Financial aficionados, welcome to the most anticipated showdown!

In one corner, you have the battle-hardened and time-tested contender, representing the tried and true — S&P 500 index, the heavyweight champion of the stock market. In the opposite corner, with a digital glint in its eye, is the disruptive underdog — cryptocurrencies, a collective of digital assets that have taken the financial world by storm.

This clash of the titans isn’t just a bout for bragging rights; it's a contest that encapsulates the essence of modern investing. On one side, the S&P 500 boasts over 65 years of market history and stands as a testament to the U.S. financial markets’ lasting strength. On the other hand, cryptocurrencies have disrupted the very foundations of the financial establishment since it stormed onto the scene.

As we prepare to witness these two asset classes slug it out in this Crypto vs. Stocks analysis, it’s important to remember that this isn't just a battle of numbers — it's a battle of ideologies and paradigms, and oversight and innovation.

Disclaimer: I own BTC and ETH.

Who will stand tall? Who will throw in the towel? Let’s find out as the two go head to head!

What is the S&P 500?

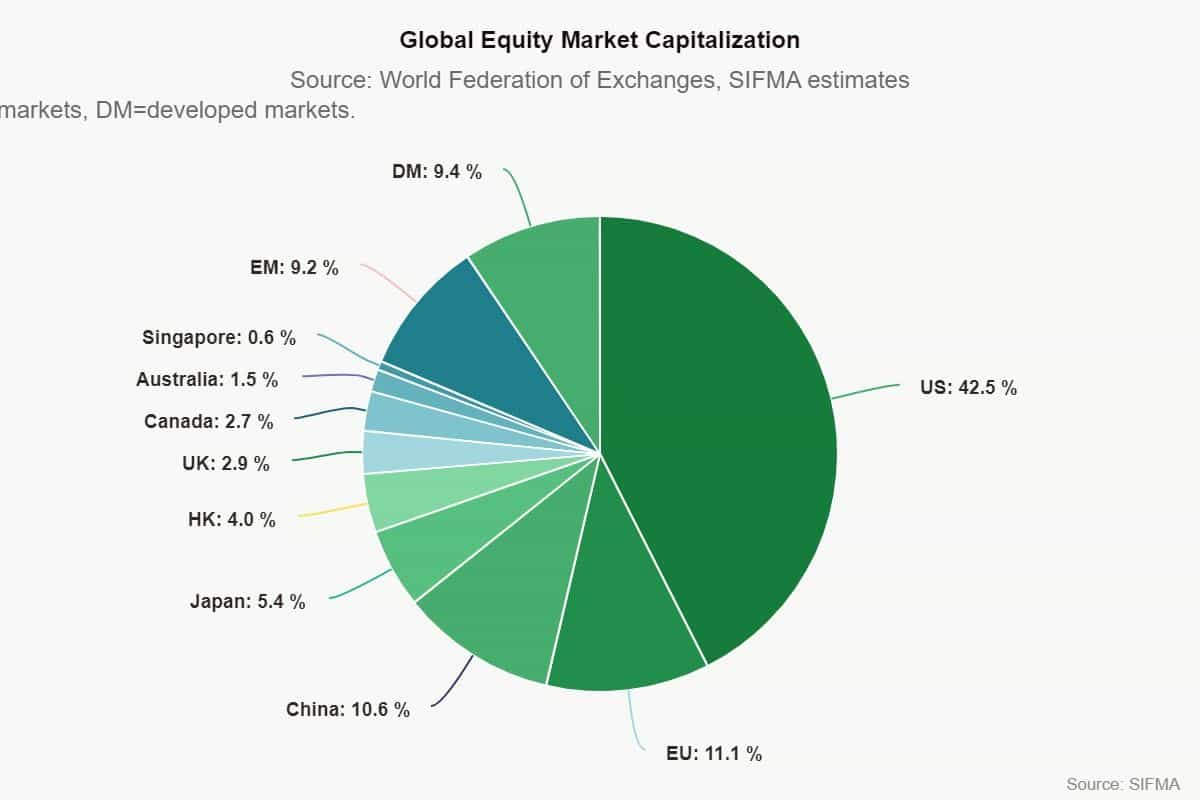

The U.S. equity markets stand at a whopping $46.2 trillion — that’s over 40% of the global equity market cap. In fact, the U.S. equity markets are 3.8x the next largest market, the European Union.

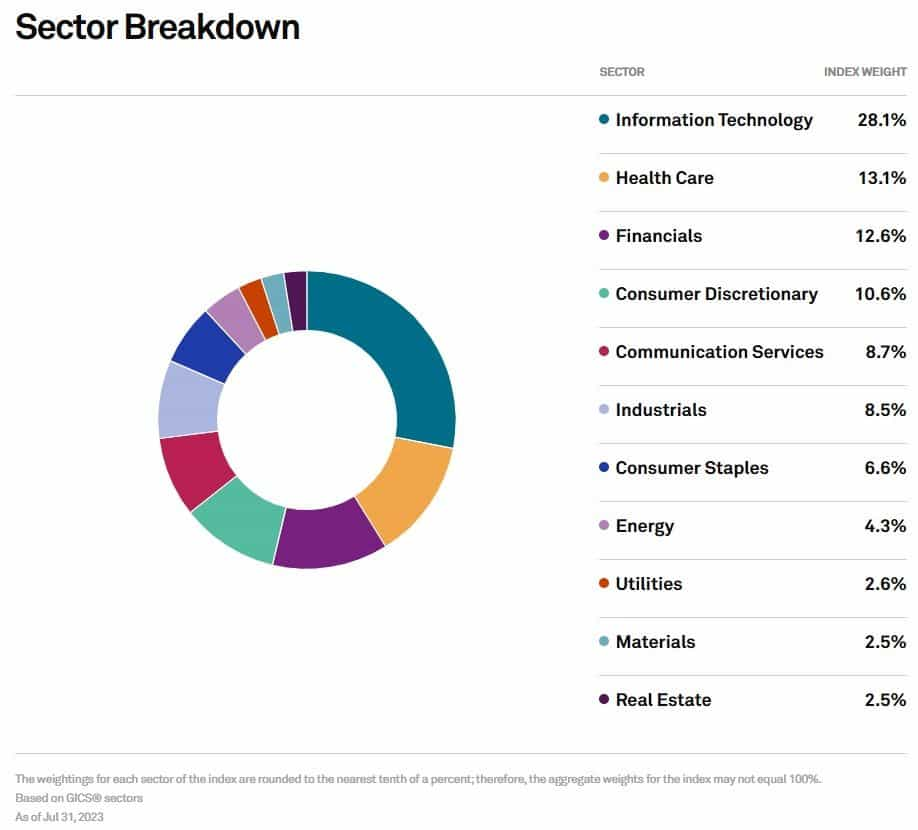

The S&P 500 is far from the only U.S. stock market index; there are roughly 25 of those, but the S&P 500 represents 500 of the largest public companies in America. It includes household names like Apple, Microsoft, Amazon, Meta and JPMorgan. When read alongside data released by the government, the index becomes a reliable proxy of the American economy.

The S&P 500 also holds significant sway not just locally but internationally as well. On any day, how well or poorly it performs affects investor behaviour and markets across the world.

But the index’s influence extends far beyond that.

