VeChain is one of the foremost supply chain-focused blockchain projects out there and has recently expanded to fulfil use cases in multiple other sectors. They continue to get quite a bit of attention since their main-net launch in June 2018. VeChain is a very interesting project and has formed some impressive business partnerships, having found a way to set themselves apart and become dominant in their respective niche, so we figured this is well worth a Vechain Review.

The mainnet launch saw them release their native VET tokens, which have seen increasing volume across a number of exchanges. However, VeChain is not alone in its supply chain focus and there are a number of blockchain technology companies and projects that have launched since then.

So, with so much competition, is VeChain still worth considering, and does it have a future? Hopefully, this VeChain review will give you the background information you need to make that decision.

This VeChain review will also analyse the use cases for the VET token and its potential for eventual mass adoption, and discuss how blockchain technology is becoming the next big thing in the supply chain management industry.

VeChain Review Summary:

VeChain is a secure and reliable blockchain technology that specializes in enterprise-grade solutions, while still capable of hosting a DeFi, DApp, and NFT ecosystem. It is highly scalable, secure, and has smart-contract capabilities. Users appreciate the low fees and passive income opportunities.

The Key Features of VeChain are:

- Two token system capable of hosting high-throughput with low fees

- passive earning of VeThor by holding VeChain

- Secure and battle-tested since 2018

- Meta-transaction features- Controllable Transaction Lifecycle, Fee Delegation, Transaction Dependency, Multi-Task Transactions

- Proof of Authority

- Low computational power requirements- Sustainable and eco-friendly blockchain

- Has multiple real-world use cases and utility, already revolutionizing carbon tracking, supply chain, and the medical industry

VeChain Pros and Cons

Alright, now with a bit of the TL; DR out of the way, let's get into our VeChain Review.

What is VeChain?

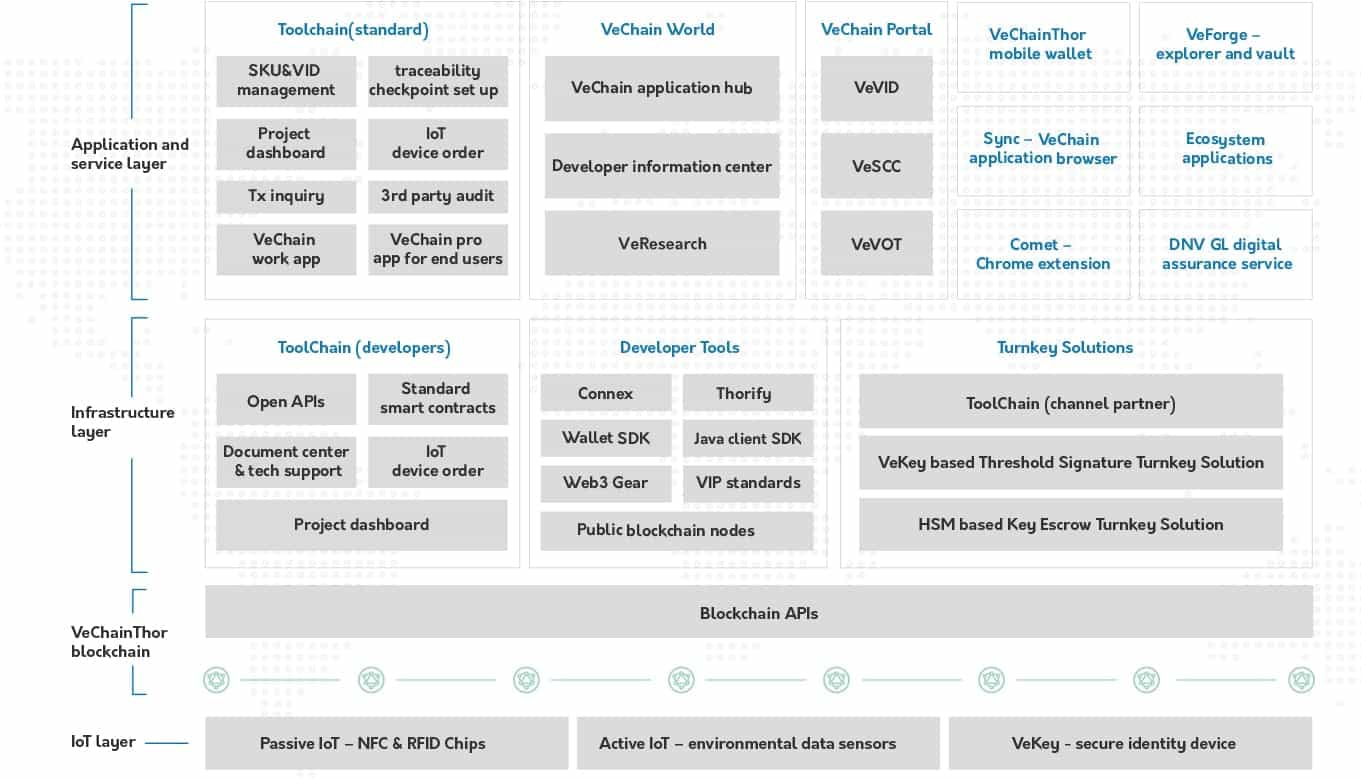

VeChain provides an interesting spin on the multiple uses of blockchain technology. Started in 2015, it is focused on business applications, primarily in the logistics field through supply chain management that provides tracking, quality control, inventory management, and much more.

One of VeChain network's roles is as a Blockchain-as-a-Service platform that facilitates services for enterprise users that utilize smart chips. Acting as a medium for implementing NFC chips, QR codes, and RFID trackers for the Internet of Things on the blockchain, VeChain can be quite specialized.

VeChain started off with a niche focus on providing blockchain supply chain management solutions, but has since expanded its focus to become a full-fledged layer 1 network with smart contract, NFT, and DApp capabilities.

The mainnet for VeChain was launched back in June 2018, and the project has pushed forward strongly since, bringing many partners into the VeChain ecosystem. In fact, hardly a month passes without the project announcing a new partnership or business that’s adopting the VeChain technology.

VeChain has become a part of the Price Waterhouse Cooper incubation program, is working on a proof of concept with BMW and Renault, and has recently partnered with Australian winemaker Penfolds to provide proof of authenticity for their wines being delivered to China.

Additional VeChain partnerships include:

- The UFC

- DNV

- Microsoft

- Volkswagon

- DHL

- Walmart

- Sponsorship with San Marino Football team

- Amazon Web Services

What is VeThor?

Huh? VeThor? I thought we were talking about VeChain?

