Eightcap Review: Complete FX Broker Overview

Access a variety of markets, including FX, shares, indices, commodities, and cryptocurrencies, with Eightcap, a multi-asset broker. Eightcap is a great option for traders looking for a straightforward and transparent trading environment because it offers a range of trading platforms, including MetaTrader 4 and MetaTrader 5, as well as affordable fees and spreads.

Eightcap is a reasonably well established CFD broker that offers leveraged trading of up to 500:1.

They are based in Australia and have been growing internationally over the past few years. This is on the back of their relatively attractive asset offering as well as their thin spreads.

However, are they a safe broker?

In this Eightcap review, we will give you everything that you need to know about this broker. We will dig into their online reputation and history. We will also give you some top tips when it comes to trading here.

Overview

Eigthcap is based in Melbourne and was established in 2009. The parent company is Eightcap Pty (Ltd). Their head offices are located at level 11, 356 Collins Street in the city. They also have offices in Shanghai.

They are a CFD broker which offers Contracts For Difference on a range of different assets. They also operate a "no-dealing desk" STP (Straight Through Processing) model which means that traders are getting close to the "raw" spread.

Given that Eightcap is a CFD broker, they offer leveraged trading with a maximum leverage ratio of up to 500:1 on assets including forex, commodities, equities and cryptocurrencies.

Although they are based in Australia, they offer their services to over 100 countries around the world. They have also had their website translated into 7 different languages including German, Spanish, French, Italian, Chinese, Japanese and Thai.

There are, however, quite a few regions that are restricted due to licences. Some of the most relevant countries on this exclusion list include the USA, Japan and some provinces in Canada

Is Eightcap Safe?

Broker safety and client protections are some of the most important criteria for us when we are reviewing their products. This is especially true given the bad reputation of unregulated firms have garnered.

So, where does Eigthcap stand?

Regulation

We were happy to see that Eightcap was fully regulated by the Australian Securities and Investment Committee (ASIC). They have an AFSL licence with number 391441. This means that they are regulated by a reputable governmental body.

This regulation comes with a number of advantages:

- Capital Reserves: The first and most important requirement in order to get a licence is that the broker has adequate capital reserves to meet any shortfalls. ASIC requires the broker to have A$1m in reserves.

- Background Checks: There are a number of KYC checks that the broker will have to undertake before they will get issued a licence. These include at the director and company level.

- Segregated Accounts: Another really important requirement that a broker has to meet is that they have segregated bank accounts for the broker's funds and those of the client. This ensures that in the event of any unforeseen circumstances the client's funds will never be touched

- Regular Reporting: It is not just about meeting the requirements up front before they are given a licence. The broker has to send the agency updates on their financial position and liquidity ratios

Apart from knowing that the broker has met these requirements, you also have the comfort of knowing that there is some agency to talk to in the event that you have a complaint with a broker. There are regular reporting protocols in place at the ASIC.

Audits & Insurance

Another independent party that can make sure that Eightcap is well covered in terms of liquidity is their auditors. Eightcap uses an independent external auditor that monitors their capital adequacy. They also perform daily client money conciliation on their accounts.

Eightcap also has professional indemnity insurance. This means that if ever the broker was liable to legal action that could result in payments, they will be covered. Brokers that do not have this coverage risk liquidity shortfalls in such an event.

Assets & Leverage

Eightcap appears to offer a pretty standard suit of assets to trade on. They have Forex (Major & Minor), equities, commodities and cryptocurrencies.

When it comes to their forex pairs, they have over 40 which is about in line with most other brokers. However, they are lacking in terms of the coverage for their commodities with only four assets on offer. If you were looking for more assets to trade then you could consider Pepperstone.

They also have a pretty average equity product offering and you can only trade index CFDs. There are no options to trade single stock assets. They offer 10 different index CFDs for you to trade.

Take note ✍️: The index CFDs will have different trading hours.