- Performance benchmark: The S&P 500 is the benchmark to beat. With a history of positive returns behind it (most years), investors often compare their returns to the S&P 500. If a portfolio outperforms the index, it’s considered a positive outcome.

- Investment vehicles: An estimated $15.6 trillion is indexed or benchmarked to the index. From mutual funds to exchange-traded funds, the goal is to replicate the performance of the S&P 500.

- Media coverage: Anytime you open CNBC or Bloomberg during market hours, chances are they’re discussing daily fluctuations and trends in the index.

- Analysis and forecasting: For number crunchers, the S&P 500 provides a treasure trove of data that can be dissected to glean insights into consumer spending, business activity and investor sentiment.

Crypto vs. S&P 500: The Battle Begins

Crypto may have established itself as an asset class, turning skeptics into adopters along the way, but comparing it with the S&P 500 is a tough cookie to crack because they’re wildly different.

- Underlying asset: Shares, such as those issued by S&P 500’s constituents, represent an ownership in a company. Crypto lives entirely digitally, and it isn’t always tied to any physical asset or the performance of a project or company. Consider memecoins, which are often traded as pure speculation.

- Regulation: The stock market is heavily regulated, cryptocurrencies, not so much. However, regulatory scrutiny of digital currencies has increased over time.

- Market maturity: The stock market dates back centuries. By comparison, cryptocurrencies are just a baby, having seen the first Bitcoin mined in 2009.

- Valuation: A company's financial performance, its growth prospects and other factors influence its stock price. Cryptocurrency valuations are often determined by technological developments, adoption, and market sentiment.

It wouldn’t be remiss to say that comparing the two is a multifaceted endeavour that requires a comprehensive analysis across various verticals.

For the purpose of this financial face-off, we will be comparing stocks and Bitcoin. Why Bitcoin? Because it is the bellwether of the industry. Similar to the S&P 500 being the primary pulse of the stock market, Bitcoin represents the digital currencies industry. Its price movement is a seismic event for the crypto industry, one that drives the prices of other tokens.

Round 1: Historical Performance Analysis

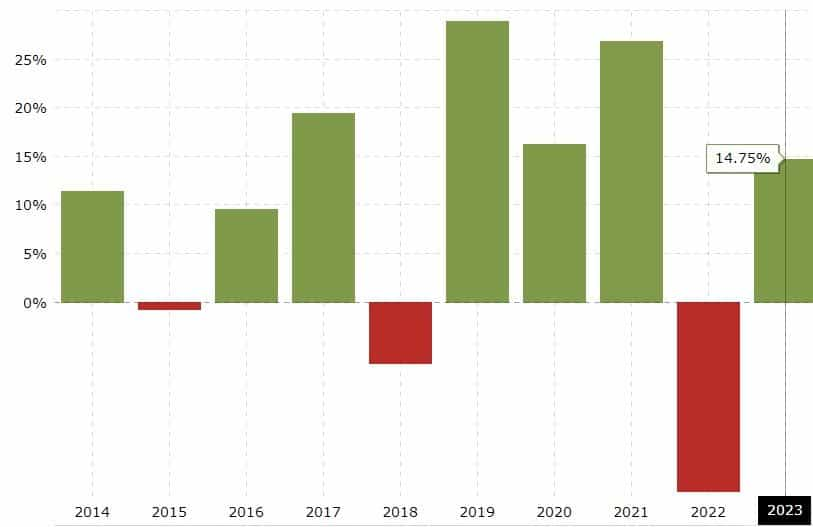

The S&P 500's average return over the past decade stood at 12.39%, up from a long-term historic average of 10.7% since its introduction in 1957.

In three of the past 10 years, the index has fallen into red. The most punishing year was 2022 when a confluence of concurrently occurring factors turned returns negative:

- Sticky inflation and the Federal Reserve going on a war footing to tamp it down

- Russia's invasion of Ukraine

- Supply chain issues

- Volatile economic data

We've covered crypto vs. S&P 500 returns in great detail if you want to dive in further.

You’d think 2022 was S&P 500’s worst year, but that was nothing compared to 2008. As the housing market crisis reached its tipping point, the index plunged 38.49% for the year.

But the S&P 500 has had banner years as well. In 1995, just before the dot-com bubble, the index posted a return of 34.11%, its highest ever.

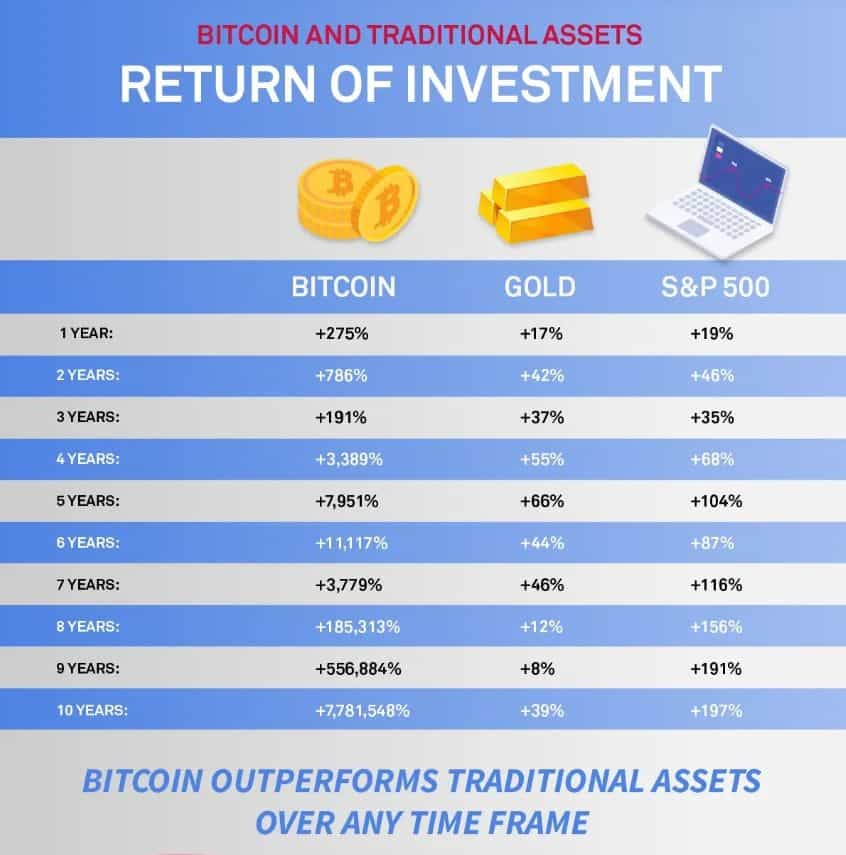

For stock market investors, a 12.39% average return over the past 10 years is a decent chunk of money. The same can’t be said for crypto investors, however.

Crypto investing isn’t for the faint-hearted. You may multiply your initial investment one year, only to lose all of it the next. For every winner, there are hundreds of casualties. But if you can stomach the volatility, the return can be oh-so-sweet.