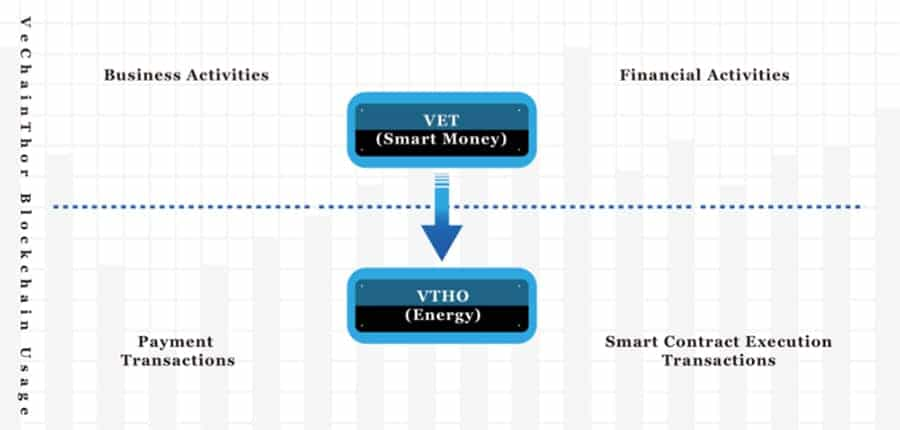

Don't worry, we are, but we can't talk about VeChain without mentioning VeThor (VTHO). You see, some layer-one networks run on a two-token system, such as Theta, Ontology, and others. This is sometimes referred to as a Dual-Token system.

This is in contrast to networks like Ethereum where ETH covers the gas fees.

- To cover the gas fees on Ethereum, you need ETH

- To cover gas fees on Theta, you need Theta Fuel (TFUEL)

- To cover gas fees on Ontology, you need Ontology Gas (GAS)

- And gas fees on VeChain need to be paid in VeThor (VTHO)

- Etc.

The beautiful thing about this system is that you can actually perform "send all" transactions without getting the "not enough gas" error message, as long as you are holding the token that covers the gas/network fees. You can learn more about the nuances in our Guide to Network fees.

Another great thing about VeChain, which is quite revolutionary, is that you can passively earn VTHO simply by holding VET. That's right, as long as you have VET held in a wallet, your VTHO balance will increase over time.

The number of VTHO a user receives depends on the number of VET tokens they hold. Blocks are created every 10 seconds, and with each block, the system creates 0.00000005 VTHO per one VET held by the users. This equates to if a user holds 1 VET, they can earn 0.000432 VTHO per day

How Does The VeThor Token Work?

VeThor Token is the primary method of payment in the VeChain ecosystem and functions as gas for the network. VTHO is required for every transaction, while it is also used for sending data to smart contracts.

To get technical, the VeThor Token is a smart contract layer and a VIP-180 standard token. Through the use of VTHO tokens, the network is able to perform high-performance, complex transactions such as multi-party payments and multi-task transactions.

After VTHO tokens have been used to pay the transaction costs, 70% of the VeThor tokens used are destroyed, with the remaining 30% paid out to the Authority Node. The Authority Node is the body that validates transactions on the network, which is the perfect transition into the next section.

VeChain Review- Proof of Authority 1.0 and 2.0

VeChain's blockchain runs on a Proof of Authority (PoA) consensus model that requires nodes by authorized before they can participate in blockchain consensus. Once a node becomes authorized it joins the pool of other authorized nodes and each has an equal chance of publishing new blocks and receiving rewards. Under this system, the rich nodes have no advantages, and there is no requirement for nodes to compete with one another and use vast amounts of resources.

The PoA system also features efficient bandwidth usage, which leads to higher throughput for the network. This equates to a greater number of transactions per second and increases the scalability of the network.

Although PoA has obvious advantages, and the VeChainThor blockchain continues to operate efficiently and securely, there are remaining limitations to this consensus method. One of these limitations is an inability to prevent a node from manipulating the entire system when it has the right to add a new block.

However, there are ways the blockchain can trace any misbehaviour and use it as evidence against the node later. Additionally, as part of the family of Nakamoto consensus methods, PoA only gives us a probabilistic assurance that transactions are secure. This could leave the network vulnerable to large-scale network partitioning.

Because of these limitations, the VeChain Foundation worked diligently to launch PoA 2.0, which went live in late 2022. This new version of PoA gives the network the stability and security needed to support the growing number of business use cases on-chain. According to the VeChain Whitepaper, the new PoA 2.0 delivers:

- Absolute finality (or safety guarantee) on blocks and transactions;

- significant reduction of the platform's risk of being temporarily disrupted, which will result in better stability of blockchain service;

- faster-converging probabilistic finality, which will result in faster transaction confirmation for applications.

Along with VIP-193, also known as SURFACE, VeChain's blockchain has vastly improved scalability, high throughput, and a TPS of about 100. The improved PoA implementation gave VeChain all the strong points found in PoW blockchains, while also making the blockchain more robust thanks to a Byzantine Fault Tolerance (BFT) mechanism.

What’s more, after VIP-193 came VIP-200. VIP-200 made it possible for the VeChain distributed ledger to reach BFT finality by allowing blocks to carry extra finality related messages.

VeChain Meta-Transaction Features

VeChain’s meta-transaction features are part of the key infrastructure that makes the network ideal for enterprise adoption.

- Multi-party payment: A decentralized application’s freemium model is enabled by flexible transaction fee delegation to onboard users with ease. VeChain’s fee delegation protocol means that enterprises can use smart contracts and have a designated gas account to manage the gas fees necessary to use the network.

- Controllable transaction lifecycle: Using BlockRef and Expiration transaction fields, users can set a time when a transaction is processed or expired.

- Multi-task transaction: Developers can batch payments and include many calls to various contract functions in a single transaction and control the order of the calls using multi-function atomic transactions. This can lead to more efficient transactions and substantially lower fees.

- Transaction dependency: Users can set dependencies to stop transactions from being executed until other transactions have been processed, ensuring that the transactions are executed in the proper order.

