Blockchain is a way to keep shared digital records without a central owner controlling the database.

This article is for beginners and non-technical readers who want a clear, practical understanding of what blockchain is, why it exists, and when it actually matters. It focuses on core concepts and real-world uses, not deep technical mechanics, trading, or speculation.

TL;DR: Blockchain in One Minute

Blockchain is a shared digital record that many computers keep in sync, without a single owner controlling the database. Once records are added, changing them quietly is extremely difficult because everyone can verify the same history.

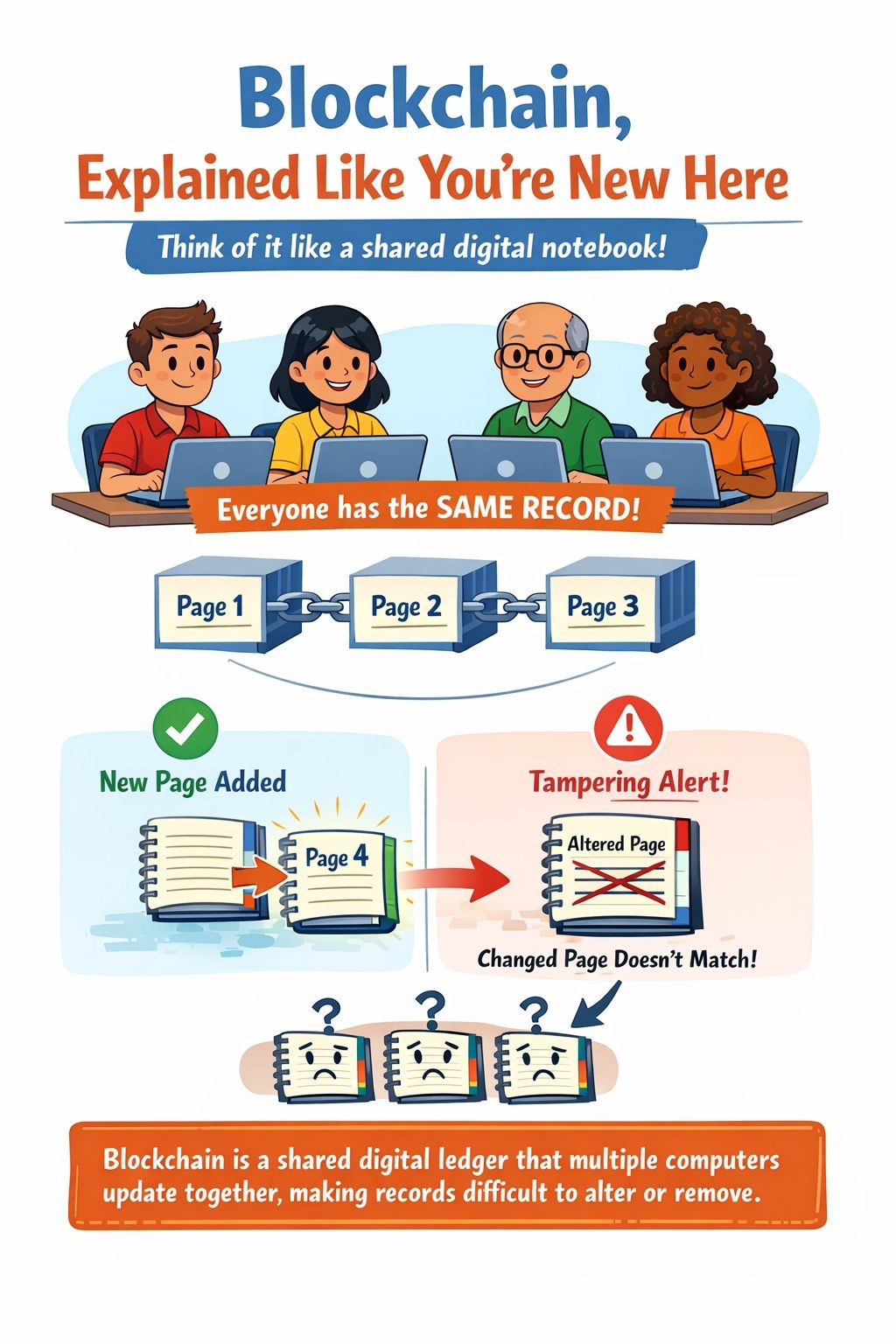

You can think of it like a shared notebook where everyone has the same copy. New pages can be added together, but erasing or rewriting old pages would immediately stand out.