On the crypto side, they offer 6 different cryptocurrencies which is slightly above the norm. These include the following:

- Bitcoin (BTC)

- Bitcoin Cash (BCH)

- Bitcoin Gold (BTG)

- Ethereum (ETH)

- Litecoin (LTC)

- Ripple (XRP)

It is important to take note though that when you are trading these cryptocurrencies, you are not buying them as an asset. These are not physically delivered but are rather derivative instruments that are marked to market every day.

Leverage Limits

Eightcap offers leveraged instrument trading. This means that you are trading on margin where the required margin is multiples smaller than the size of the position that you are taking on. In the case of the max leverage (500:1) the margin requirement is only 0.5%.

The amount that you put up for the margin will need to be topped up if the position moves against you. This is what is called a "margin call". If the position deteriorates past your margin call level then it will be stopped out.

Be Careful ⚠️: If you are stopped out, all shortfalls in margin are your liability.

When you first open an account at Eightcap, they will set the default leverage at 100:1. If you would like to request higher leverage limits then you can reach out to the customer support once you have been verified.

It is also worth noting that the maximum leverage that you are allowed on cryptocurrencies is only 1:5. This is actually quite low compared to other CFD brokers such as IQ Option.

In order to protect from the risks that are posed with leverage, Eightcap has limits in place around the maximum equity that is allowed in the account. These include the following:

| Available Leverage | Min. Account Equity | Max. Account Equity |

| 500:1 | $500 | $5,000 |

| 400:1 | $500 | $10,000 |

| 300:1 | $500 | $50,000 |

| 200:1 | $500 | $100,000 |

| 100:1 | $100 | $100,000+ |

| 50:1 | $100 | $100,000+ |

| 25:1 | $100 | $100,000+ |

| 1:1 | $100 | $100,000+ |

So, while leverage at 500:1 can be an attractive proposal if you are making money, it can be as detrimental on the downside if the position moves against you. Practice adequate risk management.

Eightcap Spreads & Fees

Given the size of the positions that you are taking on, the spreads on said positions can have a big impact on your profitability. So, they are an important criteria for us...

At Eightcap, the exact spreads that you will be charged are determined by the type of account that you have. They have their Standard account and their Raw account. The latter account has close to market "raw" spreads.

Below are some examples of the spreads that you will get for the respective assets on the Standard (S) and Raw (R).

- AUD/USD: 1.0 - 1.4 pips (S) / 0.0 - 0.4 pips (R)

- GBP/USD: 1.2 - 1.8 pips (S) / 0.2 - 0.8 pips (R)

- EUR/CHF: 1.0 - 2.5 pips (S) / 0.0 - 1.5 pips (R)

- EUR/AUD: 1.0 - 2.5 pips (S) / 0.0 - 1.6 pips (R)

- AUD/USD: 1.0 - 1.4 pips (S) / 0.0 - 0.4 pips (R)

- AUS200: 1.0 - 1.2 pips

- SPX500: 0.3 - 2.5 pips

- XAU/USD: 20 - 30 cents

- UKO/USD: 0.05 - 0.59 points

- Bitcoin (BTCUSD): 40 - 50 pips

- Ripple (XRPUSD): 1 - 2 pips

As you can see above, the spreads on the forex pairs are quite reasonable although 40-50 pips on Bitcoin is quite high. Also note that while the raw spreads are lower than standard, you will be charge a fixed "lot commission". This is $3.5 per lot that you trade.

In addition to the spreads, you may also be charged what is called the "Swap fee". This will vary according to market conditions and you can see it in your MT4 / MT5 dashboard.

The swap fee is essentially an overnight rate that is applied on your positions. It is used in order to account for the different interest rates that the currencies have. The swap rate could be positive or negative depending on the relative interest rate differential. This swap rate is charged at 00:00 every night New York time.

Take note ✍️: You will be charged a "3 day fee" on Wednesday evenings to account for no swap charges on the weekend.

Thankfully, there are no other fees that are applied to the account. There are no withdrawal fees as well as funding fees. However, if you are to make an international wire, they will charge you a $25 fee for the telegraphic transfer.

