WCX Review: Complete Exchange Overview

Editorial Update: WCX is no longer in operation as a cryptocurrency exchange. If you are looking for a place to trade crypto, I recommend checking out our article on the Top Crypto Exchanges.

WCX is a new crypto trading platform that launched their services in 2017 and have been growing their user base.

They are offering a leveraged trading service that offers over 150 assets to trade and which only accepts funding in Bitcoin. The platform has also attracted quite a bit of press on account of their crowd sale last year.

However, can such a new exchange really be trusted?

In this WCX review we will take a deep dive on the exchange and look at their security, leverage and reputation. We will also give you some top tips when trading with them.

Overview

WCX is based in Switzerland and was founded by two ex Apple engineers. These include Amatsu Soyoobu and Tagawa Hayashida. They wanted to create a brokerage that would circumvent the challenges of using traditional fiat for funding accounts.

Since the launch of the exchange, they have been growing their user base and volume numbers. For example, they have stated that the exchange has seen growth to over 125k traders from over 189 countries.

WCX is a crypto margin trading exchange means that you are trading their range of assets with leverage. Your gains and losses on the exchange are magnified by a certain factor. This makes WCX akin to a futures exchange like BitMEX or a CFD broker like IQ Option.

The exchange is not regulated as of yet and as such, there are a number of countries that they are not able to offer their services. These include the likes of the USA, Cuba, Iran and Syria. And, while the exchange is able to offer their services to European clients, the leverage they are allowed is limited to a maximum of 30:1 as per ESMA guidelines.

Although WCX only takes funding in Bitcoin, they have an extensive range of assets that you can trade on the exchange. These include numerous crypto pairs, forex, equities and commodities.

WCX Leverage

When you trade on the margin, you are essentially trading with borrowed money. You are laying down a certain percentage for "margin" and the exchange itself is covering the rest of the position.

Therefore, your effective position is only the amount that you have put down for the margin. In this case, your position is magnified by a certain factor over your initial investment. This factor is called the "leverage".

For example, if you are required to put down a margin of 5% it means that 95% of the position is borrowed money and you are leveraged 20:1. If you are required to put down a margin of 1% then your leverage is 100:1.

This magnifies the gains on your account in a profitable position. Of course, it also enhances the losses so it is sometimes seen as a potent double-edged sword. If you are trading with high leverage levels then you should practice appropriate risk management.

In terms of the leverage levels on WCX, they range from 15x all the way up to 300x. The lower leverage limits are reserved for their cryptocurrency pairs as these are more volatile. This places them in line with other exchanges and brokers.

However, with 300:1 leverage on their forex pairs, they are better positioned than the likes of other CFD brokers such as Plus500. Of course this leverage level will be dependent on where you are located.

WCX will handle losing positions by an automatic liquidation. If your position has lost 80% of the equity value then they will close out the trade. Settlement of all of their contracts occurs at 12 UTC every day.

They also operate an insurance fund on the exchange that will try and meet any shortfalls that occur in the event that there are more winning traders than losing traders. This insurance fund is built up and maintained by WCX.

WCX Fees

Fees are usually one of the most important points for any trader. With many brokers there are hidden fees and sometimes even a small fee can eat into the profitability of the trader over a long-term horizon.

What is interesting about WCX is their unique fee model. Unlike the other CFD brokers and exchanges they do not charge a trading fee for entering / exiting a position. They only charge a "decay" fee which you can think of as the overnight or financing fee that is applied by other brokers to roll over positions.

This is essentially a percentage fees that will be charged to your account for the funds that you have borrowed to keep the position open. At WCX, this will be charged on all positions that are open for more than 24 hours. Below are some stats on the max trade sizes, leverage and decay on the main crypto pairs.

| Pair | Max Size | Max Leverage | Decay |

| ADA/USD | 5 BTC | 5x | -0.3% |

| BTC/USD | 20 BTC | 20x | -0.05% |

| EOS/USD | 5 BTC | 10x | -0.3% |

| ETC/USD | 5 BTC | 10x | -0.3% |

| ETH/USD | 10 BTC | 10x | -0.05% |

| LTC/USD | 10 BTC | 10x | -0.05% |

| NEO/USD | 5 BTC | 5x | -0.4% |

| TRX/USD | 5 BTC | 5x | -0.4% |

| XRP/USD | 5 BTC | 5x | -0.5% |

These are only a small subset of all of the assets so you can see the decay for the other assets in the markets overview page. However, the decay rates for other assets such as forex is much less costly and comes in at around -0.024%.

