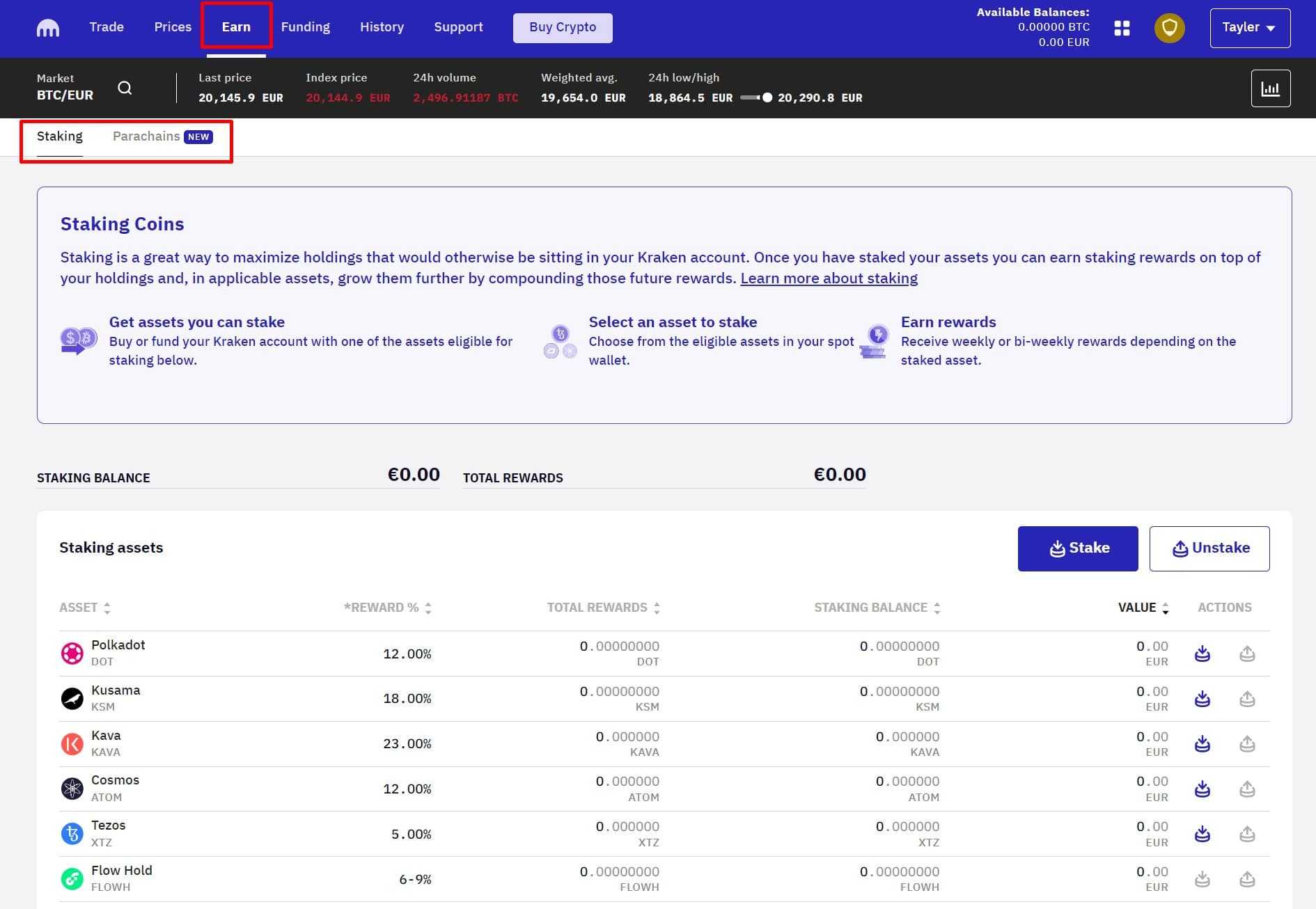

Kraken has a pretty impressive list of coins that can be staked to earn passive income, offering more than the likes of Coinbase yet far less than all the ways users can earn on a platform like Binance. The Earn section is where users can stake and access the Parachain auctions:

The Staking screen is simple. Users can find all 18 assets available and can stake and unstake. I’ll skip the funding and history screens as that provides users with their full crypto trading history and funding situation and history. Instead, let’s take a look at the trading screen.

