Bitcoin Maximalism - A Closer Look at the "Only Bitcoin" Argument

Bitcoin maximalism is the notion that there is only one cryptocurrency that is worthy of your investment, and that is Bitcoin.

It is the notion that all other Altcoins, irrespective of their promise, pale into comparison when compared to the original Cryptocurrency.

Some Bitcoin maximalists will even claim that Altcoins harm Bitcoin adoption as they remove users that would otherwise be participating with Bitcoin. Less adoption for Bitcoin, they claim, is a less secure cryptocurrency ecosystem.

Does their thesis have any good points or they being shortsighted in their pursuit of purity. We take a look.

What is Bitcoin Maximalism?

Although many people may view Bitcoin maximalists as extremists who don't value competition, they do have important theoretical justifications for their beliefs. These are based on concepts such as the "Network" effect.

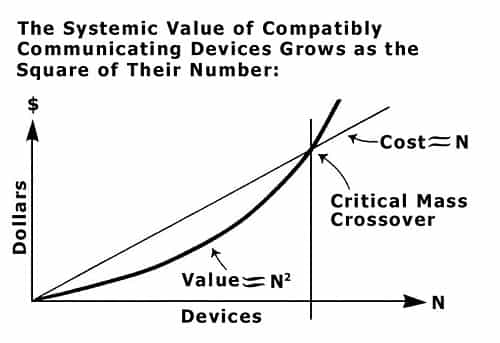

Essentially, they believe that it is better to focus all of our collective efforts to support one chain and investment than a whole host of lesser chains. They base this on the principle of Metcalfe's law which claims that the value of an investment is proportionate to the square of the number of participants.

Basically, the more people who use the network, the more valuable it is.

Bitcoin maximalists also claim that technological innovations that other chains are building, can easily be built on top of Bitcoin. They could also be built as side chains to the Bitcoin blockchain. Improvements in speed and other features like smart contract functionality can be built in.

Let us take a deeper look into each of these arguments.

The Network Effect

If Metcalfe's law is to be believed, it means that the value of a network with a certain number of participants is much greater than the value of a series of networks with the same combined networks.

Taking a look at it with simple algebra, (n) is the number of network participants. According to Metcalfe's law the value of a network is equal to (n2). Mathematically, the value of a single network with a certain amount of users is worth more than two different chains even if they have the same number of total users when combined.

Metalfe's law is not an exact science but it has been applied in a number of different models that have tried to quantify the network effect from social media to telecommunications.

Bitcoin maximalists also view Metcalfe's law in the context of network security and decentralisation. The more nodes that there are on the network, the more decentralised a blockchain becomes and hence the more secure.

This also becomes that much more necessary in an era when large mining operations are able to control more and more of the network. This is perhaps one of the reasons that Bitcoin maximalists are always pushing for users to operate their own independent nodes.

There is also the network effect of Bitcoin as a medium of exchange and investment. The more people that trade and use Bitcoin, the more liquid the markets and the more valuable they become to retail investors as an investment. They become less volatile and hence more useful as a medium of exchange.

Development on Top of Bitcoin

The other argument is that any feature that any developer would want to build into a cryptocurrency can easily be done on top of the already established Bitcoin blockchain. There would be no need to develop a completely new cryptocurrency to incorporate this technology.

For example, in this blog post that argues in favour of Bitcoin maximalism, the author claims:

Bitcoin must support fancy features like Ethereum has does in order to not lose to ETH

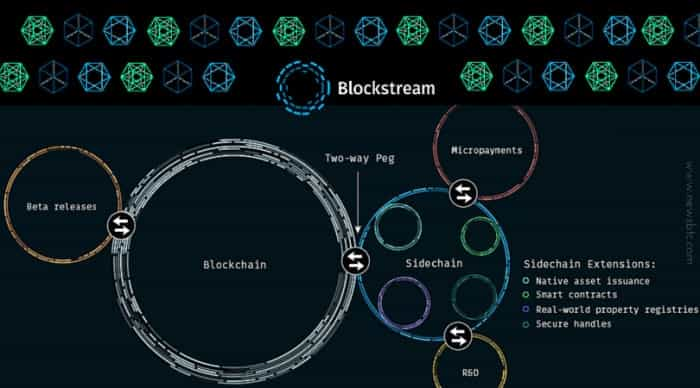

Bitcoin maximalists also favour the development of separate side chains to the Bitcoin network that do not have a native token. These side chains will share the Bitcoin supply through a mechanism called "pegged sidechains".

