The race to scale Ethereum is heating up. Over the crypto winter, layer 2 solutions have overcome significant technological hurdles, and we are experiencing a boom in the number of layer 2s available.

A field limited to state channels, plasma chains, and application-specific rollups is now dominated by general-purpose rollups like Arbitrum, Optimism, and zkSync. Recently, Coinbase has also joined the race with Base, and more players are expected to enter, including Polygon with several efforts and Scroll with their zkEVM. Less-hyped players like StarkWare are also shipping tech upgrades at a phenomenal pace.

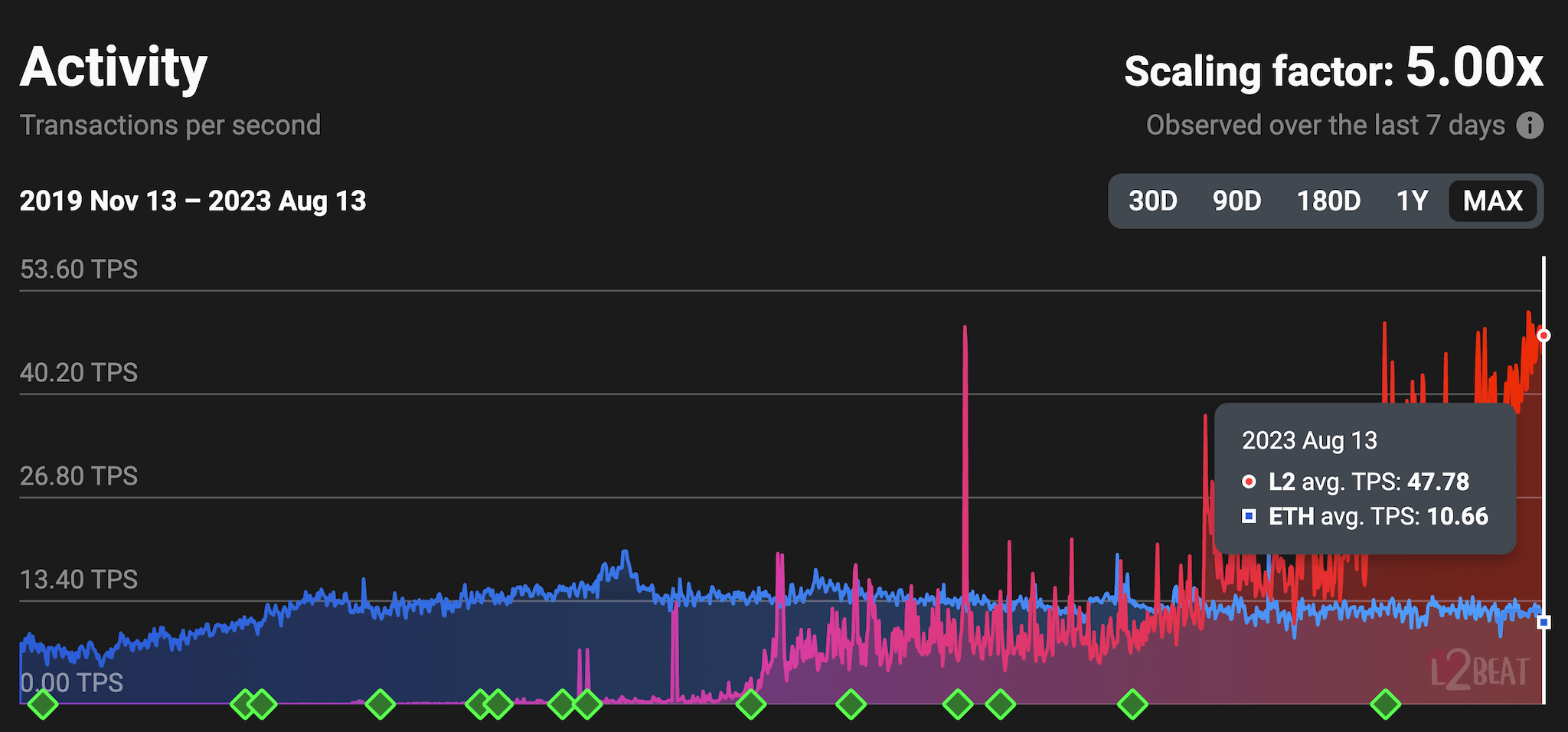

Users continue to flock to layer 2s motivated by lower transaction fees, faster speeds, flourishing dapp ecosystems, and the potential for airdrops. In less than a year, layer 2s have gone from processing fewer transactions than the Ethereum mainnet to five times the number of transactions.

Similar to general-purpose layer 1 blockchains, where only a few winners have taken the largest slice of the cake, we will likely see the same happening in rollups. I am confident in this prediction because the technological differences between rollups are prominent, so some architectures and implementations will reign over others. Do you want to know who will win?

In this article, we will cover the essentials you need to know about layer 2 solutions, the leading rollups in detail, and the features that can make a layer 2 superior to others.

Why are Layer 2 Solutions Necessary?

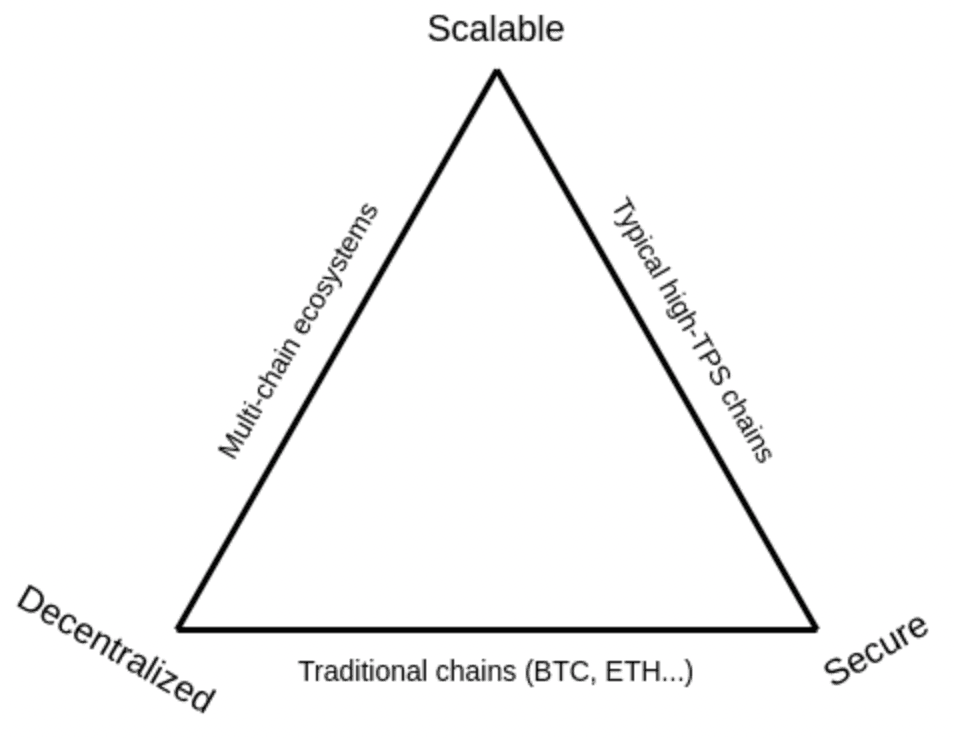

Early blockchain networks such as Bitcoin and Ethereum are limited in transaction throughput. This is for a good reason as these networks were designed with a focus on security and decentralization. Achieving the three most desirable pillars - scalability, security, and decentralization - simultaneously is notoriously challenging, an engineering problem known as the blockchain trilemma.