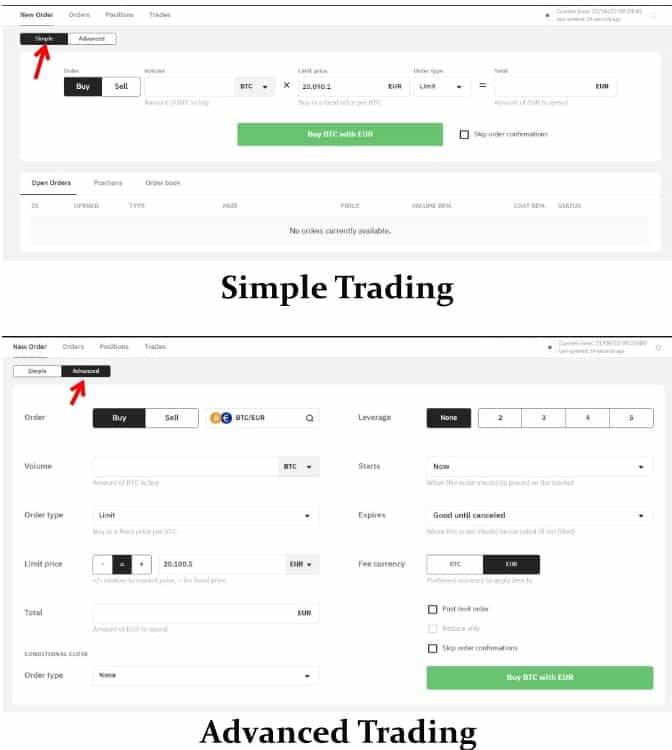

There are two options for trading, simple and advanced:

You will see that the simple option gives users the chance to buy and sell and choose either limit or market order types.

The advanced screen allows for trading between crypto pairs and fiat to crypto pairs. Here users can select the following order types and settings:

- Limit order

- Market Order

- Stop-loss/take-profit

- Stop-loss limit/take-profit limit

- Settle position

Kraken traders can also choose up to 5x leverage on the advanced trading screen and select when to start the trade. Note that there is no charting functionality here. That is the main difference between Kraken and Kraken Pro. Now let’s jump into Kraken Pro.

