SwissBorg Thematics Review: Invest in Crypto with Ease!

SwissBorg is a crypto wealth management platform that utilizes blockchain technology to provide a secure and transparent place for buying, selling, and managing digital assets. With its unique Smart Yield account, Thematics bundles, and incredibly user-friendly mobile app, SwissBorg empowers users to take control of their financial future and join the growing crypto revolution.

Cryptocurrencies' transition from fringe assets to mainstream investment vehicles has spurred the rise of a diverse range of investment products and opportunities. Today, crypto-exposed investment products such as exchange-traded funds and mutual funds cater to various investment strategies and risk profiles.

The industry may currently be on the U.S. Securities and Exchange Commission’s radar, but there’s no denying that cryptocurrencies deliver eye-popping returns that can’t be achieved by traditional asset classes such as stocks. As a result, many investors (who can stomach high volatility) are exploring innovative avenues for wealth creation.

Regardless of your investing style, whether you’re a conservative or an adventurous investor, you can be sure there’s a crypto investment product for you out there.

One such option is SwissBorg Thematics, an investment product for the Web3 era.

SwissBorg Thematics Review Summary:

SwissBorg Thematics is a departure from the traditional methods of investing in crypto. A Thematic is a bundle of crypto assets, grouped around a specific topic. Want to invest in companies driving the next generation of the internet? Sure! Invest in Bitcoin but move to gold during market volatility? That’s possible now as well, thanks to SwissBorg Thematics. Oh, and it’s all on autopilot, which means you can just sit back and enjoy passive investing.

| Number of products currently offered | 2 |

| Launched | Best Blockchains in Oct. 2022, Golden Thematic in July 2023 |

| Regulation + Licenses: | Virtual Currency Service License-Estonia, Registered as a PSAN by the AMF- France, Regulated by VQF- Switzerland, 2 licenses for GDPR requirements on data protection |

| Fee | 0.20% to 0.25% monthly subscription |

The Key Features of SwissBorg Thematics Are:

- Automated Rebalancing

- Automated Reallocation

- Quality management

- Diversification

In this SwissBorg Thematics review, we will take a look at its offerings, explore the platform's history and vision, discuss its various products and services, and analyze its performance and fees.

What is SwissBorg?

Based in Switzerland, SwissBorg is a mobile-first, blockchain-based wealth management platform that aims to democratize investing in cryptocurrencies. Along with portfolio and wealth management, SwissBorg also supports crypto trading, aggregating the lowest fees from many of the leading exchanges.

If you’re interested to know more about SwissBorg, including all the features + pros and cons, you can check out our full SwissBorg review.

History and Vision

Cyrus Fazel and Anthony Lesoismier-Geniaux co-founded SwissBorg in 2017. In a post on Medium, Fazel describes how his experience in the world of traditional finance armed him with the knowledge that helped bring SwissBorg into existence.

“Blockchain would enable us to have the maximum reach and accessibility we required where Tokens would enable us to create any tailor-made investment mandate with no cost and intermediaries. And on top of this, we could leverage a strong community with decentralization based on a trusted meritocratic system.” (Source)

SwissBorg aims to give individuals complete control over their portfolios and investments. Today, the company sits at the crossroads of blockchain technology and personal finance.

From its Auto-Invest feature to the more recent Thematics offerings, SwissBorg has transformed into a powerful crypto investment solution aimed at generating wealth.

Products and Services

Here are some of the key features of SwissBorg:

- Wealth management: SwissBorg's wealth management app allows users to track and manage their crypto portfolios.

- Smart Engine: The brains behind the SwissBorg app! As you’re aware, market volatility often leads to price differences across exchanges. Smart Engine allows users to exchange between different fiat and crypto assets in the app. It scours multiple exchanges to ensure you get the best price.