Scalability, Security, and Decentralization Tradeoffs

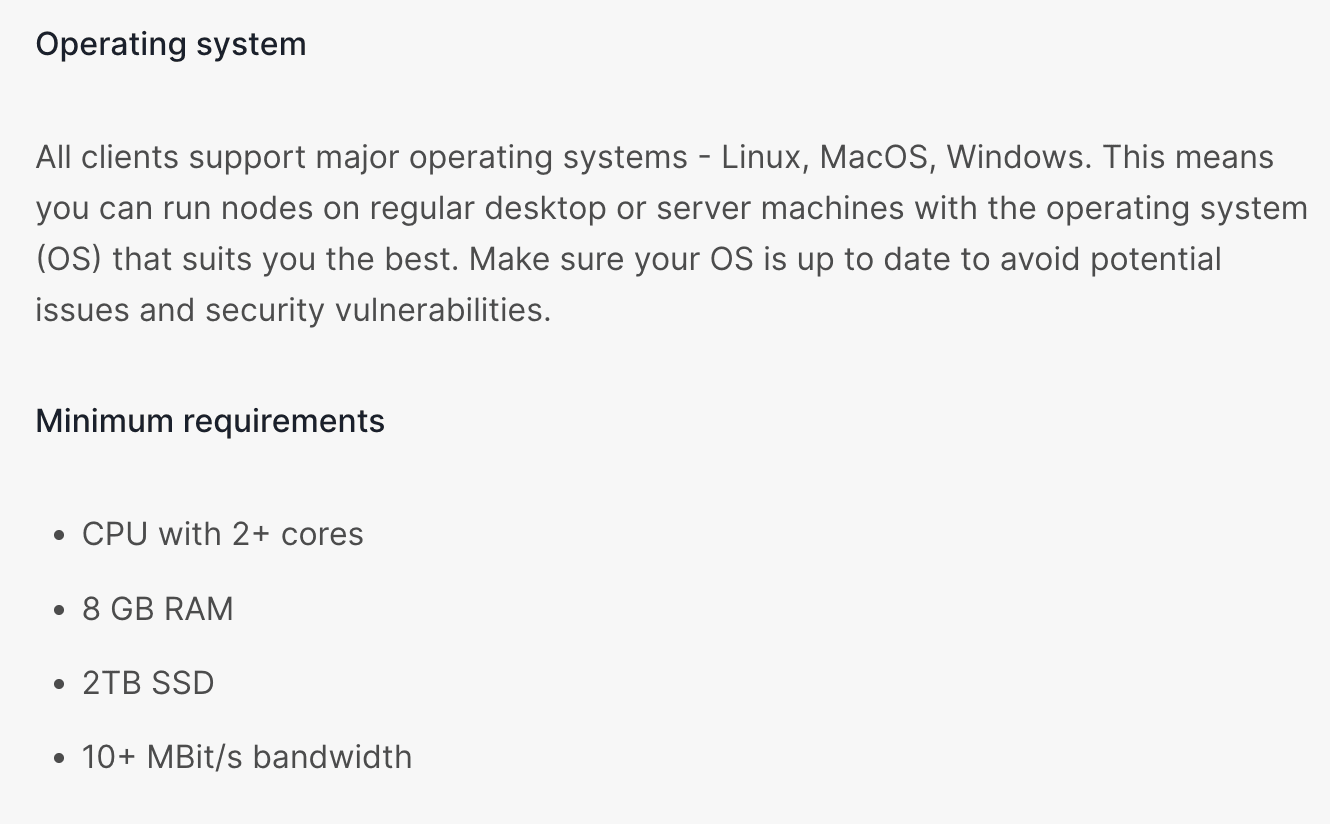

Recent high-throughput blockchains like Solana require substantial hardware capabilities to accommodate their processing demands. As a result, fewer well-resourced participants might run nodes, potentially leading to power concentration and making the network more susceptible to manipulation and majority attacks.

On the other side of the blockchain trilemma, hardware requirements to run an Ethereum node are relatively low, with network nodes able to run on consumer-grade hardware. This model encourages a more decentralized and strengthens security.

However, Ethereum's intentional design choice has led to a compromise on scalability. It can handle a maximum of ≈30 transactions per second, notably less than Solana's theoretical 65,000 maximum. This limitation has posed challenges as the blockchain's use cases and user base have expanded.

The Early Signs for the Necessity of Layer 2s

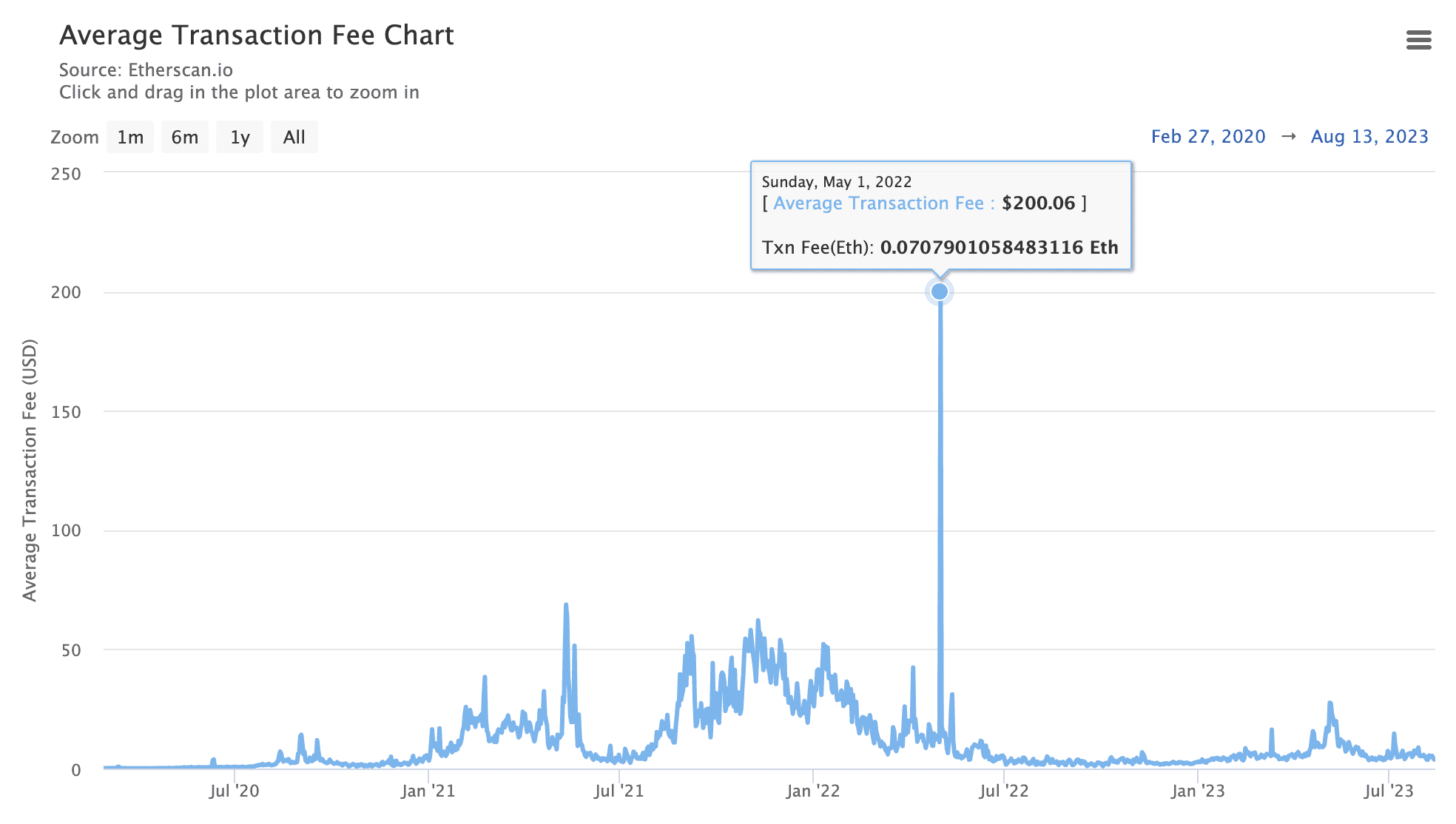

As blockchain technology matured and use cases diversified beyond peer-to-peer transactions, Ethereum's scalability limitations became more apparent. When CryptoKitties, a popular game on the Ethereum blockchain, went viral in 2017, transaction fees and waiting times rose significantly.

This was a wake-up call for the industry. It demonstrated that for blockchain networks to support a large number of users and complex decentralized applications, they need to be able to process transactions much faster and offer lower fees. After the 2021 bull run, the urge became even more apparent. Ethereum transaction fees soared, peaking at more than $200.

This necessity gives rise to layer 2 solutions, which aim to address scalability challenges while maintaining high security.

What are Layer 2 Solutions?

Layer 2 solutions are frameworks built on top of an existing layer 1, like Ethereum, and aim to enhance the blockchain in some shape or form. Layer 2s today improve transaction throughput and speed by processing transactions outside the main Ethereum chain, thereby offloading computational work and scaling the network.

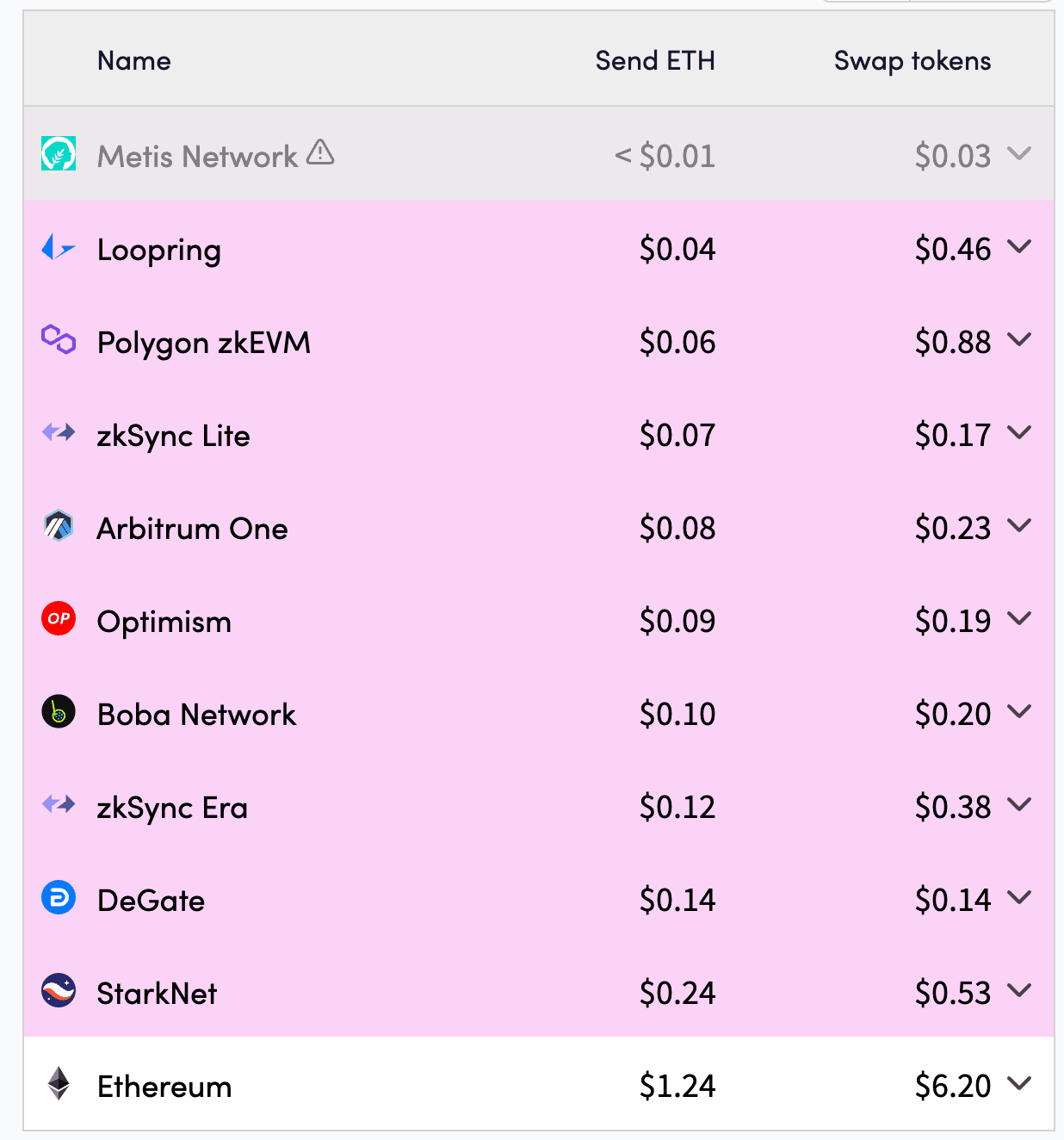

The scaling layer 2 solutions provided are significant, offering much faster and cheaper transaction fees and making blockchain technology accessible to millions of users that would otherwise find fees prohibitive. For instance, sending ETH from one address to another using Optimism would cost a user 0.09$, compared to 1.24$ on the Ethereum Network.