Eightcap Account Types

As we mentioned above, there are two different account types in the standard and the raw.

The standard account is probably the most beginner friendly for those that are just getting started at Eightcap. You have full access to both platforms as well as deep liquidity and market leading spreads.

The Raw account gives you direct market access which means that you will have slightly lower spreads (close to zero on forex). There is no dealing desk and you are guaranteed near instant execution on your orders.

We were quite impressed to see that there are very few restrictions on strategy with these accounts. You can use scalping, hedging as well as develop your own EAs (more on this below).

Both of these accounts have a minimum deposit requirement of $100 which is pretty reasonable. Moreover, the minimum lot size that you can trade is 0.01 lots. This makes it perfect for those beginner traders who would like to ease their way into the markets.

In the end, what account you do decide to set up will depend on your trading volume. If you are trading a great deal then the money you save on spreads will be greater than the commission you are charged on the lots. However, if you are starting out small then you may want to stay with the standard account.

Eightcap Demo Account

Of course, why risk funds initially if you can try for free?

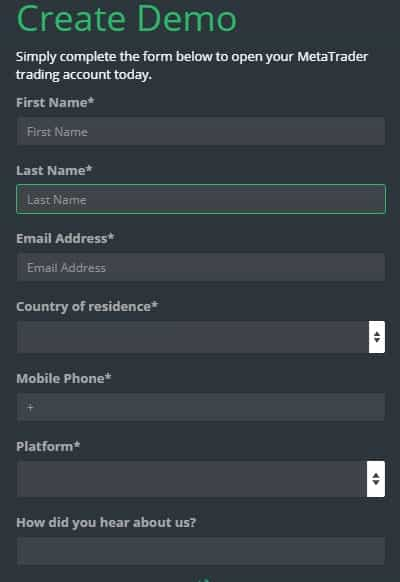

Eightcap has a standard demo account that allows you to trade with full functionality and demo money. This is a great way to test the platform out in a non-threatening way without the risk of loss.

The demo account is a no obligation trading account. All you need to do in order to get access is give them your contact details as well as the platform that you would like to try out (see below).

Apart from giving you a sense of how the platform works as a beginner, it also gives the more professional traders a chance to observe the spreads that Eightcap is charging. The demo funds can always be topped up and you can get it up to $1m in base currency.

Unfortunately, there is a 30 day limit on all demo accounts although there is nothing stopping you from opening multiple accounts.

Eightcap Platforms

For most traders out there, you will be happy to know that Eigthcap uses the most popular trading software currently on the market. These are the MT4 and MT5 platforms.

This software is developed by a third-party company called MetaQuotes and it is in use by a vast majority of brokers around the world.

Let's take a deeper look into these platforms…

MT4

The MT4 is the original platform that was developed by the company. It is perhaps the best known to traders and is the preferred platform at the brokers.

In terms of the trading technology, you have an extensive collection of charting features and can overlay your charts with a number of technical studies. This is why the MT4 platform is a favourite among technical analysts.

While the MT4 platform is quite advanced, this should not deter beginner traders. It is still relatively intuitive and you have quick buy / sell functionality right there on the dashboard. There are also a plethora of online guides on how to use it.

The MT4 platform also has its own proprietary coding language called MQL4. This allows you to code your own EAs or "Expert Advisors". EAs are automated trading scripts that you can run 24 hours a day as a trading robot.

The platform is also available across a range of different devices and operating systems. You can trade through a web-browser, on a PC, MacBook as well as through their Android and Apple mobile apps (below).

Take note ✍️: Eightcap does not have cryptocurrencies or equities on MT4. Use an MT5 for that.

MT5

As you probably were able to infer, the MT5 is the slightly more advanced and upgraded platform developed at MetaQuotes. With it, you can trade the full suite of assets at Eightcap.

The MT5 platform has been improved from a UI perspective and there are a number of features that have been added. These include the likes of a full order depth chart as well as an economic calendar right there on the platform.