In essence, they claim that this will allow for development of a separate chain that will share the supply of Bitcoin. On these sidechains, developers can create tokens that are pegged to a certain amount of BTC which is locked with a trusted intermediary.

Other Maximalist Arguments

There are a few other arguments that are made by the Bitcoin maximalists that are more practical than theoretical. One is the safety of many of these newer altcoin blockchains.

For example, the added functionality of Ethereum smart contracts comes at a cost. These smart contracts can have flaws in them that are not immediately noticed by the developers. We saw this in the DAO hack as well as the Parity freeze last year.

There are also other newer chains that are susceptible to network attack given their lack of decentralisation. A recent example is in fact a fork of Bitcoin in the form of Bitcoin gold that suffered a 51% attack last month.

Whenever there is a massive loss by a cryptocurrency blockchain it hurts the reputation of the entire ecosystem including that of Bitcoin.

They also take issue with the investment thesis of many of those who invest in Altcoins. The notion that Altcoins can be seen as a way to "diversify" a cryptocurrency portfolio are incorrect. This is because they are very highly correlated with Bitcoin and will hence make a bad hedge.

Now that we have seen the rationale for the Bitcoin maximalism, let's look at the other side of the coin.

Arguments Against Bitcoin Maximalism

While Bitcoin maximalism sounds like a compelling theoretical argument, there are a number of reasons as to why it could be flawed. Some of these are more practical and others technical.

For example, there are a number of features that Altcoins have these days which just cannot be implemented on the Bitcoin protocol. These are features that make use of some of the most advanced cryptography which has outpaced Bitcoin's original design. Similarly, there are certain nuances of Bitcoin sidechains that make it harder to merely build on.

However, perhaps one of the most compelling arguments against Bitcoin maximalism is that it is a "maximalist" position. Taking a stance on anything that requires adherence to only one maxim can be restrictive to growth.

Protocol Limitations

The Bitcoin protocol was developed in 2008 in order to be a lightweight network that facilitated peer to peer electronic cash transactions. This, together with its emphasis on provable levels of security is the reason that it cannot easily be extended.

This emphasis on security is the reason that numerous other features cannot merely be added to the Bitcoin blockchain. For example, zkSNARKs, which are the privacy enhancing feature of ZCash, could not be added. They are way too complicated and are still in a nascent stage of development.

Hence, zkSNARKs cannot offer a "provable" level of security. There are numerous other cryptocurrency features that fall into the same bucket. For example, Ethereum like smart contracts have been shown to not be 100% provably secure.