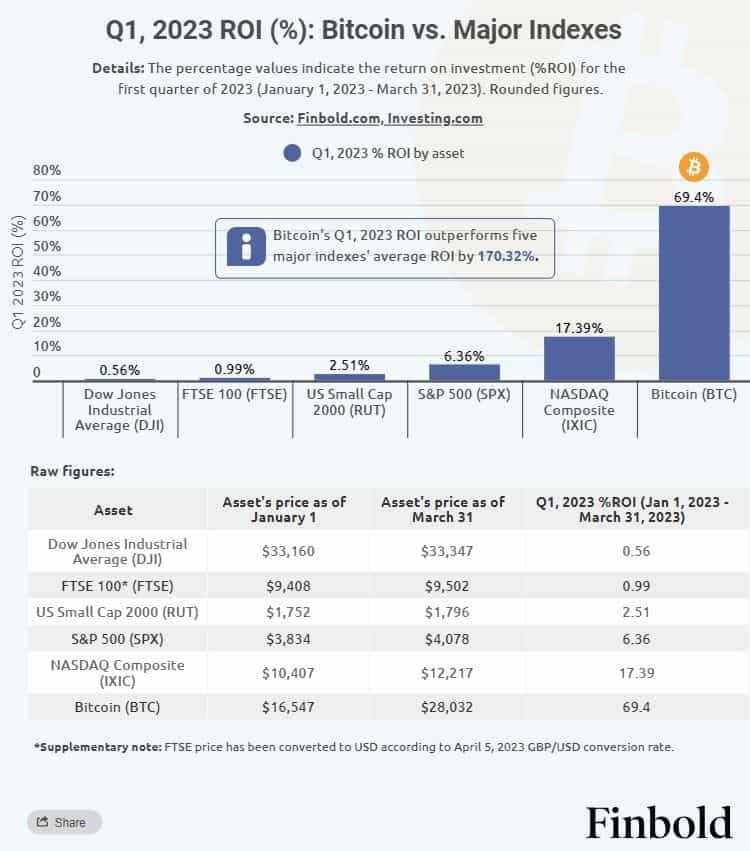

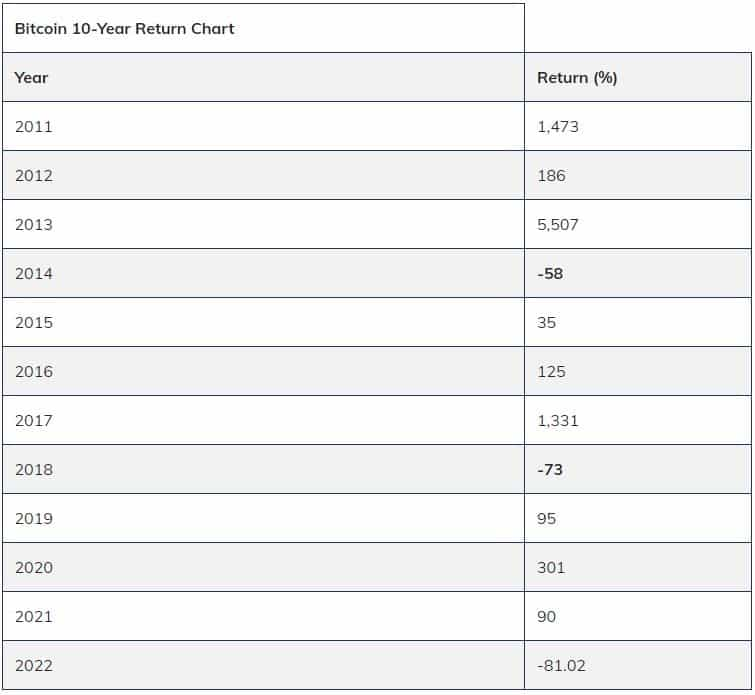

Bitcoin’s mean annual return stands at 93.8%, considerably higher than the S&P 500. But, just as the profits, losses are higher too.

In 2022, when the S&P 500’s return was -38.49%, Bitcoin’s return on investment was -81.02%. The crypto’s largest return over the past 10 years was 5,507% in 2013, a number potentially out of reach of the traditional stock market investor.

WINNER: Crypto. The underdog manages to outpunch the seasoned veteran.

Round 2: Volatility and Risk Profile

There’s no denying that cryptocurrencies are highly volatile digital assets prone to wild price fluctuations, and there are a few reasons.

- Demand and supply: Most commodity prices are determined by the demand and supply dynamics. With regards to crypto, their market value is influenced by the number of coins in circulation and how much people are willing to pay.

- Liquidity: Crypto is still new and evolving. As a result, many cryptocurrencies have a lower trading volume compared to stocks. This lower liquidity can cause more dramatic price movements if a large buy or sell order is placed.

- Technological developments: Technological advancements and updates to cryptocurrencies and their underlying blockchain technology can have a significant impact on prices.

- Market sentiment: Cryptocurrency prices are also driven by investor psychology and sentiment. In a world where crypto “tips” are just a few clicks away in the form of social media, news and Telegram, there’s no shortage of psychology-driven price movements.

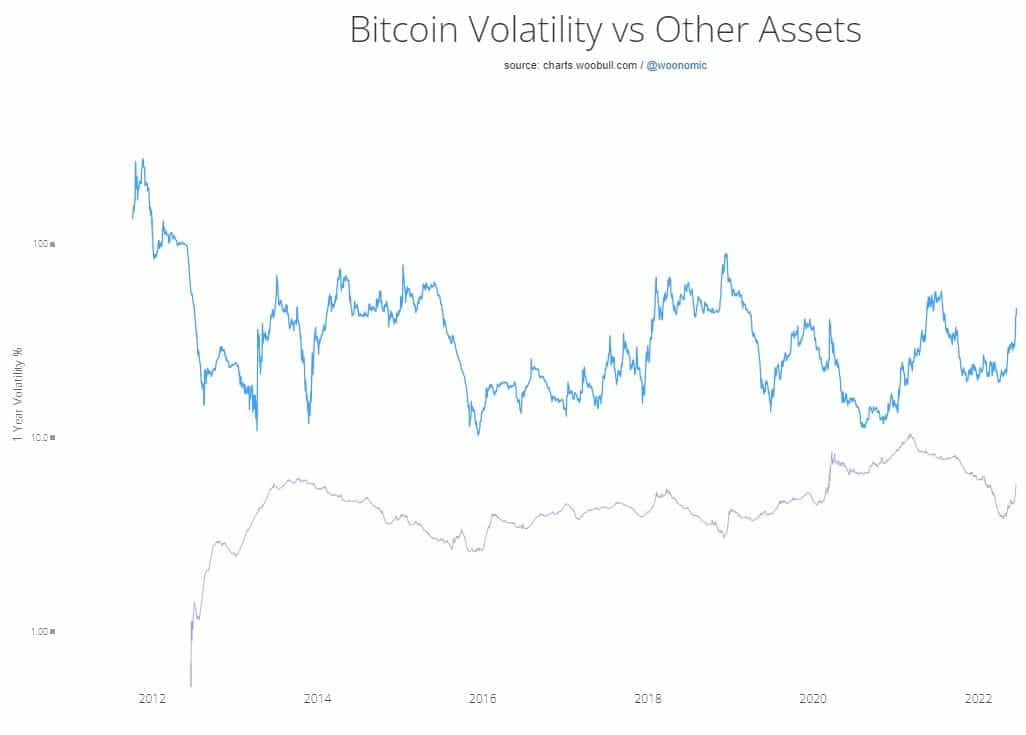

In May 2021, Bitcoin lost 30% of its value in a single day and dropped to $30,000 only to claw back to reach $38,000 later that day. These price fluctuations aren’t outside the realm of possibility in the crypto world. However, some recent headlines suggest that Bitcoin has become less volatile than the S&P 500 and gold, a traditional safe haven asset, with extreme volatility in store as crypto wakes up from its summer slumber.

