Planning for the Inevitable: How to Leave Crypto in Your Will

A Few Home Truths

There are some uncomfortable facts that anyone holding crypto needs to face up to. There’s the fact that, while on some days your portfolio balance may be up, up and up, on others it will be down, down and down. Learn to enjoy the ups and endure the downs. (And buy the dip, of course.)

Then there’s the hard fact that no, you didn’t get into crypto as early as you’d have liked. I wrestle with this one almost every day and I’m pretty sure I’m not the only one. What if I’d got into Bitcoin when it was below $100? What if I’d figured out how to mine it back in 2010? Why didn’t I buy more than one ETH this time last year? How could I not see that DOGE was going to rally like it has?

These two tough truths are not the sort of things we should dwell on too much. That way madness lies. We learn our lessons and accept that crypto – like a lot else in life – is always going to carry some regrets. In the end, it comes down to accepting our lot and being thankful for the good fortune we’ve enjoyed.

There is, however, one more inescapable fact we need to face up to. Like the first two it’s inevitable, but, unlike them, it’s not something most of tend to dwell on too much, even though we really should. The fact is that one day, the big crypto odyssey will come to an en end for all of us.

Yes folks, we’re all going to die sometime. Death is life’s only certainty – ignore what Ben Franklin said about taxes being the other, as the super-rich seem to have got around that one. The inevitability that we’ll all meet our end is one of those things you come to accept and dwelling on it too much isn’t healthy. But, when next you log in to see how your portfolio is doing – sometime in the next five minutes if you’re anything like me – consider this fact afresh.

What Happens to When You Check Out?

There is no better example to consider here than that of the godhead himself, Satoshi Nakamoto. The creator of Bitcoin quite naturally allocated a few BTC to himself – a tidy one million, in fact. Since then, these coins have sat in his wallet and have never been touched.

The consensus amongst most in crypto is that Satoshi has left us for the great cypherpunk convention in the sky. Unless he has for some reason decided not to touch a stack of BTC that would make him one of the wealthiest people on the planet, it’s fair to assume that he is no longer with us.

But, with Satoshi being (presumed) dead, the question of what happens to that almighty hoard of wealth has a pretty simple answer: nobody can touch it. Ever. Unless he left the private keys in someone else’s possession, those one million BTC - a little under 5% of the total supply, remember – are gone for good.

It's a pretty sobering thought. Perhaps it’s what Satoshi wanted and there is a slim chance that there’s another explanation as to why those coins have sat there doing nothing for over a decade. But even if there is, the story of Satoshi’s stacks should resonate with all of us.

The moral of this story is: when you die (as you inevitably will) unless you leave clear instructions about how to access your crypto, then it too will be gone forever. If you only ever bought ten ADA and then lost interest altogether, then this will probably be no great loss – assuming ADA doesn’t seriously moon between now and your demise, that is. But if you’ve carefully nurtured a portfolio over time, then you need to consider what you want to happen to it when you’re gone.

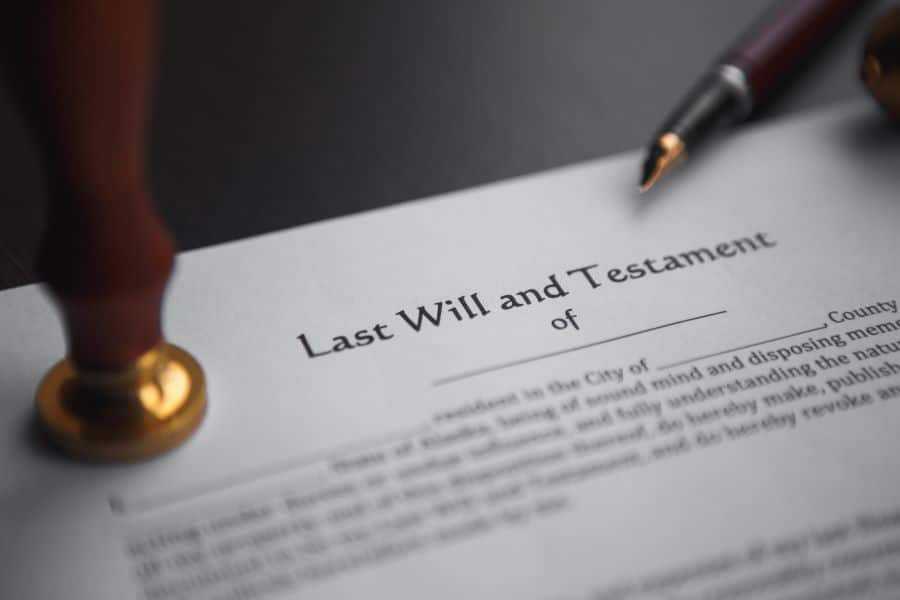

It goes without saying that everyone should make a will. If you don’t, then you can leave behind one hell of a mess for your loved ones to clear up, at a time when they’re probably stressed enough as it is.