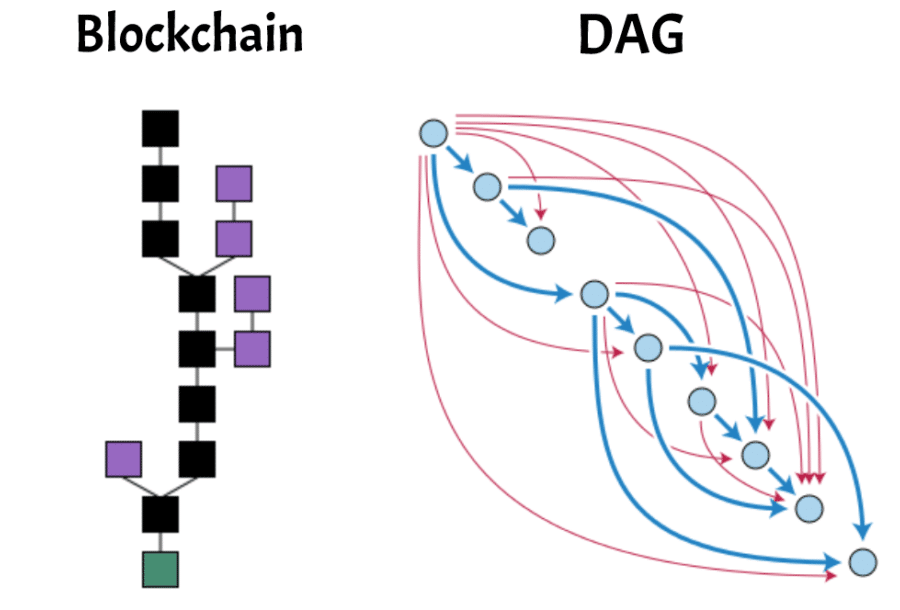

There are also a whole host of other advancements in decentralised technology which is incompatible with the Bitcoin blockchain. For example, DAGs (Directed Acyclic Graphs) such as those on NANO or ByteBall cannot are a completely different type of data structure. In this case the underlying architecture does not rely on a blockchain at all.

Moreover, even if technology can be built on top of Bitcoin, the network was not designed to be used for these purposes. It was meant to be a lightweight decentralised electronic cash which is already facing scaling difficulties. Adding more features to an already slow blockchain could have more severe implications.

While they do claim that this can be overcome by sidechain solutions, these have their own unique problems.

Sidechain Limitations

One of the main limitations that exists with sidechain solutions is that there are is a lack of a native utility token. This has a number of problems associated with it which are mostly associated with a lack of incentives.

For one, if there were mining rewards that were distributed to the block producer in the side chain then this would only be tied to a certain amount of Bitcoin that was in reserve. This would be a fractional reserve system which is used in traditional fiat money banking.

In order to get around this fractional reserve problem, there would have to be no coin creation in the side chain. This would mean that the only incentives for block propagation would be from transaction fees. The problem with this is that it eliminates the potential to bootstrap the side chain.

The block reward was useful in the initial days of Bitcoin when the transaction fees were not enough to incentivise miners to actually propagate blocks. Only once there are enough transactions in the ecosystem to justify the marginal costs will a network be able to operate without block rewards.

Lastly, one of the biggest problems with these side chains is that you have to rely on some custodian that will hold the Bitcoin for the side chain participants. If you want to convert your side chain tokens into Bitcoin you will have to request this from the custodian. This reliance of trust on the custodian can be troubling to those who hate the notion of centralised control.

Maximalists are Too Dogmatic

Many others will focus less on these technical and practical challenges as they will on the notion of a "Maximalist" approach. The anti-maximalists claim that taking a stance that is unwavering and rigid is ill advised.

They assert that there should be no reason other blockchains and cryptocurrencies can't compete with Bitcoin. The whole idea behind the Bitcoin protocol was that it was driven by verifiable code and not by an ideology.

A Middle Ground?

While both sides have points to their argument, they are in the end all fighting for the same cause. They are trying to decentralise systems of power.

Given that there is some technology which is simply too hard to build on top of Bitcoin, there is no reason that they cannot be developed as a separate cryptocurrency. As more innovation comes to the blockchain space, the more the whole ecosystem grows.

On security, it is quite hard for nascent technology to live up to the standards of Bitcoin from day one. As protocols become more advanced, the harder it is to demonstrate 100% provable security. Yet, all this means is that more work needs to be done. It should not be used as an example of Bitcoin's superiority.

Maximalists are right in their assertion that there are a number of altcoins that do not add value and are merely redundant. There are plenty examples of such coins in the top 100 list on Coin Market Cap.

Over the past year, there has been a flood of inferior Altcoins which has resulted in many who reverted to dogmatic maximalist thinking. Yet, this should not be a reason to dismiss a whole host of other projects that are adding value to the entire cryptocurrency ecosystem.

In the end, Bitcoin is still king and is revered by many in the market. The Bitcoin market share percentage is increasing and innovations to its blockchain are still being built. There is no need for the absolute position taken by maximalists.

Disclaimer: These are the writer’s opinions and should not be considered investment advice. Readers should do their own research.