A Key Distinction: Why Polygon Proof-of-Stake is Not a Layer 2

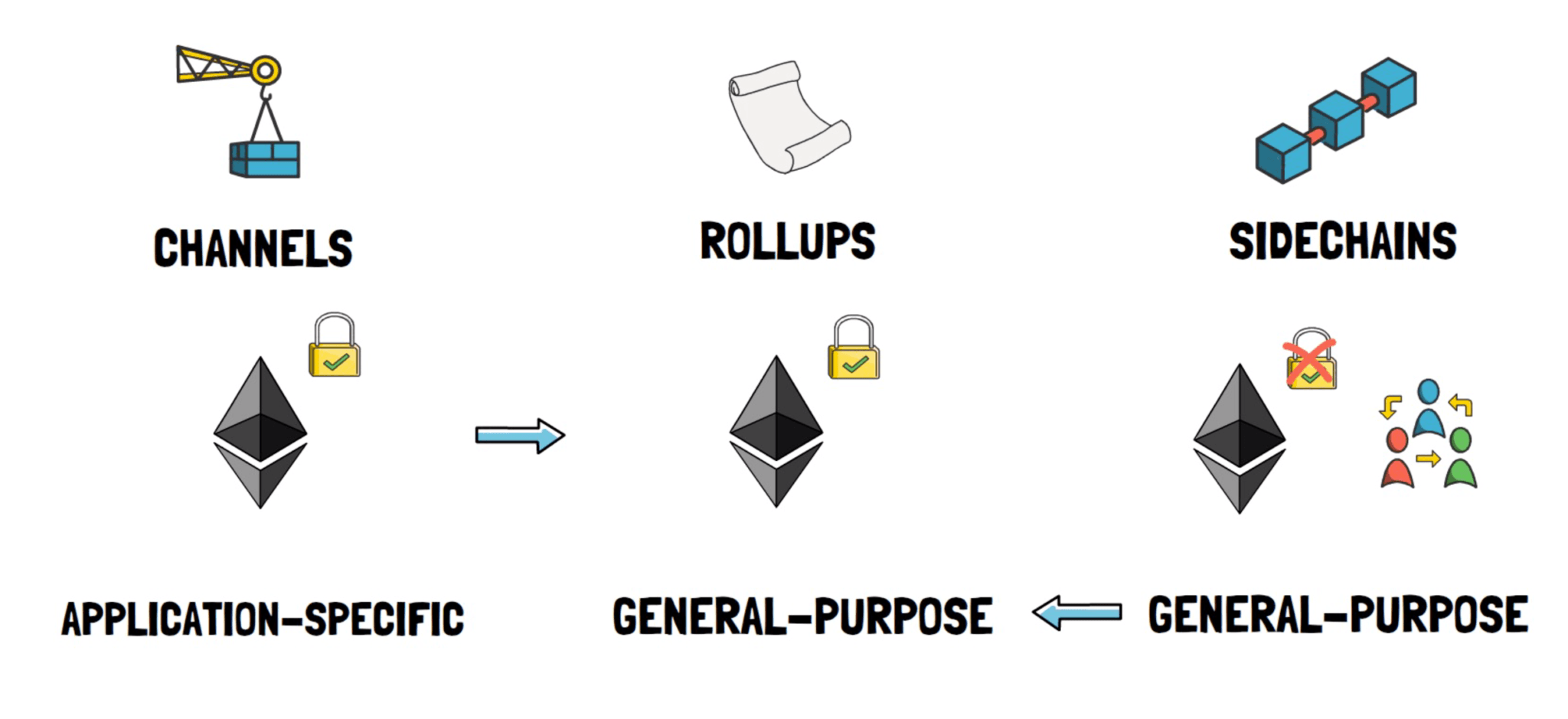

Polygon's Proof-of-Stake (PoS) chain is often associated with layer 2 solutions because of its high throughput and ease of bridging to Ethereum. However, due to its security model, it's not technically a layer 2.

Unlike layer 2 solutions, which derive their security directly from Ethereum's consensus protocol, Polygon's PoS chain operates with its own consensus mechanism and set of validators. This makes it a sidechain, a separate blockchain that runs parallel to the main one, with its security assumptions and rules, and not a layer 2.

Today's Rollup Centric Layer 2 Landscape

The layer 2 landscape today is increasingly focusing on a type of layer 2 known as a “rollup,” as they have become the most appealing solution to the scalability challenges. Engineers have developed rollups to support Ethereum dapps with minimal-to-no code changes, something impossible with other layer 2 solutions like payment channels.

How do Rollups Scale Ethereum?

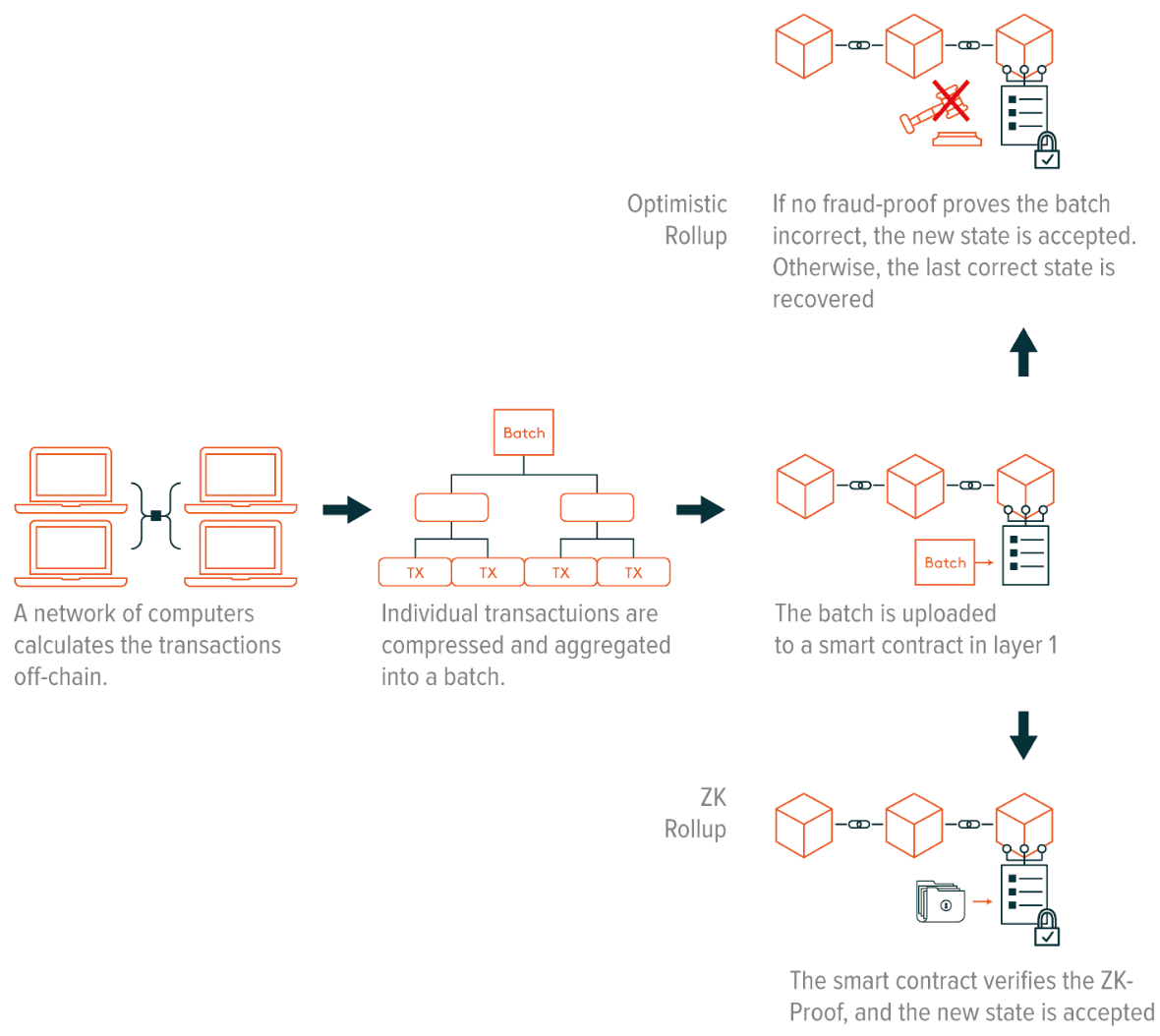

Rollups scale Ethereum by moving computation off chain, hence offloading the main chain. In rollups, transactions are processed off-chain, and then data is compressed and uploaded to Ethereum in a batch containing necessary transaction data and the new rollup state.

The final and intricate part is proving to Ethereum that the new state is valid. This is done via fraud proofs or validity proofs, depending on whether the rollup is Optimistic or zero knowledge. The gas fees for uploading the necessary data for multiple off-chain transactions and verifying either type of proof are much cheaper than doing the original computation on the Ethereum network, so the resulting system dramatically increases the transaction throughput and reduces costs.