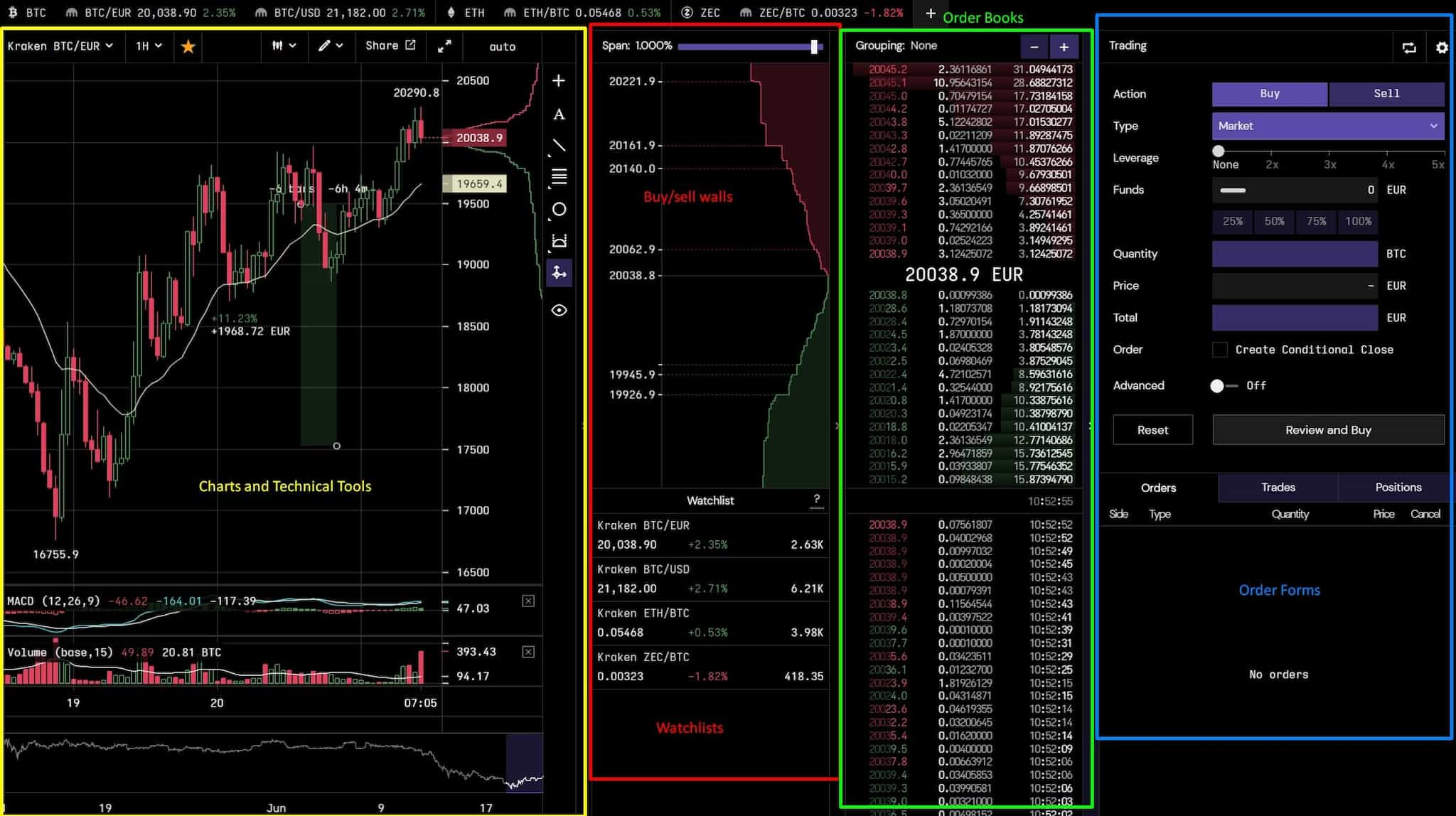

Looking at the Kraken Pro exchange:

We can see significantly more order functionality and tools for active traders. Users have a lot of options here for different charting styles like:

- Time frames - 1 minute to 1 week

- Chart styles - Candlestick, Heikin-Ashi, bar, line, mountain, percentage, logarithmic, depth chart, grid.

- Drawing Tools - Lines, extrapolator, arrows, horizontal, vertical, parallel, Fibonacci Retracement, speed fan and speed arc, and more.

- Indicators - Over 20 different trading indicators are available, including EMAs, MACD, Volume, ATR, Bollinger bands and more.

Top Trader Tip 💯: You can expand the chart to full screen to conduct more analysis. You can also close panels and extend the chart size just like standard windows