Where There’s a Will…

I’ve seen this happen to friends and family in the past: a parent has died intestate (without leaving a will) and they, as next of kin, have had to deal with a mountain of paperwork to try and get things sorted out. One friend told me that, after his father died without leaving a will, he had to spend every weekend for over six months picking up the pieces. That time spent going through the process of probate and dealing with solicitors is not something he remembers fondly.

If you want your loved ones to have the benefit of your hard-earned pile of crypto after your death, then you need to make sure that instructions about how to access it are left in your will. Otherwise, they almost certainly won’t be able to touch a satoshi of it.

Many of us invested in crypto are relatively young and might not have even considered making a will before. Well, now it’s time. If you’re like me then perhaps you happily assume that you’ve still got decades left and boring legal stuff can wait. There’s still so much to do, so many sats to stack.

If the last year has taught has anything, it should be that life is pretty precarious. Covid may have mostly carried off the elderly and ill, but plenty of young and healthy people the world over have died of it too. Quite apart from all the misery and suffering that has resulted in, that’s also potentially a lot of crypto assets that have been left in limbo – assets that would doubtless benefit grieving families.

Going about making a will should be relatively straightforward, though it will vary depending on which country you live in. A good starting point may be to speak to your parents (if you still have any) and get advice from them. They may be able to point you in the direction of the family solicitor or suggest some other options.

A little research will tell you what needs to be included in your will and, in most cases, the document will have to be signed by at least two witnesses who are not named as beneficiaries in the will itself. It must then be safely stored, either with a solicitor, bank, or a similarly trustworthy custodian.

If in doubt, then it’s a good idea to employ a legal professional to help you write your will, as they will know how to structure it correctly and ensure that it is clear and unambiguous. You can write your own will and have it witnessed to make it a legally binding document but, as any self-respecting crypto investor will appreciate – doing your own research is vital.

If you live in the UK, the gov.uk website is a good place to start, though not all governments provide online resources like this. Nevertheless, there is a wealth of online material which will talk you through the process, wherever in the world you live.

Getting Started

When making your will and deciding who you would like to inherit your crypto, you should first make a careful inventory of all your digital assets. There are plenty of helpful tools that you can use to keep track of your various holdings such as Accointing and Blockfolio, which are especially useful if you have assets stored across a variety of wallets and exchanges.

Speaking of wallets – if you have a sizeable hoard of crypto, then you should definitely consider investing in a hardware wallet. Keeping large amounts of crypto on an exchange is asking for trouble, as exchange hacks have happened in the past and will almost certainly continue to happen in the future. Although any reputable exchange will have excellent security and keep the majority of its assets in cold storage, entrusting your entire stack to any one place is a terrible idea.

If you want to learn more about hardware wallets and which are the best ones to go for, then good old Guy has a video that will tell you everything you need to know.

