When you scroll through the list of tokens listed on a crypto aggregator website like CoinGecko or CoinMarketCap, you may or may not be surprised to know that a large number of those tokens are ERC-20 tokens. These tokens run on the Ethereum network and those that support it include Layer-2s like Polygon, Arbitrum and Optimism, to name a few.

In contrast, TRC-20 tokens are not as well known, or may even be somewhat of an unknown to the average person on the street unless said person has interacted with the Tron network. The most famous TRC-20 token by a considerable margin is the Tron version of the USDT stablecoin. It is the most transacted token on the network and has an astonishing 90%+ market dominance on the Tron network.

In this article, we will analyse TRC-20 vs. ERC-20, comparing their pros and cons, investigating the use cases, how to convert one into the other and see how their future growth will impact the crypto sphere at large.

Brief Overview of TRC-20 and ERC-20 Token Standards

Before the ERC-20 token standard came along, there were no standards of any sort to speak of. In the early days of DApp development, developers had to work out a lot of complexity when creating a DApp. How a token works on one DApp vs. another has a fair amount of guesswork behind it, kind of like a world before APIs. This is also a term you hear about a lot in the tech world.

In brief, API is a set of standards for software applications to talk to each other, even if they are developed by completely different people. Each software has its own API standards. If you want to connect with that software, you will need to make your software work with theirs by following their standards. In other words, "my data, your problem".

With the introduction of the ERC-20 token standard, followed by the TRC-20 token standard, the world of DApp creation got a lot easier and more reliable as it removed all the guesswork from the tokens' interactions with another DApp. It also gave rise to the phenomenon of "financial building blocks" where one DApp can be built on top of another to achieve the kind of results that couldn't have been done on one DApp alone. This greatly increased the complexity of the DApps themselves, which made it possible for a variety of applications to burst forth.

The key difference between ERC-20 and TRC-20 is the blockchain network they're based on and the underlying technology. TRC-20 is on the Tron network while ERC-20 is on the Ethereum network. By virtue of this factor, other differences stem naturally from this distinction such as network fees involved, throughput, scalability etc.

To help you better understand these two token standards, we've put together a simple table to illustrate the differences side-by-side:

| Feature | ERC-20 Token | TRC-20 Token |

|---|---|---|

| Area of usage | Smart Contracts | Smart Contracts |

| Works on | Ethereum Virtual Machine (EVM) | Tron Virtual Machine (TVM) |

| Token Address | Starts with 0x, has 42 characters | Starts with T, has 34 characters |

| Gas Fee currency | ETH | TRX |

| Average transaction cost | $0.28 USD (Variable) | $0 (Consumes Bandwidth and Energy from staking TRX) |

| Wallet Interaction | Compatible with most wallets including Metamask, Exodus, Trust Wallet, etc. | Compatible only with wallets that support the Tron network. Popular ones include Exodus and Tron Wallet |

We'll discuss all of these in detail, so let's get started!

What Are ERC-20 and TRC-20 Standards?

We already covered a brief overview of the two, but now we'll go into the details of each of them.

ERC-20 Token Standard

Nailing it down to the basics, the ERC-20 token, short for "Ethereum Request for Comment" #20, is a representation of anything you want or deem to be of value on the Ethereum network. This can be currency of any sort, in-game assets or points, your toy collection (the whole collection or each of the toys), the drawings from your child's art class, and even your house. The process of making these real-world items into a token is commonly known as “tokenization.”

It's important to know that the ERC-20 token itself has no value. It's what it represents that gives it value. There are thousands of ERC-20 tokens out there, some have no value, plenty of them are scam tokens, and some are rug pulls, but many derive their value from the functioning underlying protocol and can be highly valuable depending on what utility they provide or what value they represent.

Tip! If you are going to get involved in the Ethereum ecosystem, it will be beneficial to learn about blockchain explorers and understand how to read Etherscan.

The ERC-20 token standard itself is a set of rules of engagement that outlines how tokens interact with each other in activities involving two addresses that are compatible with the Ethereum Virtual Machine (EVM). Anyone who wants to create a token that can be used on the Ethereum network will need to adhere to this standard.

TRC-20 Token Standard

The TRC-20 token is also a representation of any item but it's on the Tron network. This token is not directly compatible with the Ethereum network. This means that you can't send a TRC-20 token to an ERC-20 wallet address and expect it to work hunky-dory and vice versa. You will need a bridge to handle this, which we will cover in a later section.

The TRC-20 token standard was also an improvement to the previous standard used, known as TRC-10. The token protocol aims to provide developers with a standardized way to create, issue, and deploy digital tokens on the Tron network. Having it use the Tron Virtual Machine gives the token the ability to add custom functions to it, thus allowing complex transactions to be executed.

Technical Differences

As touched on earlier, one of the key differences is the address styles. Ethereum addresses start with an “0x”, while Tron addresses normally start with. a"T".

TRC-20 tokens are generally faster than ERC-20 tokens, as the Tron network has a higher transaction per second (TPS) rate than Ethereum and lower fees, made possible by the Delegated Proof-of-Stake consensus mechanism (more on this later).