The real benefit is shared trust. Blockchain lets multiple people or organizations rely on the same set of records without needing one central authority to act as the gatekeeper.

What Is Blockchain?

Think of blockchain as a shared, synchronized record book, making past changes tamper-proof.

Blockchain is a Shared Digital Ledger Everyone Can Verify And Trust

Blockchain is a Shared Digital Ledger Everyone Can Verify And TrustBlockchain, Explained Like You’re New Here

A blockchain is a digital ledger (a record book) stored as a shared database across many computers. Instead of one company keeping the “official” record, multiple participants keep matching copies. When a new record is added, it gets saved in a way that makes past entries tamper-proof (meaning: any attempt to change old records is easy to spot and difficult to pull off).

A helpful way to picture this is a shared digital notebook: lots of people have the same notebook, and everyone can see when a new page is added. Anyone changing an old page will cause a noticeable notebook discrepancy.

A One-Sentence Definition

A blockchain is a digital record system shared by many computers. Because everyone keeps the same copy and updates it together, changing or deleting past records is extremely difficult.

Why Blockchain Exists (The Problem It Solves)

Blockchain exists to solve the trust problem that happens when one person or organization controls the “official” record.

The Trust Problem With Traditional Records

Most digital records today live in central databases—the kind you’d find at a bank, a big company, or a government agency. That setup is convenient, but it creates a trust problem:

- If one organization owns the database, that organization (or anyone who breaks in) may be able to change records.

- A single database can become a single point of failure—if it’s hacked, corrupted, or simply goes offline, everyone relying on it is affected.

This doesn’t mean banks or governments are “bad.” It just means the model requires you to trust one central record-keeper and the security around it—often across many years, many employees, and many systems.

How Blockchain Fixes That Problem

Blockchain tries to reduce that trust burden by changing the default design:

- Everyone has a copy of the ledger.

- Updates happen only when the group follows agreed-upon rules (think of it as a group agreement).

- If someone proposes a “bad edit,” it gets rejected because it won’t match what everyone else can verify.

Here's an analogy: Imagine a group project where everyone has the same file open. If someone quietly changes a paragraph from last week to make themselves look better, the rest of the group immediately sees the edit history and the mismatch. That “many copies + shared agreement” idea is the core value of blockchain.

Blockchain in the Real World (Beyond Crypto)

Blockchain isn’t just about crypto. It’s useful because it helps multiple parties keep and confirm shared records—things like supply tracking, identity info, and payments—without needing a single company to run the “master” database.

Everyday Blockchain Examples

Tracking the authenticity of food and medicine supply chains. Supply chains involve various organizations, such as farmers, retailers, etc. Blockchain-style shared records can help different parties trace the same item through the chain using a common data trail. For example, IBM’s Food Trust tooling focuses on making shared supply-chain data traceable across partners.

For medicines, the U.S. FDA’s work around the Drug Supply Chain Security Act (DSCSA) includes building electronic, interoperable capabilities to identify and trace prescription drugs through distribution—because counterfeit and diverted products are a real concern.

Medical records (shared but secure access). Healthcare data is often fragmented across clinics and hospitals. Researchers and industry groups have explored blockchain-based approaches that focus on shared access control and auditability, so providers can coordinate while keeping permissions tight. This is still an evolving area (and not a universal solution), but the “shared record + permissioned access” idea is a common motivation in healthcare blockchain research.

Digital identity (proof without oversharing). Digital identity doesn’t have to mean posting your personal information everywhere. Standards like the W3C’s Decentralized Identifiers (DIDs) aim to let people prove things about themselves without being tied to one centralized identity provider. In simple terms, you can show “I’m allowed” or “I’m over 18” without handing over your entire data profile.

Cross-border payments. International money movement can be slow, expensive, and opaque. The World Bank’s remittance tracking shows that costs remain meaningful in many corridors, and global initiatives like the Financial Stability Board’s roadmap target faster, cheaper, more transparent cross-border payments. Blockchain-based payment networks are often discussed in this context because they can operate 24/7 and settle value over shared rails (though regulation and integration with existing systems are major challenges).