One of the benefits of being a completely Bitcoin funded exchange is that there are no fees for payments and withdrawals. Everything is processed on the blockchain with full transparency. If you are withdrawing Bitcoin you may have to pay a miner fee but these are not related to WCX and are relatively minimal.

WCX Security

Exchange security is one of the most important considerations in today's day and age. Cryptocurrency hacks are one of the biggest threats that are faced by exchanges and there have been numerous examples of this over the past few years.

WCX has carefully outlined their security protocols in their docs. These seem to cover most things from both an exchange server side and client side perspective.

Exchange Security

Firstly, and perhaps most importantly, WCX operates a cold storage policy. Over 98% of their coins are stored offline in a secure environment away from the threat of hackers and other threats.

There is only a small portion of their funds that are kept online in the "hot wallets" in order to facilitate their payments and withdrawals. Even then, they will operate a multi-signature transfer of these funds in the hot wallet.

In terms of the server architecture on the exchange, they have numerous sub networks and availability zones that will try and protect traffic with strict routing, firewalling and access control to limit exposure.

They also have advanced DDoS protection to guard against denial of service attacks. Finally, they back up and encrypt all of the data on the site which means that your important documents and passwords can not be read even if they are accessed.

Communication Security

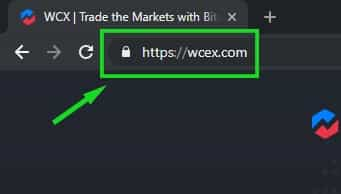

As with most sites these days, WCX has a full SSL encryption on their website which means that your communication with the exchange is secured and not susceptible to online snoops.

The certificate also helps you to identify whether you have accidentally landed on a phishing site of a hacker. This is because the moment that you land on a page that does not have the padlock in the browser, then the site may not be that of WCX.

Client Security

Even if there is a situation in which you do land on a phishing site and your password is compromised, WCX has a range of client side or user security protocols that will help protect secure your account.

The most important of these is 2 factor authentication. This will operate as a backstop for logging in and sending funds out of your account. The hacker will have to have access to your phone in order to really get into your account. This is not activated by default so you will want to do this the moment that you log in.

Secondly, in order to prevent a hacker from breaking into your account by constantly guessing your password, WCX has a protections as well. These are called "brute force" attacks and the exchange requires captchas to be completed in order to ward of these automated attacks.

Signup & Registration

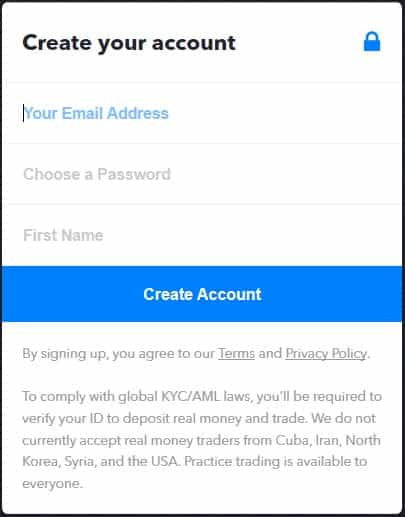

If you have decided that you would like to give WCX a try then you will need to register an account. In order to do so, they require you to provide your email address, password and a name.

After completing the form you will need to verify your email address. They will send a verification link to your email which you should follow. Once you log back into your account you will be given a choice of either running it as a demo account or to complete the KYC for a live account.

Demo Account

If you would like to just try out the platform and see how it works for you then you can start with the demo account. With this, WCX will give you 10 BTC of demo funds which you can trade with full functionality on the account.

This demo account also comes with no strings attached and you can practice on it to your heart's content. Demo accounts are offered by a number of other CFD brokers and they are a non-threatening way for you to practice without risking your actual funds.

Live Account & KYC

If you have been trading for a while on a demo account and are ready to progress onto the live account then you will need to fully verify your account. Unlike some other leveraged crypto exchanges, WCX requires full KYC in order to be in line with the regulations.

To complete this KYC they will ask you some information about yourself such as your address, DOB and full name. Once this is complete they will need to you send in some government issued photo ID as well as a proof of address (not older than 3 months).

The final thing that you will need to do is to take a selfie of yourself holding the ID as well as a piece of paper with the WCX domain written on it. This is done tp make sure that it is indeed you who is attempting to register the account and not an identity thief.