The result is a system that solves Ethereum's scalability issues with solid security guarantees. Security is maintained as the state of the rollup is available in the Ethereum network, meaning users always have the information necessary to verify transactions.

The Leading Layer 2 Solutions

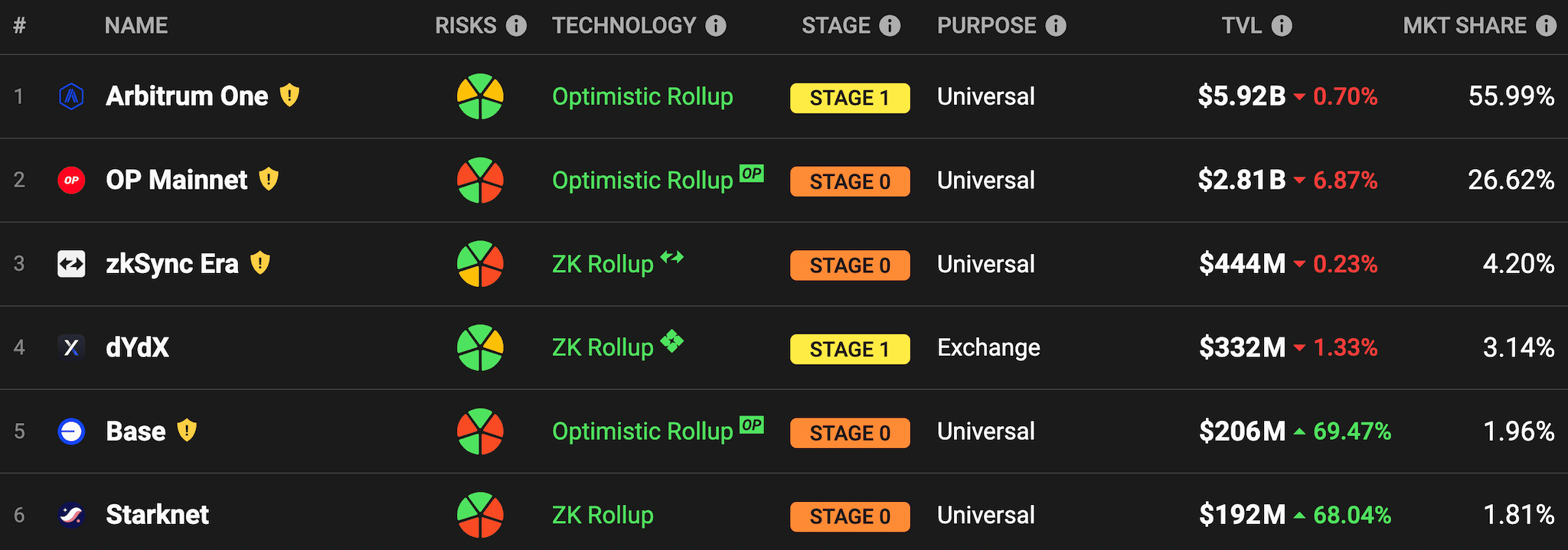

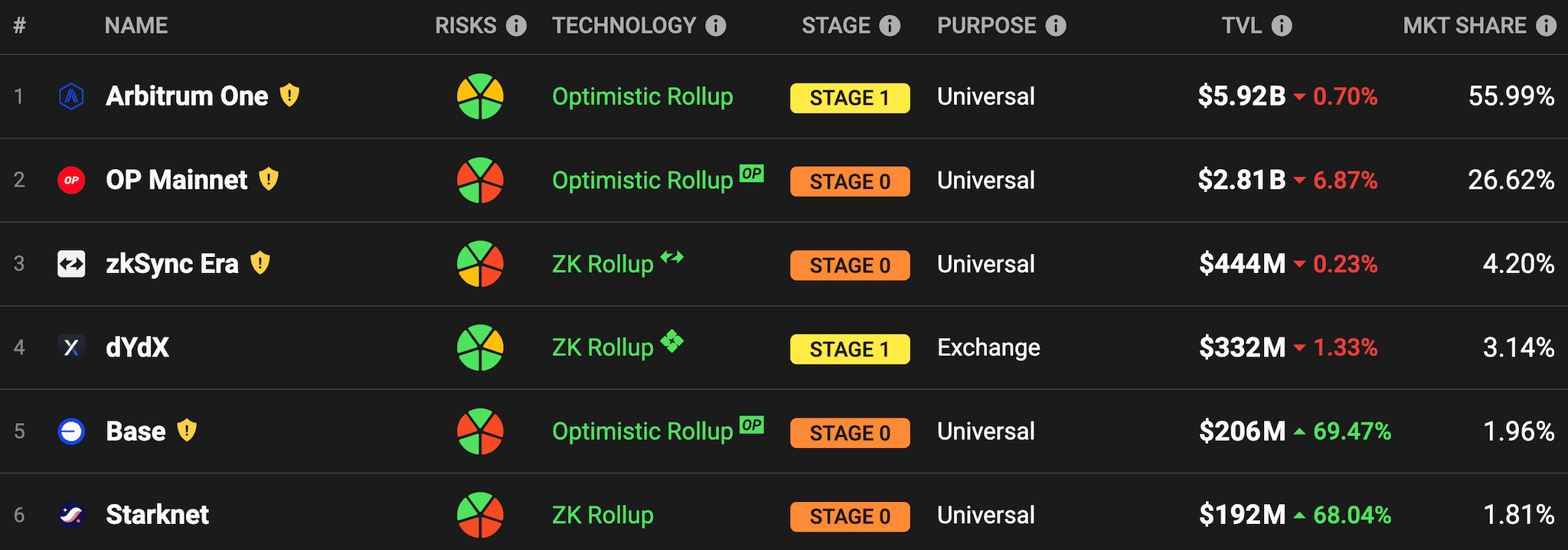

Players like Arbitrum, Optimism, zkSync, and Base lead the rollup-centric landscape. The leading rollups ranked by total volume locked are shown below:

Arbitrum: The Most Mature Rollup

Arbitrum was launched to the public on August 31st, 2021, and became the first rollup to support the permissionless deployment of smart contracts. As the first optimistic rollup that supported Ethereum dapps with virtually no coding work, DeFi in Arbitrum proliferated and is today's leading layer 2 by total volume locked, as well as one of the most extraordinary DeFi ecosystems in the whole of crypto.

The growth of the Arbitrum ecosystem has been coordinated by the Arbitrum decentralized autonomous organization (DAO) since the distribution of the ARB token on March 23rd, 2023. The Arbitrum Foundation, a Cayman Islands foundation company, stewards the ArbitrumDAO. Offchain Labs, a blockchain development company is in charge of upgrading the network.

Arbitrum Governance

Arbitrum follows an on-chain governance model that gives the DAO ownership of the chain to grow the Arbitrum ecosystem and features a “Security Council” with veto powers.

ARB token holders vote on DAO governance proposals, where an individual's voting power is proportional to the number of tokens held.

Although DAOs cannot instantly make protocol changes, quick action may be necessary in emergencies like a security vulnerability. This is where the Security Council fits. The Council, composed of 12 respected community representatives, is tasked with maintaining chain security and acting quickly during security emergencies. The Arbitrum DAO governs the Security Council, holding elections twice yearly.