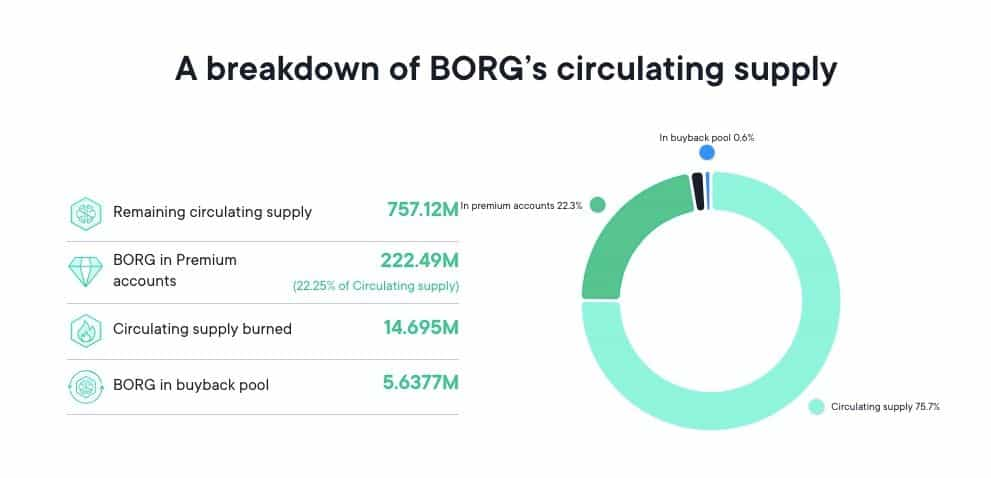

- Native token: BORG is SwissBorg’s native token. It gives holders voting rights to steer SwissBorg’s direction, unlocks higher loyalty tier benefits, and can be staked.

- SwissBorg Earn: This allows you to earn daily yield through staking or DeFi exposure. Depending on the asset you choose, you will have multiple strategies available: A conservative strategy with lower yields or a more aggressive strategy with higher returns. All profits earned are reinvested, which will compound your returns over time.

- Auto-Invest: Put investing on autopilot! This feature uses Dollar Cost Averaging (DCA), a popular strategy among investors, to reduce volatility by investing a fixed amount at regular intervals. You can auto-invest from any supported fiat or cryptocurrency to any cryptocurrency or Thematics, and you have full control over how much and how often you’d like to contribute.

- Asset analysis: Thanks to artificial intelligence, you can view full asset analysis for all cryptos available in the SwissBorg app. This is made achievable through CyBorg Predictor — which forecasts an asset's movement over the next 24 hours — and SwissBorg Indicator — which does technical analysis trend prediction. Community sentiment is also taken into account.

- Portfolio visualizer: This free tool provides in-depth investment analysis and statistics in an easy-to-understand format.

SwissBorg Security

Losing the private keys to your crypto wallet is a nightmare scenario. To address this, SwissBorg partnered with Fireblocks, which helps financial institutions protect digital assets from theft or hackers by using multi-party computation (MPC) and patent-pending chip isolation technology to secure private keys and API credentials.

MPC is the ability for multiple parties to jointly perform mathematical computations without one party ever revealing its secret to others. Fireblocks combines MPC-CMP with hardware isolation to create a multi-layer security technology. This eliminates a single point of failure and insulates digital assets from cyber-attacks, internal collusion, and human error.

Thematics Overview

SwissBorg offers multiple products that look to help crypto investors manage their wealth and offers a plethora of crypto investment avenues. Its Thematics offering is a pretty unique and innovative investment product in the industry.

Concept and Rationale

Crypto investment products are all the rage these days, and the top among those are exchange-traded funds. However, some of these ETFs don’t give you exposure to the full flavour of the industry. For example, ARK Next Generation Internet ETF's top-10 holdings do not include any individual crypto tokens. In fact, you’ll find names like car maker Tesla, e-commerce platform Shopify and games company Roblox. The only crypto-related exposure it has is through the Grayscale Bitcoin Trust, which rounds out the ETF's top 3 holdings.

This is where SwissBorg Thematics differs. Instead of doing away with crypto altogether, it exposes you directly to various tokens. It's important to note that Thematics are not ETFs.

Thematic investing is a strategy that entails putting your money to work on ideas, personal values, or trends. This holds especially true for new or potentially transformative technology such as blockchain. For reference, the global blockchain technology market stood at $11.14 billion in 2022 and should reach $17.57 billion in 2023 and $469.49 billion by 2030.

Thematic investing differs wildly from sector investing.

| Feature | Thematic investing | Sector investing |

|---|---|---|

| Focus | Multiple sectors anchored around a theme | Single sector |

| Diversification | Very high | Minimal |

| Investment strategy | Identifying broader trends expected to shape the future | Fundamental analysis, growth prospects, etc. |

| Risk profile | Less aggressive | High-risk, high-reward |

SwissBorg is touting Thematics as its “most advanced” investment product to date. A Thematic is a bundle of crypto assets, grouped around a specific topic. This lowers the barrier to entry as you do not need knowledge of individual tokens.