They have also updated the coding language that is used to develop the EAs. MQL5 is more of an object orientated language. This means that you have more functionality and can even develop your own custom indicators. Backtesing is also made much more robust with MQL5.

There is also a pretty large community of MT5 users with whom you can talk to about your scripts. If you want to use an EA but don't know how to code then you can use this community where scripts are freely shared.

Like with the MT4 platform, this is available on a number of different devices. They have the web-trader, PC / Mac client as well as a mobile app.

Eightcap Mobile App

Unfortunately, Eightcap does not have a mobile app where you can administer your account, deposit or withdraw funds. You will still have to do this through a mobile browser.

However, as mentioned, you have full access to the MT4 and MT5 mobile apps. These are available in both iOS and Android and are the most popular trading applications in these respective stores.

Both of the apps are packed with features and still have the functionality to place charts, manage orders and execute quickly with one click trade functionality. You can also monitor the trading performance of your EAs.

If you take a closer look into the app store reviews you can see that they are overwhelming positive (see image below). It's no wonder then that the MT4 app has over 10m+ installs whereas the MT5 app has over 1m installs.

Ratings in iStore and Play store for MT4 (left) and MT5 (right)

So, should you use the mobile app to trade?

Well, we always prefer the desktop client to trade on. This is because you still have way more functionality when you are on a PC. Charting on a mobile screen is quite a difficult task indeed.

You also have to consider other factors when it comes to mobile trading. This includes such things as spotty mobile connections and order latency. Yet, if you have to be away from your desk then the mobile apps are better than any other.

Deposits & Withdrawals

Eightcap let's you fund an account in a number of different currencies. You can open an account in AUD, USD, GBP, EUR, NZD, CAD and SGD.

Funding

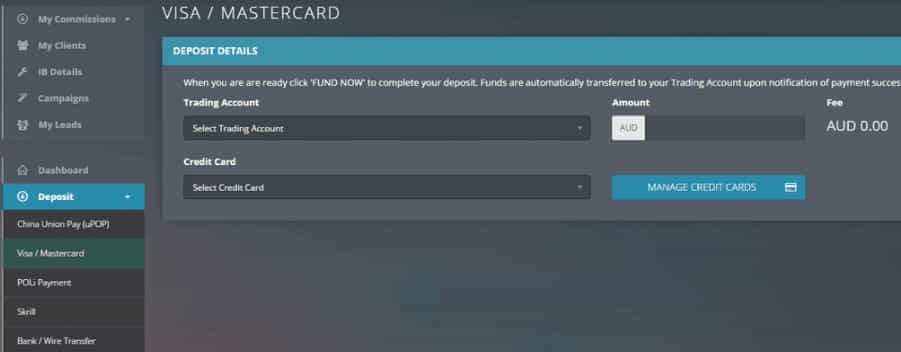

If you want to fund your account then you will need to head on over to your client portal and navigate to the deposit menu. You will be presented with an option to choose your payment method.

There you have a range of payment options the Eightcap accepts. Below are a list of the payment gateways and the terms that come with them.

- Credit / Debit Card: They accept Visa and Mastercard funding. This has instant processing and has $0 transaction fees. The available currencies are in AUD, USD, GBP, EUR, NZD, CAD and SGD.

- POLi Payment: This is another quick and easy online funding method for Australian clients. This will clear instantly with 0 fees but it is only available in AUD.

- Wire Transfer: If you are more of a fan of traditional funding methods then you can always send money through a wire transfer. This may incur some fees though and it could take 1-3 business days. The available currencies for this method are AUD, USD, GBP, EUR, NZD, CAD and SGD.

- Bpay: Another quick and simple funding option available for Aussie traders is through Bpay. This has no transaction fees but will take a day or two to clear.

- China Union Pay: If you are based in China and would like to make a payment in RMB then you could use this payment method. There are no transaction fees and it should be instantaneous.