Digital ownership (NFTs without hype language). NFTs are simply a way to represent unique ownership records on a blockchain. On Ethereum, NFTs commonly follow standards like ERC-721, which define how unique items can be tracked and transferred in a consistent way. This can apply to digital collectibles, tickets, membership passes, or proof of ownership records—separate from any “get rich quick” narrative.

How Blockchain Works

Blockchain Records Are Created, Verified By The Network, And Locked Together Securely

Blockchain Records Are Created, Verified By The Network, And Locked Together SecurelyStep 1: Someone Creates a Record

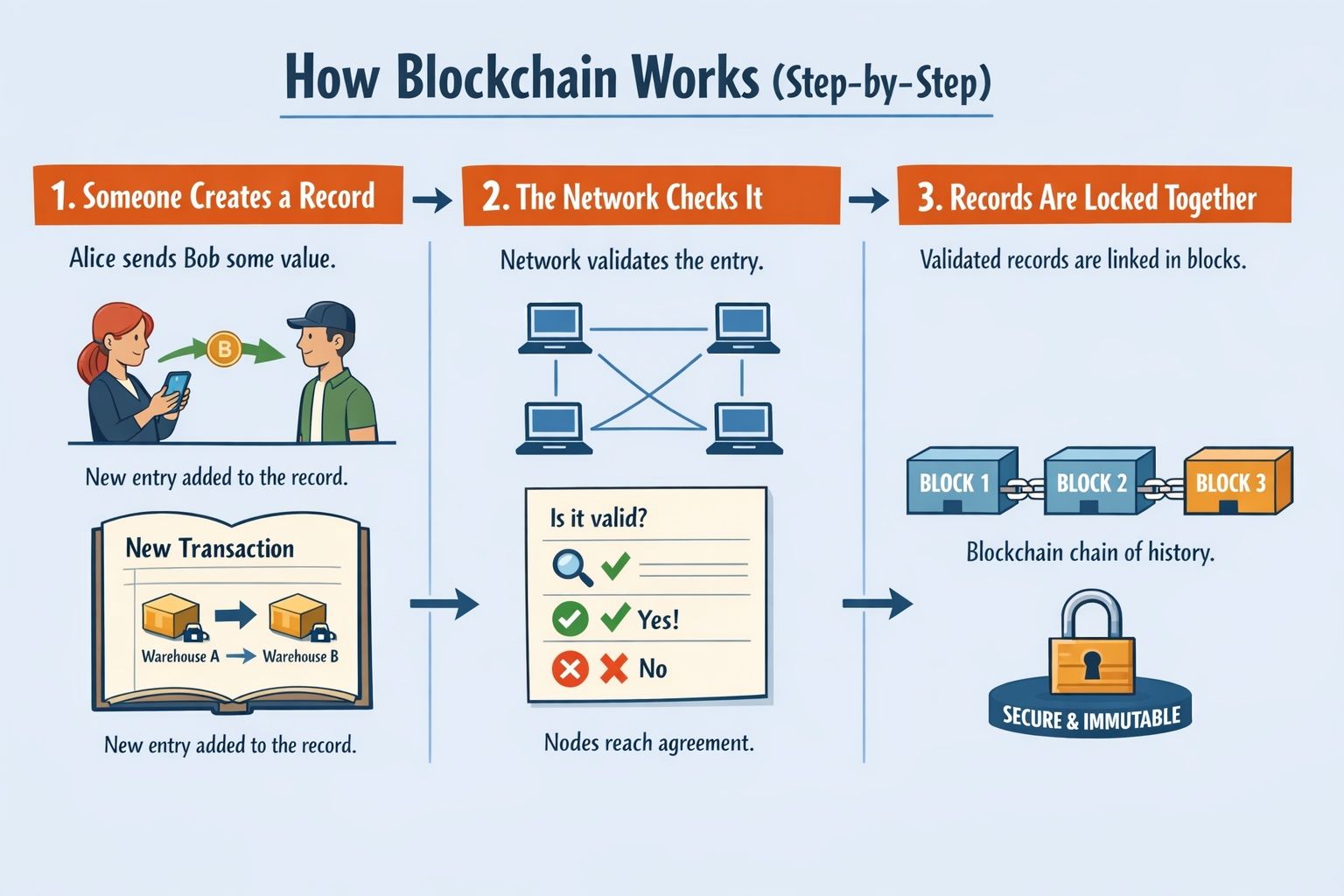

A “transaction” on a blockchain is basically a record update. That could mean:

- Alice sends Bob some value.