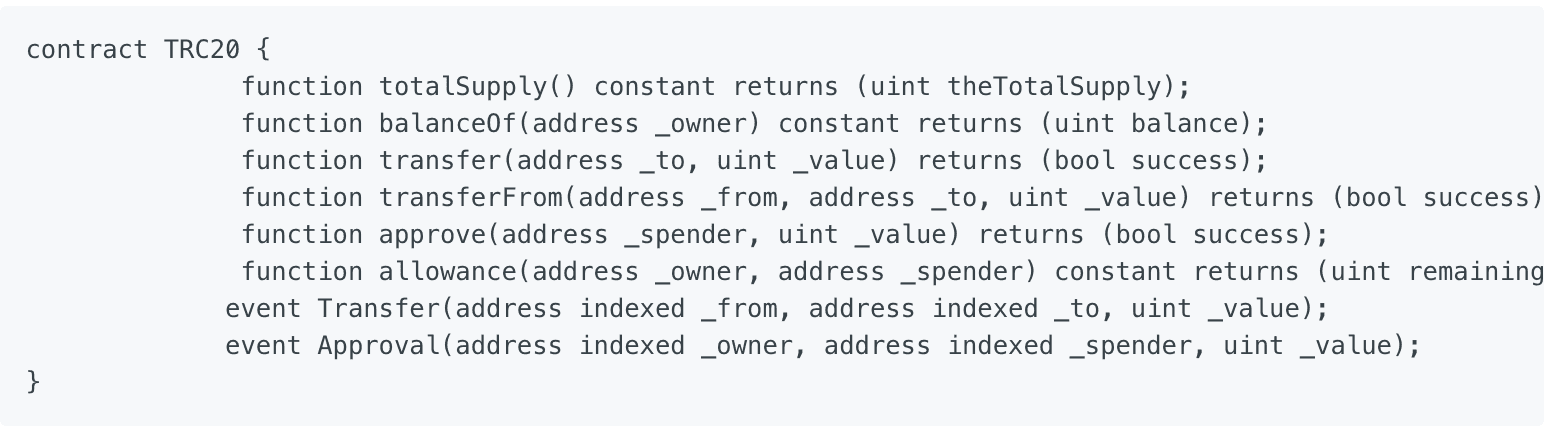

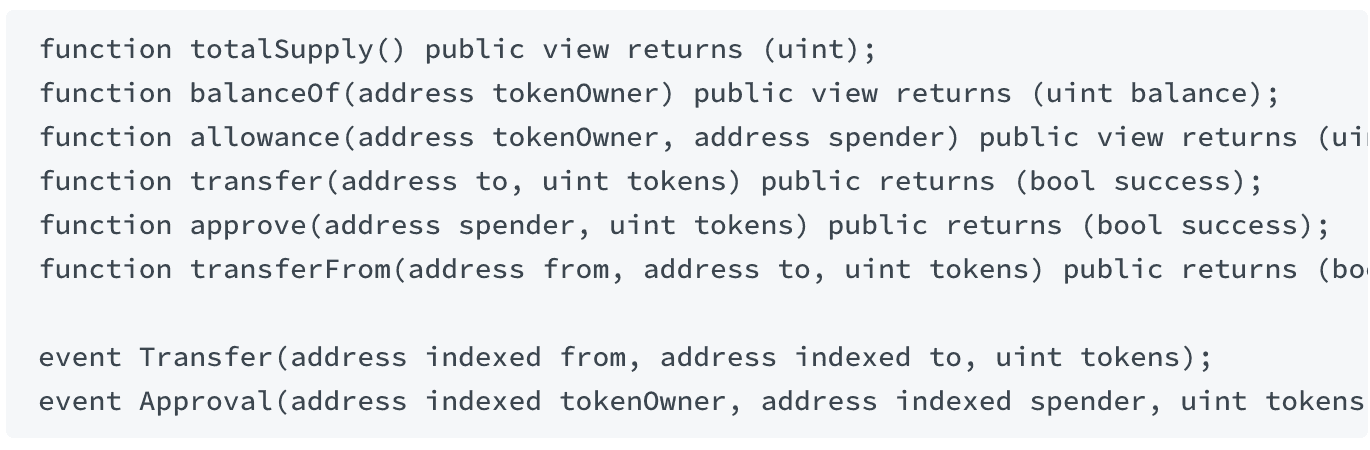

As for the token setups, there are more similarities than differences. Both have the same optional choices for token name, symbol, and decimal precision. The mandatory fields are also alike. I've provided both of the contract codes for you to see for yourself. The ERC-20 version came from the Ethereum org while the TRC-20 version came from a Medium post written by the Tron Core Devs.

Both stipulate the following as optional fields:

- Token name - name of the token. i.e. “GuyCoin”

- Token symbol - short code of the token, “GUYC”

- Token decimal/precision - up to how many decimals does the token have.

ERC-20 version

- function name() public view returns (string)

- function symbol() public view returns (string)

- function decimal() public view returns (uint8)

TRC-20 version

- string public constant name = “GuyCoin”

- string public constant symbol = “GUYC”

- uint8 public constant decimals = 2 (meaning 0.01 decimal precision)

The following are the mandatory fields for both standards:

- Total Supply - maximum supply of the token

- Balance - the balance of the account owner

- Transfer - transfer a specific amount using a smart contract to a specific address

- Transfer From - allows a third party to transfer tokens from one account to another.