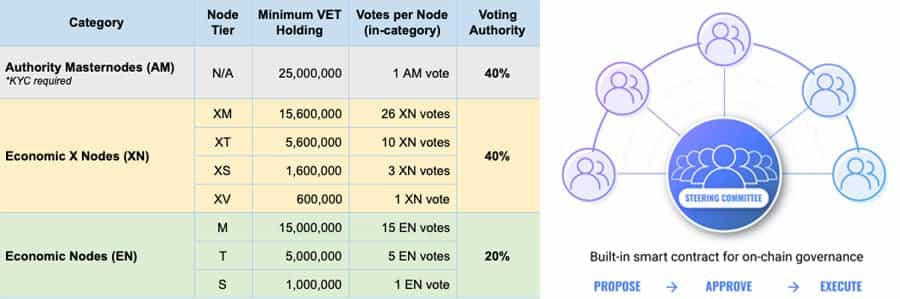

VeChain Governance and VeVote

During all these advancements, VeChain also updated its governance model in order to meet the needs of large enterprises, regulators, and government while maintaining its ability to scale. The system was released in November 11, 2019, and it gave VeChain a flexible governance model that allows for rapid changes when needed.

The revised VeChain Governance Charter includes the following changes to the Articles of Association:

- Specified the scope of fundamental subjects that require all stakeholder voting;

- Redefined the categories of stakeholders with voting authority as Authority Masternode, Economic X Node and Economic Node;

- Adjusted the voting authority model according to the new stakeholder categorization;

- Streamlined the all stakeholder voting procedure.

In addition, VeChain also introduced the VeVote platform as a way to increase governance transparency. VeVote is a decentralized voting platform and was adopted by a Steering Committee vote of 5-2 on December 13, 2019. The approval of the VeVote platform has also opened it up for use in voting by stakeholders.

VeChain describes VeVote as follows:

The VeVote platform provides an immutable, transparent and decentralized platform for stakeholders to cast their votes on important decisions based on their voting authority. The voting is done via VeVote smart contracts and the result will be recorded on the VeChainThor blockchain.

by February 2021, there were three important proposals voted on and passed by the community and 1 proposal voted on and passed by the steering committee. Two of the three stakeholder votes were for contests and the third was to postpone the 2nd VeChain steering committee election to June 30, 2021. The steering committee vote was to update the VeChain Foundation Governance Charter.

The updated charter included the following major changes:

- Specified the scope of fundamental subjects that require all stakeholder voting

- Redefined the categories of stakeholders with voting authority as Authority Masternode, Economic X Node and Economic Node

- Adjusted the voting authority model according to the new stakeholder categorization

- Streamlined the all stakeholder voting procedure

VeChain Use Cases

According to VeChain, Ethereum is unsuited for running large-scale commercial applications, due to the lack of a robust governance framework that allows for quick and transparent protocol changes, and due to unpredictable transaction costs. VeChain hopes to overcome these issues with its Meta-Transaction features, the Proof-of-Authority consensus mechanism, its on-chain governance mechanism, and its unique two-token system.

- NFTs- There is a thriving NFT community on VeChain, with the largest marketplace being VeSea.

- GameFi- Thanks to low transaction fees and high throughput, gaming apps like Plair on the VeChain network work efficiently.

- Micropayments- As VeChain has low fees, making micro-payments and using VET as a payment token is viable, which allows the marketplace DApps to run off VeChain.

- Finance- VET can be used to transfer money or make online payments as transaction speeds are very fast and have quick finality of about 6 minutes.

- Blockchain-as-a-Service Provider- VeChain has established itself as one of the most well-established enterprise-oriented blockchain networks in existence, and claims that its technology can be utilized to solve "real-world economic problems." We have already seen multiple enterprise companies leverage VeChain's technology and the team's expertise to overcome business hurdles.

- Supply Chain Management- VeChain has proven itself to provide efficient solutions for tracking goods and data, substantially increasing the effectiveness of managing supply chains. You can learn more in this article about how Blockchain can Streamline Supply Chain Management.

- Merchandise Authenticity- The Counterfeit industry is massive, with an estimated 600bn per year being sold in knock-off goods. VeChain is providing businesses with solutions that help verify authenticity.

- Phygital-as-a-Service- VeChain is among the top blockchains pioneering the bridging of physical and digital products with World of V, the first NFT marketplace to implement Phygital technology as a service.

Let's explore a couple of these in a little more detail.

Tracking Carbon Emissions

I can't say I am a fan of this one as this sounds like it could lead to a type of social credit score type ESG mandate that Guy covers in his dystopian video about Carbon Credit Scores.

But regardless of how "Big Brother" this may all sound, VeChain is providing solutions to help businesses and customers become aware of their impacts on the environment.

This sustainability tracking service helps brands record their sustainability footprints, covering everything from the usage of recycling to green production processing and packaging to logistics. This can help increase consumer confidence and transparency, doing away with companies simply buying carbon credits to claim they are eco-friendly.

In August 2022, VeChain partnered with Amazon web services to work together on its VeCarbon platform. The platform will help the firm access data about their carbon footprint.

If I were to play the glass is half full type, and hope that this isn't the early stages of a social credit scoring system, this application could have a hugely positive impact by helping entities understand their eco-footprint and learn how to minimize it.