- A digital asset changes ownership.

- A registry entry is updated (like “this item moved from Warehouse A to Warehouse B”).

Think of it like writing a new line in a shared notebook: the network is being asked to accept a new entry into the record book.

Step 2: The Network Checks It

Next, the network’s participants (called nodes) check whether the new record follows the rules. You’ll often hear the word consensus here, but you can think of it as group agreement.

A simple analogy is voting:

- A new entry is proposed.

- Participants verify it (for example: “Does Alice actually have the right to send this?”).

- The network agrees on whether the entry is valid.

Different blockchains use different methods to reach agreement, but the beginner takeaway is the same: the record doesn’t become official just because one party says so.

Step 3: Records Are Locked Together

Once records are accepted, they get packaged into blocks (containers of validated records). Each new block includes a link to the previous block, creating a chain of history.

This linking is important because it helps create immutability in practice: if someone tries to rewrite an older block, the links stop matching, and the network can detect the tampering. NIST describes blockchains as using linked blocks to make the ledger tamper-evident and increasingly difficult to modify as it grows.

What Makes Blockchain Secure

Blockchain stays secure largely because lots of computers hold the same records. If someone wanted to rewrite history, they’d have to change it everywhere at once, not just in one database.

Why Records Are Hard to Change

The simplest reason: copies are everywhere.

If a blockchain is shared across many computers, changing one copy doesn’t help much because it won’t match the others. To “rewrite history,” an attacker would need to produce a version of events that the network accepts and that overtakes the honest copies.

So the security isn’t one magic lock, it’s the combination of:

- many copies,

- shared verification rules,

- and a history that becomes harder to alter over time.

Digital Fingerprints (Hashing, Simplified)

A hash is like a digital fingerprint for data. Change the data even slightly, and the fingerprint changes.

Why this matters for blockchain: blocks can include fingerprints of their contents (and of the previous block). If someone edits old data, the fingerprints no longer line up. It's like trying to swap a page in a book but forgetting that the page numbers and references no longer make sense.

Why Hacking the System Is Hard

To successfully tamper with a widely distributed blockchain, you generally need to do more than hack one server. You’d need to:

- Change many copies at once, or

- Convince the network to accept your altered history as the “real” one.

It’s a far greater challenge than hacking one database, particularly when networks and participants expand.

Bitcoin and Blockchain

Blockchain is the “ledger” technology used to store and verify records, while Bitcoin is a digital currency that uses a blockchain to track transactions.

Blockchain Is the Technology

Blockchain is the underlying idea: a shared ledger maintained by a network, where records are grouped into blocks and linked into a chain. It’s a general-purpose technology concept, not a single product or company. NIST frames blockchain as a distributed digital ledger replicated across participants and designed to be tamper-evident and tamper-resistant.

Bitcoin Is One Use of Blockchain

Bitcoin is the first major real-world example of blockchain: it uses a shared ledger to track who owns which bitcoin, so people can transfer value without a central “bank database.” Bitcoin’s whitepaper describes it as a peer-to-peer electronic cash system and directly addresses issues like double-spending.

But Bitcoin is not the only blockchain, and you don’t need Bitcoin to “use blockchain.” Many networks, applications, and experiments use blockchain-style ledgers for different purposes.

If you want The Coin Bureau’s deeper beginner read on this specific topic, see our explainer on what Bitcoin is.

The Medici Story

This story shows how record-keeping evolved from paper ledgers to shared digital ledgers, and why blockchain is the next step in that same trust-building journey.

From Paper Ledgers to Digital Ledgers

Long before computers, societies relied on ledgers to track value—who owed what, who paid what, and what was owned. In Renaissance Florence, banking families like the Medici helped push accounting forward with methods such as double-entry bookkeeping, a system designed to make records more consistent and easier to audit.

A useful way to think about double-entry bookkeeping is that it creates a built-in cross-check: transactions are recorded in two places (debit and credit), helping spot errors and reduce fraud. Historians of math and accounting have noted how this approach supported more complex finance and scaling banking operations.

Why This History Still Matters

The big lesson is that trust systems evolve.

- Paper ledgers improved trust compared to memory and handshake deals.

- Double-entry bookkeeping improved trust compared to simple lists.

