The investment environment has widened beyond its traditional boundaries since cryptocurrencies arrived on the scene, and threatened the dominance of the S&P 500, which, as the name suggests, represents 500 of the largest publicly traded companies in the U.S.

Cryptocurrencies, which emerged from the ashes of the 2008 financial crisis, have attracted interest from both risk-tolerant mom-and-pop investors, and mainstream financial institutions, who have had a change of heart since Bitcoin’s nascent days. While crypto represents a departure from conventional financial practices, the S&P 500 provides stability and is a testament to the traditional markets’ lasting strength.

Disclaimer: I hold BTC and ETH.

In this Crypto vs. S&P 500 Analysis, we are going to compare, contrast, and explore each market in terms of ROI, but first, a bit of background.

What is the S&P 500?

The S&P 500, one of the most widely followed equity indices, tracks the performance of 500 of the largest companies listed in the U.S. and covers approximately 80% of available market capitalization. An estimated $15.6 trillion is indexed or benchmarked to the index.

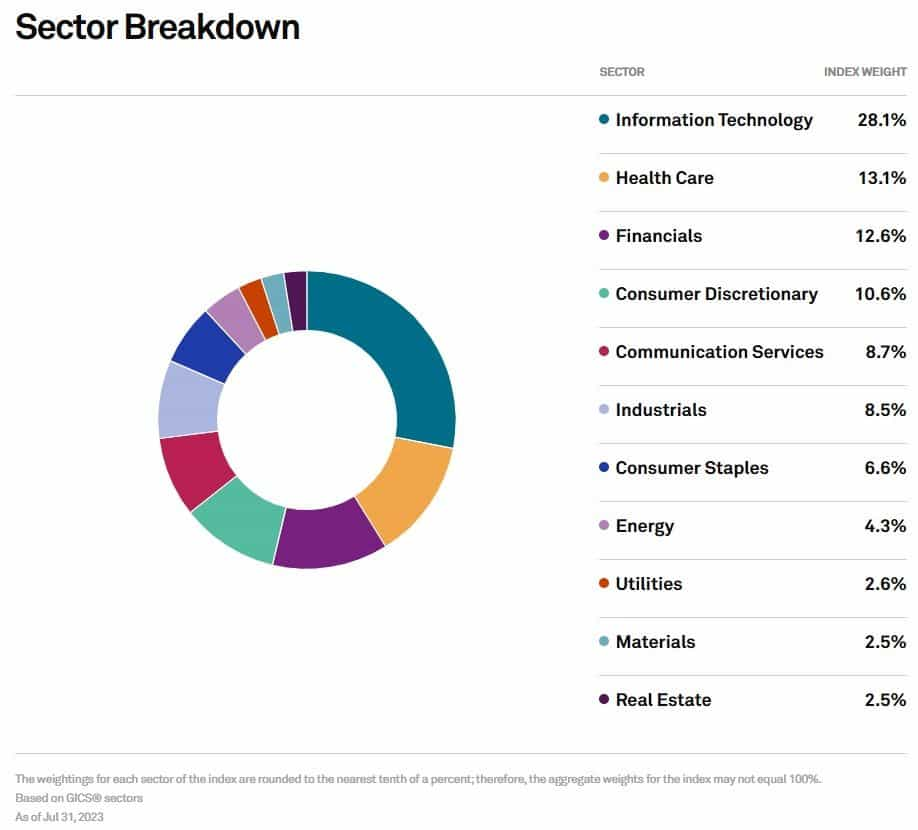

The IT sector comprises the lion’s share of the index. In fact, the five largest companies — Apple, Microsoft, Amazon.com, Nvidia and Alphabet — are all IT firms. Healthcare makes up 13.1% and financial companies round out the top three with a 12.6% share of the index.

S&P 500 traces its roots to 1923 when Standard and Poor’s introduced an index covering 233 companies weekly. The index, in its current form, was created in 1957 and would go on to become the most widely used proxy of the U.S. stock market. The index is maintained by a group of S&P’s economists and index analysts.

Why is the S&P 500 so Important?

The S&P 500 is a stalwart index representing the largest publicly traded companies in the U.S. It stands as a cornerstone of the conventional investment market and is renowned for its stability and historical significance.

The S&P 500 holds significant sway in the financial world due to several factors that make it an important benchmark and indicator of the overall health and performance of the U.S. stock market.

- Representative of economic health: As noted, the S&P 500 comprises some of the largest public companies in the U.S. When read alongside other government data, the index is considered a reliable barometer of how well or bad the economy is performing.

- Investor sentiment: The S&P 500 is far from the only stock market index in the U.S.; the Dow Jones Industrial Average and the Nasdaq 100 are two other majors. But the S&P 500 is the most widely followed index. As a result, it's performance is used to determine investors’ perception of current and future economic conditions.