Features and Functions

Thematics allows you to diversify your investments and minimize risk. Don’t have hours upon hours to sink into research? SwissBorg's analysts and Artificial Intelligence engines will do that for you.

Here are a few of its features and functions:

- Quick diversification: Instead of you having to select cryptos to diversify your portfolio, SwissBorg’s analysts will automate this process for you by picking the best crypto assets, taking into account various factors such as common theme, token performance and tokenomics, among other relevant criteria.

- Quality management: The SwissBorg team ensures quality management of the Thematics content. This is achieved by keeping the ratio of each token as close to the target as possible, while conducting extensive research to keep Thematics up-to-date, despite market conditions and other risks.

- Rebalancing: Each thematic crypto asset has an algorithmically optimized target percentage to minimize risks and maximize value. Rebalancing typically occurs every 30 days and depends on when you bought your first Thematic, regardless of any top-ups.

- Reallocation: SwissBorg always keeps an eye out for new market opportunities and low-performing crypto assets. The tokens and their allocation are changed every 70 days to ensure the Thematic stays true to its theme and performs at its desired level.

In addition to these, SwissBorg is also looking to roll out a new feature later that will let you earn rewards based on your Thematic balance. These rewards will be paid out on a weekly basis in BORG, its native token that was previously known as CHSB.

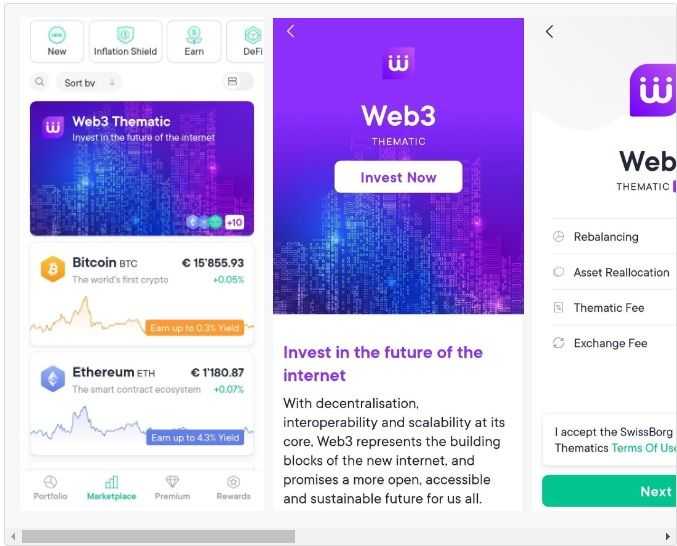

Investing in a Thematic is easy:

- In the Marketplace tab, select the Thematic you want to invest in

- Tap "Invest now" and select the crypto or fiat currency you want to use to buy into the Thematic

- You’ll come across the terms of use. Toggle the box to the right to accept, and tap “Next”

- Type the amount that you wish to invest, or select the percentage of your available balance

- Check the Market conditions and then tap “Confirm”

- Tap on Finish and you’re all good.

Performance and Fees

When it comes to Thematics' performance, SwissBorg hasn't published performance records since March 2023, but users of the SwissBorg app can go in at any time and see how these Thematics have performed, whether they are invested or not. One thing we appreciate about SwissBorg is their dedication to transparency.