- Modern databases improved speed and accessibility, but often re-centralized trust in one owner.

- Blockchain is another step in that evolution: a way to keep shared records when no single party is fully trusted to be the only record-keeper.

That doesn’t make blockchain “magic.” It’s a design choice for situations where shared verification is more valuable than one central administrator.

How Bitcoin Solved the Double-Spending Problem

This section explains the simple problem Bitcoin had to solve: stopping copied digital money without diving into heavy technical detail.

What Double Spending Means (Plain English)

Digital information is easy to copy. If money were just a file, you could duplicate it like a photo; send the same “$10 file” to two people.

That’s the double-spending problem: how do you stop someone from spending the same digital money twice without relying on a central authority to check every transaction?

Bitcoin’s whitepaper explains this problem directly: a payee needs a way to verify that the sender didn’t already spend the same coin elsewhere.

How Bitcoin Prevents It

Bitcoin’s approach is to maintain one shared history of transactions that the network agrees on.

In plain terms:

- Transactions are broadcast to the network.

- The network comes to an agreement on which transactions are valid and what order they happened in.

- Once a transaction is confirmed in the shared history, it becomes extremely difficult to rewrite without the network noticing.

Bitcoin’s paper describes building a chain of ownership using digital signatures and then using a peer-to-peer network to address double-spending by agreeing on a single transaction history.

Smart Contracts Explained Simply

Smart contracts are simply programs that follow “if this happens, then do that” rules automatically—no advanced coding knowledge required to understand the concept.

Smart Contracts Automatically Execute Actions When Conditions Are Met

Smart Contracts Automatically Execute Actions When Conditions Are MetWhat Is a Smart Contract?

A smart contract is an automatic rule-based agreement that runs as code on a blockchain.

A classic analogy is a vending machine:

- You put in money.

- You choose an item.

- If the rules are met (enough money, item in stock), the machine releases the snack automatically.

Smart contracts do something similar, but for digital actions. Ethereum’s documentation puts it plainly: a smart contract is a program that runs on the Ethereum blockchain, holding code and data at a specific address.

What Smart Contracts Are Used For

Smart contracts are used anywhere you want rules to execute automatically once conditions are met, such as:

- Payments: “Release funds when delivery is confirmed.”

- Insurance: “Pay out automatically if a verified event occurs.”

- Digital ownership: “Transfer ownership when payment arrives,” including NFT ownership transfers defined by common standards.

You don’t need legal jargon to understand the core idea: it’s software that can move or update blockchain records based on pre-set rules.

Ethereum and Web3

This section explains how blockchain evolved from Bitcoin’s payments focus to Ethereum’s smart contracts and the broader idea of Web3.

Why Ethereum Was Needed

Bitcoin proved that a blockchain could maintain a shared ledger for payments. But it wasn’t designed to be a general-purpose platform for many kinds of applications.

Ethereum was created to expand what blockchains could do by making them programmable, so developers could build applications (and smart contracts) directly on the network.

If you want the Coin Bureau walkthrough, you can read our Ethereum beginner guide.

What Web3 Means in Simple Terms

Web3 is often described in big, fuzzy terms, so here’s a practical way to think about it:

- User control: You can hold assets or identity credentials without needing one platform to “host” them.

- Fewer middlemen: Some services can be provided by networks and software rules rather than a single company controlling the database.

Many mainstream explanations describe Web3 as an umbrella for technologies (including blockchain) that aim to decentralize data ownership and control.

It’s not necessarily a “new internet.” It’s more like a new architecture for certain online services, especially where ownership, identity, and value transfer matter.

Read our explanation of what Web 3 really is.

