OctaFX Review: Complete Forex Broker Overview

With a variety of trading account types appropriate for any strategy and skill level, OctaFX is a reputable forex broker. OctaFX is a great option for investors looking for an economical way to start trading because of its low opening balance requirements, cheap spreads, and selection of trading products, including CFDs on forex, commodities, indices, and cryptocurrencies.

OctaFX is a well established CFD and Forex broker that has grown considerably over the past few years.

Through a combination of low fees, advanced technology and efficient customer support, OctaFX has managed to expand into over 100 countries. They have opened up to 300,000 accounts and achieve $4bn in daily volume.

While this is impressive, can they really be trusted?

In this OctaFX review we will take an in-depth look into this broker by delving into their tech, fees, regulation and reputation. We will also give you some top tips in order to make the most of your experience on their platforms.

Overview

OctaFX was established in 2011 and they are based in St Vincent & The Grenadines. The holding company that controls the broker is called Octa Markets Ltd and their offices are at suite 305, Griffith Corporate Centre, Kingston.

They also have a subsidiary company that is based in Cyprus and is called Octa Markets Cyprus Ltd. This is the entity that holds their CySec regulatory licence (more on this below).

They are well known for being one of the best STP (Straight Trough Processing) ECN brokers on the market. This means that they do not operate a dealing desk and can therefore give you some of the lowest fees.

Moreover, given that they are using the STP technology, their execution is well known in the industry and they have some of the lowest rates of slippage on the market. Leverage on the broker can be as high as 500:1 on some of the Forex pairs and they make a market in a number of different assets.

Although they are a global broker that is able to accept clients from over 100 countries, the bulk of their traders come from Asia. There are also some jurisdictions where they cannot accept clients and these include the likes of the USA etc.

Is OctaFX Safe?

This is one of the most important questions for any trader. You need to make sure that you are trading with a broker that has all the right protections in place in case of unforeseen circumstances.

So, how does OctaFX stack up?

Regulation

As mentioned above, OctaFX has a subsidiary entity that is based in Cyprus. This has been regulated by the Cyprus Securities and Exchange Commission (CySec) with licence Number 372/18. This means that they will fall under the jurisdiction of this authority.

Given that this is a European licence it means that they are allowed to offer their services to clients across the EU. This is because of the European "passporting" laws that form part of the MiFID directive. Essentially, licence's in one region can work throughout the Union.

So, what does this mean for you?

In order to get a CySec licence there are a number of tests and checks that the broker must pass. They are also monitored on an ongoing basis to make sure they are in compliance of these:

- Background Checks: If a broker is applying for a CySEC licence then the company that is involved in the application as well as all of the directors will have to undergo rigorous background checks.

- Investor Compensation: CySEC mandates that all regulated entities are to contribute to a shared investor protection fund. This fund will protect all of those accounts that have over €20,000 in them in the event that a broker is to under.

- Advertising Rules: There are a number of restrictions on how these firms can advertise their services. These include restrictions on bonuses etc.

- Capital Requirements: Apart from the cost that comes from applying for the licence, these brokers must meet certain minimum capital requirements. These can be seen as buffer funds at the broker and they have to be substantial

Apart from all of the above benefits that come from regulation, there is also the comfort that comes from knowing that you have someone to turn to. If ever you have any complaints about the broker then CySEC has a self reporting portal.

Segregated Accounts

Something else that OctaFX does that helps protect clients is their use of segregated funds. This essentially keeps the funds in a bank account that is seperate from that of the main broker operations.

This means that the broker cannot use client funds for their own business. It also means that the broker can easily meet all client withdrawal requests the moment that they are instituted without any sort of liquidity crunch.

Assets & Leverage

OctaFX seems to offer most of the standard asset classes including Forex, Commodities, Equities and Crypto. However, delving into the assets themselves shows the coverage to be rather lacking.

On the forex side, there are a number of minor forex crosses that are not included. Most emerging market currencies are excluded. With respect to equities, they only offer indices with no single stocks and on the commodities side, they only have Gold and Silver on the micro account.