- Global impact: As the U.S. is the largest economy in the world, its markets' influence extends beyond its borders. Indeed, U.S. equity markets represent 42.5% of the global equity market cap. As a result, the S&P 500's performance on any day impacts global financial markets from Asia to Europe.

- Market cap weighting: This means that companies with larger market values have a proportionally greater impact on the index's performance. This approach to market capitalization weighting reflects the size and influence of different companies within the economy.

- Historical data: The index in its current form came into existence more than 65 years ago. It provides a treasure trove of data to help anyone analyze market trends, economic cycles and the effects of market-moving events.

S&P 500 Historical Performance

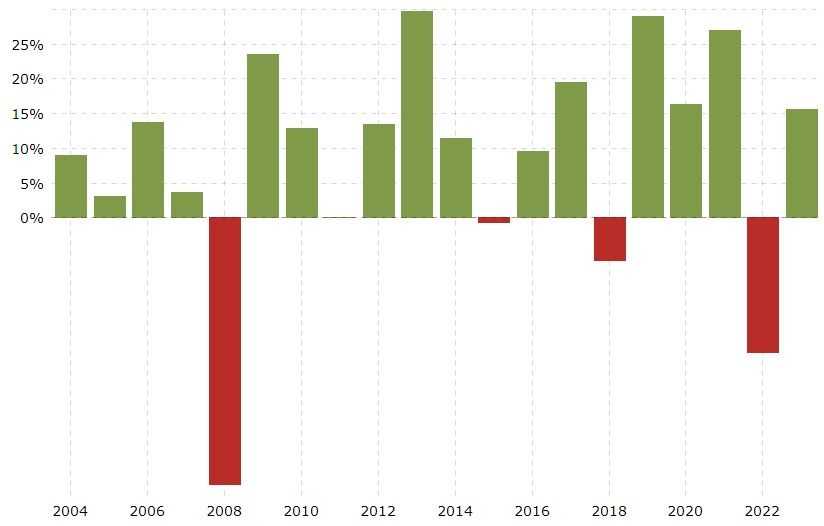

Between 1965 and 2022, the S&P 500 returned an average of 9.9%. Its highest return was in 1995, just before the dot-com bubble, when the index returned 34.11%. In 2008, when the housing market crisis was in full swing, the S&P 500 was down 38.49%. For most traditional investors, a 9.9% average return isn’t too shabby at all.

Overall, the index has returned a profit more times than it has turned red.

Most crypto investors would scoff at these returns. After all, investors in the crypto sphere can blow past these returns with their eyes closed. Axie Infinity, then a small-cap altcoin, rewarded investors with a mind-boggling 71,910.71% return in a single year. But that’s not all! Bitcoin, the largest crypto by market cap, returned over 5,000% in 2013, and Ethereum's return was 10,000% in 2017.

For traditional stock market investors, these returns are probably both head-scratchers and unattainable.

Top 10 Crypto Historical Performance

The first Bitcoin was minted in 2009. While crypto may be the new kid on the block, and as such, has a lot to prove to the traditionally minded investor, the past few years have been nothing short of remarkable (with the occasional bumps in the road).