- Approve - authorises the third party to transfer tokens on behalf of the account owner.

- Allowance - allows the third party to check how many tokens are left that they can transfer.

Advantages and Disadvantages

Advantages of ERC-20 over TRC-20

The first-mover advantage and network effect enjoyed by the Ethereum network snowballs into other areas of the crypto space. What this means is that it's a lot easier for new ideas and concepts to gain traction by choosing to launch there. The network's prominence incentivizes developers to launch their tokens on the blockchain because:

- Ethereum's reach gives ERC-20 tokens a huge boost in terms of securing interest and users.

- ERC-20 tokens can freely interact with many other EVM-compatible networks, representing an expansion that the token can benefit from when the timing is right.

- Most wallets are also compatible with EVM-compatible networks which makes token storage and exchanges relatively easy.

Advantages of TRC-20 over ERC-20

The Tron network certainly doesn't have the breadth and width of reach that the Ethereum network commands but it does have a few aces up its sleeves, namely low transaction costs, high transaction speed, and high scalability. These three key elements give TRC-20 tokens a leg up when it comes to usability. While new ideas are launched on Ethereum, the actual success of these ideas doesn't only come from how much usage is generated from the Ethereum network, but how quickly it is copied and launched on other networks including Tron.

A good example is the DeFi space. It got started on Ethereum but it has readily spread to other networks such that every blockchain worth its salt has a DEX like Uniswap, a lending and borrowing platform like AAVE, and a NFT marketplace like OpenSea (note that this is not a blockchain project but a company). All of these can be found on Tron in varying degrees of success, notably JustLend and the USDT transfer activity.

Limitations and Drawbacks of Both Token Standards

Due to the fact that there are a lot of shared similarities between the tokens, it stands to reason that there are also some risks shared by both tokens. Let's take a look at some of them:

- No direct interaction - Incompatibility between EVM and TVM means that these tokens cannot be transferred to each other's network without undergoing some kind of conversion process. This is often known as a bridge, to be discussed further in the article.

- Smart contract vulnerabilities - The complexity of smart contracts makes them both vulnerable to coding errors or hackers looking to exploit the existing codes. Frequent audits and checks are necessary to ensure that the contracts are as solid as can be.

- Phishing and Scams - Fake tokens are rampant on both networks, probably more so on the Ethereum network as there are more ERC-20 tokens in it. Nevertheless, this phenomenon is something that users need to be wary of when interacting with the networks.

Note: Check the token contract address on the blockchain explorer or a free security platform like De.Fi when possible to ensure that you are not receiving fake tokens in exchange for real money.

- Liquidity Risks - Not all ERC-20 or TRC-20 tokens have great liquidity, especially the ones with low trading volume. This could result in undesirable prices during trades or the inability to sell.

- Centralisation Risks - Many ERC-20 tokens started life as an ICO project, hence there is a risk of centralization, i.e. the majority of the tokens are in the hands of a few founding members or VC investors. The TRX network itself has been criticized for being too centralized.

Ethereum Ecosystem

Ethereum, the second most well-known blockchain project after Bitcoin, is a decentralized network with its own mission and challenges. Unlike Bitcoin, which was born from the need for a new form of payment, Ethereum was about building a new ecosystem to support innovative developments using smart contracts. The applications built on it, known as DApps, introduced new ways of engagement with users, especially in the realm of finance and further on, in the artistic and creative world with the introduction of NFTs.

The blockchain uses its own native coin known as Ether (ETH), used initially as payment for transaction costs. With the rise of NFTs, we are also starting to see it used as a denomination for price tags. It is very reasonable to say that the Ethereum network is one of the key pillars of the crypto space. Its existence is the foundation for numerous successful projects while the blockchain network itself continues to evolve in stages. Its influence in the crypto world cannot be overestimated and whatever changes it makes have far-reaching effects in the community.

To find out more, check out our Ethereum dominance article where we dissect the blockchain's rise as a tour de force in the crypto world and explore so-called “Ethereum killers” looking to dethrone the reigning monarch.

Prominent ERC-20 Tokens and Their Use Cases

USDT/USDC

Some of the top ERC-20 tokens are USDT and USDC. Known as stablecoins, you can think of them as the equivalent of cash in the crypto world. They can be used like cash to buy all sorts of crypto. We'll talk a bit more about stablecoins further in the article.

Aave

Aave is one of the earliest and most established lending and borrowing protocols on the Ethereum network. The platform allows anyone to lend and borrow crypto using smart contracts. That means no KYC, no screening criteria for borrowing, and lenders can decide how long they want to lend their funds. Auto-liquidation is how borrowers are incentivized to act in good faith and over-collateralization is the guarantee for lenders to get their capital back. This means that the value of the collateral you put in to secure the loan is always much higher than the value of the loan.

wBTC

wBTC is an Ethereum wrapped version of Bitcoin. As Bitcoin is a completely different blockchain and is not Ethereum-compatible, developers came up with a way to transfer the value of Bitcoin onto the Ethereum network. The term “wrapped" Bitcoin is a bit misleading as there is no actual Bitcoin being wrapped in Ethereum.