Moreover, on the crypto side they only have three cryptocurrency pairs being Bitcoin (BTC), Litecoin (LTC) and Ethereum (ETH).

However, what they do lack in terms of asset coverage, they may make up for in leverage.

Leverage

Given that OctaFX is a CFD broker, this means that you will be trading on margin and with leverage. This means that your gains and losses are multiplied by this leverage factor.

The amount of leverage that you can take out on each trade depends on the account that you have created as well as the asset that you are trading. At OctaFX you have a maximum of 1:500 leverage that can be attained on their currency pairs as well as 1:200 for metals and 1:50 for indices.

We were, however, quite disappointed with the leverage on the cryptocurrency assets. OctaFX only allows you leverage of 1:2 on these pairs. If you are looking for a broker with higher limits on crypto then you can look at IQ Option.

Having said that though, OctaFX does offer their traders negative balance protection. This will help ease the fear of traders as it means that they will never lose more than they have deposited into their accounts.

Spreads & Fees

When trading at a broker with leverage, one of the most important factors to consider is the asset spreads as well as any other fees that may apply.

In general, OctaFX has some pretty low spreads when compared to the competition. For many of their major Forex pairs these spreads are close to zero and are especially low for their ECN accounts.

Apart from just being tight, there is also no slippage nor re-quotes.

When it comes to the exact spreads that you will be charged on the trade, it will vary slightly according to the type of account that you have chosen. Here are some live spreads (in pips) that we have pulled for the Micro/Pro/ECN:

- EURUSD: 0.9/0.8/0.8

- USDJPY: 1.3/1.1/0.8

- EURCHF: 2.2/1.4/1.2

- AUDCAD: 2.7/1.5/1.7

- Gold: 2.7/3.3/3.0

- Nasdaq: 1.5/1.5/NA

- Bitcoin: 1.7/1.7/NA

Of course, these are not the minimum spreads that you will sometimes see being quoted. You can see a complete list of the spreads that are applied to the different assets on their spreads page.

You are also likely to incur some other trading fees based on the account that you have.

For example, if you are on the Micro account then you may have to pay a swap fee. This could be a fee or a rebate as it is tied to interest rate differentials outside of the control of OctaFX.

If you are on the MT5 Pro account then you won't pay a swap fee but you will have to incur what they call their "Three Days Fee". This is charged every third rollover, that is, every third night at Midnight.

If you have an ECN account then you won't be paying either a swap or an overnight fee. However, you will be paying a fixed "Lot commission" on the lots that you trade.

Finally, you will be happy to know that there are no withdrawal / deposit fees at OctaFX and they will cover all fees that are incurred by their payment processors.

OctaFX Account Types

As mentioned before, there are three main account types that you can use at OctaFX. The choice of these accounts will determine the platform that you trade on and the fees that are applied.

Starting with the entry level, you have the Micro account. This is run on the MT4 platform and it has the lowest minimum deposit amount at only $100.

Then you have the Pro account which uses the slightly more advanced MT5 platform. This offers slightly lower spreads than the Micro account and will have less trading costs for higher volume. The minimum deposit is slightly higher though.

Finally, you have the ECN account which is run on the OctaFX cTrader platform. This is the platform that allows for STP and the lowest execution latency. These do come with lot commissions though.

For a more in-depth breakdown of the accounts, you can take a look at the table below:

| Micro | Pro | ECN | |

| Platform | MT4 | MT5 | cTrader |

| Spread | Floating, starting at 0.4 pips; Fixed, starting at 2 pips | Floating, starting at 0.2 pips | Floating, starting at 0 pips |

| Commission | No сommission, Markup | No сommission, Markup | No markup, Commission |

| Recommended Deposit | $100 | $500 | $100 |

| Instruments | 28 currency pairs + gold and silver + 4 indices + 3 cryptocurrencies | 28 currency pairs + 4 metals + 2 energies + 10 indices + 3 cryptocurrencies | 28 currency pairs + gold and silver |