Next Steps

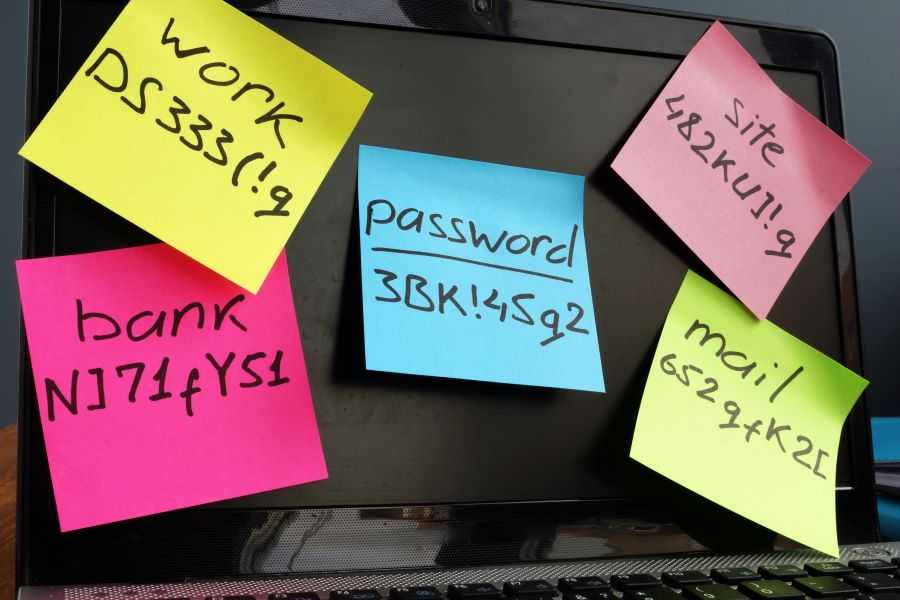

Once you’ve made an inventory of all your crypto, you should make sure that you have all the necessary information with which to access it. It’s easy to get blasé about this, as most of us are by now used to logging into various apps via our smartphones, with often only a fingerprint of PIN code required. Remember, when you’re gone, PINs and passwords go with you and, unless some deeply macabre situation has unfolded, your loved ones won’t have your fingerprint handy either.

Depending on how many wallets or exchanges you have crypto stored on, this could end up being a lot of information that needs gathering. The best way to go about things is to imagine yourself in the shoes of someone with no idea about how to access your crypto. What information will they need? Do not assume that they will be familiar with any part of the process.

This information should include PIN codes, passwords, seed phrases and any other security details that might be needed. If you’re sensible, these should be different for every wallet and exchange account. That way, if someone shady gets their paws on some of your information, they can’t use it to clean you out entirely.

Your beneficiaries should also know where they can find your hardware wallet if you use one. If you’ve done a good job of hiding it up to now, it may well be horribly difficult for them to find – something they won’t thank you for, even if there is a ton of money stored on it.

You should also provide the access information for any online password managers, as well as links to the exchanges and custody services you use. Assume that the person you're granting access to is starting from square one.

It’s also vital to ensure that your loved ones have the necessary information to access your phone, computer and email accounts. It’s all well and good them having your Binance login details, but matters will be made a lot easier if they can gain access in the same way you did. Having access to your devices will also enable them to use the two-factor authentication you should have set up. It may also be that vital information is stored on your computer, so make sure they know where to look.

The best way to ensure that all this information is accessible is to write down a step-by-step guide that can either go in your will or be entrusted to your next of kin to be opened in the event of your death. List all the places where you have crypto stored, along with a clear guide about how to access each one. This is a good opportunity to review your security procedures too and to check that every repository you have is properly fortified.

Once you’ve written out this guide, you can check whether you’ve set out the process correctly by sitting down with the person you’re naming in the will and go through the process step-by-step. This is particularly useful if your beneficiary is unfamiliar with crypto.

Keep it Secret, Keep it Safe

The obvious downside to writing all this information down is that if it gets into the wrong hands then your crypto could be seriously compromised. You therefore need to choose a safe and secure way to store all this information, which can then be accessed by your beneficiaries after your death.

If you’re storing your will with a bank or other secure custodian, then you can take the opportunity to store your vital information here too. Another good option is a safe deposit box – it may seem extreme, but keeping your crypto safe is of paramount importance if you want to have any to pass on.

When writing your will, it’s important to make reference to the fact that you’ve written down this information and leave instructions as to where it is and how it can be accessed. It’s important however not to put this information in the will itself. This is because wills become part of the public record during the probate process and this will obviously risk leaking your access information.

The best place to leave this information is therefore in a memorandum to your will. This is a separate document that does not go on record but which can still be cited in your will, meaning that only your beneficiaries will be a party to it. Or, you could store all the relevant information in an encrypted document or safe deposit box and use the will’s memorandum to pass on the access information for either method.

The other, much riskier option, is to store your account details yourself and make sure that your beneficiaries know where they can be found. This makes them more vulnerable in the event of a burglary or house fire, but does at least ensure that they can be quickly retrieved after your death.

Leaving Crypto in Trust

While passing on your crypto holdings via your will is one option, another is to leave them in trust, for your beneficiaries to gain access to at a later date. A trust is a method of estate transfer that hands control to a third party when the creator of the trust dies. This third party – the trustee – then administers the trust according to the conditions laid down by its founder, for the benefit of their successors. You can get a more detailed breakdown of the difference between wills and trusts here.

There are a number of advantages to using a trust, not least of which is the fact that it can be quicker, easier and cheaper than going through probate. This is the process by which your property is submitted to the court and then distributed according to the terms of your will (if you’ve left one). This can often take weeks, or even months, during which the value of your crypto could decrease. It can also incur court costs and can drag on for years if other parties decide to contest the will.