Wrapping Bitcoin is the process of locking Bitcoin up, removing it from the circulating supply, and then isssuing an equal amount of Bitcoin as an ERC20 token. With this version of Bitcoin, BTC holders can also participate in the variety of DeFi activities happening on the Ethereum blockchain. BTC holders who exchange their BTC for a wrapped version are free to swap it back to the original BTC later.

MANA

MANA is the native token for Decentraland, one of the earliest metaverse projects launched on the Ethereum blockchain. With MANA, token holders use it to buy plots of virtual land and fulfil their dream of being a monopoly tycoon. It wasn't long though, when actual real estate developers started to move into the space and develop land as they would in real life. This project kickstarted the metaverse segment of the crypto space with other projects like Sandbox (SAND) following suit.

Nowadays, a few major real-life brands like Adidas hold events in Decentraland as they recognise the future of drawing crowds in the virtual space could be the norm in the coming decades. There was even a Decentraland Fashion Week, supported by the likes of Dolce & Gabbana and Estee Lauder to name a few.

Ethereum's Role in DeFi and Decentralized Applications

It's not a stretch to say that without Ethereum, there would be no DeFi and decentralized applications. As the first blockchain project to introduce smart contracts, which is a set of rules that executes actions on an “If this (happens), then (do) that” concept, Ethereum has a first-mover advantage in the new frontier. Smart contracts themselves are also helping to pave the way towards automation.

Gone are the days of trusting middlemen to monitor and verify that two parties will act in good faith. With smart contracts, the rules are set and changes to the code are onerous affairs. These contracts are executed without prejudice or sympathy. One key example is in liquidation of collateral.

When obtaining a loan through a DeFi DApp, over-collateralization is required to secure the loan. If you want to borrow a thousand, you need to put up collateral that's worth at least 30% more, usually in the form of crypto tokens. This is to act as a buffer against the volatility of the token's price. If the value of the collateral falls to a point that's lower than the loan, the collateral will be liquidated immediately with very little notice and no grace period. In the midst of the collapse of human-run companies like Three Arrows Capital and Celsius, DeFi loans are the ones that get paid without fail.

Ethereum is the testing ground and was witness to the birth of decentralized finance (DeFi) and continues to be the incubator of new ideas in the Decentralized application space today. A huge majority of DeFi activity happens on Ethereum. New projects often choose to launch on an Ethereum-compatible blockchain or on the main network itself before branching off to other blockchains. The network effect is very much at play as users have come to trust the Ethereum “brand”, reputation and security, and are more likely to interact with the DApps found on its network.

Where to Buy and Store Ethereum

The ETH token is one of the most popular tokens and can easily be bought in many places. Be sure to get it from reputable exchanges like Coinbase, Kraken, and OKX to name a few. You can also get the token from decentralized exchanges or peer-to-peer platforms but you will need to watch out for fake tokens when transacting at those places. At least if you buy it from centralized exchanges, there's no chance of getting a fake token from there. For more information about which exchanges to buy from, check out our best crypto exchanges article to look for one that suits your needs.

The next big decision to make is where to store the ETH after buying it. The often-cited types available are hot and cold wallets. These fall under the non-custodial category, which means you are in full control of your tokens. Storing them on exchanges belongs to the custodial category, of which there is a risk that funds could be lost if anything were to happen to the exchange. For those who prefer the non-custodial route, we also offer a variety of choices in our article covering the best Ethereum wallets.

Tron Ecosystem

Like Ethereum, the Tron ecosystem also uses the account-based model for their blockchain network. Instead of Proof-of-Stake, the network uses Delegated Proof-of-Stake as the preferred consensus mechanism, which explains the fast transaction speed and high scalability feature that Tron is known for. This consensus mechanism also contributes to the low transaction fees that make Tron a favourite for transferring USDT around. Bigger transfers may not balk at the gas fees charged by Ethereum but small transfers definitely benefit from this feature.

It is important to note that Tron doesn't use gas fees as Ethereum does. Instead, they use energy and bandwidth to calculate transaction costs. The only way to get these two components is by staking their native token, TRX, on the network, to generate them. You can also rent energy from DApps like TronNRG to maintain the cheap costs. If users have enough energy and bandwidth from staking TRX, Tron transactions can be completely free!

You can learn more about Tron and how the network fees operate in our in-depth Tron Review or get stuck into the variety of Tron DApps by reading our 8 best Tron DApps article that also gives you some insight on TronNRG.

Successful Projects and DApps Utilizing TRC-20 Tokens

Even as Tron positions itself as the premier decentralized network for content creation and entertainment, it's the stablecoin sector that has given the network its greatest successes. Here are the top TRC-20 tokens that have helped to put Tron at the forefront of the consumer's minds:

USDT

Although there are many versions of USDT floating around in the crypto space, the TRC-20 version of USDT is the favourite amongst many crypto holders. Billions worth of Tron USDT are transferred across wallets and exchanges. Tether, the company that issues USDT, was attracted to the low transaction fee and 3-second block time on the network and decided to issue a TRC-20 version of the token. Since then, the Tron network has played catch up to Ethereum in the dollar value issuance of USDT at more than $37 billion compared to $39 billion on the Ethereum network. Functionally, the token works the same way on both networks.