| Leverage | Up to 1:500 for currencies, 1:200 for metals, 1:50 for indices, 1:2 for cryptocurrencies | Up to 1:200 for currencies, 1:100 for metals and energies, 1:50 for indices, 1:2 for cryptocurrencies | Up to 1:500 for currencies 1:200 for metals |

| Margin Call / Stop Level | 25% / 15% | 45% / 30% | 25% / 15% |

| Swaps | Optional | No Swap | No Swap |

| Overnight Commission | Swap / Swap free commission | 3 days fee | Weekend fee |

| CFD Trading | Yes | Yes | No |

| Crypto Trading | Yes | Yes | No |

It is also important to point out that all of these accounts have a minimum lot size of 0.01 with no cap on the maximum size of lots that you wish to trade.

Moreover, you are allowed to hedge your positions, use scalping techniques as well as code your own Expert Advisors (EAs) on all of these trading accounts.

Islamic Account

OctaFX is also known for offering one of the best Islamic accounts in the industry. These accounts are 100% Shariah compliant and you will pay no interest on your overnight positions.

Their Islamic account is available on all of their trading accounts that they have listed above. All that you will need to do is to check the "Swap Free" box when you are signing up at the broker.

If you wanted to see the commission that you would pay on particular Islamic compliant trades then you can visit this page. It has a handy tool at the bottom where you can select the asset, trade size and account type. This will tell you how much you are likely to pay.

OctaFX Demo Account

Why risk the funds initially?

If you would like to give OctaFX a try in a risk-free environment then you could always set up a demo account. These replicate the live trading platform but you will be given demo money to initially trade with.

You will have free access to all of the trading accounts and these are unlimited. You can top up your demo funds on request while you refine your trading strategies or test your trading bots.

Something else that we found quite exciting about the demo platforms at OctaFX is that they have a range of trading competitions. These include their champion demo contest as well as the weekly cTrader demo contest.

These have real money prizes that are attached to them. For example, on the Champion demo the first prize is $1,000 credited to your account. The cTrader competition is for a weekly draw of the $400 prize pool. You can read more about these competitions on their demo page.

OctaFX Trading Platforms

We were quite impressed with the selection of online and computer-based trading platforms at OctaFX. These include the MT4, the MT5 and the cTrader platforms.

What is surprising though is that they have split the platforms according to the account type that you hold. We have gone over these above and if you are looking to use a particular platform then you will have to open that account.

MT4

This is perhaps the most well-known trading platform on the market and is used by countless brokers around the world.

The MT4 platform is developed by the Metaquotes company as third-party trading software. The platform was developed by traders for traders and has a plethora of tools and charting.

For example, you have advanced order forms where you can set parameters around your positions. You also have numerous technical analysis indicators and studies that you can overlay your charts with.

Moreover, you can code your own trading algorithms and bots on the MT4 platform. This is through the use of the their MQL4 programming language which was developed specifically for this platform.

The MT4 platform is available in three different formats. There is the web based platform, a PC and Mac based version as well as a mobile version that is available in iOS and Android.

For the most efficient trading experience we will advise you to use their computer based trading software. These are likely to give you the most tools and functionality. You are also likely to have less latency as you are connected directly to their servers.

MT5

For those traders who have chosen the pro account, you will be able to use the slightly more advanced MT5 platform.

As you would most likely have guessed, this is the latest generation trading software that has been developed by MetaQuotes. This has a different layout to the MT4 platform so it may take a bit of time getting used to.

However, there are a range of different features that are have been packed into the MT5 platform. These include things such as market depth charts as well as an economic calendar right there on the platform.

Moreover, there is much more functionality when it comes to coding your EAs. This is because the MT5 uses an object orientated language called MQL5. You also have one-click trading on the MT5 platform which is not available on MT4.