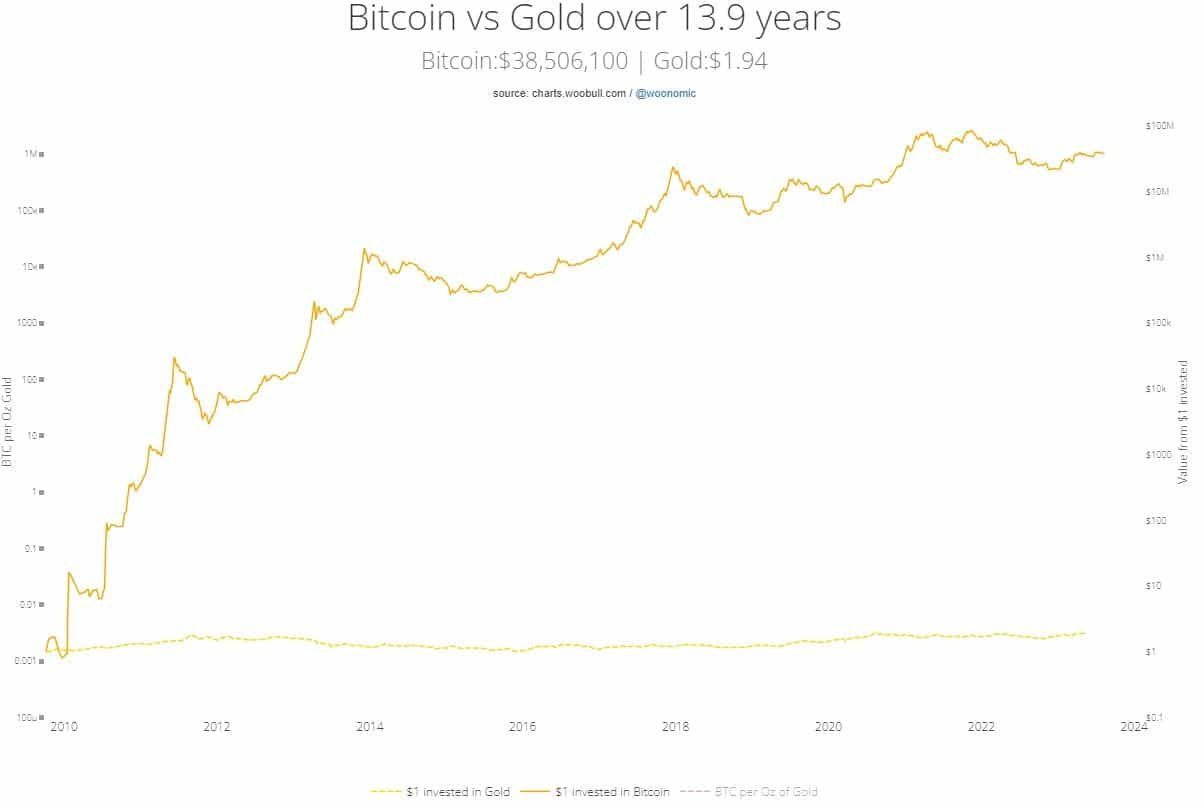

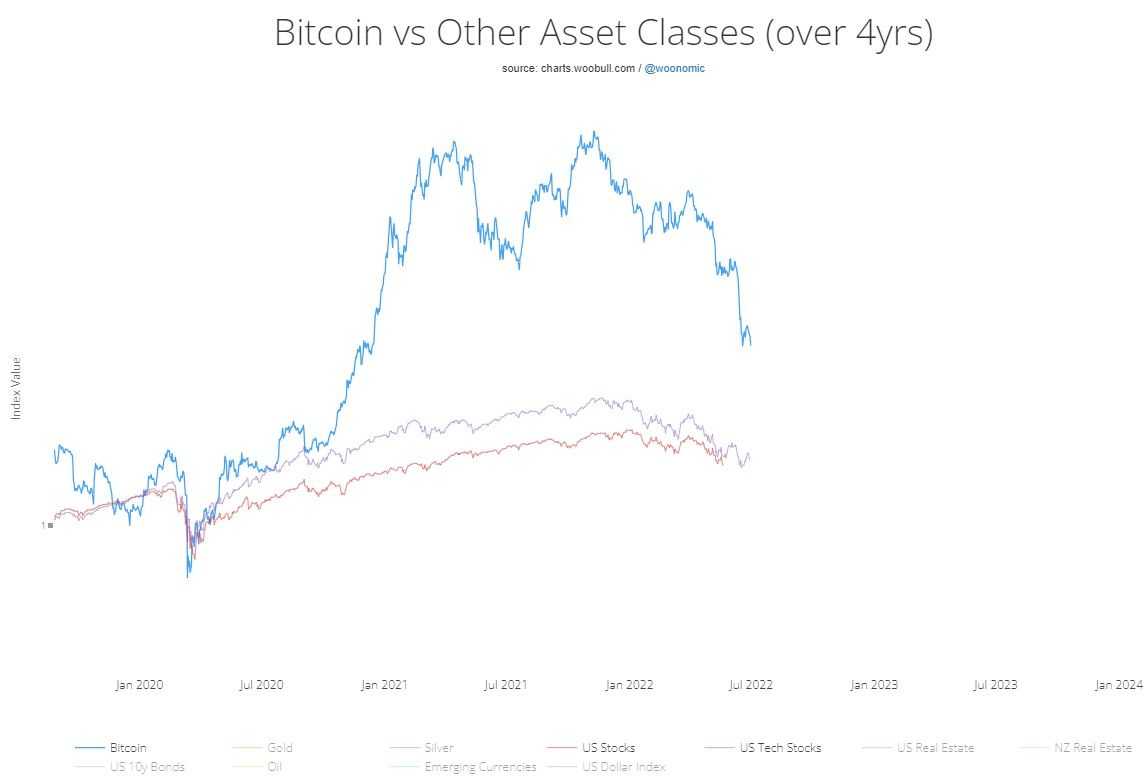

This chart looks at how much money you’d make if you had invested $1 in Bitcoin and gold 14 years ago. Investing in gold, a traditional safe haven asset class, would make you $1.93 over 14 years. Bitcoin? Over $3.8 million, that’s a fat return on a mere buck! So much for gold being much of an inflation hedge.

But enough about Bitcoin.