Deposits and Withdrawals

If you are going to be trading on the live account then you will need to fund it. As mentioned, WCX is a Bitcoin only exchange which means that there is no fiat funding functionality (credit cards, wire etc)

While this may limit some traders who prefer to use these funding means, it does make the process more transparent, faster and cheaper. Moreover, given how easy it is to buy Bitcoin with fiat currency these days, it should not really be an issue.

In order to fund your account you can merely hit the "deposit" button on the platform. They will present you with an exchange generated wallet that will have a Bitcoin address. You can then send your funds over to this address and once the transaction has received 2 confirmations then it will be credited to your account.

The withdrawal process is just as easy. You will head on to the "withdrawal" button in the account management option and it will ask for your personal Bitcoin address. In order to confirm the withdrawal a link will be sent to your email and you will be asked to confirm through two factor authentication (if enabled).

WCX Trading Platform

Once you have an account and you start trading, you will be spending over 90% of your time on their trading platform. So, let's take an in-depth look into their trading technology and platform functionality.

When you open up the platform you will be presented directly with the main user interface. You have all the markets that you can trade on the top and the main charts in the middle. To the right in the sidebar you have the order forms.

In the top right you have access to all of your account administration and in the bottom, you can toggle between your previous orders, open orders and your funding / trading history. You also have a quick funding and withdrawal button where the order form is.

In terms of the charting itself, WCX has integrated Tradingview charts into their platform. This is well known charting technology that is used by technical analysts to complete most of their charting.

Tradingview technology is also widely in use on a number of different exchanges. This means that once you have learned to use the charts and supplement your trading with them, you have flexibility when it comes to your choice of exchange.

Placing Orders

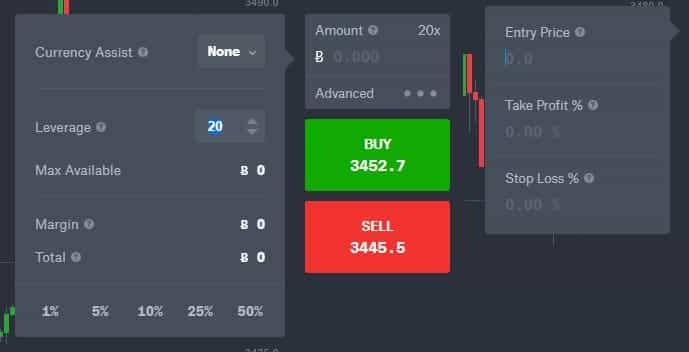

Taking a look at the order forms, it is well positioned for quick and easy trades. If you are looking for a quick market order at the current price then you merely have to enter the amount that you would like to trade as well as the leverage.

You can also change the currency if you prefer to calculate your positions in fiat instead of in BTC. The order breakdown will appear below that as well as the amount of margin that will be required in order to open the position.

There is also an "advanced" order form but the only other orders that you can place are a limit order with a defined stop loss and take profit. We encourage traders to make use of these stop losses especially when you are trading with leverage.

This falls short of a number of other exchanges and brokers that have an extensive range of order options. These can be essential tools especially for those traders that need more options with their limit and stop orders.

WCX API

If you are a developer and you would like to code your own bots or trading algorithms then you can make use of the WCX API. WCX has both a websocket as well as a REST API that is available to all traders.

It is important to note that WCX has rate limits on their API. This is done in order to prevent abuse by some traders who send too many requests to WCX. Currently, this limit is 5 requests per second per IP address.

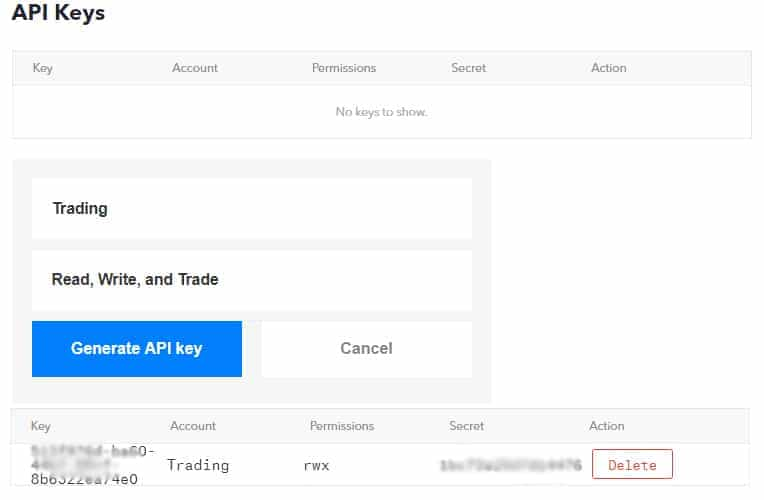

If you want to start using the API then you will have to get your API key. This will allow the WCX API to identify your requests and hence respond to them with the required information. You can get your API key in your account management settings.