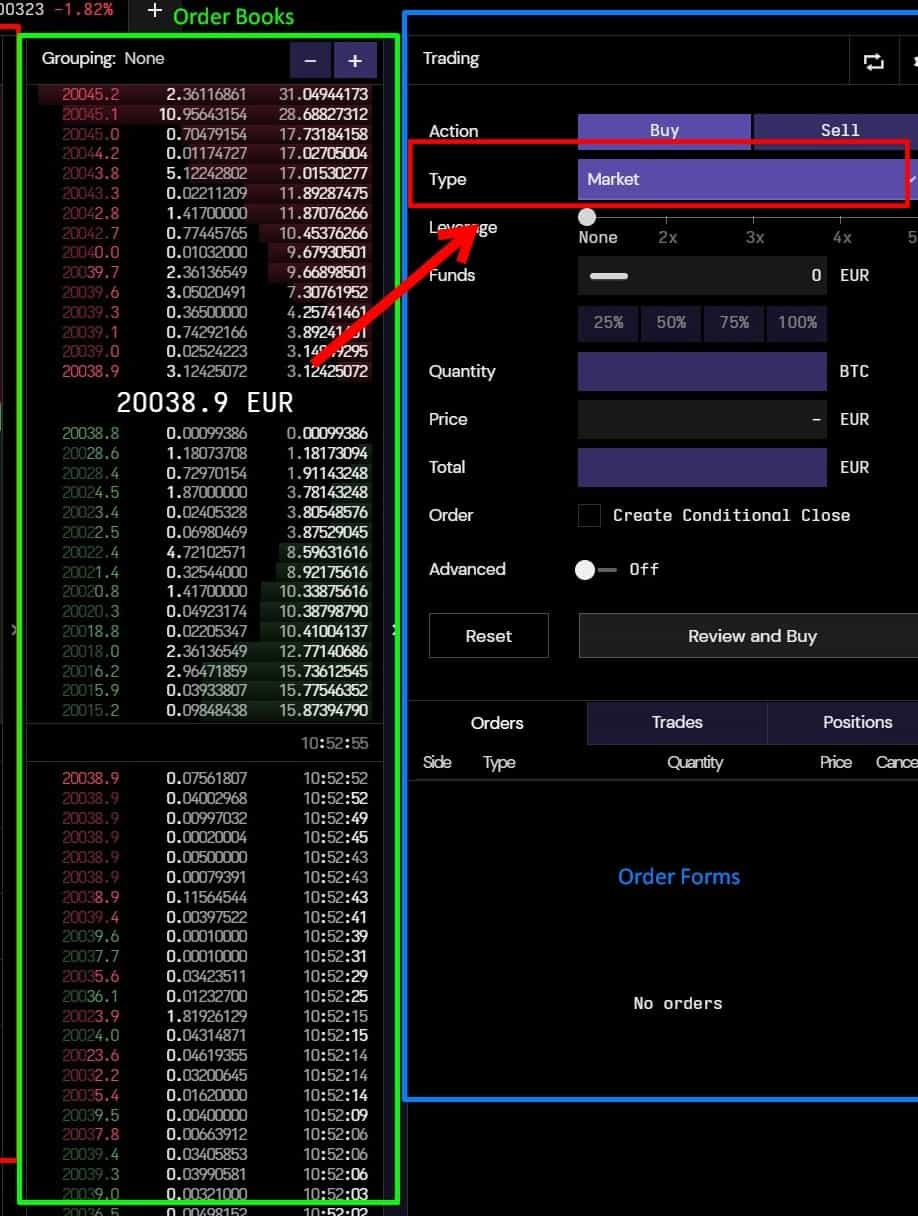

The middle channel is where the watch list is as well as the buy/sell walls showing the trader the current bullish or bearish sentiment. Besides that, you have the exchange order book and previous orders, and the right-hand side of the screen is where traders can place their order types. Let’s look closer at the order types:

It is a good idea to know what all the different order types are and what they mean:

- Market Order: This order is placed at the market level and will be executed immediately.

- Limit Order: This is set at a predetermined price and quantity that could be away from the current market level. It will remain open until either executed or expires. For the expiry options, you have Good-Till-Cancelled, which will remain open until executed or cancelled. You can also choose a daily, weekly, monthly, or custom expiry.

- Stop Loss: Simple limit order that will be executed once reached and limit the loss you have on your account.

- Take Profit: The opposite of a stop loss. This will be executed once your profitable position has reached a specific price limit.

- Settle Position: This is an order that you will use if you want to settle an open margin traded position.

For traders who have specific stop/take profit levels in mind, you can set a conditional close. These orders will open an order for closing a position at the same time as the order for opening it

So, for example, assume you were about to go long BTC at a certain limit level. You would place this order, and at the same time, you could set the stop loss that you would apply to this open order.

Note ✍️: It is not possible to place both a stop loss and a take profit with a conditional close

If Kraken Pro looks like Egyptian hieroglyphics and you want to learn how to trade, check out our article on How to Perform Technical Analysis.

Alternatively, Guy also has a fantastic three-part series on how to perform technical analysis; part one is here:

Ultimately, Kraken strikes a fantastic balance between functionality and ease of use with the Kraken platform while providing a valuable platform for serious traders who need advanced charting capabilities with Kraken Pro.

Deposits and Withdrawals at Kraken

Kraken is pretty good in deposit and withdrawal methods, supporting multiple methods and fiat currencies, along with crypto deposits and withdrawals.

Crypto can be purchased directly with a debit card using the “Buy Crypto Widget,” but as outlined in the fees section, this isn’t the most cost-friendly way to go about that. Instead, your best bet is to deposit funds via bank transfer and swap them for your digital asset of choice.