- Skrill: This is one of the most popular online web wallets around and used to be called "money bookers". If you want to fund your account in USD or EUR then you can use this with no fees. It will take about a day or two to clear

So, it appears that the quickest methods for you to get your funds to the broker are through a card. You can make a payment 24 hours a day and the moment that your funds hit the brokers account then they will work to credit it.

NB 🚨: Eightcap will not accept third party deposits so make sure to send it from an account in your name!

Withdrawals

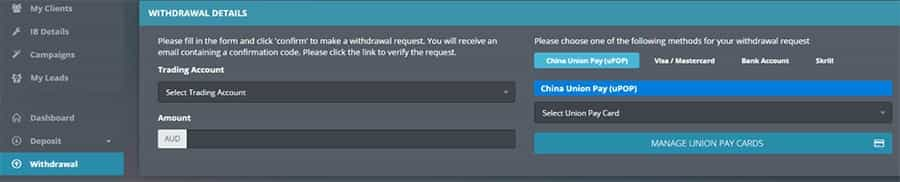

Withdrawals are just as simple as deposits. In your client portal you will navigate to the "Withdrawal" section. You will be presented with the below form where you can select the withdrawal amount and method.

If you are going to be requesting a withdrawal, make sure that you have completed the KYC requirements. It is in the terms and conditions of Eightcap to refuse a withdrawal until they can verify their traders.

All of the withdrawal requests at the broker that are submitted before 01:00pm AEST / AEDT will be processed on the same business day. If the request does not meet this deadline then it will have to wait till the next day.

If you have funded your account by a card in the past 90 days then when you withdraw they will send you back the initial funding via your card. If your withdrawal is for more than you funded then the balance will have to paid through another method. The same protocol will be followed for deposits that were made in Skrill.

If you are withdrawing to a bank account then this could take between 2-5 days if it was a SWIFT withdrawal. While there are no withdrawal fees that are charged at Eightcap, they will ask you to cover the $25 fee for telegraphic transfers.

As is the case with the deposits, you cannot make a payment into a third party account so it will have to be in your name.

Eightcap Customer Support

We all know that customer support can make or break your experience at a broker. Hence, it is a really important criteria for us when it comes to rating these brokers.

At Eightcap, they have a pretty standard selection of methods whereby you can reach customer support. You can reach them on email at [email protected]. They also have a phone line on +61 3 8373 4800 for that personal touch.

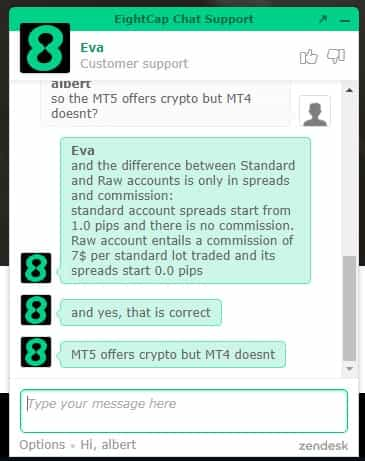

But, perhaps the most user-friendly method that we found was the use of their online live chat function. This is a 24-hour manned Zendesk chat function. When we tried reaching their agents, we were attended to instantly.

Indeed, it does not appear to just be us. Through a number of different forums and trader groups, the broker has got good feedback for the way that they deal with their traders and potential customers.

Promotions

There are a number of promotions that are on offer at Eightcap. These are a nice touch that sweeten the deal when you create an account.

The first promotion that they were running was their $30 no deposit bonus. This is essentially free trading money that you can use to start your account off with. This is much less risky than a standard bonus which requires a deposit.

This bonus only runs at certain periods and you will only be able to withdraw your bonus once you have completed the minimum required trading volume. We encourage you to read the T&Cs before you make use of such an offer in the future.