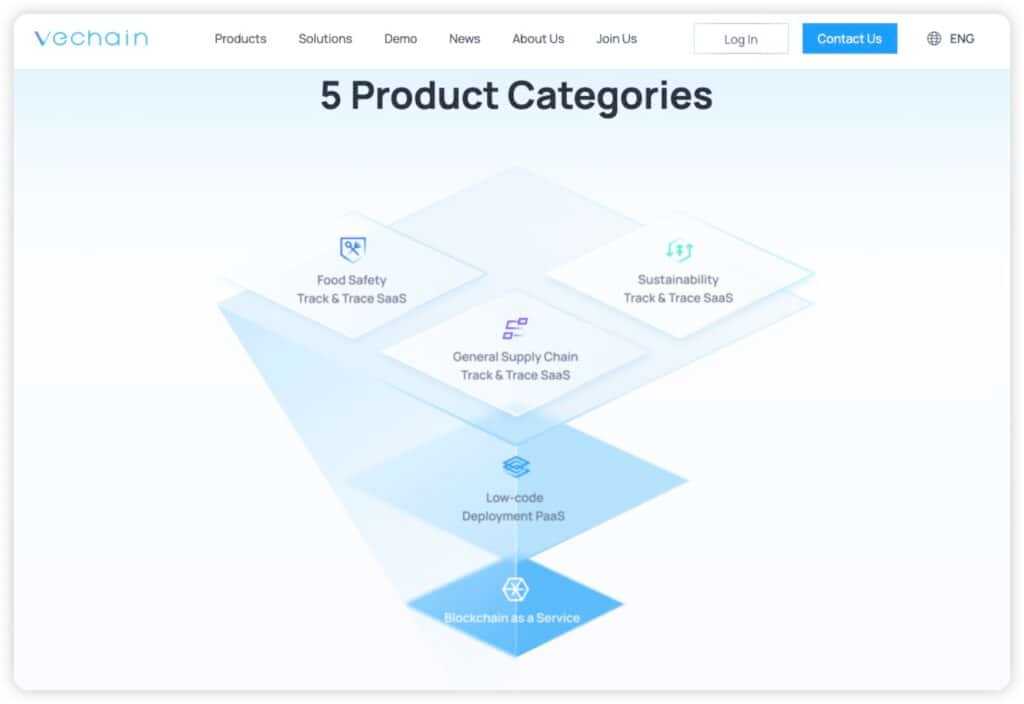

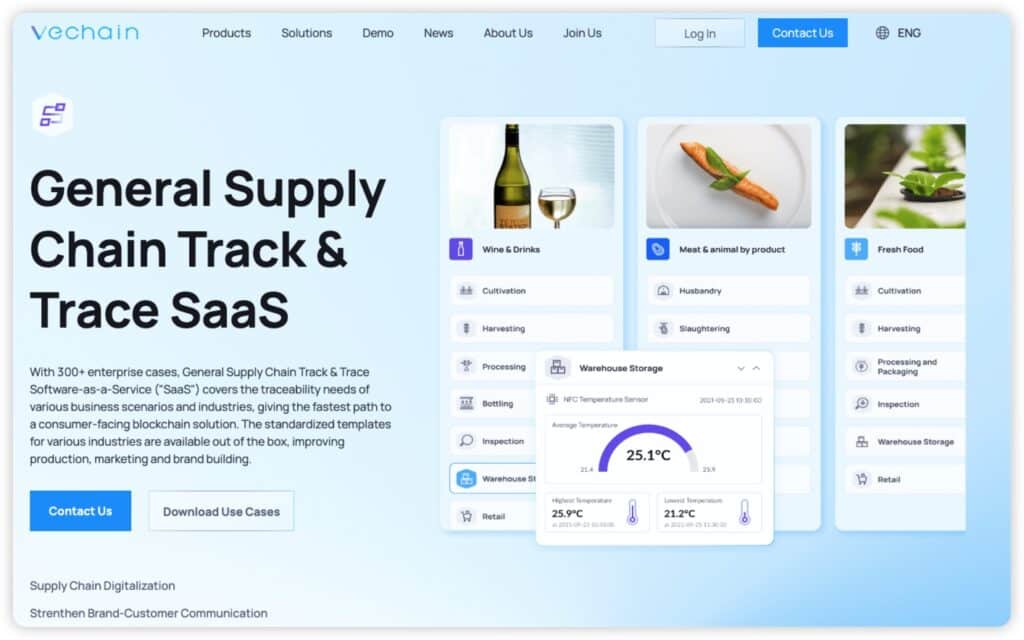

Track and Trace

VeChain provides track-and-trace blockchain solutions for over 300 use cases as part of its Software-as-a-Service (SaaS) offerings. This covers the traceability needs of various businesses, covering everything from food to vaccinations, medicine and products.

This service can provide solutions such as data collection checkpoints, temperature confirmations, warehouse storage conditions, time in transit, etc. This standardized approach to information collection can help shorten project launch time, lower communication costs, and increase transparency and visibility about data surrounding the transit and storage process. Much of this can be accomplished with simple qr code technology.

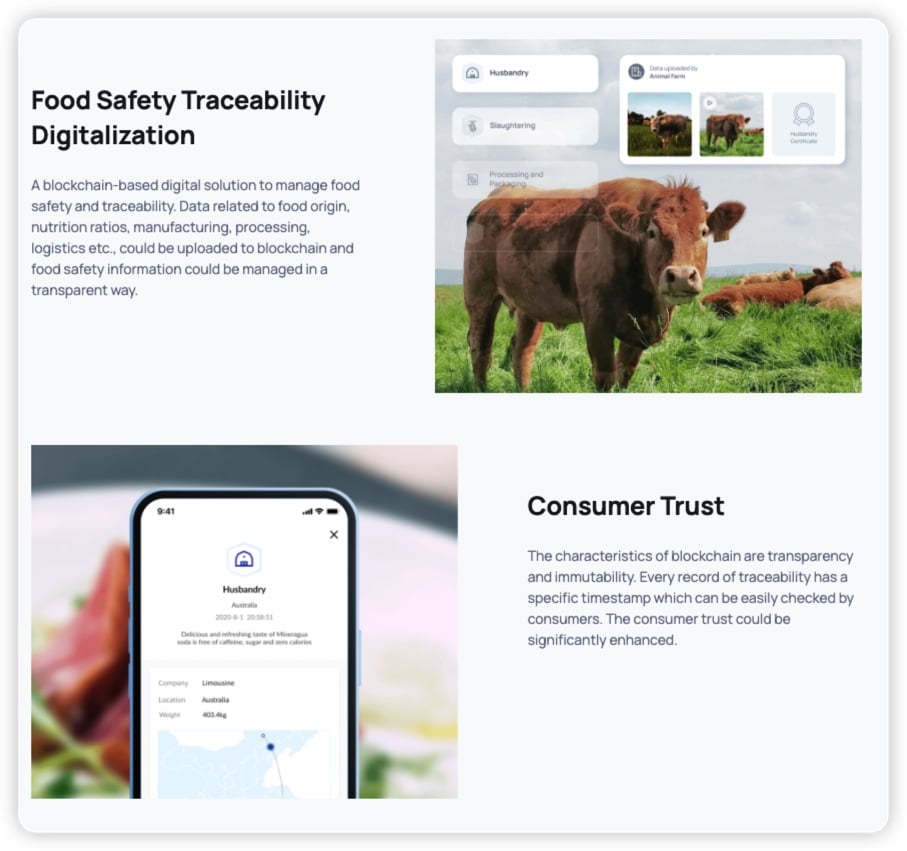

Food Safety

Food traceability is important to be able to identify where outbreaks such as salmonella or ebola may have originated. It is a common occurrence for grocery stores to have to mass-recall produce after traces of diseases, fungi, or viruses are found in food. This can be costly and wasteful, as not being able to identify the source of the contagion can lead to removing the entire supply held by the store.

VeChain's Food Safety Track and Trace service comes readily deployable and includes product provenance and quality certificates. Not only does this help track the journey of the consumables, but allows for consumer interaction in ways that were not before possible, allowing food and beverage companies to communicate and build brand awareness in a trustworthy manner.

Thanks to this solution, consumers don't need to trust, but can verify the claims of their foods such as whether or not it is free-range, grass-fed, transported from a certain location, kept at a certain temperature etc.

Fight Against Counterfeit Products

We know that the counterfeit industry is a multi-billion dollar industry that both hurts brand reputation and reduces profits, but did you also know it can be deadly?