The following funding currencies and methods are supported (methods vary based on location):

- USD- ACH, FedWire, SWIFT, Signet, Silvergate Exchange Network

- EUR- SEPA, SEPA Instant, SWIFT

- CAD- Wire Transfer, in-person cash or debit, Interac e-Transfer, SWIFT

- AUD- Bank Transfer, Osko, SWIFT

- GBP- FPS/BACS, CHAPS, SWIFT

- CHF- SIC, SWIFT

- JPY- SWIFT, Furikomi/Domestic remittance

And withdrawals look a little something like this:

- USD- ACH, FedWire, SWIFT, Signet, Silvergate Exchange Network

- EUR- SEPA, Instant SEPA, SWIFT

- GBP- FPS, CHAPS, SWIFT

- CAD- EFT, Interac e-Transfer, Wire transfer, SWIFT

- CHF- SIC, SWIFT

- AUD- Bank Transfer, Osko, SWIFT

- JPY- SWIFT, Furikomi/Domestic remittance

Kraken Customer Support

Time to cover the ever-important topic of customer service, which is crucial for you day traders out there. Don’t wait until all hell is breaking loose and you have live money being risked on the line before you realize that your chosen platform has terrible support.

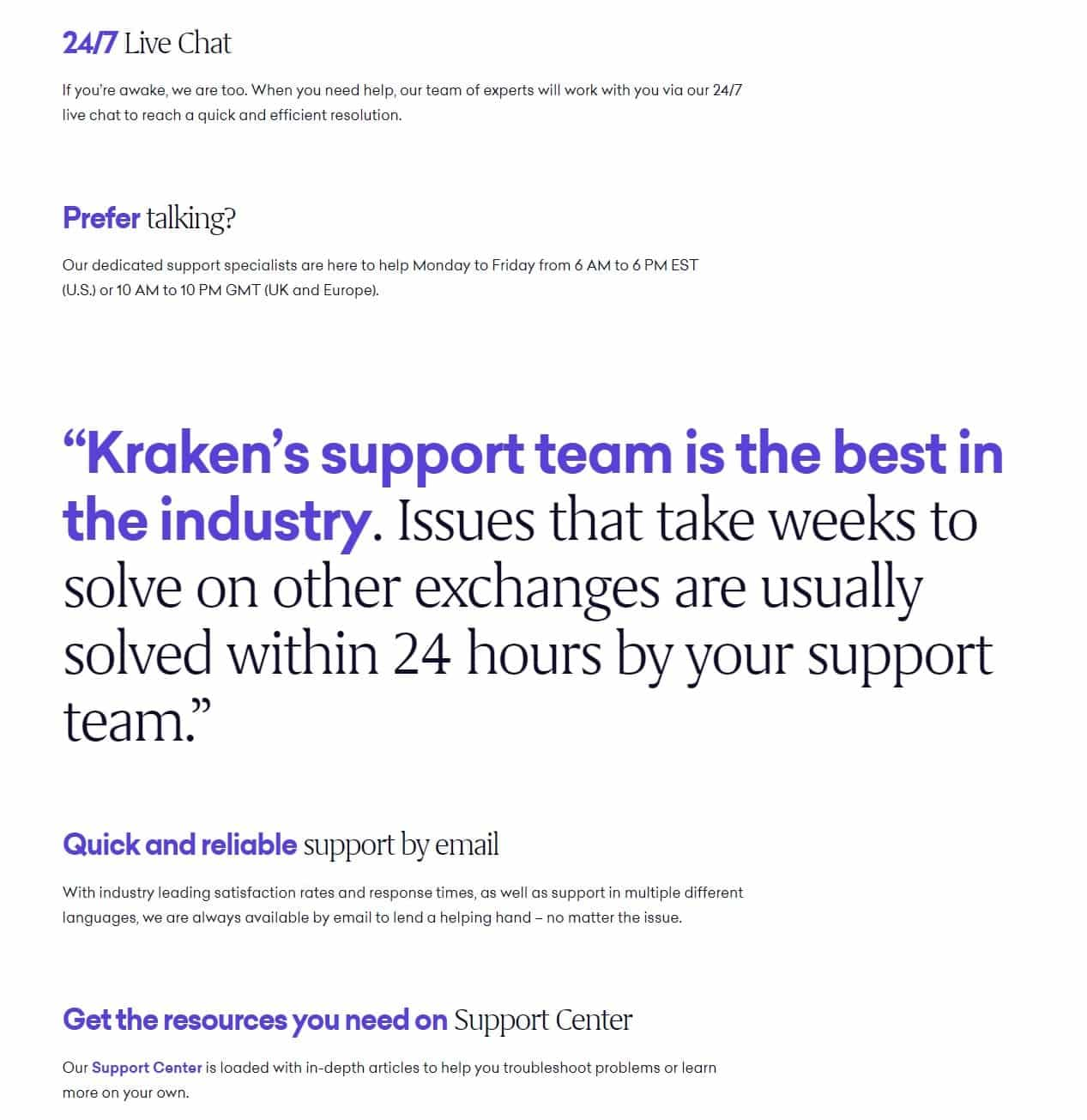

Kraken truly blows the competition out of the water, offering 24/7 customer support. I was honestly amazed at what I found. They’ve got hundreds of trained staff members based in the US, UK, and Europe, ready to answer customer queries and issues. They offer email, in-app chat, and even live phone support. Huge thumbs up to them for phone support and live chat support. Super convenient! 👍

On the Kraken support site, they claim that they have a 90% client satisfaction rating score, which is pretty incredible, but this diligent crypto researcher dug a little further to see if I could substantiate that claim, find some unbiased opinions, and of course, test this out for myself.

I will point out that I could not find how this 90% score was calculated. Come on, Kraken, you've gotta back up claims like that with data. I don't throw down all over town, walking into local bakeries telling them that my grandma makes 100% the best cookies (which she does), and if I did, you bet I'd have heaps of data and studies backing up those claims of cookie goodness.