USDC

Following the success of USDT, Circle, the issuer of USDC, also created a TRC-20 version of their stablecoin. While USDT holds dominance in the stablecoin sector, USDC has been doing its best to chip away at USDT's market share. Unfortunately, the recent de-pegging event due to SVB bank's collapse really put a dent in consumer confidence in the token. Ironically, USDC is more transparent about its financial situation than USDT but it doesn't seem to benefit much from that transparency.

USDD

Stablecoins are a very lucrative business and it makes sense for Tron founder, Justin Sun, to get in on the action. Unlike the other stablecoins mentioned above that are backed by cash or cash-like assets, USDD is an algorithmic stablecoin that is overcollateralized. The algorithm is handled by an open-source program known as Peg Stability Module (PSM) which also allows the exchange with other stablecoins instead of just with cash alone. USDD was launched at the heels of the collapse of UST, the most infamous algorithmic stablecoin that almost destabilized a major part of the crypto industry. Usage of USDD is mainly confined to the Tron network and is nowhere as popular as the others. Its market cap at the time of writing is $724 million, a far cry from USDT's $83 billion and USDC's $25 billion.

BTT

In 2019, the BitTorrent network was acquired by the Tron Foundation as it faced difficulty in monetizing the highly popular services. Upon acquisition, the BTT token was soon introduced as a TRC-10 token, to solve issues such as slow download speed and fewer files being available on the network. This token is the utility token for the network as it is used by users when requesting files for download or to increase their download speed. The token is accepted by providers as compensation for their sharing efforts. It is also used to pay for premium features on the BitTorrent network such as ad-free browsing or buying storage, bandwidth, and computing power on the network. After the TRC-20 standard went into effect, the token transitioned to the new version which allowed it to interact with other Tron DApps easily.

Where to Buy and Store Tron

You can easily buy Tron on centralized exchanges such as Coinbase, Kraken, Bitget, Binance and OKX. If you're wondering where to start, give our Where to Buy Tron article a read to get some ideas.

TronLink is Tron's native wallet and is fully supported by the Tron network. The wallet is available in more than 200 countries and has multiple versions, suited to all preferences. There's the Chrome extension, iOS and Android mobile devices support. This wallet can interact with all the Tron DApps easily and is known as a hot wallet, meaning it's always connected to the internet, which is why it works well with DApps.

I do have to caution you though, that a hot wallet is not as secure as a cold wallet. As the name implies, a cold wallet doesn't have online connectivity, effectively removing remote attack vectors and making it less hackable. To learn more about which Tron wallet to get, we have an article on the 8 Best Tron wallets for you to choose from. You can also find out more about the differences between hardware, desktop and mobile wallets.

Use Cases and Real-World Examples

For all the wonders that ERC-20 and TRC-20 tokens promise, it's the use cases for these tokens that really count. What that boils down to is that these tokens may be nice-to-haves now but it won't be long before they become the must-haves in the not-too-distant future.

Below are some of the areas where these tokens are already in the midst of disrupting known ways of doing things while also introducing new scenarios that we would be wise to take into account.

Stablecoins

Stablecoins first came into being as a way to mitigate the volatility of the prices of cryptocurrency. They achieve this by being the more stable version of a cryptocurrency, where its price is not prone to market speculation. After all, there's nothing to speculate about a dollar bill. Its price is always tied to the denomination it is tied to. That's what a stablecoin is in a nutshell. The USDT was the first dollar-pegged stablecoin that continues to be widely used. Other stablecoins include DAI (backed by a mix of crypto and real-world assets) and USDC to name a few.

You can think of stablecoins as a virtual version of the cash in your wallet. This can be a bit of a mind-bender as we already have digital versions of cash through our credit cards and e-wallet payments. How is stablecoin any different?

The stablecoin is a token that presents the possibility of programmable money is capable of interacting with smart contracts and participating in decentralized finance (DeFi). However, this also means that whoever issues the token can, technically, put restrictions on what the token can be used for. Sounds like a double-edged sword? It's the sharpest one there is! This is where governments worldwide got the idea of central bank digital currencies (CBDCs), which Guy has quite an opinion on.

Decentralized Finance

One of the rallying cries in crypto is “Anyone can get access to banking services without prejudice or bias”. The only caveat is that you need some kind of collateral for a DeFi loan in the event of a default. Banks would ask the same of you except they make you jump through more hoops than you'd care to know and the process is usually a tedious one. Part of that can be attributed to regulation. Banks do their due diligence so that the loans have a reasonable chance of being repaid.

With decentralized finance, once you convert your cash into a cryptocurrency that can be used as collateral, you can borrow and lend with ease without all that pesky paperwork (and credit checks). That will, technically, open up the playing field so that more people can get loans. The only and biggest barrier in many parts of the world is the conversion from cash to crypto, which prevents people from getting on board. We also placed the burden of due diligence on the borrowers and lenders to do their own homework as there isn't any regulatory body they can rely on in case the platform runs away with their money.