It isn't just Prada and Gucci knock-off bags, but things like counterfeit alcohol and medications are a serious problem and lead to the deaths of thousands of people a year. Thanks to solutions provided by VeChain, simple QR codes can be used as part of the track and trace product where anyone can scan an item and verify its origins, history, and authenticity. By leveraging blockchain technology, all parties involved can be sure of the authenticity of data captured, protecting against falsified data.

As for luxury goods, VeChain is using blockchain to track and verify luxury apparel. Each item can be assigned a unique ID and a set of keys, giving it a digital identity that follows its real-world status from initial production to purchase and onwards.

“In one way, you guarantee security. In another, you make it auditable,” says Sunny Lee, founder of VeChain. “Even if someone steals your key, you can trace it.”

You can learn more here in our article on how VeChain combats counterfeits and fakes.

Health Records

Covid proved to be an interesting time for all of us, but VeChain in particular as the benefits of blockchain tracking became apparent when it came to the shipment of vaccinations. As the vaccines had to be kept at a certain temperature, there was no way to verify this with 100% trust if it wasn't for relying on the immutable data captured by blockchain.

In 2020, VeChain collaborated with I-Dante to co-develop the E-HCert App, which provided an archival solution for Covid test records. This was deployed across airports to streamline the check-in process and certify test results' authenticity.

Later in 2020, VeChain helped pharmaceutical giant Bayer create a traceability platform for clinical trial supply chains, which continuously captures and tracks clinical trial supply chain data. Then there is MyCare, which helps companies build a foundation aligned with national requirements and provides an approach to infection risk management.

VeChain has formed multiple partnerships along these lines, you can read more about them on the vechaininsider.com site.

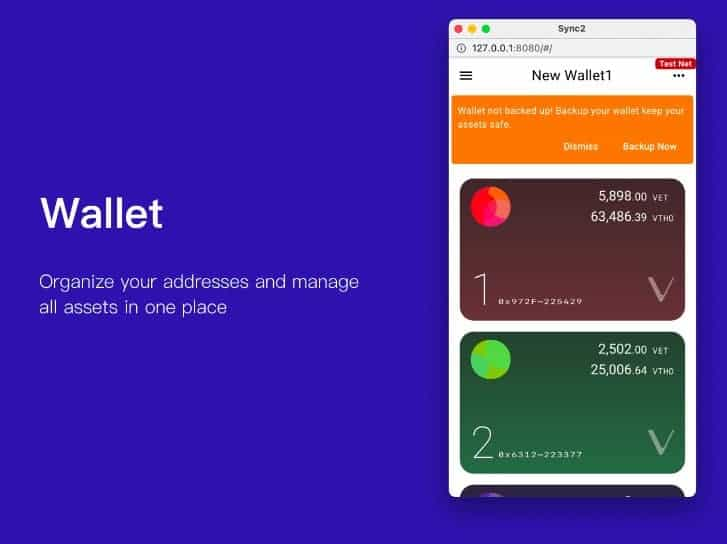

The Sync 2 Wallet

Anyone who's been using the internet knows what a web-based application is, whether the purpose is ecommerce, communications, or simply entertainment. And thanks to the development of the modern web browser these web apps are accessible across all types of hardware devices and operating systems.

While we would like to think that blockchain dApps are just as simple the truth is the emerging technology isn't there yet. Blockchain dApps for users to use specific browsers or wallets to access them, and users may need to switch the wallet or browser being used depending on the hardware or operating system being used. It's really inconsistent and inconvenient for users.

Add to this the need to manage the crypto assets necessary for the dApp and pay gas fees, not to mention the need for a certain degree of technical savvy that's needed when using decentralized platforms. All of this awkwardness, cost, and complexity has kept dApps as they are currently implemented from reaching mainstream adoption.

VeChain aimed to change all this with the introduction of the Sync 2 digital wallet app. The Sync 2 provides the missing pieces of critical infrastructure in enabling the true mass adoption of dApp technology. Think of it like an easier-to-use MetaMask, that is sleeker, more user-friendly, and available on mobile!

Sync 2 frees users from the restrictions of browser type, hardware, and OS and makes using dApps as simple and intuitive as using any web-based app. In combination with VeChain’s native fee delegation protocols, users will no longer need to manage crypto to pay gas fees. Instead, dApp owners or DaaS service providers can fund gas fees on a user’s behalf.

Sync 2 is designed to work with all mainstream web browsers (e.g., Chrome, Safari, MS Edge, Firefox, etc), allowing dApps to be accessed by ever-greater numbers of users

It can be installed as a local app on desktop or mobile device, or used simply as a web application with no installation requirement, providing maximal flexibility and consistent user experience.

Put simply — Sync 2 is the missing jigsaw piece that enables a truly seamless dApp experience, paving the way for the mass adoption of decentralised applications by removing all barriers to entry. A first for the entire blockchain industry. You can learn more about it and other wallets in our Best VeChain Wallets article.

VeChain Partnerships

VeChain recognizes the importance of having an established business and client base, and with that in mind has been very active in creating partnerships. As of 2024, VeChain has over 40 partnerships and is working with enterprises on solutions that could lead to a breakthrough and wider adoption of the blockchain. And they continue adding new partnerships.

Onboarding of new partners and clients is handled quite smoothly by VeChain since they operate on a Blockchain-as-a-Service model, and set up all the infrastructure for clients, including any necessary customization. It’s this model that has allowed VeChain to partner with such a broad and diverse group of industries.

The partnership with PwC has given VeChain access to many companies across China and Southeast Asia and has been valuable in spreading the word about VeChain.

With LVMH, VeChain is developing a system that tracks limited-edition luxury goods. Pirating of these types of products is widespread, as is creating knock-off look-alikes, especially in China and Southeast Asia. With LVHM’s broad offerings of luxury goods, this is a perfect use case for VeChain.

VeChain has also been working with DNV GL to increase the transparency of products from the factory or farm to the consumer. In this partnership, VeChain has developed a blockchain-powered digital assurance solution they’ve called MyStory.

Using the MyStory DApp, consumers are able to learn about the story behind a bottle of wine from the vineyard to the bottler, through distribution, and to their store’s shelves. All this is accomplished by simply scanning a QR code on the wine bottle.

Other valuable partnerships are the ones with the UFC, as this is bringing brand recognition to millions of viewers, the Walmart China partnership, and the partnership with Chinese automaker BYD, where VeChain has been working on a proof of concept for handling carbon emission imbalances. This partnership is working on building a dApp that will track and record the emissions data of millions of cars, buses, trains, and other vehicles onto the public VeChain blockchain.