As I tested out their support, I called them to ask where that score came from and how it was calculated but was told that, unfortunately, it was internal information. But they send out surveys, and the chat support can be rated good or bad, which likely contributes to that score.

I will tell you how I found their support in a moment, but now, back to some unbiased sources.

Right off the bat, we have Trustpilot showing a dismal score of 2.2 out of 10 for 1,700 reviews. Now, I always take Trustpilot reviews with more than a pinch of salt. There is so much fake review writing, bots, and competing firms paying companies to spam negative reviews on the competition, so I am not too concerned about the Trustpilot score. Many negative reviews simply call Kraken a scam, which it clearly isn't after so many years in operation and being heavily regulated.

Falsified reviews are a huge issue online across many platforms. One crypto project that is looking to tackle that issue is Revain. Take a look at our Revain article for more information about that interesting and much-needed crypto project.

There are a lot of negative reviews about Kraken denying users access to funds on Trustpilot and a few scattered around Reddit. Of course, this is a potential cause for concern, and I cannot verify if these are fake reviews or misunderstandings from the user side, but I did want to point that out. Though similar claims exist for every crypto exchange, and 9 out of 10 times, there is a reasonable explanation.

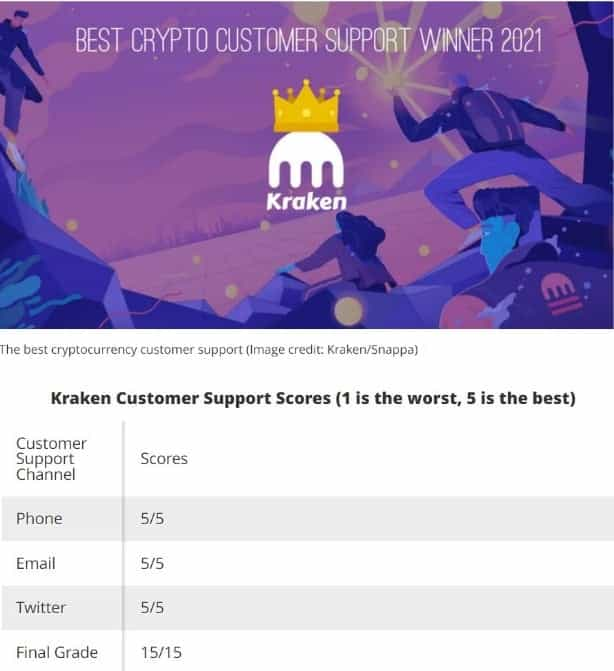

The company LaptopMag.com conducted an independent review of the customer support for many of the major exchanges and gave Kraken the top score, 100% across the board, and named them the "Best Crypto Customer Support Winner" for 2021:

I agree with LaptopMag's findings and would give them a perfect score. I have not dealt with Kraken support much in the past, but for this review, I reached out to them via phone and live chat support and am not exaggerating when I say I was connected to an agent within seconds across both channels. Both agents were friendly and incredibly efficient, straight to the point and helpful.

