Celer Network Review: The Next Layer 2 Scaling Solution

The Celer Network (CELR) is another high profile project that is looking to develop a layer-2 scaling platform.

More specifically, it wants to enable developers quickly build and operate highly scalable decentralized applications. They join a long list of companies that are trying to acheive similar ends. Celer Network is also quite well known as they are completing their ICO on the Binance Exchange Launchpad.

However, should the project be considered given the number of competing solutions?

In this Celer Network review we will give you everything you need to know about the project including its technology, roadmap and team members. We will also analyse the long term potential of the CELR tokens.

What is The Celer Network?

The Celer Network is building off-chain solutions to help scale blockchain throughput. The project claims that its network will scale to billions of transactions per second, giving it internet level scalability.

The theoretical reasoning is that since the network processes transaction off the blockchain its throughput is limited only by the number of nodes in the network. Throughput will increase linearly as more nodes get added to the network.

Although there have been doubters, the Celer team remains confident their off-chain solution to scalability is the right direction to take. They acknowledge that on-chain solutions such as sharding and alternate consensus methods can make a blockchain faster. But they also point out that there will always be limitations to on-chain consensus that keep it from reaching internet-level scalability.

In order to provide a suitable decentralized application (dApp) platform this internet-level scalability is needed. Celer Network is designed as a way to scale dApps in a user-friendly interface. At some point in the future it could be as easy to connect to the Celer Network as it is to connect to the internet today. And this is what dApps need to achieve mass adoption.

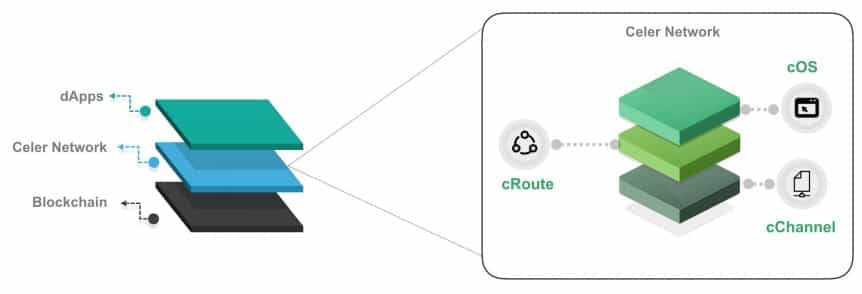

The Celer team has named its architecture the cStack, and it is a four layer architecture based on the same principles that allowed the internet to become so successful. The four layers of the cStack are as follows:

- cApps – This is where applications will reside and it is designed to scale and to maintain user privacy. The team has already released the first working cApp.

- cRoute – This is the protocol developed for routing states, such as a payment, in a trust-free manner between users. The protocol is said to be highly resistant to failure, and able to scale to 15x greater throughput than the Lightning Network or Raiden.

- cOS – This is the development framework for dApps that will handle storage, operation, tracking and any disputes of off-chain states.

- cChannel – The cChannel is a sidechain suite which maximizes liquidity and supports rapid state transitions. This layer of the architecture will allow Celer to transition to large throughput applications such as online gaming, decentralized exchanges, prediction markets, insurance products and online auctions.

The CELR Token

The upcoming ICO on Launchpad will be selling the CELR token, which is the native token for the Celer Network. There is a total supply of 10 billion CELR and nearly 6% of that will be available in the ICO, with pricing at $0.0067 per token.

There is a hard cap of $1,500 per account, and the tokens can only be purchased with Binance’s BNB tokens. While the ICO is planned for March 19 through March 24 it is likely that it will sell out within hours of the previous Fetch and BitTorrent ICOs on Launchpad are any guide.