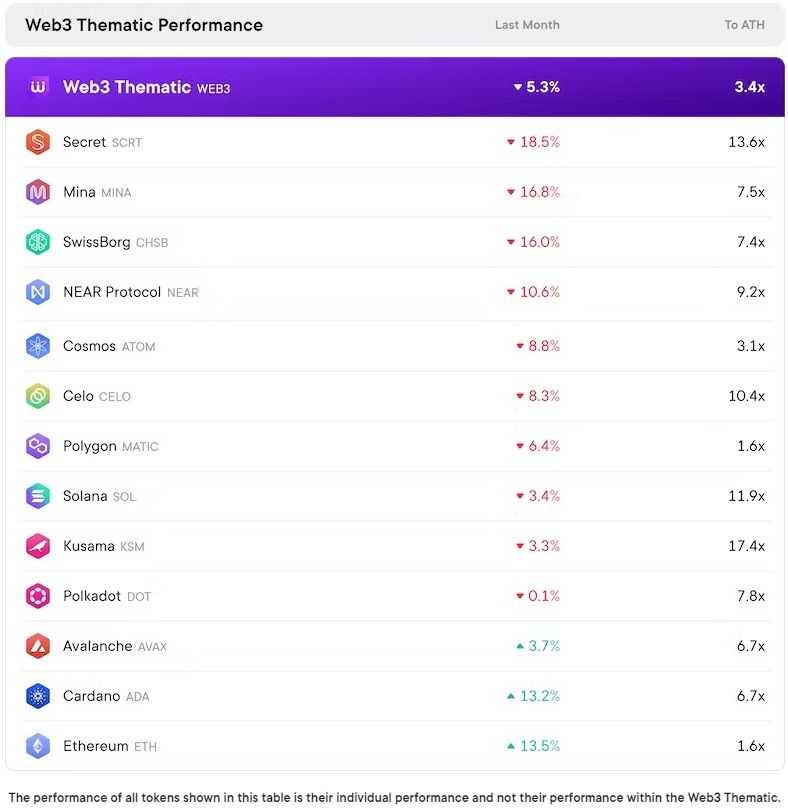

Its last performance update for the Best Blockchains Thematic was in March 2023, and the company hasn't provided performance data for the newer Golden Thematics. The Best Blockchains Thematic was previously called Web3 Thematic.

In the March update by SwissBorg, total assets under management dipped 3.4% to €7.7 million, but the number of users grew 2.8% to 13,400. Overall, the Best Blockchains Thematic was down 5.3%. BORG, SwissBorg's native token, was among the worst performers. As a reminder, BORG was previously called CHSB.

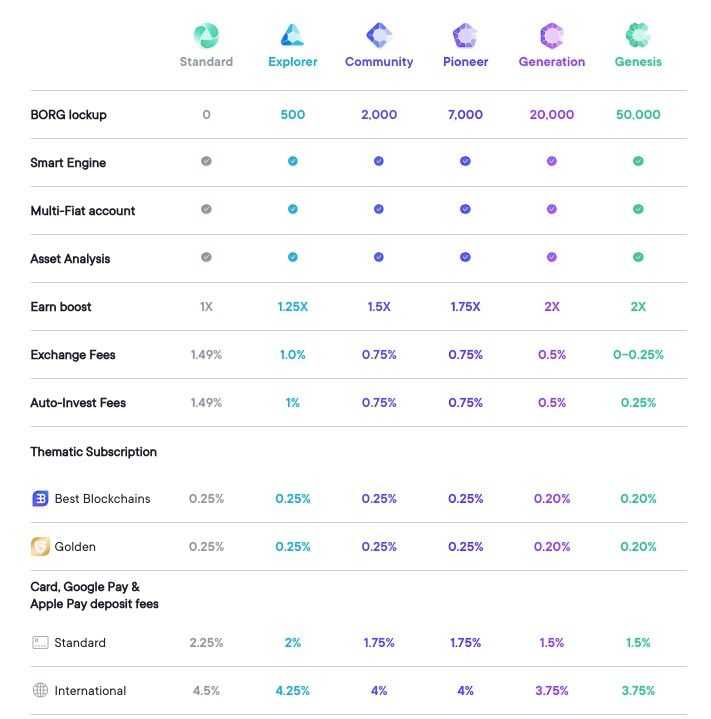

Turning to fees, SwissBorg recently lowered the fees it charges for Thematics. Before we dive into that, however, let's first explore the company's plans because the fees depend on what tier you're on.

Your tier is defined by the number of BORG tokens you're willing to lock up for a year. Of course, the more you do, the more you can get out of the SwissBorg platform. That means a higher earn boost, and lower exchange and auto-invest fees.

This mantra also extends to Thematics. Standard, Explorer, Community and Pioneer are charged a monthly subscription of 0.25%, while Generation and Genesis members pay 0.20% per month.

Thematics Products Available

SwissBorg currently offers two Thematics products: Best Blockchains and Golden.