The Arbitrum Token: ARB

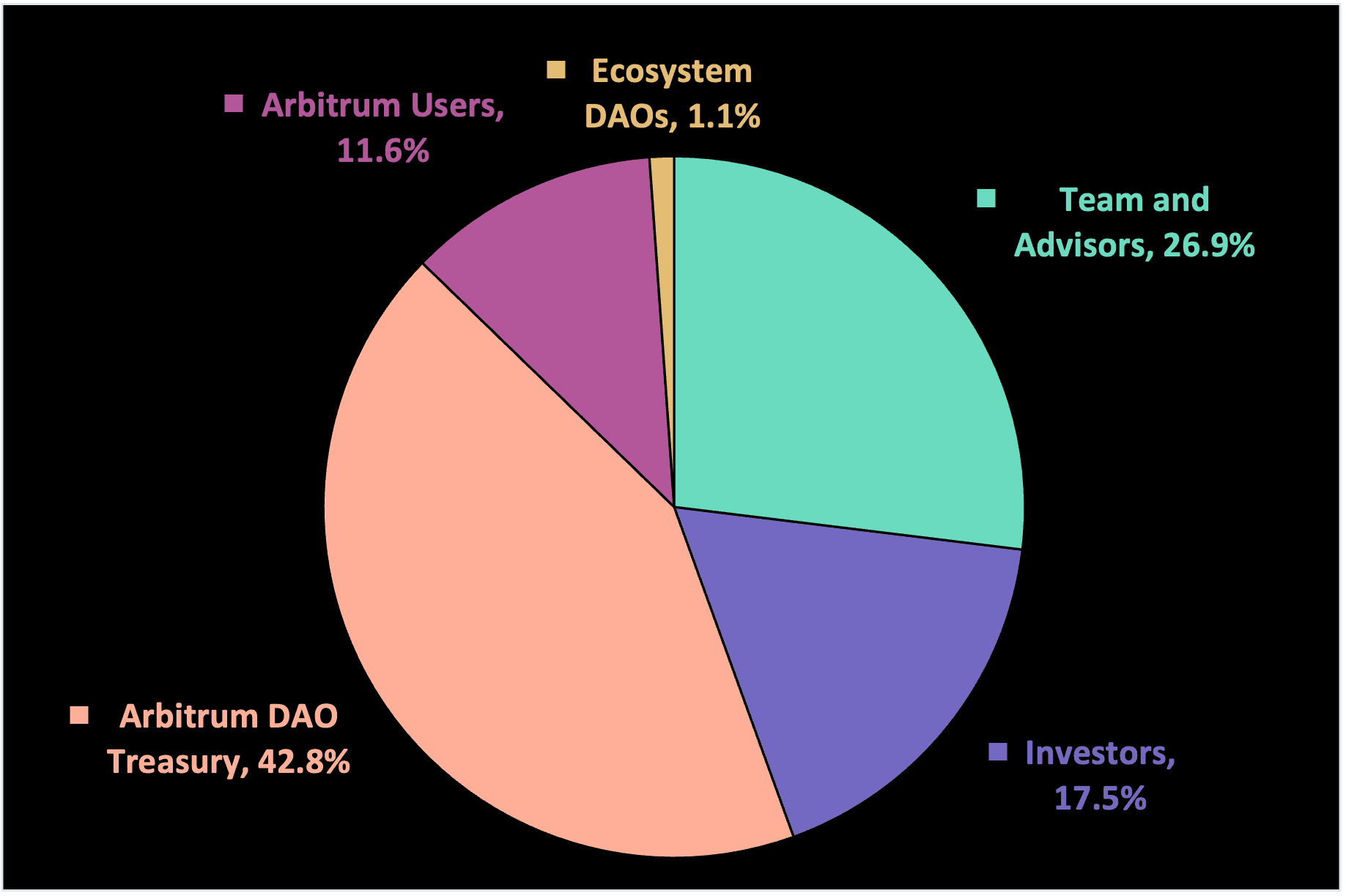

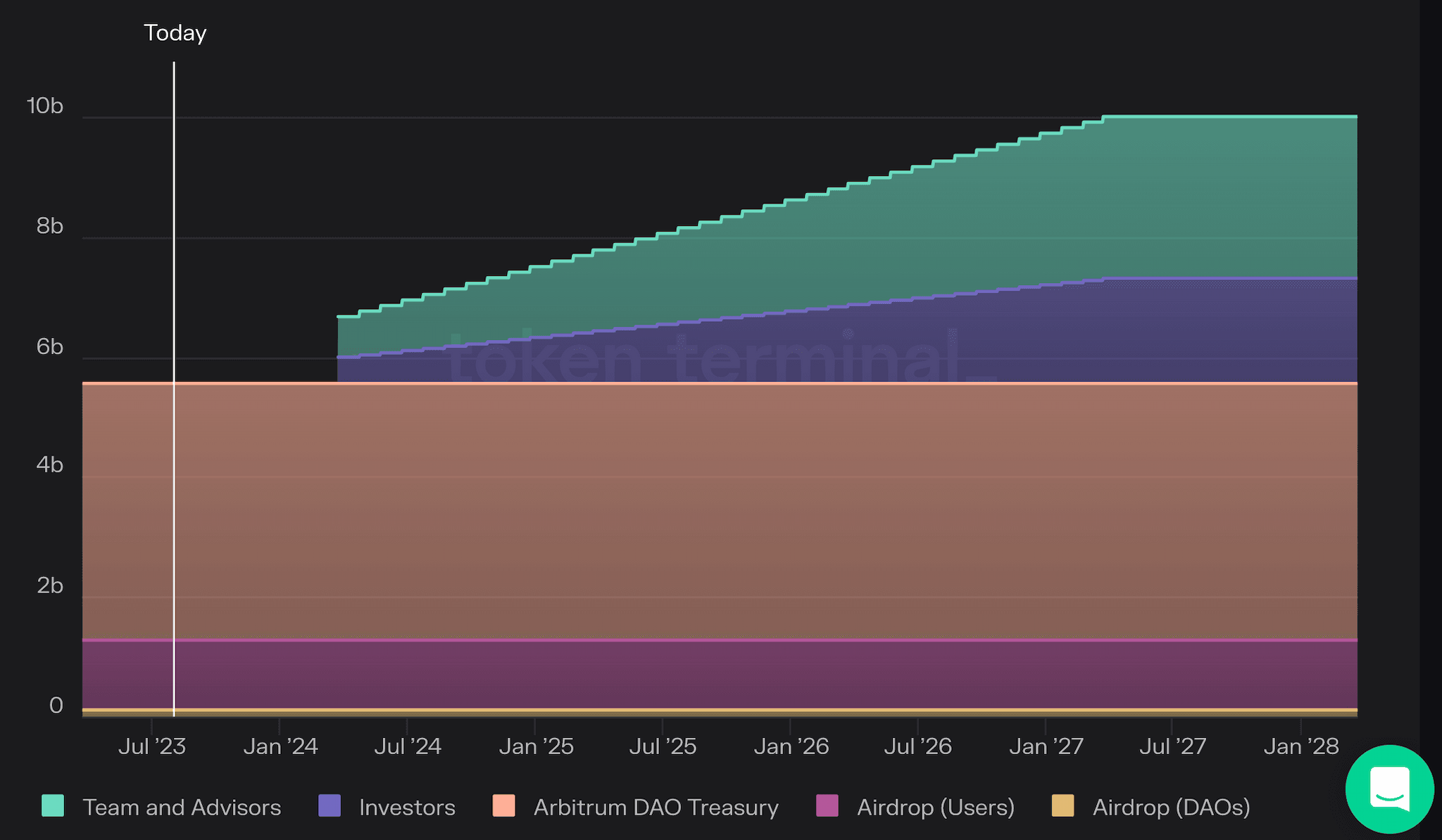

Currently, ARB is purely a governance token. ARB has an initial supply cap of 10,000,000,000 tokens, with the following initial allocation:

11.6% awarded to early Arbitrum users via Airdrop.

1.1% awarded to DAOs in the Arbitrum ecosystem via Airdrop.

42.8% allocated to the Arbitrum DAO Treasury. Governance can decide how to use these funds.

26.9% allocated to Core Contributors, distributed between Offchain Labs team, treasury, and Advisors.

17.5 % allocated to Offchain Labs investors.

Optimism: The Superchain

Optimism was the first rollup to be available to the public, launching on January 16th, 2021, although smart contract deployment was reserved for a few whitelisted developers until December 16th, 2021.

The network's ongoing development has been coordinated by an innovative governance system, the Optimism Collective, since the distribution of the OP token on March 23rd, 2023. The Collective is stewarded by the Optimism Foundation, whose goal is to support the establishment of the Optimism Collective and the network's decentralization. OP Labs, a blockchain development company, spearheads network engineering upgrades.

The Collective's vision to scale Ethereum is distinct and ambitious. It features architecture that lays the ground for multiple Layer 2 and Layer 3 solutions working together in an ecosystem coordinated by an innovative governance model.

In Optimism's words: “Optimism isn’t building a blockchain—it’s building a digital society. Ambitious goals demand equally ambitious infrastructure.”

The OP Stack: the Software Enabling the Superchain

Optimism’s groundbreaking architecture enabled by its open-source software package, the “OP stack,” is its key feature. The OP Stack allows compatible L2s and L3s, termed “op-chains.” that can communicate through a shared message-passing format. This group of integrated chains will form what the Optimism team calls the “Superchain.” It aims to provide the scalability of parallel chains and the composability of a single blockchain.

The most notorious player to subscribe to this vision is Coinbase. The exchange surprised the world when it announced the launch of its new Layer 2 solution, Base, which will be the second rollup on the OP stack.

The OP stack was built with modularity at its core. Whether it's swapping out Ethereum for Celestia as a data availability layer or supporting optimistic rollups and zero-knowledge rollups (zk rollups), the flexible architecture of the OP Stack prepares Optimism for future developments in Ethereum.

The Optimism Collective

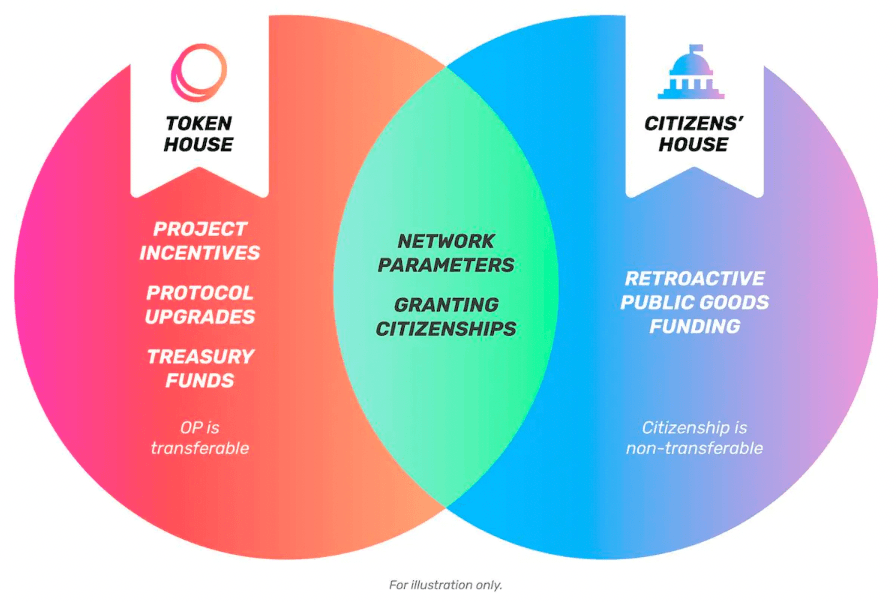

The Optimism Collective is a Bicameral governance system divided into two distinct houses: the Token House and the Citizens’ House.

Token House

The Token House is akin to the Arbitrum DAO. OP token holders have voting rights on matters such as protocol upgrades and allocating the Governance Fund, the equivalent of the DAO treasury.

Citizens’ House

The Citizens’ House is tasked with facilitating and governing a process to distribute retroactive public goods funding. The membership to the Citizens’ House, or “citizenship,” will be granted via non-transferable NFTs, which are soulbound to the holder. As the Optimism community expands, so will the set of citizens.