More recently, Vechain has been active in adding hospitals and tracking infection risk management in connection with the COVID-19 pandemic.

VeChain Partners With the UN

The Vechain Foundation has established a notable partnership with the United Nations to collaborate on blockchain-based sustainability projects, looking to achieve 17 sustainable development goals established by the UN

The sustainable development goals include a range of diversified issues pertaining to green initiatives, preserving the environment and benefitting humanity. Issues such as hunger and poverty, as well as education, health, clean water, clean energy, sanitation, and economic development, are a few topics on the docket.

Not surprisingly, these solid partnerships are helping VeChain grow, although it does remain smaller than major players such as Ethereum and Tezos, who have more highly developed dApp ecosystems, with greater offerings of games and other applications.

The VeChain Team: History of Creation and Teamwork

The primary driving force behind the adoption of VeChain and the VET token is the VeChain Foundation, an organization founded in Singapore which governs and maintains the project, its development, and promotion. The Foundation is governed by the Steering Committee, which is elected every two years and is currently represented by the project founders.

Sunny Lu is the CEO of VeChain and one of the founding members of VeChain. Prior to founding VeChain, he was CIO at Louis Vuitton China. He has over a decade of experience working for Fortune 500 companies in executive IT positions.

Jay (Jie) Zhang was the CFO at VeChain, and is also a co-founder of the project. Due to a hack that occurred in December 2019, which he accepted full responsibility for, he has reportedly stepped down from his role as CFO. Prior to working at VeChain, he was employed at Deloitte and prior to that, he spent more than a dozen years with PwC. He was responsible for the design of the VeChain governance framework.

Kevin Feng is a partner at VeChain and the former COO of the project. He came to VeChain with over 12 years of experience working at PwC. His expertise is in risk assurance and cybersecurity, and he was a driving force behind the development of PwC’s blockchain services. Kevin resigned in late 2020 for “personal reasons”

Antonio Senatore is the CTO of the VeChain Foundation and the General Manager of the Irish branch. He brings with him over 5 years of experience working for Deloitte and previously held the title of Vice President of Researching and Development at Deutsche Bank.CTO of Vechain Foundation and General Manager of Irish Branch

Dublin

VET and VTHO Tokenomics and VeChain Price Analysis

Both VET and VTHO are drastically different in terms of the function they serve, total supply, and inflation.

VeChain is currently ranked #37 on CoinMarketCap, and has a circulating supply of 72,511,146,418 VET, which is 84% of the total supply. The market cap is hovering just above 1.6b and has a healthy trading volume of over 59m.

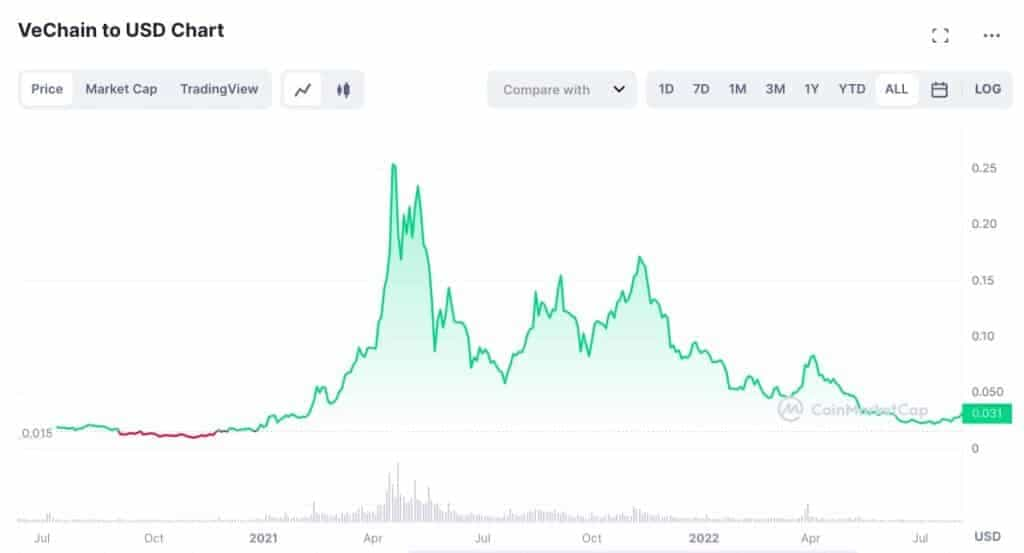

Unfortunately for investors, VeChain's advanced technology stack, partnerships and use cases have not resulted in VeChain price posting the same mind-numbing gains as some of its competitors. Vechain Token (VET) underperformed throughout 2018 and further failed to mount much of a recovery in 2019 and early 2020, dropping again following the March 2020 meltdown in traditional financial markets.

Investor confidence rallied during the 2021 bull run, seeing VET price shoot up over 400% to an all-time high of $0.28. VeChain price is currently down over 90% as it struggles alongside the broader crypto market. The amount of interest experienced by VeChain in 2021, and its exposure to the popular UFC sporting audience, along with the Walmart partnership suggests that the project has a strong foundation in which it could launch from in the next bull run if they continue their successful marketing and B2B efforts.

As mentioned, VeChain had a hard time in terms of price action during its first few years, possibly due to western investors being put off exposure to a Chinese blockchain company, and with Chinese retail investors being unable to invest in crypto. VeChain exploded in adoption during the 2021 bull run, reaching an all-time high of $0.25. The VeChain price is currently down over 90% sitting at $0.02.

Turning our attention to VTHO, another benefit to using a dual token model is that network fees are kept separate from the potential volatility in the price of the VET token, which in turn makes the blockchain more suitable for business and enterprise uses.

VeThor has a huge total supply of over 58 billion, which makes sense when we understand that this token is for fuelling the network, and not so much about speculating on for investors. But, crypto degens will speculate, and VTHO shot up to an all-time high of $0.02 during the 2021 bull run and is down over 98% now to where it sits at $0.001. VTHO is ranked #325 on CoinMarketCap, and 100% of the supply is in circulation.

In the section above, I mentioned how those who hold VET in a wallet will generate VTHO over time. This can be thought of as similar to being able to make transactions for free, (essentially) and could drive demand for VET in the future. If enterprises and retail users keep a high enough VET balance to earn VTHO, they could have all of their fees covered at no cost to them.

Besides generating small amounts of VTHO it is possible to generate much larger amounts by running nodes to help support the network. There are three types of nodes in use, and each requires a substantial amount of VET.