Best Blockchains Thematic (Previously Called Web3 Thematic)

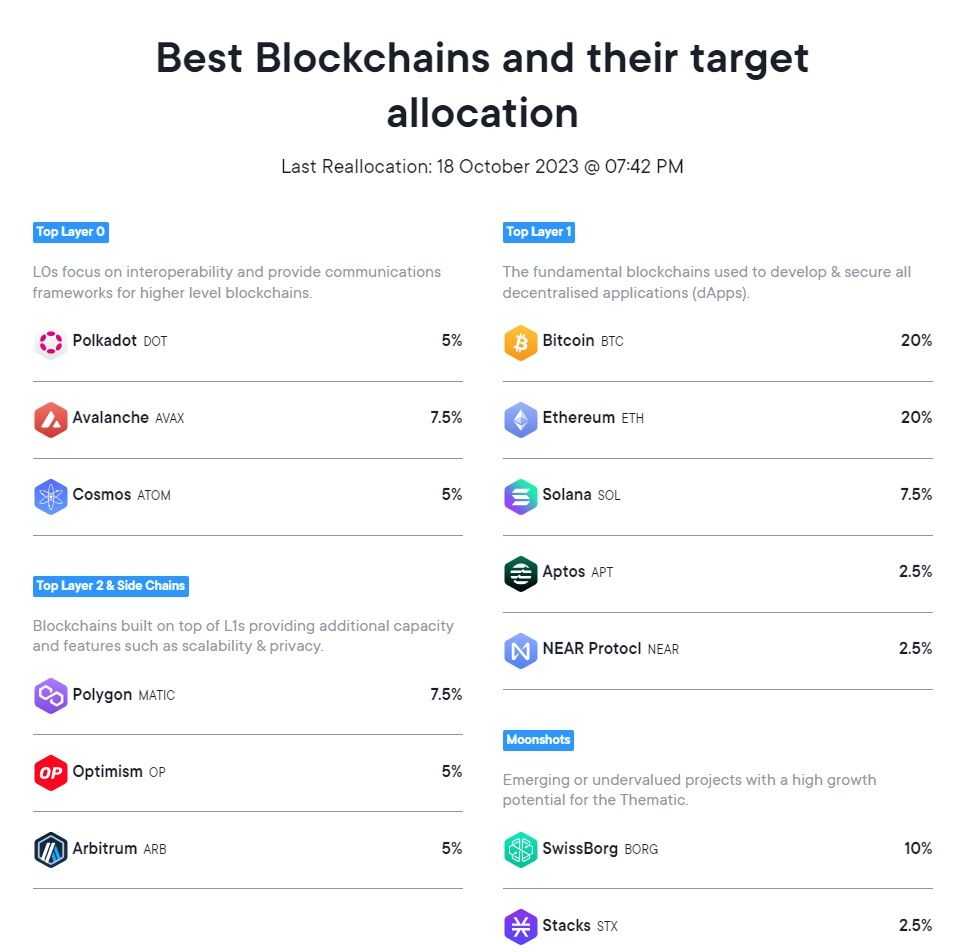

SwissBorg's approach offers diversified exposure, covering a range of Layer 0, Layer 1, and Layer 2 blockchains, encompassing both established blockchains and rising stars. The thematic's aim is to provide investors with access to and insights in the fundamental infrastructure of the decentralized future.

Here is a look at the basket of tokens that makes up the Best Blockchains Thematic:

The Best Blockchains Thematic is spread among 13 tokens, including Bitcoin, Polygon, Cosmos, Ethereum, Polkadot, Solana and SwissBorg's native BORG.

Golden Thematic

The Golden Thematic capitalizes on Bitcoin's growth potential during market upswings and switches to gold during a bear run or downside volatility in a fully automated manner.

The Golden Thematic provides access to Gold through Tether Gold (XAUT), a digital token backed by physical gold. Each XAUT token represents 1 troy ounce of gold held in a physical vault. As of March 30, Tether's gold reserves totalled $3.4 billion. By comparison, XAUT's market cap is $470.2 million, according to CoinGecko.

During different market regimes such as bull, correcting, bear, or accumulating markets, the SwissBorg algorithm adjusts the investment allocations to optimize returns. The reallocations are subject to predefined limits. Unlike the Best Blockchains Thematic, which follows a recurrent schedule and a monthly rebalancing, the Golden Thematic does not have a recurring queue. Instead, you are placed in a random queue upon a new signal, and the SissBorg Smart Engine executes reallocations.

This is an interesting investing concept as the Golden Thematic looks to capitalize on Bitcoin's upward price movements when they happen and then retreats to the safety of gold to protect against drops in Bitcoin's price.

Future Thematics

In a YouTube video, SwissBorg laid out options for other such investment products. Before we dive into that, however, I'd like to direct your attention to SwissBorg's native BORG token.