I thought it may have been a fluke, so I tried the next day, same results again. This was hands down the fastest support I've ever received, not just from a crypto company but from any company. I took a quick look on Reddit (the ultimate source of truth) and found similar sentiment to my own, many Kraken users praising Kraken's "Phenomenal Support", as one user put it.

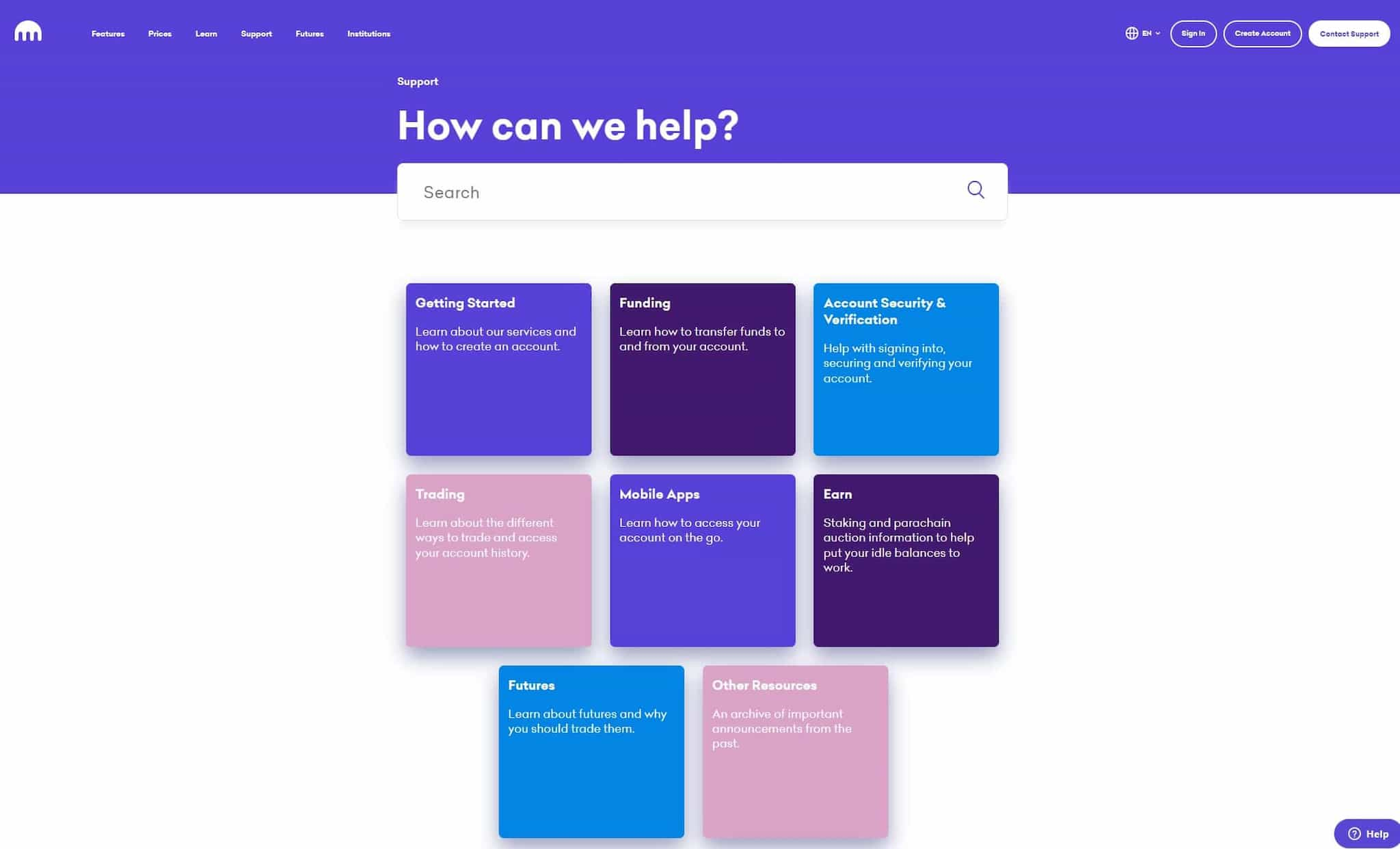

On the topic of customer service and support, a mention of Kraken's fantastic self-help section also deserves a shoutout.