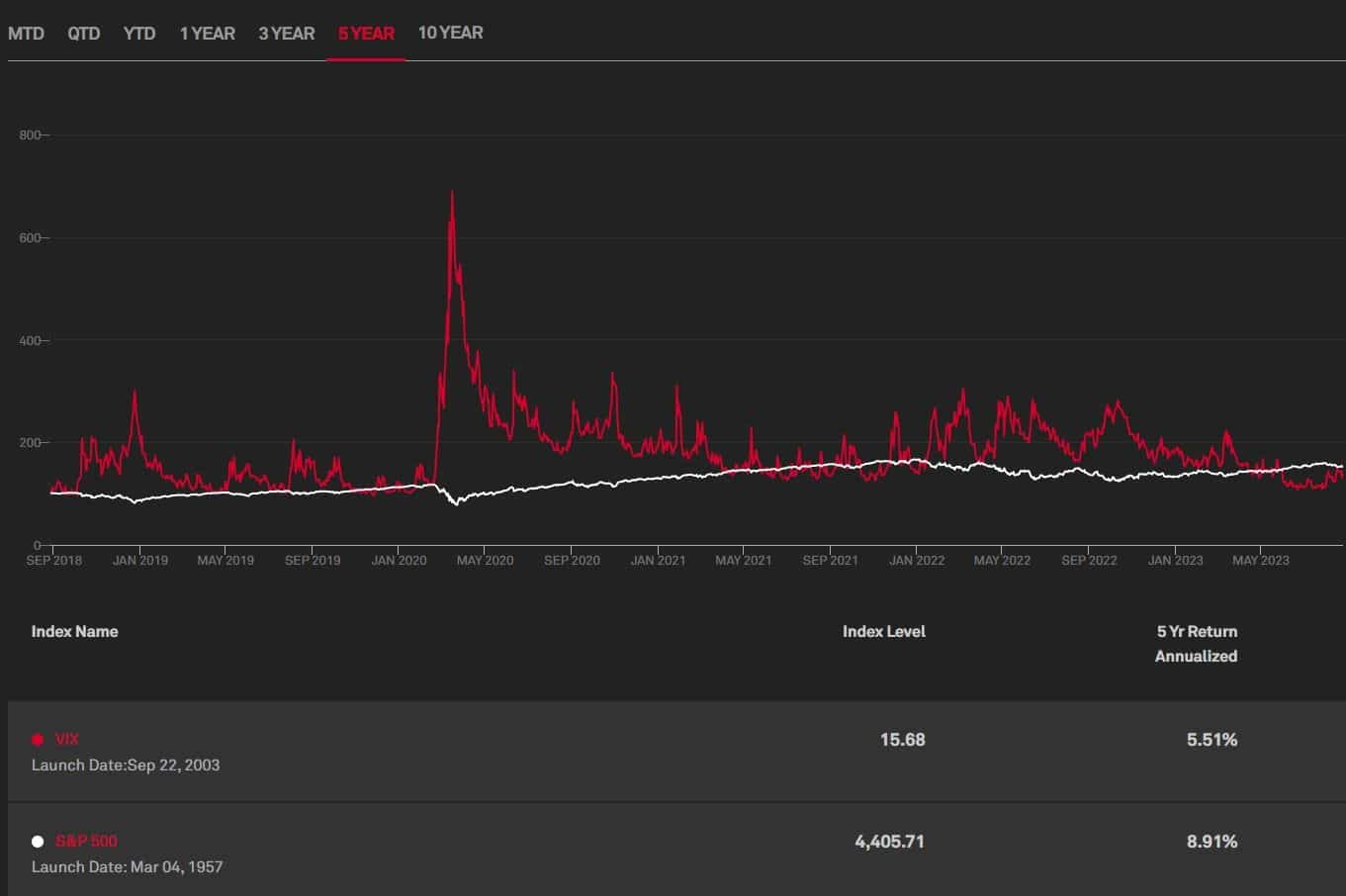

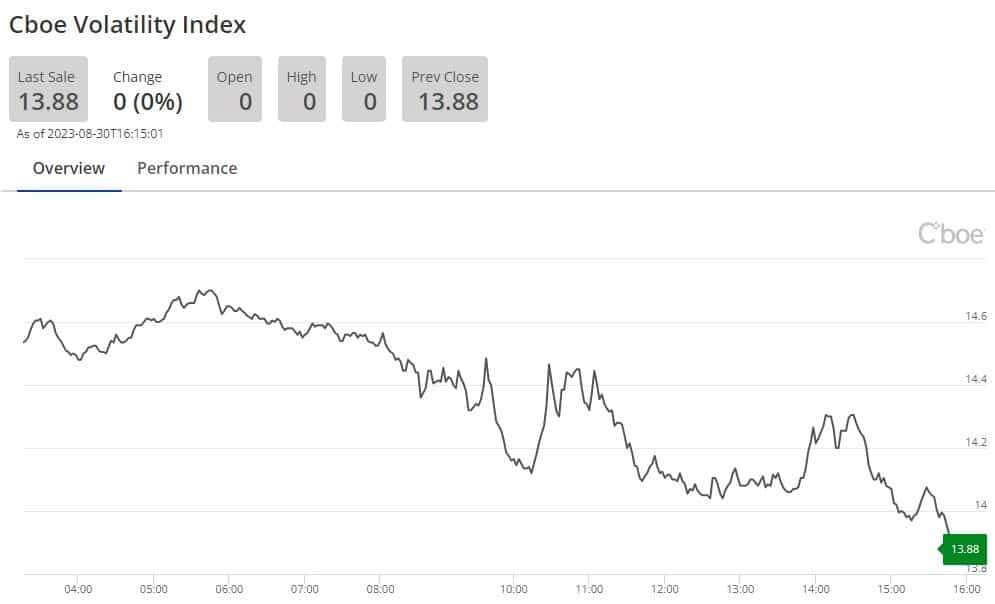

For stocks, the most common barometer of volatility is CBOE Volatility Index (VIX), which measures the implied volatility of the S&P 500 for the next 30 days.

Since VIX reaches its highest levels when the stock market is jittery, the index is also referred to as the “fear” gauge. For example, in March 2020 when COVID-19 disrupted the world, VIX reached an all-time high of 82.69.

A VIX reading of 25 and above is considered high volatility. It currently sits at a breezy 13.88, suggesting optimism in the market.

WINNER: Stocks. Steady jabs triumph over frenzied price fluctuations.

Round 3: Market Adoption and Maturity

Initially, many of the largest American banks were hesitant to accept crypto’s potential. Now, the banking industry is racing to catch up and compete with each other to profit from it.