Here you have the option to generate the key and you can decide whether you would like the key to be Read, Write or Trade. The latter option allows the most functionality with all the permissions and will let your bot place trades.

Once that is done, it will generate the key and present it below. Keep these passwords and keys safe and away from prying eyes. You should also be very careful with these keys when it comes to third party bots as these may be malicious. Make sure that you can vet the Bots code.

Lastly, if you wanted to make sure that the API was fully up and responding then you could head on over to their status page. This will show you the average response times to API requests.

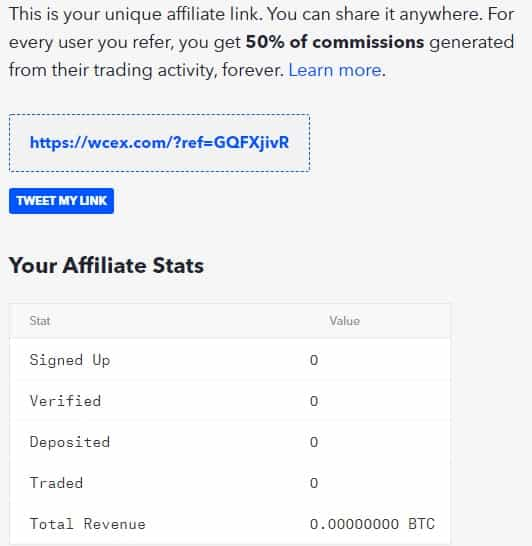

WCX Referral Program

If you have been satisfied with the experience at WCX then the exchange offers you the chance to refer others. This is through their referral program and it could also be a great way for you to earn some referral income.

In fact, the commissions at WCX are indeed quite attractive when compared to some of the other exchanges. They offer up to 50% revenue share on the fees that the exchange makes. If we were to compare that to the likes of Binance which offers 40% or BitMEX which offers 10%.

There is also a benefit for those people that you refer to the platform. They will be given a rebate on their losses of 10% for the first three months. This is more attractive than the simple "fee discount" that has been offered by other exchanges.

If you want to start referring people to the platform then you will have to get your referral link. This is is located within the referral section of the account.

Once you have your link you can start promoting it or sending it to your friends. You can also come back to the referral panel to track the signups that you have captured and how much they have earned you.

What We Didn't Like

Of course, no review would be complete without a look into some things that we thought warranted improvement. These may be things that WCX is due to work on but they bear mentioning.

Firstly, they should try and improve the order functionality on their trading platform. Although they have the tradingview charts, you cannot make the most of your analysis if you do not have a range of order and trading options.

Secondly, WCX has not offered any mobile Apps or PC clients for their traders to download. This means that you will have to stick to the web-based platform which is sometimes not as efficient as a desktop version. Similarly, it is quite difficult to trade on a mobile phone through the browser.

Lastly, this is a full KYC exchange. This means that you cannot trade with an anonymous account and you have to send over all your documents. While this does appear to be the norm now, there are still a number of exchanges that do not require this such as BitMEX and Deribit.

This is of course a personal preference and some traders don't mind the KYC checks whereas others may find it an invasion of privacy. They are after all only dealing in Bitcoin where privacy is one of its main use cases.

Conclusion

WCX seems to be a relatively attractive exchange that will offer traders the benefits of high leverage on a number of different assets. Given that they only accept funding in Bitcoin, they have made it easier for people to send money into their accounts.

Moreover, their lack of any trading fees is a great selling point that is likely to attract many traders who see their margins being eaten by excessive fees. They are also one of the few exchanges and brokers that allow traders to enter positions of up to 300x on Forex.

There were of course some things that we did not like but most of these may be as a result of the exchange still being in its initial stages. Perhaps they take these perspectives into account as they roll out new functionality.

So, if you are looking for a relatively user-friendly platform that allows you to trade a range of different markets with leverage then WCX should be considered.

Disclaimer: These are the writer’s opinions and should not be considered investment advice. Readers should do their own research.

Disclaimer: These are the writer’s opinions and should not be considered investment advice. Readers should do their own research.