Some of the tokens that fall in this category include AAVE, the Curve token (CRV) and UNI (the governance token for Uniswap, a decentralized exchange).

Tokenization of Real-World Assets

Imagine owning a car that you want to sell and the buyer needs to pick it up from you. It's not enough to just hand over the car keys because there is the paperwork involved like ownership, insurance, etc. Now imagine all that paperwork bundled together into one coin that you hold in your hand. Whoever owns that coin owns everything related to the car. This is what tokenization is all about. The key use case is the ease of transference of ownership of physical things. Now let your imagination fly towards this direction and you may begin to see what kind of life-changing implications this has in the way the world operates.

How To Convert ERC20 To TRC20

Let's say that Coin Bureau pays me in USDT to write this article and they sent the money to my MetaMask wallet via the Ethereum network. At the same time, I need to pay someone else for services rendered but that person gives me a Tron wallet address. I will now need to convert the USDT in my MetaMask wallet to USDT which works on the Tron network. To do that, I have two choices:

Use an Exchange

I can deposit my USDT into an exchange that supports the Tron network and withdraw my funds via the Tron network to the recipient's Tron wallet. I'll need to pay some kind of transaction fee and it's not the cheapest option but it is the most hassle-free version. As long as I choose the right network (Tron) when making the transfer to the person I need to pay, everything will turn out okay.

Use a Bridge

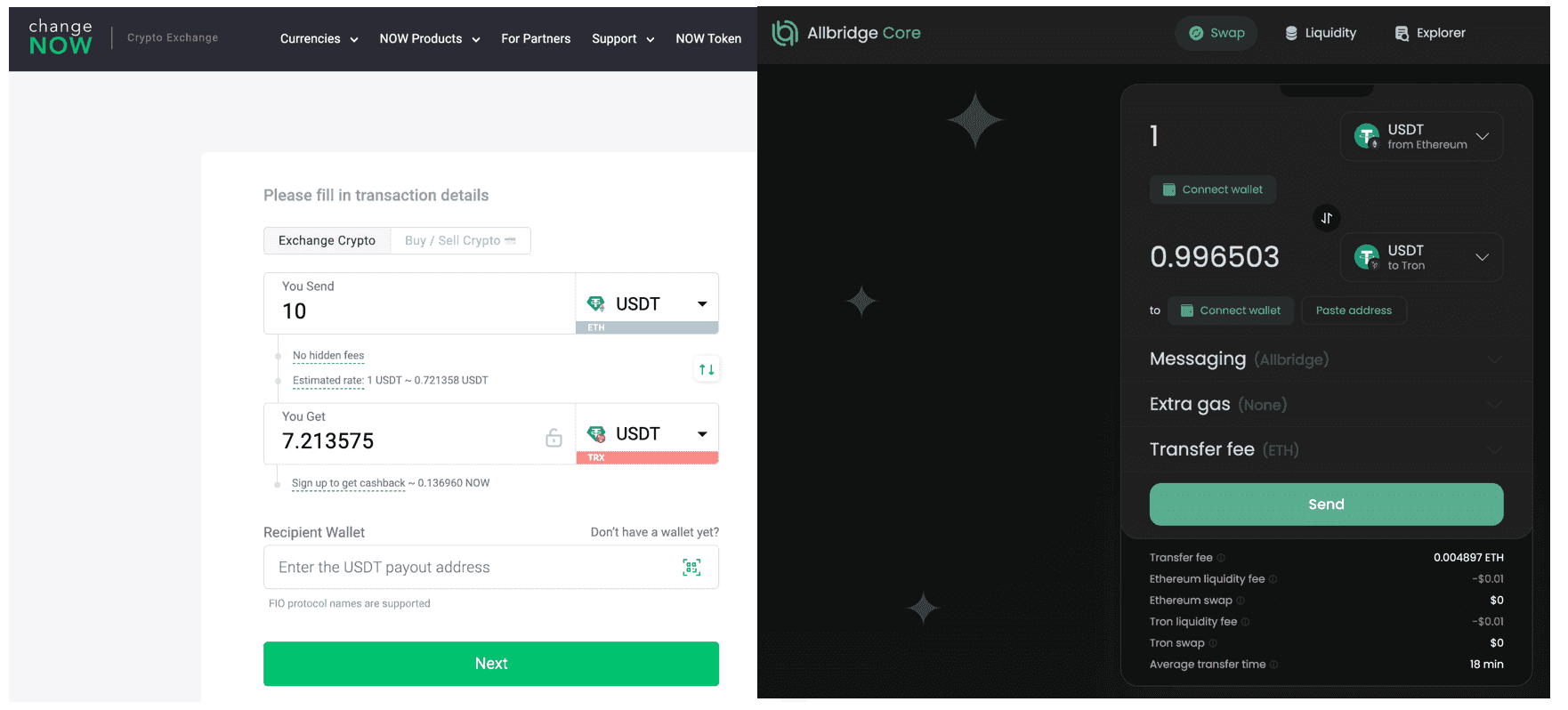

As the name implies, a bridge is a service that helps your tokens “cross over” from one blockchain network to another. It can be a DApp or a service offered by a company. The way most bridges work is:

1. Enter the amount you want to convert. Note that there is usually a minimum amount so it can't be too low like 1 USDT.

2. Connect with the wallet you are getting the funds from to do the transfer.

3. Connect with the wallet you are sending funds to.

4. Check that all the wallet details are correct, especially the one you're sending funds to. Take note of the transaction fees.