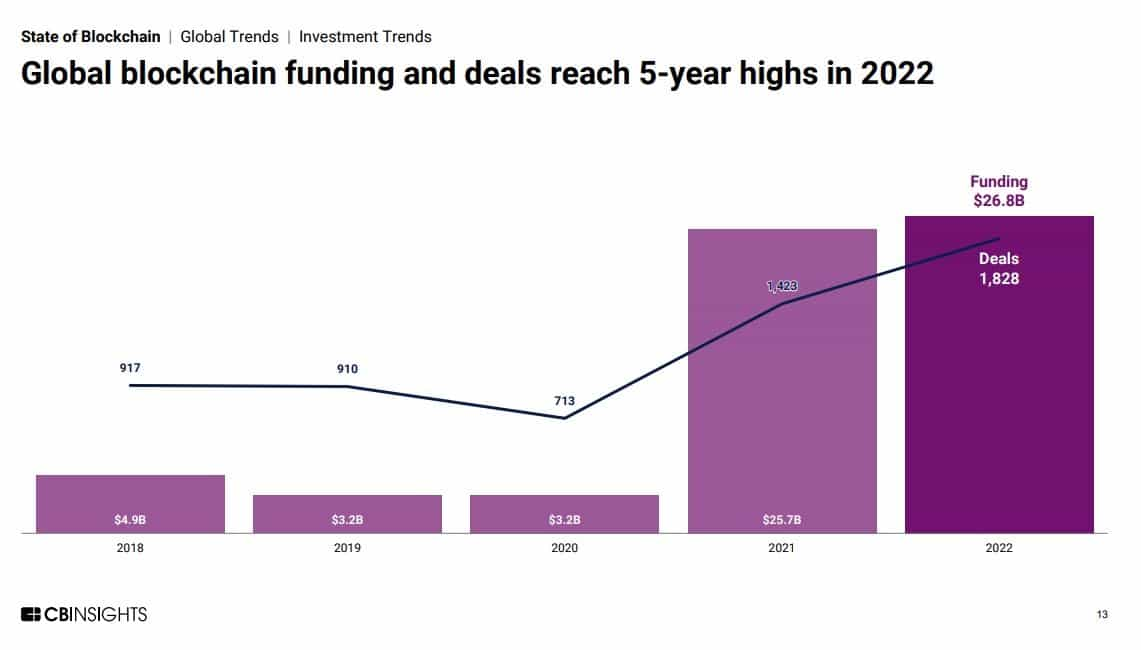

Blockchain funding reached a mammoth $26.8 billion in 2022. The U.S., Europe and Asia tied for fourth-quarter 2022 funding, each attracting $1 billion. But in a year marked by a stablecoin’s collapse, multiple crypto bankruptcies, the fall of FTX and macroeconomic pressures, the average deal size dropped 24%.

Ally Bank, Goldman Sachs and USAA are three prominent traditional financial institutions that offer crypto services. It isn’t just traditional banks; hedge funds, which typically cater to high-net-worth individuals, want in on the action too. Crypto job openings by financial services firms are on the rise as well. If you are looking for a blockchain-focused career, be sure to check out our Crypto Jobs Guide.

One major holdout is Jamie Dimon, CEO of America's largest bank, JPMorgan, and the face of the U.S. banking industry. He has described Bitcoin as a “hyped-up fraud” and a “waste of time.” But it seems the bank has at least warmed up to the idea even as it doesn’t offer a product for retail investors yet. In June, the megabank deployed its blockchain-based payment system, JPM Coin, for euro-denominated payments for corporate clients.

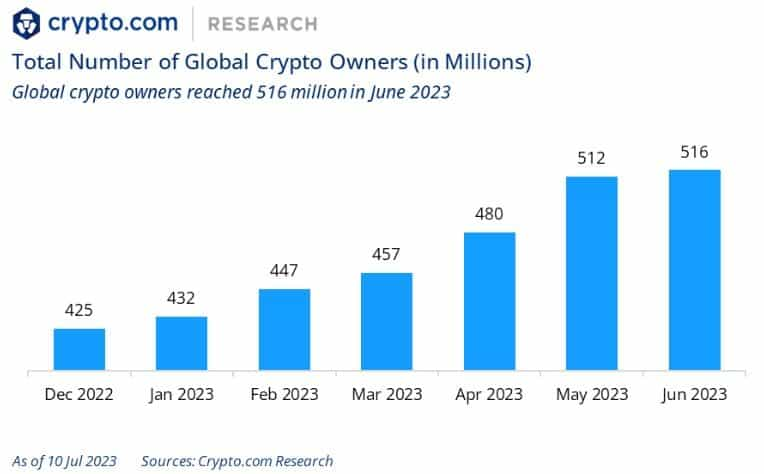

Speaking of mom-and-pop investors, the number of global crypto owners grew to 516 million in the first half of 2023 from 425 million in December 2022, a 21% increase. Bitcoin owners grew by 22%, while Ethereum owners increased 21%. Two major events in this six-month period served as catalysts for the increase.

- The introduction of Bitcoin Ordinals protocol, which allowed NFTs and fungible tokens to be minted on the Bitcoin network.

- Ethereum’s Shanghai upgrade, which allowed the withdrawals of staked ETH from the now-Proof of Stake blockchain.

But comparing crypto and stocks in terms of adoption and maturity wouldn’t be right. The two have different characteristics and adoption patterns. One’s the new kid on the block, while the other has centuries of experience behind it.

Winner: Tie. As the bell rings, it’s clear crypto adoption is on the rise, but it has a long way to go.

Round 4: Regulatory landscape

Oh, boy! The gloves are off now.

Regulating crypto assets has been a topic of focus for policymakers and regulators across the world, with the collapse of FTX only aggravating the situation.

Cryptocurrencies are a loosely regulated asset. One of the reasons, apart from being decentralized and each project having its own governance system, is whether crypto should be considered a security, a commodity or something else entirely.

If it is indeed a security, that would put it under the purview of the Securities and Exchange Commission, something Chairman Gary Gensler believes to be true. It’s important to note that in the SEC’s ongoing legal battle with Ripple Labs (it issues the XRP token), a judge denied the regulator’s argument that XRP is a security in a major win for the crypto industry.

As you can see, the SEC has been busy clamping down on crypto companies and individuals. In an April hearing before Congress, Gensler said:

“All of these companies should come into compliance with the law, and until they do, we will continue to pursue them as the cop on the beat, and investigate and follow the facts and law.” (Source)

Zooming out a bit to look at the broader picture, the Atlanta Council looked at 45 countries and concluded that crypto is legal in 20 countries, including 10 G20 countries which account for over 50% of the world’s GDP. Not only that, but nearly 75% of the countries reviewed are in the process of making substantial changes to their regulatory framework.

Both the World Bank and the International Monetary Fund have issued statements on the matter as well.

“A practical, comprehensive, and transparent regulatory framework that addresses some critical challenges that have appeared from recent crypto-related insolvencies could help to reduce some of these risks” - The World Bank

“A global regulatory framework will bring order to the markets, help instill consumer confidence, lay out the limits of what is permissible, and provide a safe space for useful innovation to continue.” - IMF

Here’s where some of the world’s largest economies are in terms of crypto regulation.

U.S.

Crypto has been in the SEC’s crosshairs for a while, with Gensler going as far as comparing it to “the Wild West” in 2021. But it’s only been recently that the regulator has cranked up its effort to rein in the industry, starting with its suit against Ripple Labs. The judge presiding over the case recently ruled in favour of Ripple, but the SEC plans to appeal.

It’s important to note here that not everyone feels that the regulator’s effort is stemming from malice. The crypto sphere, as everyone’s aware, is rife with frauds and scams, and getting balanced and complete information isn’t exactly a walk in the park. The SEC wants to address this issue so retail investors are protected.