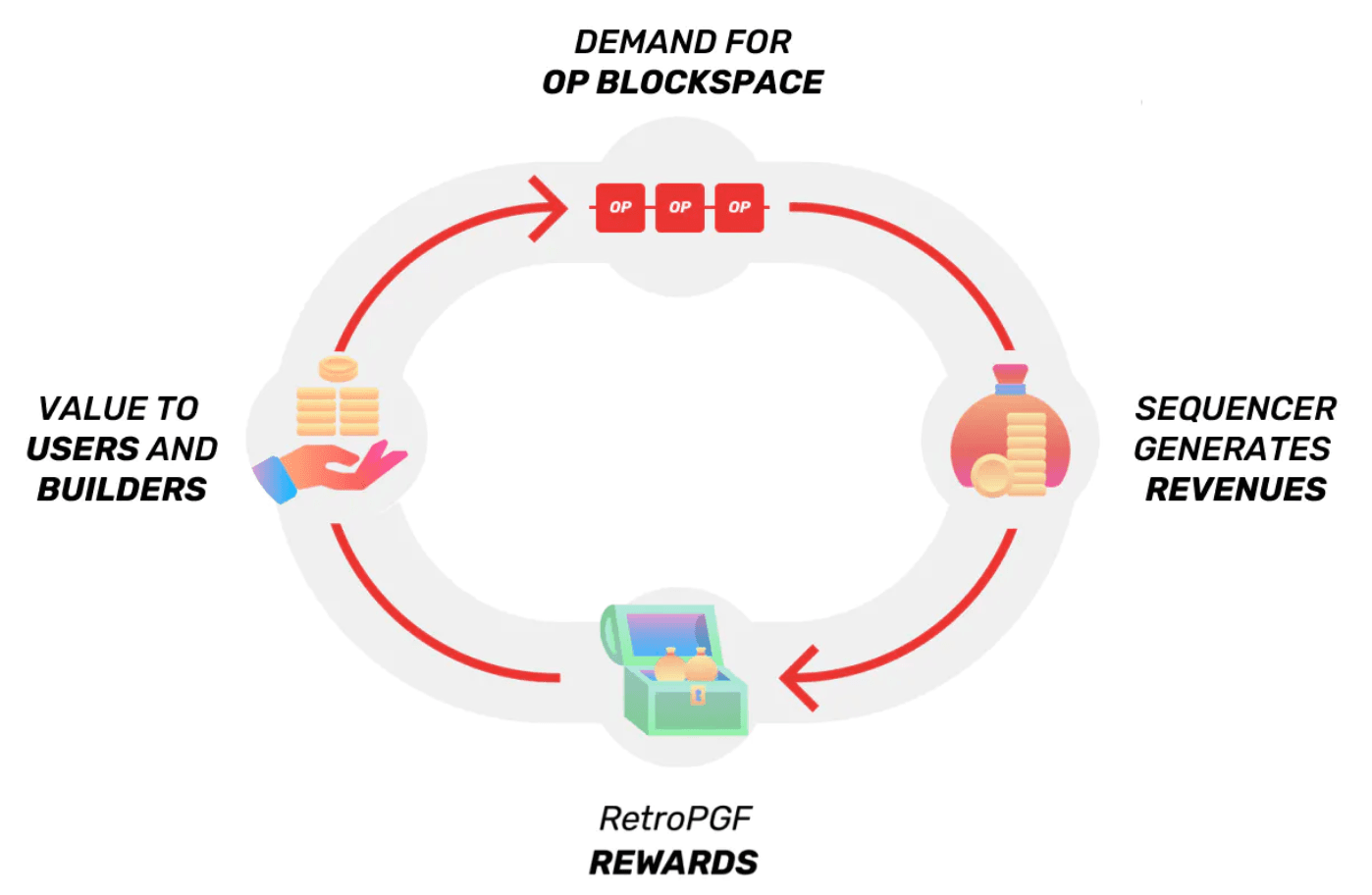

Retroactive Public Goods Funding and Network Effects

Retroactive public goods funding rewards projects or contributions that have already demonstrated value to the Optimism ecosystem. It recognizes positive impacts that might otherwise go unrewarded, incentivizing network growth. Two rounds have taken place, and a third is scheduled for fall 2023.

Funding will come from the following revenue sources:

- 20% of the initial OP token supply is reserved for retroactive funding.

- Optimism and other OP chains’ network transaction fees.

Both the Citizens’ House, via retroactive public goods funding, and the Token House, via allocation of the OP treasury in the Ecosystem Fund, collaboratively allocate OP to support the growth of the Superchain. A positive feedback effect is anticipated from this model, where the funding of public goods grows the ecosystem, which enhances the value of Optimism blockspace, leading to increased revenue for public goods and so on.

The Optimism Token: OP

OP is at the heart of Optimism Collective's vision as the Token House governance token and the incentives system's money. The Optimism Collective has created a dynamic, governance-centric system of incentives for projects and users in the Optimism ecosystem that revolves around the OP token.

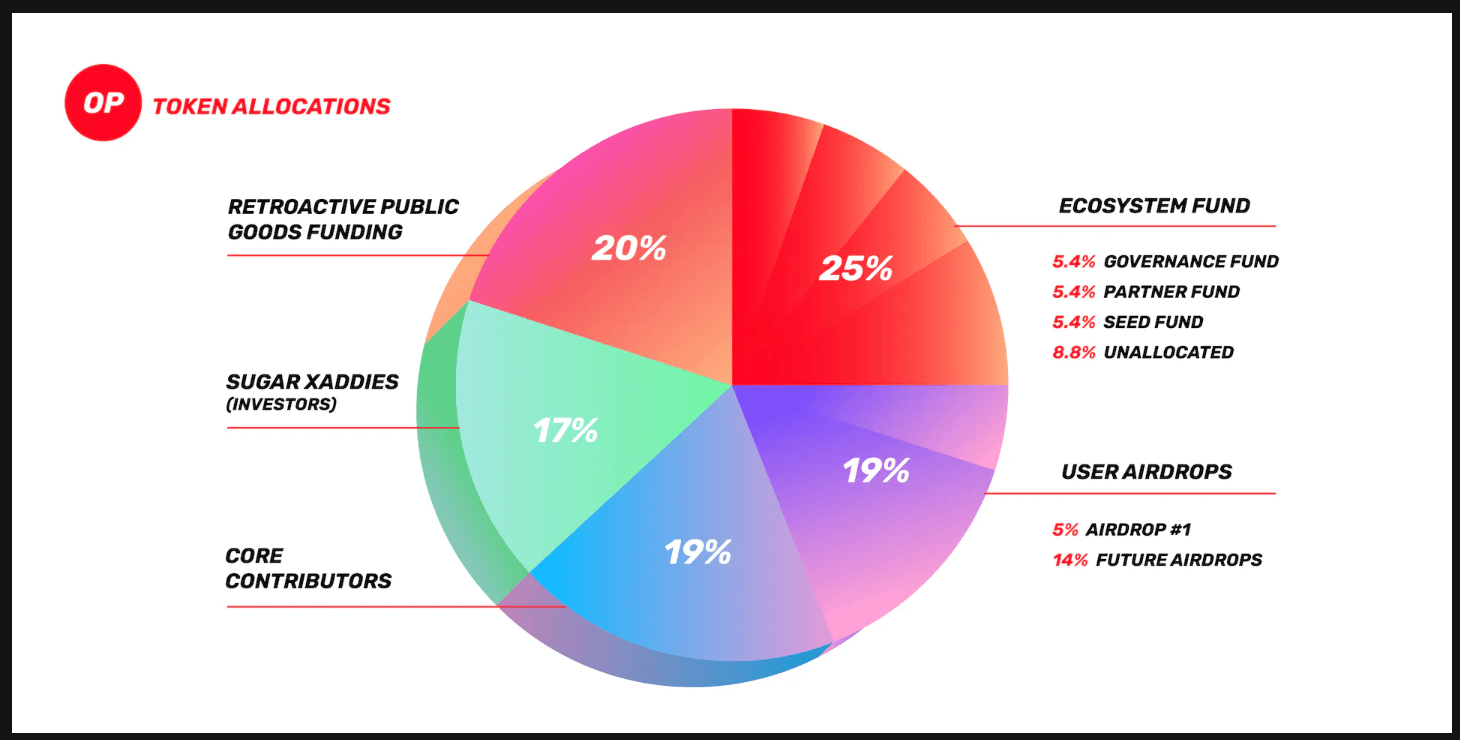

OP has an initial supply cap of 2^32 (4,294,967,296) tokens, with the following initial allocation:

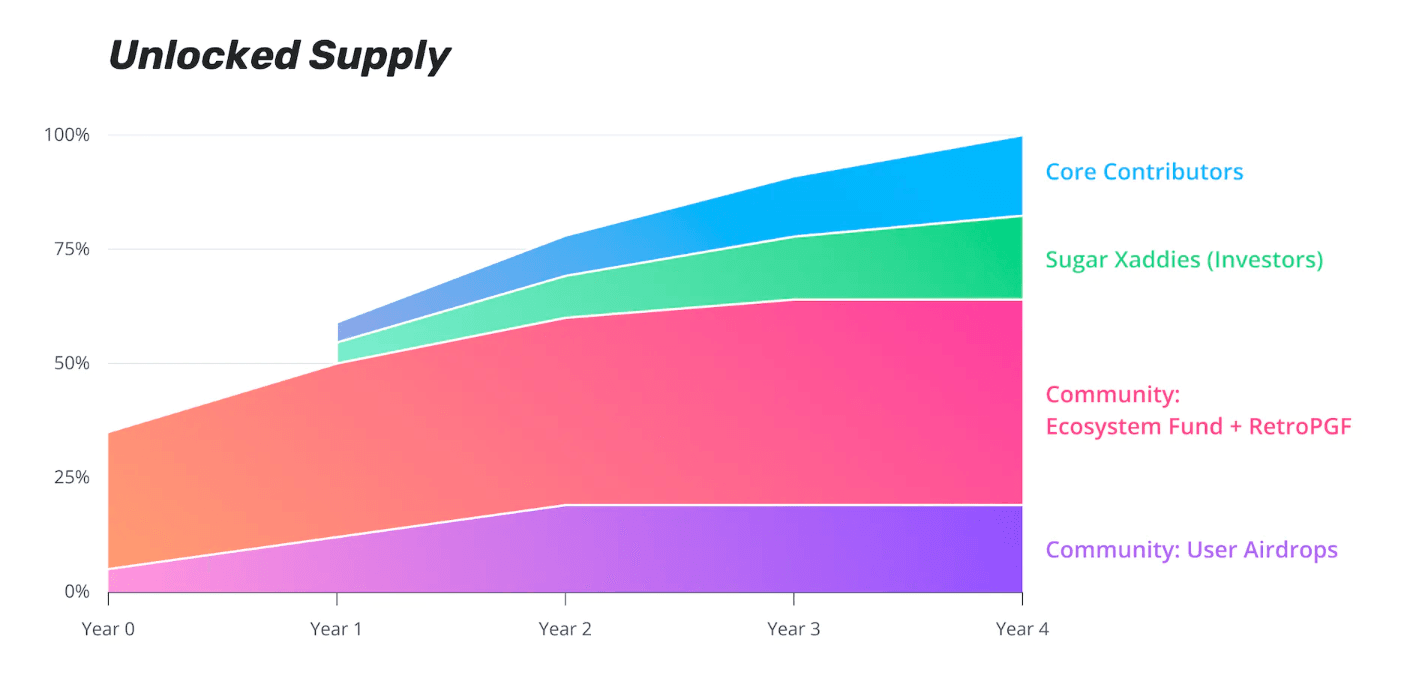

The collective believes that multiple, staggered airdrops are more conducive to creating a longer-lasting incentives system over a single airdrop. There have been two airdrops to date. The first airdrop distributed 5% of the tokens to early users of Optimism. Airdrop number 2, much smaller than the first, distributed 0.27% of OP to Token House delegators and Optimism power users.

20% to the Citizens' House's retroactive public goods funding reserve.

25% to the Ecosystem Fund. This allocation is split into the following categories:

- 5.4% to the Governance Fund, a treasury managed by the Token House. An experimental governance sub-dao, the Optimism Grants Council, makes grants to support incentive program strategies and to support builders innovating on novel applications and infrastructure.

- 5.4% to the Partner Fund. These funds will be distributed strategically by the Optimism Foundation to grow the Optimism ecosystem.

- 5.4% to the Seed Fund for early-stage projects launching in the Optimism ecosystem.

- 8.8% will be held in reserve for future governance or Foundation programs.

The Ecosystem Fund is intended to be a kick-starting mechanism that will be replaced once its reserves are used. The Optimism Foundation expects the function served by the Ecosystem Fund to eventually be replaced by private third-party investors who can expect to be paid out by the Retroactive Public Goods Funding mechanism.

19% allocated to Core Contributors, distributed between Foundation members, OP Labs, and advisors.

17% allocated to OP Labs investors.

Base: The Chain To Onboard Billions of Users

Launched on August 9th, 2023, Base is the newest optimistic rollup joining the party. Coinbase launched Base as the next step towards increasing economic freedom worldwide by giving users an easy way to onboard the on-chain economy.

Base will be integrated with the Coinbase Wallet (as well as other Ethereum wallets) and the Coinbase app in jurisdictions where the regulatory landscape allows, aiming to make web3 available to more people. Importantly, Coinbase's 110 million verified users could benefit from an easy route to onboard the Ethereum blockchain, an unprecedented number in the on-chain world.

The Second Layer 2 to Join the Superchain

Base joins the Optimism Superchain, with the resources and human capital of Coinbase joining OP Labs in contributing to the mission of the Optimism Collective. This mutually beneficial relationship helps Coinbase by providing Base with a robust, interoperable, scalable architecture. It also helps Optimism by adding value to the Superchain, accelerating its road to decentralization and accruing funding revenue. As stated by Coinbase:

“We will provide a percentage of the fees earned through transactions to the Optimism Collective to be a part of the Superchain, contributing back to funding the core public goods infrastructure of both the Superchain and the broader crypto economy.”

Base Could Be the Prime Chain For Real-World Tokenized Assets

Base is uniquely positioned in the layer 2 landscape and could be the prime platform for deploying real-world blockchain assets. Every Coinbase user has passed KYC/AML checks to trade on Coinbase, meaning its 110 million verified users could have less friction to trade assets such as securities that require KYC/AML checks.

Is there a Base Token?

Coinbase has often announced that there will NOT be a token native to Base, likely ever. Beware of scams that try to impersonate Base!

ZkSync Era: The Dark Horse

ZkSync Era (also known as Era or zkSync) is the first EVM-compatible zk rollup (zkEVM) available to the public, launched on the 24th of March, 2023. Many, including Vitalik Buterin, have dubbed zkEVMs as the holy grail of scaling because, out of all Ethereum scaling solutions, zkEVMs are the only ones that offer high scalability, EVM compatibility, and trustlessness.

Currently, zkSync Era sits 3rd in Layer 2s by total volume locked and hovers around first in transaction activity. Although metrics could be inflated in anticipation of its token airdrop, it is the clear leader of all zk rollups and features the most advanced tech.

When Will the zkSync Token Launch?

A zkSync token is coming - it is even talked about as a given in the documentation. But there is no specified date, and the team has vaguely stated that the token will be launched “when the time is right.”

Decentralizing the rollup is a primary goal for which the token will be essential. However, the network is still in its early stages, and the team believes that having control over the upgradeability and the sequencers benefits all users in case there is a bug or attack and quick action is required.

The next step in decentralization would be transitioning to a community-elected security council model, and at this stage, a token would start making more sense. Until then, beware of any zkSync impersonators and scammers!

Comparing the Layer 2 Solutions

The competition within the layer 2 ecosystem is fierce. The design space for rollups is ample, and each solution is working tirelessly on what they believe is the best approach to scaling Ethereum.

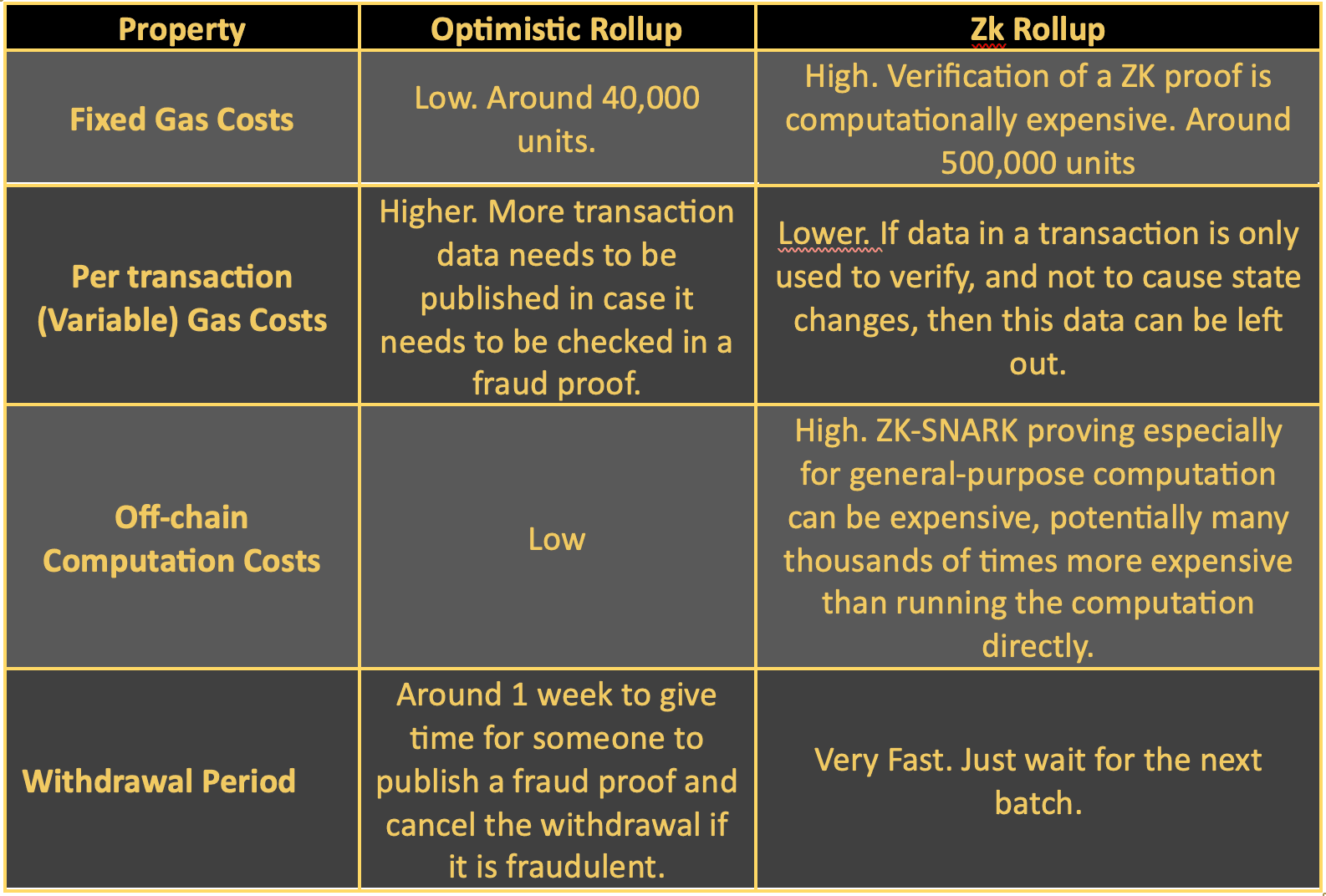

The choice between optimistic rollups and zero knowledge rollups is a primary differentiator affecting performance. To know what rollup may win, it is worth understanding some technicals.