I write a lot of reviews about crypto platforms and spend a worrying amount of time scouring the self-help sections of websites. Kraken's is, by far, the easiest and best I have used in terms of accurate answers and ease of navigation. They have articles for everything; nothing is left unanswered. Most importantly, Kraken's indexing and searching algorithm made every article easy to find based on my search terms.

Top Benefits Reviewed

So, is Kraken legit? Absolutely!

Kraken strongly emphasises two of the most important factors: security and support. From my years of crypto research and using just about every exchange you can name, I can truthfully say that, in my opinion, nobody does these two things better. I also like that Kraken is both incredibly beginner-friendly, while still being able to cater to advanced users.

Kraken is a long-standing, battle-tested, highly respected and solid crypto asset exchange. I wouldn't hesitate to recommend them to anyone.

What Can Be Improved

I like seeing more product and feature support with my crypto platforms of choice. Binance is my go-to, just because I enjoy the insane amount of features they support. Kraken could up its game and offer more products and features.

Though, to play devil's advocate, they use simplicity to their advantage. Many crypto users shy away from exchanges like Binance and KuCoin as there is too much "noise", and I get that point as well, so they may see this lack of feature support as a strength, not a weakness. It would also be nice to see them provide users with a more fee-friendly way to purchase crypto with a card.

Kraken Exchange Review: Conclusion

I was incredibly impressed with everything I uncovered during this review. I have had a Kraken account for a while but have only used it seldomly in the past to pick up some altcoins not supported elsewhere and to have it on standby as a backup exchange, but I foresee myself utilising it more often after my findings.

Kraken's amazing security and support, coupled with beautiful simplicity and ease of use and low fees, make it clear why they are the fourth biggest exchange in the world in trading volume, with millions of happy users worldwide.

As I alluded to in this article, Kraken strikes the perfect balance, or "sweet spot," between ease of use and functionality. Many veteran crypto enthusiasts and active day traders graduate and move on from exchanges like Coinbase due to a lack of features and charting functionality. At the same time, some other exchanges are often criticised for trying to do too much, becoming too complex and overwhelming. Kraken splits this down the middle and offers all the critical functions and valuable features without all the extra “noise.”

After learning everything for this review, I am a bit disappointed that I have been overlooking Kraken for so long and not taking advantage of this world-class exchange. So now, anytime I get asked for my opinion on what I think the best exchange is for someone new to crypto, my answer is going to be Kraken, without a doubt.

👉 Sign-Up for Kraken and take advantage of this top crypto exchange!

Frequently Asked Questions

Absolutely, they are one of the world's oldest and most well-respected and highly regulated crypto exchanges. Users enjoy that Kraken is safe and highly licensed and regulated.

Kraken and Binance fulfil different roles in the industry. Binance is better for users looking to access more earn features, launchpads, use crypto cards, and access an insane amount of features. Binance is like the Swiss army knife of digital assets, where users can do almost everything. Check out our Binance review to learn more about the feature-packed exchange.

Kraken specializes in simplicity, security, and customer support, outshining Binance in these regards.

Kraken and Coinbase are fighting for the same market share and are very similar in their offerings. It is my personal opinion that Kraken is better than Coinbase for the following reasons:

- Lower fees

- Far better customer support

- It has never been hacked

- Offer more features and tradeable markets

- It offers more advanced charting functionality

- Superior educational resources and content

Yes, Kraken is one of the largest US-based exchanges, currently ranked #3 in trading volume for spot trading and #8 for derivatives trading.

Kraken is located in San Francisco, California.

No, Kraken is a centralized exchange, similar to Coinbase and Binance.

Yes, Kraken is a well-established cryptocurrency exchange platform. It has been operating since 2011 and is one of the largest and most reputable exchanges in the world.

Disclaimer: These are the writer’s opinions and should not be considered investment advice. Readers should do their own research.