5. Hit enter and wait for the funds to go through. You can also double-check the transaction by looking up the transaction ID on a blockchain explorer.

The above steps are applicable to the conversion of ERC-20 to TRC-20 and vice versa.

Security Tip: After interacting with a DApp, if you have no more business with it, always revoke permissions to your wallet. This will prevent your wallet from getting hacked later down the line if the platform falls victim to a security breach.

There aren't too many bridges out there offering a bridge with Tron. ChangeNow.io and Allbridge Core are examples, but please do your own research and use them at your own risk. We have not used these platforms to bridge tokens and cannot vouch for them.

One more word of advice: Always check that the asset you are bridging is actually supported by the network you want to bridge to. There are way more ERC-20 tokens out there and the majority of those tokens don't exist outside of the EVM ecosystem. Similarly, a lot of the tokens issued on Tron don't have a counterpart in any other blockchain network. It never hurts to use a site like CoinGecko to verify that these tokens are officially supported before making the transfer.

Remember, all blockchain transactions are irreversible by design so any wrong transfers could result in loss of funds. A best practice is to always test using a small amount and verify that the amount is safely received before initiating a second transaction.

Future Outlook and Potential Growth

Without a doubt, Ethereum has the more prosperous ecosystem of the two. The community is thriving and there are numerous ETH meet-ups on all corners of the globe. Many of these events are well-attended by crypto enthusiasts and knowledgeable industry insiders as well.

The Ethereum roadmap has plenty of work to keep the devs busy for the next few years. Although the terminology initially presented by Ethereum Co-Creator Vitalik Buterin is not officially adopted by Ethereum.org, it's how many refer to it in the industry. These are:

- The Merge: upgrades relating to the switch from proof-of-work to proof-of-stake

- The Surge: upgrades related to scalability by rollups and data sharding

- The Scourge: upgrades related to censorship resistance, decentralization and protocol risks from MEV

- The Verge: upgrades related to verifying blocks more easily

- The Purge: upgrades related to reducing the computational costs of running nodes and simplifying the protocol

- The Splurge: other upgrades that don't fit well into the previous categories.

- sourced from Ethereum.org.

The first one was successfully upgraded to great fanfare. I remember attending a countdown party online to witness the cutover. In between The Merge and the Surge is the Shapella upgrade that allows ETH stakers to unstake their ETH at any time (although there is an exit queue — too many people wanting to leave a building at the same time yet there is only one door leading out).

It is unlikely that the rest of the upgrades will have as much attention paid to them as the first one since that was a major change. Still, those who are fans of the network will be celebrating each upgrade in their own way.

Changing over to look at Tron, we see a slightly different picture. The Tron network also has a similar roadmap, which we will separate into two sections:

Already achieved

- Exodus - Allows users to easily access, upload, publish, share, and store their data via a decentralized system created by the Tron team.

- Odyssey - The creation, distribution, and dissemination of content will be done while using TRX as a form of payment to obtain fair rewards for those involved.