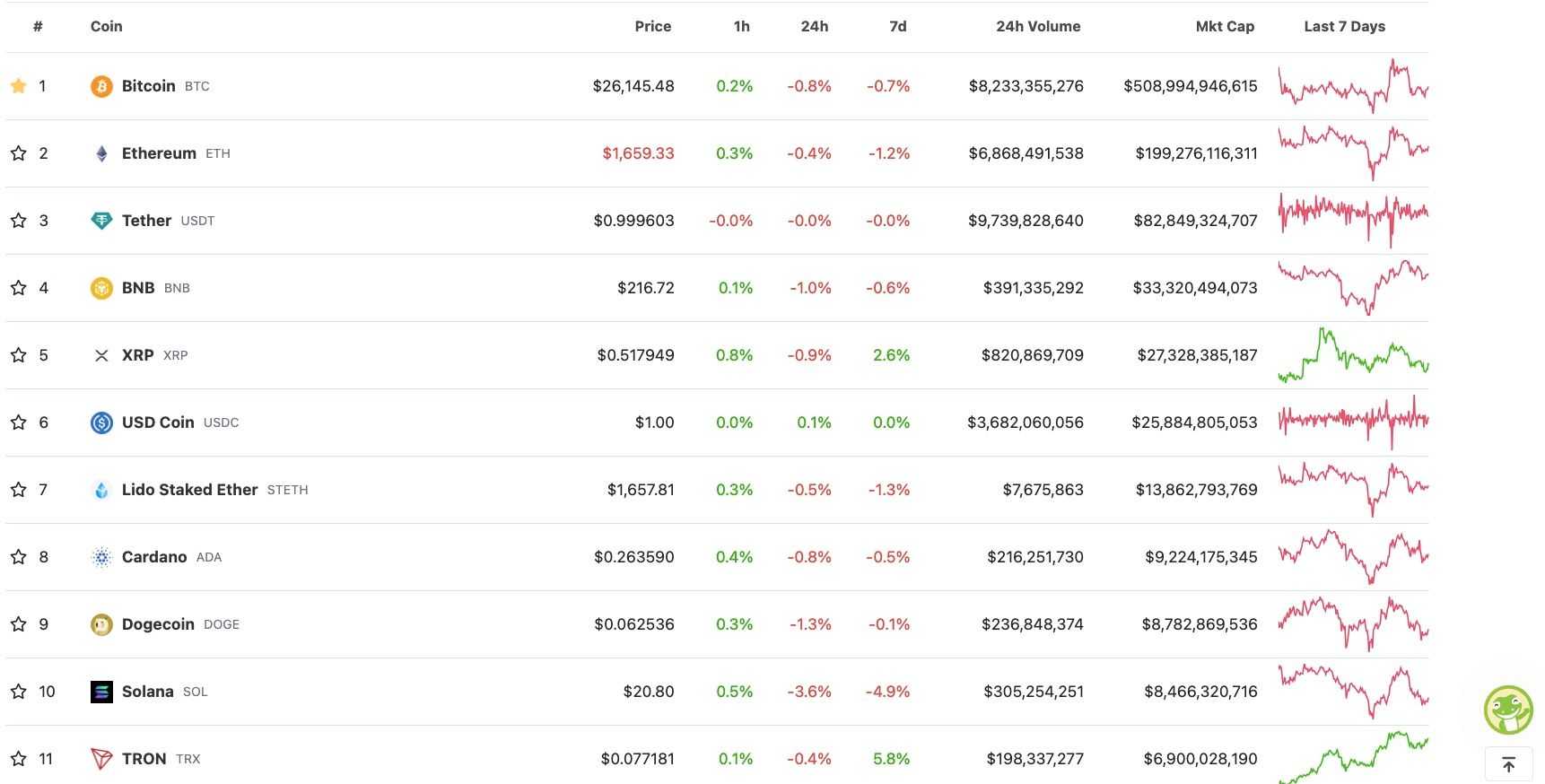

The top-10 cryptocurrencies often trade places. Some move down the list, while others gain a rank or two. Favorites such as Bitcoin and Ethereum continue to maintain their first and second spot, respectively. But there is a surprise entrant that has managed to break into the coveted top-10 group.

Doge, a meme coin started as a joke, sits at No. 9. Tesla founder and billionaire Elon Musk has arguably been Doge’s biggest proponent. His tweets, which are often, are a seismic event for the cryptocurrency. Anytime he tweets about Doge, the meme coin’s price tends to surge.

In addition, two stablecoins are in there as well — Tether (No. 3) and USD Coin (No. 6). Some favorites such as Litecoin, Polygon, TRON and Polkadot have fallen off the top 10 mark.

To track how our top-10 group has fared, we’ll take help from the Crypto Market Index 10 (CMI10), which tracks the performance of, you guessed it, top-10 cryptocurrencies. As a reminder, S&P 500 investors fetch an average return of just under 10% each year.