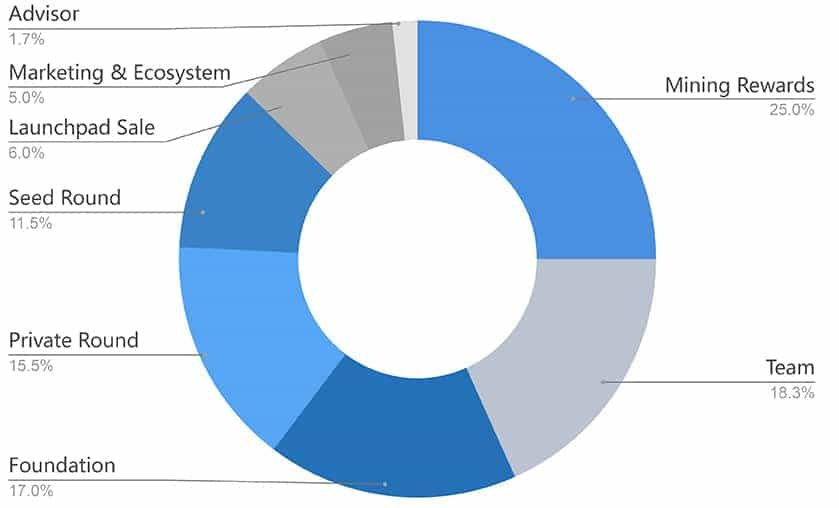

You can see the breakdown of the distribution of funds from the ICO. The Binance Launchpad sale is only a small percentage of the funds and there were two previous fund raising rounds took place which saw the distribution of a sizable portion of the coin supply.

There was a seed sale of tokens for 11.5% of the CELR and a private sale for a further 15.5%. In terms of the vesting period, they are 10 months for the former and 3 months for the latter. Hence, you are unlikely to see much selling pressure at least for the first three months of the project.

There are several uses being planned for the CELR token, from adding value for users to providing network security and stability. Of course it will be used as a platform currency, but it is also planned to have the following additional uses:

- Proof of Liquidity Commitment (PoLC) – This is a mining process that is designed to maintain liquidity. It is a staking system in which users have to lock up CELR for a period of time and are rewarded with additional CELR tokens.

- Liquidity Backing Auction (LiBA) – This will allow off-chain providers to request liquidity, and lenders will be able to stake tokens to offer them as loans. The lenders will be ranked in the system based on the number of staked tokens, the liquidity already provisioned, and the interest rate being offered.

- State Guardian Network (SGN) – Any user will be able to submit their state before going offline to have it protected for a set period of time for a set fee. Holders of CELR tokens will be able to stake them to earn service fees for providing state protection.

As is true for most blockchain networks, the CELR tokens should gain in value as more users join the network and use the tokens. An increasing number of applications will also help support increased value, as will transaction speeds and ease of use. And the above mentioned incentive features will also help to increase demand for the CELR token, thus increasing its value.

Team & Partners

The Celer Network and its team are based in California in the United States. It is a small team, comprised of the four founders (all of whom are PhDs) and 8 additional team members, most of whom are blockchain developers.

You can learn more about the four co-founders below:

- Dr. Mo Dong – Dr. Dong was previously an engineering team lead and product manager at Veriflow, where he worked on network formal verification for four years. He has a background in game theory, formal verification and distributed systems.

- Dr. Junda Liu – Dr. Liu was previously at Google for seven years, performing a number of roles. His background is in large-scale networks and high performance networking.

- Dr. Xiaoxhou Li – Dr. Liu spent two years at Barefoot Labs as a software engineer, and previously he was a research assistant at the University of Pennsylvania, Intel, Microsoft and Princeton University. His background is in data management, storage, networking and distributed systems.

- Dr. Qingkai Liang – Dr. Liang was a research assistant at MIT Laboratory for over four years and also held research intern roles at Bell Labs and Google. His background is in network control algorithms and distributed systems.

There are also some pretty well known investors and VC firms that have taken part in the earlier stages of the Celer Network. These include the likes of Pantera capital, Arrington XRP Capital and FBG Capital among many others.

Finally, they have also entered a number of commercial agreements with other blockchain based projects. For example, they are piloting cross-shard off-chain transactions with Quarkchain, testing Qtum's new x86 virtual machine and working with Chainlink to combine real world information with layer-2 scalability.