However, if the U.S. already had a robust, real-time payment system, crypto wouldn’t have received as much attention as it has, Paige Paridon, senior vice president of Bank Policy Institute, argued in a program hosted by the Brookings Economic Studies.

U.K.

Crypto assets aren’t generally regulated in the U.K. However, the Financial Conduct Authority requires crypto-related companies to have effective measures in place to combat money laundering and terrorist financing.

The only FCA-regulated cryptoassets are security tokens that provide rights and obligations similar to specified investments, like a share or a debt instrument.

Canada

Canada was the first country to approve a Bitcoin exchange-traded ETF. Today, there are several crypto-linked ETFs trading on the Toronto Stock Exchange.

Crypto trading platforms and dealers in Canada are required to register with provincial regulators. The federal securities regulator also maintains a list of authorized and banned trading platforms.

Because the country considers all crypto investment firms as money service businesses, they’re required to register with the Financial Transactions and Reports Analysis Centre of Canada.

China

China has taken a draconian approach towards the industry.

In 2013, banks were banned from crypto transactions, followed by a ban on initial coin offerings in 2017. Enforcement efforts ramped in 2020 and the central bank said it blocked more than 120 foreign websites offering crypto exchange services. Crypto exchanges are banned in the country as well.

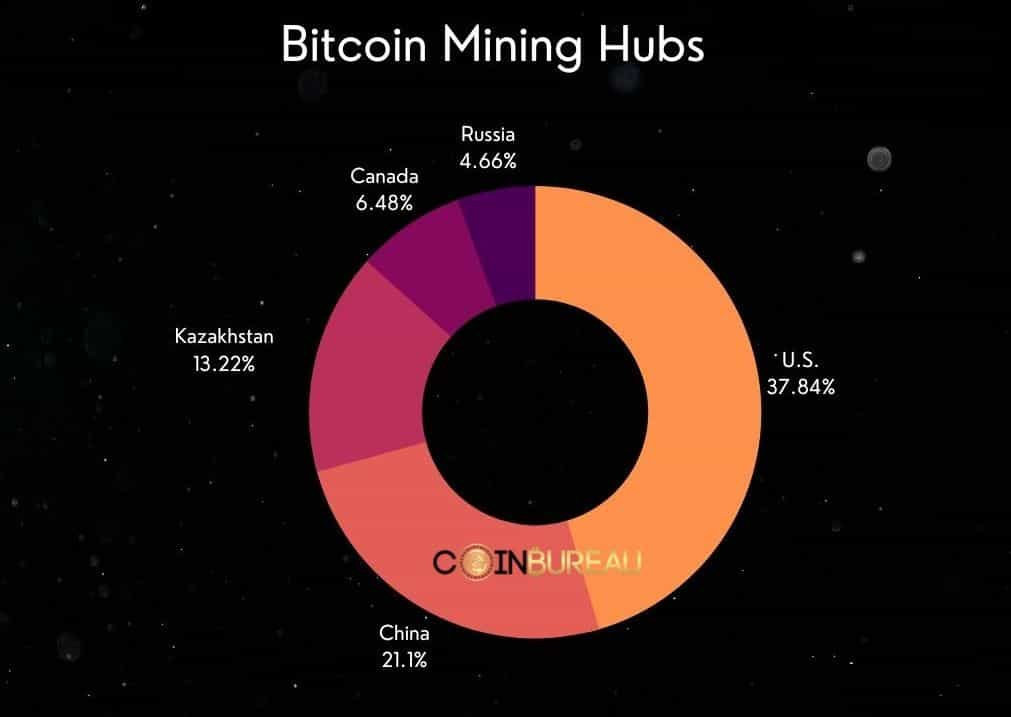

China was once the world’s largest crypto mining hub, but the government banned token mining in June 2021. However, soon after, underground mining operations emerged, and the country made up just over 21% of the global Bitcoin hashrate from September 2021 to January 2022.

The U.S. stock market is rigorously regulated, and there are laws that govern various segments of the market.

- Securities Act of 1933: This law regulates the distribution of new securities.

- Securities Exchange Act of 1934: Different from the 1933 law, it regulates trading securities, brokers and exchanges

- Trust Indenture Act of 1939: This law applies to debt securities such as bonds, debentures and notes that are offered for public sale.

- Investment Company Act of 1940: It regulates the organization of companies, including mutual funds, that engage primarily in investing, reinvesting, and trading in securities.

- Investment Advisers Act of 1940: This act regulates investment advisers

- Sarbanes-Oxley Act of 2002: This act was enacted following the Enron and WorldCom accounting scandals. It mandated a number of reforms to enhance corporate responsibility, enhance financial disclosures and combat corporate and accounting fraud.

- Dodd-Frank Act: Passed following the Great Recession, this law regulates trade, credit rating, corporate governance and corporate transparency

- Jumpstart Our Business Startups Act of 2012: This act regulates requirements for capital markets.

Even with so many safeguards in place, the stock market isn’t insulated from hiccups.

- In May 2010, three major indices — the S&P 500, Dow Jones Industrial Average and Nasdaq Composite — experienced significant declines, only to rebound quickly. The CFTC later described it as one of the most turbulent periods in the history of U.S. financial markets. New regulations were put in place following the stock market crash.

- More recently, in 2020, the stock market experienced a pandemic-induced panic selling when COVID-19 was in full swing. Prices fell so much that multiple trading halts were triggered. The stock market would later go on to rebound in August and hit record highs as the world adjusted to the new normal.

WINNER: Stocks. While crypto made a valiant effort to find its footing, stocks’ rigorous regulatory framework emerged victorious.

Round 5: Diversification and Portfolio Allocation

As the old adage goes, “Don’t put all of your eggs in one basket.”

Both crypto and stocks can co-exist in a portfolio for the purpose of diversification, something investment gurus stress so often. Diversification is basically allocating your investments among different asset classes, such as stock, bonds, crypto and cash equivalents. Diversification offers two main benefits:

- Lower risk: Because you’re spreading your investments across a range of asset classes, you minimize the effect of an investment turning sour.

- Exposure: The SEC recommends allocating your investment between asset categories and within asset categories. A diverse portfolio allows you to benefit from trends and opportunities across asset classes.

A report by the CFA Institute Research Foundation found that a quarterly rebalanced 2.5% allocation to Bitcoin would have improved the traditional diversified portfolio’s returns by 23.9 percentage points. Between 1965 and 2022, the compounded annual gain in the S&P 500 was 9.9%.

Experts are of the opinion that allocating 5% to 10% of your portfolio to crypto is the sweet spot for most retail investors. Anything more and you’d be at risk of seeing your investment wipe off if there’s a market downturn.

There’s no denying that crypto returns can beat traditional asset classes, as long as you can stomach the volatility.

WINNER: Crypto. It’s not about a knockout punch, but a winning strategy that fetches you returns.

Round 6: Investment Horizon

Investment professionals recommend a long investment horizon for a number of reasons.

- It allows you to ride market volatility.

- There’s a potential for higher returns.

- You’ll likely keep emotions at bay because you’re in it for the long haul.

Crypto is generally considered to be a short-term investment, but there are several who “hodl” (hold on for dear life), crypto parlance for buying a token and holding on to it. Both have their merits and downsides.