Authority Nodes

These nodes participate directly in consensus and require a minimum of 25 million VET. In addition, the owners of authority nodes must be able to prove they are able to make a significant contribution to the VeChain ecosystem as well as passing stringent KYC measures.

Authority masternodes are awarded 30% of the daily VTHO usage.

Economic Nodes

There are three different types, and while they don’t participate in consensus, they do provide network stability. Economic nodes receive a portion of VTHO generated by a pool of 15 billion VET set aside for this purpose.

The economic nodes also receive VTHO based on their VET stakes. The three types of economic nodes and staking requirements are the Mjolnir Masternode (15 million VET required), the Thunder Masternode (5 million VET required), and the Strength Masternode (1 million VET required).

X-Economic Nodes

These are nodes that supported VeChain in its early stages of development. They receive the VTHO generated by a pool of 5 billion VET set aside for this purpose. It’s no longer possible to create new X Economic nodes.

How to Buy VeChain

As VeChain is a popular project, the VeChain and VeThor crypto tokens are available on most international exchanges. To buy VeChain, I recommend Binance, KuCoin, or Crypto.com.

You can find full reviews, how-to guides, discount codes and sign-up bonuses in our following articles:

- Binance Review- King of Crypto Exchanges

- KuCoin Review- Top Altcoin Exchange

- Crypto.com Review- A Robust All in One Platform

Best Crypto Wallets for Storing VET

Once you have bought your VET tokens you are going to want to take them offline and store them in a crypto wallet. We all know the risks that come from keeping tokens on large centralised exchanges.

The Sync2 and VeChainThor wallet are the two most popular VeChain crypto wallets. The Sync2 is a desktop wallet that can be downloaded directly sync.vecha.in while the VeChainThor wallet is a mobile wallet available on the Google Play and Apple App store. Ledger is also

Given that these are the native VET tokens, you don't have too much choice for storage. We actually have a post on the best VeChain wallets. Perhaps your best bet for storage ought to be a secure hardware wallet.

Traditional Competition

While the threats from blockchain projects are currently minimal, there are players in the traditional technology sector that do pose a real threat already.

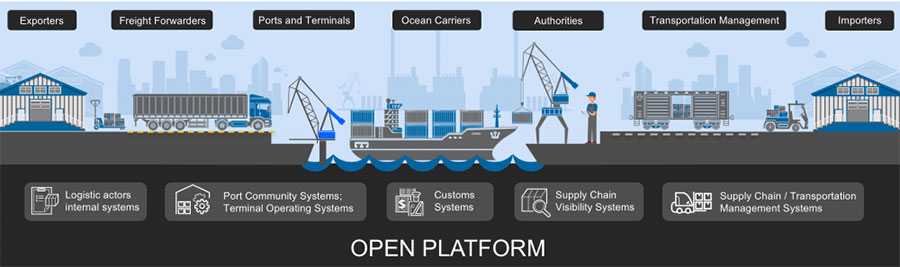

One of these is IBM, who have partnered with the shipping giant Maersk to create a global shipping management blockchain platform. This platform has attracted great interest already and has nearly 100 companies on-board, including ocean transport companies, logistics companies, ports, and others.

IBM has also begun work with Walmart and Unilever to uncover new areas of the supply chain that can benefit from blockchain technology and improve business processes. With its technological dominance and global reach, IBM is a threat that can’t be overlooked.

SAP is also entering the blockchain logistics space and is working with shipping and pharmaceutical companies to create a blockchain-based supply chain tracking system which will greatly improve efficiency and business processes. SAP is another huge global player with massive resources and an extensive customer base to draw upon.

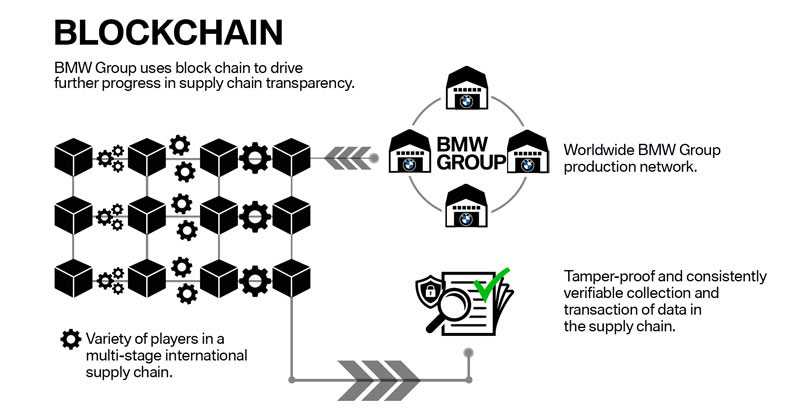

The most recent addition to traditional competition is coming from the world-famous auto manufacturer BMW. It’s interesting to note that BMW was one of the early partners of VeChain.

This will be beneficial in the complex supply chains employed by BMW, where components are sourced from multiple international suppliers. Eventually, BMW hopes to create “an open platform that will allow data within supply chains to be exchanged and shared safely and anonymized across the industry.” In the long term, they hope to bring tracking all the way to the raw materials used to create automotive components, thus greatly improve supply chain management.

With all of that, however, VeChain maintains its lead in the niche for now. There haven’t been any major developments reported from IBM, SAP, or BMW which could shake VeChain's bright future.

While VeChain is targeting several different markets, its core focus remains on the supply chain and logistics industries. It has also been developing its smart contract functionality and has its eyes on delivering Internet of Things solutions.

The focus on the supply chain industry makes sense, as this is a massive, multi-billion industry that can benefit immensely from the addition of blockchain technology.

VeChain has already forged several partnerships with luxury brands to develop blockchain tracking systems that will serve to maintain the authenticity of products, whether that be luxury handbags, premium wines, or the service history of automobiles.

One key to these tracking systems is the VeChain NFC chip. This tiny chip can be embedded in any product, and consumers are then able to scan products with their smartphone to confirm their authenticity. Counterfeiting luxury goods is a huge problem globally, with some estimates claiming global counterfeiting affects some $1.2 trillion in goods annually.

Another area of strength for VeChain has been in the medical space. Its tracking technology is now in use by a number of hospitals and other medical facilities. It is also making inroads into the food industry, as its tracking technology can be used to authenticate the freshness of highly perishable products such as seafood.

Oddly, the biggest threat competitively for VeChain is not other blockchain projects, although there is some competition from that direction, but rather from traditional companies who invest heavily in improving supply chain efficiency.

In the crypto space, VeChain is up against competition from IOTA in the Internet of Things space, and from Waltonchain in supply chain management. But the adoption of these two projects remains low, and until we have a blockchain project that can scale a working case it isn’t likely there will be a leader in the blockchain space.