Development & Roadmap

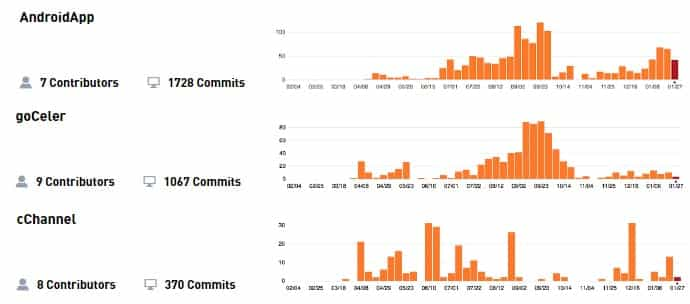

The Celer network has been working on their technology for some time already. For example, they released their whitepaper back in June of 2018. Hence, we can get an idea of how much work has been done by looking into Celer Network's GitHub repositories.

The Celer network has a public GitHub repository where you can view the recent activity. However, because this is still a relatively new project, the bulk of their development work is taking place in their private repositories. However, they have shared this data in this Binance Research report.

As you can see from the above, there has been an enormous amount of code commits in these repositories over the past 12 months. This shows that the developers have been quite active getting their product ready before they moved on to their crowd sales.

The Celer team will slowly start pushing these private commits to their public repos in batches. In other words, the release is done as a single code drop on each occasion instead of regular daily commits that would take place in a traditional GitHub.

Despite this though, the extent of the development is quite impressive for a project that has yet to complete an ICO and is more than I have seen for other projects at this stage. This all makes sense when viewed in conjunction with the extensive development roadmap that they have laid out.

So, what can we expect to see from the project over the coming year?

Below is a breakdown of what we can expect to see for the upcoming quarters for the Celer Network:

As we are toward the end of the first quarter of the year, it will be interesting to see how much of the development goals they meet from above. This could give a good indication of whether they can realistically meet their milestones in the quarters that follow.

Opportunities and Challenges

Celer appears to have some competitive advantages over other similar projects that could help lift it to prominence. Chief among these is its demonstrated speed, with the network performing 15x faster than rivals thanks to its generalized state channel and channel balancing solutions. In addition to being faster, there have been reports of inefficiencies from the Lightning Network and other similar projects showing Celer may be more advanced than competitors.

The four founders are a benefit to the project, with strong backgrounds in network infrastructures, distributed systems, and performance networking. They also have years of experience with some of the largest tech companies and research labs.

Celer has avoided the obsolescence problem by becoming blockchain agnostic. Because it can work with any blockchain there is no chance of it becoming obsolete due to the blockchain it supports losing support. And not least of all the staking mechanism used by Celer Network ensures the token will remain valuable.

On the other side of the spectrum there are some concerns and challenges faced by Celer. One is the lack of marketing the project has seen so far, although that may be changing as the team now includes two Marketing & Operations members. Along the same lines there is very little social presence for the project, with less than 10,000 Twitter followers and just 39 followers of the Celer Network sub-Reddit.

Let’s not forget the competition the project faces from more established payment networks such as Raiden, Funfair and the Lightning and Loom Network.

Conclusion

Celer Network is ready to launch the third ICO on the new and popular Binance Launchpad platform, and while the competition of off-chain scaling solutions is stiff, the popularity of ICOs on Launchpad almost guarantees this ICO will sell out quickly.

With that in mind, similar projects have had poor post-ICO performance (Raiden at 0.45x ICO price and Trinity at 0.05x ICO price). The fact that we are deep in a bear market could help limit downside however.

In looking at the proven speed of the network (15x faster than rivals) and the projected scalability it appears Celer Network could be a ground-breaking technological development, but it remains unproven. The Celer Network is also a fairly new project, having gotten its start in June 2018.

The team has deep knowledge and expertise, and this could give them an edge in delivering a unique off-chain scaling solution.

That said, this solution could be some time in coming, so those looking to participate in the March 19 ICO on Launchpad may need to show a good deal of patience in waiting for a working product.

Disclaimer: These are the writer’s opinions and should not be considered investment advice. Readers should do their own research.