An example of a short-term investment, whether crypto or stocks, is day trading. The objective is to turn a quick profit, which is achievable if done right. One con is that price changes might cause you to lose your initial investment.

Long-term investors tend to focus on a small number of digital currencies, and in the case of stocks, companies flying under the radar with high-growth potential, and make a recurring investment. The hope is that they’ll be able to earn a return over the course of a few years. This strategy is less demanding.

The S&P 500’s historical emphasis has been on long-term growth and compounding returns.

Ultimately, there’s no “right” approach. Your risk tolerance, financial situation and goals will dictate how you go about diversifying your portfolio.

Winner: Tie. Both crypto and stocks are fast on their feet!

Round 7: Market Sentiment and Speculation

Market sentiment is an all-encompassing term that mainly refers to an investor’s attitude towards a particular stock. Put another way, it is the perceived feel or tone as revealed through price movement in the markets. Broadly speaking, rising prices are taken as bullish market sentiment, while falling prices are indicative of bearish market sentiment.

The CBOE Volatility Index (VIX) is perhaps the best gauge of market sentiment for stocks. Also referred to as the “fear gauge,” VIX measures the implied volatility of the S&P 500 for the next 30 days. It achieves this by tracking the amount of put options investors buy to shield their portfolios. Put options are typically bought when investors think the value of the underlying stock will fall.

A 2021 study analyzed the news sentiment of 87 companies among the most reported on Reuters for a period of seven years. The report concluded:

“There exists a weak but statistically significant association between strong media sentiment and abnormal market return as well as volatility. Such an association is more significant at the level of individual companies, but nevertheless remains visible at the level of sectors or groups of companies.” - Nature.

Crypto isn’t too different. Cryptocurrencies do not have a central governing authority. As a result, sentiment drives prices for the most part. For example, Grayscale recently triumphed in a legal battle with the SEC, which must now review the asset manager’s spot Bitcoin ETF application. Following the news, Bitcoin rose over 5%.

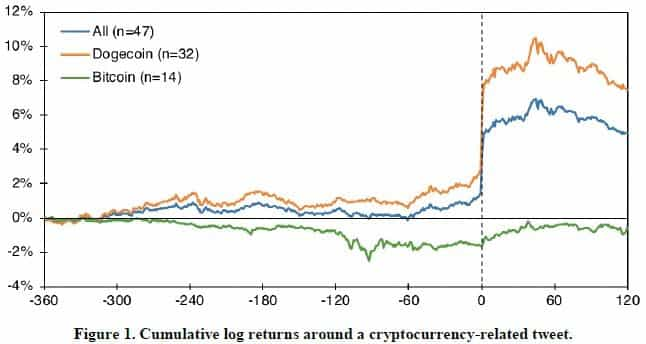

But, wait, there’s more. Elon Musk, a noted crypto proponent, single-handedly drove Bitcoin’s price higher within few hours after he added “#Bitcoin” to his Twitter bio. A 2021 study analyzed this “Musk effect” and identified significant positive abnormal returns and trading volume following his tweets.

A Harvard study advances an alternate viewpoint, concluding that the scope of speculative demand in crypto can be magnified as fund managers mimic their competitors instead of trading on their beliefs. So, if some managers are deploying funds to a particular crypto, others may follow suit, helping to increase that digital asset’s value as demand increases.

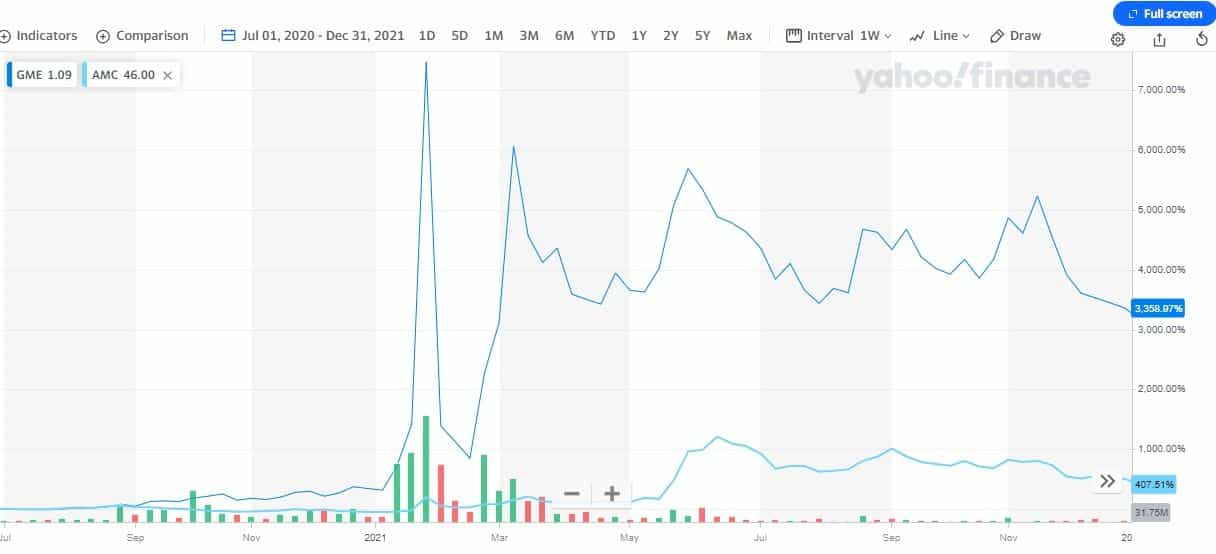

Speculation in the stock market was evident during the whole GameStop saga when retail investors stuck indoors during the pandemic pulled off a spectacular short squeeze, hyping stocks on Reddit. Enthusiastic investors piled into speculative assets and propped their prices higher.

Two darling meme stocks, as they came to be known, were GameStop and AMC Entertainment. The former saw its stock price pop over 1,000% in January 2021, while AMC’s stock price hit an all-time high in June of that year. Both would later go on to give up most of these gains.

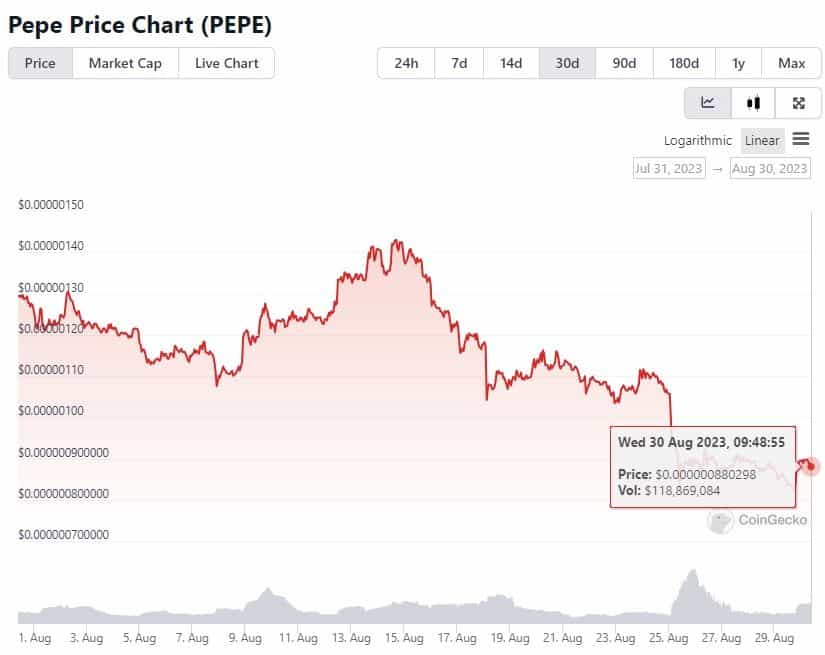

Speculation is rife in the world of crypto as well. PEPE, a meme coin with essentially no use case, reached $1 billion in market capitalization a month after its debut for no reason other than hype. But there are fears of a rug pull amid chatter of rogue Pepecoin developers changing the number of signatures required to move tokens from their multisig wallet to two out of eight from five out of eight.