VeChain Roadmap

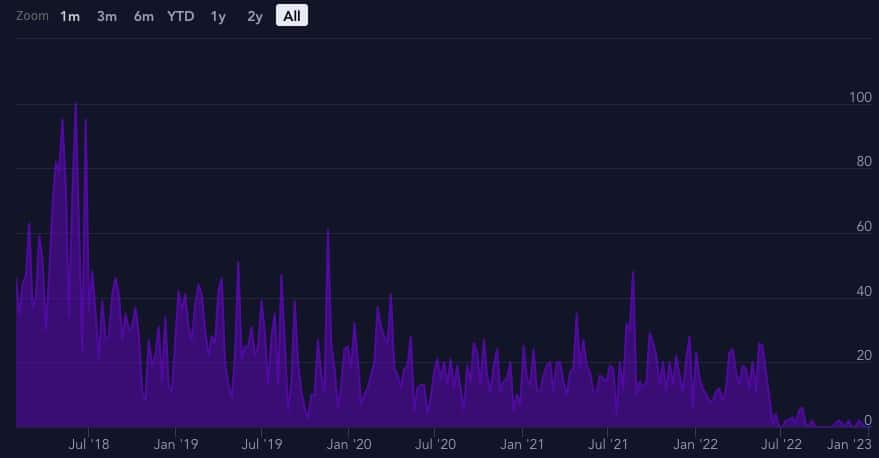

There is no doubt that the VeChain team has been active making partnerships and rolling out updates, but how much of this work is actually reflected in the code?

Given that VeChain is an open-source project it may make sense to go into their public code repositories. This can give you a good idea of just how much work is being done on the protocol.

Hence, I decided to dive into the VeChain GitHub by navigating to stack.money and take a look at the developer activity in their repos. Below is the activity on 56 of their repos since inception.

As you can see, there has been a very healthy, sustained amount of activity until mid-2022 when the crypto market decided to go to sleep, and all hell was breaking out with crypto companies collapsing, DeFi projects going bust, and hacks at all-time highs. A silver lining is that in the past 356 days, there have been 345 commits vs the average of 200, so developer activity is increasing overall as developers invest their time in the project.

Looking forward, there are quite a few things that one can look forward to. In 2023, the VeChain team announced that they plan to spend the first half of the year working on a carbon footprint explorer, a wallet browser extension, and an Ethereum token bridge, along with others. In the back half of the year, the team will turn its attention to implementing a VeChain naming system, launching an asset lending platform, a multichain generic data bridge, as well as develop oracles and smart city ecosystems.

Also listed for 2023 is a sustainability Web3 summit titled The Hive, coming to Las Vegas in March,

The ambitious team isn't stopping there. In 2024, they plan to work on decentralized file storage, layer-2 rollups, smart contract security analysis tools, algorithmic stablecoins, DAO governance wizards along with a DAO operating system and smart contract library.

For example, there are also developers working on cross-chain interoperability of VeChain, while other devs are working on implementing anonymous transactions, utilizing technology already in use by the likes of Monero (XMR).

If you want to keep up to date with the project development then you should keep your eyes on their official blog as well as their Twitter account.

VeChain Review Conclusion

There’s no doubt that VeChain has been one of the most successful blockchain projects in terms of generating partnerships and pioneering niche use cases. With pilot projects ongoing for over 40 companies, VeChain is beginning to see some success. If it can build on those it could see increased adoption.

The project is well-thought-out, with good governance, and a unique economic model that works very well when taking into account the needs of large organizations and enterprise customers. It also hasn’t faced the scalability issues common at many blockchain projects, although that could be due to lack of adoption.

It’s also been able to successfully get past the December 2019 hacking issue, which could have been a major concern for the VeChain community.

With all the successes VeChain has had, there is still the threat of competition faced from large traditional technology companies such as IBM, BMW, and SAP. Investors are understandably worried that VeChain will be buried by these mammoth companies. The VET token has been able to make strong gains during the altcoin rally of 2021, but if VeChain can’t establish a dominant position in the logistics space soon investors could lose their optimism for the project.

Surviving the coming year and "crypto winter" will be vital for VeChain and emerging technologies. If it can remain relevant, increase its domination in the niche, and continue to build on its partnership and high-profile clients it will have the means to attract more high-profile clients, it could be in a strong position to retain its lead.

VeChain Price Prediction

While trying to give an accurate VeChain price prediction, or any crypto price prediction, is often considered a fool's errand as over 95% of price predictions prove to come untrue, there are some key areas we can focus on. The most obvious price target to look at is the previous all-time high of $0.28. There is a very good chance that VeChain's price will surpass this by at least 2x as long as the project can continue their marketing and solid partnership campaigns, increasing awareness, adoption, and utility of the VeChain ecosystem.

Frequently Asked Questions

Yes, VeChain does have a growing NFT ecosystem. For creating and trading VeChain NFTs (VIP-181 tokens), users can check out VeSea, which is the #1 NFT marketplace on VeChain.

The Sync2 and VeChainThor wallet are the two most popular VeChain crypto wallets. The Sync2 is a desktop wallet that can be downloaded directly from VeChain.org while the VeChainThor wallet is a mobile wallet available on the Google Play and Apple App store.

Security-minded hodlers will also be happy to know that VeChain is supported on Ledger hardware wallets.

VeChain crypto is considered a good investment by users who are bullish about the project and believe that VeChain is a leader in Blockchain-as-a-Service providers and has solidified its usefulness in the key areas in which it focuses: improve supply chain management, carbon management, food safety tracking, and others. VeChain bulls are likely to invest in VET, while traders and speculators may look to invest in the VTHO token.

I feel VeChain's strength from an investment perspective is also a weakness. VeChain is unlikely able to compete with the likes of Ethereum, but thanks to its advanced technological approach, it may not need to. VeChain has carved a separate, unique niche and has already made further strides in this area than most other layer one networks.

Then there is another element that could be seen as a strength and weakness, and that comes from the split between the east and west. VeChain's origins stem from close ties to China, which could result in the project seeing success in the Asian markets but could alternatively lead to getting the cold shoulder in the west. There is some speculation as to this possibly being why VeChain has not been listed in Coinbase.

The final risk VeChain faces is in the harsh competition coming from the traditional, non-blockchain space. All of these are factors to consider before deciding whether or not you should buy VeChain. Before investing money, always invest your time and do your own research.

Disclaimer: These are the writer’s opinions and should not be considered investment advice. Readers should do their own research.