Like with the MT4 platform, you can trade the MT5 on a PC, on a Mac as well as through a mobile app on an iOS or Android device.

cTrader

This is the platform that will give you the STP access with some of the lowest spreads on the market.

cTrader is also quite a sophisticated platform and comes with a host of features. For example, it comes with level 2 quotes as well as access to the FIX API. Orders are also processed much more quickly without any order queues.

The platform also has a much more functional trading interface which allows for a high degree of customisation. For example, you have up to 28 chart timeframes and you can create and save these chart templates.

If you are a heavy technical analyst then you can create your own charting indicators through the cTrader developer network. Of course, this may not really be needed when you consider that there are already 70 different indicators included on the platform.

What use is advanced technical analysis without the ability to customise orders?

cTrader allows you to set Scale-Out and Stop-losses at a number of levels. You also have a host of risk management features that allow you to diversify exposure across a range of different asset classes.

Finally, if you would prefer to automate your trading strategy then you can use the cTrader automate which will help you develop custom robots. You have extensive back-testing capability with this suite of programming tools.

To get the most out of this functionality you will probably want to download cTrader to your PC although it can be used in a browser or traded through your mobile phone.

OctaFX Mobile Apps

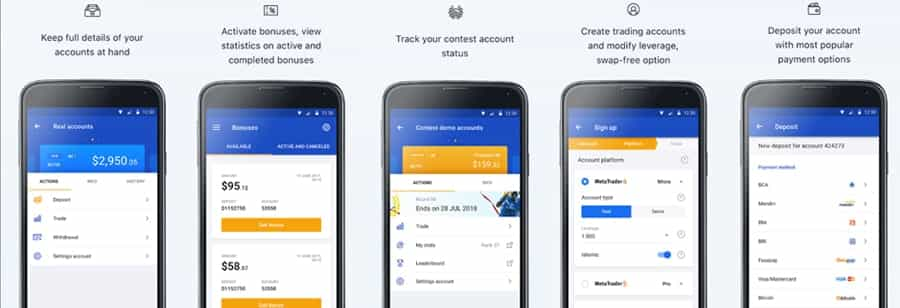

We were quite impressed with the range of mobile apps at OctaFX.

Firstly, they have their own proprietary app that can be used for account management. This will allow you to create the trading accounts, fund said accounts as well as modify leverage and other trading parameters. You can also view trading history and statistics.

This is currently only available in Android but the app seems to have pretty good reviews from the users. Over 80% of all the reviews in the Google play store are 5-star reviews.

What is even more important is that for any of the reviews that were not that positive, the OctaFX team has followed up with the reviewer. They have taken suggestions into account and appeared to have acted on them a number of times.

Then, on top of this you have all of the third-party apps.

As mentioned, Metaquotes develops a mobile application for both the MT5 platform as well as the MT4. These are perhaps one of the most downloaded trading apps in the world and have been perfectly honed over the years.

cTrader also makes an app for both iOS and Android. This is quite an intuitive application and was surprisingly easy to use for an app that has so many features.

So, should you use the mobile apps?

We would strongly suggest that you use the PC or web-based version for some of your more advanced trading. They have the full screens and allow for a more uninterrupted experience.

Of course, there is nothing really wrong with the mobile apps and they could work just fine. If you are going to be away from your desk and you need to monitor your positions then these are probably your best alternative.

OctaFX Deposits and Withdrawals

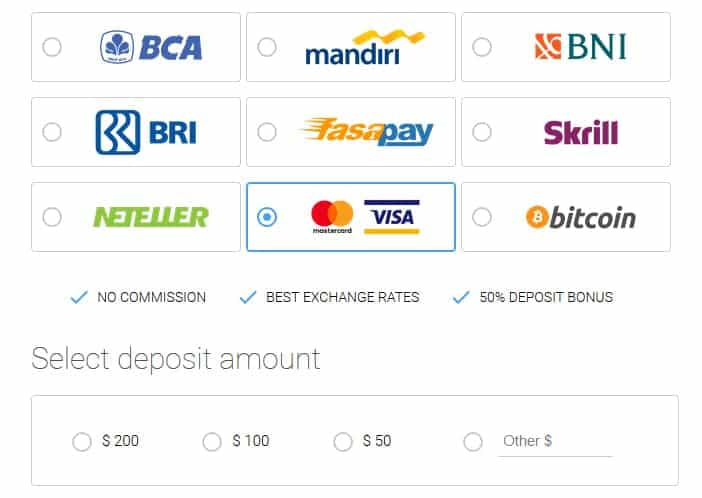

As one would expect from any large Forex broker, there are a range of funding options at OctaFX both on the fiat money side as well as in crypto.