WINNER: Tie. The long-reigning investment champion and the underdog aren’t too different.

Round 8: Liquidity and accessibility

Liquidity refers to the ease at which an asset can be converted to cash without affecting its market price. The same definition applies to crypto and stocks.

Liquidity provides the crypto market with stability and protects participants from the adverse effects of price swings. An asset with high liquidity, such as Bitcoin, means it can be bought and sold fairly easily without any roadblocks.

Crypto is a highly liquid asset class because you can buy and sell them via a reputable exchange. And unlike the stock market, you’re not time-bound. Crypto exchanges operate 24/7, which means you can buy and sell anytime you please. Generally speaking, larger exchanges will have higher liquidity than their smaller peers.

One metric we can use to glean insights into liquidity is market volume.

Market volume assesses the trading activity of a particular asset. A high trading volume means there is a higher interest in a particular asset, which leads to higher liquidity. Bitcoin’s 24-hour trading volume was over $25 billion, suggesting it is a highly liquid asset.

Not only is crypto highly liquid, but the industry has made significant strides in improving accessibility.

- Financial Literacy is on the rise. A survey reported a year-over-year increase in participants correctly answering questions. But a vast majority still failed.

- Crypto markets are always open. Think you have a good trade on hand to make a quick profit? You don’t have to wait for the markets to open because crypto can be traded anytime.

- There are now more crypto exchanges than ever. Buying crypto is easier than ever now. In the early days of Bitcoin, you either had to mine Bitcoin to earn it or engage in P2P transactions. But as popularity grew, regulated exchanges sprung up to fill in the demand.

- Crypto investment products are out and about. If you’re looking to take advantage of crypto’s eye-watering returns, there are several investment products on the market you can deploy capital in.

Stocks are highly liquid too. As the stock market is gargantuan, it’s more liquid than crypto.

Unlike crypto, you can only trade stocks when the markets are open (9:30 a.m. to 4 p.m. ET in the U.S.) In addition, you’ll also need a brokerage account, but apps like Robinhood have considerably lowered the barrier to entry with regards to stock investment.

WINNER: Stocks. Crypto may be making improvements from an accessibility perspective, but stocks stand victorious here.

Round 9: Innovation and technological disruption

While public financial institutions have been hesitant to embrace a digital experience, innovation and technological disruption are the driving forces behind cryptocurrencies. Powering the crypto world is blockchain technology in the form of unalterable mathematics.

Traditional banks are so far behind that their lack of digital innovation gave rise to a new breed of banks dubbed “challenger banks.”

These all-digital banks differ from legacy financial institutions in a number of ways.

- They provide a digital-first experience. 57% of Millennials are more likely to bank with a digital bank.

- Most challenger banks charge a lower fee than regular banks.

- They’re constantly innovating.

Traditional banks had started their journey to this digital transformation a while back, but it wasn’t until the pandemic hit that they put their efforts into high gear.

But crypto, or the underlying blockchain technology, has the potential to disrupt the banking industry in a variety of manners.

- Payments: Blockchain-based payments are faster and cheaper than traditional banking payments.

- Clearance and settlement: Distributed ledger technology could blow SWIFT, which powers international money and security transfers, out of the park by allowing transactions to be settled directly.

- Securities: Moving securities on blockchains, which removes the middleman, could save as much as $24 billion per year in global trade processing costs.

- Trade finance: Leveraging blockchain could shorten delivery times for cross-border trade transactions.

The report concludes:

Die-hard believers expect blockchain and cryptocurrencies to replace banks altogether. Others think that blockchain technology will supplement traditional financial infrastructure, making it more efficient. It remains to be seen to what degree banks embrace the technology. One thing is clear, however: blockchain will indeed transform the industry."

Crypto vs. Stocks: Final Bell

We’ve just witnessed a spectacle of modern finance. Here’s a round-by-round breakdown.

- Historical performance analysis: As the bell rings, crypto charges forward and displays its meteoric rise and incredible gains. Stocks fight back, showcasing their time-tested track record. In the end, however, crypto takes the round.

- Volatility and risk profile: Stocks hit jab after jab at crypto's volatility. Not to back down so easily, crypto highlights a recent headline emphasizing Bitcoin’s relatively low volatility. But stocks manage to land a solid blow.

- Market adoption and maturity: With the showdown 1-1, the contenders enter this round cautiously. Stocks showcase their decades of maturity and market adoption. Crypto retorts rapid adoption by tech-savvy individuals and institutional investors. The round is called a tie as both display strengths in different segments of the market.

- Regulatory landscape: Stocks deliver powerful punches highlighting their compliance with rigorous regulations. Crypto fights back showcasing recent regulatory scrutiny of the asset class. But it proves too much for the contender, and stocks take the round.

- Diversification and portfolio allocation: Both crypto and stocks make their case as a means to diversify an investment portfolio. Crypto’s eye-popping returns in a portfolio prove no match for stocks, however.

- Investment horizon: With the match once again tied, the contenders emphasize their ability to generate consistent returns for investors with a long investment horizon. But neither is able to deliver a decisive blow, and the round is called a tie.

- Market sentiment and speculation: Both contenders managed to match each other’s move amid proof that both are prone to sentiment- and speculation-driven price movements. The round is a tie as both sides acknowledge the sway of emotions and speculation in the financial world.

- Liquidity and accessibility: Stocks came out swinging emphasizing the ease of conducting trade. Crypto, however, showcases its 24/7 accessibility and borderless nature. With a narrow margin, stocks take the round and now lead 3-2.

- Innovation and technological disruption: With pressure now building on crypto, it enters the round with confidence nevertheless, delivering a volley of punches showcasing its potential to reshape payments, trade finance and the clearance and settlement process. Stocks fight back, but crypto takes the round thanks to blockchain technology’s potential to reshape the financial world.

After an intense battle across various dimensions, it's time to declare a winner. The match was closer than anyone thought, and in this epic clash of financial heavyweights, the judges' scorecards revealed a split decision: 3-3.

But who knows, maybe there will be a rematch!

Frequently Asked Questions

The choice comes down to factors unique to each individual, such as goals, financial situation, and risk tolerance. While stocks are a time-tested method of generating wealth, crypto's eye-popping returns may be too much to ignore for some investors.

Crypto is a loosely regulated asset class. However, regulators around the world are making efforts to regulate the industry. In the U.S., crypto has been in the Securities and Exchange Commission's crosshairs for a while.

Cryptocurrencies are digital assets, and they operate outside the traditional financial system.

Disclaimer: These are the writer’s opinions and should not be considered investment advice. Readers should do their own research.