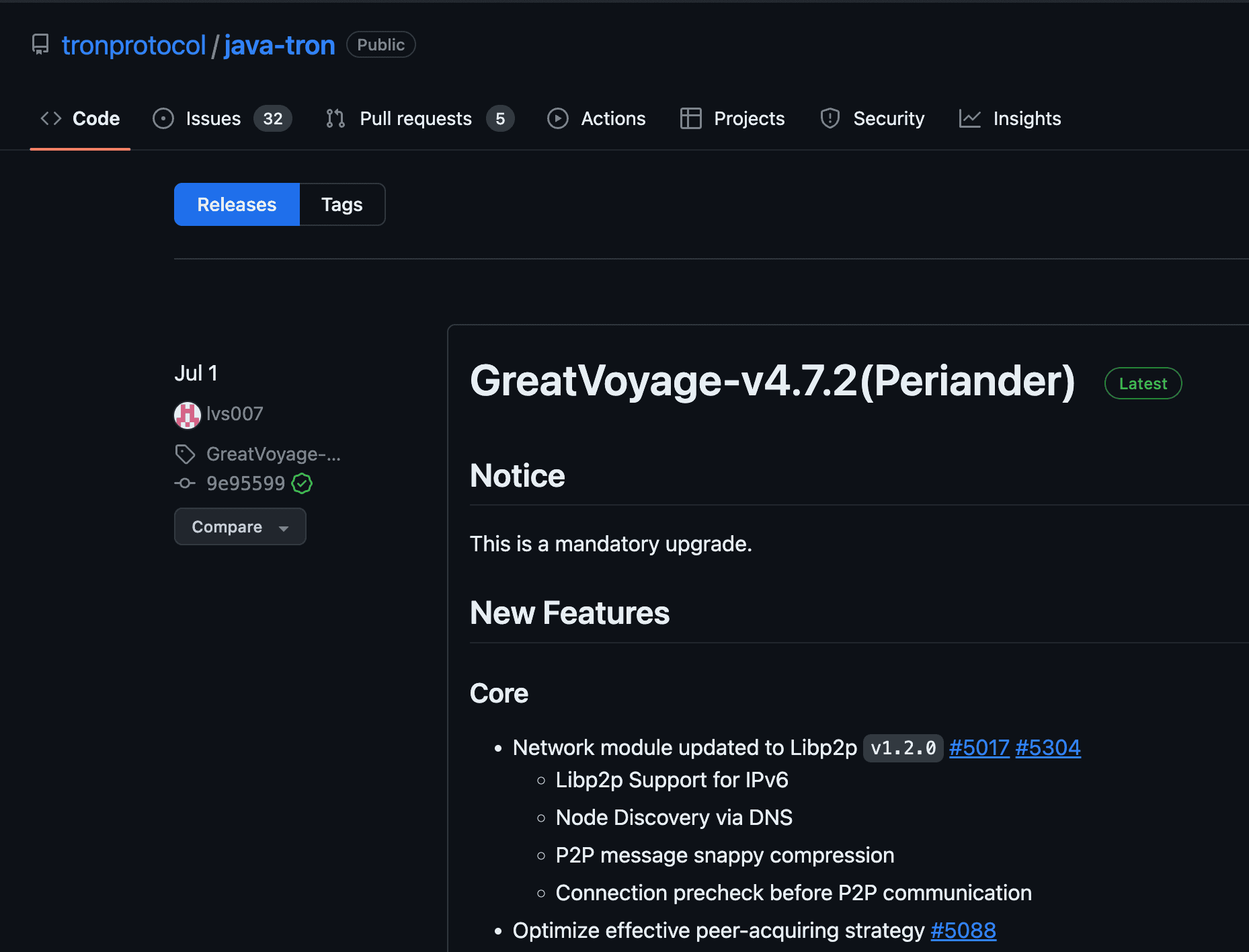

- Great Voyage (Periander) - Provide the infrastructure for launching ICOs on the Tron network. It will also handle dividends and income, as well as the management of supporters.

We're currently in this phase, launched in July 2023, as seen on the Github platform. According to Tron's development team blog post on Medium, there are plans to release GreatVoyage-v4.7.3 (Chilon) in the last quarter of 2023. This non-mandatory upgrade aims to provide a better development experience for developers with three areas of improvement: faster start-up time for nodes, better stability for network connection, and more efficient network performance.

Coming soon

- Apollo - Another ICO launch coupled with the ability for Tron users to launch their own tokens, similar to what Ethereum is doing now.

- Star Trek - This stage is all about gaming, harkening back to TRX's original function of being a gaming coin. All the functionality of a gaming platform will be built in this phase and TRX gamers can fully indulge in Play-to-Earn games. It will also have a prediction feature, which is, of course, the root of all speculative activity. This will no doubt drive up user engagement.

- Eternity - The final stage of the roadmap is where all the finishing touches will be in place for Tron to truly live up to its promise of being a fully functional global decentralized gaming platform. It is at this stage where Tron is expected to shine its brightest.

Given the information above, the Tron network still has quite a ways to go towards fulfilling its mission outlined in its early days. The development progress has been inching along and so far, from what we can tell, still on track. It will be interesting to note how Tron will juggle the two spheres of activity between gaming and DeFi, which is its current bread-and-butter for selling blockspace.

Conclusion

Both Tron and Ethereum are their own complete and separate ecosystems, and the tokens they support are far-reaching, having multiple utilities and use cases. It is quite evident though that Ethereum has a much larger sphere of influence than Tron and is much further developed.

At this point, it's fair to say that whatever developments Ethereum makes to its network will be closely regarded by the crypto community at large due to its size and influence. On the other hand, Tron can play the stealth game by flying under the radar and doing its own development without too much scrutiny or attention paid to it. This could be a very good strategy for Tron as it seeks to carve out its own niche in the crypto sphere by focusing on being the decentralized gaming network it aspires to be, leaving the rest of the miscellany to Ethereum, which is fast becoming a catch-all for all kinds of development.

As Ethereum is fast becoming the jack-of-all-trades, Tron aims to be the master of one, with a few side gigs. We do live in the era of the hustle culture after all!

Frequently Asked Questions

You can do this by either sending transfers through a centralized exchange or use a bridging solution that allows you to convert your tokens from one version to the other for a minimal cost.

It really depends on what the DApp is primarily used for. Tron has low transaction fees so it's suitable for DApps that want to utilise that as part of its strategy.

The Ethereum blockchain can give the DApp the kind of adoption success that is not yet possible through the Tron network. Ethereum DApps also often need to rely on layer 2 solutions for scalability and keeping fees low.

TRC-20 tokens are only traded on the Tron network with limited support on other chains. ERC-20 tokens can be traded on the main Ethereum network and also on all the other layer-2 networks that support the Ethereum network.

Disclaimer: These are the writer’s opinions and should not be considered investment advice. Readers should do their own research.