Placing your crypto in a trust means that it does not need to go through probate and your trustee can distribute it to your beneficiaries as you have stipulated. This could be right away, or at a later date if your beneficiaries are younger. Court delays and costs are avoided and your successor trustee can carry on running the trust according to your wishes.

A trust is also a great option if your beneficiaries are not tech-savvy, as you can appoint a trustee who is to ensure they receive the funds. It’s also a great deal more private than leaving it in your will, as it won’t go through the courts and be subject to scrutiny. If you have a large crypto stash then you could stipulate that the trustee manages it for longer, either to grow the holdings, or to disburse portions of them at regular intervals. This way, you can maintain a degree of control over your crypto even long after you’ve gone.

Do Lawyers Need to be Involved?

As we’ve seen, if you decide to draw up a will yourself and have it witnessed correctly, then it can function as a legally binding document. That at any rate is the case here in the UK – if you live elsewhere then you should double-check with the authorities there, as their rules may be different.

However, if your will is more complicated than simply leaving all your worldly goods and chattels to one particular person, or you’re worried that there may be difficulties in interpreting your wishes, then it’s always best practice to seek legal advice. A local Google search will point you in the direction of the sort of professional you need to speak to, be it a solicitor, lawyer, notary etc. Again, this may vary from country to country.

Trusts do require a great deal more to set up, though as we’ve seen they have a number of advantages over wills. If you decide to set up a trust for your crypto, then you’ll need to seek legal advice.

Communication is Key

Let’s face it, crypto can be daunting for some. There may well be many future beneficiaries out there who are unfamiliar, uncomfortable with or downright hostile towards crypto. Therefore it’s important to discuss these matters, where possible, with the people you’re planning on leaving it all to.

If the beneficiary of your crypto is unwilling to deal with digital assets when you’re no longer around, you should make sure that they know how to convert them to fiat currency once they’ve inherited them. Again, this can be done by leaving instructions along with your passwords and private keys, but talking through these issues is time well spent.

It will save them a lot of worry and stress if they know in advance that they can cash out your assets if needed. It’s also important to explain to them that transaction and exchange fees are likely to be levelled on any withdrawals.

Alternatively, you can make sure that the executor of your will – the person responsible for seeing that your wishes are carried out – is familiar with crypto and with converting it into cash. Having someone trusted to take on this job could also save your loved ones a lot of trouble and anxiety further down the line.

A conversation with your loved ones about getting access to your crypto in the wake of your death is probably not an appealing prospect to many people, but is a necessary step all the same. That way, you can gauge how receptive they are to the idea of taking on your digital assets and also get a clearer idea of what sort of information you need to leave them.

Talking through matters like these is also a healthy and responsible step to take. Planning for the future is vital, even if it’s a future without you. If you have children then your crypto investments could one day go towards their college funds, or help them in any number of other ways, so there’s no excuse for burying your head in the sand.

It may be that your intended beneficiaries themselves hold crypto, so any conversation about what to do with yours should also prompt them to put similar measures in place. You will thank yourself for bringing the matter up if you one day turn out to be bequeathed their crypto instead.

It Pays to Plan Ahead

It’s not much fun planning what to do with your crypto when you’re no longer around to enjoy it, but it’s one of those steps any responsible hodler needs to take.

Most of us probably have dreams about using our crypto to provide for us in later life or to help finally buy that dream home we’ve always wanted, take the holiday of a lifetime, or fulfil any number of other daydreams that, let’s face it, are all that get us through the day sometimes.

With a bit of luck, those dreams will become a reality for us one day. But an unfortunate few will check out earlier than expected and assuming that it won’t be you is just tempting fate. Crypto is not some passing fad and it’s going to be one of the forces that shape our lives in the years ahead. Those who see it as here today, gone tomorrow need to think again.

A bit of careful planning is all that’s needed to ensure your crypto lives on after you’ve shuffled off this mortal coil. We all know it can be a wild ride and we all wish we’d got into it sooner. There is however pretty much nothing we can do about either of those facts.

We can though plan for the future and for when we’re gone. We may not be able to take it with us, but we sure can make our crypto keeps doing wonders for our loved ones after we’ve gone. Leaving a nice stash of sats is the best way for any true hodler to be remembered, after all.

Disclaimer: These are the writer’s opinions and should not be considered investment advice. Readers should do their own research.