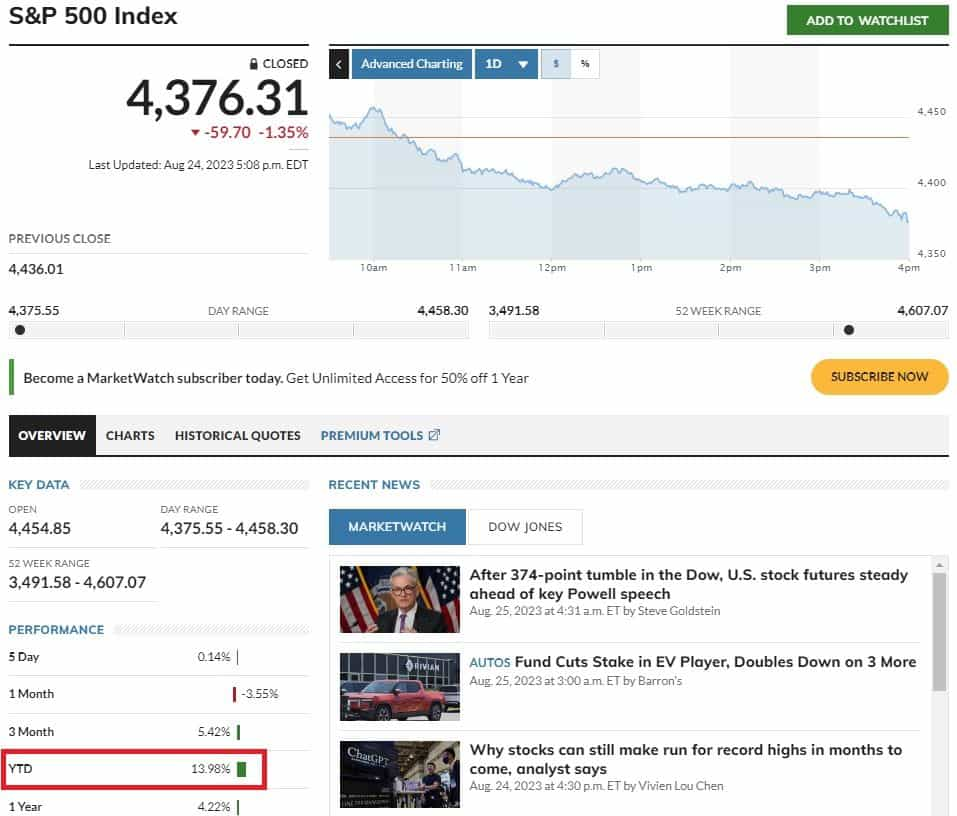

Year to date, the Crypto Market Index 10 is up 47.25%. The S&P 500 is up only 14.44%.

Bitcoin

First minted in 2009 by the elusive Satoshi Nakamoto (nobody knows their true identity), the granddaddy of all cryptocurrencies has since turned naysayers into believers. Examples include mega financial institutions like BNY Mellon, Citibank, Morgan Stanley and Goldman Sachs, who all agreed to invest in the space.

The ProShares Bitcoin Strategy ETF's (BITO) launch in October 2021 kicked off a flurry of other such funds being made available for the public to invest. Global X also introduced three new exchange-traded products in Europe. The Grayscale Bitcoin Trust launched to much fanfare as well. It currently boasts over $16 billion in assets under management.

These investment products are just a few among many Bitcoin ETFs, Bitcoin mutual funds and Bitcoin futures. Of course, you can also trade bitcoin as you would any stock listed on an exchange by using a reputable crypto exchange.

It wouldn’t be wrong to say that Bitcoin has proven its value as an asset class, store of value and a hedge against inflation. Bitcoin’s growth not only outpaces stocks generally, but tech stocks specifically as well. As a reminder, tech companies are the S&P 500’s largest constituent.