Looking at the fiat side deposits, you can pay in either EUR or USD. If you are going to be depositing into a USD denominated account in EUR then they will do their best to give you the closest market rate on this pair.

They can take payment via and of the major credit cards, through an e-wallet or through traditional bank wires / deposits.

Perhaps the fastest method to fund your account for international clients is through a credit card, Bitcoin, Skrill or Neteller. However, if you are based in Indonesia then you can use their local banking institutions (Mandiri, BCA, BNI and BRI).

If you are going to be making a local bank payment then there are three options at your disposal. These are either through an online transfer, with an ATM or via a standard deposit at your bank account.

These payment could take anything from 1-3 days to hit your bank account as they have to be confirmed internally during the office hours of their Finance department (Monday-Friday 06:00-15:00 EET).

Pro tip: If you want to speed up this transfer then send OctaFX the payment proof.

Withdrawal

Withdrawals are just as simple and all that you need to do is to head to your "withdraw" section in your account. Before you can request a withdrawal make sure that your free margin exceeds the withdrawal amount.

If this is the case and you hit the withdrawal, it will be processed in 1-3 hours. Take note that the withdrawal will be returned through the same method that funding came in.

In the case of a credit card funding, you will be refunded the initial deposit amount. If there are any profits that are above this funding level then you will have to receive this through another method such as e-wallet or bank wire.

Customer Support

Customer service is one of those things that can really make or break your trading experience.

In terms of the customer support options at OctaFX, they offer 24 hour a day service 5 days of the week. You can reach them either through live chat, email, ticket support or a dedicated phone number.

OctaFX also proudly touts their average 7 second response time with 3 minutes required to clear most support queries. This has contributed to their 96% customer satisfaction level.

We wanted to see how accurate these stats were so we opened up the live chat option and got an immediate response. We also found their support agents to be quite knowledgeable about the products on offer as well as their regulations.

It appears as if this is something of a trend at OctaFX as they have also been recognised by others in the industry. They have won the best customer service in Asia award by the Global Banking and Finance magazine.

Their customer support is also multilingual and they have English, Indonesian, Malay, Thai, Hindi and Urdu agents available. If you would prefer to speak to someone on the phone then you can reach them on one of their numbers below:

- United Kingdom: +44 20 3322 1059

- Hong Kong: +852 5808 8865

- Indonesia: +62 21 3110 6972

- WhatsApp (Texts only) +34 605 122 333

OctaFX also provides a FAQ section where you can get some of the most relevant account questions. However, given how quick and effective their customer support or chat functions are, you are probably best just reaching out to them off the bat.

OctaFX Copy Trading

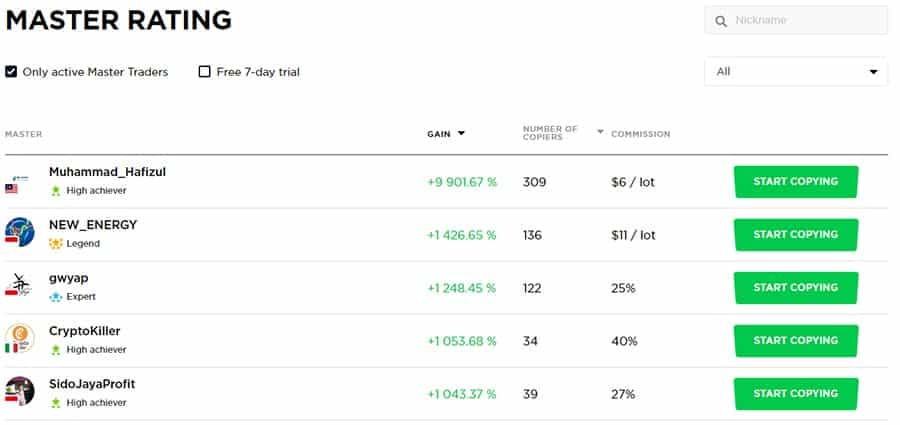

This is an interesting concept that has been used by other European brokers.