Benefits and Downsides of Blockchain

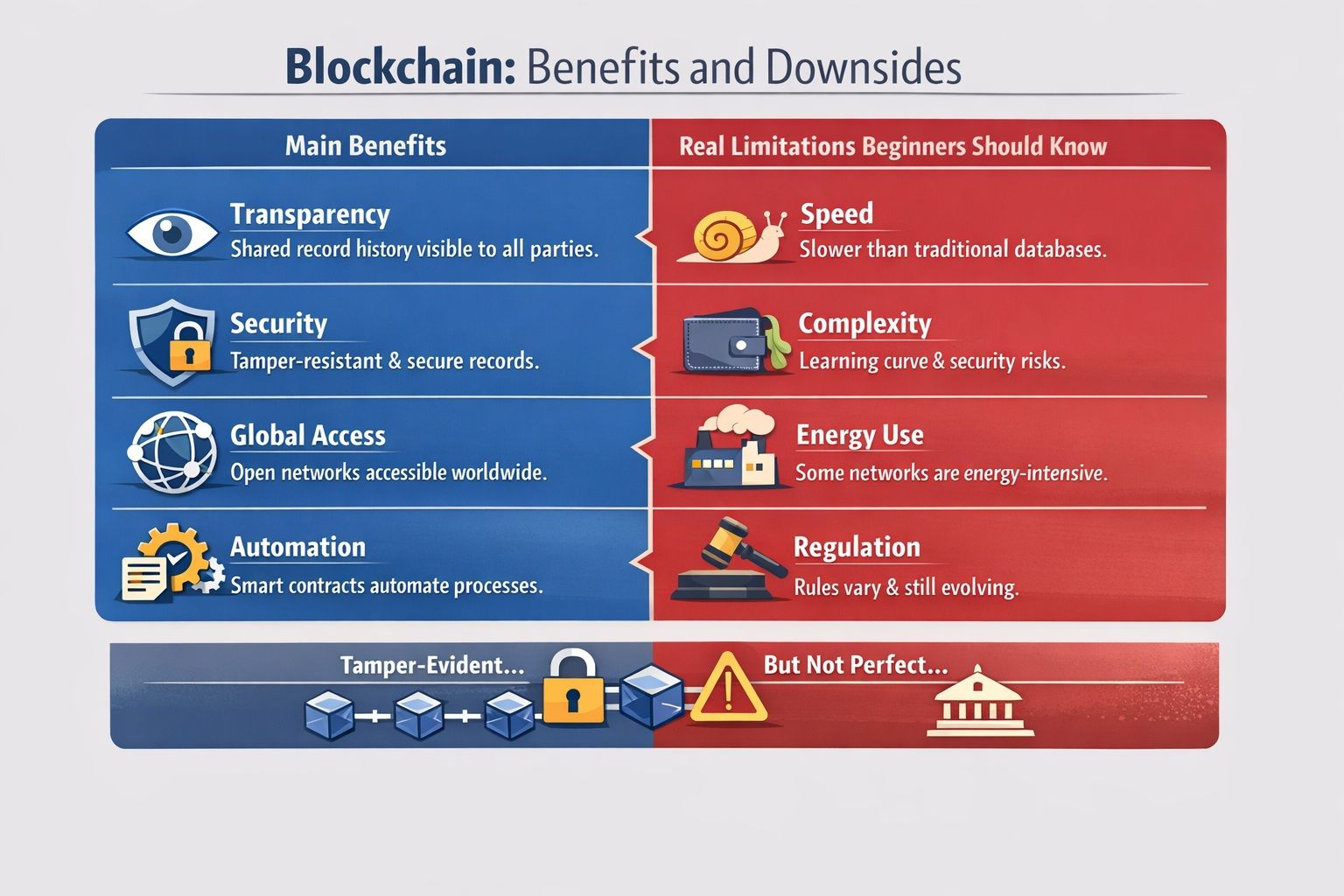

Blockchain is one of those technologies that can be really useful but only in the right situations. It does have some obvious strengths, like making records more transparent and harder to mess with. At the same time, it comes with trade-offs that people rarely notice until they actually try using it: things can be slower, harder to use safely, sometimes more energy-heavy (depending on the network), and the surrounding rules are still being written in many places.

Blockchain Delivers Transparency And Security Alongside Real World Limitations

Blockchain Delivers Transparency And Security Alongside Real World LimitationsMain Benefits

Transparency:

One of the biggest selling points is that blockchains can work like a shared record book. Instead of each company (or department) keeping its own database and arguing about which one is “correct,” everyone can look at the same history of records. That doesn’t automatically solve every disagreement but it can reduce a lot of the back-and-forth that happens when people are comparing different versions of the truth.

Security:

Blockchain stays secure mostly because it’s like a shared logbook that everyone holds a copy of and the pages are numbered and connected. If someone tries to go back and rewrite an earlier entry, the mismatch shows up. That’s what people mean by tamper-evident, and that's why it becomes more tamper-resistant as the chain grows. It’s still not invincible, but it’s much harder to quietly edit the past compared to a typical database.