The Tech Behind Optimistic Rollups and Zk Rollups

Optimistic rollups use fraud proofs to ensure that the new rollup state is valid, a process where any validator can challenge the state data if they detect it invalid. Sufficient transaction data must be published from the optimistic rollup to the underlying blockchain to allow challenging the state. There is also a window of around seven days to issue a fraud proof to allow enough time for challenges.

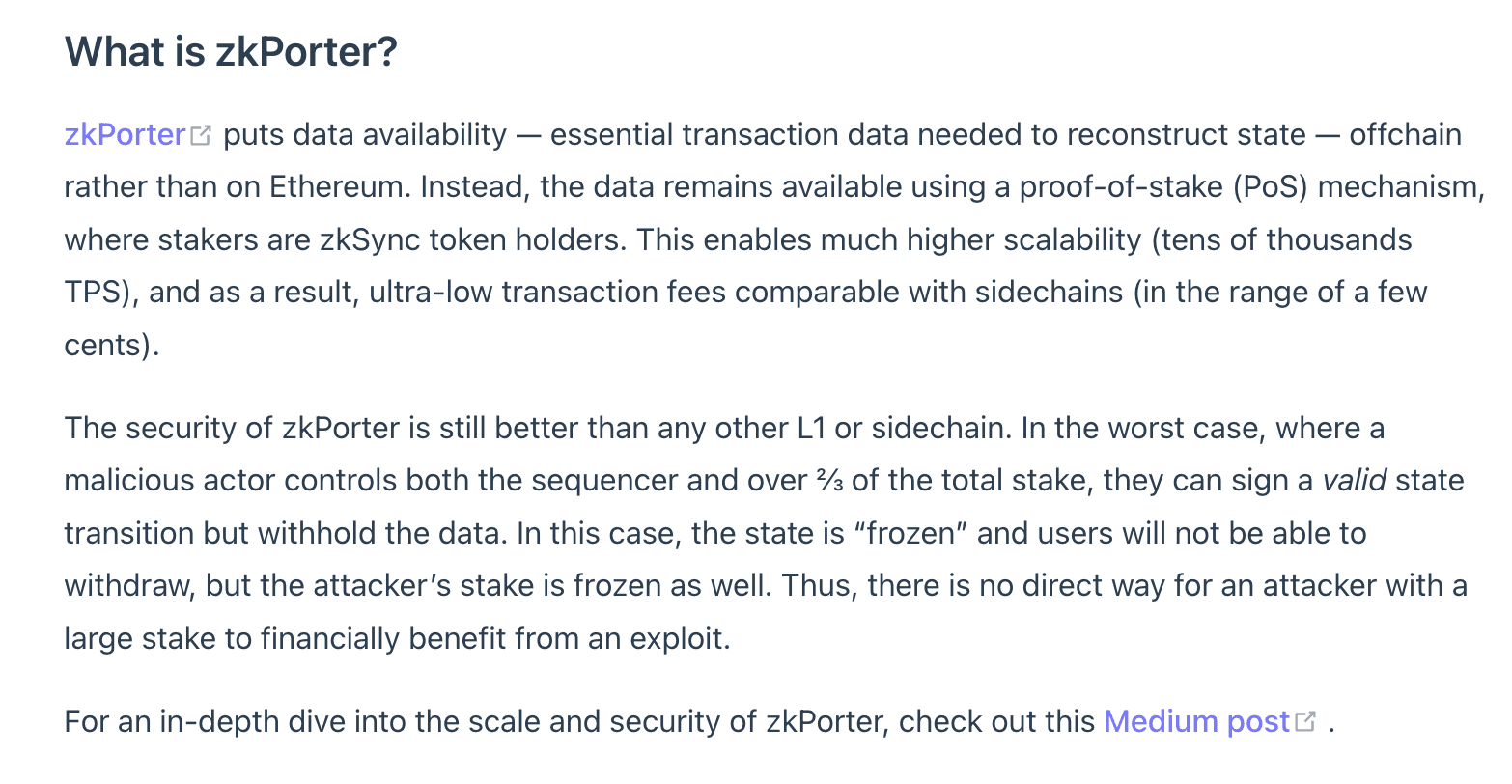

Zk rollups use validity proofs to ensure the new rollup state is valid. A validity proof is a cryptographic proof that allows proving data without revealing the data itself (the type of proof used in zkSync is known as a ZK-STARK, Zero-Knowledge Scalable Transparent Argument of Knowledge). Validity proofs involve higher computational costs than fraud proofs, but they offer key advantages.

Optimistic Rollups vs Zero Knowledge Rollups

Zk rollups rely on math rather than economic games and third parties to ensure validity, making them completely trustless. Validity proofs are verified quickly, giving zk rollups a faster time to finalize transactions than optimistic rollups that have to go through a seven-day dispute resolution period. Therefore, bridging back to Ethereum is much quicker in zk rollups.

Finally, as zk rollups are trustless, you can have some designs that only upload the state root change to the main chain, such as zkSync. In contrast, optimistic rollups require transaction data as well as the state root change to be uploaded to the main chain to make challenging the state possible.

Shard Chains: How Will More Data Availability Affect Rollups?

The first iteration of shard chains, EIP-4844, aka proto-danksharding, will make uploading data to Ethereum much cheaper. There is no set date for proto-danksharding yet. The word is that it could happen as early as late 2023. Both optimistic and zk rollups will benefit massively, and transaction costs will decrease significantly.

It is worth pointing out that as proving zk proofs is costly, zk rollups use a smaller share of gas in uploading data out of their total gas consumption than optimistic rollups. Therefore, shard chains will have a more pronounced effect on optimistic rollups than zks.

The Current Stage of Leading Rollups

As well as design choices that affect performance, when evaluating rollups, it is also critical to look at the stage in the development of said rollup, as this can affect the chain's security.

Today, Arbitrum is the most developed rollup, with the required features to make it a "stage 1" rollup, a terminology popularized by Vitalik Buterin describing training wheel phases. ZkSync is a "stage 0" rollup with some missing features that increase risks. L2beat does a great job showing the rollup training wheel stages and the associated risks.

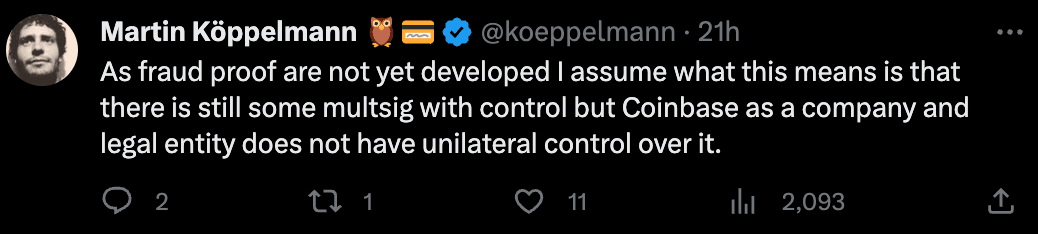

Regarding Optimism and Base, knowing that their fraud proofs are currently under development is essential, as this carries significant risks that are not fully understood.

Condensing Everything: Who Will Win?

When we look at the current landscape, it is evident that Arbitrum leads the layer 2 race. Offchain labs have shipped tech fast, which has enabled Arbitrum's lead in DeFi and rollup security features. With proto-danksharding axing optimistic rollup transaction costs by 5-10x, Arbitrum is set to stay at the top of the layer 2 race for the short term.

Arbitrum’s most imminent challengers are the other two optimistic rollups covered: Optimism and Base. The innovative retroactive goods funding and grants systems could add energy to the superchain's flywheel, and both chains could eventually explode in popularity. My eyes are on Coinbase for how they could integrate Base into their products, as this could onboard many on-chain.

Finally, zkSync is a significant longer-term threat, as zk rollups have the highest potential for Ethereum scaling efficiency. While they will remain more expensive than optimistic rollups in the short-term, zk tech is nascent. We can expect game-changing technological advancements to make zk rollups the go-to way to scale Ethereum for almost all applications.

Further down the road, we could anticipate zk rollups that are not EVM compatible but have a specialized environment for efficiency to proliferate. The leader in this field is Starkware, and they are working on significant upgrades to their tech stack.

Frequently Asked Questions

Layer 2 (L2) in crypto refers to a secondary framework or protocol built atop the main blockchain, known as Layer 1. L2 solutions are created to address scalability issues, enabling faster transaction speeds without congesting the primary layer. Essentially, they process transactions off-chain and then record them on the main chain, enhancing the overall transactional throughput in a blockchain ecosystem.

Yes, Layer 2s are beneficial for Ethereum. They tackle Ethereum's scalability challenges by enabling faster and cheaper transactions. By offloading some of the transactional volume from Ethereum's main chain (Layer 1) to these secondary layers, Ethereum can maintain its security and decentralization while boosting its transactional capacity.

Additionally, layer 2 solutions need to pay the network in ETH to settle transactions, and therefore, contribute to the burning of ETH introduced in EIP-1559.

Not currently, but a zkSync token is in the pipeline. The documentation hints that it will exist, but its release date remains unspecified. The zkSync team has expressed intentions to launch the token "when the time is right." As they focus on decentralizing the rollup, the token will play a crucial role. Nevertheless, potential users should be vigilant about impersonators and scammers until the official token launch.

Coinbase has clearly stated that Base will not have a native token, and there's no plan to introduce one in the foreseeable future. It's crucial for potential investors and users to remain alert to potential scams or impersonators claiming otherwise.

Polygon, the team, has launched a plethora of scaling solutions. The most popular, the Polygon PoS chain with the MATIC token as native currency does NOT use zk-rollups. The Polygon PoS chain is a side-chain that has its own security premises and isn't considered a layer 2 solution.

Other Polygon scaling solutions, most prominently the Polygon zkEVM does use zk rollups, and it is a pure layer 2 solution, settling transactions on Ethereum.

Disclaimer: These are the writer’s opinions and should not be considered investment advice. Readers should do their own research.