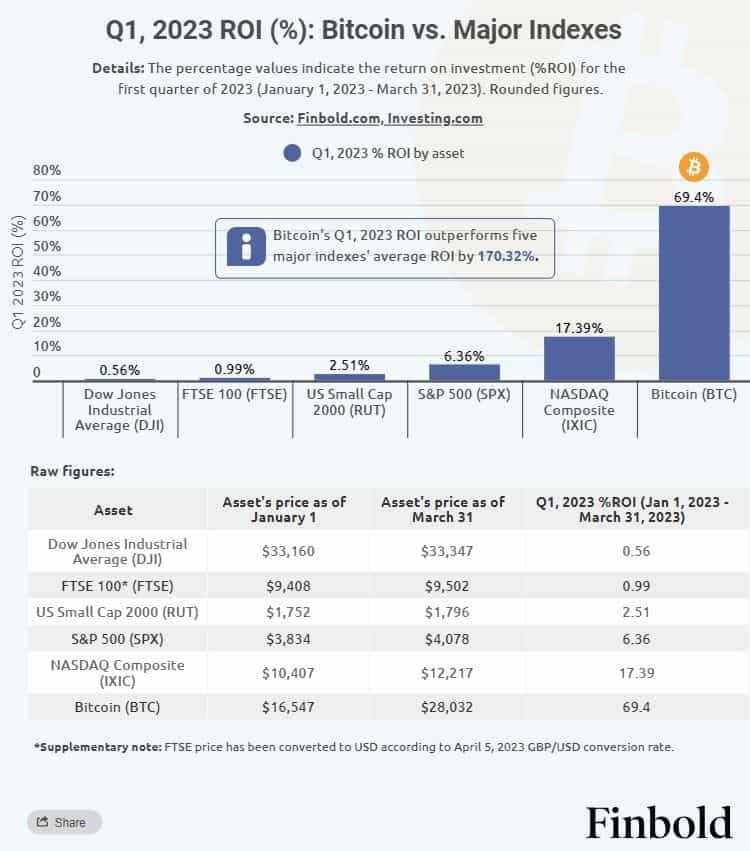

Turning to returns, in no surprise to anyone, Bitcoin outpaces every other major stock market index.

S&P 500’s 6.36% return in the first quarter of 2023 and NASDAQ Composite’s decent 17.39% return pale in comparison to Bitcoin’s return on investment of 69.4% during the period. It’s important to note that the quarter saw regulators seizing a number of banks in high-profile closures, which prompted the Average Joe to call into question the health of the entire financial system.

Ethereum

The second most popular cryptocurrency has earned itself the moniker “digital oil.” This analogy is not an official designation but rather a way to highlight Ethereum's role in powering a wide range of decentralized applications and services through its smart contract capabilities. Many crypto enthusiasts argue that Bitcoin doesn’t have a real utility other than a store of value. Ethereum, however, is an entirely different story.

- Foundation for DApps: Ethereum provides a foundational platform for building decentralized applications, which can span across finance, supply chain management, gaming and more.

- Smart contracts: Ethereum's smart contract functionality enables the creation of self-executing contracts with predefined rules and conditions. This has opened the door to decentralized finance applications, which allow for complex financial interactions without intermediaries.

- Digital transformation: Just as the discovery and utilization of oil transformed industries and economies, Ethereum has the potential to transform the digital landscape by enabling new business models and interactions through blockchain technology.

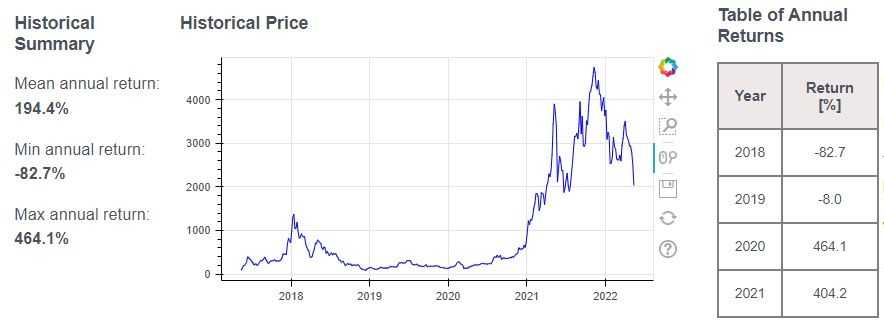

Ethereum’s mean annual return is 194.4%. In 2022, the cryptocurrency’s return on investment was over 300%.