Global access:

Many public blockchains are open networks. That means if you have an internet connection, you can participate; no need to ask permission from a single company or central operator. This is one reason blockchains can be attractive for global services. But there’s a very important caveat: just because a network is open doesn’t mean you can ignore compliance or local laws. Regulations still apply, and access in the real world often depends on where you live and what rules your region enforces.

Automation:

Smart contracts are basically programs that run on a blockchain and follow “if X happens, then do Y” logic. They can automate record updates and value transfers based on clear rules, which can reduce manual processing in certain workflows. In plain terms: fewer steps where a human has to double-check, approve, reconcile, or push paper from one place to another, assuming the rules are simple enough and the contract is built correctly.

Real Limitations Beginners Should Know

Speed:

Blockchains usually move more slowly than a normal database, and that’s not an accident; it’s part of the design. A single company database can be fast because one party controls it. A blockchain has to get many independent participants to agree on the same outcome, and that shared agreement process can take time, especially on large public networks. So yes, you often trade speed for the ability to run a system without one central controller.

Complexity:

This is a huge one, especially for beginners. To use blockchain safely, you usually have to get comfortable with tools and habits that most people aren’t used to, like wallets, private keys, making backups, and generally staying on top of basic security hygiene. And that learning curve isn’t just a “regular people” issue; it hits businesses, too. The tricky part is that, unlike most apps, blockchain mistakes can be pretty unforgiving. If you lose your keys, approve the wrong transaction, or get fooled by a scam, there often isn’t an easy “undo” button or a support team that can reverse it for you. That usability hurdle is a big reason why blockchain adoption can feel harder than people expect.

Energy:

Energy use really comes down to the kind of consensus mechanism a network relies on. Some networks (not all) are built in ways that can be energy-intensive, and Bitcoin is the example that comes up most often. For Bitcoin specifically, researchers at Cambridge run the Cambridge Bitcoin Electricity Consumption Index (CBECI), which estimates the network’s electricity demand. In the U.S., a 2022 White House OSTP report also looked at climate and energy questions tied to crypto-asset activity, which is part of why this topic stays in the wider public conversation. The important nuance is this: “blockchain uses a lot of energy” can be true for some networks, but it’s not a blanket rule that applies to all blockchains.

Regulation still evolving:

Regulation is still a work in progress, and it doesn’t look the same everywhere. Countries take different approaches, and the rules can move fast. Internationally, the FATF publishes guidance on how anti-money-laundering requirements apply to “virtual assets” and the businesses behind them. In the EU, frameworks like MiCA are being used to regulate crypto-asset markets more clearly. The key point: what you can do, what’s restricted, and what platforms need to do for compliance depends on your location and those expectations can change as governments get more serious about enforcement.

Do You Need to Understand Blockchain?

You don’t need to understand every technical detail, just the core idea of shared records so you can recognize when blockchain actually matters.

When Blockchain Matters to You

Blockchain becomes relevant when you interact with systems where shared records and digital ownership matter, such as:

- Payments: Especially cross-border transfers, where speed, cost, and transparency are pain points.

- Identity: Show proof (like “I’m over 18” or “I’m a student”) using verifiable credentials or decentralized IDs, without exposing extra personal data.

- Ownership: Use the chain as a receipt of ownership, whether that’s collectibles, tickets, memberships, or other assets—with NFTs serving as the ownership record when that’s the goal.

- Work and business: Makes sense for supply chains, cross-company data sharing, and audit trails; anywhere lots of people need to trust the same history.

When It Might Not

Not every problem needs blockchain.

If you’re building something where:

- One trusted organization can operate the database

- Speed and simplicity matter most

- And shared verification isn’t a major requirement

Then, a normal database is often the better engineering choice. Even many blockchain advocates emphasize that the technology is best used when multiple parties need to coordinate, and no single party should have unilateral control.

Conclusion

Blockchain is like a shared digital notebook where many computers keep the same history, which makes quiet edits hard to hide. It exists because relying on a single central database creates trust and failure risks when many parties need to rely on the same records.

Records are grouped into blocks and linked together over time, while digital fingerprints called hashes make any attempted rewriting obvious. Bitcoin is one use of this system, with platforms like Ethereum extending it to programmable applications, but blockchain still comes with real trade-offs around speed, complexity, energy use and regulation.