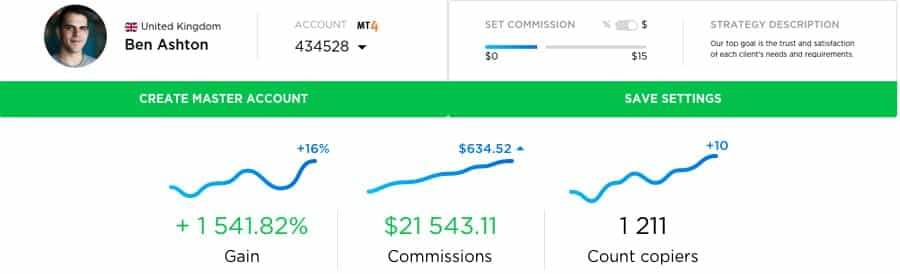

Copytrading gives you the ability to copy some of the most successful traders on the OctaFX platform. You can take a look at the leaderboard of all of these master traders and examine their trading history.

On the copy trading dashboard, you can see the rankings of the various "masters". You can see their return over the past year as well as the copiers that they have and the compensation they would like.

The compensation is either charged as a commission per lot that you trade or a piece of the spread as a revenue share. You can think of this as the fee that the master is charging to let you follow them.

If you want to start copying traders on the platfom then you will first need to create a live account. Once you have your account up and running you can head to the leaderboard and choose the masters that you would like to copy.

Once you have activated the copying then trades will be executed on your behalf and will replicate that of the master. You also do not have to follow only one master and you can diversify this list in order to benefit from more than one trading strategy.

You also have full control over the copying process and you can stop following any master as well as close out live trades.

Want to become a master?

OctaFX also accepts applications from their client to become a master. This will allow you to show off your trading prowess as well as build up a community. Of course, it will also give you an opportunity to earn passive income from the spreads and rev share.

Anyone can become a master but you will have to take into account how well you trade. No one will follow you if you are not profitable. Moreover, if your spreads are too high on the commission then their chance of making a profit is also eroded.

Education

As is the case with most other brokers, OctaFX has included a host of educational materials and resources for their traders.

Most of these resources are actually available free of charge on their website and can be viewed by you right now. This will give you a good grasp of the trading concepts before you dive in with an account.

Videos

There are some simple videos that are provided in the education section that will help you to set up your MT4 account. These include both on the PC version as well as the mobile apps.

There is also a video that will walk you through your account section and help you locate important functions. These videos appear to be well produced and easy enough to follow.

Forex Basics

These are some introductory articles to Forex trading that are well positioned at the beginner / intermediate level. In these pieces, the authors cover some of the most important concepts in FX trading.

These include such concepts as Technical and Fundamental Analysis, charting and indicators. These guides not only include the theory behind the disciplines but they also have helpful images that explain the concepts with examples.

We found these guides to be quite comprehensive and informed. They were relatively easy to follow and could help supplement the demo account if you are starting out.

Glossary & Manuals

Something that is pretty standard among brokers is the trading glossary. Here you will find a number of different explanations for terms that you may be unfamiliar with on the platforms or in the OctaFX's T&Cs.

If you are looking for more in-depth explanations and documentation for some of the functions on the trading platforms then you can use their comprehensive manuals. These cover the interface, charts, EAs, signals as well as Autochartist.

OctaFX Deposit Bonus

OctaFX has a deposit bonus for all new accounts of 50%. If you deposit at least $50 then they will give you half of the initial deposit as bonus funds.