Binance Coin

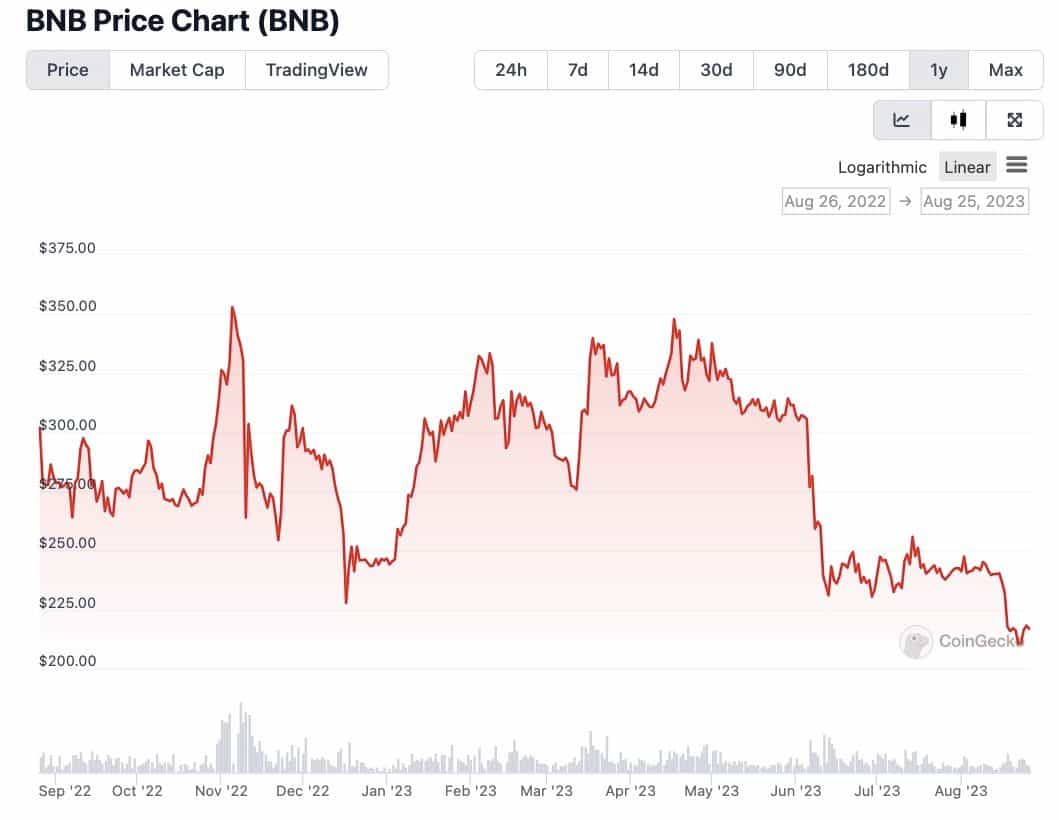

Binance Coin (BNB) is the native cryptocurrency of Binance, the world's largest and most popular cryptocurrency exchange in terms of daily trading volume. Binance Coin was initially launched as an Ethereum-based token but was later migrated to Binance's own blockchain, known as the Binance Smart Chain (now called BNB Chain), where it operates as the native digital asset.

In 2017, when BNB was launched to the public, the coin’s value was $0.15. It reached an all-time high of $690 in 2021. That is an astronomically staggering 459,900% return.

Over time, Binance Coin has gained significant popularity and value due to its association and utility with one of the most influential cryptocurrency exchanges and BNB Chain network. It has grown beyond being just a utility token for the Binance platform and has become a tradable asset in its own right, often included in various cryptocurrency portfolios.

Binance's native token took a hammering in June after the U.S. Securities and Exchange Commission sued the exchange.

Year to date, the token is down 11.79%. Over the last year, it has fallen 28.69%. However, since inception, the token is still up a mind-boggling 187,158.36%

XRP

Fresh off a partial win in its long legal tussle with the SEC, some crypto enthusiasts think the token’s price might finally hit $1 this year. The SEC contends that XRP should be considered a security, which would put Ripple Labs (which issues XRP) under the SEC’s purview. However, in her summary judgment, the judge focused on Ripple’s marketing of the token instead. The SEC is appealing the ruling.

The back-and-forth with the SEC was one of the reasons why the token didn’t participate in the November 2022 bull run. Nevertheless, the SEC lawsuit is a massive overhang on XRP’s price and how this plays out would ultimately dictate any upward price movement.

In the preceding one-year period, XRP is up 46.57%. Since inception, the token’s ROI stands at a whopping 8,623.91%.

S&P 500 vs. Top 10 Crypto Returns 2019-2022

The S&P 500 ended 2018 in the red, 2019, 2020 and 2021 with a bang, but it ended 2022 with a whimper.

The return in 2018 was -6.24%. Then, in the next three years, returns outpaced the average — 28.88%, 16.26% and 26.89% in 2019, 2020 and 2021, respectively, as everyone was hunkered indoors and the U.S. government handed free money as COVID-19 aid. But that’s where the trouble began.

The following year, the economy was red hot, leading to stubbornly high inflation, which forced the U.S. Federal Reserve to raise interest rates. The invasion of Ukraine, supply chain issues, and volatile economic data also kept markets on edge. All of this proved to be a perfect storm for the S&P 500, which posted a return of -19.44% in 2022.

Cryptocurrencies aren’t insulated from macroeconomic factors with many coins having lost over 90% of their value, with many unlikely to recover, but major assets such as Bitcoin are suggesting that they may be able to weather bad news better than traditional asset classes like stocks.

Performance of Top 10 Cryptos vs. S&P 500 in 2023

The research arm of megabank JPMorgan expects a more challenging macro backdrop for stocks in the second half of 2023. This is driven by expectations that global inflation will remain above 3% (the U.S. Fed’s target is 2%) and the ensuing monetary tightening by central banks.

Following the bloodbath in 2022, the S&P 500 appears to be on stable footing again. Year to date, it is currently up about 14%. The return is, frankly, mediocre compared to a vast majority of top-10 crypto tokens. Let’s compare.

- Bitcoin: The largest crypto is up 57.13% this year or $9,486.80.

- Ethereum: The second largest token has gained 37.76% year to date. In dollar value, that’s $453.11.

- BNB: Binance Coin is down 11.46% year to date.

- XRP: The token on the SEC’s radar is up 50.36% thus far in 2023.

- Cardano: The token ADA is up 5.13% in 2023.

- Dogecoin: Elon Musk’s favorite crypto is 11.30% in the red.

- Solana: SOL is down 34.83% over the preceding year.

- Tron: The token is up 40.14% year to date.