The BORG token is a multi-utility token that embodies the basis of the SwissBorg ecosystem. It can be used for staking and allows you to select and rate ICO projects. More importantly, the token also gives you the power to steer SwissBorg's strategic direction. BORG can be used by community members to participate in the referendums.

Right, back to future SwissBorg Thematics.

Gaming Thematic

In the diverse DApps landscape, gaming reigns supreme. According to DAppRadar, the gaming sector remained the leader in the second quarter with a market share of 37%. According to another estimate, Web3 gaming will onboard up to 100 million gamers in the next two years.

SwissBorg aims to capitalize on this new frontier in gaming. The minimum investment will be $5, with rebalancing occurring every 30 days. Reallocations will be dependent on market conditions. The allocations outlined looked like this:

- Top games: 50% will be allocated to top-tier titles offering play-and-earn mechanics and immersive gameplay. Iluvium, Sandbox, Decentraland, Axie Infinity and Gods Unchained were each assigned a 10% allocation.

- Top infrastructure: This pertains to the ecosystems and blockchains powering the next generation of decentralized gaming apps. Immutable, Polygon, Solana and Render will get a combined 35% allocation.

- Top community: Projects with thriving communities of passionate gamers, such as those at Ultra and ApeCoin, which were each assigned a 5% allocation.

- Moonshots: This is reserved for projects with high-growth potential. Wilder Worlds, which provides procedurally generated 5D NFT vehicles to race in the Metaverse, was allocated 5% of the total portfolio.

SwissBorg has a sister company, XBorg, which operates in the Web3 gaming space. It has onboarded 10,000 users and received soft commitments of $7 million.

Mass Adoption Thematic

Adoption is a sensitive subject in the crypto sphere. Grassroots crypto adoption across the world is down, according to Chainalysis, but not all hope is lost: Lower-middle-income countries, such as India, Nigeria and Ukraine, are witnessing a rise in crypto adoption. SwissBorg is betting that DApps, whose market size is expected to reach $368.25 billion by 2027, will play a big part.

The minimum investment for MAD Thematic, as it may come to be known, is once again $5 with rebalancing occurring every 30 days. The allocations will look something like:

- Top DeFi: The most promising DeFi project will get a 15% allocation.

- Top SocialFi: A 40% allocation, the largest, will be reserved for companies revolutionizing social media.

- Top GameFi: Companies in this space will get a 15% allocation.

- Top brands: Reserved for the most recognized names in the blockchain industry, this one will be allocated 30% of the total portfolio.

SwissBorg Thematics Review: Closing Thoughts

SwissBorg Thematics offers an innovative approach to diversification and risk management by bundling crypto assets around specific themes, making the product accessible to a wide array of investors. Its emphasis on security, automation and rebalancing means you can take your hands off the steering wheels and enjoy crypto exposure without the need for constant monitoring and research.

Thematics is the crown jewel in SwissBorg's current product offerings, and it represents an intriguing option for anyone looking to diversify their crypto holdings. The potential expansion of Thematics into other verticals, such as Web3 gaming and DApps, showcases the company's ambition to stay at the forefront of crypto investment trends.

As with any crypto investment, it's important to understand the inherent volatility of the cryptocurrency market, which can lead to varying levels of returns in a given period. Whether TradeFi or crypto, thorough research and an understanding of the associated risks will prove to be a win-win strategy.

Frequently Asked Questions

SwissBorg is a mobile-first, blockchain-based wealth management platform that aims to democratize investing in cryptocurrencies.

SwissBorg Thematics is a departure from the traditional methods of investing in crypto. A Thematic is a bundle of crypto assets, grouped around a specific topic. It provides investors with one-stop diversification and portfolio rebalancing on auto-pilot.

SwissBorg is one of the easiest crypto apps to sign up to and use. It only takes a few minutes and requires the entering of personal information and KYC on the mobile app. SwissBorg has a handy guide to help you sign up.

Yes. The minimum investment amount for Golden Thematics is $40 USD, while that for Best Blockchains Thematics is €5.

The SwissBorg app is available in select countries in Africa, Europe, Asia Pacific, North America and South America. There's a full list of supported countries on the website.

Zero. Nada. None. You are free to sell your Thematic investment at any time. However, SwissBorg plans to launch a feature later that will let you earn rewards based on your holding duration.

Disclaimer: These are the writer’s opinions and should not be considered investment advice. Readers should do their own research.