We were actually quite surprised to see this being offered.

These deposit bonuses were recently outlawed in Europe and regulators such as CySEC have forbidden brokers from offering them. Perhaps these bonuses are only available to their traders in other jurisdictions.

It is also important to point out that this deposit bonus cannot be withdrawn until you have traded the minimum amount of lots. This minimum lot number is determined according to the following:

(bonus amount)/2 (bonus amount divided by two)

There are also a host of other conditions that come attached to these bonuses so we would recommend that you read all of these on the OctaFX website.

Should you take the bonus?

We would suggest that you rather avoid this. Although the prospect of trading with free money sounds great, bonuses are an incentive for you to trade aggressively to meet your targets which could erode your profit.

Awards

It is always good to see when a broker is well regarded not just by their clients but also by fellow industry members.

As such, there are a number of awards that have been given to OctaFX over the years. These cover such aspects as their customer service and STP spreads. There are a host more awards on their websites but we are only listing those from reputable sources.

- 2012: They were awarded as the fastest growing Micro Forex broker in 2012 by the Global Banking and Finance review.

- 2013: OctaFX won the best customer service broker in Asia from the same magazine. They also won the best broker in central Asia and Central / Eastern Europe from the World Finance Magazine

- 2014: They won the best ECN broker in Asia from the Global Banking and Finance as well as the best broker in Central / Eastern Europe by Forex Report Magazine.

- 2015: They won the best STP broker by the FX Report magazine as well as the European CEO Magazine.

- 2016: OctaFX won the same award from Forex Report Magazine as well as an award for the best trading conditions. They also won the most transparent broker in 2016 by the European CEO magazine

- 2017: Finally, they won the same award for the European CEO magazine as they did in 2016 as well as an award for the best trading conditions in 2017. They also won an the Best ECN Forex broker in 2017 by the UK Forex awards.

These awards are all verifiable and you can see their listing on the respective websites. Of course, these awards should not be your main reason for using OctaFX but they could help inform your decision.

What We Didn't Like

We could not have completed a full OctaFX review if we did not cover those things that we thought warranted improvement…

Firstly, their asset coverage is really quite lacking. Yes, they have the major Forex pairs but they have virtually no emerging markets. They also have no stocks, only two commodity assets and only two cryptocurrencies. If you want to trade more asset classes then you may want to consider 24option.

Secondly, when it comes to their cryptocurrency assets, these leverage levels are really quite low. At 2:1 leverage, this makes them one of the lowest leverage crypto CFD brokers that we have seen.

Moreover, if you are trading on the cTrader platform then you do not have access to cryptocurrency trading at all. So if you prefer trading on the cTrader platform but want to trade cryptocurrencies then you are in a bit of a bind.

We were also quite disappointed to see that although they did offer EAs, there were no VPS promotions. These are usually packaged with most brokers and provide the client with a pre-installed VPS with a discount code at a hosting service.

Finally, there are some regions like the USA that OctaFX cannot accept clients from. This means that if you are from one of these regions then you will have to find an alternative broker such as Pepperstone.

Conclusion

Overall, we were quite impressed by OctaFX. They have developed a competitive broker with global reach, low spreads and great technology.

They have also got some of the most responsive customer support which has won them a number of awards. We also found the copy trading concept together with their educational resources a nice touch.

While there were some things that we thought warranted an improvement, these are not beyond the reach of OctaFX. Moreover, given that they have shown a willingness to take constructive criticism, we could possibly see these suggestions implemented.

So, should you use OctaFX?

We would encourage you to do your own research and make sure that they are right for your individual preferences. Having said that, they should be on the top of your list.

If you are going to be trading with them, make sure that you practice appropriate risk management. As you know, CFDs are very risky products.

Disclaimer: These are the writer’s opinions and should not be considered investment advice. Readers should do their own research.

Disclaimer: These are the writer’s opinions and should not be considered investment advice. Readers should do their own research.