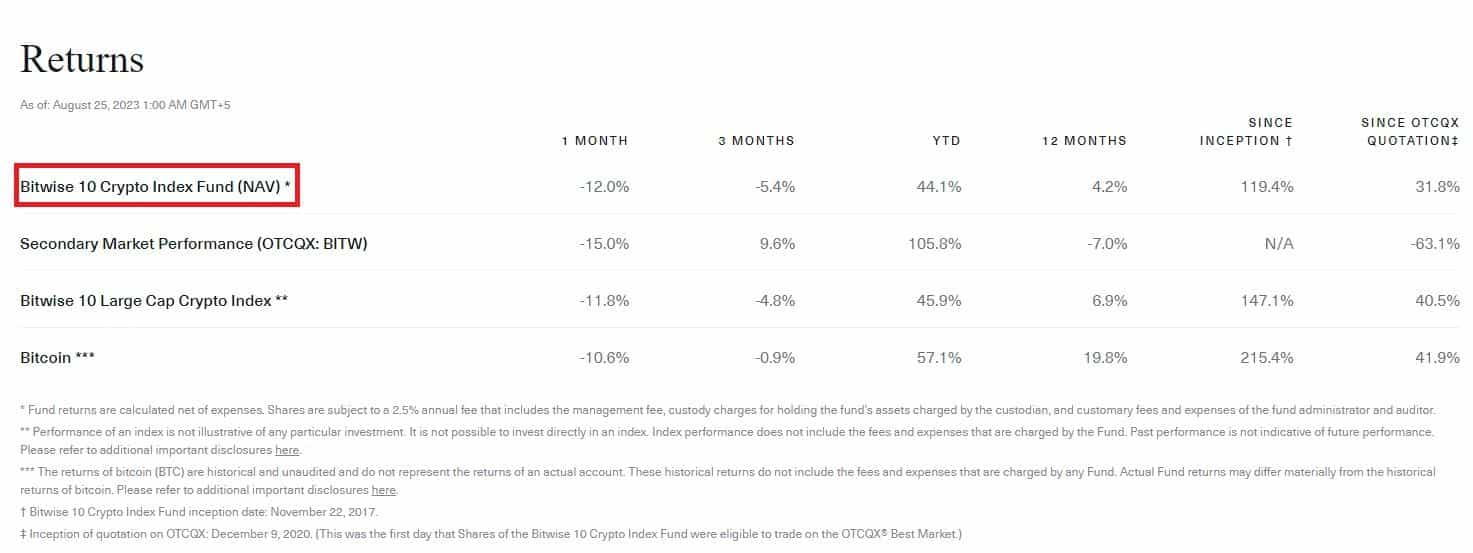

The Bitwise 10 Crypto Index Fund is up 44.1% year to date and 119.4% since inception. But it’s important to note that it has deployed a vast majority of funds in Bitcoin (65.6%) and Ethereum (25.7%), both of which are considered blue-chip tokens.

Crypto vs. S&P 500: Conclusion

In the ever-evolving arena of investments, the battle between traditional stalwarts and disruptive newcomers rages on. The S&P 500, a revered index tracing the growth of the largest U.S. companies, stands as a testament to the enduring strength of established markets, with its historical returns and pivotal role in assessing economic health.

Contrastingly, the realm of cryptocurrencies has stormed onto the financial stage, offering breathtaking returns and embodying a paradigm shift in investment ideologies. In this digital arena, crypto tokens have achieved meteoric rises (and losses), outpacing the traditional market indices by margins that appear surreal. The volatile nature of the crypto landscape, while presenting risks, has also demonstrated its resilience to macroeconomic turmoil for the most part.

As the global financial landscape evolves and adapts to new challenges, both the S&P 500 and cryptocurrencies continue to shape investor strategies. The former, grounded in historical significance and offering steady growth, remains a foundation for many portfolios. The latter, with its explosive returns and transformative potential, is intriguing for risk-tolerant investors seeking to capitalize on innovation and disruption.

Frequently Asked Questions

There quite a few differences between the two.

- Stocks offer dividends, which can be a decent sources of passive income. And while cryptocurrencies do not issue dividends, there are other ways to make money while you sleep such as staking or mining.

- If you're looking to trade stocks, you can only do it within a certain timeframe. Crypto can be traded anytime you want.

- Both stocks and crypto are intangible, but the former represents a tangible entity.

- Public companies that issue shares are highly regulated. Crypto is generally a loosely regulated sector but winds of change have started to blow.

What goes up must come down! Both crypto and stocks can reach dizzying highs or fall to terrifying lows. Both stocks and blue-chip cryptocurrencies historically suggest that over a long enough time frame, long-term investors enjoy steady returns.

It isn't. Cryptocurrencies are inherently a volatile asset class that's prone to wild price swings. For every big winner, there are dozens of casualties. Many consider the volatility of crypto to not be the ideal choice for risk-averse investors.

Disclaimer: These are the writer’s opinions and should not be considered investment advice. Readers should do their own research.