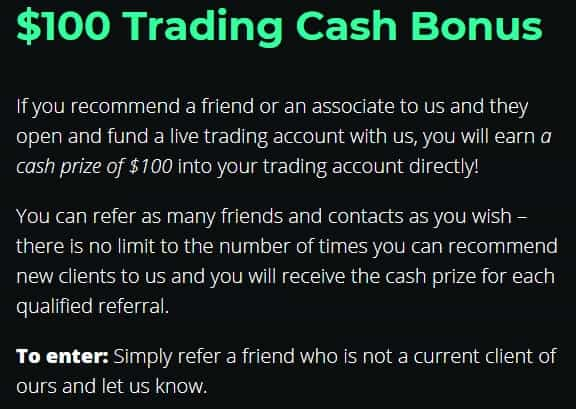

Another promotion that they have currently going on is the introducer bonus. This will give you $100 for each trader that you refer to the broker which subsequently funds an account. You can refer as many friends as you want.

Of course, even though they have called this a "promotion" it is not really that. You can think of it more as a referral / affiliate scheme that is offered by other brokers and exchanges.

Analysis & Education

As with most other brokers these days, Eightcap has included some free education material. This is great for those new traders who are looking for some guidance on strategies and more general forex lingo.

Trading Analysis

Eightcap provides general market updates and analysis to all of their traders. This covers some of the most important market movers during the day. It also takes a closer look at the impact of potential Economic announcements on the forex market.

They also provide some pretty helpful technical analysis on key levels for a number of different forex pairs. These could help supplement the analysis that you have completed independently.

These market updates are pretty well written and are relatively intuitive. However, they are unlikely to be as comprehensive as the resources that you can find on other websites and forums.

Education & Trading Strategies

These guides are more for the beginner traders and walk you through the basics of Forex trading. They cover such disciplines like the difference between fundamental and technical analysis etc.

They also delve a bit more in depth into specific trading strategies that you can employ. These are mostly related to technical analysis-based trading that is formulated based on important charting indicators.

These are pretty succinct and well written. They are also quite instructive with numerous charts that help illustrate the strategies in question.

Metatrader Guides

Struggling to understand the MT4 & MT5 platform?

Eightcap has provided a range of Metatrader guides that take you through the platform step by step. These cover such aspects as installation, setup, account management, trading and charting analysis.

As is the case with the other education material, these are well written and include a host of images which graphically take you through the platform. Hence, we would definitely suggest reading through these if you are new to Metatrader.

What We Didn't Like

Our Eightcap review would not be complete without listing some of the things that we thought warranted an improvement.

Firstly, we were slightly disappointed with their asset coverage. They only have 4 commodities asset on offer and two of these are oil (WTI & Brent). You also cannot trade any single stock assets and the only equity that you can trade are index CFDs.

Secondly, although they do offer crypto assets to trade, these have low leverage limits of only 1:5. This is far below the limits that we have seen at other crypto futures exchanges such as BitMEX et al with 100:1 leverage.

We were also quite disappointed to see that they did not have any third party plugins or integrations on offer. These are pretty standard at other brokers and help clients to copy trade, complete in-depth analysis or follow signals. There were also no VPS deals where traders could set up their own independent EAs.

Lastly, they do not provide Islamic accounts nor do the accept a range of clients from regions like the USA, Japan etc. This means that traders of this faith or from this region will have to find an alternative broker.

Conclusion

In summary, Eightcap appears to be a pretty reasonable broker. They are fully regulated with low fees, fast execution and a responsive customer support desk.

They also offer their traders some of the most advanced platform technology through the Metatrader suit. This allows them to trade a pretty reasonable range of assets which should satisfy most traders.

Of course, there were quite a few things that we did not really like and that we thought needed to be improved. Whether these are deal breakers is something that you will have to decide based on your own trading preferences.

So, should you give Eightcap a try?

Well, they could be an attractive option if you are looking for a no-nonsense CFD broker with low and transparent spreads.

Warning ⚡: If you do decide to trade with Eightcap, be sure to use risk management. Leverage is a double-edged sword

Disclaimer: These are the writer’s opinions and should not be considered investment advice. Readers should do their own research.

Disclaimer: These are the writer’s opinions and should not be considered investment advice. Readers should do their own research.